Abstract

Since the “resource curse” phenomena was first mentioned in literature, it has received a significant empirical confirmation both on national and regional scales. However there are several exceptions of the economies that obtained advantages from resource wealth. Among the reasons of inability to turn a resource curse to blessing scholars identified weak institutes, the neglect of education, and poor manufacturing crowded out by high-yielding extracting sector. These effects generate a system of innovation failure that is slowing down economic growth. This paper aims to obtain further empirical evidence of the resource curse hypothesis from Russian regions. Secondly, we examine innovative system failures that slow down the pace of economic development. Our econometric calculations provided another proof of resource curse. We discovered a negative relationship between economic growth and resource wealth of Russian regions. Then we analyzed the case of Krasnoyarsk Krai, a Russian resource-abundant region. We used the survey response by executive directors of small and medium enterprises to identify innovative system failures. The most significant systemic failures in resource-rich region were corruption, hindered interactions between actors and institutions, a high level of taxation and natural monopolies’ prices. Our study contributes to adjusting policy development to the specific conditions of resource-dependent counties.

Keywords: Innovative systemregional developmentresource cursesystem failures

Introduction

A curious effect of a negative relationship between economic growth and natural resource endowment has been empirically evidenced on a national level (Auty, 1993, Sachs & Warner, 2001). However, the existence of resource-rich countries that avoided a “natural resources curse” leaves some place for further discussions (Gylfason, 2007). Regional aspects of the resource curse are also ambiguous. Some scholars describe a positive local impact of the extractive industries on employment and incomes (Fleming, Measham, & Paredes, 2015). Other researchers indicate a slowdown in economic growth in the regions with a dominant commodity sector (Papyrakis & Gerlah, 2007; James & Aadland, 2011). That is why extra empirical evidence of the resource curse is needed, especially on a local level, since regional scales provide some advantages. First, one can compare resource-rich and resource-poor counties within the same institutional conditions. Also, the influence of the extracting industries becomes more visible on micro- and regional scales. So, the first aim of our study is to examine the resource curse hypothesis using the data from the regions of Russian Federation, a major resource-rich country.

Another research question is how to overcome the resource curse. The negative influence of natural resource endowment on the economic growth includes several perspectives: (i) manufacturing industry is crowded out with high-yield extracting sectors that tend to impede learning by doing (Gylfason, 2007; Van der Ploeg, 2011); (ii) prevailing natural capital suppresses human capital (Gylfason, 2007); (iii) the weakness of political and market institutes leads to corruption and inefficiency of natural rent distribution (Mehlum, Moene, & Torvik, 2006; Van der Ploeg, 2011). These three perspectives constitute the elements on an innovative system which is a core driver of long-term economic growth. The second aim of our study is to analyze innovative system failures in resource-rich regions and provide the foundation for growth-intensive policy design.

The theory of innovation system is a helpful framework for regional strategy development (Magro & Wilson, 2013). National, regional, sectoral innovation systems are considered as a set of actors, networks and institutions that interact to achieve the technological development of the economy (Bergek, Jacobsson, Carlsson, Lindmark, & Rickne, 2008). According to this approach, innovation is an interactive, non-linear process in which actors (firms), interact with a conglomeration of other organizations (universities, customers, government bodies, financiers) and institutions, including regulations and culture (Edquist, 1997). The success of innovation is determined by the interaction and feedback (Klein Woolthuis, Lankhuizen, & Gilsing, 2005). The innovation systems theory is based on the Triple helix model defined “as a set of: (i) components (the institutional spheres of university, industry and government, with a wide array of actors); (ii) relationships between components (collaboration and conflict moderation, collaborative leadership, substitution and networking); and (iii) functions described as processes taking place in the “Knowledge, Innovation and Consensus Spaces” (Ranga & Etzkowitz, 2013). This model is systemic and explains the role of institutions and actors’ networks in the creation and dissemination of knowledge and technology. It forms a conceptual framework for studying the dynamics of post-industrial society, preparing innovation development strategies and policies.

Innovation system analysis gives insights for considering the problems of low innovative performance (Bergek et al., 2008). There are three conceptual assumptions explaining the development of innovation systems: (i) interactions, cooperation and interactive learning play a central role in the effectiveness of innovation; (ii) institutions are crucial to economic behavior and performance (Smith, 2000); (iii) the trajectory of innovation system development depends on social evolutionary processes (Klein Woolthuis et al., 2005). Thus, problems of the innovation systems development are caused not only by the market failures, but also by the systemic failures, i.e. failures within the innovation system (Bledaa & del Río, 2013). However, a unified approach to the classification of systemic failures including main barriers, obstacles and defects has not yet been formed in the literature (Carlsson & Jacobsson, 1997).

We classified the innovation system failures by the spheres of their occurrence into infrastructural, institutional, networks, and capabilities failures (Klein Woolthuis et al., 2005). These failures were identified and described at different times by different authors (table

Problem Statement

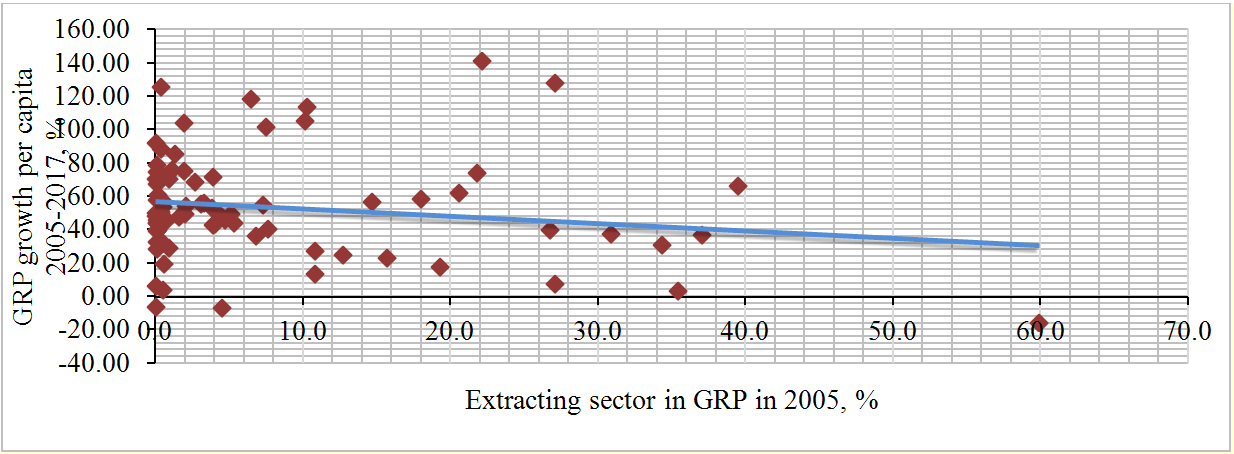

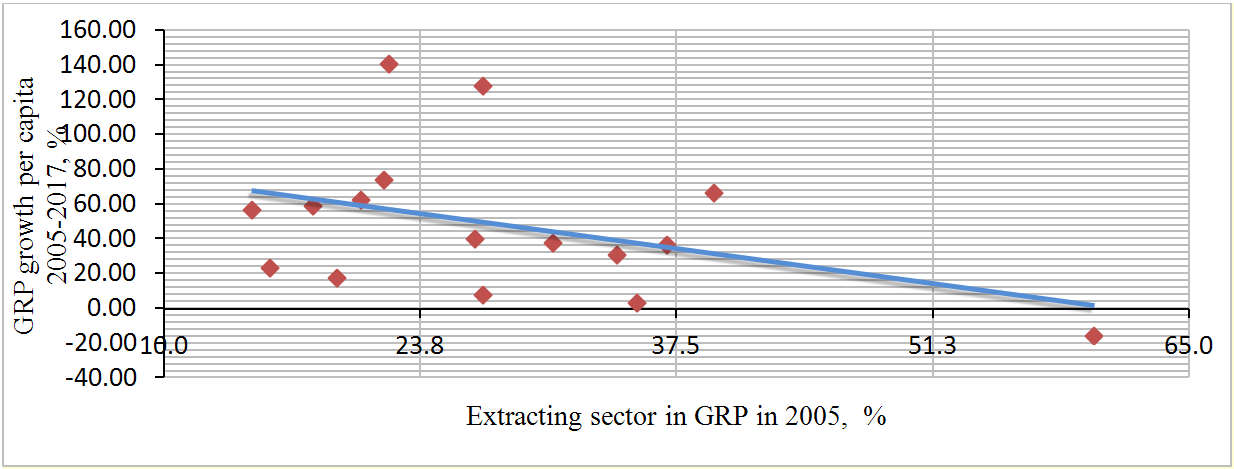

We tested the resource curse hypothesis using the statistical data from 80 Russian regions. Comparing the growth of GRP per capita from 2005 to 2017 and the share of the extracting sector in GRP, we found the inverse relationship of economic growth and resource availability (Figure

Research Questions

The study raises two research questions. Can the resource cursed regions have an effective innovation system? What are the specific barriers to innovative performance in resource-rich regions?

Purpose of the Study

This study contributes to adjusting the regional policy design to avoid the natural resource curse. Our aim is to analyze the innovative system failures of the resource-rich Russian region to find specific perspectives of growth-intensification policy for resource-abundant counties.

Research Methods

-

The empirical data was collected by the method of the survey (phone interviews) of 142 firms-respondents of Krasnoyarsk Krai, which is a typical Russian resource-rich region. The survey was conducted in 2017-2018, the questionnaire included, among other things, the questions for identification of interviewees preference in technology transfer channels. 41% of our respondents were in the field of construction, 19% – in trade, 15% – in energy power industry, 19 % in manufacturing (chemical industry, metallurgy, production of construction materials, machinery engineering, food processing, wood processing). Over 90% of interviewees belonged to the sector of small and medium enterprises. Most questions were formulated to find out the respondens’ attitude and were estimated on the Likert scale (where answer “1” means “strongly disagree”, answer “7” means “strongly agree”). To measure a grade of respondents` attitude to the importance of a systemic failure we made the reverse coding of scale, where “1” means the weakest barrier, “7” is the strongest. -

The character of variables determined the limitations on their processing: variables estimated in Likert scale are non-metric, they have a different gap (distance) between a neighboring value from the point of view of different respondents. Thus, we cannot applicate the algebraic operations, such as addition or averaging, to these data. Therefore, we obtained normalized components` estimates for the groups of failures. For this purpose, the response data of each interviewees was summarized according to the block of questions that identify the component of failure, and then, using the one-parameter Rasch model, they were converted into comparable metric values – logits. This made it possible to compare separate groups of failures with each other, despite the differences in the number of questions and, in some cases, the scales of their ranking .

Findings

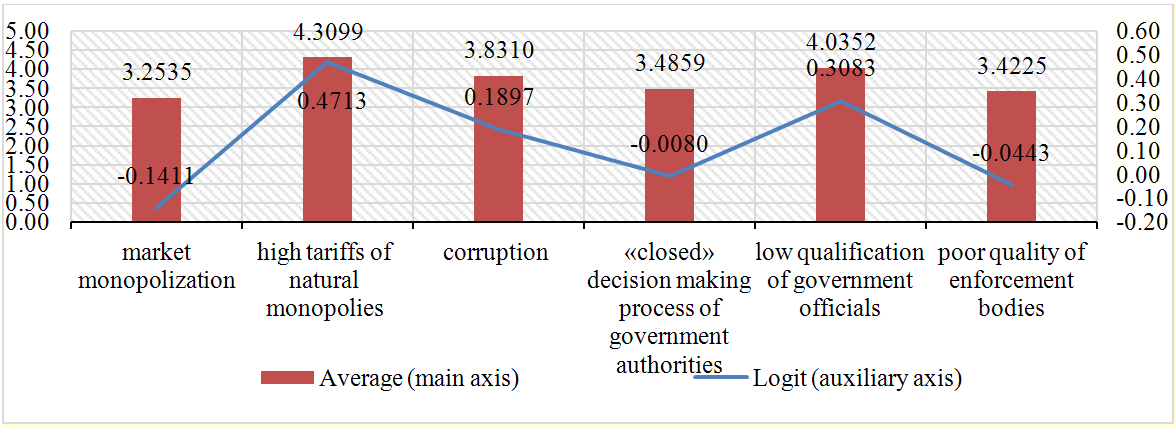

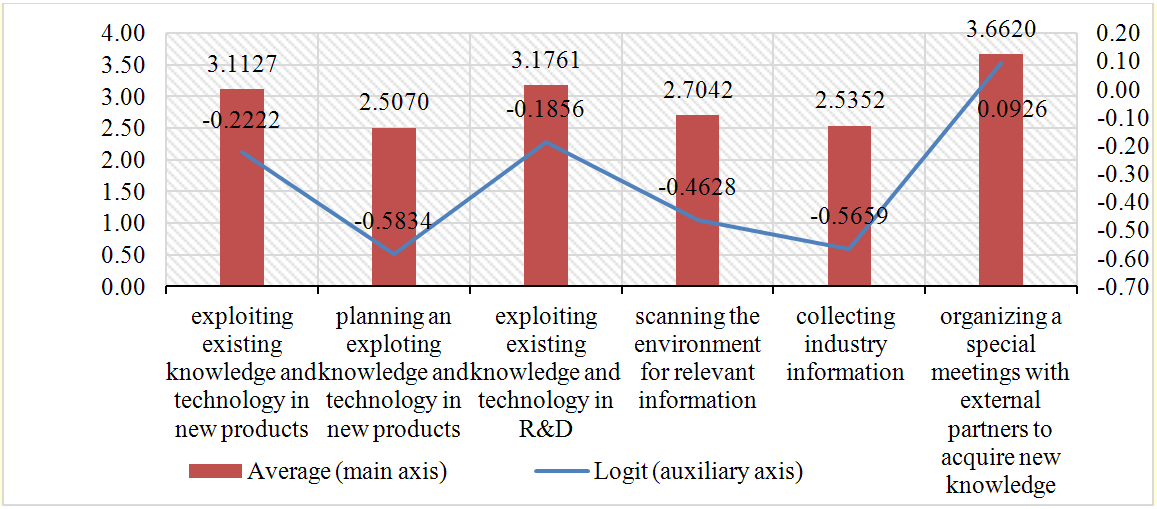

Considering the sample size and the extreme values on the survey scale, in our case the logit value of +0.29 corresponds to the neutral ratio of all respondents to the barrier. When the logit value is -1.8, all respondents rate the barrier as insignificant, when it rises to + 6.9 the barrier is considered the most significant and insurmountable. We also compare the results with the average respondents’ assessment of the significance of the failure. In this case, we assume that their subjective assessments of significance coincide.

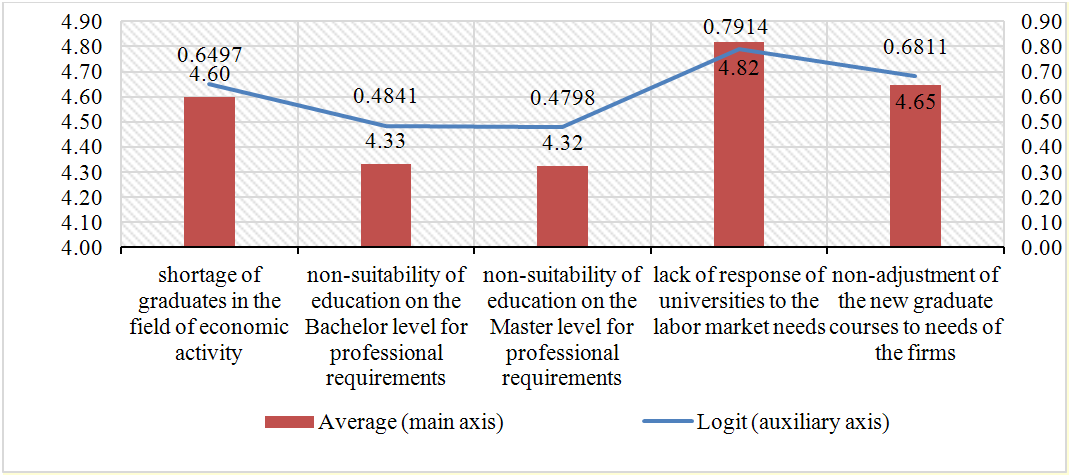

Our findings demonstrate that these failures are primary and they cause, among other groups of systemic failures, the most pronounced negative reaction of representatives of the business community. It can be assumed, they produce the weakness of network interactions between the two main groups of the “Triple helix” actors, that is firms and universities. That process leads to the stoppage of channels of knowledge and technology transfer and blocks the dissemination of innovation. It should be noted that firms are experiencing a significant shortage of qualified personnel and assume that universities are extremely weak in their reaction to the modern economy needs in terms of educating as well as in terms of the preparing graduate programs.

At the same time, interviewees are quite satisfied by the quality of education.

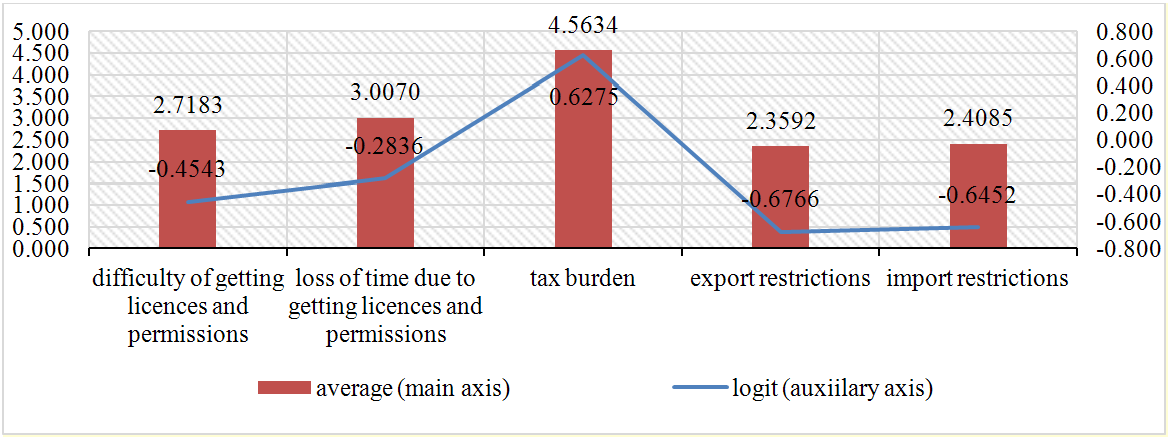

The institutional failures estimation was based on the respondents` assessment of the severity of certain institutional barriers to the development of entrepreneurial and innovative activity. Among hard institutional failures (Figure

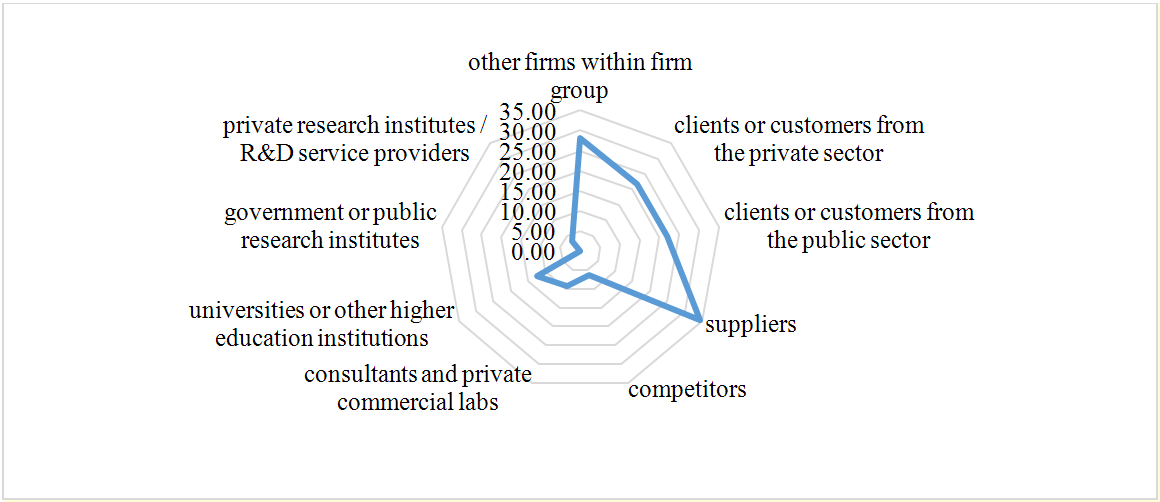

We evaluated the networks failures using a share of firms that chose strategies of cooperation with other actors of the “Triple helix”. At the same time, we considered the interaction between components (universities, firms and government bodies) and also within the entrepreneurial community proper (Figure

We studied the capabilities failures (Figure

Conclusion

This paper confirms the resource curse hypothesis at a regional scale. Russian resource-abundant regions have recently demonstrated that they grow slower than the regions without substantial natural resources. Literature demonstrates that natural resource wealth as such is not a barrier for sustainable economic growth (Gylfason, 2007; Mehlum et al., 2006). The weakness of governmental policy to avoid the negative effects of extracting sector dominance leads to the failures in innovative system, the main driver of economic growth. Our analysis of the innovation system failures for Krasnoyarsk kray, a Russian resource-rich region, showed several significant barriers to innovative activity.

The first barrier to high innovative performance in resource-abundant regions is the problems of higher education. Universities develop their curriculums without taking into account the requirements of local businesses. This leads to a lack of the necessary employees and additional expenditures of companies for personnel training. Another significant barrier is high taxation level and natural monopoly prices that expropriate substantial amounts of entrepreneurial profit. Corruption and a non-transparent fiscal system increase the pressure on non-extractive companies, especially small and medium-size ones.

A failure in the functioning of the Triple Helix in resource-rich regions leads to the lack of interactions between actors of innovative process is a result of technology adoption from abroad. Such a policy allows companies to reduce R&D expenditures but creates a barrier to further development of breakthrough technologies. Weak technology transfers demonstrated by the companies are typical for the competition style in Russian regions and decreases the innovative performance of businesses. Stronger intellectual property protection that requires a legislative reform can solve this problem.

Coping with innovative system failures in resource-abundant regions is possible after implementing a well-designed policy based on the proper analysis of the regional features. The policy may include simplification of license procedures, tax reporting and accounting. Secondly, policy makers should pay attention to investment activity support especially in non-extracting sector, and, finally, should create incentives for the interaction of universities and business in employee training and technology development.

Acknowledgments

The reported study was funded by Krasnoyarsk Regional Fund of Science according to the research project: “Development of mechanisms for the knowledge and technology transfer in high-performance sectors of the economy as the basis for modernizing the strategy of innovative development of the Krasnoyarsk Krai in the conditions of digitalization of the economy”.

References

- Auty, R. M. (1993). Sustaining Development in Mineral Economies: The Resource Curse Thesis. London: Routledge.

- Bergek, A, Jacobsson, S., Carlsson, B., Lindmark, S., & Rickne, A. (2008). Analyzing the functional dynamics of technological innovation systems: A scheme of analysis. Research Policy, 37, 407–429. DOI:

- Bledaa, M., & del Río, P. (2013). The market failure and the systemic failure rationales in technological innovation systems. Research Policy, 42, 1039–1052. DOI: 10.1016/j.respol.2013.02.008.

- Carlsson, B., & Jacobsson, S. (1997). In Search of Useful Public Policies - Key Lessons and Issues for Policy Makers. In B. Carlsson (ed.), Technological Systems and Industrial Dynamics (pp. 299-315). Boston: Kluwer Press. DOI:

- Edquist, C. (1997). Systems of Innovation Technologies, Institutions and Organizations. London and Washington: W.W. Norton

- Fleming, D. A., Measham, T. G., & Paredes, D. (2015). Understanding the resource curse (or blessing) across national and regional scales: Theory, empirical challenges and an application. Australian Journal of Agricultural and Resource Economics, 59 (4), 624-639. DOI:

- Gylfason, T. (2007). The international economics of natural resources and growth. Minerals and Energy, 22 (1-2), 7-17. DOI: 10.1080/14041040701445882

- James, A., & Aadland, D. (2011). The curse of natural resources: An empirical investigation of US counties. Resource and Energy Economics, 33 (2), 440-453. DOI: 10.1016/j.reseneeco.2010.05.006

- Johnson, B., & Gregersen, B. (1995). System of innovation and economic integration. Journal of Industry Studies, 2, 1–18. DOI:

- Klein Woolthuis, R. J. A., Lankhuizen, M., & Gilsing, V. (2005). A system failure framework for innovation policy design. Technovation, 25(6), 609-619. DOI:

- Magro, E., & Wilson, J.R. (2013). Complex Innovation Policy Systems: Towards an Evaluation Mix. Research Policy, 42, 1647-1656. DOI:

- Mehlum, H., Moene, K., & Torvik, R. (2006). Institutions and the resource curse. The economic journal, 116 (508), 1-20. DOI: 10.1111/j.1468-0297.2006.01045.x

- Papyrakis, E., & Gerlagh, R. (2007). Resource abundance and economic growth in the United States. European Economic Review, 51 (4), 1011-1039. DOI: 10.1016/j.euroecorev.2006.04.001

- Ranga, M., & Etzkowitz, H. (2013). Triple Helix Systems: An Analytical Framework for Innovation Policy and Practice in the Knowledge Society. Industry and Higher Education, 27, 237-262. DOI:

- Sachs, J. D., & Warner, A. M. (2001). The curse of natural resources. European economic review, 45 (4-6), 827-838. DOI: 10.1016/S0014-2921(01)00125-8

- Smith, K. (2000). Innovation as a Systemic Phenomenon: Rethinking the Role of Policy. Enterprise & Innovation Management Studies, 1 (1), 73-102. DOI:

- Van der Ploeg, F. (2011). Natural resources: curse or blessing? Journal of Economic Literature, 49 (2), 366-420. DOI: 10.1257/jel.49.2.366

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Samusenko, S., Zimnyakova, T., Popodko, G., & Bukharova, E. (2019). Innovation System Failures In Russian Resource-Abundant Regions. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 181-190). Future Academy. https://doi.org/10.15405/epsbs.2019.04.21