Abstract

The relevance of the research lies in the importance of innovative development of the oil refining industry in Russia as one of the main directions of industrial policy and the transition of the country from the export-raw material model of development to intensive. In this study, there was the analysis of innovative development of oil refining industry of Russia and its production capacity. The targets of oil refining development are considered. The causes of technological backwardness of the domestic refining industry and proposed possible measures were addressed. One of the main reasons for the decrease in efficiency in the industry is the organizational and technological lack of production. The article made a comparative assessment of the economic efficiency of the introduction of two gasoline production units (EURO 5): standard, used in domestic oil refining and proposed, using constructive innovation in the technological scheme of the production process. The estimated cost-effectiveness of the proposed installation is much higher. There is a decrease in capital costs, identified savings in energy, material and labor resources, an increase of the output of the target product and an increase of the competitiveness of products. The proposed installation is recommended for implementation in the existing production and becomes relevant, since the production of automotive gasoline at Antipinsky oil refinery is the only high-quality product on the regional market, in particular in the South of the Tyumen region. The product will be in demand and will cover the needs of the territory in full.

Keywords: Oil refininginnovationcompetitivenessefficiencytechnology

Introduction

The concept of long-term socio-economic development of the country has set the strategic goal of achieving economic and social development, corresponding to the status of a leading world power with an attractive lifestyle, which takes a leading position in the global economic competition and reliably ensures national security and the realization of citizens' constitutional rights. The Russian Federation's accession to the world trade organization (WTO), the global financial crisis, and the annexation of Crimea and Sevastopol are making adjustments. At the same time, the country's leadership, along with anti-crisis measures, has firmly decided to continue the transition to innovative change. This applies both to institutional reforms, the implementation of priority national projects, and direct support for promising economic activities (The impact of global Mega-trends on the petrochemical industry in Russia until 2030, 2017).

The Russian oil refining industry is one of the largest in the world. Russia is among the five world leaders in terms of the total volume of oil refining, second only to the USA and China. The great importance of the oil refining industry is determined by the high share of the value added of oil products exports compared to oil exports, and the fact that the industry is a link between the fuel and energy sectors and such strategically important industries as engineering, aviation and telecommunications. Thus, the problem of innovative development of the oil refining industry in Russia at the present stage is an important task that requires close attention (Russia's largest oil refineries, 2017. The oil and gas industry of Russia, 2017).

Problem Statement

The oil refining industry of Russia and, in particular, Antipinsky oil refinery JSC were chosen as the object of research. The subject of the research is organizational-administrative and technical-economic relations arising in the process of using modern experience of innovative technologies in the oil refining industry of Russia. The objectives of the study are:

the study of the basic approaches to the concept of "innovation", " innovation activity";

research of the role of "innovations" for the Russian oil refining industry;

study of methods of an assessment of innovative activity of domestic and foreign oil refining;

analysis of the development of innovative activity of the Russian oil refining industry;

economic justification for the technological upgrade of the high-octane gasoline unit EURO-5 in a specific production process JSC «Antipinsky oil refinery».

.

Research Questions

The theoretical significance of the scientific research is associated with the development of theoretical and methodological approaches to assessing the effectiveness of innovation in the oil refining industry in Russia. The practical significance of the scientific research lies in the possibility of using its results by domestic oil refining companies in the framework of innovation.

Purpose of the Study

The purpose of the study is to assess the efficiency of technological upgrading of the high-octane gasoline EURO-5 production unit at the specific production equipment of the Antipinsky oil refinery on the basis of studying the innovative development of the Russian oil refining industry and identifying the reasons for the technological backlog of domestic refining (Vazhenina, 2011, 2017).

Research Methods

Russia is one of the leading countries in terms of volumes of processed hydrocarbons and ranks 3rd after the USA and China (The Ministry of energy, 2017). Table

The main leader in the processing of petroleum products remains the United States (20.4% of the total world refining volume in 2015). China (13.4 %) and Russia (7.3 %) are in second and third place respectively.

In 2016, the total production capacity of Russian primary oil processing amounted to 285 million tons; in Russia there are 32 large oil refinery and 80 mini-plants.

About 90% of capacities are 32 large enterprises of different profile, the rest of capacities are gas processing complexes and mini-plants.

It should be noted that in Soviet times, 26 of 32 enterprises were built, which operate today, including 8 plants built before the World War II, 6 plants - in the period of 1939-1950, 11 plants - in the period of 1951-1979, 2 plants - in the period of 1980-1982, 6 after 1982. (Adzhiev & Purtov, 2014).

Most of the plants had a low depth of oil refining and had primitive technological schemes.

In Russia, the oil refining industry is largely consolidated. Ten vertically integrated oil and gas companies control about 89% of the refining capacity (table

In 2015, 89% of all oil refining was carried out at oil refineries, which are part of eight vertically integrated oil and gas companies. About 8.9 % of the processing was carried out at large factories, not included in the structure of VG, and 2.4 % fell on the share of mini-enterprises (Information-analytic review, 2015). An important criterion, taking into account the export orientation of the industry, is the extremely uneven distribution of capacities of Russian oil refineries from the point of sale of products, both on the domestic and foreign markets.

Thus, 44% of the refinery capacity is concentrated in the Volga Federal district, which is the leader in the volumes of primary oil refining in the country and produces 40 %. The North Caucasian district does not have any major oil refinery (Kasperovich &Magaril, 2008).

Only Tuapse and Kirishi plants operate in the immediate vicinity of the ports, which is confirmed by their high economic efficiency and the possibility of regular exports to the full-fledged foreign markets of petroleum products. Indicators of oil refining industry development in Russia are presented in table

Assessing the level of plant load, we can say that the highest level of capacity load is typical for districts such as North–West, Central and Siberian, below the average level is occupied by the Volga, South and Ural districts (Dynarski, 2007).

In the period 2012 to 2016 the volume of oil processing grew by 13 million tonnes and a Constant growth of volumes of processing of oil of relative stability in capacity led to a sharp increase in their load from 61.6 % in 2000 to 93.0 % in 2016.

In 2016, the production of basic oil products in Russia decreased by 13.5 million tons (-7.2%). There is a sharp reduction in the production of heating oil by 14.5 million tons (-20.3%), which is slightly offset by an increase in the production of motor gasolines and diesel fuel by 0.8 million tonnes (2.0%) and by 0.2 million tonnes (+ 0.3%), respectively. This situation is caused by a decrease in the efficiency of exports of fuel oil due to a gradual increase in the rate of export customs duty to 100% of the duty on crude oil in 2017.

The share of AI-95 is growing in the structure of production of motor gasolines. Over the past six years, it increased by 13.6 pp to 30.1%. The share of production of motor fuel of the fifth ecological class has significantly increased: gasoline - up to 93%, and diesel fuel - up to 85% (caused by the introduction of a ban on the turnover of motor fuels of the fourth ecological class and lower in Russia since 2016) (Information-analytic review, 2017).

The provision of raw materials is the main factor determining the potential and opportunities for the development of the oil refining industry. About half of the produced oil is processed in Russia. In the period from 2014 to 2016, the share of oil refining industry decreased from 54.9% to 51.3%, which adversely affects its development. The share of oil refining is presented in table

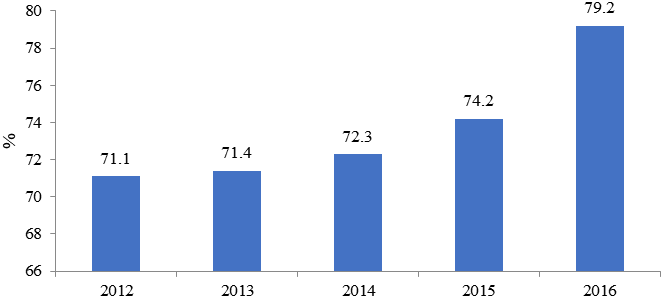

In Russia, there is low competitiveness compared to developed countries, due to the low depth of oil refining, low quality of oil products, high energy consumption, backward structure of production, equipment wear and non-modern technologies. The feature of oil refineries located in Russia is also a low level of processing of raw materials into target products. The dynamics of oil refining depth is shown in figure

Exceptions are some modern refineries, such as Antipinsky oil refinery with a processing depth of 98 %, Yaysky oil refinery (92 %), Omsk oil refinery (91.5 %). The largest group consists of plants with a depth of processing of petroleum products of 60-70 % (10 plants) and 71-80% (12 plants). More than 90% of processing depth has only 3 plants.

In 2016, refineries were modernized, which allowed one to increase the depth of oil refining to 79% and painlessly switch consumers to the use of automotive fuel of the highest environmental class.

If we consider the oil refining industry of Russia in this period, the output of gasoline and diesel fuel is low, and the share of fuel oil production in the raw material is very high. If we compare the relatively developed industrial countries of the world, this figure also leaves much to be desired. The increase in the depth of oil refining is directly affected by the high cost of introducing high-tech production facilities and their insufficient return, which depends on the pricing policy and the amount of export duties on crude oil in Russia (Forecast of energy development in the world and Russia until 2040, 2014).

Currently, the price of a ton of crude oil on the world market is higher than the price of petroleum products produced in Russia. In this regard, the oil business of Russia in the short term is not focused on investing in the processes of deepening oil refining, but on obtaining super-profits and fulfilling obligations to shareholders of companies that can be provided only at the expense of export revenues from the sale of oil and dark petroleum products. Main targets of the oil refining industry in Russia are presented in table

The main strategic document regulating the process of development and modernization of the Russian oil refining industry remains the "Energy strategy of Russia until 2030" (ES-2030) (The strategy of innovative development of the Russian Federation up to 2020, 2014). With regard to the development of oil refining, ES-2030 includes three stages of implementation: the first stage covers 2010-2015; the second stage - 2016-2020; the third stage - 2021-2031.

The main purpose and objectives of this strategy are: the creation of completely new oil processing plants, as well as the modernization of all existing enterprises; smooth introduction of investment projects to increase the economic efficiency of companies; increase the number of product names with improved quality; creation of programs to reduce costs and improve production efficiency. The main directions of radical changes in the oil refining industry will be: increasing the depth of oil refining; improving the quality of petroleum products; smooth change in the direction of export flows of oil and petroleum products to the East.

Target indicators of the strategy are: increasing depth of oil refining with a modern 72% to 82-83% by 2020 and up to 89-90 % by 2030; the output of light oil products is expected to increase to 67-68 % by 2020 and up to 72-73 % by 2030; the share of Eastern Siberia and Far East in oil production will increase from 3 % in 2008 to 10-12 % in 2015, 12-14% in 2020 and 18-19% in 2030, and total exports of oil and petroleum products from 8 % in 2008 to 10-11 % in 2015, 14-15% by 2020, 22-25% by 2030 (The strategy of innovative development of the Russian Federation up to 2020, 2014).

In our opinion, based on priority development of technological systems that allow one to reach the target indicators and high-tech production in the oil refining industry in Russia, there should be: deep processing of oil; a reduction in specific oil consumption per unit of target product; modern processes and technologies catalytic cracking, hydrocracking, coking residues, viscosity breaking, bitumen production, innovative technologies of catalytic reforming of gasoline, diesel hydrotreating, fuels for jet engines, isomerization, and alkylation; reconstruction and modernization of existing capacities of primary oil refining and commissioning of new petrochemical complexes (Zolotukhina, 2014)

There is a different level of implementation of innovative technologies, both Russian and foreign plants, which is reflected in the uniformity of various process parameters. These parameters are indicated in table

Experts believe that all investment projects and programs planned in Russia will not lead to large-scale changes, and most likely, refineries will not reach the level of enterprises in developed countries.

It should be noted that foreign countries have a dominant position in the Russian market (The Ministry of energy, 2017. The oil and gas industry of Russia, 2017). Foreign companies supply about 50-70% of catalysts used in refineries. Also on the Russian market, there are world licensors and engineering companies with a large production and financial potential.

There is a simultaneous reduction in the introduction of domestic technologies by oil refineries with the displacement of national design organizations from the market of engineering services and the widespread introduction of imported technologies and equipment (The strategy of innovative development of the Russian Federation up to 2020, 2014. The oil and gas industry of Russia, 2017).

The way of borrowing technology from abroad cannot be seen as a promising way to develop the Russian oil refining industry. Therefore, it is necessary to develop domestic developments by generating their own effective technologies and modernization of production. It will allow receiving multiplicative effect in the industry on the basis of "reverse engineering" and the mastered experience of new technologies and productions (Vazhenina, 2017).

At the moment, Russian oil companies are significantly inferior to foreign ones in terms of research and development work financing. The share of expenditure on research and development work of Russian oil companies does not exceed 1% of their revenue. There is a low share of innovative products of oil producing and oil refining enterprises in the total volume of shipped products.

Despite the need for innovation in the oil refining industry, there are a number of problems that make it difficult to implement them. Table

Findings

During the study of these problems of technological backwardness of domestic oil refining and possible measures to address them, we have identified "bottlenecks" in the constructiveness of the production process of oil refining, i.e. in its constructive and technological imperfections.

As a concrete example, the refinery company Antipinsky oil refinery JSC was selected, where a constructive innovation in the production process of oil refining was proposed and its approbation with the justification of economic efficiency was carried out. For the production of high-octane gasoline standard Euro 5, it is possible to use two types of installations: standard and proposed (innovative) (Vazhenina, 2011, 2017). The standard installation includes 4 sections: two hydrotreating sections; isomerization section; reforming section.

In the proposed (innovative) installation, there are 3 sections: section naphtha hydrotreating delayed coking unit, the reactor unit with a hydrotreating stripper column; section isomerization "Peneks"; section platforming with a moving catalyst bed. Next, we conducted the comparative evaluation of the two reporting units and selected the most effective, from the point of view of investing money and obtaining the result. Calculation of indicators of the production program is presented in table

A comparative assessment of the economic efficiency of The Euro 5 gasoline production units under consideration is presented in table

A comparative assessment of the effectiveness of the proposed innovation in the production of automotive fuel showed that all the indicators are better at the proposed Euro 5 gasoline production unit. As a result of the introduction of innovative production, the change compared with the current one will be: an increase in sales profit by 2889 million rubles, a decrease in production costs by 2836 million rubles, a reduction in the number of equipment by 42 units, an increase in the profitability of sales and costs by 11.7 and 23.7%, respectively, a reduction in the specific values of energy, material and labor intensity, an increase in labor productivity by 18296 thousand rubles/person, and as a result, a reduction in capital expenditures, a reduction in energy, material and labor resources, an increase in the yield of the target product, and so on.

Conclusion

In conclusion, it should be noted that the author carried out a comparative analysis of the effectiveness of the implementation of the two units of the current and proposed Euro 5 standard for the production of gasoline. According to the calculations, the indicators of economic efficiency of the proposed installation is much higher than in the current production. Thus, a decrease in capital costs, identified savings of energy, material and labour resources, increasing the yield of the target product, etc. In this regard, the proposed installation is recommended for implementation in the current production. Application of this innovative production becomes actual as release of automobile gasoline on Antipinsky oil refinery is the only high-quality product in the regional market, in particular the South of the Tyumen region. The product will be in demand and will cover the needs of the territory in full.

References

- Adzhiev, Y., & Purtov, P. (2014). Preparation and processing of associated petroleum gas in Russia: scientific publication. Krasnodar, ADVI.

- Dynarski,Y. (2007). Basic processes and apparatuses of chemical technology: teaching in the expedient design. Moscow, Publishing house Alliance.

- Federal state statistics service Russia. (2017). Retrieved from http://www.gks.ru/ wps/wcm/connect/rosstat_main/rosstat/ru/statistics/publications/catalog.

- Forecast of energy development in the world and Russia until 2040. (2014). ERI RAS and Analytical center under the Government of Russia. Retrieved from https://www.eriras.ru/files/forecast_2040.pdf.

- Information-analytic review. (2015). The fuel and energy complex of Russia. 2005-2014. Moscow, Publishing analytical centre Energy.

- Information-analytic review. (2017). Fuel and energy complex of Russia 2016. Moscow, Analytical center under the Government of Russia.

- Kasperovich, A, & Magaril, R. (2008). Balance calculations in the design and planning of hydrocarbon processing and gas condensate oil and gas condensate fields: a tutorial. Moscow, KDU.

- Russia's largest oil refineries. (2017). Retrieved from http://xn--d1acfdrboy8h.xnp1ai/rynok_diztopliva/krupneyshie_npz_rossii.

- The strategy of innovative development of the Russian Federation up to 2020. (2014). Retrieved from http://ac.gov.ru/files/attachment/4843.pdf.

- The impact of global Megatrends on the petrochemical industry in Russia until 2030. (2017). Retrieved from http://www.oilexp.ru/news/russia/vliyanie-mirovykh-megatrendov-na-neftekhimicheskuyu-otrasl-rossii-do-2030-g/116602/.

- The Ministry of energy. Official statistics. (2017). Retrieved from https://minenergo.gov.ru/activity/statistic.

- The oil and gas industry of Russia. (2017). Retrieved from http://fb.ru/article/263751/neftegazovaya-otrasl-rossii.

- Vazhenina, L. (2011). Associated petroleum gas: experience of processing and performance evaluation. [Monograph]. Tyumen, Tyumen oil and gas University.

- Vazhenina, L. (2017). Formation of mechanisms for the development of energy saving and energy efficiency in the gas industry. [Monograph]. Tyumen, Tyumen industrial University.

- Zolotukhina, T. (2014). Organizational and economic support of modernization of oil refining industry enterprises. [Monograph]. Nizhny Novgorod, Nizhny Novgorod state University N. Lobachevsky.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Vazhenina, L. V. (2018). Use Of Innovations In Russian Oil Refining Industry. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 1322-1333). Future Academy. https://doi.org/10.15405/epsbs.2018.12.162