Abstract

The article presents the results of studies on the problem of assessing the business activity of regional socio-economic systems. It has been substantiated that business activity is the ability to mobilize the region’s resource potential in order to ensure sustainable economic growth. An integrated approach to the analysis of business activity in the region resulted in the identification of four main components: production, labour, investment, and innovation activity. The article describes the characteristics of each element and justifies the use of indicators of evaluation. Production activity is estimated through the ratio of the number of registered and liquidated companies, as well as the number of small enterprises in relation to the population. The indicators of the efficiency of the production sphere include return on capital and labour productivity, which, in turn, serve as an assessment of investment and labour activity, respectively. Labour activity is determined by the dynamics of the number of labour resources and the unemployment rate. Innovation activity is determined by the relative indicator of the number of researchers and the proportion of companies engaged in innovation. A common indicator of innovation and investment activity is the efficiency of innovation. The interconnection and interdependence of the production, labour, investment and innovation spheres are presented in the developed net scheme assessment. The proposed model makes it possible to assess the influence exerted by each factor index on the level of business activity, and, therefore, to respond promptly to their changes.

Keywords: Asymmetry of regional developmentbusiness activityregional economy

Introduction

High differentiation of the regional development of Russia was noted by economists at the dawn of the development of market relations, and today the situation is only getting worse. A significant gap in the socio-economic situation of the regions can create a threat to the sustainability of the country’s economic development, even if there are favorable external and internal factors for economic growth. Regional asymmetry is reflected in a significant discrepancy between the main indicators showing the level of economic and social well-being in the region; it causes an increase in the concentration of capital, scientific and technical resources in the leading regions, whereas the outsider regions lose their ability to recover. A comprehensive study of the existing development potentials in the regions and their actual implementation will make it possible to identify possible points of growth for the regional economy and help restore business activity in depressed territories. In this regard, it could be relevant to study the business activity of the regions as a set of efforts of all economic agents of the system in the production, labor, investment and innovation sphere.

Problem Statement

In the scientific literature there is no holistic idea about the essence of the business activity of regional socio-economic systems as an economic category. Often there is a substitution of the concepts “business activity” and “entrepreneurial activity”. However, it should be noted that activity in economic terms is associated not only with the implementation of business processes, but with a special approach to them, manifested in the high mobility of economic actors, the use of new ideas and the search for new means to achieve sustainable development. Many Russian economists have attempted to rank the regions by level of business activity, but the basis of such classifications used only one or several indicators chosen depending on the objectives of the study. For a more in-depth analysis, which allows identifying the points of activation of the main efforts to restore business activity and to direct regional socio-economic systems on the path of sustainable development, it is necessary to single out the main components of business activity. At the same time, their interrelation and interdependence should be taken into account and assessment indicators should be selected accordingly.

Research Questions

The research involves finding answers to the following questions:

3.1. What is the essence of the category “business activity” at the mesoeconomic level?

3.2. What indicators of the socio-economic situation of the regions can be used as a basis for assessing their business activity?

3.3. What is the nature of the relationship between the components of the business activity of regional socio-economic systems?

Purpose of the Study

The purpose of the study is to develop a new methodological approach to determining the level of business activity of regional socio-economic systems. The objectives of the study are to identify the structural components of business activity and the selection of parameters for their evaluation. The network approach will make it possible to determine the influence of individual system characteristics on trends in the economic development of regions. In our opinion, this scheme of research will help identify areas for necessary concentration of efforts for restoring the business activity of the territories. Structural analysis of business activity of regional socio-economic systems will increase the degree of forecasting accuracy and improve the process of strategic planning for the development of territories.

Research Methods

The methodology of this research is based on the fundamental provisions of the regional and spatial economics and applied aspects of the theory of system analysis. In the given research the system approach is realized with the support of theoretical generalization and the analysis methodology.

Findings

Literature Review

Initially, the concept “business activity” appeared in macroeconomic studies of world economists who tried to justify the cyclical nature of the development of national economies and the world economy as a whole. According to the majority of Keynesian school scientists, trajectory of the development of the economic system was the result of the interaction of the entire set of economic entities, anticipating the upcoming market changes, reinforced by the multiplication effect.

The methodology for assessing business activity at the macro level is the calculation of indices characterizing the economic situation as a whole. The idea of indicating business activity was developed in the 1920-1930s in the United States, and now in many countries, business activity monitoring is conducted on a regular basis.

At the micro level, the concept “business activity” is interpreted as a dynamic characteristic of a business entity. At present, there is a whole range of definitions of this concept united by the idea that the business activity of an enterprise is an assessment of its activities from the standpoint of efficiency. The methodology for analyzing the business activity of enterprises is based on the calculation of indicators of turnover, profitability, and dynamics of development.

There is an extensive research on the business activity of macro-and microeconomic systems, however, the problems of business activity of the regions are not sufficiently covered. The entrepreneurial activity at the regional level was studied by Antsygina, Zhukov, & Sypchenko (2017), who considered the number of enterprises in the region in dynamics and used the data as indicators of entrepreneurial activity at the level of the subject of the Federation.

Regional economy is a set of economic agents (households, organizations, government bodies) that are in close relationship with each other and adjust their behavior depending on the prevailing market conditions. Among the research on the problems of regional development of the Russian Federation, one should single out the study by Stolbov & Sharygin (2016), in which the authors analyze the potential of regional development. In their opinion, the potential is “the maximum capacity (potency) of an object, the actualization (realization) of which is determined by a multitude of possibilities, a specific combination of internal and external factors, the presence of appropriate objective and subjective prerequisites”. Researchers also point out that “the potential of a territory is entering a phase of sustainable existence, realizing one of the main principles of socio-economic formation of a region - perspective” (p. 1024).

The main problem of the socio-economic development of Russia from the very beginning of a market economy is the uneven regional development. In addition, it was the transition to market relations that significantly influenced the differentiation of the Russian regions. In her research, Moroshkina (2016) notes that “the inequality of the Russian regions in terms of socio-economic development and economic growth rates is determined by the economic and geographical position, the level of infrastructure development, investment attractiveness, innovation potential and many other factors” (p. 109).

Rastvortseva & Ternovsky (2016) underline the fact that regions are often not partners, but competitors. According to the researchers, “in more successful regions, agglomeration effects arise that stimulate the concentration of resources, manufacturing enterprises and services, skilled workers, scientific and technical knowledge” (p. 153). As noted by Nizhegorodtsev, Piskun, & Kudrevich (2017), the value of the coefficient of variation of GRP per capita over the past few years remains at a fairly high level and comprises 42% for federal districts and 79% for the regions.

The article by Zubarevich (2015) is devoted to the dynamics of regional economic development, employment, incomes of the population and the state of regional budgets during the periods of the crisis phase of the business cycle. The paper discusses the features and risks of a crisis in different types of regions. The dynamics of business activity on the basis of macroeconomic indicators of development with the consideration to the diffuse index of entrepreneurial expectations was analyzed by Shakirova (2012). Zimnyakova & Samusenko (2017) classified resource regions by indicators of concentration of enterprises in the industry, labor productivity and investment activity. The classification of all regions of Russia according to the criteria of “innovation” and “investment attractiveness” was carried out by Kroshilin, Leonova, Medvedeva, & Ivanina (2015). The evaluation of the level of business activity of the regions from the standpoint of small business development is carried out by Zemtsov & Tsareva (2018).

A selection of indicators for assessing the components of business activity in the regions is based on a review of publications on regional development issues.

Structural components of business activity in a region and indicators of their evaluation

In our opinion, business activity at the regional level is an aggregate indicator, evaluating the activities of all economic agents of a specific territorial location. The result of regional development is the interaction of all elements of the socio-economic system of the region, aimed at the effective realization of the existing potential. Thus, the business activity of a region can be defined as the ability to mobilize its resource potential in order to ensure sustainable economic development.

On the basis of generalizations of various approaches to the assessment of business activity of regional socio-economic systems, the following components were identified: production activity, labor activity, investment and innovation activity.

The production activity of the region is primarily conditioned by the economic relations that are developing in regards to the involvement of the production factors in the economic circulation, as well as the efficiency of their use. The main indicator of industrial activity in the region is, undoubtedly, the dynamics of the gross regional product per capita. GRP is the basis for many regional ratings and forecasts for the development of regional economic systems (Moroshkina, 2016). However, we believe that activity in the regions is largely characterized not by production volumes, but by the dynamics of the number of operating enterprises. The ratio of registered and liquidated companies is one of the indicators reflecting the degree of economic and political uncertainty in the region, as well as investment expectations from the business. An indicator that characterizes the involvement of the population in entrepreneurship is the ratio of the number of small enterprises to the population. The expediency of using these data to assess entrepreneurial activity is justified by Zemtsov & Tsareva (2018).

When assessing production activity, one should take into account that its growth is limited on the one hand by market needs, and on the other, by production capabilities.

The labor activity of a region primarily depends on its human potential, which is determined by the number of the human resources, their age and professional structure, and skill level. The most significant factors determining the labor potential of a region are the ratio of birth and death rates, the processes of interregional migration and the level of development of the system of secondary vocational and higher education. An important indicator is the unemployment rate in the region, which indirectly affects the processes of interregional migration. Borodina (2017) in the study of regional features of population dynamics states that migration growth is concentrated in a limited number of regions. The steady trend of the last two decades is the strengthening of the spatial unevenness of population dynamics processes, which leads to a significant polarization of environment.

The investment activity of the region is determined by the ability of the territorial production complex to reinvest profits and attract resources from external sources in amounts that guarantee expanded reproduction. Investment activity is determined by the growth rate of investments directed to the reproduction of fixed capital. However, it should be noted that an important role in the investment process is played by direct foreign investment. The regional structure of foreign investment entering the Russian economy demonstrates the mismatch of interests of foreign investors with the needs of the national economy. Problems of the differences in the attractiveness of Russian regions for foreign investors are described in detail by Kuznetsova (2016a, 2016b). In the interregional distribution of FDI, the structure of the regional economy, including the presence of industries and enterprises that are attractive to potential investors, is of decisive importance. In our opinion, it is advisable to use the ratio of FDI to GRP, calculated on the basis of data published by the Bank of Russia, as an indicator of the region’s investment activity.

Innovative activity of the region implies a high level of mobilization of innovative potential. The article by Golova (2015), devoted to the assessment of the innovative competitiveness of the Russian regions, notes that the scientific potential of the territory can become a source of the organization of high-tech business. However, according to the calculations made by the author, the leaders in the innovation sphere are two types of regions: those with a traditionally high share of R & D and those specializing in the extraction of oil and gas resources. Based on research by I.M. Golova, we suggest evaluating the innovation activity by indicators of the ratio of the number of researchers to the total number of employees in the region, as well as the proportion of companies engaged in innovation.

Net analysis of the level of business activity in the region

We suggest a net approach for analyzing and forecasting business activity at the regional level. A detailed analysis of the use of the net approach in the study of socio-economic systems is presented in the work of Baggio & Shereshova (2014). The authors note that the application of this approach implies the consideration of socio-economic systems through finding a number of different components which have different sizes and perform different functions; these components are connected in many ways, which, as a rule, are dynamic and nonlinear in nature (Baggio & Sheresheva, 2014). Moreover, if structural relationships can be reproduced in a simple form, then a mathematical model can be constructed.

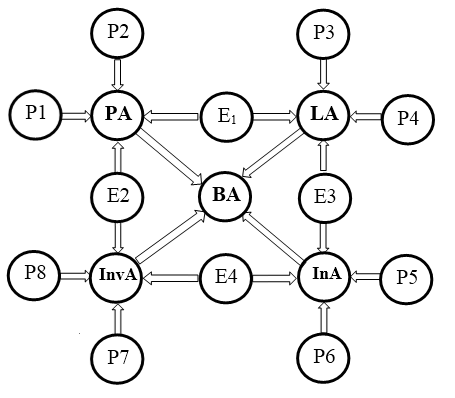

To analyze the level of business activity in the region, we suggest the following net scheme, the nodes of which are the components of business activity that have been selected before (Figure

The central place in the net is assigned to the indicator of business activity in the region, which depends on the assessment of individual components: production activity, labor activity, investment and innovation activity. They are the main nodes of the network. The components of the business activity of the region are interrelated, and the connecting element is the “efficiency contour” (E1-E4), evaluated through the following indicators: return on capital, labor productivity, efficiency of innovation activity and patent activity in the region. Between the considered components of business activity there is a synergistic interaction. The intensification of the labor potential of the region depends not only on the professional capabilities of the workers, but also on the amount of capital, as well as the possibility of modernizing production on an innovative basis. The total generated level of business activity in the region depends on the power of the impulses of the individual components, as well as on the nature of the corresponding synergistic interactions.

The net represented in the figure forms a region, the boundary points of which are the indicators of the economic situation of the regions, published by RosStat (Russian Statistics) and, therefore, available for comparative analysis. The proposed net scheme allows assessing the impact of each factor on the final result (level of business activity), and, therefore, responding to changes in a timely manner. It should be noted that the net is simplified, and in the future it could be more detailed.

Conclusion

As a result of research, we clarified the category “business activity” in the context of a study of regional socio-economic systems, identified the components of business activity in the regions: production, labor, investment and innovation activity. The use of a network approach for a comprehensive assessment of the level of business activity of regional socio-economic systems, allowing the definition of its individual components’ impact, is substantiated.

Acknowledgments

The article was prepared with the financial support of the Russian Foundation for Fundamental Research (Scientific project 18-010-01011 A).

References

- Antsygina, A. L., Zhukov, A. N., & Sypchenko, A. E. (2017). Macroeconomic determinants of entrepreneurial activity in various phases of the business cycle: regional level. Economy of the Region, 13(4), 1095-1106. DOI: 10.17059 / 2017-4-10.

- Baggio, R., & Sheresheva, M. Yu. (2014). Network approach in economics and management: interdisciplinary character. Bulletin of Moscow University. Series 6: Economy, 2, 3-21.

- Borodina, T. L. (2017). Regional features of the dynamics of the population of Russia in the post-Soviet period. Proceedings of the Russian Academy of Sciences. Geographical Series, 1, 47-61.

- Golova, I. M. (2015). Innovative competitiveness of Russian regions. Economy of the Region, 3(43), 294-311. DOI: 10.17059 / 2015-3-24.

- Kroshilin, S. V., Leonova, Z. K., Medvedeva, E. I., & Ivanina, V. M. (2015). Typological features of economic development in Russian regions under the conditions of development of continuous education. Economic and Social Changes: Facts, Trends, Forecast, 6(42), 78-90. DOI:

- Kuznetsova, O. V. (2016a). The role of foreign capital in the economies of regions of Russia: possibilities of assessments and interregional differences. Studies on Russian Economic Development, 3, 276-285. DOI:

- Kuznetsova, O. V. (2016b). Differences in the attractiveness of Russian regions for domestic and foreign investors. Economic Issues, 4, 86-102.

- Moroshkina, M. V. (2016). Differentiation of the regions of Russia based on level of economic development. Studies on Russian Economic Development, 4, 441-445. DOI:

- Nizhegorodtsev, R. M., Piskun, E. I., & Kudrevich, V. V. (2017). Forecasting indicators of socio-economic development of the region. Economy of the Region, 13(1), 38-48. DOI: 10.17059 / 2017–1–4.

- Rastvortseva, S. N., & Ternovsky, D.S. (2016). Factors of concentration of economic activity in the regions of Russia. Economic and Social Changes: Facts, Trends, Forecast, 2(44), 153-170. DOI: 10.15838 / esc / 2016.2.44.9.

- Shakirova, A. I. (2012). Forecasting the dynamics of business activity and determining the prospects for socio-economic development of the region (the case of Republic of Tatarstan). Forecasting Problems, 6, 87-98.

- Stolbov, V. A., & Sharygin, M. D. (2016). Regional potential and regional capital: “possible” – “real” – “necessary”. Economy of the Region, 12(4), 1014-1027. DOI: 10.17059 / 2016-4-4.

- Zemtsov, S. P., & Tsareva, Yu. V. (2018). Entrepreneurial activity in the regions of Russia: how spatial and temporal effects determine the development of small business. Journal of New Economic Association, 1(37), 145 - 168. Retrieved from http://journal.econorus.org/pdf/NEA-37.pdf

- Zimnyakova, T. S., & Samusenko, S. A. (2017). Specifities involved in enterpreneurship development in the regions relied on raw materials. SGEM2017 Conference Proceedings, 5, 895-902. DOI:

- Zubarevich, N. V. (2015). Regional projection of the new Russian crisis. Economic Issues, 4, 37-52.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Parshutina, I., Shmanev, S., Ilminskaya, S., & Ilyukhina, I. (2019). Methodological Approaches To The Analysis Of Business Activity Of Regions. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 123-130). Future Academy. https://doi.org/10.15405/epsbs.2019.04.14