Abstract

Relevance of the research corresponds to the problems of incoherence of support measures for localization and export development in the Russian regions, as well as overlapping and lack of the resources to implement such measures especially in the small peripheral regions. Nowadays localization is one of the priority tasks of the Russian federal and regional policy. One of the actual measures to develop localization is interregional industrial cooperation via public-private partnership, that lets to jump-start regional economic growth. The goal of the research is to establish a role of public-private partnership in export-oriented localization development in order to increase the Russian regions investment. Scientific novelty of the research includes estimating correlation between cumulative investments in the public-private projects and cumulative investments for localization development in the Russian regions. The results of the research might be used for strategizing export-oriented localization on the regional level using interregional industrial networks, which lets to optimize regional resources use in interregional clusters and to extent growth areas in the regions, as well as to increase regional industries international competitiveness and sustainable development. Within the research, the public-private projects of the North-West Federal District of Russia were analyzed to reveal leaders and outsiders, as well as the main spheres and sectors of public-private projects implementation. As a result, the Russian regions were classified according to the spheres, forms and duration of the public-private projects. Correlation and regression analysis performed a tight connection between public-private investment projects implementation and export-oriented localization development in the Russian regions.

Keywords: Exportinvestment projectslocalizationpublic-private partnership

Introduction

Nowadays localization is one of the primary objectives of the Russian national and regional policy. Under sanctions and embargo, most Russian regions were left in limbo. On the one hand, it became difficult or impossible to use accustomed import materials in manufacturing and to provide population with the foreign foodstuffs. On another hand, the Russian regions had new opportunities for growth. In this context, the Russian Government had implemented some measures to support localization. At the same time, international experience shows that internal localization sidelines opportunities to develop international trade and essentially is a step to export orientation of a national economy, but not a goal in itself. At the same time in the RF there is an active support of the export activities on national, regional and local levels last years. Herewith measures to support localization and export aren’t interconnected and often double each other. Additionally, to reach goals of localization and export development set by the Government is difficult or simply impossible on the regional level, especially for the small peripheral regions with a lack of resources. This problem might be solved within interregional industrial cooperation using public-private partnership in order to spur economic growth in the Russian regions.

Problem Statement

Localization development acquires high scientific importance in the current conditions of zero rates of economic growth and a sharp drop in oil prices, which negatively affects the filling of budgets, aggravates the problem of paying debts and forces the authorities to search for new models of attracting investments in vital sectors.

In world practice, public-private partnership (PPP) is the most promising tool that can significantly increase investment activity and efficiency of property use (Akhmetshina & Mustafin, 2015; Saggia, 2015). There is a large number of foreign publications revealing the features of PPPs in different countries, at the same time, in the domestic literature, scientific support for the use of the PPP mechanism in strategizing export-oriented localization is insufficient (Ershova & Ershov, 2016; Voronkova, Baryshnikov, & Baryshnikova, 2017; Apokin, Gnidchenko & Sabelnikova, 2017; Chernova, Zobov, & Starostin, 2017).

In modern Russia, with regard to public-private partnership (PPP), active work is carried out at different levels: the federal and regional legislative base is gradually being formed, PPP management bodies and development institutions are being created, PPP forms are being implemented as leases of state and municipal property, mixed enterprises (Budnyk, 2015; Trynov, 2016). However, the main difficulties arise with the most promising forms of PPP, primarily such as concessions and production sharing agreements, which allow to implement strategic investment projects of import substitution (Smirnov & Dudko, 2016; Volkodavova, Zhabin, & Yakovlev, 2016).

Strategic documents of Russia's long-term social and economic development (for example, Strategy 2020) constantly emphasize public-private partnership as the most promising investment policy tool that allows to attract private investors' funds for implementing strategic projects and increasing the efficiency of the industrial and social infrastructure use, to stimulate innovation, etc. (Leigland, 2018).

To assess the development of the public-private partnership in Russia, an analysis was carried out of the implementation of investment projects in the North-West Federal District of Russia for 2015-2016.

Research Questions

-

How different are the regions of the Russian Federation in terms of the level of PPP development?

-

How does the volume of economic investments affect the level of PPP development in the region?

-

How are the volumes of investments in public-private projects divided by spheres and sectors of implementation in the regions of the North-West Federal District?

-

How big is the share of PPP projects having a high degree of implementation?

-

What is the degree of interrelation between the volume of investments in PPP projects and the volume of export-oriented localization of RF regions?

Purpose of the Study

The purpose of the research is to establish a role of public-private partnership in export-oriented localization development in the Russian regions. To reach the purpose 160 public-private projects implemented in the North-West Federal District were analyzed, according to the database of the website "Platform for Support of Infrastructure Projects" (http://www.pppi.ru), the rating of the Russian Federation regions was formed according to the level of PPP development.

Scientific novelty of the research includes establishing the degree of interrelation between volumes of PPP projects investments and volumes of localization development in the Russian Federation regions. That allow to form the most effective export-oriented localization strategy at the regional level on the basis of interregional industrial networks for the integrated use of regional resources through a combination of processes of clustering at the interregional level and ensuring the competitiveness of regional enterprises at the world market.

Research Methods

To achieve the goal of the research the following methods and tools were used.

Findings

Table

As can be seen from the Table

There are 160 projects in the North-West Federal District PPP project base, of which 126 projects (78.8%) are implemented at the municipal level and 34 projects (21.2%) at the regional level. The leader in the number of projects is the Vologda region (37 projects, 23.1% of the total number in the federal district), almost the same number of projects has Arkhangelsk region (36 projects, 22.5% of the total number). Eight projects (5% of the total number) are submitted from Pskov region, as well as from the Republics of Karelia and Komi. It should be noted that Vologda region also ranks first in the number of municipal-private partnership projects (36 projects); Arkhangelsk region ranks second with 34 projects. From the Komi Republic and St. Petersburg there are no municipal-private partnership projects, for them the regional authorities are a public partner. On the other hand, all projects submitted from Pskov and Novgorod regions are projects of private partner and municipal authorities.

When considering the share of participation of each North-West Federal District region in implementation of PPP projects in terms of the amount of investment in project implementation, the picture will be completely different (see table

The total volume of investments in the NWFD is 429 billion rubles, among which 91.2% (391 billion rubles) accounted for St. Petersburg, followed by Leningrad region with a volume of investments of 21.4 billion rubles, which is 5% of the total investments in NWFD. Leadership of St. Petersburg may be explained by the implementation of large infrastructural projects. The remaining regions account for less than 4% of the PPP investments. The NWFD regions are also significantly different in terms of the average volume of investments in a project: the maximum volume has St. Petersburg (32.6 billion rubles), the minimum volume - the Republic of Karelia (33 million rubles.).

The typology of the NWFD regions according to a total volume of PPP investments is not without interest (see table

Four groups of the North-West Federal District regions were identified according to a total volume of PPP investments. The first group includes two regions with a total investment volume of less than 1 billion rubles - Pskov region and the Republic of Karelia. The second group includes the largest number of regions (Arkhangelsk, Vologda, Murmansk, Kaliningrad, Novgorod regions and the Komi Republic), for which the volume of investment in the PPP projects varies from 1 to 10 billion rubles. The third group with investments from 10 to 100 billion rubles is represented by only one region - the Leningrad region (the volume of investments is 21.4 billion rubles), as well as the fourth group (the volume of investments is over 100 billion rubles) - St. Petersburg.

Further, a distribution of the volume of investments in public-private partnership projects by industry is presented (see Table

As can be seen from Table

Further, a typological grouping of public-private partnership projects is presented, depending on how many regions in the North-West Federal District implement projects in a particular industry.

The first group includes 9 spheres of PPP projects implementation, which are represented by only one or two regions of the North-West Federal District. For example, the "Culture and leisure" sphere is represented only by the project of the Komi Republic "Komi Culture Development Center of Ust-Kulomsky District", the sphere of sea and river vessels is represented by the project of the Arkhangelsk Region "Concession Agreement for the Hydraulic Engineering of the Port - Temporary Floating Quay with the Placement of an Open warehouse for storage of building materials, construction equipment and goods on the territory of the Solovetsky Archipelago" with an investment volume of 52 million rubles.

The second group of typology is represented only by 1 sphere - "Social services for the population", projects in which are implemented by the Vologda and Kaliningrad regions, the Komi Republic and St. Petersburg. For example, the largest project is the "Creation of a modern boarding house for elderly and disabled people in Repino" (St. Petersburg) with an investment volume of 529 million rubles, the public partner of which is the Government of St. Petersburg, and the private partner is LLC "SGEC" OPECA".

The most common sphere of PPP projects implementation is “Heat supply”, which is included in the 4th group we identified. Projects of this important for any region sphere of economy are presented in 8 regions (except for the Komi Republic and St. Petersburg). The largest in terms of investments volume is the Leningrad Region project on boiler plant modernization.

It is proposed to unite all projects into enlarged sectors of implementation: communal, energy, social and transport.

It can be concluded that the largest share of PPP projects is implemented in the transport sector (366 billion rubles, 85.4% of the total investments) (Tsevtkov, Zoidov, & Medkov, 2016, 2017), followed by the energy sector (41.7 billion rubles, 9.7% of the total investments), social sector occupies the smallest share (21 billion rubles, 4.9% of investments).

The structure of investments in public-private partnership projects for the NWFD regions may be represented by three types. The first type is typical for a half of the regions (Arkhangelsk, Vologda, Kaliningrad, Leningrad and Novgorod regions). For these regions, more than 80% of investments are in the communal and energy sector, and the rest of the investment goes to the social sector (except for the Arkhangelsk region, where the rest of the investment goes to the transport sector).

The second type is presented in the economy of Murmansk and Pskov regions, as well as in the Republic of Karelia. Here, all PPP projects are implemented in the communal and energy sectors. And, finally, the third type is typical for the Republic of Komi and St. Petersburg. In these regions over 90% of investments (and almost 100% in the Komi Republic) fall on the transport sector.

The distribution of PPP projects according to the volume of investments on different stages of implementation is analyzed in table

It can be concluded that the majority of PPP projects are in exploitation stage (69 projects, 43.1% of the total number of projects), where a greater volume of investments is concentrated (282 billion rubles, 65.8% of total investments). A few smaller projects are at the investment stage (62 projects, 38.8% of the total number of projects). The volume of investments in projects at the investment stage is 26 billion rubles (6.1% of total investments). At the stage of selection of a private partner are 19 projects (11.9% of the total number), while agreements have been signed for 102.6 billion rubles, which is 23.9% of the total amount of investments in PPP projects. The pre-investment stage accounts for the lowest volume of investments (3.9 billion rubles, 0.9% of the total volume), while at this stage there are 9 projects (5.6% of all projects). At the completion stage there is one project - "Project for the creation and subsequent operation of real estate and movable property on the basis of public-private partnership, part of the plant for the processing of solid domestic waste" (St. Petersburg).

Of particular interest is the typology of public-private partnership projects that are on different stages of implementation in the North-West Federal District regions.

The considered regions were divided into 4 groups depending on the stage of implementation the most part of PPP projects is in this region. The first group includes Pskov region - half of the projects of this region is on the stage "Selection of a private partner and signing of an agreement". The second group is also represented by one region - the Republic of Komi - in this region 62.5% of the projects are on the pre-investment stage. The third group includes 4 regions: Vologda, Murmansk, Leningrad regions and the Republic of Karelia. In this group of regions most of the projects are brought to the investment stage of implementation (in Murmansk region 100% of the projects). And, finally, the fourth group, where most of the projects are already on the exploitation stage, is represented by four regions: Arkhangelsk, Kaliningrad, Novgorod regions and St. Petersburg. Most of the projects on the exploitation stage are implemented in Kaliningrad region (81.3%).

The vast majority of PPP projects are implemented in the form of a concession agreement (141 out of 160 projects), concluded in accordance with Federal Law No. 115-FZ of 21.07.2005 "On Concession Agreements", which until 2015 was considered the only federal document of Russia in this field.

The form of implementation of six NWFD projects is the agreement on public-private partnership concluded in accordance with the current regional legislation, as well as in accordance with Federal Law No. 224-FZ of July 13, 2015 "On public-private partnership, municipal-private partnership in the Russian Federation and amending certain legislative acts of the Russian Federation ". This form is implemented in the Republic of Komi and St. Petersburg. For example, in the Republic of Komi, the Law "On public-private partnership in the Republic of Komi ..." was enacted on 01.03.2016 No. 17-RZ. On such conditions in the Republic of Komi, the project "Attachment of the Surgical Corps in the village of Sudayag" is implemented with a total investment volume of over 3 billion rubles. In Saint-Petersburg the PPP project “Highway Western high-speed diameter” is implemented using that form with a total volume of investments 212.7 billion rubles.

The form of implementation of 4 PPP projects in Leningrad Region is a life cycle contract or a long-term state contract with an investment component. All projects of this form are implemented in the sphere of healthcare and spa treatment.

One project in the North-West Federal District is implemented in the form of a lease or gratuitous agreement with investment obligations (Leningrad region). Another project in the North-West Federal District is implemented in a form of an investment agreement (Vologda region).

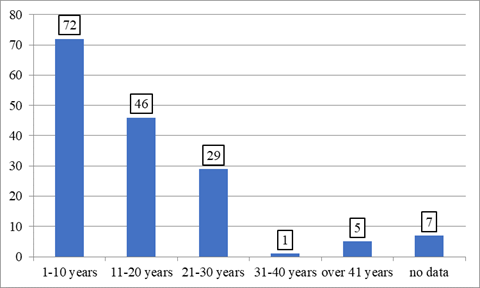

Figure

From Fig.

The most long-term projects of public-private partnership (over 40 years) are typical for Vologda region (2 projects) and St. Petersburg (3 projects). In Vologda region, these are projects in the spheres of health and sanatorium and resort treatment. In St. Petersburg, long-term PPP projects are implemented in such spheres as: healthcare and sanatorium-resort treatment, tourism, social services for the population.

Among projects with a short implementation period (up to 10 years), the majority (35 projects, 48.6%) is represented in the heat supply sphere, followed by water supply and sanitation (26 projects, 36.1%). Most of the projects with an implementation period of up to 20 years are also implemented in the heat supply industry (25 projects, 54.3%), water supply and wastewater (10 projects, 21.7%) are on the second place.

Nine projects (31%) with an implementation period up to 30 years are also implemented in the heat supply sector, eight projects (27.6%) - in the sphere of solid municipal waste management. As it was said above, only the project on municipal waste management in Murmansk region applies to a group of industries where PPP projects are being implemented for a period of up to 40 years.

Finally, five the most long-term projects (for a period of implementation of more than 40 years) were divided in the following way: 2 projects in the sphere of Health and Spa Treatment, and 1 project in each sphere - "Road Infrastructure", "Social Services for Population", "Tourism".

An interrelation between the volume of investments in PPP projects and the volume of export-oriented localization in the Russian Federation regions was assessed. The results show that correlation between the amount of investment in PPP projects and the volume of imports of the RF regions is 0.96 (according to www.gks.ru). The main linear regression equation is represented as:

y = 0.0366x + 1617.3

at the level of approximation R² = 0,9331.

Thus, the results of the research show the high efficiency of using the mechanism of public-private partnership in export-oriented localization development in the North-West Federal District.

Conclusion

The research was aimed at revealing the main factors influencing investment attractiveness of the RF regions, as well as the role of public-private partnership in export-oriented localization development, especially in small regions with a lack of resources.

In the frame of the research PPP projects implemented in the North-West Federal District were analyzed, leaders and outsiders among the regions were identified, the main spheres and sectors of project implementation were revealed. The research identifies the types of regions according to such criteria as stage, form and duration of PPP projects. Using the method of correlation-regression analysis, a high degree of interrelation between the following processes was revealed: implementation of investment projects based on PPP and implementation of the policy of export-oriented localization.

The research made it possible to clarify certain aspects of the strategy of export-oriented localization at the regional level in order to mobilize available resource potential of the territories by using the PPP mechanism to ensure stable growth rates of the regional economy, improve the competitiveness of domestic products in the domestic and world markets and reduce the dependence of the Russian economy on imports.

Acknowledgments

The research was carried out under the financial support of the Russian Foundation for Basic Research in the framework of a scientific project № 18-410-600004 r_а.

References

- Akhmetshina, E., & Mustafin, A. (2015). Public-private partnership as a tool for development of innovative economy. International Conference on Applied Economics (ICOAE) (JUL 02-04, 2015). Procedia Economics and Finance, 24, 35-40.

- Apokin, A., Gnidchenko, A., & Sabelnikova, E. (2017). Import Substitution Potential and Gains from Economic Integration: Disaggregated Estimations. Ekonomicheskaya politika, Volume 12, Issue 2, 44-71.

- Budnyk, V. (2015) Interests of Public-Private Partnership Participants Adjustment. Economic Annals-XXI, Volume 1-2-2, 47-50.

- Chernova, V., Zobov, A., & Starostin, V. (2017). Sustainable marketing communication strategies of Russian companies under the import substitution policy. Entrepreneurship and Sustainability Issues, Volume 5, Issue 2, 223-230.

- Ershova, I., & Ershov, A. (2016). Development of a strategy of import substitution. 3rd Global Conference on Business, Economics, Management and Tourism (BEMTUR) (NOV 26-28, 2015). Procedia Economics and Finance, Volume 39, 620-624.

- Leigland, J. (2018). Public-Private Partnerships in Developing Countries: The Emerging Evidence-based Critique, World Bank Research Observer, Volume 33, Issue 1, 103-134.

- Pratap, K., & Chakrabarti, R. (2017). Public-Private Partnerships in Infrastructure: Managing the Challenges. India: Springer Singapore.

- Saggia, M. (2015). Current situation of the public-private partnerships for drugs in Brazil. Value in Health, Volume 18, Issue 3, A100-A100.

- Smirnov, M., & Dudko, V. (2016). Innovation-investment aspect of import substitution in Russia. Economic Annals-XXI, Volume 157, Issue, 3-4, Part 1, 44-46.

- Trynov, A. (2016). Public-Private Investment Partnerships: Efficiency Estimation Methods. Economy of region, Volume 12, Issue 2, 602-612.

- Tsevtkov, V., Zoidov, K., & Medkov, A. (2016). The Implementation of Transportation and Transit Projects on the Basis of Public-Private Partnership in Russia. Economy of region, Volume 12, Issue 4, 977-988.

- Tsevtkov, V., Zoidov, K., & Medkov, A. (2017). Public-Private Partnership as the Core Form of the Implementation of Russia’s Transport and Transit Potential. Economy of region, Volume 13, Issue 1, 1-12.

- Volkodavova, E., Zhabin, A., & Yakovlev, G. (2016). Dichotomy of import substitution and cooperation strategies in industry. Economic Annals-XXI, Volume 11-12 (162), 48-52.

- Voronkova, O. Yu., Baryshnikov, G. Ya., & Baryshnikova, O. N. (2017). Organic production on fallow lands and import substitution. Ukrainian journal of ecology, Volume 7, Issue 4, 73-80.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Malyshev, D., & Bakumenko, O. (2019). Public-Private Partnership: A Mechanism Of The Russian Export-Oriented Localization Development. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 271-281). Future Academy. https://doi.org/10.15405/epsbs.2019.04.31