Abstract

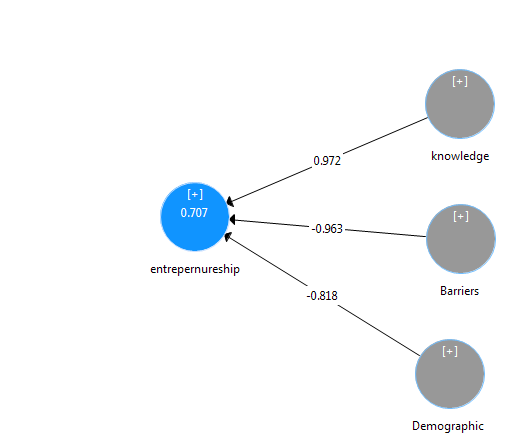

The knowledge spillover theory of entrepreneurship (KSTE) holds individual characteristics as given but rather lets the context vary. In particular, high knowledge contexts are found to generate more entrepreneurial opportunities, where the entrepreneur serves as a conduit for knowledge spillovers. Start-ups are playing a significant role especially at early stages of the life cycle, when technology is still fluid. Therefore, this paper assumes that fundamental innovation comes from new firm start-ups. Malaysia is amongst the few economies in Asia Pacific and South Asia where finance and physical infrastructure to support entrepreneurship is widely available. Thus; the empirical evidence of KSTE from Malaysia refers that there are three factors effect on entrepreneurship (knowledge economy factors, barriers factors and demographic factors). The results show that

and total effects of the three factors on the entrepreneurship. In addition, knowledge economy factors have a significant impact on enhancing the entrepreneurial activities, whereas; 46.0% of the variance in entrepreneurship can be explained by knowledge factors. On the other hand, entrepreneurial activities could be affected negatively by administrative barriers and government policies, the results show that 97.8% of the variance in entrepreneurship can be explained by barriers factors. Finally, there is no evidence that demographic factors have a significant impact on entrepreneurship in Malaysia.

Keywords: Knowledge spillover theory of entrepreneurship KSTEknowledge economyentrepreneurshipR&DMalaysia

Introduction

Endogenous growth theory has provided two essential contributions. The first is that the formation of knowledge and human capital takes place as a response to market opportunities. The second is that investment in knowledge is likely to be associated with large and persistent spillovers to other agents in the economy.

According to Arrow’s recognition that knowledge is not the same thing as economically relevant knowledge (Arrow 1962). The main aim of endogenous growth proponents (Romer 1990) was to introduce spillovers explicitly into models of growth. Aggregate knowledge capital was defined as a composite of R&D and human capital, not embodied in processes or products. Accumulation of capitalized knowledge assets was shown to lead to increased growth in a general equilibrium setting. This result could be traced to the characteristics of non-excludability and non-rivalry attached to knowledge, implying that marginal productivity of knowledge capital does not need to diminish as it becomes available to more users. Still, the first wave of endogenous growth models paid little attention to how spillovers actually took place and treated the process as exogenous. Their emphasis was on the influence of knowledge spillovers on growth without specifying how knowledge spillsover.

The knowledge spillover theory of entrepreneurship (KSTE) has emerged as a useful framework for guiding empirical investigations that can guide both research and policy decisions relating to innovation and entrepreneurship (Braunerhjelm et al. 2010; Acs et al. 2013). KSTE embraces Romer’s (1986) views on the importance of new knowledge to innovation and economic growth but takes exception to neoclassical assumptions that all knowledge is necessarily economically useful or automatically spills over to other organizations.

According to the KSTE, the decision-making to become an entrepreneur is derived from the context. This context generates more entrepreneurial opportunities when it has more ideas created and commercialized via the creation of a new firm. Based on that the entrepreneurs work as a canal for the spillover of knowledge, moreover they follow the innovative activity and enhance economic performance (Acs et al. 2013). The KSTE combines contemporary all thoughts and entrepreneurship theories with predominant economic growth theories. In particular, this approach enhances endogenous growth theory that provides an explanation of the unobserved heterogeneity of growth rates between regions and nations. By keeping the motivations of entrepreneurs constant, any increase in the rate of start-ups and entrepreneurial activities should reflect a change in the costs and benefits of creating a new venture based on changes in the costs and benefits of the operating context (Acs et al. 2013).

Based on major global technology indexes which refer that Malaysia has a good score comparing to Asian countries, such as Technological Activity Index, which focuses on production of new knowledge, not absorption and diffusion of knowledge. Malaysia’s score is 0.466 places the country at the 55th position (UNCTAD, 2005). As a consequence, R&D is a fundamental factor to sustain new knowledge production. Malaysia has a dual economy with its modern sector being dominated by multinational companies rely on R&D and technology. Based on that, new knowledge leads to opportunities that can be exploited commercially by entrepreneurship. The challenge for Malaysia lay on the capability of the entrepreneurship in Malaysia which make the requisite investments in new knowledge and idea; such as expenditure on research and development (R&D), would accrue a rich return for its efforts in terms of enhanced economic performance.

Malaysia and the Global Entrepreneurship Monitor

Based on the Global Entrepreneurship Monitor report (Singer. et.al, 2015), Malaysia is classified as economic development phases in transition to Innovation-driven economies; whereas the companies compete by producing and delivering new and different products and services by using the most sophisticated processes. The role of entrepreneurship in Innovation-Driven Economies can be explained as an economy matures and its wealth increases, one may expect the emphasis in industrial activity to gradually shift toward an expanding service sector that caters to the needs of an increasingly affluent population and supplies the services normally expected of a high-income society. The industrial sector evolves and experiences improvements in variety and sophistication. Such a development would be typically associated with increasing research & development and knowledge intensity, as knowledge-generating institutions in the economy gain momentum. This development opens the way for the development of innovative, opportunity-seeking entrepreneurial activity that is not afraid to challenge established incumbents in the economy. Often, small and innovative entrepreneurial firms enjoy an innovation productivity advantage over large incumbents, enabling them to operate as ‘agents of creative destruction.’ To the extent that the economic and financial institutions created during the scale-intensive phase of the economy are able to accommodate and support opportunity-seeking entrepreneurial activity, innovative entrepreneurial firms may emerge as significant drivers of economic growth and wealth creation.

Malaysia is amongst the few economies in Asia Pacific and South Asia where finance and physical infrastructure to support entrepreneurship is widely available. However, despite such positives entrepreneurial activity in terms of total early stage entrepreneurial activity, which is the second lowest in Asia Pacific and South Asia surpassed only by Japan. Intentions for entrepreneurship and attitudes towards entrepreneurship are also among the lowest within the region. Job growth expectations is relatively low at below 0.01% of new businesses expecting to hire more than 20 workers. In addition, Malaysia has the lowest fear of failure amongst those who see opportunities at 33% against the regional average of 41%. Malaysia is closely followed by China (34%) and Indonesia (35%). Proactive Malaysian government policies and evolving cultures (embracing innovation and entrepreneurship) have played a role in causing such perceptions amongst those who anticipate opportunities for entrepreneurship.

Malaysia and Singapore rate the highest globally for Finance for entrepreneurs at 3.4 and 3.5 respectively. In National Policy for entrepreneurship Malaysia is rated at 3.1 above the average of 2.8 for the Asia Pacific and South Asia region. However, where National Policy for regulations are concerned Malaysia was rated at 2.5 below the regional average of 2.6. Malaysia’s Governmental support and policies are second highest at 3.3 with Singapore leading at 3.4. Thus, Malaysia’s National Policy and Regulations, as a whole, have much room for improvement when compared against the region’s best.

Problem Statement

There is no difference in the KSTE model in regarding the origin of new product innovations whether they come from incumbent firms or start-ups (Acs and Audretsch 1988). It could be thought that the incumbent firms are more depending on progressive innovation from the knowledge flow, while the start-ups are more likely to engage in revolutionary innovation leading to new industries or replacing existing products. According to Baumol (2004): ‘‘…the revolutionary breakthroughs continue to come predominantly from small entrepreneurial enterprises, with large industry providing streams of incremental improvements that also add up to major contributions.’’ Entry by start-ups has played a major role in revolutionary innovations, such as software, semiconductors, biotechnology (Zucker et al. 1998) and the information and communications technologies (Jorgenson 2001). Start-ups are especially important at early stages of the life cycle, when technology is still fluid. Therefore, this paper makes the strong assumption that revolutionary innovation in Malaysia comes from new firm start-ups.

Research Question

The main research question of this study is as follow:

To what extent does knowledge spillover is considered as source of entrepreneurial opportunity in Malaysia.

Purpose of the Study

This paper develops a KSTE to improve the microeconomic foundations of endogenous growth models, in which the creation of knowledge expands technological opportunity. The theory shifts the unit of analysis from exogenously assumed firms to individual agents with new knowledge endowments. Agents with new economic knowledge endogenously pursue the exploitation of such knowledge, implying that the existing stock of knowledge yields spillovers. This further suggests a strong relationship between such knowledge spillovers and entrepreneurial activity. The theory provides an explanation for the role of the individual and the firm in an economy. In consequence, this study aims to analyse the relationship between the knowledge economy factors and the entrepreneurial activities in Malaysia.

Research Methods

The theoretical model explains entrepreneurship as a function of the following factors: knowledge stock, R&D exploitation by incumbents and barriers to entrepreneurship. It considers factors such as risk aversion, legal restrictions, bureaucratic constraints, labor market rigidities, taxes, lack of social acceptance, etc. This explains why economic agents might decide against starting up, even when in possession of knowledge that promises potential profit opportunity. In addition, culture, traditions and institutions are more difficult factors to identify than strictly economic factors, but they also play an important role in entrepreneurship.

Based on the KSTE, this study will apply the same hypotheses of KSTE as a case study of Malaysian economy. Given that entrepreneurial activity exceeds zero, the following testable hypotheses are derived from the model:

Hypothesis 1. An increase in knowledge stock has a positive effect on the level of entrepreneurship in Malaysia.

Hypothesis 2. Entrepreneurial activities decrease under greater regulation, administrative barriers and market intervention by government.

Hypothesis 3. Entrepreneurial activities can be expected to increase under higher urban environment level.

This model explains entrepreneurship as a function of the following factors: knowledge stock (KNOWLEDGE), barriers to entrepreneurship captured by (BARRIERS) and demographic factors captures by (DEMOGRAPHIC). It considers factors such as risk aversion, legal restrictions, bureaucratic constraints, labor market rigidities, taxes, lack of social acceptance, etc. (Parker 2009). The existence of such barriers is reflected by a low value of . This explains why economic agents might decide against starting up, even when in possession of knowledge that promises potential profit opportunity. In addition, culture, traditions and institutions are more difficult factors to identify than strictly economic factors, but they also play an important role in entrepreneurship. To capture such differences, this study estimates the following equation;

The dependent variable, entrepreneurship (ENT), proxies country share of self-employed (excluding the agricultural sector) as a percentage of the labor force. There are several reasons to expect the self-employment rate to decrease as economies become more developed. Blau (1987) argues this is a fundamental economic change. He shows that the time series of self-employment is correlated with a measure of the extent to which technological change has been biased towards industries in which self-employment is important. The self-employment rate is the best available measure across-countries and over time, and it serves as an acceptable proxy for high-impact entrepreneurship.

With respect to explanatory variables, the main focus is the endowment of knowledge within an economy. Firstly, elaborating a stock measure composed of accumulated annual R&D flows (K1). Therefore it was chosen to approximate knowledge stocks over the entire period with annual R&D flows, which actually constitutes variation in the stock variable once the stock has been built up. Considering that the correlation between the knowledge stock variable and R&D flows was very strong, annual R&D outlays are an acceptable approximation for knowledge stocks. In line with the model, it is expected an increase in relative knowledge endowment to increase the profitability of entrepreneurial activity by facilitating the recognition of entrepreneurial opportunities. Secondly, using two variables that are important indicators of the extent to which incumbents draw upon knowledge flows. The first is the number of patents (K2) in relation to population, where a higher proportion implies that incumbents use more of the existing knowledge flows (Griliches 1986). The second approximation is the number of technician in R&D (K3). Thirdly, In addition to the above variables, the study also inserts a control variable where previous research has shown an influence on entrepreneurship. Therefore, part of public sector expenditure is devoted to education, and education has been shown to be positively associated with entrepreneurship. The education expenditure variable (K4) is defined as public expenditure on education in relation to GDP.

Based on the previous studies that used a set of variables to capture the extent of barriers to entrepreneurship this study tries to apply the following variables in the Malaysian economy. First, total government expenditure in relation to GDP (B1) as an approximation of total tax pressure and the extent of regulatory interventions in the economy (Nicoletti et al. 2000). As an alternative, this study also includes tax share in GDP for both taxes on income, profits and capital gains (B2) and taxes on goods and services (B3). It is expected these variables to be negatively associated with entrepreneurship.

In addition to the above variables, the study also includes a number of control variables where previous research indicates influence on entrepreneurship. Numerous studies claim urban environments are particularly conducive to entrepreneurial activities, innovation and growth because of agglomeration economies (Krugman 1991). Information flows are denser in cities, where different competencies and financial resources are more accessible, and market proximity is obvious (Acs et al. 1994). Therefore the study includes a variable to capture the share of the population living in urban areas (D1). It is expected greater urbanization to be reflected in higher entrepreneurial activities. Studies on demographic variables conclude that individuals in the age cohort 30–44 are most likely to undertake entrepreneurial activities. A large share of population in this cohort (D2) is expected to relate positively to the share of entrepreneurs.

Findings

Based on the available data from GEM for Malaysia, a time series data during 1996-2014 was used from 10 variables (9 independent variables and 1 dependent variable).

The loadings of construct variables are illustrated in Table

The results of the structural model are presented in Figure

Based on the results are shown in Table

Conclusion

The KSTE focuses on individual agents with endowments of new economic knowledge as the unit of analysis in a model of economic growth, rather than exogenously assumed firms. Agents with new knowledge endogenously pursue the exploitation of knowledge. This suggests that knowledge spillovers come from the stock of knowledge, and there is a strong relationship between such spillovers and entrepreneurial activity. The empirical results of KSTE for Malaysia showing that knowledge economy factors have a significant impact on enhancing the entrepreneurial activities. On the other hand, entrepreneurial activities could be affected negatively by administrative barriers and government policies. Therefore this study recommends for Malaysian policy makers to pay more efforts and support the early-stage entrepreneurial activity through supporting and promoting the SMEs.

References

- Acs, Z. J, & Sanders, M. (2013). Knowledge spillover entrepreneurship in an endogenous growth model. Small Business Economics. doi:10.1007/s11187-013-9506-8.

- Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: An empirical analysis. The American Economic Review, 78, 678–690.

- Acs, Z. J., Audretsch, D. B., & Feldman, M. P. (1994). R&D spillovers and recipient firm size. The Review of Economics and Statistics, 76, 336–340.

- Arrow, K. (1962). Economic welfare and the allocation of resources for invention. In R. Nelson (Ed.), The rate and direction of inventive activity. NJ: Princeton University Press and NBER.

- Baumol, W. J. (2004). Entrepreneurial enterprises, large established firms and other components of the free-market growth machine. Small Business Economics, 23, 9–21.

- Blau, D. M. (1987). A time-series analysis of self-employment in the United States. The Journal of Political Economy, 95, 445–467.

- Braunerhjelm, P., & Svensson, R. (2010). The inventor’s role: Was Schumpeter right? Journal of Evolutionary Economics, 20, 413-444.

- Griliches, Z. (1986). Productivity, R&D, and basic research at the firm level in the 1970s. The American Economic Review, 76, 141–154.

- Jorgenson, Dale W. (2001). Information Technology and the U.S. Economy. American Economic Review, 91(1), 1-32.

- Krugman, P. (1991). Increasing returns and economic geography. The Journal of Political Economy, 99, 483–499.

- Nicoletti, G., Scarpetta, S., & Boylaud, O. (2000). Summary indicators of product market regulation with an extension to employment protection legislation. Concepts and measurement of labour markets flexibility/adaptability indicators. Paris: OECD Economics Department.

- Parker, S. C. (2009). The economics of entrepreneurship. Oxford: Cambridge University Press.

- Romer, P. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94(5), 1002–1037.

- Romer, P. M. (1990). Endogenous technological change. The Journal of Political Economy, 98, 71–102.

- Singer, S., Ernesto Amorós, J., & Arreola, D. M. (2015). Global Entrepreneurship Monitor 2014 Global Report.

- United Nations Conference on Trade and Development (UNCTAD). (2005). World Investment Report 2005, Transnational Corporations and the Internationalization of R&D.

- Zucker, L. G., Darby, M. R., & Brewer, M. B. (1998). Intellectual human capital and the birth of us biotechnology enterprises. The American Economic Review, 88, 290–306.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 July 2018

Article Doi

eBook ISBN

978-1-80296-043-3

Publisher

Future Academy

Volume

44

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-989

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, industry, industrial studies

Cite this article as:

Khudari, M. (2018). The Knowledge Spillover Theory Of Entrepreneurship An Empirical Evidence From Malaysia. In N. Nadiah Ahmad, N. Raida Abd Rahman, E. Esa, F. Hanim Abdul Rauf, & W. Farhah (Eds.), Interdisciplinary Sustainability Perspectives: Engaging Enviromental, Cultural, Economic and Social Concerns, vol 44. European Proceedings of Social and Behavioural Sciences (pp. 587-595). Future Academy. https://doi.org/10.15405/epsbs.2018.07.02.63