Explaining Venture Capital And Technology Commercialization In Eu Countries Through Dynamic Modeling

Abstract

Technology commercialization is envisioned as an important indicator of economic growth through academic environment. The assurance of financial capital to accelerate the technology commercialization is a big challenge for European countries and above that, European Venture Capital (VC) market has not been fully exploited according to its potential. Using a dynamic model approach on 21 European Union countries data from 2007 to 2013, we found an empirical stance for an interaction between research and development (R&D) expenditure and VC for accelerating technology commercialization in the form of contemporary patents and startups. The results depict that venture capitalists are more oriented towards startups as compared to patenting activity. The application of dynamic model approach helped to generalize the results across Europe and for other developed countries. Particularly, the study argues that a contemporary knowledge and simulation of VC in framing the innovation system and promising the business formation is much desired. In line with the perspective of innovation led ecosystem, an active contribution and understanding of VC would also be acknowledged.

Keywords: Venture CapitalTechnology CommercializationDynamic ModelPatentsEntrepreneurshipInnovation

Introduction

Global and dynamic competitive environment, technological innovation, information society, thirst for higher education, economic, social and cultural environment demand the economies to move from new growth theory towards Knowledge Based Economy (KBE). Irrespective to various factors; research and development (R&D), technology and innovation are argued as crucial components of KBE (OECD, 1996). The importance of R&D can be realized with the bulk of volume, governments are allocating for expenditure. European Union (EU) member countries are also paying much attention towards this key feature of ecosystem. In year 2012 alone, EU-28 spent around EURO 266.898 million on R&D with an increase of 2.9% from previous year (European Commission, 2009).

The commercialization of R&D is believed as one of the elementary factors of economic growth. However, this belief may not become fruits of research until commercialized to open market. Technology can be commercialized through an integrated and comprehensive process. The technology commercialization process begins with R&D, followed by stages such as disclosure of technology, evaluation and feedback and third party input before it turns into a patent. Once the patent has been declared, a marketing mechanism is placed for licensing and start-ups.

Indeed, technology commercialization is a dynamic concept (Powers & Campbell, 2011). Although, technology is an essence that involves in products across various fields. Technology commercialization is a greater breadth of technologies in products and its speedy access to market (Nevens, 1990). The study of research and technology commercialization is especially important because policymakers and managers get important evidences from such analysis (Markman, Siegel, & Wright, 2008). Additionally, technology commercialization also seems dominant in economic growth through academic environment (Bramwell and Wolfe, 2008; Breznitz & Feldman, 2010). Moreover, Audretsch (2014) believes that universities are evolved as entrepreneurial universities to promote research and technology commercialization for progressive and sustainable ecosystem. The success of technology commercialiation depends on the involvement of multidimenstional stakeholders such as government, academicians, business and community (Markman et al., 2008). However, not only these stakeholders have different missions and objectives, the commercialization itself have various implementations for them. Further, the success ratio in technology commercialization is correlated with the competency of the organization (Nevens, 1990). Several organizational archetypes are operating around the world for technology commercialization to strengthen the start-ups and licensing the patents by performing several activities and arranging resources. Among the all, some well-known are Business Incubators, Science and Technology Parks, Technology Transfer offices, Industrial Liaison offices, Business Angels and VCs (Jamil et al., 2015; Jamil et al., 2016). Although incubators ensure technological assistance, VCs are more inclined towards financial and managerial alliance (Lu, Kao & Chen, 2011).

The two of the most recognized channels and measurements of technology commercialization recognized by researchers are patents and startups (Grimm & Jaenicke, 2012; Markman et al., 2008; Samila & Sorenson, 2010). The growth and survival of startups rely heavily on technology commercialization due to rapidly changing environment and technology advancement. Additionally, technology commercialization effects the performance of new ventures while VC support interacts to boost this relationship in a positive way (Chen, 2009).

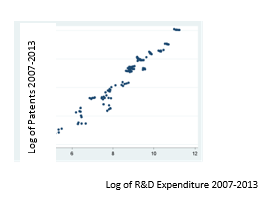

Here, Figure

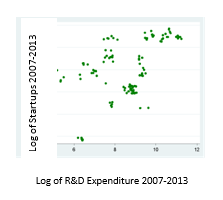

On the other hand, the relationship between R&D expenditure and start-ups is also linear and positive as shown in Figure

Many governments are interested in promoting technology commercialization to ascertain its ultimate output. In consistent with promotion of technology commercialization agenda, several governments provide financial support to its institutes for developing the infrastructure and to fulfil the needs for technology commercialization. In developed countries, various funding streams are available to excel technology commercialization such as government grants, tax incentives, soft loans while from private sectors are VC, business angels and, friends and family. Indeed, Government support is the base for development of new innovative ventures and patenting the research. Zhao and Ziedonis (2013) analyse the USA state as a financial bank to support and encourage the technology commercialization. Likewise in European perspective, European states are the driver of technology commercialization by introducing public policies; supportive and favourable for establishing new businesses and claiming the patents through extensive R&D (Al-mubaraki & Busler, 2010).

Irrespective to the diligence of public support, the cluster of private sector needs to be integrated with public to meet the challenge of boosting technology commercialization. Bonaccorsi et al. (2012) study also claims the private sector to contribute in enhancing the research activities along with government machineries. Researchers argue VC as a source of private financial intermediation between public funding for basic research and innovation (Samila & Sorenson, 2010).

VC is an equity financing model to access funds for new innovative and potential start-ups (European Commission, 2009). VC has a broader aspect in mitigating the financial need across various fields. Wonglimpiyarat (2011) also endorses VC as a key financing instrument for transforming research into technology commercialization. Researchers argue VC as an active participant to stimulate the technology commercialization in the form of patents and start-ups. In a comparison study between US and EU, (Croce, Grilli, & Murtinu, 2013) evidence VC as a significant financial capital in transferring technology from academia to society.

Indeed, VC interacts to foster the relationship between technology commercialization and new venture’s performance (Chen, 2009), R&D expenditure and IPO underpricing (Cho & Lee, 2013). However, the researchers’ consensus to generalize the positive role of VC is still lacking. Hall and Lerner (2009) and; Sun, Uchida, and Matsumoto (2013) argue a weak interaction between VC and commercialization. Hirukawa and Ueda (2011) endorse the existence of reverse relation between VC and commercialization by analyzing patent counts and productivity growth in USA environment.

Problem Statement

To become knowledge based economy and stimulating ecosystem, the better use of publicly funded R&D is analysed as a challenging problem for Europe (EC, 2007). Moreover, European countries are also experiencing far less inventions and patents as compared to USA. The production of knowledge and innovation through R&D may not be sufficient until transfer it to the beneficiaries i.e. industry and society in real terms. The product or process innovation development needs to be delivered to their users for which technology needs to be commercialized. (Siegel et al., 2003) exemplify the commercialization process in which R&D is the base route. Among European nations, United Kingdom firstly adopted the idea of commercialization in early 1980s followed by Netherlands. Later the idea spread to other European countries (Geuna & Muscio, 2009).

Many countries of the world are facing various challenges in efficiently conversion of R&D expenditures into economic gains. Shrinking the knowledge filter is one of the ways toward efficient conversion of R&D expenditure into economic gains. In this regard, a legislative reform of Bayh Dole Act in 1980s was introduced in USA for facilitating the university R&D commercialization (Audretsch, 2014). On the same pattern, OECD’s 2003 legislation was adopted in Europe. While knowledge filter is considered as the constraint and barrier towards economic knowledge (Acs et al., 2003; Audretsch, 2014). In addition, lack of financial support has been identified as another major problem in commercialization, innovation and entrepreneurship (Al-mubaraki & Busler, 2010; Bonnet & Wirtz, 2012; Bozkaya & De La Potterie, 2008; Chandra et al., 2007; Wonglimpiyarat, 2013b; Zane, 2011). The gap exists in the literature to identify the suitable financial mechanisms for these phenomena (Chen, 2009; Pierrakis, 2012).

Financial capital is considered as the most auspicious resource for venture’s efficacy (Cooper, Gimeno-gascon & Woo, 1994). Among all resources, financial capital enjoys the benefit to be transformed into the shape of any other resources (Dollinger, 2008). Commercialization process requires significant resources to overcome related challenges and constraints (Hsu, 2007) and financial capital can be used to overcome these challenges by speeding up commercialization and establishing start-ups (Zane, 2011). For technology commercialization, finances can be generated through many ways; however, VCS have gained much admiration. The assurance of financial capital to accelerate the technology commercialization is also a big challenge for European countries and above that, European VC market has not been exploited fully, according to its potential (European Commission, 2009).

Research Questions

The research questions of this study are

Does Venture Capital impacts on patents?

Does Venture Capital impacts on start-ups?

Purpose of the Study

The purpose of the study is to fill the gap by investigating the effectiveness of VC in fostering commercialization in the form of patents and start-ups by estimating the dynamic panel data of 21 European countries during the period 2007-2013. The function of VCs in accelerating commercialization is analysed using Generalized Methods of Movement (GMM) approach.

Research Methods

For the analysis, a balanced panel dataset of number of patent applications, number of new firm’s birth, R&D expenditure, number of VC firms and VC Investment for the period of seven years from 2007 to 2013 was obtained from EUROSTAT, a European Commission’s office for statistical analysis of EU countries. The country level data reflects the broader aspect of VC in technology commercialization in European region. Here, the (Table

Patents are one of the most common patterns of technology commercialization. Researches support patents as a key element of commercialization. In this study, number of patent applications at European Patent Office (EPO) was used as frequency of patent. The number of patent applications were used as measurement instead of patent grants in line with previous contributions (Cho & Lee, 2013; Faria & Barbosa, 2014). However the data of 21 countries was obtained from EUROSTAT. Germany registered the most number of patents as compared to other European countries. The other European countries were remained far behind to meet the level of Germany in patents registration. The limitation regarding the patents data is the amount earned by licensing the patents.

The level of technology commercialization is also assessed by counting the number of new enterprises births in European countries over a longitudinal period from 2007 to 2013. Proceeding to previous studies, the same pattern to measure start-ups is used to ensure validity. In comparison to other European countries, France led in start-ups formation during the analysis period and followed by Italy, Germany, Spain, UK and Poland in a respective order. However, the issues arose during analysis are; EUROSTAT data is aggregated on country level but not on industry level. The availability of industry level data would be advantageous to specify the industrial trends of commercialization; which European industry is more oriented towards commercialization and which industry is the VC’s favourite.

Many of the developed nation’s Governments spend a handsome portion of their budget in R&D. Initially the support was more leaning towards basic research. However, the idea is now changing towards R&D having economic return with a direct application to society. Currently, society issues are the priority of the nations. Indeed, society is the ultimate beneficiary of R&D. The logged of the amount of R&D expenditure made by selected European countries during the analysis period was taken as R&D measurement. In R&D expenditure race, Germany left others behind with an aggregated mean investment of € 69,550 million. However, the other countries such as France, UK, Italy and Spain were also remained positive about the importance of R&D.

Many of the developed nation’s Governments spend a handsome portion of their budget in R&D. Initially the support was more leaning towards basic research. However, the idea is now changing towards R&D having economic return with a direct application to society. Currently, society issues are the priority of the nations. Indeed, society is the ultimate beneficiary of R&D. The logged of the amount of R&D expenditure made by selected European countries during the analysis period was taken as R&D measurement. In R&D expenditure race, Germany left others behind with an aggregated mean investment of € 69,550 million. However, the other countries such as France, UK, Italy and Spain were also remained positive about the importance of R&D.

The study estimates the impact of VC activities on patenting. Thus the empirical innovation function of the patent applications can be presented as:

In equation 1 of pooled OLS model, P

As study is based on the panel data with cross sectional and time series characteristics, GMM estimation technique is suitable (Hansen, 1982). However in equation 2, system generalized method of movements (GMM-SYS) is used for estimates of patent applications. The reason behind the application of GMM-SYS is due to the country specific time-varying characteristics that we are not able to control. Moreover, VC activities are influenced positively (negatively) by these latter characteristics. Though the results generated through OLS would be biased. In order to account for the biasedness through OLS model, a two-step (GMM-SYS) model is run to validate and generalize the hypothesis (Blundell & Bond, 1998).

In accordance with Drobetz et al. (2013), this study follows the model that is presented by Blundell and Bond, (1998) for “System GMM Estimation” and applied “xtdpdsys” STATA estimation (detailed overview of the model can be referred in Drobetz et al. (2013).

represents the dependent variable i.e. patent application in this study. is the lag of dependent variable and indicates the independent variables which are R&D expenditure and VC activities while is the error term.

To elucidate and further enlighten the understanding about the phenomenon of VC support for formation of new businesses, the same set of estimates are applied as followed in previous analysis of patents.

Similar to equation 2 of patent GMM-SYS estimation, the impact of VC activities on start-ups is also estimated through two step GMM-SYS.

The application of GMM-SYS benefits us to estimate the effect of VC by addressing the endogenous challenges. Further we estimate the impact of VC by adding an additional variable following the approach of Sørensen (2007). The number of VC companies involved in investments is also added in this study. Though, two dimensional scenarios; VC investments and number of VC companies, are analyzed as over VC intensity to see their impact of technology commercialization.

Findings

Table

Firstly, we found that R&D expenditure and patent activities are significantly correlated in European countries. Resultantly, an assumption is raised that as R&D expenditure in European countries has increased so did the patents. Likewise, a significant interaction is also exists between R&D expenditure and startups for both OLS and GMM estimation. This supports the results of Siegel, et al. (2003) which shows that R&D expenditures are correlated with technology commercialization. Hence, R&D expenditure plays an important role in fostering patenting and new start-ups which in turn strengthens the technology commercialization.

In column I, a significant positive relationship is exists between VC and patents. In terms of GMM-SYS estimation for patents, we find a negative and statistically significant relationship for both VC investment and number of VC companies. Moreover, a negative relation between VC and patents is in line with the results of Caselli, Gatti, and Perrini (2009). Column III and IV are focused on the impact of VC on start-ups. We estimate the impact by considering both VC investment and number of VC companies as VC intensity. The results evidences that VC intensity significantly impacts the start-ups and growth of new business formation. However, the amount of investment by venture capitalists is more crucial for the growth and survival of start-ups as compared to the number of VC companies involved. The negative impact of number of VC companies on start-ups is also recorded by Samila & Sorenson (2010).

The results of GMM-SYS estimates are generally in line with those of OLS and reveal that VC activities significantly interacts the innovation system and entrepreneurial environment in Europe. Although the level of this effect is reduced by GMM-SYS estimator, still valuable in both economic and statistical means. The dynamic pattern and the magnitude of the treatment effect of VC on patents and start-ups are somehow similar to those highlighted by Samila & Sorenson (2010) on US metropolitan areas.

Conclusion

In this research, the role of VC in inspiring the technology commercialization is empirically examined across European region by using dynamic model approach. The interaction has been examined at the country level, by searching the validation to promote and strengthen VC in a modern way. Consistent with the findings, a contemporary knowledge of VC in framing the innovation system and promising the pacy business formation would not only fruitful to fortify innovation policies and entrepreneurship. Rather an active contribution of VC would strengthen the technology commercialization. Further, technology commercialization support to a sustainable innovation led ecosystem and entrepreneurial society with institutional and leadership development. To achieve this, venture capitalists also needs to be incentivize to get involve in patenting activities apart from their core dedication to business formation. Moreover, the results suggest that many European countries would be advantageous through surpass the VC. This study would encourage European countries to take initiatives for strengthening the sustainable environment for venture capitalists at the national as well as regional level. More public funded VC programs would need to be inaugurated while integration with private venture capitalists would also demand to build robust.

In the future scenario, researchers may also consider other commercialization activities such as research contracts with industry, joint ventures and licensing. The role of VC as a financial stream along with other sources such as government funding programs, business angels and private banks in technology commercialization may also be helps in better understanding of the phenomenon. Meanwhile, the studies on role and provision of financial capital for technology commercialization would also help to magnify the innovation led ecosystem, promote institutional development and strengthen the entrepreneurial society.

References

- Acs, Z., Audretsch, D., Braunerhjelm, P., & Carlsson, B. (2003). "The Missing Link: The Knowledge Filter and Endogenous Growth." In DRUID Summer Conference on Creating, Sharing and Transferring Knowledge: The Role of Geography, Institutions and Organizations. Copenhagen. Retrieved from http://www.druid.dk/uploads/tx_picturedb/ds2003-736.pdf

- Al-mubaraki, H. M., & Busler, M. (2010). "Business Incubators Models of the USA and UK: a SWOT analysis". World Journal of Enterprenuership, Management and Sustainable Development, 6(4), 335–354.

- Audretsch, D. B. (2014). "From the entrepreneurial university to the university for the entrepreneurial society". The Journal of Technology Transfer, 39(3), 313–321. doi:10.1007/s10961-012-9288-1

- Blundell, R., & Bond, S. 1998." Initial conditions and moment restrictions in dynamic panel data models". Journal of Econometrics, 87(1), 115–143. doi:10.1016/S0304-4076(98)00009-8

- Bonaccorsi, A., Secondi, L., Setteducati, E., & Ancaiani, A. (2012). "Participation and commitment in third-party research funding: evidence from Italian Universities". The Journal of Technology Transfer, 39(2), 169–198. doi:10.1007/s10961-012-9268-5

- Bonnet, C., & Wirtz, P. (2012). "Raising capital for rapid growth in young technology ventures: when business angels and venture capitalists coinvest". Venture Capital, 14(2-3), 91–110. doi:10.1080/13691066.2012.654603

- Bozkaya, A., & Potterie, B. V. P. D. La. (2008). "Who Funds Technology-Based Small Firms? Evidence From Belgium". Economics of Innovation and New Technology, 17(1), 97–122. doi:10.1080/10438590701279466

- Bramwell, A., & Wolfe, D. a. (2008). "Universities and regional economic development: The entrepreneurial University of Waterloo". Research Policy, 37(8), 1175–1187. doi:10.1016/j.respol.2008.04.016

- Breznitz, S. M., & Feldman, M. P. (2010). "The engaged university". The Journal of Technology Transfer, 37(2), 139–157. doi:10.1007/s10961-010-9183-6

- Caselli, S., Gatti, S., & Perrini, F. (2009). "Are venture capitalists a catalyst for innovation". European Financial Management, 15(1), 92–111. doi:10.1111/j.1468-036X.2008.00445.x

- Chandra, A., He, W., & Fealey, T. (2007). "Business Incubators in China: A Financial Services Perspective". Asia Pacific Business Review, 13(1), 79–94. doi:10.1080/13602380601030647

- Chen, C.-J. (2009). "Technology commercialization, incubator and venture capital, and new venture performance". Journal of Business Research, 62(1), 93–103. doi:10.1016/j.jbusres.2008.01.003

- Cho, J., & Lee, J. (2013). "The venture capital certification role in R&D: Evidence from IPO underpricing in Korea". Pacific-Basin Finance Journal, 23, 83–108. doi:10.1016/j.pacfin.2013.01.005

- Cooper, A. C., Gimeno-gascon, F. J., & Woo, C. Y. (1994). "Initial Human and Financial Capital as Predictors of New Venture Performance". Journal of Business Venturing, 9(5), 371–395.

- Croce, A., Grilli, L., & Murtinu, S. (2013). "Venture capital enters academia: an analysis of university-managed funds". The Journal of Technology Transfer, 39(5), 688–715. doi:10.1007/s10961-013-9317-8

- Dollinger, M. J. (2008). ENTREPRENEURSHIP Strategies and Resources. (L. Rubenstein, Ed.) (Fourth.). Marsh Publications, Lombard, Illinois U.S.A.

- Drobetz, W., Gounopoulos, D., Merikas, A. G., & Schröder, H. (2013). “Capital structure decisions of globally-listed shipping companies”. Transportation Research. Part E, Logistics and Transportation Review, 52, 49–76

- European Commission. (2009). Cross-border venture capital in the European Union: Summary report of the European Commission work on removing obstacles. Enterprise and Industry, European Commission.

- Faria, A. P., & Barbosa, N. (2014). "Does venture capital really foster innovation"? Economics Letters, 122(2), 129–131. doi:10.1016/j.econlet.2013.11.014

- Geuna, A., & Muscio, A. (2009). "The Governance of University Knowledge Transfer: A Critical Review of the Literature". Minerva, 47(1), 93–114. doi:10.1007/s11024-009-9118-2

- Grimm, H. M., & Jaenicke, J.( 2012). "What drives patenting and commerzialisation activity at East German universities? The role of new public policy, institutional environment and individual prior knowledge". The Journal of Technology Transfer, 37(4), 454–477. doi:10.1007/s10961-010-9195-2

- Hall, B. H., & Lerner, J. (2009). The financing of R&D and innovation (No. 012). United Nations University- Maastricht Economic and Social Research Institute on Innovation and Technology (MERIT), Maastricht, The Netherlands.

- Hansen, L. P. (1982). "Large sample properties of generalised method of moments estimators". Econometrica. doi:Doi 10.2307/1912775

- Hirukawa, M., & Ueda, M., (2011). "Venture Capital and Innovation: Which Is First?" Pacific Economic Review, 16(4), 421–465. doi:10.1111/j.1468-0106.2011.00557.x

- Hsu, D. H. (2007). "Experienced entrepreneurial founders, organizational capital, and venture capital funding". Research Policy, 36(5), 722–741. doi:10.1016/j.respol.2007.02.022

- Jamil, F., Ismail, K., Mahmood, N., Khan, N. U., & Siddique, M. (2015). Technology incubators and institutional development. Journal Teknologi, 12, 133-139.

- Jamil, F., Ismail, K., Siddique, M., Khan, M. M., Kazi, A. G., & Qureshi, M. I. (2016). Business incubators in asian developing countries. International Review of Management and Marketing, 6(4S).

- Lu, C. S., Kao, L., & Chen, A. (2011)." The effects of R&D, venture capital, and technology on the underpricing of IPOs in Taiwan". Review of Quantitative Finance and Accounting, 39(4), 423–445. doi:10.1007/s11156-011-0259-7

- Markman, G. D., Siegel, D. S., & Wright, M. (2008). "Research and Technology Commercialization". Journal of Management Studies, 45(8), 1401–1423.

- Nevens, T. M. (1990). "Commercializing technology: What the best companies do". Strategy & Leadership, 18(6), 20–24. doi:10.1108/eb054310

- OECD. (1996). The Knowledge-Based Economy. Paris.

- Pierrakis, I. (2012). Investment and Innovation: Regional Venture Capital Activity, Business Innovation and An Ecology of Interactions. Cardiff university.

- Powers, J. B., & Campbell, E. G. (2011). "Technology Commercialization Effects on the Conduct of Research in Higher Education". Research in Higher Education, 52(3), 245–260. doi:10.1007/s11162-010-9195-y

- Samila, S., & Sorenson, O. (2010). "Venture capital as a catalyst to commercialization". Research Policy, 39(10), 1348–1360. doi:10.1016/j.respol.2010.08.006

- Siegel, D. S., Waldman, D. a, Atwater, L. E., & Link, A. N. (2003). "Commercial knowledge transfers from universities to firms: improving the effectiveness of university–industry collaboration". The Journal of High Technology Management Research, 14(1), 111–133. doi:10.1016/S1047-8310(03)00007-5

- Sørensen, M. (2007). "How Smart Is Smart Money? a Two Sided Matching Model of Venture Capital". The Journal of Finance, 62(6), 2725–2762.

- Sun, Y., Uchida, K., & Matsumoto, M. (2013). "The dark side of independent venture capitalists: Evidence from Japan". Pacific-Basin Finance Journal, 24, 279–300. doi:10.1016/j.pacfin.2013.02.001

- Wonglimpiyarat, J. (2011). "Government programmes in financing innovations: Comparative innovation system cases of Malaysia and Thailand". Technology in Society, 33(1-2), 156–164. doi:10.1016/j.techsoc.2011.03.009

- Wonglimpiyarat, J. (2013). "The role of equity financing to support entrepreneurship in Asia—The experience of Singapore and Thailand". Technovation, 33(4-5), 163–171. doi:10.1016/j.technovation.2012.12.004

- Zane, L. J. (2011). How Social Capital and Firm Knowledge Influence the Acquisition of Resources in Technology Based New Ventures. Drexel University.

- Zhao, B., & Ziedonis, R. (2013). State Government as Financiers of Technology Statrtups: Implications for Firm Performance. Retrieved from http://ssrn.com/abstract=2060739

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 May 2018

Article Doi

eBook ISBN

978-1-80296-039-6

Publisher

Future Academy

Volume

40

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1231

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Jamil, F., Ismail, K., Jahanzeb, A., Kiyani, A. F., & Yasir, M. (2018). Explaining Venture Capital And Technology Commercialization In Eu Countries Through Dynamic Modeling. In M. Imran Qureshi (Ed.), Technology & Society: A Multidisciplinary Pathway for Sustainable Development, vol 40. European Proceedings of Social and Behavioural Sciences (pp. 695-705). Future Academy. https://doi.org/10.15405/epsbs.2018.05.57