Abstract

At the moment, Russian industrial policy is aimed at the development of import substitution. Many of the measures and mechanisms for import substitution are not producing the desired results. Therefore, the economists had to find the most effective mechanism, aimed at increasing the production of competitive Russian products on the world market. The Russian government tries to reduce dependence in production cycles. Council of Ministers try to allocate state investments most effectively in the machine-building industry. Industrial enterprises want to increase profits and reducing risks in modern conditions. Mechanism import of substitution should affect the pace and efficiency in the machine-building industry. The authors suggest a mechanism for import substitution, which should create new companies for the production of food equipment. This mechanism ensures economic and national security of the country. The mechanism will increase the level of industrial production in the region, and achieve growth in import-substituting production. The article analyses the concept of import substitution in a complex geopolitical situation in the world. The paper reveals the advantages of developing industrial clusters. Therefore, it is assumed that companies will be merged into a cluster form, which will allow meeting the emerging needs. The developed model for the distribution of state investments in import-substituting production.

Keywords: Clusterimport of substitutionexport-oriented productionprinciplemanagement theorymulticriteria

Introduction

The results of research in the field of economic content, essence and efficiency of the implementation of the association of industrial enterprises in the region, as well as the diversity of their shaping processes, along with convincing evidence, revealed the advantages of integrated business structures to independently operating enterprises in today's challenging conditions. The nature of these causes initiated the development of a model demonstrating the pooling of industrial enterprises' resources as key factors for import substitution in the engineering sector (Beregova & Klipin, 2017).

The scientists established that the joint activity of machine-building enterprises is an important component in determining the development of import-substituting and export-oriented production. This is determined by the fact that integration, based on the idea of the partnership and harmonization of interests, allows creating effective, fully completed production and technological chains, to which it is involved to the fullest extent and, within the framework of which the economic and innovative potential of the merging enterprises is fully disclosed to achieve import substitution goals (Bruton, 1998).

Problem Statement

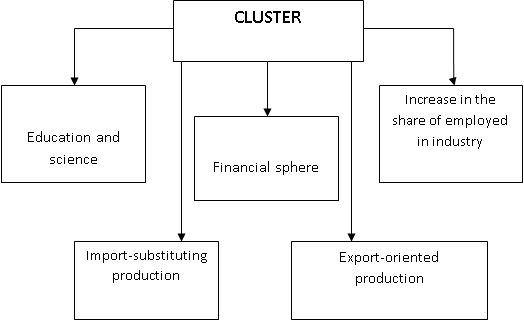

Therefore, it is assumed that companies will be merged into a cluster form, which will allow meeting the emerging needs. It was revealed that the development of the sub-sector of the production of food equipment in the territory of the Irkutsk region should eliminate the dependence of regional agro-industrial enterprises on imported equipment (Pandove, Rani & Goel, 2017). The block diagram is shown in Fig.

The enterprise development program should be built not only on the amount invested, but also on the composition of implemented measures to improve efficiency. There are fundamental approaches that make it possible to draw up a table of the organizational development plan for the enterprise.

During the development of the import substitution mechanism proposed for implementation at machine-building enterprises, a formalized approach should be formed to assess the current situation of the enterprise, identify areas for the allocation of public investment (in the form of subsidies and targeted loans), and identify characteristics on which the development forecast will be modeled at the industrial enterprise (Sedlacek, Sapienza, & Volker, 2008).

Research Questions

The developed model for the distribution of state investments in import-substituting and export-oriented production makes it possible to make correct management decisions on the distribution of investments in the activities due to the implementation of which the economic effect was observed. This model allows us to identify those activities in which investment resources are not profitable, and to determine the most rational and optimal measures (Culbertson, Guralnik, & Stiller, 2018).

Table

The task of forming the mechanism of import substitution is divided into a number of management tasks, solved using various mathematical methods, with the aim of the most efficient allocation of public investment:

Modeling the distribution of investments between activities by solving a multicriteria optimization problem for given normative investments and the estimated effects from them.

Modeling the obtained effect of investment between all product groups (Delgado, Porter & Stern, 2014).

Let us introduce the variables that will participate in the formation of the model:

The vector of investment in activities , where . This vector reflects the direction of investment, which the company defines as the most promising.

The vector of effects obtained from investments , where .

Purpose of the Study

Next, we construct matrix A of effects from the activities carried out:

(1)

Element

of matrix

It is worth asserting that the accumulated investment should be distributed depending on the type of investment, because some ongoing activities, in particular investments in automated production, entail initial investment in procurement and commissioning. That in the end leads to the need for investments in maintaining the created infrastructure and improving it with the release of modern high-tech products. (Porter, 2001).

To implement the mechanism of import substitution, it is necessary to build matrix A for the planned period of time t in order to determine the coefficients of investment influence on the effect obtained from them, depending on the type of investment. So investments in the personnel training system or in increasing production capacity can be of a straightforward nature, their coefficients are stable throughout the planning period, while with the introduction of the budgeting system, the maximum effect is felt in the first years of implementation, and later the effect of distributed investments stabilizes (Viederytė, 2014).

Therefore, it is necessary to exclude the investment of financial resources in ineffective measures.

Accounting for dependent investments, discussed earlier, also adjusts vector

by the amount of dependent investment for each specific event. In Table

Resulting final vector

.(2)

This equation is based on class of multicriteria optimization-distribution problems. This class of tasks has proved itself well in solving practical tasks related to enterprise resource management. This equation takes into account all the major limitations associated with real market conditions. When solving multicriteria optimization problems, it is necessary to form target functions, a system of linear equations that connect variables and objective functions. It is necessary to take into account all the main limitations within which the enterprise operates.

Research Methods

The target functions are the elements of vector , reflecting the result of investing public investments in the target areas, which are written in the form of restrictive criteria:

, where is an element of the function , which indicates the effect when investing in R & D activities and corresponding to the market trends predicted for the next period. The function element is measured in rubles and shows the forecasted growth in R & D in the next period, based on the trends in technology development in the industry (Ramon-Gonen, & Gelbard, 2017). It should be noted that the development of a market forecasting model for a combination of the effects obtained is determined by experts in the industry and is not an accurate estimate that can be obtained using a mathematical apparatus, although methods for analyzing numerical series (trends, moving averages) can be applied in markets where the trends are clearly traced.

, where

is an element of the function

, which indicates the effect of investing in measures to improve the material and technical base and optimize the work with suppliers, which should correspond to the market trends predicted for the next period. The function element

is measured in rubles and shows the predicted growth of this factor in the next

, where is an element of the function , which indicates the effect of investing directly in activities related to the production of food equipment. Should correspond to the market trends predicted for the next period. The function element is measured in rubles and shows the forecasted growth in the next period, based on the trends in the development of production equipment in this industry. The predicted indicator, as in the case of R & D and the purchase of equipment, is found by interviewing internal or external experts.

, where is an element of the function , which indicates the effect when investing directly in activities to develop the personnel potential of the enterprise, which should correspond to the market trends predicted for the next period. The function element is measured in the number of people working in the enterprise. Shows the forecasted growth in the next period, based on labor market trends in the engineering sector. The predicted indicator is found by analyzing the statistical materials of the Federal State Statistics Service (Zhang & Lam, 2016).

The allocated restrictions play an important role in the distribution of investments, because if the products of the enterprise in question have technological properties lagging behind or outstripping the market in each segment, then sales in these segments will fall dramatically, even with high gross margin per product, which will lead to losses due to overstocking of stocks in warehouses and underloading of production capacities:

.

This restriction differs from those considered earlier. Index is calculated from forecasting of sales in the domestic and foreign markets, based on the production plan (planned revenue) for the next period. The production capacity for the next period should be calculated for each segment separately, then the total necessary capacities to be purchased or sold must be calculated.

Findings

We offer the following restrictions criteria. Index reflects the costs for materials and components. reflects costs for salaries of production personnel, reflects costs of conducting case studies). demonstrate commercial and administrative costs and seek maximum.

Effects from investments aimed at cost optimization and commercial and administrative expenses are the key to the success of the company's products in each market segment, not only in maximizing profits, but also in preserving and improving the competitive position of the company (Yang, Pu, & Cai, 2015). The distribution of investments in these areas is extremely necessary, but less significant than the need to improve the technological parameters of products in new markets. In connection with geopolitical instability in the world, Russians and foreign enterprises have many economic problems. Russian companies need to be constantly prepared for a negative scenario of development of events in the target markets, which can be achieved by increasing organizational and production efficiency.

Conclusion

The mechanism of import substitution is built on the basis of a model for allocating investments into potentially promising activities, and dividing the profits received among enterprises within an industrial cluster. The mechanism allows:

inclusion in the cluster of scientific centers that have ready-made developments in the field of import substitution;

ensuring the continuity of the finished cycle of production of competitive products, increasing the efficiency of production activities on the basis of contracts between scientific centers, machine-building and agro-industrial enterprises;

elimination of the duration of the production cycle caused by the need to purchase imported raw materials and components through close coupling of the main and auxiliary (servicing) industries;

distribution between the enterprises of the works connected with performance of separate industrial processes on the basis of attitudes of subcontracting and intrapring;

In addition, a shorter production cycle is characterized by a lower level of risk, the possibility of attracting "short money" allows you to quickly release the monetary resources that can be used to upgrade.

Acknowledgments

The authors acknowledge that the research is not a part of the Federal Research Program “Irkutsk National Research Technical University” funded by the Government. We bear responsibility for errors and heavy style of the manuscript.

References

- Beregova G.М., & Klipin А.О. (2017) Analysis and assessment of economic state of enterprise in context of strategy of import substitution Advances in Economics, Business and Management Research, 38, 70-76. doi:10.2991/ttiess-17.2017.12

- Bruton, H. J. (1998). A Reconsideration of Import Substitution Journal of Economic Literature, 36, 903-936

- Culbertson, J., Guralnik, Dan P. & Stiller Peter F. (2018). Functorial hierarchical clustering with overlaps Discrete Applied Mathematics. 236, 108-123. doi: https://doi.org/10.1016/j.dam.2017.10.015

- Delgado, M., Porter, M. E. & ScottStern, (2014). Clusters, convergence, and economic performance Research Policy 43, 1785-1799. doi: https://doi.org/10.1016/j.respol.2014.05.007

- Hudson, R.A. (1998) Brazil: a country study Washington, D.C.: Federal Research Division, Library of Congress, 34, 658.

- Palma, G. (2006). Stratégies actives et stratégies passives d’exportation en Amérique latine et en Asie orientale: La croissance liée à la composition particulière des produits et à la spécificité des institutions Revue Tiers Monde, 186, 390.

- Pandove, D., Rani, R. & Goel, G. (2017). Local graph based correlation clustering Knowledge-Based Systems. 138, 155-175. doi: https://doi.org/10.1016/j.knosys.2017.09.034

- Porter, M.E., (2001). “Regions and the New Economics of Competition” in A.J. Scott (ed.), Global City-Regions. Trends, Theory, and Policy, New York: Oxford University Press, pp. 145-151.

- Rodrigues, M., (2010). Import substitution and economic growth Journal of Monetary Economics. 57, 175-188. doi: https://doi.org/10.1016/j.jmoneco.2009.12.004

- Roni Ramon-Gonen, & Roy Gelbard (2017). Cluster evolution analysis: Identification and detection of similar clusters and migration patterns Expert Systems with Applications. 83, 363-378. doi: https://doi.org/10.1016/j.eswa.2017.04.007

- Sedlacek, H. H., Sapienza, A. M. & Volker (2008). Eid Ways to Successful Strategies in Drug. Research and Development. 25, 275.

- Sosnovskikh S. (2017). Industrial clusters in Russia: The development of special economic zones and industrial parks Russian Journal of Economics. 3, 174-199. doi: https://doi.org/10.1016/j.ruje.2017.06.004

- Yang, Z., Hao, P. & Ca, J. (2015). Economic clusters: A bridge between economic and spatial policies in the case of Beijing Cities. 42, 171-185. doi: https://doi.org/10.1016/j.cities.2014.06.005

- Zhang, Yi & Lam, J. S. L. (2016). Estimating economic losses of industry clusters due to port disruptions Transportation Research Part A: Policy and Practice. 91, 17-33. doi: https://doi.org/10.1016/j.tra.2016.05.017

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Schupletsov, A., Klipin, A., & Skorobogatova, Y. (2018). Formation Of Model Of Import Substitution In Machine-Building Complex. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 1071-1077). Future Academy. https://doi.org/10.15405/epsbs.2018.12.131