Abstract

The purpose of this article is to study the influence of the monetary policy of various countries on the growth of the gross domestic product in these countries. It has been established that government regulators use one of the three models of monetary policy: monetary; expansionary; combined. In the Russian Federation, a tight monetary policy is conducted, which comes down to reducing inflation, reducing budget spending while maintaining the ruble’s floating exchange rate and minimizing the budget deficit. It revealed a decline in real incomes of the population in Russia and it was established that, in terms of the average salary, Russia lags behind most European countries. It is concluded that inflation in Russia is caused by non-monetary factors: market pricing, which is formed by large monopolists; growth rates of natural monopolies; increase in interest rates on loans; devaluation of the ruble. It is established that after the global financial crisis of 2008-2009 many countries have significantly increased the monetization of their economies in order to neutralize the consequences of the negative effect of the influx of speculative money. For the growth of the Russian economy, it was proposed to use the budget mechanism and mechanisms available to the Central Bank: sources of financial resources as an emission center; reduction of the key rate to the level of the average profitability of the real sector; ensuring the growth of monetization of the economy through a multi-channel target emission mechanism for refinancing commercial banks.

Keywords: Monetary policygross domestic product (GDP)real sector of economyinterest rate

Introduction

Monetary policy of any state is always an integral part of government policy and serves as an instrument of macroeconomic regulation aimed at achieving a number of goals: intermediate (price stability, interest rates and exchange rates) and final (ensuring growth of gross domestic product (GDP), income and total employment). Monetary policy clearly defines the ranking of goals in different periods of economic development. At the same time, monetary policy targets are always money supply, determined by central banks, and the demand for money that has a credit and deposit nature (Boughton, 2001; Glazyev, 2015). As international experience shows, governments, central banks, financial institutions are regulators that constantly have a direct or indirect impact on the volume and structure of the money supply, choosing the appropriate tools: interest rates on loans and deposits; refinancing of commercial banks; reserve requirements for commercial banks; foreign exchange intervention; the establishment of indicators of money growth; conducting operations on the open market; determination of indicators of direct quantitative restrictions; bond issues of central banks and government. As a rule, central banks and governments around the world use one of the following models of monetary policy: the monetary (restriction) policy of “expensive money”; expansionary policy of “cheap money”; a combined model, when regulatory tools from another model are added to one of the models, which is used in a separate segment of economic development (Dimbylow, 2015). In the Russian Federation, tight monetary policy has been conducted over the past 25 years, which come down to reducing inflation, reducing budget spending while maintaining the ruble’s floating exchange rate as a part of its so-called internal conversion and minimizing the budget deficit. Therefore, it is reasonable to ask about the effectiveness of monetary policy, developed and implemented today by the Government of the Russian Federation and the Central Bank. In other words, it is necessary to analyze how adequate the selected tools are, and how often other countries use similar tools to regulate economic development processes.

Problem Statement

Today, Russia is conducted a tight monetary policy aimed at reducing inflation, cutting budget spending while maintaining the ruble’s floating exchange rate and minimizing the budget deficit. The use of monetary policy instruments, which allow money to be withdrawn from the economy, now ceases to justify itself. Consequently, there is a need to study the world experience and trends of the monetary policy of the state and its impact on the growth of GDP in order to apply them in Russia.

Research Questions

To achieve the goal of the study, the article reveals the following research questions: disclosure of the essence of monetary policy; study of the dynamics of GDP growth in Russia and other countries; analysis of real incomes of the population; analysis of the actions of governments around the world in times of crisis; justification of proposals for improving Russia's monetary policy.

Purpose of the Study

The purpose of the article is to study the influence of the monetary policy of various countries on the growth of the gross domestic product in the country.

Research Methods

To study the influence of the monetary policy of various countries on the growth of gross domestic product, as well as to study world experience and relevant trends of the modern world, the authors turn to general scientific research methods - the method of induction, deduction, synthesis and formalization. In conducting the study, the authors also use the methods of comparative analysis and processing of statistical information. The authors rely on the hypothesis that in modern conditions, a tough monetary policy implemented in Russia becomes ineffective.

Findings

First of all, we note that the need for a tight monetary and credit policy in Russia over the past 25 years has been predetermined by a number of circumstances that regulators have accepted as postulates: low inflation causes investment activity, primarily of foreign entities; investments should be predominantly foreign, because Russian investments will lead to inflation; approval of regulators about the need to reduce the money supply to ensure low inflation in the country. For this purpose, a reserve fund and a National Wealth Fund were created, through which free cash flowed out of the country, investing the economies of developed western countries (Ershov, 2015).

The study revealed that foreign investors often come to the Russian market with one goal - to remove a competitor from the market. A striking example is the scandal that broke out in summer 2017 with the delivery of four energy turbines to the Crimean electric power plant. A joint venture company of Siemens and “Silovye mashiny” of St. Petersburg, Siemens Gas Turbine Technologies, initiated a lawsuit against OAO and ООО “Tekhnopromexport” - the structures of “Rostekh” State Corporation (Glazyev, 2017). It bears reminding that the power turbines were produced by the Russian subsidiary “Silovye mashiny” of Siemens located in St. Petersburg. And during the Soviet era, an enterprise with the same name “Silovye mashiny” operated in Leningrad, which produced highly efficient gas turbines that had no competitors at the world market. In 90s the German investor of the Siemens concern came to the St. Petersburg to “Silovye mashiny” and quickly brought all the technologies from Russia to Germany, conquered the world market by Russian technologies. As a result, Russia gave development and technology, and in return received a ban on the purchase of these products.

Another striking example is the situation in the aircraft industry. During Soviet times, 46% of the world's passenger traffic was carried by aircraft manufactured in the USSR. In 90s American capital came to the Russian aircraft manufacturing market, as a result of which investment there was a withdrawal of aircraft production abroad. Today, Russia's share in world passenger transportation by domestic aircraft is less than 3%, and in Russia itself today, the aircraft fleet is 80% represented by foreign aircraft. Experts say that today “Boeing” consists of 70% of the components developed by Soviet and Russian designers. At the same time, economists considered that over 25 years Russia had received about $ 250 billion from selling oil, and if it had retained the status of a world power in the aircraft industry in that period of time it would have received more than $ 500 billion. Attracting foreign investment to Russian economy has become the main aim of Russian government over the past 25 years. What did this activity lead to? According to experts 70-80% of companies are registered outside of the Russian Federation. Accordingly, all profits of companies, income from the sale of securities remain also outside Russia.

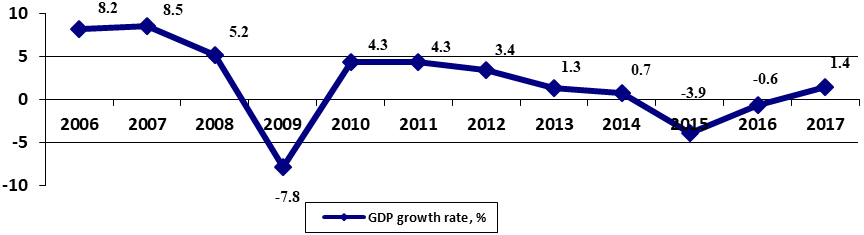

As the study showed, over the past ten years (2008–2017) the average annual GDP growth in Russia was 1%, and over the past six years (2012–2017) – it was 0.7% (Figure

Compiled by the authors on the basis of the data of Rosstat (URL: www.gks.ru) and the CIA (https://www.cia.gov/library/publications/the-world- factbook)

At the same time, the growth rates of GDP began to decline long before the economic sanctions from Western countries, although the Government of the Russian Federation and the Central Bank of Russia are trying to explain the causes of the crisis with sanctions.

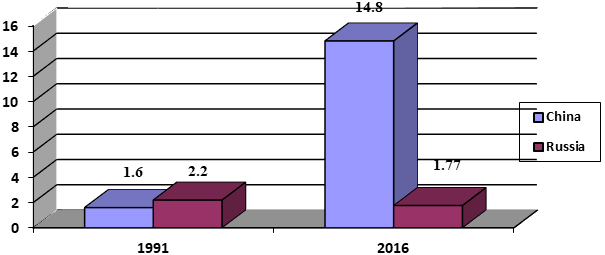

During the time GDP grew more than 8% per year, a barrel of oil cost more than $ 100 many Russian economists (Glazyev, 2015; Glazyev, 2017; Delyagin, 2017; Urnov, 2015) noted that at that time Russian economy showed statistical growth, but at the same time, there were no real structural changes and modernization in the economy. An economic model was created, when with high oil prices the economy showed growth and illusory well-being but without real economic development. This led to the fact that as soon as the cash flow from petrodollars began to decline, problems immediately arose in Russian economy and Russia's share in global GDP decreased. So, if in 1991 Russia's share in world GDP was 2.2%, then after 25 years in 2016 it was only 1.77% or 0.43% less (Figure

Built by the authors based on CTA (https://www.cia.gov/library/publications/the-world-factbook)

We should pay attention to the annual growth of world GDP. Thus, the global GDP for the last 8 years (2008-2016) grew by 30%, in the Russian Federation the GDP for 2008-2016 grew only by 4.3%. From 192 countries in the world, Russia takes 163

According to the IMF estimates, in 2016 Russia took 14th place in absolute terms of GDP, and in terms of per capita GDP, it took only 73rd place ($ 7,750). The country did not even hit the first fifty, and the Russians in 2016 became poorer by $ 1,300 per person (Official website of the International Monetary Fund). If GDP is considered at the exchange rate of currencies, then the Russian economy is already only in the second ten of the world economies and keeping 73 places among the countries of the world in terms of per capita GDP will be a serious and far from predictable success. Table

Thus, it is legitimate to assert that inflation in Russia is caused by non-monetary factors: pricing in the market, which is formed by large monopolists; growth of tariffs of natural monopolies for electricity, gas, rail transportation, utilities; rising interest rates on loans. And one can call another factor - the devaluation of the ruble (Simonov, 2015a). We note that today in Russia, the real sector of the economy receives loans at best at 12% per annum, and small business from 19%. For comparison, in Canada, the real economy is credited at 2-3% per annum.

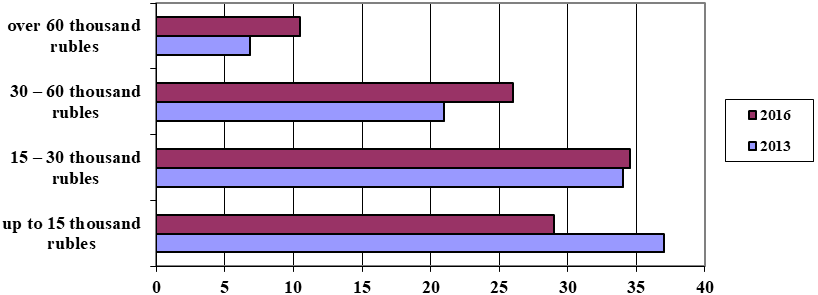

According to the Fitch Ratings agency, over the past four years (2014-2017), the incomes of Russian consumers have collectively declined by 11% (Russian consumer market in the context of global trends). Four years of decline in real disposable incomes of the population is a colossal failure, which is comparable to what was in 1992. If we talk about the structure of the population by income, then 65% of the population has incomes of up to 30 thousand rubles and only 10% of the population has incomes of more than 60 thousand rubles (Figure

Compiled by the authors according to Rosstat (URL: www.gks.ru)

Real incomes of the population continue to decline, so for 12 months of 2017 they decreased by 1.7% on an annualized basis. The fall in household income is the main problem of economic growth in Russia. In terms of average wages, Russia lags behind most countries in Western and Eastern Europe. For example, in Lithuania, the average salary with regard to PPP is 1.9 thousand dollars, in the Czech Republic - about 2.0 thousand dollars, in Spain - more than 3.1 thousand dollars (Rosstat, 2018)

The reduction in incomes of the population has become disastrous for small and medium-sized businesses, which is completely focused on the consumer and payment demand within the country. Low incomes of the population, high lending rates became the main obstacle to economic growth, as they restrain economic growth. The key rate of the Central Bank of the Russian Federation at 7.75% today exceeds the annual inflation by more than 3 times in 2017.

Today in the Russian Federation bankruptcy is rapidly growing among Russian citizens. The size of the debt of insolvent borrowers in 2017 reached 32 billion rubles. Half of Russian borrowers face difficulties in repaying loans. In 2017, more than 8.4 million Russian citizens delayed payment on loans for 90 or more days, which amounts to 11.2% of the economically active population of Russia (75 million people) (PRIME Economic Information Agency). If in the next 2-3 years the real incomes of Russian citizens will not grow, then by 2020 the number of bankruptcies can grow 4-5 times (Simonov, 2015b). It is impossible to call a positive situation with the bankruptcies of small and medium enterprises (SMEs). As of December 1, 2017, the absolute amount of overdue debt of SMEs (for 90 days) in the total amount of debt amounted to 14.7%.

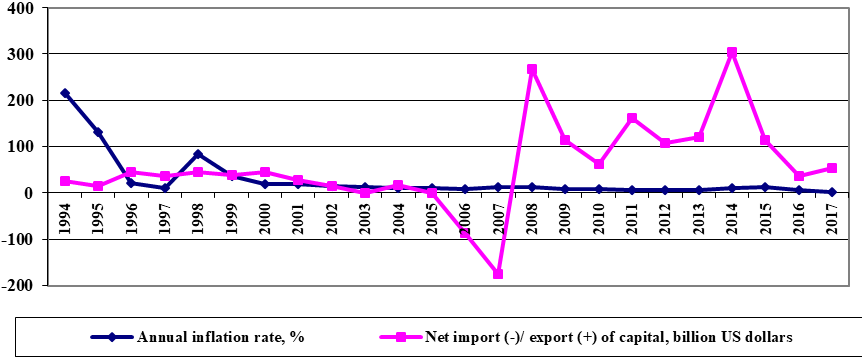

Now back to the statement that low inflation will provide a flow of foreign investment. For the analysis, we use two graphs (Figure

Compiled by the authors according to Rostat (URL: www.gks.ru); According to IMF (World Economic Outlook, 2017).

As can be seen, Figure

When deciding where to invest their money, each investor looks not only at the rate of inflation in the country of investment. At the same time, the investor considers all types of investment risks from falling demand for products, the possibility of competitors appearing, to seizing assets by the state and initiating criminal cases on seizing assets in favor of third parties (Trunin, Bozhechkova, & Kiyutsevskaya, 2015). For Russia, from this point of view, the picture is disappointing: the consumer market is shrinking, risks are rising, the return on capital is shrinking:

1) according to the results of the nine months of 2017, according to Rosstat, from all sectors of the economy, only the mining industry showed a significant increase in profits, since it is focused on the international market, all other activities (construction, trade, agriculture, processing industry, etc.) – show collapse of financial indicators;

2) real incomes of the population have been declining for four years already, both investment and consumer demand is in stagnation, there is a weak credit activity of enterprises due to the high cost of bank loans and the emerging crisis in the banking system, all this does not contribute to the growth of investment.

Experts of the “Center of Development” from HSE believe that in 2018 a new recession is possible in Russia (that is, zero growth or economic recession for at least six months). There is a clear downward trend in investment growth and a negative growth rate in the third quarter of 2017 compared to the previous quarter (minus 2.2%) and investment activity in the fourth quarter even became negative if we focus on the indicators of seasonality.

The decline in investment activity in 2017 even affected oil and gas production; for 9 months of 2017, the decrease was about 1%, in construction by the corresponding period of 2016 the decrease in investment was 6.1%. This decline occurred despite the construction of the largest infrastructure facilities - Kerch Bridge, football stadiums, airports and hotels for visitors to the World Cup in 2018. The demand for services of restaurants and hotels falls particularly sharply in the context of falling incomes of the population when the population switches to home-based meals and private accommodation, which makes the business low-profitable or unprofitable.

When analyzing the development trends of the Russian economy in 2018, some doubts should be expressed regarding the sustainability of its growth. It should be noted that in 2017 Rosstat obtained an increase in investment largely due to the increase in the volume of investments not observed by direct statistical methods, as well as carried out by small businesses. Rosstat estimated this kind of capital investment in the amount of 2.5 trillion rubles, which is about 25% of all capital investments (Rosstat, 2018). The slowdown in industry and other sectors of the economy calls into question the beginning of full-fledged GDP growth in Russia in 2018.

The main indicator characterizing the security of the national economy with money (liquid assets) is the coefficient of monetization of the economy - an indicator equal to the ratio of money supply (cash, cash in settlement accounts of enterprises, deposits of enterprises and the population in banks) to gross domestic product (GDP). The world average monetization of the economy is 125%, in Japan and the Netherlands – it is about 250%, in China, Switzerland and Spain – it is almost 200%, in the United Kingdom and France – it is 160%. Even Brazil has 81%, Bulgaria 82%, India 76%, and these figures are higher than in Russia. The monetization of the Russian economy today is on par with the monetization of such countries as: Paraguay (46%), Uruguay (45%) and Romania (43%).

After the global financial crisis of 2008-2009 many countries have significantly increased the monetization of their economies in order to neutralize the consequences of the negative effect of the influx of speculative money. These countries, increasing the amount of money in the economy and reducing their cost, thereby increasing the volume of investment and stimulate economic growth. So, in the USA, Japan, China and other countries, the monetary base from 2007-2015 increased from 4.6 to 3.2 times, in Russia during this time, the monetary base grew only 0.7 times, but during this period only due to inflation, the money supply decreased by almost 30%. In fact, it turns out that the money supply in Russia not only didn’t grow at a high pace but was reduced annually by 4-5%. In other words, it is impossible to achieve its growth by withdrawing money from the economy, and by tightening monetary policy during a slowdown in economic growth, it is possible to exacerbate such a difficult situation.

An analysis of the governments’ actions of 40 countries of the world in times of crisis, conducted as part of a study, showed that most “sensible” countries abandoned a tight monetary policy. We’ll give some examples.

Thus, the Ex-President of the USA B. Obama during the crisis of 2008-2009 did not reduce spending on health and education, but rather increased it. In 2009, the US Senate adopted a plan of anti-crisis measures, which included direct investment in health care and education, changes to the tax code, measures to deal with the crisis of the banking system, the housing market in the interests of the middle class and the poor. The Japanese government has introduced tax compensation to companies ($ 118 billion) and $ 5 trillion Yen ($ 54 billion) was sent to the population, small and medium businesses and regions, an emergency fund was created for companies that are not able to get a loan of $ 1 trillion yen (10 billion dollars). The Central Bank of Japan has reduced the discount rate from 0.5 to 0.3%. And the result was not long in coming. Japan emerged from the crisis without any economic and political turmoil (Sokolov & Tishina, 2015). In 2008, the German government adopted an anti-crisis plan for a period of two years in the amount of 500 billion euros. From July 1, 2009, the income tax was reduced from 15 to 14%, the contributions of working citizens to the health insurance scheme were also reduced from 15.5 to 14.5%, expenses for education were increased by 18 billion euros and unemployment benefits for citizens with children were increased. The Germans who want to buy a car, the government began to pay a lump sum of 2.5 thousand euros. During the crisis, the Danish Central Bank took unprecedented measures to revitalize the housing construction market, cut deposit rates to zero, and commercial banks offered their clients a negative mortgage rate during the crisis. In other words, the bank pays the client a bonus for taking a loan. In December 2008, the Central Bank of Canada reduced the refinancing rate to 0.1%, the lowest level since 1958.

As for Russia, monetary policy here will continue, at least in the next three - five years. This will lead to a constant decrease in budget revenues and expenditures according to the GDP created in the country, which is an undesirable tendency for several reasons: 1) this indicator characterizes the part of GDP accumulated in the state budget and the further development of the country's economy directly depends on this part of GDP ; 2) the amount of GDP going to the budget will determine the financing of such important areas as education, health care, social welfare, science and culture. We believe that if the ratio of federal budget revenues to GDP in the next three years remained at the level of 2011, then in the budget of 2018 revenues would be 3.6 trillion rubles higher than they were declared. Accordingly, revenues in 2019 would have increased by 4.4 trillion rubles, in 2020 - by 5.1 trillion rubles. And, while maintaining the same ratio between budget expenditures and GDP, as in 2011, budget expenditures would have been higher by 3 trillion rubles than they were announced for 2018, respectively, in 2019 - by 4.3 trillion rubles, in 2020 - by 5 trillion rubles.

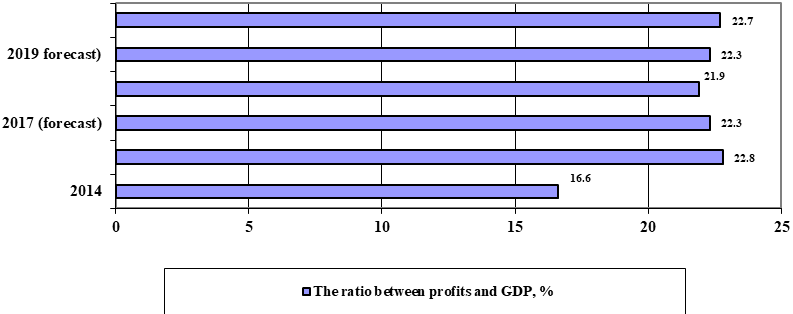

Considering the main macroeconomic indicators of the country's development, on the basis of which the budget of the Russian Federation is being formed, it should be noted that the share of total profits in GDP received by all economic entities of the country will increase in comparison with 2014 (Figure

Compiled by the authors based on data from the Official website of the International Monetary Fund (URL: https://www.imf.org/external/

A reasonable question arises, due to which there is a rapid decline in the share of the wage fund in the country's GDP in comparison with 2014? If it is expected that in 2020 the share of GDP profits will be 22.7%, versus 16.6% in 2014 and will grow by 6.1%, then for what reason will the share of the wage fund in GDP be almost 42% in 2020 lower in comparison with 2014?

And at last we will consider expenses of the federal budget according to 14 sections of the functional classification in 2017-2020. So, according to 8 out of 14 items, expenses are cut, according to five there is a slight increase (without considering the level of inflation). But in fact, considering the inflation factor of 4% (the Central Bank of Russia forecasts such inflation for the next 4 years) will lead to the fact that real expenditures for the national economy, health care, education, science will steadily decrease, and expenditures for financing physical culture and sports will decrease more than three times. As an example, we’ll consider health financing. In 2018, the government plans to allocate 460.3 billion rubles for health financing, which is more than in 2017 by 1.7%. Considering inflation at a rate of 4%, the real amount of health financing will decrease from 2% to 3%. In the budget for 2020, it is proposed to allocate 10% more funds to health care than in 2017, but according to the same forecasts of the Government of the Russian Federation, inflation over the next three years will be 12%. As a result, the real amount of health financing will be reduced by 1-2% Today, the share of health expenditure relative to GDP is 7%, and by 2020 it will drop to 6%.

The Central Bank of the Russian Federation, continuing the same monetary policy with its actions, has already cooled the interest of banks in the mortgage with a small fee, and the next step is the rise in consumer loans. Since 01.01.2018, the Central Bank of the Russian Federation has already decided to increase the coefficient of credit risk on mortgages and consumer loans, which will reduce access to loans for borrowers (Monetary Policy Report, 2018).

Without structural reforms, Russian economy will not be able to grow by more than 1.5% per year. It will take at least 50 years to double the GDP, and the forecasts of the Russian Government is that Russia's GDP will be 2.3% in 2020 are not realistic and are not supported by anything. In Russia today, we need a new economic policy, not stabilization measures to curb inflation, to strength the ruble and to reduce the expenditure side of the budget. This is evidenced by the world experience (Hartmann, 2008; Frankel, 2005), and the Russian practice.

In order to grow the economy, it is necessary to use both the budget mechanism and the mechanisms at the Central Bank’s disposal: sources of financial resources as an emission center; reduction of the key rate of the Central Bank to the level of average profitability in the real sector of the economy; ensuring the growth of monetization of the economy from 47% to 90% of GDP, using a multi-channel target emission mechanism for refinancing commercial banks and other development institutions under state obligations.

Almost 4 years of sanctions announced by Western countries led by the United States have shown that Russia has a huge scientific and industrial potential. First of all, it was proved by the Russian military-industrial complex. All this shows only one thing: in Russia these technologies were already developed and lay “dead weight”. It turned out that Western sanctions and money allocated for the state defense order were needed, and the result was not long in coming (Borsch, 2015). And how much talk was there that the sanctions imposed would not allow Russia to extract oil in the Arctic, as it turned out to be cut off from foreign technologies. But the past tense has put everything in its place. In November 2017, in the presence of Russian Prime Minister D.A. Medvedev near Khanty-Mansiysk the first industrial plant for the extraction of oil was launched, which used the new Russian technology. The absolute majority of units, assemblies, equipment, technological machines, which are used here, are made in Russia. All the equipment, which was launched under the Khanty-Mansiysk commissioning, meets the highest environmental requirements, which indicates a high innovative potential of the Russian oil and gas complex. Sberbank became the first financial institution in the world to receive a quantum communication setup that is ready for industrial operation. The similar systems of protection and communications are being developing today in the USA, China and the European states. All this suggests that the Russian Federation today has sufficient scientific, technological and industrial potential for sustained innovative development.

Conclusion

Thus, the conducted study confirmed the hypothesis that in modern conditions the tight monetary policy implemented in Russia has become ineffective, which is determined by: a decrease in GDP growth rates; the fall in real incomes of the population; lagging behind in terms of average wages from most European countries; influence of non-monetary factors. By taking money out of the economy, it is impossible to achieve its growth, and by tightening monetary policy during a slowdown in economic growth, it is possible to exacerbate a difficult situation. For the growth of the Russian economy, it is necessary to use the budget mechanism and mechanisms available to the Central Bank. First of all, we are talking about reducing the key rate to the level of the average profitability of the real sector and ensuring the growth of monetization of the economy through a multi-channel target-issue mechanism for refinancing commercial banks and other development institutions under state obligations.

References

- Borsch, L.M. (2015). The concept of institutional development of monetary hegemony through the prism of time. Volga scientific Bulletin, 8, 29-37.

- Boughton, J.M. (2001). Silent Revolution: the International Monetary Fund 1979–1989. Washington: International Monetary Fund. Retrieved from URL: https://www.imf.org/external/pubs/ft/history/2001/ch18.pdf.

- Dimbylow, O.E. (2015). The role of monetary policy of the Bank of Russia in the economic development of the state. Russian entrepreneurship, 16 (20), 3387-3398. https://dx.doi.org/10.18334 / rp.16.20.2009

- Ershov, M. (2015). Opportunities for growth in the conditions of currency dips in Russia and financial bubbles in the world. Economic issues, 12, 32-50.

- Frankel, J. (2005). Peg the Export Price Index: A Proposed Monetary Regime for Small Countries. Journal of Policy Modeling, 27(4), 495–508.

- Glazyev, S. (2015). Inflation Targeting. Economic issues, 9, 1-12.

- Glazyev, S.Yu. (2017). Economy of the future. Does Russia have a chance? Moscow: Book world.

- Hartmann, P. (2008). Currency Competition and Foreign Exchange Markets: The Dollar, the Yen and the Euro. Cambridge: Cambridge University Press

- Kulikov, N., & Kulikov, A. (2016). The economic and financial crisis in Russia: is it just a matter of sanctions? Humanities, socio-economic and social Sciences, 3, 134-142.

- Monetary Policy Report. (2018). September, №3 (23). Moscow: Bank Of Russia.

- Rosstat (2018). Consumer price indices for goods and services. Retrieved from: https://fedstat.ru/indicator/31074 Accessed 05.08.18

- Simonov, V. (2015a). Anti-Russian sanctions and systemic crisis of the world economy. Economic issues, 2, 49-68.

- Simonov, V.V. (2015b). The economy and banking system of Russia: some actual problems of anti-crisis policy. Money and credit, 7, 14-20.

- Sokolov, M.A., & Tishina, V.N. (2015). The impact of financial globalization processes on the national economy. Young Scientist, 6-5, 465-469.

- Trunin, P.V., Bozhechkova, A.V., & Kiyutsevskaya, A.M. (2015). What does the international experience of inflation targeting? Money and credit, 4, 61-67.

- Urnov, M.Yu. (2015). The economic crisis in Russia: causes, deployment mechanisms and possible consequences. Journal of the New economic Association, 2, 186-190.

- World Economic Outlook (2017). USA, Washington: International monetary fund.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kulikov, N., Molotkova, N., Menshchikova, V., & Kudryavtseva, Y. (2019). Monetary Policy Of The State And Its Impact On Gdp Growth. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1231-1242). Future Academy. https://doi.org/10.15405/epsbs.2019.03.125