Abstract

Consumer’s activation and the population’s investment demand is the most important tool of the state policy for economic stimulation. However, the choice of priorities to implement such policies and the correlation of consumer and financial activity is a rather complex and widely discussed task. This is due to the fact that the effectiveness to increase final demand and investment growth is largely determined not only by economic, social, political and cultural factors, but also by the national characteristics of consumer behavior. The article analyzes the dynamics of the Russian population’s consumer and financial activity and it makes conclusions about the peculiarities of consumer behavior in Russia. Different behavior determines the need for various approaches to manage consumer and financial activity of Russian buyers, as such activity is based on different sources and motivation. This implies the main task to optimize consumer and investment behavior taking into account the national cultural and educational characteristics of the Russian population. At the same time, the conceptual direction is to form a stable model of enlightened consumer and financial behavior. The implementation of this task involves a comprehensive approach to the development of consumer culture both in the framework of national policy and at the level of public initiative.

Keywords: Consumer behaviorconsumer and financial activity

Introduction

Ensuring sustainable economic growth is the main objective of the country’s economic policy, regardless the social, political structure and the chosen course. This is connected with the statement that the dynamics of economic development largely determines the level of social welfare and the quality of people’s life. In the official and unofficial circles, there has been debate for many years concerning measures needed to boost consumer and financial activity, but there is no appropriate answer to this question.

The behavioral aspects of consumer and financial activity, the issues of their correlation, as well as the directions of their stimulation remain insufficiently elaborated

The concepts of consumer and financial activity should be divided, because their manifestation has different motivation and various nature of consumer behavior. Hence, there should be different approaches for managing and stimulating such activities.

For having achieved the goal of stimulating the economy, the state faces a problem either to increase the final demand (consumption) or to increase investments

The choice is not always clear and it is due not only to economic, but also social and political factors, as well as national characteristics of consumer behavior.

The main determining factor here is the standard of living and the amount of received income. If there is a lack of funds to meet basic needs and pay for mandatory services, an increase in financial activity is out of the question.

There are studies, according to which the higher the share of food costs in the consumer's budget, the poorer he is and the lower the share is, the richer he is. Thus, according to the US Department of agriculture in 2014, the share of these costs (excluding food in the public catering) in the US budget was 6.5%, in Germany it was 10.6%, in Russia and 56.6% in Nigeria ( Engel, 1881).

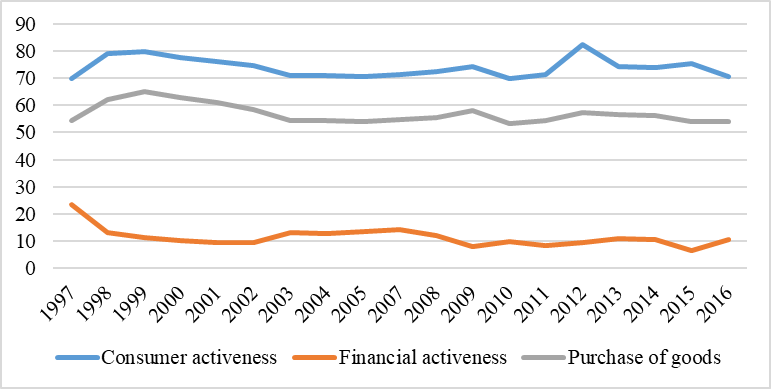

In 2015 and 2016 the situation in Russia did not improve, that is, nutrition costs were 32.8% and 33.5% respectively (Official statistics, 2017). If we look at the dynamics of expenditures of the Russian population for almost 20 years (figure

1 ), the picture has not changed, if in 1997 the share of costs on the purchase of goods and services was 69.85%, in 2016 it was 70.72%. For the entire period of research, this figure did not only decrease, but even increased to 82.44% in 2012.

There have also been no visible changes in the consumption of goods and services, so the share of expenditure on services remains roughly at the same level. This fact means that the quality of life is not improving ("The lack of budget growth", 2016). In the context of falling real incomes in Russia, this characterizes the so-called economical type of consumer behavior.

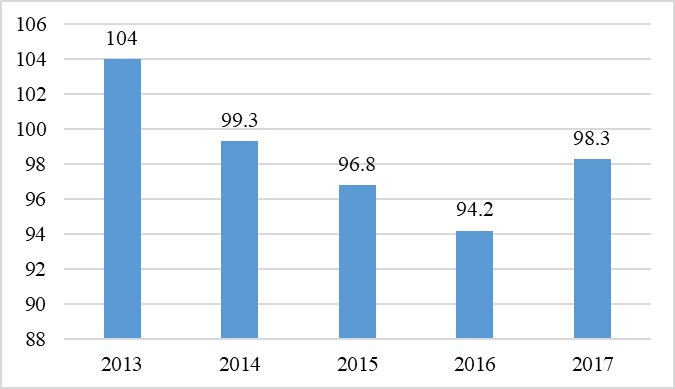

If we follow the theory, we can recognize the fact that Russian population in recent decades has not become richer. This is confirmed by the actual data. Only in January 2018, for the first time in more than three years, the real disposable income of the population stopped falling (figure

2 ).

-

As for the financial activity of the Russian customers, it is also possible to observe certain stagnation. The level of investment activity over the past 20 years has remained steadily low and has not reached 15% in the structure of total expenditures

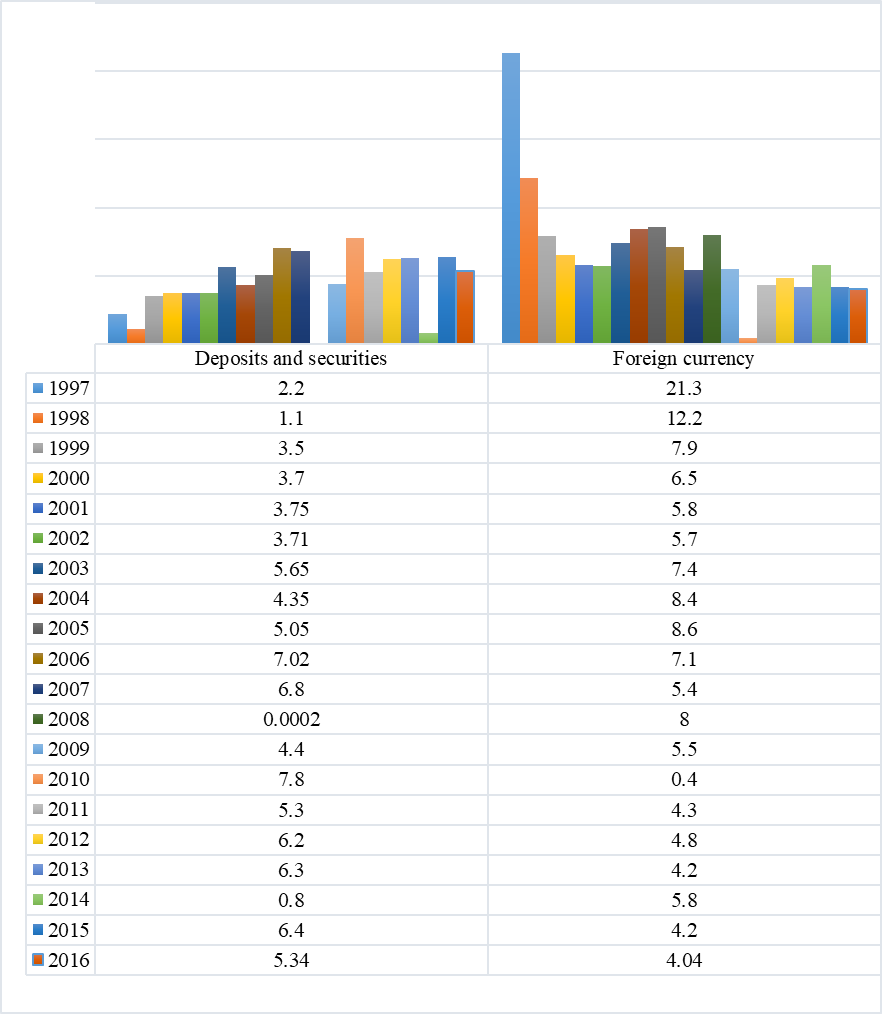

Meanwhile, the structure of financial investments looks insufficiently productive. After observing the behavior of such expenses for the period from 1997 to 2016 (figure

Such model of investment and savings behavior does not absolutely correspond to the behavior of a financially enlightened consumer and especially to the goals of increasing consumer and financial demand in the economy ( Imaeva, Ajmaletdinov, & Sharova, 2017; Svetlova, 2017).

Problem Statement

The question of mechanisms to activate the population’s consumer and financial demand in the policy of economic stimulation is ambiguous. The most important aspect to implement this policy is associated with the behavioral characteristics of the population ( "National G20 financial literacy", 2013).

The current situation with consumer demand in Russia is considered to be a negative trend, when the lack of consumption growth is compensated by changes in its quality

This is a very serious problem, which can lead not only to a decline in the quality of life, but also to more harmful consequences that can affect the health of the nation as a whole. Hence, the protection of consumer interests is becoming large-scale and of high importance at the level of national security interests.

Another goal of the policy of economic incentives should be to optimize the nature of the financial behaviour of citizens and strengthen investment activity with the subsequent introduction of deferred consumer demand

The solutions of this task should be sought in the consistent formation of the citizens’ financial (investment) culture. ( "Assessment of the level of financial", 2017; "Results from PISA" 2015); "Research of financial literacy", 2017

Research Questions

The article analyzes the dynamics of the Russian population’s consumer and financial activity over the past 20 years, it also examines the change in the structure of consumer spending and investment and studies the features of consumer behavior among Russian citizens. ( "Federal budget implimentation", 2017)

Purpose of the Study

Ensuring the activation of the population’s consumer and investment demand within the policy of economic stimulation makes it necessary to take into account consumer behavior. The aim of the study is to assess the dynamics of consumer and investment demand in Russia and to develop effective approaches to the management of consumer and financial activity among the citizens, paying attention to national, cultural and behavioral characteristics.

Research Methods

The sources concerning the issues of behavioral theory in the context of consumer and financial behavior make the theoretical basis for the study. The article shows the implementation of quantitative analysis methods for statistical data according to the population’s consumption and investment expenses in Russia for 20 years and sociological research methods to identify behavioral preferences and national specifics of consumer behavior. Evaluation of the behavioral model of the Russian consumer allowed to develop the concept of its optimization.

Findings

The problem of activation of consumer and financial (investment) demand has a systemic nature and requires an integrated approach on the part of the state, taking into account the current economic conditions and the national specifics of both the market itself and the behavior of its main participants ( "Financial education database", 2017; Tochilinskaya, Ajmaletdinov, & Sharova, 2017)

At the present stage of the Russian economy development it seems necessary to develop a consumer culture in general

A competent consumer will choose a better product, thereby stimulating competition and clearing the market from fake products, and what is more, a financially educated (cultural) consumer will use convenient and effective services, encouraging further growth of scientific and technological progress and financial innovation, and competition in the financial sector, saving him from unscrupulous and ignorant financial institutions.

The main idea is to optimize consumer and financial behavior of Russian citizens on the basis of the concept for the consumer and investment culture formation ( "National financial education improvement", 2013; "Strategy and growth of financial", 2017; Zelentsova, Bliskavka, & Demidov, 2012)

Conclusion

The problem of activation of consumer and financial (investment) demand has a systemic nature and requires an integrated approach on the part of the state, taking into account the current economic conditions and the national specifics of both the market itself and the behavior of its main participants.

The choice of priorities to stimulate consumer or financial activity is due not only to economic, social and political factors, but it is also due to national characteristics of consumer behavior ( Miloslavskij Gerasimov, Tranova, Gerasimova, & Hejlyk, 2016).

The situation with consumer demand in Russia is characterized by a negative trend, and investment (financial) demand reveals low productivity.

In order to increase consumer and financial demand in the Russian economy, it is necessary to form an appropriate model of investment and savings behavior among the Russian population.

References

- Assessment of the level of financial literacy of the population. (2017). Retrieved from https://www.minfin.ru/ru/om/fingram/directions/evaluation/

- Dynamics of financial activeness among Russian population 1998-2015. Analytical report. (2015, October 20). Retrieved from http://www.zircon.ru/upload/iblock/fa5/MFAN_album_charts_2.3.pdf

- Engel, E. (1881). Des Rechnungsbuch der Hausfrau und seine Bedeutung im Wirtschaftsleben der Nation [Housewife's accounting book and its significance in the economic life of the nation], Berlin: Simion.

- Federal budget implimentation in the Russian Federation 2016 (preliminary summaries) (2017, April). Retrieved from https://www.minfin.ru/common/upload/library/2017/04/main/0454_Ispolnenie-2017_preview.pdf

- Financial education database. (2017). Retrieved from http://www.financial-education.org/home.html

- Imaeva, G.R., Ajmaletdinov, T.A., Sharova, O.A. (2017). Russian trust for banks. Sociology. Statistics. Publications. Field reviews. Vol. 8 (12). Moscow, Analytical center NAFI. – M.: Publishing house NAFI

- Miloslavskij, V.G., Gerasimov, V.S., Tranova, V.A., Gerasimova, O.S., & Hejlyk, I.A. (2016). Financial Literacy: problems and prognosis. A young scholar, 4, 452-456. Retrieved from https://moluch.ru/archive/108/26271/

- National financial education improvement. Cooperative publications of the Russian Federation representatives. (2013) Retrieved from http://ippk.arkh-edu.ru/web_community/financial/1.%20G20_OECD_final%20RU.pdf

- National G20 financial literacy strategies are presented. (2013. September 5). Retrieved from http://ru.g20russia.ru/news/20130905/782374131.html

- Official statistics, 1997-2017. Retrieved from http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/population/level/http://www.gks.ru/

- Research of financial literacy. (2017). Retrieved from https://www.minfin.ru/ru/om/fingram/directions/evaluation/

- Results from PISA-2015 Financial Literacy. (2015). Retrieved from http://www.oecd.org/pisa/PISA-2105-Financial-Literacy-Russian-Federation-Russian.pdf

- Svetlova, A. (2017, March 18). A quarter of Russian people preferred to keep their money at home. Retrieved from https://www.moe-online.ru/news/view/360067.html

- Strategy and growth of financial literacy in the Russian 2017-2023, determined by the Russian government on 25 September 2017. (2017, September 25). Retrieved from http://static.government.ru/media/files/uQZdLRrkPLAdEVdaBsQrk505szCcL4PA.pdf

- The lack of budget growth compensated by its quality change (2016, June 6) Retrieved from https://www.acra-ratings.ru/research/28

- Tochilinskaya, I.E., Ajmaletdinov, T.A., & Sharova, O.A. (2017). Russian market for financial services. Sociology. Statistics. Publications. Field reviews, 6(10). Moscow, Analytical center NAFI: Publishing house NAFI

- Zelentsova, A.V., Bliskavka, Y.A, Demidov, D. N. (2012). Financial literacy growth: international and Russian practice. Moscow, Knorus.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 February 2019

Article Doi

eBook ISBN

978-1-80296-055-6

Publisher

Future Academy

Volume

56

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-719

Subjects

Pedagogy, education, psychology, linguistics, social sciences

Cite this article as:

Rykova, I., Uvarova, E., Golaydo, I., Shcherbakova, S., & Gubina, O. (2019). Behavioral Aspects Of The Population’s Consumer And Financial Activity. In S. Ivanova, & I. Elkina (Eds.), Cognitive - Social, and Behavioural Sciences - icCSBs 2018, vol 56. European Proceedings of Social and Behavioural Sciences (pp. 687-693). Future Academy. https://doi.org/10.15405/epsbs.2019.02.02.75