Abstract

Two-sided marketplaces are the type of companies that connect external parties starting from ― vendors such as a seller, host, and driver, and at the same time customers such as buyer, renters and service user, to interact and transact inside the marketplace they had developed. This kind of marketplace often risk disintermediation which happens when users may rely on the market to find the potential problems related current and future transactions without the platform‘s involvement, paying any fees, and the platform may charge. This paper assesses all of the factors that trigger disintermediation happened in the marketplace, how sensitive the price fee or premium determines the level of potential disintermediation might occur, and also a set of strategies that can implement to reduce it. Furthermore, the theory used in assessing these factors includes Customer Lifetime Value, Customer Relationship Management, and Disintermediation theory. The arguments have led this paper to choose the recommendation to the research question as immediately assess the kind of disintermediation occur; other psychological factors can be the solution or ways to better shaped the platform, and always learn the pain point of buyer and seller.

Keywords:

Introduction

International Network or in short Internet had been overgrowing since August 1962, when J.C.R Licklider reveals his ―Galactic Network concept to the world. It was later developed and improved across worldwide. Internet then becomes the single global system of interconnected computer networks that use the Internet protocol suite (TCP/IP) to link devices worldwide (Stewart, 2015). At first, the primary function of the Internet is actually to share information and enhance communication between people across the world, but now it is being used almost for everything, such as social communication, e-commerce, entertainment, education and so on.

Internet had been tremendous growth, in 2000 to 2009, the number of Internet users globally rose from 394 million to 1.858 billion (Statista, 2016). By 2010, 22 percent of the world's population had access to computers with 1 billion Google searches every day, almost 300 million Internet users reading blogs, and 2 billion videos viewed daily on YouTube. Then the world's Internet users surpassed 3 billion or 43.6 percent of world population in 2014, but two-thirds of the users came from wealthiest countries, with 78.0 percent of Europe countries population using the Internet, followed by 57.4 percent of the Americas (Dent, 2014).

Based on Stewart et al. (2015), there are four reasons why internet grows so tremendously: 1) price, internet used to be expensive during early years, and it had become more affordable from time to time, Smartphone invention makes the internet access is more affordable price, 2) as essential thing’s for human life, 3) improvement of security for supporting third parties financial transactions (Visa, Master, etc), and two-sided market places (eBay, Airbnb, etc.), and antivirus companies which protect us from most of the risk of being hacked, virus, or malwares that could put us on data stolen risk, and 4) fast communication (currently, people start to use fibre optic cable which is multiple times faster than its counterpart, half of the world populations use it, and there are a lot of internet service package provided, such as business, social, entertainment, or for personal purpose). In other words, Internet now has the ability in connecting people from all around the world. The form of these communications can find in most of the Internet-based platforms, social media applications, such as Facebook, Instagram, Linkedin, and so on.

The invasion of smartphones and tablets in the market can be more popular at the beginning of the digital era. Lots of electronic or technology companies race to win smartphones and tablets‘ market share by innovating its features and abilities, which results in the continuous appearance of new products. The era leads to the fast movement of technology advancement. E-Marketer surveys within the year 2014 to 2015 regarding about global smartphone users. As quoted from Statista, it predicted that the users of the smartphone in 2016 would reach 2.1 billion and is expected to reach up to five billion by 2019 (Statista, 2016).

Human life gets more comfortable every day due to the help of smartphones and tablets than before. New applications appear every day in many forms but same goals, which is to solve humanity‘s problems. Nowadays, finding transportation, buying products, booking tickets or hotels is just a tap of our fingertips away. It is fair to say that today‘s society is depending on their smartphones or tablets.

The transformation of people‘s behavior towards internet has moved the internet-based companies to create platforms that provide solutions to its users. The competitive advantage of many tech companies relies on its ability to solve problems that usually occurs in the traditional market (Teece, 2000). Therefore, through cutting-edge technology, many tech companies or often called start-up companies offer solutions that benefited from technology. It can be said that the business model of well-known tech companies mostly generated from the existing conventional businesses such as hotels, taxis, markets, or newspapers, namely; Airbnb, Uber, Amazon, e-Bay, and Twitter.

Many of these tech companies have succeeded because it creates the new market or emerging markets. But, amongst them also combined its conventional market and e-commerce. For example, Wal-Mart is one of the biggest supermarket chains in the U.S., its regular stores are no doubt becoming market domination, but Wal-Mart also adds its online store to add more value for their customers. On the other hand, Amazon shaped the history of e-commerce. Starting from just selling books to becoming 'The everything store‘, Amazon mainly sells everything. It provides ultimate solutions to the customer to find the easiness to shop for their needs.

Amazon and eBay were two rivals that play the significant role in shaping the world of e-commerce. The two platforms make people aware of the existence of e-commerce and also educate people to accept its reality. Not only was that, many of CEOs, developers, and engineers born from these two companies. As a result, Amazon and eBay have become the benchmark for the early new tech companies (Statista, 2016).

Two-sided markets are economic platforms that have two distinct user groups that provide each other with network benefits. The organization that creates value primarily by enabling direct interactions between two (or more) different types of affiliated customers is then called a multi-sided platform (Hagiu & Wright, 2015).

Two-sided markets can find in many industries which share the space with traditional product and service offerings. For example, the demands include credit cards, operating systems, recruitment sites, search engines, and communication networks, such as the Internet. The instance of internet-based two-sided markets is organizations such as eBay, Alibaba, Facebook, Uber, or Tokopedia. Each side in the two-sided markets demands benefits in term of economies of scale. Consumers, for example, prefer credit cards honored by more merchants, while merchants prefer cards carried by more consumers. Another example would be online buyer would prefer buying stuff in e-commerce site with more sellers, and seller would prefer selling things in e-commerce site that potentially have more online buyers.

Two-sided markets defined as platforms that enable interaction between two groups of customers that value each other's presence (Kouris & Kleer, 2012; Tåg, 2008). According to Weyl (2010), there are three essential characteristics of two-sided markets: price discrimination between two distinct group of users, cross-network effects between market sides, and bilateral market power of the platform.

The market will get the increasing return to scale, because of the successful platform that impacted the network. Thus, consumers will pay more for access to a more critical system, so margins improve as user bases grow. The sets network platforms apart from most traditional manufacturing and service businesses. In traditional companies, growth beyond some point usually leads to diminishing returns: Acquiring new customers becomes harder as fewer people, not more, find the firm's value proposition appealing.

With the agreement and promising of increasing returns, competition in two-sided network industries can be fierce (Breinlinger, 2013). As a result, mature two-sided network industries are usually dominated by a handful of large platforms, for example in Indonesia in travel app we have Go- Jek, Uber, and Grab. In extreme situations, some industries, such as PC operating systems, one or two company become a monopoly, taking almost all of the market (such as Windows and Apple).

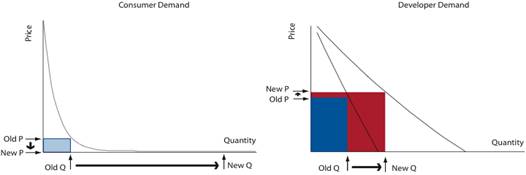

In two-sided markets, platform managers must choose the right price to charge each group in a two-sided network, and if they ignore it, the network effects can lead to mistakes (Parker & Alsyne, 2005). In traditional markets, the company usually just figure out what is the most effective pricing to increase sales. But in Figure

If the company takes this into account, that the adoption on one side of the network will drive passage, on the other hand, they can do the different thing. They can subsidize the user of the platform. So long as the potential revenue gained (red box) exceeds the tax lost (light blue box), a discounting strategy is profitable. The subsidy mainly changes network size.

This strategy can see by different companies, such as e-commerce company such as Alibaba, or Tokopedia that gives free transaction fees in the first year or even 3 to 5 years when they start running the business (Investopedia, 2017). In the start, the app such as Uber and Go-Jek also subsidize user to use their platforms and then increase the price afterward.

Alibaba and Tokopedia can do this because they believe that in the future, there will be more significant benefits gained when they charge fees, and users are already used to do transactions in their platform and willing to pay it then. Uber and Go-Jek also work on the same line of thinking. This e-commerce, and apps will be the focus of this paper for the potential of disintermediation.

Meanwhile, E-commerce is a trading platform that allows user trade products, or services using computer networks, such as the Internet. E-commerce uses some technologies such as mobile commerce, electronic funds transfer, supply chain management, internet marketing, online transaction processing, electronic data interchange (EDI), inventory management systems, and automated data collection systems, where the activities in e-commerce involve purchasing, sales, and marketing. According to O‘Brien & Maracas (n.d), e-commerce also includes product, service, and information on the Internet and network. Meanwhile, it promotes a broader definition of e-commerce, not just selling and buying products or services, but also customer service, collaboration among business partners and brings a company to conduct transactions to the general public.

App platforms are a particular form of electronic markets. Via app platforms, software developers can distribute their software applications (apps) among users of mobile devices. Hence, developers and users are indirectly connected, where developers get profit from the users purchasing their apps and users benefit from the apps. Apps such as Uber and Go-Jek itself is free to download, and included in the intermediary system app, where an app with this business model aims to connect producers and consumers by providing a variety of ways and facilities to create a relationship that is more profitable and efficient of the two.

The groups of buyer and seller in apps or e-commerce are not separated, since some buyers are also sellers, and some sellers can also act as a buyer from another seller in the same or different platform. Due to these direct and indirect network effects, app platforms can be analyzed using two-sided market theory, and are subject to disintermediation (Breinlinger, 2013).

Disintermediation is the process of removing the middleman or intermediary from future transactions. It is usually to reduce the overall cost involved in the process of operations while at the same time allow the processing time of the purchase to be completed more sooner. Notable examples of disintermediation include Dell and Apple, which sell many of their systems direct to the consumer, thus bypassing traditional retail chains, having succeeded in creating brands well recognized by customers, profitable and with continuous growth.

Notable examples of disintermediation include Dell and Apple, which sell many of their systems direct to the consumer, thus bypassing traditional retail chains, having succeeded in creating brands well recognized by customers, profitable and with continuous growth

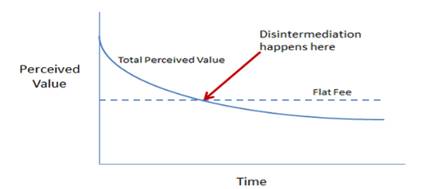

In the context of e-commerce, the disintermediation can happen for some reason, such as fees. If customers feel that the marketplace used to have high perceived value because they had done an excellent job to connect them, and it is worth to pay the flat fee, they will not do disintermediation. But, if they feel the prices are high due to the repeated transactions, they might think that they can do it without the marketplace. The causes the parties to attempt disintermediation, whereas the buyer that wants a lower price and the seller that does not wish to their revenue share to give to the platform (Breinlinger, 2013).

In this case, the company (e-commerce or mobile app) that works as an intermediary mainly only have two options. Either increase the value to the users such that the amount exceeds the fees, or lower. For example, the value of marketplace and impact of disintermediation perceived by users. There is a high value placed on the matching component (the ability to find a useful resource, product, etc.) but it has no long-term value. There is a smaller, but long-term value of everything else the marketplace might provide, for example, payment tools (such as Alipay for Alibaba), collaboration tools, and transaction security. The figure

Customer Lifetime Value (CLV) also plays a significant role in the pricing decision. CLV is used to know the average value of the customer to the company (Kumar & George, 2007). CLV formula is broken down into four major factors which are: profit contribution each transaction: the average amount of purchase per operation, number of investment annually: the average time of purchase yearly, average number of years that they remain a customer: the average time a customer, and Customer Acquisition Cost: cost required to attain the customer, where CLV = Profit Contribution each transaction X Number of purchase in a Year X Average number of years that they remain a customer – Customer Acquisition Cost (Frip, 2017). For Example, the frequency of purchase in Go-Jek is higher than the renting property of Airbnb, which is why the Airbnb should charge fees higher than Go-Jek.

Other reason might be the buyer have already known the seller and trust them enough to do the transaction without the marketplace such as e-commerce. Meanwhile, on the other side, it‘s hard for the marketplace to control this behavior (Breinlinger, 2013; Kumar et al., 2007). One key to understanding disintermediation behavior of the customer is to understand that if there is a mix of the economic and psychological factor in play in the customer's mind. Suppliers and consumers both have emotions of loyalty, fear, pride, and guilt. The best marketplaces understand their users on an emotional level and build a product and culture accordingly. According to Mike Towsend (2014) there are four most important contributing factors that play into the psychology of the supplier and consumer in doing disintermediation. The factors are: 1) Freq = Frequency that the two sides exchange value through the platform, 2) Rel = Relationship the supplier and consumer have with the marketplace, 3) Value = Value the company provides after meeting, and 4) Take = The relative pain of the transaction fee.

Frequency is the difference between one time purchases compared to recurring exchanges. Mike Townsend (2014) defines the value of something like the amount you would pay if it were removed from your life, hence measuring relationship is a reliable indicator. There is also some other psychological factor that e-commerce or mobile app company should put in their mind, such as n in entirely backdooring, the trust between suppliers and consumers that allows consumers to come and order again, and fear of being removed from the platform for legal reasons (Townsend, 2014).

When it comes to selling and buying activities, the price is an integral part of it. It defined as a set of perceived or estimated value given to a product or service (Nagle et al., 2016). Price can also identify as a financial reward for providing the product and service for the consumer (Dent, 2014). Therefore we can define price as a perceived or estimated value given to a product or service and act as a financial reward for providing it. This definition is price definition from the seller perspective. On the other hand from the consumer perspective, the price can be seen as the value, which is the consumers believes that a product or service offered suitable for them. According to the research, this amount could affect the purchasing behavior, and the value means the price that fit their needs (Alfred, 2013).

Price sensitivity is a concept of how individuals perceive and respond to the changes in prices in products or services offered (Mamun et al., 2014). According to some research, price sensitivity is related to the routine decision that response to price changes, price format, or price framing (Bucklin et al., 1995). The interesting facts about moderate consumer and the low-end consumer are the sensitivity level. The reasonable user is less sensitive than the low-end user when there were price changes (Hee & Toh, 2006).

Satisfied customers always lead to a better bond between the consumer and the company. It could lead to trust building by the consumer towards the brand, and they become a loyal consumer. It would be less sensitive for the loyal consumer towards price changes, but it would be a painful matter for a non-loyal or new consumer (Yoon & Tran, 2011). Therefore, price sensitivity itself affecting the consumer behavior that could affect the demand in the market.

Price sensitivity consumer, in the long run, could create a problem. The consumers might demand a competitive price and lead to price reduction. This competitiveness in the market might lead to disintermediation (Rowley, 2000; Lamb et al., 2011). But through, strategic pricing, it can be used to diminish disintermediation, if it does correctly.

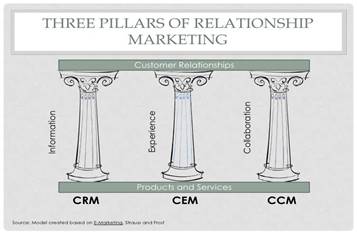

In most of the service companies usually use customer relationship management (CRM) as the backbone of its marketing strategies (Starust & Frost, 2013). CRM systems gather information about the customer and allowing it to deliver to the company various touch points. For a customer, CRM systems enable them to have customization and personalization. Meanwhile, the service provider will have access to each customer‘s information, knowledge of customer preferences and past transactions, or history of a service problem. The providers are allowing the company to make improvement and increased customer value (Ball et al., 2006). CRM system has a function to add, from a company‘s perspective, CRM systems allow the company to understand better, segment, and tier its customer base, better target promotions and cross-selling and even implement churn alert systems as a signal danger of defecting.

Even though CRM needs to be looked like a system and process within the business activity as a whole rather than just the use of technology alone, most of the time successful CRM relies on technology (Verhoef et al., 2009). Moving customers through the life cycle can be done much easier due to technology, such as toll-free numbers, electronic kiosks, voice mail, live chat, emails; these techniques will help to enhance CRM processes.

Three Pillars of Relationship model allows a company to have two ways communications between the company and its customers, sourcing useful customer information to be used for company‘s improvements. The three pillars consist of CRM, which deals with gathering customers‘ information. CEM or customer experience management represents the discipline, methodology, and process used to manage a customer‘s cross-channel exposure, interaction comprehensively, and transaction with a company, product, brand or service explained (Starust & Frost, 2013). The last pillar is CCM or customer collaboration management; often seen as ways to engage with customers to build the relationship through conversation, nowadays the use of social media becomes common.

These three pillars are interrelated and will affect a company‘s brand image and revenue growth. When the three pillars managed well, the organization will gather beneficial information or insights about its customer behavior and preference. It will give advantages to the team when taking actions towards their customers.

To revenue growth and increase the brand image, the company must intend to customer loyalty. Hence, commitment and dedication will lead to increase customer retention. Improved customer retention will directly have a positive impact on the company's operations section six fields. One type of positive impact of increasing customer retention is the acquisition and marketing costs to be reduced (Singh & Khan, 2012). The reducing happens because the customer acquisition costs five to twelve times higher than the value of retaining customers (Singh & Khan, 2012). The second impact of a 5% increase in the area of customer loyalty will increase 75% profit of the company. The cost of customer turnover can reduce when those lost customers replaced by newer ones (Singh & Khan, 2012).

The third impact is the success of cross-selling increased because the company knows consumers more profoundly and because of that, the company knows what they have to sell and what kind of promotion. The fourth is the impact of the news by word of mouth becomes more positive, with the assumption that loyal customers are also satisfied. The method is important because only 4% of consumers who are not satisfied that report to related companies, and consumers who are not satisfied can tell nine other people about their dissatisfaction with the (Singh & Khan, 2012). The last impact is the cost of failure as a product rework, warranty claims and other will be decreasing.

Customer touch service as part of customer relationship management (CRM) can define as a place or time. When the customer interacts with the product, company, or its organization that could result in a reaction, and this interaction is at personal experience level and could differ from one individual to another (Verhoef et al., 2009; Gentile et al., 2007). Meyer and Schwagger (2007), defined customer touch service as a service that gives the customer an internal experience and response when the customers are making contact with the company, directly or indirectly. There we can conclude that customer touch services could give the customers personal experiences is subjective and limited to the customer itself.

Customer touch services can transform into many customer-experiences related program and strategy to retain the customer. A weak customer touch service will lead to disintermediation (Schmarzo, 2016). Through customer touch service, an organization will be able to identify their customer‘s needs and the way to make them keep coming back, even use the word of mouth technique. The customer service can do with advanced data analytics, and this could leverage the business in the long term and able to understand the company, for example, Uber and Airbnb (Schmarzo, 2016). An organization is always in need to move forward to ensure its survival, especially when it depends mostly on customer relationship.

Problem Statement

As two-sided marketplace had become more and more widely used by people all over the world, its image is slowly changing. People used to be unfamiliar with e-commerce, and they were afraid of fraud especially two-sided marketplace which connects two people that didn‘t know each other (Investopedia, n.d). As time pass by, the image of two-sided marketplace had become definite. People had got more to use it, fraud might be still there, but people get a guarantee from the two-sided marketplace.

The main problem is, that was a long time ago. Today, people feel even more used to the two-sided marketplace, which indirectly results in disintermediation. People are not that afraid of fraud anymore, even without the guarantee from the marketplace because they knew that it is not dangerous to do disintermediation. They started to trust each other (the buyer and the seller). There might be a risk, but some people just feel that it‘s worth.

In two-sided marketplace perspective, the marketplace job is to connect the buyer and seller, or the user and the provider of the service, but at the end of the day, after both parties had contacted, they make the payment outside the marketplace. Disintermediation happens for a lot of reason; the first one is because of the fees. People might feel that the marketplace had done an excellent job to connect them, it is worth to pay the cost, but as they had done the transaction over and over, they feel that they can do it without the marketplace (Breinlinger, 2013). The fee causes the parties to attempt disintermediation, the buyer that wants a lower price and the seller that does not wish to their revenue share to give to the platform.

Secondly as mentioned in the previous paragraph, people had got to be used to the- two-sided marketplace. They feel safe even when they disintermediate the marketplace. Meanwhile, on the other side, the marketplace cannot control it. Thus, it is apparently possible for them to get benefits of the two-sided marketplace and do the rest how they used to do without that platform (Breinlinger, 2013; and Hagiu et al., 2015).

Through a very straight blocking method, some marketplace might be able to prevent disintermediation such as block the user information, limit their conversation method, and other things. This technique had the side effect, the experience of the user who wants to do disintermediate and those who had no intention to disintermediate will be unpleasant since they cannot contact how they want and get information that they need to.

The marketplace pressured by these factors. It will be very dangerous for that company if they did not block disintermediation and just let it pass by because it will create dominos effect and as a result, more and more people will start disintermediation (Investopedia, n.d). The marketplace will corrupt, thus income will decrease dramatically, and the data gathered will be inaccurate. On the other hand, if the marketplace is too harsh on the prevention on disintermediation, the user experience will become very unpleasant, and eventually, they will switch to another marketplace that allows them to do so.

Research Question

This research questions work on the assumption that factors and the root cause of disintermediation that happened in e-commerce transactions involving two-sided marketplaces. We suggested some platform providers strategies to reduce the potential disintermediation. In this research, we also assess the price sensitively on other factors. Therefore, some analysis will be done to answer the question what are the elements of disintermediation, how it can happen, and what kind of strategies to reduce the potential in two-sided marketplaces.

Purpose of the Study

Based on the questions, this research will analyze: 1) the factors that trigger customer to disintermediate and investigate the cause of the disintermediation, 2) the sensitivity of price and another factor that determines the level of potential disintermediation might occur, and 3) the strategies that can be used to help the platform providers to prevent disintermediation from happening or at least reduce it.

Research Methods

This research used descriptive research method, where it will obtain answers which are related to opinions, feedback or one's perception so that the result should be in the form of qualitative description or using words. This study used the case, it defined as a process of analysis of a particular phenomenon presented in the context of limited (bounded text), although the limits between the event and the setting are not entirely clear (Yin, 2013). A case study research is suitable for analyzing in some circumstances. First, the case acts as a critical test of a theory. Second, it is a rare and unique event. And third, it is related to the disclosure of a game.

In determining the method of data collection, the data can be obtained through two sources, namely primary data and secondary data. Thus, in this paper, researchers will use secondary data sources, which will be derived from the books and literature review of subjects related to disintermediation in e-commerce and mobile app platform. Meanwhile, the primary data is obtained from the case study given.

Findings

Disintermediation, whether in an e-commerce or non-e-commerce company, happens when customers rely on a marketplace/platform to find a seller of certain goods, but then perform related future transactions, or even the current operation without the involvement of the platform. This type of behavior is especially harming the company in the two-sided marketplace because by doing this, the customer will be able to avoid paying any extra fees the platform charge. Besides endangering the company economically, disintermediation also reduces data collected by the marketplace. By having less data the marketplace/platform will have less insight in setting rules that benefitted both sides (buyer & seller). It also prevents the platform to provide appropriate oversight of the transactions and reduce the control of the platform to its visitors.

In the long term, disintermediation will reduce the revenue of a two-sided marketplace platform and may even make an otherwise-viable marketplace non- viable. Thus, two-sided marketplace operators try to adjust their services, rules, and incentives to discourage disintermediation (Eisenmann et al., 2008). According to Schmarzo, (2016), the two side marketplace‘s function is to be the matchmaker between buyer and seller. Disintermediation, in this case, happens when the consumers choose to leave the platform to complete the transaction, including any contract and payment. In this case, the two side marketplace platform will be unable to charge fees for the purchase, and the platform will not receive that a transaction even occurred.

Example for this case is when a passenger gets into a car ordered through Uber or a motorcycle through Go-Jek, the passenger could cancel the Uber or Go-Jek and pay the driver directly instead (Investopedia, n.d). Other case is when a buyer uses Tokopedia.com or Mataharimall.com to find a product sold by a third-party seller, the buyer could contact the vendor and agree to pay directly. A direct purchase would circumvent let the seller avoid Tokopedia & Matahari mall fee, and the seller could sell it for less price to the buyer.

In this particular case, a two-sided marketplace platform is in danger of disintermediation when the platform depends solely on the matchmaking feature and has no other complementary features to support it. Also, the larger the value of the current transaction, the more significant both parties incentive to avoid the fees in the marketplace. For example, on rush hour, if the price spike too much on Uber price, it might encourage some disintermediation for a potential passenger. According to Weyl (2010), a two-sided marketplace platform is in danger of disintermediation when the platform depends solely on the matchmaking feature and has no other complementary features to support it. Also, the larger the value of the current transaction, the more significant both parties incentive to avoid the fees in the marketplace. For example, on rush hour, if the price spike too much on Uber price, it might encourage some disintermediation for potential passenger

In this case, both parties might complete their first transaction through a platform, but later conduct additional operations with each other outside of the platform. This approach is particularly likely to happen when the nature of the service invites a buyer to continue with a single service provider. For example, a homeowner might find a housecleaner through Handy.com and pay for the first cleaning through that marketplace, but later contact the same housecleaner without using Handy.com (Investopedia, n.d). Using this strategy, the customer would pay a lower price for future visits, and the customer might give higher fees as the incentive for the housecleaner.

Another example would be buyers that repeatedly buy the same type of stuff from the same seller in Tokopedia.com for an extended range of time. These buyers might then just contact the seller because they have already trusted him/her. When facing disintermediation for subsequent transactions, a marketplace is still able to capture value on the first purchase between each pair of parties, but there are far fewer repeat transactions, which the market perceives as churn. This effect is most harmful to marketplaces platform that mainly depends on repeat transaction. This type of disintermediation is also harder to prevent in the long run. Therefore, the economic and psychological behavior of customers should be taken into account and play in customers mind (Breinlinger, 2013; Kumar et al., 2007). The best marketplaces understand their users on an emotional level and build a product and culture accordingly. According to Towsend (2014), four most important contributing factors play into the psychology of the supplier and consumer in doing disintermediation. Those considerations are: 1) Freq = Frequency that the two sides exchange value through the platform, 2) Rel = Relationship the supplier and consumer have with the marketplace, 3) Value = Value the company provides after meeting, and 4) Take = The relative pain of the transaction fee

After analyzing the different type of disintermediation, researchers conclude that several factors encourage the disintermediation behavior. For current transactions, the most significant factor would be: 1). The complexity of the current operation. If the procedure is simple enough, the customer would be better off just using the platform, because they don‘t use it regularly. Vice versa, when the operation is complicated, they will be better to deal with it firsthand with the seller. For example, simple procedure to go from work to home that happens between Uber passenger and driver can be done merely through the platform, but when the transaction is very complex like driving to a faraway place, the passenger would prefer not use Uber; 2) The duration needed to complete the transaction. If the customers need a long time to complete their purchase through the platform, they will be incentivized just to contact the seller and close the deal; 3) High fee. If the two-sided marketplace has a high price, it also will encourage a buyer to talk to the seller directly to reduce the cost.

For recurring/subsequent transactions, the most significant factor would be: 1) Similar kind of seller with similar service. If the service or product that offered related over a period, then the buyer would be incentivized just to contact the seller and ask for a discount, rather than just depend on the two-sided marketplace platform. 2) Fixed requirements by the buyer: If the buyer only has similar demand for an extended range of time, for example, an Airbnb customer that just need a single bedroom in a simple house, then it‘s easy for them to do disintermediation. Vice-versa, if the customer has different requirements for home every time. Then it‘s much better for the customer to check it through Airbnb, No other ―fun features, if the two-sided marketplace only has matchmaking features without any other features that make the transaction more secure, then the buyer would only use it once and prefer just dealing with the buyer directly later. These factors need to be put in mind of every two-sided market platform provider so that the customer isn‘t incentivized to do disintermediation or the platform attract many people that just do transaction once and do it by themselves afterward.

Meanwhile, to analyze how big of an impact the price of a goods/service, or its fee to the disintermediation behavior, researchers will first go through the factor that encourages people to buy on the two-sided markets, especially on the internet which means Consumers shop on the Internet. It caused by they find their choices increase dramatically. They have access much more information when making purchasing decisions. So that, busy consumers can save time and find shopping more convenient as online merchants can serve them each requirement better and higher access to information, combined with a lower operating cost for many Internet businesses may, in turn, drive reductions in prices or improvements in quality (Margherio et al., 1998).

Moreover, the issue of convenience and speed seem to be the most apparent reasons why shoppers prefer online shopping in contrast to traditional bricks-and-mortar method of shopping. Consumers have also described as time-poor, thus desperate to spend their time to find many recreational needs as argumentation for their reason to add and sustain online shopping (Parsons, 2002).

Based on the study conducted by ACNielsen Research, Table

The second dominant factor that influences consumers to shop online is the competitive prices and deals offered by online retailers. The most straightforward reason for consumers to purchase online is to save money from the lower rates offered by online retailers compared to traditional channels. Online retailers can offer lower prices because of the shrinking cost of information processing, lower operating cost and global reach provided by the Internet (Rowley, 2000). Another main reason that lower prices offered to online shoppers is that of competitive pressure, especially from new online retailers. New online retailers also use rate as a primary competitive weapon to attract customers (Hanson, 2000).

The third dominant factor that motivates online consumers to purchase goods and services over the Internet is an excellent selection and broader availability of product choices offered by online retailers. Online retailers can provide a wide range and assortments of products as compared to traditional channels just because there is no physical space limit on the number of products that online retailers can display on their online storefronts. Furthermore, many online stores that consumers can visit online far exceeds the number of physical stores, thus, providing them with a broader selection of products to choose. Table

So judging from that ACNielsen research, we can conclude price is a pretty significant factor (51%) in online shopping. After that, the two-sided marketplace or platform should observe its Customer Lifetime Value (CLV) as it will play an essential role in the pricing decision. The platform can use CLV to know the average value of its customer. The factors included in CLV are: 1. Profit Contribution each transaction: the average amount of purchase per transaction, 2. The number of buying annually: the average time of purchase yearly, 3. The average number of years that they remain a customer: the average time a customer, and 4. Customer Acquisition Cost: cost required to attain the customer

Any e-commerce platform should recognize any changes in these four factors and make sure they are stable if they want to prevent a reduction in profit by any disintermediation act in the future. Due to the elasticity of demand theory when the price increased is increased to raise the profit contribution, the number of purchase will automatically decrease. While on the other side, when the company lowers the rate, although the profit reduced, the number of purchase automatically will raise and it might be more profitable due to the increasing amount of quantity. After the buyer makes sure the CLV is stable, the platform can put in other factors to calculate the disintermediation rate. Those elements are:

1. Freq: The platform where the two sides might be able to exchange value -

2. Rel: Relationship, the supplier, and consumer have with the marketplace +

3. Value: Value the company provides after meeting +

4. Take: The relative pain of the transaction fee +

5. Dif: Difficulty in actually backdooring +

6. Trust: Trust between supplier and consumer -

7. Ava: The likelihood that the supplier will be available at next request -

8. Fear: Fear of being removed from the platform for legal reasons +

Therefore, to calculate the disintermediation rate, each factor is identified with its positivity or negativity effects to disintermediation. The more (+) sign, the less disintermediation will happen, and vice versa. Each company will rate the scale of 1 - 10 The result will later be combined and divided by 8 to get the actual disintermediation rate. The formula then is as follows.

For example, we can say that an imaginary buyer, Sally is the frequent passenger of Uber to drive her to work each morning, and Adam is a driver that lives near Sally, so he frequently took Sally‘s order.

Let‘s say Adam drive Sally at least once a week, which is pretty frequent.

Freq = 8.

Sally has good relationship with Uber because Uber had helped her so much in her life

Rel = 9

Sally doesn‘t know the real value of going to work by taxi, but she knows Uber is cheaper and easy to use.

Val = 8

Sally also doesn‘t know the fee Uber takes, but she feels it‘s pretty insignificant.

Take = 4

Sally already has Adam number, so it‘s not hard to backdoor the Uber if Adam is free

Dif = 4

Sally trust Adam because she has gone to work accompanied by him multiple times

Trust = 8

Adam will usually be available on the next request because he is the closest driver to Sally‘s home

Ava = 7

There is no legal restriction to do disintermediation by Uber

Fear = 0

The disintermediation rate is = 100 - (100 x (((10-8) +9+8+4+4+ (10-8) + (10-7)+0)/8)) = 60%.

So with the following example, there is 60% that Sally will disintermediate from Uber service. We can see in that equation, that price is one of the factors, but it is not more important than another qualitative factor, such as trust between seller and buyer, or the frequency of transaction. So researchers conclude price is one of the factor customers do disintermediate, but it isn‘t the most significant factor.

On the other side, customers or users are significant for every company. Acquiring them is somewhat hard, and maintaining them is an even more challenging task. Starting from prospects to low or even high-value repeat customers, those come as the ultimate goal of a business organization that is to maximize the lifetime value of a customer. Thus, the importance of CRM become increasing in the Internet era or so-called the e-commerce era. The implementation of CRM has been there since the conventional business rule the world; it has become even more advanced nowadays. The goal of implementing CRM is to maximize the number of high- value repeat customers while minimizing customer churn (Rainer & Watson, 2014).

As mentioned above, the advancement of technology has made customers more potent than before improvement. If they are not satisfied with a product or a service from one marketplace, a competitor is often just one click away, which makes CRM even more crucial to help businesses maintain its customers. According to Verhoef et al., 2009), in most of the e-commerce marketplace, The platform infrastructures will construct CRM. Depending on the needs, the free or open source such as Prestashop, until the complicated and expensive systems such as Magento is available in the market. These are the e-commerce software that includes CRM within the back-end system or also known as content management systems. Moreover, to better explain the analogy of the human body, CRM system is similar to human‘s spine that supports the whole body to be well placed and structured. The same thing goes for CRM; it enables the software to track and record the behavior of customers and do it‘s computing to create customer‘s insights as well as disintermediation behavior.

Conclusion

The research assessed the disintermediation in two-sided markets whereas there are different factors in play for disintermediation to happen in e-commerce transactions. Disintermediation occurs when the operation is complicated, lengthy duration to finish the transaction and the platform charge high fees. The disintermediation typically happens in current deals. On the other hand, disintermediation usually occurs when there is only similar kind of seller with similar service, and also when the requirements from the buyer stay the same for a period, which usually happens in a subsequent transaction.

Price indeed affects the probability of disintermediation in a significant way, especially during the first impression, but for the following reaction, the two-sided market cannot depend on it alone. There are several other aside price that also must put into consideration. Those factors are a frequency of the transactions, relationship and trust between two parties, the value that the two-sided marketplace provide other than matchmaking, the relative pain and difficulty in doing disintermediation, the likelihood that supplier will be available next time, and legal reason connected to the situation.

Therefore, to prevent disintermediation from happening, or at least minimalize it, the company can do some other strategies instead of focusing more on the blocking side because it can give a wrong impression to the user. Those policies include exceptional payment and customer service for the buyer side, also empower seller and provide them with feedback and reputation system. And above all, the two-sided market platform must learn why people are leaving their platform and fix the weakest link in their process. By implementing this strategy, instead of caging the user, the company provides them more features to maintain their loyalty. The application of Customer Relationship Management can enforce procedures within the business activities.

Finally, to be able to efficiently and effectively minimalize disintermediation from occurring, two-sided marketplace based platform should focus on finding out all of the types of disintermediation which is currently happening in their market, affect them and which kind of disintermediation should be solved first since it endangers them more than the other. Either it‘s in the current category or the subsequent ones. Another psychological factor should take into account. It might have the same or even higher efficiency than just the price of the goods or fees. That‘s why it is essential that two-sided markets have something to hold the communities of buyer and seller together through their platform, not just doing matchmaking function.

Acknowledgement

This research supported by IBI Darmajaya and Pelita Harapan University. We thank our colleagues from Anuar Sanusi who provided insight and expertise that greatly assisted and helped the study, although they may not agree with all of the interpretations/conclusions of this paper.

We thank professor John Tampil Purba (University of Pelita Harapan) for assistance with methodology and literature, and Radityo Fajar Arianto (Prasetya Mulya) for comments that improved the manuscript much better.

We would also like to say our gratitude to Dr. Muhammad Imran Qureshi (University of Technology Malaysia) for sharing their suggestions with us during the dissemination of this research, and we thank “anonymous” reviewers for their so-called insights. We are also immensely grateful to our colleagues for their comments on an earlier version of the manuscript.

References

- Abdullah-Al-Mamun, M. (2014). A Critical Review of Consumers’ Sensitivity to Price: Managerial and Theoretical Issues. Journal of International.

- Alfred, O. (2013). Influences of Price And Quality On Consumer Purchase Of Mobile Phone In The Kumasi Metropolis In Ghana A Comparative Study. European Journal of Business and Management, 5(1), 2222–2839.

- Ball, D., Coelho, P. S., & Vilares, M. J. (2006). Service personalization and loyalty. Journal of Services Marketing, 20(6), 391–403. https://doi.org/10.1108/08876040610691284

- Breinlinger, J. (2013). A Crowded Space, Disintermediation in Marketplaces and How to Fight. Retrieved May 5, 2017, from http://acrowdedspace.com/post/28387454995/disintermediation-its-a-bitch

- Bucklin, R. E., Gupta, S., & Han, S. (1995). A Brand’s Eye View of Response Segmentation in Consumer Brand Choice Behavior. Journal of Marketing Research, 32(1), 66. https://doi.org/10.2307/3152111

- Dent, S. (2014). There are now 3 billion internet users, mostly in rich countries. Retrieved August 22, 2017, from https://www.engadget.com/2014/11/25/3-billion-internet-users/

- Eisenmann, T., Parker, G., & Alstyne, M. Van. (2008). Platform Envelopment. Retrieved from http://www.hbs.edu/faculty/Publication Files/07-104.pdf

- Frip, G. (2017.). Simple CLV Formula – Customer Lifetime Value. Retrieved August 22, 2017, from http://www.clv-calculator.com/customer-lifetime-value- formulas/simple-clv-formula/#

- Gentile, C., Spiller, N., & Noci, G. (2007). How to Sustain the Customer Experience: European Management Journal, 25(5), 395–410. https://doi.org/10.1016/j.emj.2007.08.005

- Hagiu, A., & Wright, J. (2015). Multi-sided platforms. International Journal of Industrial Organization, 43, 162–174. https://doi.org/10.1016/j.ijindorg.2015.03.00

- Hanson, W. A. (2000). Principles of internet marketing. South-Western College Pub. Retrieved from http://dl.acm.org/citation.cfm?id=554733

- Hee, W. K., & Toh, D. E. S. (2006). Moderating the Price Sensitivity of Online Customers. In The 8th IEEE International Conference on E-Commerce Technology and The 3rd IEEE International Conference on Enterprise Computing, E-Commerce, and E-Services (CEC/EEE’06) (pp. 13–13). IEEE. https://doi.org/10.1109/CEC-EEE.2006.63

- Investopedia. (2017). Disintermediation. Retrieved October 22, 2017, from http://www.investopedia.com/terms/d/disintermediation.asp#

- Kouris, I., & Kleer, R. (2012). Business Models In Two-Sided Markets: An Assessment Of Strategies For App Platforms Business Models In Two-Sided Markets: An Assessment Of Strategies For App Platforms. Retrieved from http://aisel.aisnet.org/icmb2012

- Kumar, V., & George, M. (2007). Measuring And Maximizing Customer Equity: A Critical Analysis. Journal of the Academy of Marketing Science, 35(2), 157–171. https://doi.org/10.1007/s11747-007-0028-2

- Lamb, C. W., Hair, J. F., & McDaniel, C. (2011). Essentials of Marketing - Charles W. Lamb, Joe F. Hair, Carl McDaniel - Google Books. Retrieved November 15, 2016, from https://books.google.co.idLin,

- Margherio, L., Henry, D., Cooke, S. & Montes, S. (1998). The Emerging Digital Economy. Retrieved from http://www.ecommerce.gov

- McGann, R. (2004). Online Holiday Purchases to Grow Despite Growing Security Concern. Retrieved October 27, 2016, from http://www.esecurityplanet.com/trends/article.php/3440061/Online-Holiday-Purchases-to-Grow-Despite-Growing-Security-Concerns.htm

- Meyer, C., & Schwagger, A. (2007). Customer Experience. Harvard Business Review, 1–11. Retrieved from http://www.dlls.univr.it/documenti/Avviso/all/all999201.pdf

- Nagle, T., Hogan, J. & Zale, J. (2016). The Strategy and Tactics of Pricing: New International Edition

- Parker, G. G., & Alstyne, M. W. (2005). Two-Sided Network Effects: A Theory of Information Product Design. Management Science, 51(10), 1494–1504. https://doi.org/10.1287/mnsc.1050.0400

- Parsons, A. G. (2002). Non‐functional motives for online shoppers: why we click. Journal of Consumer Marketing, 19(5), 380–392. https://doi.org/10.1108/07363760210437614

- Rainer, R. K. & Watson, H. J. (2014). Management Information Systems. Retrieved October 10, 2016, from http://dl.acm.org/citation.cfm?id=2787950

- Rowley, J. (2000). Product search in e‐shopping: a review and research propositions. Journal of Consumer Marketing, 17(1), 20–35. https://doi.org/10.1108/07363760010309528

- Schmarzo, B. (2016). Customer Loyalty: The Big Data Disintermediation Cure – InFocus Blog | Dell EMC Services. Retrieved February 17, 2017, from https://infocus.emc.com/william_schmarzo/customer-loyalty-big-data-disintermediation-cure/

- Singh, R., & Khan, I. (2012). An approach to increase customer retention and loyalty in B2C world. International Journal of Scientific and Research.

- Statista. (2016).Number of internet users worldwide 2005-2017 | Statista. Retrieved October 27, 2016, from https://www.statista.com/statistics/273018/number-of-internet-users-worldwide/

- Stewart, W. (2015). Internet History One-Page Summary - How Invented, Created. Retrieved December 20, 2016, from http://www.livinginternet.com/i/ii_summary.htm#

- Starust, J., & Frost, R. (2013). E-marketing - Judy Strauss, Frost Raymond D. - Google Books. Retrieved August 25, 2017, from https://books.google.co.id/books

- Tåg, J. (2008). Essays on Platforms: Business Strategies, Regulation and Policy in Telecommunications, Media and Technology Industries. Retrieved from https://helda.helsinki.fi/dhanken/handle/10227/291

- Teece, D. J. (2000). Strategies for Managing Knowledge Assets: the Role of Firm Structure and Industrial Context. Long Range Planning, 33(1), 35–54. https://doi.org/10.1016/S0024-6301(99)00117-X

- Townsend, M. (2014). A Deeper Understanding of Disintermediation (backdooring) in Marketplaces – Medium. Turban, E., Rainer, R. K., & Potter, R. E. (2005). Introduction to information technology. John Wiley & Sons.

- Verhoef, P. C., Lemon, K. N., Parasuraman, A., Roggeveen, A., Tsiros, M., & Schlesinger, L. A. (2009). Customer Experience Creation: Determinants, Dynamics and Management Strategies. Journal of Retailing, 85(1), 31–41. https://doi.org/10.1016/j.jretai.2008.11.001

- Weyl, E. (2010). A price theory of multi-sided platforms. The American Economic Review. Retrieved from

- Yin, R. K. (2013). Case Study Research: Design and Methods

- Yoon, K., & Tran, T. V. (2011). Capturing consumer heterogeneity in loyalty evolution patterns. Management Research Review, 34(6), 649–662. https://doi.org/10.1108/01409171111136185

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 May 2018

Article Doi

eBook ISBN

978-1-80296-039-6

Publisher

Future Academy

Volume

40

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1231

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Desfiandi, A., Singagerda, F. S., & Sari, N. (2018). The Review Of Disintermediation Strategies In Two Sided Marketplace. In M. Imran Qureshi (Ed.), Technology & Society: A Multidisciplinary Pathway for Sustainable Development, vol 40. European Proceedings of Social and Behavioural Sciences (pp. 178-196). Future Academy. https://doi.org/10.15405/epsbs.2018.05.16