Abstract

The current solution to the most acute and significant social and economic problems of Russia is largely due to the fact that most Russian families are dissatisfied with housing conditions. The main feature of solving this issue is finding the optimal combination of interests between the main participants (housing and communal services, people, investment and construction complex, regions, state) of the process improving the level of housing comfort and affordability. The analysis of the legal framework carried out in the study and the monitoring of mortgage programs implemented to improve the quality of life of the population indicate the lack of tools when selecting the most acceptable schemes for improving housing conditions that are optimal for the region - society. The study of developments, approaches, methods and techniques used by foreign and Russian authors led to the idea of using two methods in the competitive selection process and evaluating state mortgage programs from the standpoint of improving the quality of life of the population: a cumulative method and a method of analyzing hierarchies. The study describes in general terms an algorithm for evaluating state mortgage programs, which indicates the role and place of the evaluation procedure in relation to regions. The authors suggest a technique in which programs are compared for each criterion directly with each other by such indicators as the relevance of the problem for the region and business, the proportion of the population experiencing a problem, etc.

Keywords: Statemortgage programsquality of lifepopulationevaluation

Introduction

In all countries of the world, social problems are acute, one of which will always be people's dissatisfaction with housing conditions. The degree of state participation in solving housing problems is very different. In each country, there is state support for the development of the housing sector (Kornilova & Kirsanova, 2014), the activity of which is different in different countries. World practice shows (Akunina, 2015) that in a steadily developing state no more than 25% of the gross domestic product is spent on providing citizens with housing. According to the World Bank, in 2017 this figure was 17.9% of GDP in Russia, in the European Union - 20.6%. Russia was far behind the developed foreign countries in solving housing problems in the period up to 2000, at the present time the situation is changing for the better:

The legislative base is being improved and specified.

In recent years, government agencies have been implementing such programs as the Dwelling (The federal target program “Dwelling” for 2015–2020), favorable social credit facilities for the purchase of housing provided to certain categories of the population (Resolution of the Government of the Russian Federation, 2018), falling under the concept of “Social mortgage”. At the regional level, several regions accept mortgage programs, for example, in the Samara region, the programs “Young Family”, “Housing for Russian families”.

The level of housing affordability is growing.

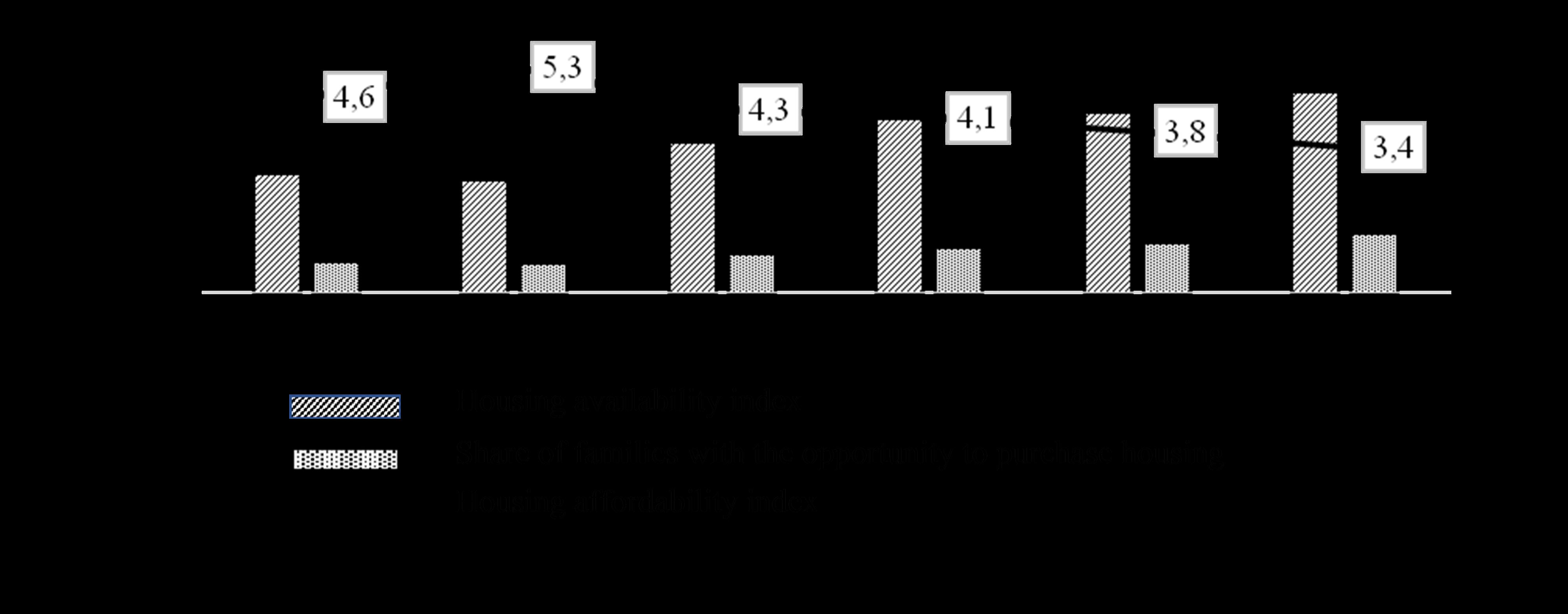

The data of the Foundation “Institute for Urban Economics” (Figure

The figure shows that the number of years during which a family can save for an apartment is reduced by 35%, as evidenced by the housing availability index. At the same time, the HAI - Housing affordability index grew by 0.7 (70%) in 2006, and by 1.18 (118%) in 2016, which means that the income of an average family exceeds the income required to purchase a standard apartment with using a mortgage loan with interest rate of 18%. According to Forbes Media LLC, the main reason is the increase in the share of mortgage loans issued in the framework of the state program of subsidizing interest rates on mortgage loans for the purchase of housing in new buildings.

At the same time, it is very early to talk about solving the housing problem. If we consider the performance of indicators in Figure

A strong variation in the level and quality of life of the population provokes constant social conflicts in relations between the population, state and private structures. The quality of life today is shaped by the general well-being of people, so we can talk about the need to evaluate mortgage programs from the standpoint of improving the quality of life of the population as a social indicator of the state and region.

The authors of the study agree with the opinion of Kukarskaya (2016), Menshikova & Pruyel (2017) that the main feature of solving this issue is finding the optimal combination of interests between the main participants (housing and communal services, people, investment and construction complex, regions, state) of the process improving the level of housing comfort and affordability. Moreover, the severity of conflicts varies greatly depending on the region of residence. In this regard, the state is obliged to balance the interests (Grechishkina, 2015) of each region and to ensure the synchronization of interests of all participants in mortgage programs (Ebrahim, Shackleton, & Wojakowski, 2011). Here, the quality of life of the population becomes the most important element of goal-setting in state mortgage programs, suggesting a preliminary and final evaluation of its implementation on the main indicators (Akunina, 2015): the housing affordability index, the proportion of families having the opportunity to purchase an apartment. All this suggests the need to search for tools for selecting the most acceptable housing improvement schemes that are optimal for the region — society.

Problem Statement

A large array of scientific developments today is devoted to questions of the appropriate and objective use of existing approaches, methods, techniques for evaluating target programs. The significance of the evaluation is evidenced, for example, by the fact that for the World Bank the availability of a project monitoring and evaluation system is one of the key criteria for lending. Professional communities are known abroad (about 60), each of which operates with its own evaluation schools.

Thanks to the activities of overseas evaluation schools in the USA, Germany, Switzerland, societies in the UK, France, international organizations (European Society, Australian-Asian, USAE), the international network “Program Evaluation”, the International Organization for Cooperation in the Field of Evaluation has developed a large number of evaluation standards: Program Evaluation Standards; Guiding Principles for Evaluators; Evaluations-Standards et al. (Viscusi & Aldy, 2003). The basis of these standards is the processing of previously collected data using formalized mathematical operations (quantitative analysis), followed by a qualitative analysis of the results obtained. Menshikova (Menshikova & Pruyel, 2017) considers that the most common quantitative data analysis methods are correlation analysis, factor analysis, multiple regression.

The state solves these issues through a program-oriented approach. The research performed by Aksenova (2013) with the support of the Russian Foundation for Basic Research, showed that “the existing methodologies for evaluating the efficient implementation of targeted programs are focused on their application at the final stage”. At the initial stage of evaluating state targeted mortgage programs, the following methods may become relevant: ranking (Kosyakova, Gavrilova, Shepelev, Belikova, & Chistik, 2016), if we consider the period before the program starts in a country or region.

A team of authors (Viscusi & Aldy, 2003; Aksenova, 2013; Akunina, 2015; Grechishkina, 2015) propose a technique that will improve the focus of targeted programs at the stage of their formation and will ensure transparency at the stage of their implementation. However, it is more oriented towards managerial components and built on the basis of the concept of balanced management (the authors are American scientists R. Kaplan and D. Norton) of the education system (Kaplan & Norton, 2003). There are also methodologies for evaluating the efficiency of the state program using a profitability index of budget funds. In their study, the authors Kosyakova et al. (2016) believe that using the method of evaluating government programs based on the analysis of “costs - results” will allow making a decision “by making the right choice between different uses of resources by identifying and evaluating costs and benefits in such a way that it allows evaluating their consequences in terms of the goal achievement of the socio-economic development of the region”.

The study of the legislation of the Russian Federation (Resolution of the Government of the Russian Federation, 2018; Order of the Ministry of Finance of the Russian Federation, 2018), allowed identifying a number of problem parties that have not been resolved yet:

A formal process is used to select management authorities of the main participants in state mortgage programs.

In some cases, non-adapted foreign models for evaluating and solving the housing problem are used.

There is no preliminary analysis of the relevance of state mortgage programs with reference to the conditions of the region.

Funding allocated by the federal budget is not always linked to the needs of people living in a territory.

Only a rating and / or ranked approach is used at the preliminary stage on social efficiency.

There is no objectivity in the process of evaluating mortgage programs due to the lack of evaluation tools approved at the legislative level.

The existing guidelines do not contain information about the evaluation tool and information about the criteria and their significance.

Regional government bodies view mortgage programs as a source of non-repayable financing and pay little attention to alternative sources of financing for the housing problem.

There is no information on the evaluation of mortgage programs by regions due to an avalanche-like increase in their number (sub-programs).

To solve the identified problems, it is suggested to combine the interests of regional and local authorities to solve national problems and concentrate investment resources in the priority areas of public infrastructure development (Resolution of the Government of the Russian Federation, 2018), linking mortgage programs to all participants based on two methods.

The cumulative method can be used to evaluate a large number of programs (Malganova & Ishmuratov, 2016). For each of the criteria for the program, an expert rating is put in points, based on the developed scale, in this case “the program evaluation is defined as the sum of points for all the criteria” (Kukarskaya, 2016). At the same time, such alternatives as simple summation are possible (the method is suitable for estimating any number of mortgage programs, but not more than 10 at a time). The method of analyzing hierarchies is used in different directions. Most often it is involved in the development of management decisions in crisis management and evaluation of the reliability ratings of counterparty banks. It is based on a systematic procedure for the hierarchical presentation of programs that affect the quality of life of the population. The essence of the methodology used is the decomposition of a set of criteria for expressing the degree of significance of mortgage programs for the population of different regions. This method is a universal method, the purpose of which is to compare various state mortgage programs by priorities between criteria, established according to the degree of their influence on the choice of option. At the same time, the results of the compared programs can be expressed in various quantitative indicators.

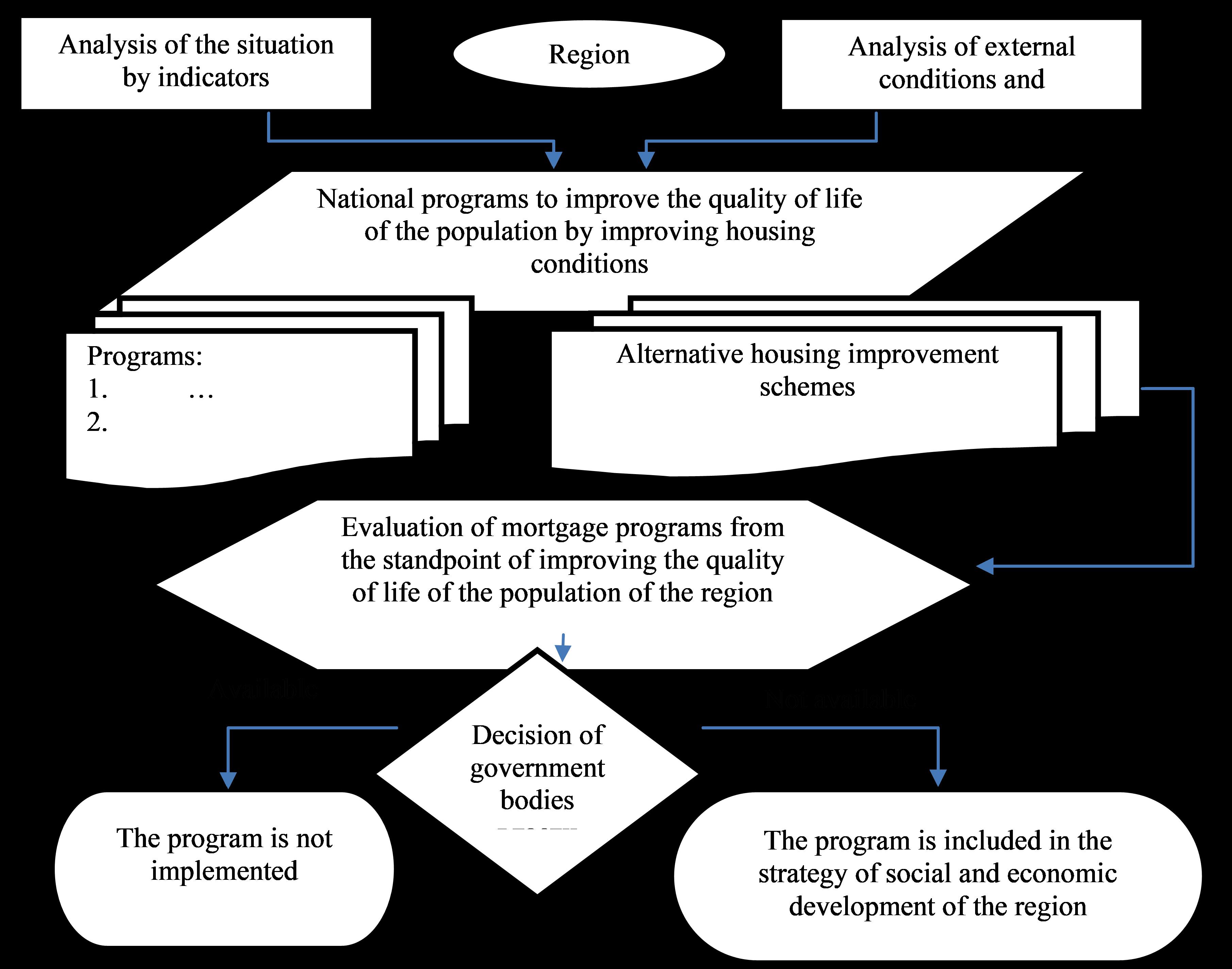

The role of the procedure for evaluating state mortgage programs from the standpoint of improving the quality of life of the population can be seen in Figure

At the first stage, the region should conduct an analysis of the situation in terms of the proportion of families that have the opportunity to purchase housing, the housing affordability and availability index, while simultaneously analyzing the external conditions and financial possibilities for the availability of resources and problems in the region. Next, we consider the mandatory state programs, the implementation of which is regulated by the supreme governing body. For example, in 2017, a new version of “Providing Affordable and Comfortable Housing and Utilities for Citizens of the Russian Federation” was adopted, in the structure of which other programs were added, one of which was the priority project “Mortgage and Rental Housing”. In addition, inside the priority project, the so-called “pilot” projects will be developed, which imply a public-private partnership. “Social Mortgage” includes three basic subprojects, each with its own conditions.

Therefore, the evaluation of mortgage programs, from the standpoint of improving the quality of life of the population of the region, according to the criteria of “Relevance of the Mortgage Program” and “Efficiency” will allow making informed decisions about the inclusion or non-inclusion of subprojects in the strategy of socio-economic development of the region.

Research Questions

Taking into account the insufficiently considered problems in foreign and Russian literature, the most relevant are the following research questions:

What existing mathematical tools can be used in the process of competitive selection and evaluation of state mortgage programs from the standpoint of improving the quality of life of the population?

What is the role of the procedure for evaluating state mortgage programs from the standpoint of improving the quality of life of the population in the existing evaluation algorithms? What criteria should be applied?

Purpose of the Study

Using the research questions highlighted, we can formulate the main purposes of the study:

Analyze the existing developments, approaches, methods and techniques used by foreign and Russian authors for competitive selection and evaluation of state mortgage programs;

Develop a toolkit that allows obtaining the final ranks of state mortgage programs on various criteria from the standpoint of improving the quality of life of the population.

Research Methods

The evaluation methodology for competitive selection of mortgage programs includes two main areas in which programs will be evaluated:

C1-“Relevance of the Mortgage Program for the Region” - criterion of relevance and necessity of implementing the program (the importance of the mortgage program for the region, the relevance of the mortgage program for the investment and construction industry);

C2 - “Efficiency” (housing affordability and affordability index);

C3 – “Proportion of Families with the Opportunity to Purchase Housing”.

The main criteria for program evaluation are the criteria of relevance, necessity and efficiency. The list of criteria is open, that is, you can add additional criteria that will be taken into account when calculating the proportion of each criterion (Malganova & Ishmuratov, 2016).

The result of the evaluation, which is carried out by one or several experts from the government, business representatives, the public, is the selection of the most important program. In the case of the participation of several experts in comparing programs, the final rating is determined as an arithmetic average.

Programs are compared in pairs for each criterion. An example of the form to be filled out by experts is presented in Table

The experts fill in the empty cells of the antisymmetric matrix, marked with the sign “...” (Table

Calculation of values for each criterion is made after the experts conduct their rating. Further, the calculation is performed in several stages.

At the first stage, the geometric mean (n1) of the estimated values for each program is determined by formula 01:

n1

where

At the second stage, the sum of all geometric means (Σ

At the third stage, the rank of the program (

The program comparison procedure will include the following elements:

Determination of comparison criteria and calculation of specific values of comparison criteria;

Comparison of programs by each of the criteria;

Calculation of the final ranking of each program.

The calculation of the final ranking of each program is carried out according to the formula 03 (Chivers & Flores, 2002).

where

Rpj - the proportion of the j-th program by p-th criterion;

dp - the significance of p-th criterion.

After that, it is determined which program is the most significant for the region, based on the largest value.

Thus, the method of analyzing hierarchies is a procedure that expresses expert ratings numerically, the evaluation is subjective. Therefore, it is necessary to include experts from various fields in the expert group.

Findings

Comparative evaluation of mortgage programs using the hierarchy analysis method is carried out using the example of evaluating state mortgage programs in the Samara region. It was decided to select experts in three areas, namely in the field of banking, construction and consumer. Comparison of the criteria of relevance and the need to implement mortgage programs based on (Malganova & Ishmuratov, 2016) expert ratings are presented in Table

Interpretation of the values of Table

C1 “Relevance of the Mortgage Program for the Region” slightly exceeds the criterion 2 “Relevance of the Mortgage Program for the Investment and Construction Industry” and moderately exceeds the criterion 3 “Proportion of the Population in Need for Better Housing Conditions”;

C2 “Efficiency” in its relevance slightly exceeds the criterion 3 “Proportion of the Population in Need for Improved Housing Conditions”.

Processing of data for comparing mortgage programs was carried out using the Microsoft Office package (Excel, Word). Calculations comparing mortgage programs for each criterion show that:

The criterion of “Relevance of the Mortgage Program for the Region”. Family Mortgage slightly exceeds Maternity Mortgage in relevance, moderately exceeds Social Mortgage, and as much as possible exceeds Military Mortgage; Maternity Mortgage is as relevant as Social Mortgage and significantly exceeds Military Mortgage, and Social Mortgage slightly exceeds Military Mortgage in relevance.

The criterion of “Relevance of the Mortgage Program for the Investment and Construction Industry”. Family Mortgage is as relevant as Maternity Mortgage, moderately exceeds Social Mortgage and significantly exceeds Military Mortgage; Maternity Mortgage slightly exceeds Social Mortgage and significantly exceeds Military Mortgage, and Social Mortgage significantly exceeds Military Mortgage.

The criterion of “Proportion of the Population in Need of Better Housing Conditions”. Family Mortgage in the proportion of the population experiencing problems is equally relevant to Maternity Mortgage, moderately exceeding in the proportion of the population experiencing a problem in Social Mortgage and as much as possible exceeding Military Mortgage; Maternity Mortgage moderately exceeds Social Mortgage and Military Mortgage significantly exceeds Social Mortgage and moderately exceeds the population in Military Mortgage.

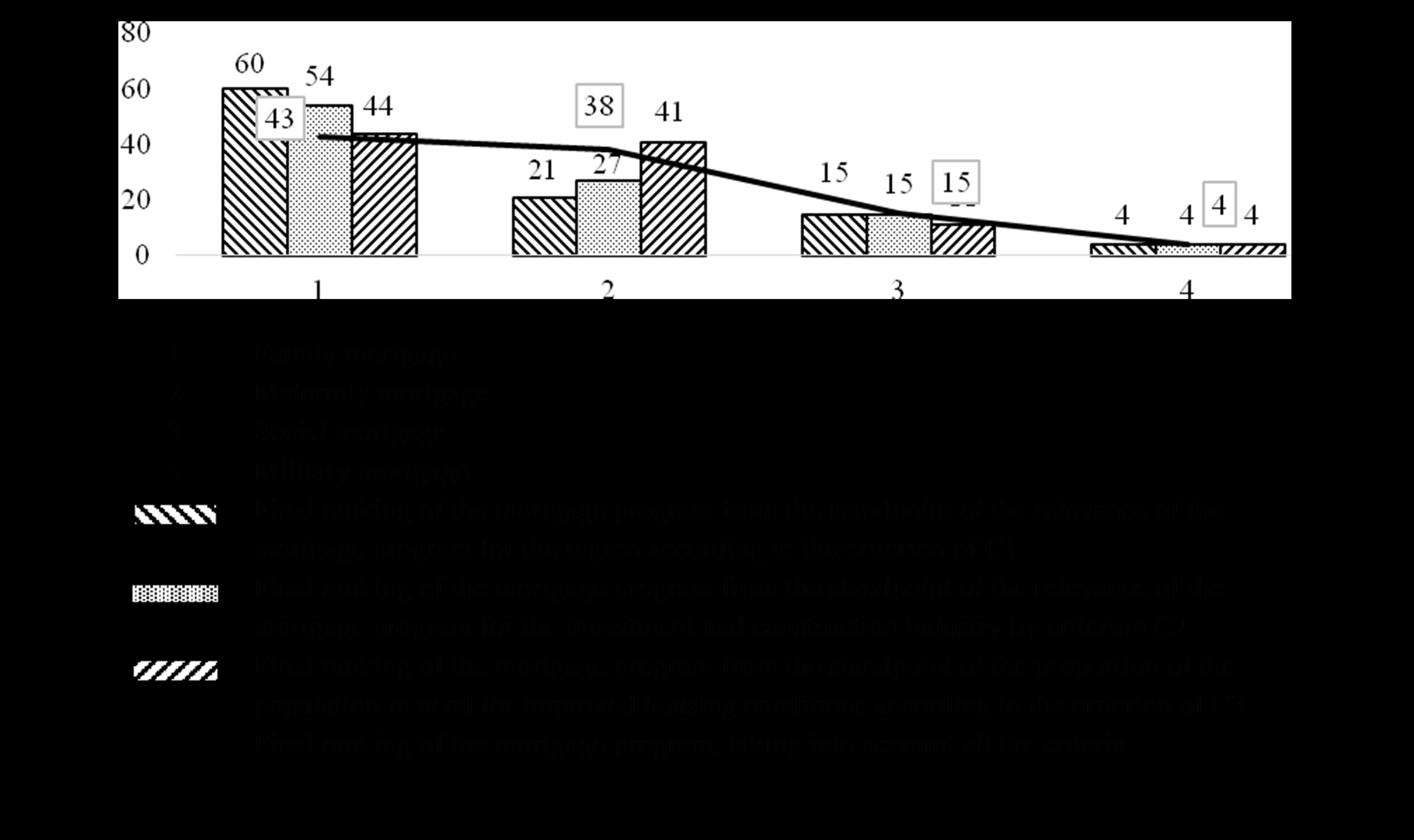

The final ranking of each program for all three criteria is presented in the form of a graph presented in Figure

In accordance with the schedule in Figure

Conclusion

In conclusion, it is worth noting that more and more authors are inclined to consider regional development strategies from the point of view of a region — a society, and not a region-market. In this regard, one can not disagree with the statements of Elsinga (Elsinga & Doling, 2012) and Grechishkina (2015) that at the regional level, there is often a constant imbalance between the target characteristics of strategies to improve the quality of life of the population and the increase in financial revenues to local budgets. That is why there is a need to improve the highest priority state mortgage programs with a focus on the needs of certain segments of the population.

To evaluate the programs for competitive selection it is possible to use two methods: the cumulative method and the method of analyzing hierarchies, the use of which allows comparing programs for each criterion directly with each other.

The proposed method of evaluating state mortgage programs from the standpoint of improving the quality of life of the population will allow the Ministry of Construction and Housing and Communal Services of the Russian Federation, as well as the Agency for Housing Mortgage Lending to distribute intergovernmental transfers to subjects of the Russian Federation more efficiently. The regions will be able to evaluate government programs in a short time, with the ability to adapt to new tasks in a rapidly changing external and internal environment.

References

- Aksenova, T.N. (2013). Adaptation of methodology of development and assessment of regional target programs as element socially – economic policy. Modern Problems of Science and Education, 5. URL: http://science-education.ru/ru/article/view?id=10457

- Akunina, O.M. (2015). Foreign experience of state regulation of reproduction of housing stock. Policy, state and pravo, 3. URL: http://politika.snauka.ru/2015/03/2521

- Chivers, J., & Flores, N.E. (2002). Market failure in information: the national flood insurance program. Land Economics, University of Wisconsin Press, 78 (4), 515-521.

- Ebrahim, M.S., Shackleton, M.B., & Wojakowski, R.M. (2011). Participating mortgages and the efficiency of financial intermediation. Journal of Banking & Finance, 35(11), 3042-3054.

- Elsinga, M.G., & Doling, J.F. (2012). Housing as Income in Old Age. International Journal of Housing Policy, 12 (1), 13-26.

- Grechishkina, E.A. (2015). Mechanism of social investment: regional aspect. Regional economy. South of Russia, 1(7), 14-21.

- Kaplan, R., & Norton, D. (2003). Balanced system of indicators. From strategy to action. Moscow: Olymp-business

- Kornilova, A.D., & Kirsanova, M.V. (2014). Real estate economics. Yelm, Yelm: Science Book Publishing House LLC

- Kosyakova, I.V., Gavrilova, M.A., Shepelev, V.M., Belikova, L.F., & Chistik, O.F. (2016). Assessment of entrepreneurial territorial attractiveness by the ranking method. International Journal of Environmental and Science Education, 14, 6866-6875.

- Kukarskaya, K.V. (2016) Socio-economic problems of a mortgage note. Problems of Social Work, 1 (5), 136-142.

- Malganova, I., & Ishmuratov, R. (2016). The influence of sectotal makeup of economy on its efficiency. Journal of Economics and Economic Education Research, 17, 21-26.

- Menshikova, G.A., & Pruyel, N.A. (2017). Bases of the public and municipal administration (Public Administration). Moskva: Yurayt publishing house

- Order of the Ministry of Finance of the Russian Federation (2018). «About methodical recommendations to territorial subjects of the Russian Federation and municipal units on regulation of the inter-budgetary relations». Retrieved from https://zakonbase.ru/content/part/390054. Accessed 08.08.18

- Resolution of the Government of the Russian Federation (2018). «About measures for the system development of mortgage housing lending in the Russian Federation». Retrieved from URL: http://www.vse-obipoteke.ru/normativnaja_baza_po_ipoteke/postanovlenie_28/. Accessed 08.08.18

- The federal target program “Dwelling” for 2015–2020. (2018). Retrieved from http://molodaja-semja.ru/wp-content/uploads/2016/09/molodaya-semya-na-2015-2020-gody.pdf. Accessed 08.08.18

- Viscusi, W. K., & Aldy, J. E. (2003). "The Value of a Statistical Life: A Critical Review of Market Estimates throughout the World. Journal of Risk and Uncertainty, 27 (1), 5-76.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Savoskina, E., Horina, I., Brazhnikov, M., & Alontseva, E. (2019). Evaluation Of State Mortgage Programs For Improving Life Quality Of The Population. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1586-1596). Future Academy. https://doi.org/10.15405/epsbs.2019.03.161