Abstract

The study focuses on the development of small to medium enterprises (SMEs) in Russia. The role of SMEs for the socio-economic development of the country as a whole and its regions is determined. The current state and the main problems of SME development are considered. A comparative analysis of SMEs in Russia and abroad showed a serious lag of Russia in the development of SMEs. The study showed that despite some positive steps taken to address the problem, the development of small and medium businesses is still too slow. A huge tax burden, corruption, administrative barriers, lack of credit and some other factors hinder the development of this most important sector of the economy. The study proposes the main strategies to solve the problems of SME development in Russia and its regions. As evidenced by the experience of other countries, the most important trend for SME development is its participation in mechanisms that imply the use of public private partnerships. It also highlighted that the tool of public private partnership can solve problems through various mechanisms of involvement of SMEs in projects on mutually beneficial terms. Implementation of these goals will help develop SMEs to create a highly efficient and competitive economy in Russia and its regions.

Keywords: Small and medium businessessmall innovative enterprisepublic-private partnershipconcessionmunicipal-private partnershipregional economy

Introduction

The consistent implementation of structural reforms in the economy, improved management of market processes at all levels of government and creation of favorable environment for business development are essential for sustainable economic growth in society.

The history of entrepreneurship goes back to the period from the Middle Ages to the mid-19th century and shows the evolution of business forms from simple trade and mediation to the predominant form of economy. The history of entrepreneurship is closely associated with the names of such economists as (Higgs & Cantillon, 1959), (Say, 1803), (Smith, 2006), (Ricardo, 1908), (Clark, 2011), (Schumpeter, 1995), and (Hayek, 2006).

The most appropriate and reliable assessment of entrepreneurship was proposed by J. Schumpeter. Schumpeter (1995) believed that entrepreneurship completely violates the previous forms of production and organization of society and becomes a pioneer of the socio-political revolution. According to his theory, an entrepreneur is constantly in the process of "creative destruction", being a significant figure in the economic development of society.

Small business is currently becoming a significant economic and social phenomenon that has a diverse and growing impact on all aspects of Russian society. Its willingness to instantly respond to any changes in market conditions leads to relatively high dynamics and ability to timely change business profile in order to find more profitable areas for capital allocation and to ensure sustainable competition (Volkova & Popova, 2016).

In the regional economy, entrepreneurship should be developed not only in terms of profitability, but also in terms of the solution of main social problems of the region. For example, the creation of new jobs is especially important for recreational areas that depend on market conditions. Kabardino-Balkaria is one of the regions where the development of the tourist and recreation complex (TRC) is a priority for its development. Therefore, the study of the state of small business in the region, its impact on economic development and the main trends of its development is one of the key research questions.

Problem Statement

The role of SMEs in society is enormous. They are expected to create jobs and provide incomes for the majority of people, in many aspects to impact the level of the socio-economic situation of the country as a whole and its regions. The development of SMEs increases competition in economics, which in turn leads to an increase in the quality of goods and services. Titov (2018) highlights another advantage of SMEs – innovation. He notes that turnover growth in high-tech innovative enterprises will ensure the growth of the tax basis, create new high-paying jobs, and solve social problems. However, Russia needs a completely different economic policy. It implies affordable loans and reasonable tariffs, removal of administrative and criminal pressure on businesses, and ensuring a fair trial. The study conducted in the United States shows that the number of patents per employee in SMEs is 16 times more than that in large businesses. Russia has not realized an enormous potential for the development of the SME sector in both the country as a whole and its regions. Hence, the problem of studying Russian SMEs is one of the most urgent problems of modern science in Russia.

Research Questions

The study aims to identify the level of SME development in Russia. A comparative description of the development of SMEs in Russia and in foreign countries is performed. The main factors that hinder the development of SMEs in Russia are identified. The experience of SME development in foreign countries is considered. The necessity of using public private partnership (PPP) for SME development, in particular, in the region, is validated.

Purpose of the Study

The purpose of the study is to determine the main strategies for SME development in Russia and its regions:

1. Adoption of experience of foreign countries for the development of SMEs;

2. Improvement of tax legislation;

3. Removal of administrative barriers;

4. Improvement of credit policy;

5. Development of partnership between public and private sectors as a tool for SME development.

Research Methods

The research employed the following methods. Analysis and synthesis, where analysis is a method of study, a logical technique, when the researcher makes a mental disintegration of the object or subject investigated. The analyzed issues were the share of SMEs in the gross domestic product (GDP), the SME share of total employment, the number of SMEs per 1,000 people, etc. Then, synthesis was performed to determine the level of SME development in Russia and in foreign countries. The study also employed a statistical method. The SME development was considered in dynamics. A systematic approach was used to consider SMEs as a holistic concept that consists of different elements in the totality of relations and connections between them. Historical, logical and graphical methods were used as well. To identify the main problems hindering business development, a survey was conducted among Russian businessmen. They were asked to highlight the main hindrances to SME development in Russia. The employers submitted 18 thousand questionnaires.

Findings

The state took steps to support SMEs in 2009, when the annual state support attained 18.5 billion rubles. In 2008, the share of SMEs in the GDP of the country was about 13%, and in 2014 it exhibited a 1.5-fold increase and amounted to 21%. In 2008, the support allocated by federal budget funds to SMEs (billion rubles) amounted to 13.9; in 2009 – 18.6; in 2010 – 17.8; in 2011 – 17.8; in 2012 – 20.8; in 2013 – 19.9; in 2014 –23.0 (Putin, 2016a)

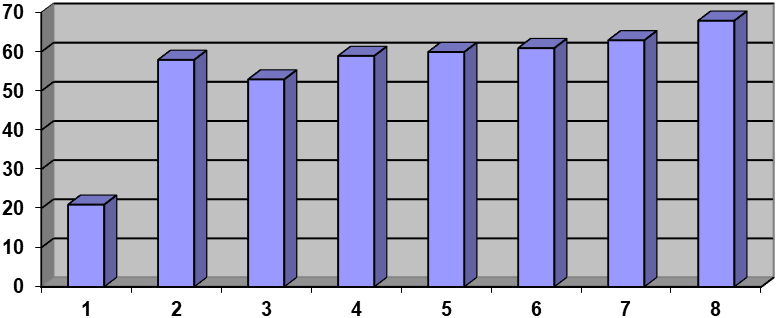

What is the current state of SMEs in Russia? The development of SMEs in Russia seriously lags behind European countries. In Italy, SMEs occupy a leading position as the biggest contributor to the GDP of the country. In this country, SMEs contribution to GDP attains 68%, in the Netherlands, it equals 63%, in Norway, it attains 61%, in England, it amounts to more than 50 %, and in Russia this indicator is 21% only. (Table

The data summarized in Table 0.1 can be represented as a graph (Fig. 1).

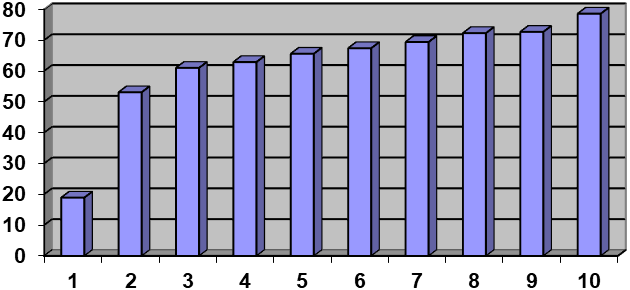

Russia lags behind other countries in terms of employment in SMEs. As can be seen from the table, the largest share of employment in this sector is observed in Italy (78.6%). High indicators are also observed in the Czech Republic, Belgium, Turkey, and Spain (Table

In Russia, the share of employment in SMEs is only 18.9 %.

The data presented in Table

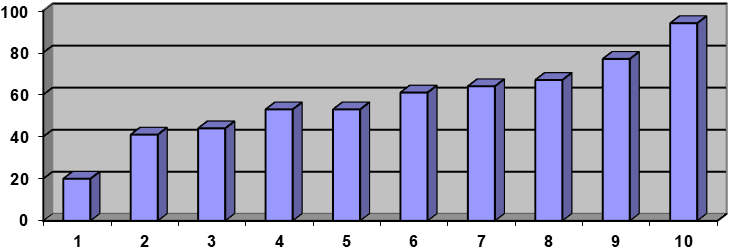

For example, England, the United States and Malaysia exhibit lower indicators. However, it seems paradoxical that despite a smaller number of entrepreneurs per 1,000 people, the share of SMEs in GDP is

much higher in these countries, which indicates a low efficiency of SMEs in Russia (Putin, 2016b)

The data presented in Table

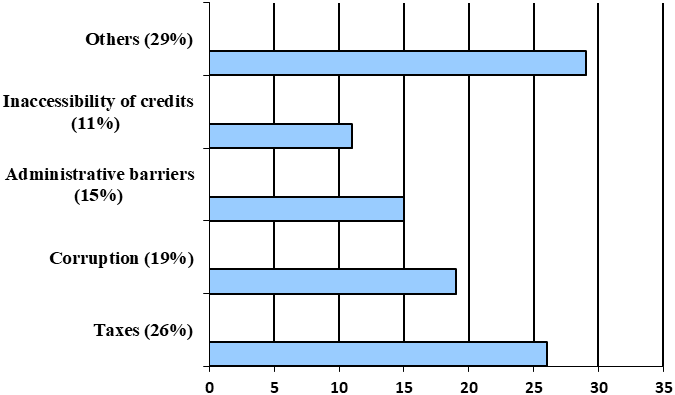

A survey was conducted among Russian businessmen. They were asked about the main hindrances to the development of SMEs in Russia. According to entrepreneurs (18 thousand questionnaires were received from employers), the main hindrance to SME development is a huge tax burden. But this is not the only hindrance. The respondents also noted corruption, administrative barriers, lack of credit, and some other factors as serious hindrances (Fig. 4) (Starostina, 2016)].

Economic factors such as rising expenses, decreasing demand, and economic uncertainty are among the main problems encountered by SMEs.

Interest rates remain prohibitive. At the beginning of 2018, the real interest rate for a period over 1 year for Russian SMEs was not less than 7%. As a result, the volume of loans issued in 2017, even in nominal terms, did not return to the values of 2014 and to those of 2013. The tax burden remains extremely high. The current tax policy does not stimulate business development and confines itself to performing a fiscal function.

The payroll tax burden in Russia is 2.3 times higher than the world average value. The level of tax burden in Russia does not correspond to the level of labor productivity, which is significantly lower than that in developed countries.

The burden for SMEs is higher than that for large businesses. This hinders development of the SME sector, does not facilitate its growth and causes its split-up and shift to the underground economy. The inefficiency of the tariff setting system for services of natural monopolies primarily affects SMEs.

The problem of criminal pressure on business has not been resolved. 61.6% of the respondents believe that the situation with the protection of the rights and legitimate interests of entrepreneurs in the country over the past two years has worsened or remained the same. 51.5% of the respondents do not trust law enforcement agencies.

The level of administrative burden does not reduce. 83.5% of the respondents believe that over the past year the administrative pressure on their business increased or remained the same. 52% of the entrepreneurs underwent from 1 to 6 inspections, and 5.6% of the respondents had more than 6 inspections.

One of the most systematic and effective support programs of the Ministry of Economic Development for SMEs is constantly shrinking. In 2015, the total amount of support for 85 regions of the Russian Federation was 16.9 billion rubles, however in 2018, it reduced to 5.02 billion rubles. It should be noted that this program finances the most important projects in the regions – innovation infrastructure development (Titov, 2018).

The general conclusion is that business problems do not change, but their priority values become different. Earlier the focus was on business climate, but during the crisis financial resources came to the fore, and the business climate was secondary problem.

The President of the Russian Federation Vladimir Putin called for developing a strategy to support SMEs. The measures aimed at supporting SMEs include available financing (stimulation of bank crediting, development of the guarantee scheme), development of predictable fiscal policies (including easing of business fiscal burden), staff training, and creation of new market places (including demand stimulation).

Partnership between the public and private sectors as a tool for SME development

As can be seen, all the above measures suggest a quantitative increase in SMEs, which, in turn, is hardly possible without investment programs.

Undoubtedly, PPP as a new phenomenon cannot be neglected, since SMEs have not yet found their place in this management system (Kabashkin, 2010).

Vladimir Putin spoke about this important issue in February 2016 at a meeting with leaders of the informal association of SMEs from different sectors of the Russian economy. The President stressed the need for SMEs to participate in work through the PPP mechanisms (Putin, 2016b).

Certain measures to maintain PPP are being taken in the regions of Russia. At present, the government of the Republic of Kabardino-Balkaria has taken several steps to develop PPP. This is evidenced by a number of documents developed and adopted in the region (Ministry of Economic Development of Kabardino-Balkaria, 2016). Table 0.4 presents the list of objects for which it is planned to conclude the PPP agreement. However, in the Republic of Kabardino-Balkaria and in most Russian regions, the projects that can employ the PPP model are mainly big and expensive and can only be implemented by large enterprises. Obviously, these circumstances contribute to the fact that Russian SMEs are not sufficiently involved in the PPP mechanisms.

However, the republic provides great opportunities for the development and involvement of SMEs into the PPP projects implementation (Tatuev, Kiseleva, Kurshaeva, Nagoev, & Vilisova, 2017).

So, the analysis of the tourist and recreational complex of the republic showed that there are some problems which can be solved with the help of SMEs:

The analysis of the infrastructure in the republic showed that the communal infrastructure is still in poor condition, which is evidenced by the lack of roads and bridges, ski slopes, accommodation facilities, catering and entertainment infrastructure, sports facilities, as well as meager engineering and environmental protection. The network of fast-food enterprises and trade and consumer services is poorly developed. There is a poor network between the tourist infrastructure and other sectors of the republic economy (Tappaskhanova, Mustafayeva, Tokmakova, & Kudasheva, 2015).

There is a niche for SMEs in the field of innovative development of tourism. New tourist directions that can be developed in the Republic of Kabardino-Balkaria include:

Thus, it is necessary to create the infrastructure that would provide support services for tourists; to create a system of material incentives for managers and professionals who work effectively in the field of ecotourism; to develop excursion eco-programs for various categories of visitors; to equip ecological paths and routes and to develop and implement a system of their certification; to modernize existing museums of nature and create new museums and information centers in specially protected areas; to establish partnerships between nature reserves, national and natural parks of the republic with ecotourism companies in Russia and foreign countries interested in the development of ecotourism. No doubt, all this will contribute to attracting eco-tourists (Ligidov, Tappaskhanova, Mustafayeva, & Kudasheva, 2015).

In modern conditions of globalization and stiff competition, the issues of rational use of resources and their development on the basis of innovative approaches become topical. One of these issues is the development of new tourist destinations.

SMEs face a host of obstacles in navigation the challenges. In our opinion, one of the effective tools for providing an appropriate investment climate in the region is the creation of an investment agency in the form of PPP. A positive effect of its application can be mutual: the government initiates significant projects with maximum benefits for the budget, whereas the private sector diversifies the business ensuring a long-term income.

In the Ministry of Economic Development of Kabardino-Balkaria, the development of a high-quality and well-developed catalog of investment prospects for SMEs should be followed by search for a private investor for the project, development of mechanisms for the state participation and interaction with a private investor, and identification of benefits of participation in the project. The PPP tool can contribute to the solution of these problems through various mechanisms of SME participation in the project on mutually beneficial terms.

It should be noted that projects that can employ PPP models do not necessarily big ones. Worldwide, 90% of the projects employing PPP are those implemented locally in the SME sector. The problems of creating social, communal and even industrial infrastructure can be solved by SMEs.

Some reports indicate that PPP is not a prerogative of large enterprises only. The reports of the upper chamber of the German Parliament published in 2006 stated that SMEs accounted for half of 46 national PPP projects amounting to 10 million euro (SMEs actively participate in land construction in Germany) (Norekyan, 2010).

An increase in budgetary discipline is additional powerful argument of the PPP employment is an. Put simply, PPP prevents stealing (or, as we say, budget disbursement). Due to this factor only, the projects employing PPP in Russia can be much more profitable (Safin, 2016).

Conclusion

Thus, SMEs facilitate the growth of the Russian economy which is based on the modern infrastructure and innovative framework. The main strategies for SME development are reported in various programs of federal and regional significance. However, the development of SMEs is hindered by the lack of funding and needs an effective legal and regulatory framework. In addition, SMEs must be involved in different PPP projects. The use of various forms of partnership in different sectors of economy will be a major breakthrough in the enhancement of the economy of the country and its regions.

The president of Russia stressed that the authorities of all levels should provide the basis for the development of attractive, affordable and prestigious business. To do this, it is crucial to ensure equal conditions for all entrepreneurs, to develop stable and understandable rules and laws, to guarantee fair and open competition, and to eliminate "protection racket" and imposed services. A favorable business environment in the regions is a key factor for successful development of SMEs in Russia.

Putin (2017) noted that the main objective is to make people feel free, to help them realize themselves and to support their strive for more comfortable life and their wish to contribute to the common good. An entrepreneur should not live in constant expectation for another checkup and be afraid of penalties that can be imposed on his actions.

References

- Clark, B. R. (2011). Creation of entrepreneurial universities: organizational transformation paths. Moscow, State University Publishing House.

- Hayek, F. (2006). Law, Legislation and Freedom. Modern understanding of liberal principles of justice and politics. Moscow, IRISEN.

- Higgs, H., Cantillon, R. (1959). Essai sur la Nature du Commerce en Général (French and English). London Frank Cass and Company LTD.

- Kabashkin, V.A. (2010). Public Private Partnership: International Experience and Russian Perspectives, Moscow: Intern. Innovation Center.

- Ligidov, R., Tappaskhanova, E. O., Mustafayeva, Z. A., Kudasheva, M. Z. (2015). Innovative development of the tourist and recreational complex of the region, 4, 201.

- Norekyan, M.S. (2010). Small and Medium Businesses from the Perspective of Public Private Partnership Society. Environment. Development (Terra Humana), 4, 30–32.

- Ministry of Economic Development of Kabardino-Balkaria (2016). Order of the Ministry of Economic Development of Kabardino-Balkaria, January 15, 2016 No. 8/1 "On approval of the list of objects (projects) for which it is planned to conclude concession agreements and public private partnership agreements, public private partnership" Retrieved from: http://www.kbr-invest.ru/sites/default/files/basic_pages_files/prikaz/

- Nagoev, A.B., Rokotyanskaya, V.V., Batova, B.Z., Bischekova, F.R., Hokonova, M.Z. (2018). Mobilization of investment and investment resources for environmental management in the regions of RF. Environmental Quality Management, 4, 47–54.

- Putin, V.V. (2016a). It is necessary to create a methodology for interaction between government and business in the field of PPP. Retrieved from: http://allmedia.ru/newsitem_.

- Putin, V.V. (2016b). By 2020, the share of small business in GDP will have exhibited a 2.5-fold increase. Retrieved from: http://360tv.ru> news / vladimir-putin ... dolja-v-vvp. .. 25 ... 18240 /

- Putin, V.V. (2017). Business should become attractive, affordable and prestigious. Retrieved from: https://www.1tv.ru/news/2015-04-07/22851-

- vladimir_putin_zanyatie_biznesom_dolzhno_stat_privlekatelnym_dostupnym_i_prestizhnym /

- Ricardo, D. (1908). The beginnings of political economy and taxation. Leningrad: Per. Obraz. Tip. Publishing House.

- Safin, R.A. (2016) Public private partnership as a tool for the development of small and medium businesses. Retrieved from: http://helion-ltd.ru/state-partnership/.

- Say, J.-B. (1803) Traité d’économie politique, ou Simple exposition de la manière dont se forment, se distribuent, et se consomment les richesses. Paris: de l’Impr. de Crapelet: chez Deterville.

- Schumpeter, Y.A. (1995). Capitalism, Socialism and Democracy. Moscow, Economy.

- Smith, A. (2016). Study on the nature and causes of the common good. Moscow, Eksmo.

- Starostina, Y. (2015). Small business named four main problems. Retrieved from: https://www.rbc.ru/economics/02/11/2018/5bdaf0159a79475b517b04ed.

- Tappaskhanova, E.O., Mustafayeva, Z.A., Tokmakova, R.A., Kudasheva, M.Z. (2015). Development of the tourist-recreational complex of the region, Economy of the region, 2, 208–220.

- Tatuev, A.A., Kiseleva, N.N., Kurshaeva, F.M., Nagoev, A.B., Vilisova, M.L. (2017). International Competition Rate. The Turkish Online Journal of Design Art and Communication, S-APRLSPCL, 363–371.

- Titov, B. (2018). Sector of small and medium enterprises: Russia and the World.

- Volkova, I.I., Popova, A.Yu. (2016). Modern problems of small and medium businesses in Russia. Concept, 04, 6–10.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Tappaskhanova, E., Tokmakova, R., Mustafayeva, Z., Shadova, Z., & Zumakulova, Z. (2019). Small Business As A Priority For The Development Of The Russian Economy. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 1723-1734). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.201