Abstract

This work presents the study of currently important aspects of the banking system stability over the last years. Particular significance is attached to the issues of stability evaluation of credit and financial institutions acting as the banking capital agents within the framework of the economical system. Stability and reliability of the banks directly influence national economy development since the credit and financial mechanism determines dynamics and pace of the capital redistribution, ensures mobilization, accumulation and generation of money savings. Therefore, the authors developed and applied method of banking sector stability evaluation within macroeconomic aspect and dynamics. The main applied scientific principles were relative indicators, comparative analysis, coefficients and matrix model of the banking system stability in the national definition. The definitional term of the banking system stability is described as a comprehensive phenomenon including its quality characteristics. The work includes evaluation tools with the use of macroeconomic indicative figures that were applied for calculation of the dynamic macroeconomic stability of the banking system in its national definition. Pivotal indices characterizing macroeconomic stability of the banking system over a period of 2015-107 were reviewed. Analysis and evaluation of the indicative figures were based on the data revealing internal causes that act as principal conditions ensuring stable functioning of the banking system. There were found the core results of the banking system stability evaluation, general level was discovered. Primary factors of the internal aspect, that impacted the level of the Russian banking system macroeconomic stability, were identified.

Keywords: Banking systembanking system stabilityreliabilityevaluationanalysisindicators

Introduction

Development level, stability and security of the banking sector are important indicators characterizing operations of the credit and financial institutions at the present stage which enables a more effective approach to the assessment of risks and financial challenges. Academic and economic community is focused on the search of ways and means to stop local crisis developments or put an end to their transformation into the global crisis (Murashov & Strizhkova, 2012). Timely performed analysis of the banking system stability, identification of systemic risks, financial condition analysis of the systematically important banks enables quicker handling of coming threats and detailed forecast of future trends of the national economy development.

The following authors studied approaches to evaluation of the banking system stability and issues of the stability provision at the macroeconomic level: Afanasyeva (2016), Semenyuta, Danchenko, & Panchenko (2014), Ovchinnikova (2014), Khasyanova (2012). Stability of the regional banking system at the regional level was studied by Bibikova, & Valinurova (2017), Mozhanova, & Antonyuk (2014) and others.

Conducted study of the conceptual approaches to the definitional term of the “banking system stability” allowed stating the following definition of the banking system stability – it is such a state wherein the system is able to stand against the detrimental effect of various internal and external factors, re-build this state in case of deviations from secure characteristics and parameters as well as to dynamically develop while properly and efficiently serving its purpose and functions in the economy considering specifics of the social and economic environment (Tavbulatova, & Tashtamirov, 2017)..

Problem Statement

So far, national science doesn’t have a unified approach to the evaluation of the banking system stability. Some authors consider the aspects of the banking system stability characterizing micro-level of certain banks or bank group which is due to determination of the credit organization’s ability to fulfill the central bank’s standards on the credit rating and liquidity (Murati, 2012). Thus, determination of the stability level is based on indicators and standards of the banks representing successfulness of the internal financial management but not considering the macro level. Other researchers focus on the banking system ability to recover its stable state after being affected by exo- and endo-level factors (Ovchinnikova & Bets, 2006). Hence, determination of the stability comes down to evaluation of the banking system stability indicators as opposed to the pre-crisis level.

Some studies also contain determination of the banking system stability through assessment of the certain banks’ ability to protect interests of their shareholders and discharge their liabilities to the depositors. Such an approach comes down to determination of micro-stability of a certain credit organization and cannot characterize its level for the whole banking system. Especially since this determination is more of a customer-focused nature.

In terms of the macroprudential analysis, one should take a more comprehensive approach to the banking system stability evaluation. In this case it is important to consider the metrics used internationally. For example, the International Monetary Fund developed the metrics of financial stability of credit organizations which enable the most holistic evaluation of a bank’s stability and reliability. This method is used by the Central Bank of Russia (Borio, 2003).

It is important to distinguish between the two terms: banking system stability and stability of credit organizations (Afanasyeva, 2015). The aforementioned authors focus their studies on evaluation of the stability of certain banks’ operations. Priority of this work is determination of methods and tools required for evaluation of the banking system stability in its macroeconomic aspect.

Research Questions

To cover the aforementioned study subject, it is necessary to set up the primary tasks:

1. To establish the top-priority set of indicative figures for their implementation in the method of the banking system stability evaluation in the interconnection with the monetary system development;

2. To analyze appropriate indicators of the monetary and banking systems state and development over the last years;

3. To identify main challenges on the way of achieving sustainable development of the systems;

4. To create banking system stability matrix based on the results of the indicators.

Purpose of the Study

The purpose of the study is to evaluate current banking system stability level using the indicative approach for a more comprehensive detection of prevailing problems in banking sector development.

Research Methods

To evaluate stability level of the system of the interrelated components in the interconnection with the larger-scale super-system, it is important to choose methods and tools pointwise.

Since the study considers banking system stability in its macro aspect, it is appropriate to evaluate stability level applying indicators characterizing internal and external factors. For instance, O.N. Afanasyeva suggests determining banking system stability from the perspective of macroeconomic indicative criteria related to currency circulation, foreign currency predominance and loan portfolio (Afanasyeva, 2016). This approach is deemed to be reasonable, however, a certain modification shall be performed within the framework of this study.

To carry out the study, it is suggested to use the tools listed in the Table

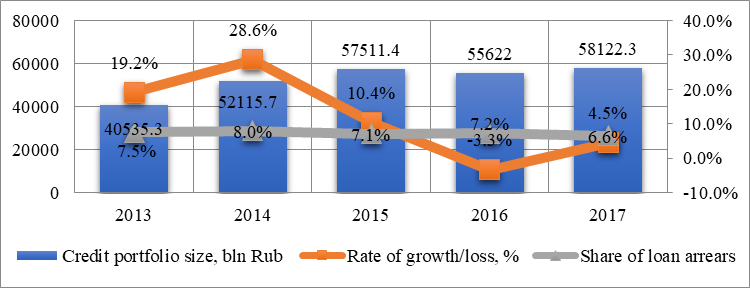

Important indicator, characterizing state of the banking sector assets, is the state of its credit portfolio.

According to the data in the Figure

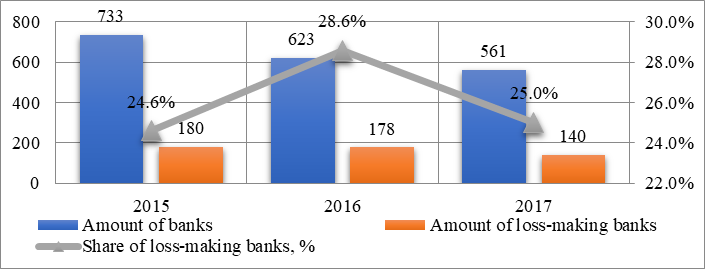

Besides, banking system stability evaluation includes application of the structural indicators. Important indicator, characterizing systematic financial stability of the country’s banking system, is the amount of credit organizations, their dynamics, amount of unprofitable credit organizations and their share in the general system.

Data in the Figure

In this particular case, one can observe the second scenario since reduction of the number of banks leads to the increased share of unprofitable credit organizations, which was 25% in 2017. Hence, a fourth of the country’s banks is currently making loss. To determine the threshold values, it is necessary to find the lowest value of profitability of the banks in the system considering Russian practice. When examining the retrospective, the lowest value of the banking system unprofitability during the post-crisis period was 5,1% in 2011, there was also the lowest aggregate loss this year. Therefore, high stability can be characterized with the value lower than 5%, average – 5-15% and low one – higher than 15%.

Findings

Application of the suggested banking system stability evaluation method resulted in analysis of the main indicators given in the Table

Conclusion

Following on from the conducted study on evaluation of modern dynamic macroeconomic stability of the banking system, one can sum up that stability level value of the Russian banking system is low but with the opportunity of reaching the mean values. Evaluation showed that most of the indexes have a low level, 7 values out of 11 follow a downward trend. Others show a slight growth. Money stock structure, money velocity, foreign currency predominance coefficient and money stock growth outrunning consumer price index can be one of the risks causing instability in the banking business which is hereto related to the depreciation shock recurrence and possible upturn in inflation in the future. Reduction of operating enterprises, worsening of their financial situation and deceleration of crediting of the legal bodies can lead to the credit exposure growth, which directly impacts financial stability of the banking system. Besides, a great deal of unprofitable banks, decrease of credit interest rates and deposits ratio, reduction of credit organizations, loss of liquidity, increase of the cash gap among the 10 largest banks can affect stability of the banking sector in the most negative way and have a domino effect in the banking business.

The factors indicative of improvement of the banking system stability are slight growth in reduction of loss-making banks, lending growth and decrease of arrears.

Provided analysis characterizes stability level from the macro-approach perspective and more detailed evaluation of the banking sector stability and reliability requires a broader analysis tools considering institutional characteristics and indicative figures of the economy’s banking services security.

Acknowledgments

The study is conducted under the grant of the Russian Foundation for Basic Research No. 18-410-200002.

References

- Afanasyeva, O.N. (2015). Criteria and Indicators of Stability, Balance and Reliability of the Banking System Banking Business, 8, 35-39

- Afanasyeva, O.N. (2016). Method of Banking System Stability Determination. Banking Business, 1, 11-16.

- Borio, C. (2003). Towards a Macroprudential Framework for Financial Supervision and Regulation, BIS Working Paper, 128, Basel: Bank for International Settlements.

- Bibikova, Ye.A., Valinurova, A.A. (2017). Method of Evaluation of the Regional Banking System Financial Stability. Finances and credits, 20, 23, 1154–1172.Mozhanova, I.I., Antonyuk, O.A. (2014) Financial Stability of the Banking System as a Factor of Its Development in a Region. Banking Business, 1, 25-29.

- Khasyanova, КR.Yu. (2012). On System of Banking Sector Stability Evaluation. Money and Credit, 12, 24-28.

- Murashov, S., Strizhkova, L. (2012). Liquidity Model of the Banking System. Economist, 11, 80-85

- Murati, A.I. (2012). Evaluation and Stabilization of Banks Based on the Reference Parameters of Their Operations (Dissertation for candidate degree). Retrieved from: https://www.rsl.ru/

- Ovchinnikova, O.P., Bets, A.Yu. (2006). Main Directions of Dynamic Stabilization of Banking System. Finances and credits. No. 22.

- Ovchinnikova, O.P., Ovchinnikova, N.E. (2014). Systemic Financial Crisis and Its Impact on Banking System Stability. Finances and credits, 7, 16-24.

- Semenyuta, O.G., Danchenko, Ye.A., Panchenko, N.O. (2014). Banking Market as a Banking System Stability Factor. Finances and Credits, 22 (578), 2-9.

- Tavbulatova, Z.K., Tashtamirov, M.R. (2017). Stability of the National Economy Banking System: Definitial Determination and Conceptual Approaches, Scholarly Notes of Crimean Engineering and Pedagogical University, 4 (58), 92-99.

- Tashtamirov, M.R., Tavbulatova, Z.K., Galazova, S.S., Abayev, R.M. (2017). Current Iinstability in the Monetary and Credit System of Russia. Journal of Applied Economic Sciences, 12. 1 (47), 303-311.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Tavbulatova, Z., Tashtamirov, M., Aleshin, V. A., Yushayeva, R., & Mazhayeva, E. (2019). Banking Sector Stability Evaluation Method: Trends And Problems. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 1735-1741). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.202