Abstract

The urgency of the research is in the complex of measures on formation of tax policy, creation of the legal frame and mechanisms of taxation, and also planning of financial safety and stability on Internet trading market for the long-term period. The authors have revealed the problems of the modern e-commerce market development. Special attention is paid to the analysis of foreign experience in selling goods via the Internet. Also the analysis of the domestic e-commerce experience is carried out; the static data underlie the forecast of sales and services through the Internet till 2020. On the basis of the research the authors offer the model of relations between participants of the Internet-trade in order to develop the innovative component. According to the authors, investment and innovative tools should be implemented for development of the e-commerce market. Investment tax credit can be one of such instruments. It will enable Russian industry to increase turnover of innovative goods/services and bring the e-commerce market to a higher, level. A new experimental innovative scheme of calculating the investment tax via annuity payments is proposed. Thus, e-commerce will contribute to the development of innovative economy with access to new markets, increasing competitiveness, reducing financial and temporal resources, etc.

Keywords: E-commerceinvestmentsbusiness processescompetitioninvestment tax credit

Introduction

Stimulation of an innovative component of business activity in order to increase business efficiency is of special role in modern national economy. Conventional methods of doing business in Russia do not fully correspond to international business development. E-commerce is one of the modern ways of doing business.

E-commerce is used as a rapid means of transforming the world into an information society. It enables business to expand from a simple transaction to a broader and more complex concept of cooperation between companies. In global markets and increasing interdependence of national economies, the use of e-commerce remains an important but complex and elusive phenomenon with little knowledge of its determinants (Awagah, Kang, & Lim, 2015). Business environment of both large and small and medium-sized enterprises has been involved in e-commerce significantly (Grandón, Nasco, & Mykytyn Jr., 2011).

Active development of information technologies and the Internet creates crucially new conditions for business development (Al-Khouri, 2014; Suliman Al‐Hawamdeh 2002).

Though e-commerce still comprises a small part of many economies, its employment as a possible means of lower costs and higher efficiency is widely accepted (Chan & Al‐Hawamdeh, 2002; Goldmanis, Hortaçsu Syverson, & Emre 2010; Kartiwi & MacGregor, 2007).

The urgency of the research is due to the fact that the invention and development of new information technologies lead to a new type of world economy activity— e-commerce.

"E-commerce" generally refers to economic activity in which all financial and electronic transactions are carried out with modern information technologies.

The concept of "e-commerce" is closely related to that of "e-business" and is an integral part of it. E-Business as an economic category means business activity via global information and telecommunication networks in order to profit. The key difference between e-commerce and e-business is in the fact that e-commerce is a form of transactions, while e-business is the main business activity of the enterprise aimed at transformation of enterprise business processes (Valigurskij, 2011; Haig, 2002; Makarova, 2001).

Problem Statement

Information and Internet technologies form a new internal business culture, with quick adaption of business model and strategy to changing economic conditions and new opportunities being key factors for success in the rapidly changing conditions of the Internet economy (Ershov, 2012).

Research Questions

In global economy, it is necessary to promote innovative goods and services into domestic and overseas markets.

Purpose of the Study

The purpose of the article is to determine the role of e-commerce in the development of the national economy and to structure investment and innovative approaches to its development. The object of the research is e-commerce as an instrument of development of innovative economy in the Russian Federation.

Research Methods

Analysis of domestic and foreign e-commerce market

In Russia, e-commerce faces a number of problems; therefore tendencies of its development and structural components are to be analyzed for its further development.

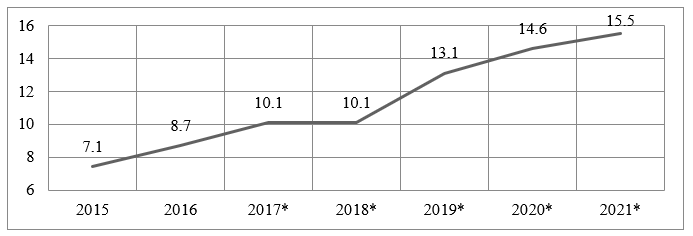

Analysis of domestic and foreign e-markets is carried out. The world e- retail share is shown in Figure

Statistics shows that in 2015, e-retails is 7.4% worldwide. In 2017-2018 e-sales decline – experts link that to global economic crisis, but they are forecast to increase twice and comprise 15.5% in 2021.

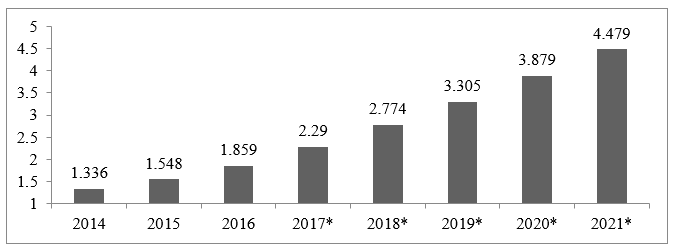

Dynamics of e-retails around the world in 2014-2021 is reviewed (Figure

In 2014, e-retails amounted to 1.336 trillion USD worldwide; now figures have reached 2.29 trillion USD, and in 2021 they are expected to reach 4.48 trillion USD.

Personal computers, tablets, mobile phones and other electronic devices are the most popular on-line shopping means. In the United States, consumer goods proved to be the fastest growing category of e-commerce as at January 2017.

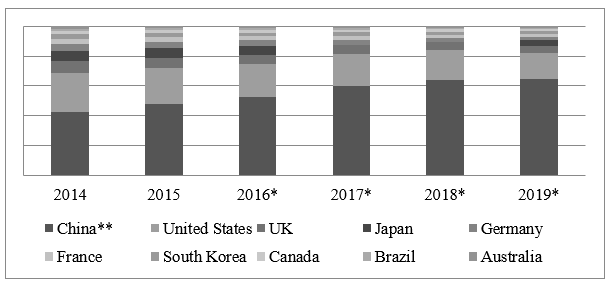

Figure

China leads in e-retailing: in 2014 its sales amounted to 472.91 million US dollars, whereas they are expected to reach 1973.04 ml by 2019 that is 23.96% higher than in previous years. China has ranked first in sales due to its large population and well-developed export network around the world as the authors suggest.

The United States rank second: in 2014 sales were 298.26 ml dollars, in 2019 the sales are forecast to reach 534.94 ml dollars, that is 55.75% more.

The TOP-10 countries include the UK, Japan, Germany, France, South Korea, Canada, Brazil; Australia is the last on the list of leaders. In 2014, the sales were 17.4 ml dollars; in 2019 they can reach more than 25.61 ml dollars that is 8.21 ml dollars higher.

The statista.com shows that of goods and services e-retails are forecast to increase in future. Therefore, this direction is ought to be promoted.

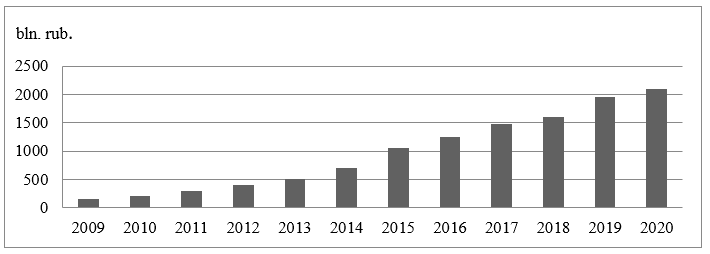

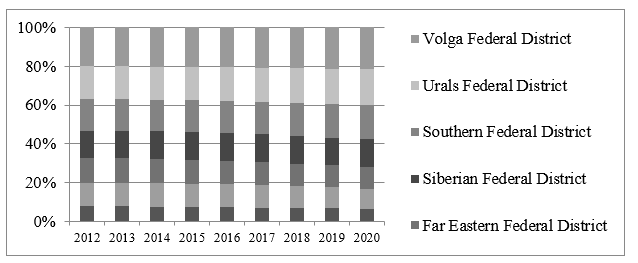

Although Russia is not in the TOP-10, the potential for further development is still obvious. The e-commerce increase rates within 2009-2020 are shown in figure

Thus, experts believe that e-sales will reach 20,180 billion by 2020. That shows a steady growth rate at 15-20% annually.

In 2016, 22-23 million Russians shopped via the Internet, Rosstat says. The e-commerce market in Russia grows fast and therefore the number of on-line shoppers increases.

Figure

The data show that in cities of more than 100,000 inhabitants the use of electronic technologies comprises more than 30-40%. Such indices show a high possibility of structural transformation of many goods and services markets and considerable prevalence of electronic transactions already in the next few years.

Russian e-market is influenced be development of mobile applications and mobile Internet, which is currently around 70%. As the number of smart phones and tablets users increases, the total number of active mobile Internet users is expected to exceed 150 million people by the end of 2018.

The slow development of e-platforms is due to the following factors:

the lack of clear legal framework for e-business doing;

bureaucracy impedes business starting;

the lack of storage facilities;

logistic expenses;

fraud to undermine the reputation of the company, etc.

State regulation is a part of e-commerce institutionalization and one of the factors to form marketing environment of global network economy. The mission of the State is to define a legal framework and rules for e-commerce and to bring it out of the shadows through the accelerated creation of network infrastructure. If Russia does not develop the e-commerce infrastructure in the coming years, foreign networks will prevail the Russian consumer market (Kaluzhskij, 2013).

Measures to stimulate e-market in Russia

Basic measures to stimulate the e-commerce market in Russia are:

to change a number of statutory and regulatory acts to improve the law in order to make the users confident about purchasing goods by means of electronic devices through the Internet and non-disclosure of their personal data;

to train qualified specialists in the sphere of e-commerce and business;

to expand international cooperation on Internet platforms;

to participate in international trade and industrial exhibitions;

to promote e-commerce among enterprises and buyers;

to promote Russian goods into overseas markets;

to improve the service of e-customers, including the logistics (interchanges), i.e. it is necessary to develop the multichannel strategy of retail in the logistics market enabling the client to choose the most convenient model of order, delivery, payment, and return;

to establish regulatory bodies;

to grant preferential tax regimes;

to provide storage facilities for Internet trade in dynamically developing regions of the country that will help to involve new clients among inhabitants of remote regions.

Russia's competitiveness in the global economic space cannot be improved without effective functioning of the national innovation system (Mamleeva, 2016).

Many researchers believe that venture capital investments are required for the development of innovative Internet platforms. A public-private partnership can be another incentive tool. These methods and tools will allow us to develop e-commerce in Russia successfully.

We consider that one of the tools to stimulate the e-commerce market is to introduce an investment tax credit for innovative activities.

Scheme of interaction between e -participants in development of Russian innovative economy

The main models of e-commerce are as follows: B2C (Business-to-Consumer), B2B (Business-to Business), C2B (Consumer-to-Business), C2C (Peer-to-Peer), online banking, online trading, and online services. Each model has both advantages and disadvantages, but e-market development and consequently maximum profit are common for them.

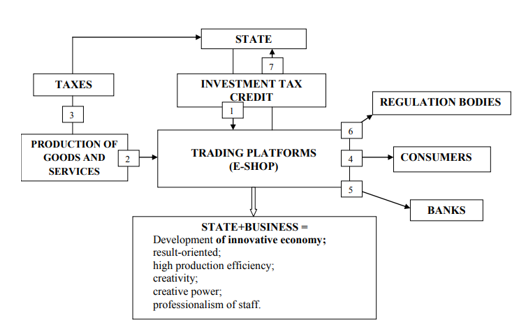

The authors offer their model of interaction between the participants of e-commerce in development of innovative economy in Russia (Figure

where:

is organizational and economic relations between the State and the Borrower;

is placement of investment tax credit in innovative goods and services;

is budget revenue collection;

is innovative goods and services sales through Internet-platforms;

is granting of credits through credit organizations (if necessary);

is audit by monitoring bodies;

is repayment of financial resources in the form of payment of the loan amount and accrued interest.

The implementation of a modern tool, investment tax credit, is peculiarity of the offered scheme of relations between the participants of e-commerce in innovative economy development. When providing an investment tax credit, the State allows its industry to increase turnover in production of innovative goods/services, thereby replenishing tax revenues to the state budget with increasing sales of innovative goods and services via electronic Internet platforms, as well as brings the e-commerce market to a higher level.

The Scheme presented emphasizes the role played by the State in developing e-market and innovative economy. Furthermore, it is impossible to progress without involving business as it is businesses that possess necessary financial recourses. Legal and financial cooperation of the State and Business is the main source to develop innovative economy.

Authors offer a technique for investment tax credit calculation in order to provide rationale for implementation the e-commerce tools.

Calculation technique of e-commerce development efficiency

The aim of the technique is to calculate the effectiveness of investment tax credit in innovative e-commerce development.

Investment tax credit is granted for the amount of the loan, which is 100% of the value of the purchased goods, or for the amount of credit determined by the Parties. Interest at the rate of not less than ½ and not exceeding the ¾ CBR's rate of refinancing is set on the amount of the investment tax Credit (Nikityuk, 2016).

The organization, which has received the investment tax credit, is entitled to reduce its payments on the relevant tax during the term of the Investment Tax Credit Agreement.

In the view of the foregoing, the authors formulated coefficients of investment tax credit, which facilitates innovative e-platforms:

1. Coefficient of the amount of the investment tax credit relatively the amount of income tax:

, (1)

where ITCR (Invest tax credit) is the amount of the investment tax credit with the accrued interest taken into account;

TPROFITt (Tax on profit) – the amount of income tax debt.

2. Coefficient of the amount of investment tax credit relatively the amount of property tax:

, (2) where TPROPERTYt (tax on property) is the amount of the property tax debt.

3. Coefficient of the amount of investment tax credit relatively transport tax ratio:

, (3),

where TCARt (Tax on car) is the amount of the transport tax debt.

If coefficients :

≥ 0.5, tax investment credit is considered possible;

, the tax investment crediting is not possible.

These coefficients enable one to determine if to grant or not an investment tax credit to the entity with different types of taxes accounted.

If the coefficients (Chapter 9 of the RF Tax Code, Art. 66 p. 3) are ≥ 0.5, the calculation of the investment tax credit with the interest accrued by redeemable annuity payments (ITCR) taken into account are as follows:

(4)

where, S is the loan amount;

P is the interest rate on the investment tax credit;

n is the number of months during which the loan is paid;

y is refinancing rate.

The novelty of the investment-innovative technique is in the possibility to apply the seamounts coefficients of the investment tax credit to the amount of taxes in order to identify potential e-commerce entities that can claim an investment tax credit as to a number of federal and regional taxes and allocate investment tax credit on sales of innovative goods and services through the Internet.

It should be emphasized that electronic payments in the given model are carried out via the Russian national payment system "MIR".

Findings

The proposed set of measures for the formation of tax policy will contribute to the stable development of innovation in the market of Internet trade. It is important to emphasize that role of e-Commerce will be increased in Russia that will contribute to innovative economy development of new generation, to growth of healthy competition, small entrepreneurship development and to quality of goods and services increasing accordingly. Such significant economy structural changes and information technology development blur the territorial boundaries of the entrepreneurial activity and increase opportunities for domestic enterprises to enter on world markets, to reduce costs of implementing activities including transaction servicing, that leads to reduction of goods/services cost and improving enterprises economic efficiency.

Conclusion

E-commerce is a promising and new direction in the development of domestic innovation entities. An analysis of domestic and foreign experience revealed that in various countries of the world, development of e-commerce leads to positive dynamics of market volume, and the Internet involves all activities increasingly. Authors identified the problems that the State and businesses face in e-trade developing.

The measures proposed that formation of tax policy will promote stable innovative development of Internet-trade.

It should be emphasized that the role of e-commerce in Russia will increase only and facilitate innovative economy, new profitable offers and healthy competition and, consequently, higher goods and services quality, access to overseas markets, lower transactions expenses and therefore lower goods and services costs, increased demand, etc.

References

- Al-Khouri, A.M. (2014). Digital identity: transforming GCC economies. Innov: Manage Policy Pract, 16, 2, 184–194.

- Awagah, R, Kang J & Lim, J I. (2015). Factors Affecting E-Commerce Adoption among SMEs in Ghana; Information Development, 32, 4, 815–836.

- Chan, B., & Al‐Hawamdeh, S. (2002). "The development of e‐commerce in Singapore: The impact of government initiatives", Business Process Management Journal, 8, 3, 278-288.

- Makarova, N.M. (2001). E-Business Revolution. The living and working in an interconnected world/Daniel Amor; Translated from English by N.M. Makarova, 751 p.

- Kaluzhskij, M.L. (2014). E-commerce: Marketing networks and Market Infrastructure; OSTU, 328 p.

- Grandón, E. E., Nasco, S.A., Mykytyn Jr., P.P. (2011). Comparing theories to explain e-commerce adoption. Journal of Business Research, 64, 3, 292-298.

- Ershov, S.A. (2012). Management of innovative development of e-commerce enterprise on the basis of informatization, Creative Economy, 6. 11, 65-69.

- Goldmanis, M., Hortaçsu A., Syverson C., & Emre O. (2010). E-commerce and the market structure of retail industries. Econom. J., 120, 545, 651–682.

- Haig, M. (2002). E-Business Essentials, Translated from English by S. Kosikhina. 208 p.

- Kaluzhskij, M.L. (2013). Priorities of institutional regulation of e-commerce: Russia and world trends//National interests: priorities and security, 4, 231, 11-22.

- Kartiwi, M., & MacGregor R. (2007). Electronic commerce adoption barriers in small to medium-sized enterprises (SMEs) in developed and developing countries: A cross country comparison. Journal of Electronic Commerce in Organization, 5, 3, 35-51.

- Kholodkova, K.S. (2013). Analysis of the e-commerce market in Russia, Modern research and Innovation, 10.

- Mamleeva, E.R. (2016). State regulation of innovation activity, Innovative development of Economy, 3, 33, 7-10.

- Nikityuk, L.G. (2016). Investment tax credit for development of innovative activity in housing and utilities sector. Taxes and taxation, 1, 13-19

- Suliman, Al‐Hawamdeh. (2002). "The development of e‐commerce in Singapore: The impact of government initiatives", Business Process Management Journal, 8, 3, 278-288,

- Valigurskij, S.D. (2011). Problems and prospects of e-commerce development in Russia. Fundamental and applied research of the cooperative sector of the economy,3, 44-50.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Timchuk, O. G., Gorbachevskaya, Е., Nikityuk, L., & Evseeva, G. (2018). Role Of E-Commerce In Development Of Innovative Economy. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 1179-1187). Future Academy. https://doi.org/10.15405/epsbs.2018.12.144