Abstract

After the occurrence of various factors that bring about fraud and increasing fraud in organizations, institutions try to find a solution to the problem. The main objective of our study is to analyse the individual and organizational factors which lead to detrimental behaviours particularly fraud and to examine the relations between intention to fraud and job engagement. In this frame, the relationship between individual and organizational factors and the intention to fraud is discussed and the connection between intention to fraud and job engagement has been examined in the light of collected data. In addition, the mediator role of intention to fraud between individual and organizational factors and job engagement has been examined. The main objective of the study is to make a contribution to organizational behaviour literature concerning fraud. In this context, in several cities, data is collected a sample of employees from various sectors through survey method. The collected data were analysed. The results show that there is positive relationship between individual and organizational factors and intention to fraud, and positive relationship between intention to fraud and job engagement. Finally, the mediator role of intention to fraud between individual and organizational factors and job engagement is revealed.

Keywords: Fraudjob engagementintention to fraudcounterproductive work behaviour (CWB)

Introduction

Today’s dynamic and high-pressure workplace raises counterproductive workplace behavior about employee behavior. Counterproductive workplace behavior indicates volitional employee behavior aim for abusing organizations and employees for threatening effective organizational functioning (Spector & Fox, 2002). For example, verbal and physical abuse, performing task incorrectly, withholding effort and theft continues to be challenge for organizations (Matta, Korkmaz, Johnson, & Bıçaksız, 2014). Counterproductive workplace behavior affects both organizations and employees’ welfare negatively. One of the most common counter workplace behavior is employee fraud (Marcus &Schuler, 2004). In the literature the negative effects of employee fraud have been investigated in aspect of both organizations and countries. Employee fraud have a bad influence on customer loyalty, organizational prestige and reputation, decreasing credibility via creditors as well as financial losses. For example, corporate scandals in Enron and Worldcom have savaged the reputation of this organizations as well as depleting their assets.

In the last decade, many studies have been focused on deviant behavior and employee fraud especially in Western countries. However, few studies have been investigated the outcomes of workplace fraud in Turkey. Additionally, past studies did not carry out the reasons of employee fraud intention comprehensively. According to Hollinger & Davis (2006), it is hard to explain the reasons of fraud in organizations and earlier researches are inadequate for developing and empirically testing the model. Moreover, employee fraud is investigated business ethics discipline however in organizational behavior context studies are nascent.

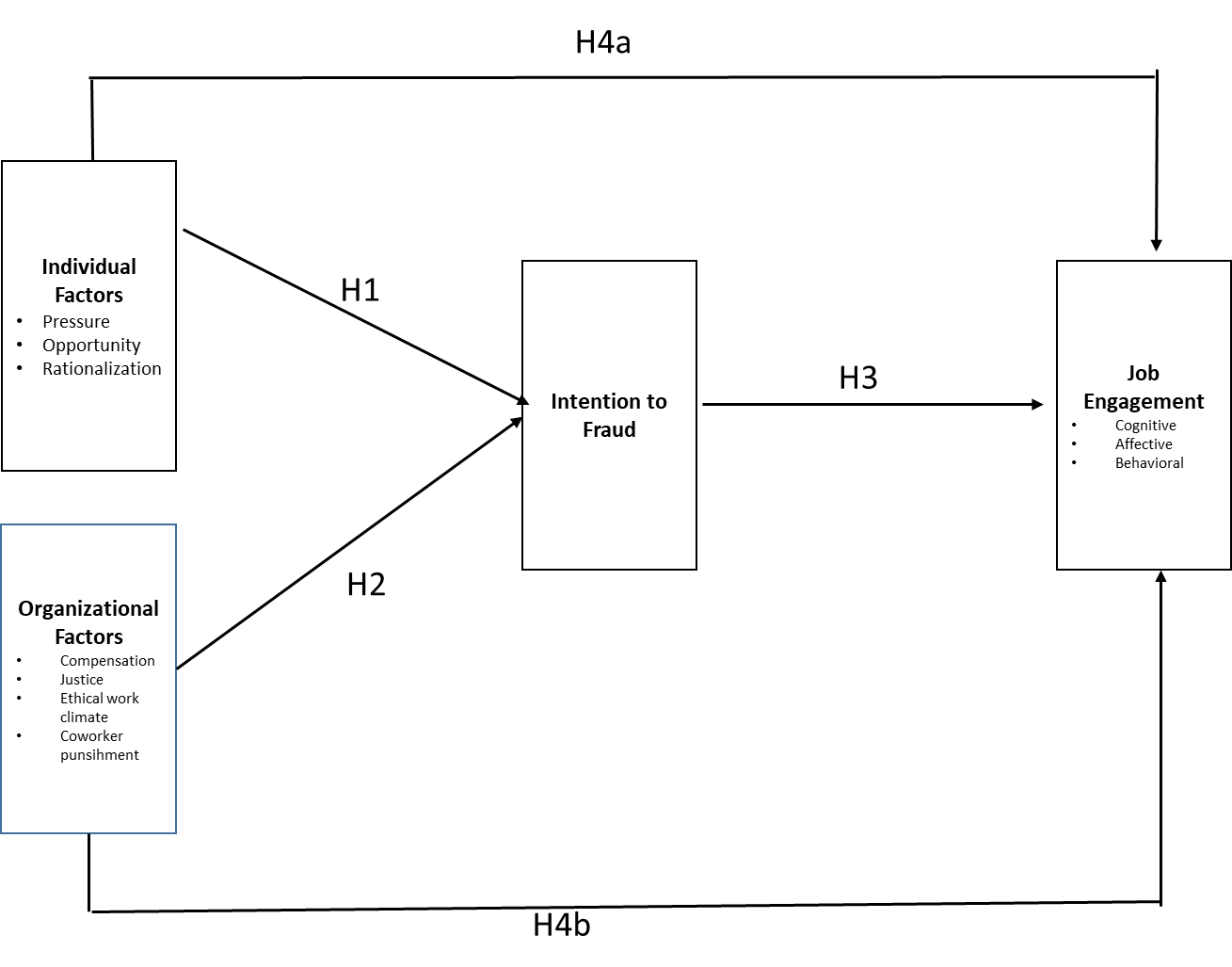

Therefore, the aim of this study is to empirically test the relationship among individual and organizational factors on intention to fraud and job engagement. Specifically, this study investigates (i) the impact of individual factors (i.e. need, opportunity and personal characteristics), and organizational factors (i.e. compensation, justice, ethical work climate and coworker fraud and punishment), on intention to fraud, (ii) the impact of individual and organizational factors on job engagement (i.e. behavioral, cognitive and affective), (iii) the mediating role of intention to fraud in the relationship between individual and organizational factors and job engagement.

Literature Review

Individual Factors

In organizations many individual and organizational factors such as financial and social needs, opportunities, personal characteristics and habits lead to employees’ fraud. For example, Moorthy et al., (2014) demonstrated organizational and individual factors in their study.

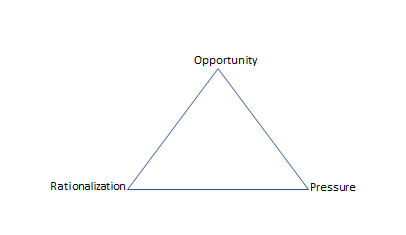

The literature points to a number of factors that motivate employees to fraud at the individual level. However, in recent years’ scholars tend to follow ‘Fraud Triangle’ for conceptualizing fraud which is developed by Cressey (1950). Fraud triangle includes opportunities, motives/incentives and rationalization as the factors of fraud as seen in Figure

Firstly, opportunity for fraud indicates gap in security checks, lack of supervision and is the first and most important element of fraud triangle. According to Greenberg & Barling (1996), people are greedy in nature, and every employee will steal if the opportunity is given. Researchers advocating this theory argue that this greediness will not turn into an anger unless there is an opportunity. Opportunity is created by an administration system or an ineffective control system that might leads to an individual's organizational crime. This is the weakness of the internal control system in accounting (Abdullah & Mansor, 2015). According to Comer, the opportunity is driven by four factors (Savona, Mignune, & Negro, 2002):

The ability of criminals to find, or have access to, territory, accounts, assets and computer systems

Ability to identify and use opportunities to fraud in the workplace

Having the right time to plan and being able to successfully execute the trick

Degree and seniority are, in general, the higher the seniority of an employee require less control.

Secondly, rationalization (moral justification) in fraud triangle demonstrates the attitude and thought process of the dishonest individual for justifying fraud. A dishonest employee, expressed in an attempt to justify the crime with thoughts and explanations, for example “I hate my manager”, “I do not steal, I work hard, I deserve it” (Wilson, 2004). In addition to the benefit-cost relationship, the physical character possessed by the worker also influences the worker's decision to commit a crime (Özeroğlu, 2014). Confidence or arrogance can affect the cost-benefit analysis of a fraudster.

Lastly, pressures; are expressed as conditions necessary in any environment in which the fraud flows (Wells, 2001). The pressures that are considered as the reason for pushing employees to fraud are financial and non-financial pressures. These are grouped into personal, business and external pressures (Hollow, 2014).

Organizational Factors

In the organizations, problems that lead employees to fraud are generally due to the inequality that real or perceived by employees. For this reason, when employees think that they are being paid unfairly, they can demonstrate unethical behaviors such as cheating to destroy or harm their business assets. Based on exhaustive literature review, the following organizational factors are identified, namely, compensation, justice, ethical work climate and coworker fraud and punishment.

Firstly, inadequate and unequal payments, unnecessary salary cuts, delay in premiums or paying premiums create dissatisfaction with the job. Consistently as explained in the individual factors, inadequate payment justifies the fraud. As a result, the employee's efficiency and motivation falls down and employee wants to make irregularities at work.

Secondly, employees feel dissatisfied if they realize that their employers are not treating them fairly and this situation foster fraud among employees. Colquitt, Noe & Jackson, (2002) demonstrated that organizations that are known to be fair and supportive is not common absenteeism, workplace theft and violence.

Thirdly, ethical work climate indicates ethical procedures, policies and practices related to ethics (Victor & Cullen, 1988). In the literature there are numerous studies show the relationship among ethical workplace climate and organizational commitment, psychological welfare, job satisfaction and organizational citizenship behavior (Martin & Cullen, 2006). Hollinger & Davis (2006) argue that, when employees perceive unsupportive and unpleased workplace climate they tend to express dishonesty activities.

Finally, in an organizational setting punishment for fraud impacts coworker fraud behavior and decisions about their own fraud behavior. According to Muir (1996), dismissing an employee for theft provide to both punishment of dishonest employee and avoid other employees from theft.

Hypotheses development and conceptual framework

Antecedents of intention to fraud

Almost nearly all cultures and business ethic discipline fraud has been treated as aspect of personality and social life. For example, Greenberg, and Barling (1996) argued that personality factors influences counterproductive behaviours including theft. According to scholars psychological factors, gaining prestige and uplifting in workplace foster fraud in organizations. Moreover, pressure such as high educational costs, high medical expenses, financial needs, personal debts and a desire to live well entails fraud in organizations. Additionally, employees’ bad habit causes fraud in workplace for example, gambling, drug addiction and night life increases need of money and promote to fraud (Bozkurt, 2009). Besides pressures, individual unethical values foster intention to fraud. Therefore;

H1: There is a positive relationship among individual factors and intention to fraud.

Fraud continuous to be a challenge for organizations in the last two decades and scholars have been examined how organizational factors increases intention to fraud. For example, studies show that unfair treatment among co-workers, procedural and distributive injustice motivate employees to fraud intention. If employees perceive fairness in their organizations demonstrate positive attitudes like job satisfaction and commitment (Yadav & Yadav, 2016). Additionally, past studies and theories have noted that inequality in payment, unfair compensation, unfair incentive and imbalance between salary and cost of living motivate to fraud in organizations. Moreover, organizational ethical climate, employee’s attitudes and values influences tendency to fraud. Employee who worked in an unethical climate felt that they had not done anything wrong, through unethical climate employees tend to fraud and express more counterproductive work behaviours. Hence;

H2: There is a positive relationship among organizational factors and intention to fraud.

Intention to Fraud and Job Engagement

We argue that intention to fraud have positive effects on job engagement. Job engagement, which includes cognitive engagement (i.e. focusing, devoting and concentrating on the job), emotional engagement (i.e. feeling pride, exciting and enthusiastic in the job), and physical engagement (striving and working with intensity). This means that when employee work they use their hands, head and heart (Ashforth & Humphery, 1995). According to KPMG (2016) defrauder employee works approximately 5 years in the organization and usually does not prefer to take annual leave. Defraud employee usually comes work earlier and leave late, they prefer work individually and don’t want to work with teams (Bozkurt, 2009). Bozkurt (2009) noted that defraud employee have curiosity their job and want to create new business models. Dishonest employee avoids to absentees and delegate their responsibility because they are concerned about revelation of the fraud. Hence;

H3: There is a positive relationship among intention to fraud and job engagement.

Mediating Effect of Intention to Fraud

We argue that intention to fraud mediates the relation between individual and organizational factors of fraud and job engagement. In particular, the existence of need, opportunity and pressure in individual level and injustice, compensation inequality and unethical climate in organizational level influences job engagement. If employee aware to negative work environment or applied harmful procedures, they justify intent to fraud and will be less likely to be devoted to work. Therefore;

H4a: Intention to fraud mediates the relationship among individual factors and job engagement.

H4b: Intention to fraud mediates the relationship among organizational factors and job engagement.

Research Design

Measures

To test proposed hypotheses, we adopted multi item scales from earlier studies for the measurement of variables. In the study, 5 point Likert scale has been used ranging from, strongly disagree (1) to strongly agree (5) to measure variables. We also assessed demographic characteristics of participants.

For the individual and organizational factors of fraud we adapted from Moorthy, Seetharaman, Jaffar & Foong (2014). Individual factors were measured using 16 questions including three dimensions, namely rationalization, need and opportunity. Rationalization was measured with 5 items. An example item is ‘I think fraud only for a good purpose is acceptable’. Need was measured with 6 items. An example item is ‘I think increasing education expenses foster fraud in organizations’. Opportunity was measured with 5 items. An example item is ‘I think lack of security checks foster fraud in organizations’. Organizational factors was measured using 21 items including four dimensions, namely compensation, justice, ethical work climate and coworker fraud. Compensation was measured with 6 items. An example item is ‘I think inequity in payment foster fraud’. Justice was measured with 5 items. An example item is ‘I think unfair treatment foster fraud in organizations’. Unethical work climate was measured with 5 items. An example item is ‘I think unethical supervisor foster fraud in organizations’. Coworker fraud and punishment was measured with 5 items. An example item is ‘I think coworkers non organizational interests influences my behavior’. For the intention to fraud we modified the questions from Moorthy et al., (2014) was measured with 7 items. An example item is ‘I think bigger organization size foster fraud in organizations’. For the job engagement variable, we adopted Rich Lepine & Crawford (2010) job engagement scale, which includes cognitive, behavioral and emotional engagement. A few example items are ‘I exert my full effort to my job’, ‘I feel positive about my job’ and ‘I pay a lot of attention to my job, at work’.

Sampling

To test the above hypotheses, one hundred and eighty three employee from various sectors have participated our survey. In the sample most of the participants had bachelor’s degree (64%) and 55% were men. The respondents held the following positions; work under supervisor (72%), manager (21%) and owner (7%).

Analysis and Results

Measure validity and reliability

After data collection we conducted a second order confirmatory factor analyses using the maximum likelihood estimation technique. Table 1 presents factor loadings and reliabilities for each variable. The Cronbach alpha scores range from .71 to .87 and composite reliability estimates range from .76 to 87. Beside average variance extracted (AVE) for each variable are well beyond the threshold as Fornell & Larcker (1981). Additionally, the results showed that the models adequately fit the data. The fit indixes were x2=1165.409, x2/ df=1.53, (CFI)=.902, (IFI)=.903, (TLI)=.894 (RMSEA)=.054, and (PNFI)=.707 Table 01. Factor loadings and reliability scores Variables Factor Loadings Cronbach’s α CR AVE

Hypothesis testing

To test our hypotheses, we used structural equation modelling using AMOS. Table

IF: Individual Factors, OF: Organizational Factors, ITS: Intention to Fraud, JE: Job Engagement

H1 predicted a positive relationship between individual factors and intention to fraud. Findings indicate that the relationship is significant (β=.33; p<.01). Therefore, H1 was supported. The relationship between organizational factors and intention to fraud was tested. The findings for H2 suggested that organizational factors have a positive and significant effect on intention to fraud. (β= .55; p<.001). The findings for H3, which predicted a positive relationship between intention to fraud and job engagement, has been supported (β= .33; p<.01). To test the mediation effect (H4a/ H4b), we built three different SEM models by using AMOS. In the first model as shown in Table

Discussion and Implications

This study has showed the interrelations among individual, organizational factors, intention to fraud and job engagement. Specifically, this study first empirically showed that individual and organizational factors of fraud positively to related to the job engagement. Whereas prior studies found that fraud negative consequences such as workplace theft behaviour (Moorthy et al., 2014) we specifically showed a positive consequence.

Our results unexpectedly showed that intention to fraud did not mediate the relationship among job engagement and individual and organizational factors. It looks like when employee have opportunity, pressure or have rational reasons they engage their work. Similarly, organizational procedures and politics and ethical work climate affect job engagement directly.

From this research management can understand the individual and organizational factors that foster fraud. Management should focus on security checks, regular checking of accounts, frequent surprise audits and strong anonymous reporting system. Additionally, management should clarify the roles of supervisors. Supervisors demonstrate that they care their employee treatment, compensation and incentives. Next, management should enhance informal communication among employees. For example, they should learn individual needs such as medical expenses, education expenses or personal debts. Management should also prevent fraud by providing ethical work climate. Managers should be transparent and must have ethical values.

Some additional for future research can be done. Firstly, the moderating of internal control systems such as formal monitoring (Chen & Sandion, 2007) should be investigated. Because internal control systems include policies and practices and add value for employee fraud. Second, future studies should investigate the relationship between human resource practices and intention to fraud in organizations. Lastly, future studies may examine the role of leadership in organizational fraud. Specifically the role of authentic leadership should be investigated. Hence authentic leaders promote positive ethical climate and foster internalized moral perspective among followers.

References

- Abdullah, R., & Mansor, N. (2015). Fraud triangle theory and fraud diamond theory. Understanding the Convergent and Divergent For Future Research. International Journal of Academic Research in Accounting, Finance and Management Sciences, 5, 38-45.

- Ashforth, B. E.,& Humphery, R. H. (1995). Emotion in the workplace: A reappriasal, Human Relations, 48,2,97-125

- Bozkurt, N. (2009). İşletmelerin Kara Deliği Hile: Çalışan Hileleri. İstanbul, Alfa Yayınları.

- Chen, C., X., & Sandion, T. (2007). Do internal controls mitigate employee theft in chain organizations. Master thesis, University of Southern California.

- Cressey, D. R. (1950). The criminal violation of financial trust. American Sociological Review. 15, 6, 738-743.

- Colquitt, J. A., Noe, R. A., & Jackson, C. L. (2002). Justice in teams: Antecedents and consequences of procedural justice climate. Personnel Psychology, 55, 84-109.

- Fornell, C. & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18, 39–50.

- Greenberg, L., & Barling, J. (1996). Employee Theft. Queen’s University, Ontario, Canada.

- Hollinger, R.C.,& Davis, J. L. (2006). Employee Theft and Staff Dishonesty. The Handbook of Security.

- Hollow, M. (2014). Money, morals and motives: an exploratory study into why bank managers and employees commit fraud at work. Journal of Financial Crime, 21, 174-190.

- KPMG, (2011). Who is the typical fraudster? KPMG analysıs of global patterns of fraud.

- KPMG, (2016). Who is the typical Fraudester?”, KPMG analysis of global pattrns of fraud.

- Marcus, B., & Schuler, H. (2004). Antecedents of counterproductive behaviorat work:A general perspective. Journal of Applied Psychology, 89, 647-660.

- Martin, K. D., & Cullen, J.B. (2006). Continuities and extensions of ethical climate theory: A meta analytical review. Journal of Business Ethics, 69.

- Muir, J. (1996). Theft at work. Work Study, 45, 27-29.

- Matta, F. K., Korkmaz, H.T., Johnson, R.E., & Bıçaksız, P. (2014). Significant work events and counterproductive work behavior: The role of fairness, emotions and emotion regulation. Journal of Organizational Behavior, 35, 920-944.

- Maslach, C., Schaufeli, W. B., & Leither, P. (2001). Job Burnout. Annual Reviews Psychology, 52, 397-422.

- Moorthy, M. K., Seetharaman, A., Jaffar, N., & Foong, Y. P. (2014). Employee perceptions of workplace theft behavior: A study among supermarket retail employees in Malaysia. Ethics & Behavior, 61-85.

- Özeroğlu, A.İ. (2014). Finanasal aldatmaca ve işletme hileleri. Akademik Sosyal Araştırmalar Dergisi, 2, 2/2.

- Rich L. R., Lepine J.A., & Crawford E. R.. (2010). Job engagement: Antecedents and Effects on Job Performance. Academy of Managment Journal, 53, 617-635.

- Savona, E. U., Mignune, M., & Negro L.D. (2002). Business crime prevention in Europe: Implementing an early warning strategy. Final Report, Transcrime.

- Spector, P.E., & Fox, S. (2002). An emotion-centered model of voluntary work behavior. Some parallels between counterproductive work behavior and organizational citizenship behavior. Human Resource Management Review, 12, 269-292.

- Wells, J. T. (2001). Why Employees Commit Fraud. Journal of Accountancy.

- Yadav, L.K., & Yadav, N. (2016). Organizational Justice: An Analysis of Approaches, dimensions and Outcomes. NMIMS Management Review, 31, 14-40.

- Victor, B., & Cullen, J. (1988). The organizational bases of ethical work climates. Adminstrative Science Quarterly, 33, 101-125.

- Wilson, R.A. (2004). Employee dishonesty: National survey of risk managers on crime. Journal of Economic Crime Management, 2, 1-25.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 January 2019

Article Doi

eBook ISBN

978-1-80296-053-2

Publisher

Future Academy

Volume

54

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-884

Subjects

Business, Innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Müceldili, B., Uzun, F., & Erdil, O. (2019). An Investigation Of Individual And Organizational Factors On Intention To Fraud. In M. Özşahin, & T. Hıdırlar (Eds.), New Challenges in Leadership and Technology Management, vol 54. European Proceedings of Social and Behavioural Sciences (pp. 536-546). Future Academy. https://doi.org/10.15405/epsbs.2019.01.02.45