Abstract

This article explores and analyses several factors that are interconnected and affect the cost of alternative sources of energy, such as wind, solar PV, hydro and kinetic energy, and compares them to current fossil fuels such as nuclear, coal and natural gas that provide 85% of the total residential and industrial energy consumption worldwide. In addition, we provide a forecast of the levelized energy cost (LEC) until parity of alternative sources of energy that is directly correlated to the multiple factors seen and analyze such as: government tax breaks and subsidies, weather conditions, market conditions, technological advancements, fuel prices and economic conditions between other with their defining role and their related impact in the price of energy. Moreover, we analyzed the consumers’ role and the possibilities of creating mini-grids and smart home systems that will increase savings in the short and long run and how will they co-exist with currently utility energy providers.

Keywords: Renewable energyTechnologyEnergy CostLECNon-renewables

Introduction

There are several different technologies available nowadays that provide energy generation at different levels and costs. There is an ongoing debate and concern over which technologies deserve the governments and public attention and support as well as which of them is more effective.

In this paper, we will compare and analyze the so-called levelized energy cost (LEC) of 5 non-carbon energy generation technologies; wind, solar, hydroelectric, nuclear and kinetic against traditional fossil based fuels (coal, natural gas) that currently provide about 85% of all the energy worldwide.

It is important to note, that fossil-based fuels are constantly being depleted and cannot be replaced within any practical time spam. Based on the BP statistical review of world energy of June 2016, the current reserves-to-production ratio (R/P) of fossil fuels are estimated as: oil-46 years, natural gas-58 years, coal-118 years. The usage, production and new deposits of non-renewable sources of energy are constantly changing and therefore, the (R/P) ratio is calculated annually (BP., 2016, Merz, 2016).

Cost comparison of energy sources

While renewable energy is unlimited and widely available, the upfront cost is currently high because of technology and efficiency constraints. On the other hand, nuclear and fossil-based fuels are cheaper, but have undesirable side effects on the environment and the wellbeing of the population as was pointed out by Saidur, R., Rahim, N. A., Islam, M. R., & Solangi, K. H. (2011) and Stephens, J. C. (2014).

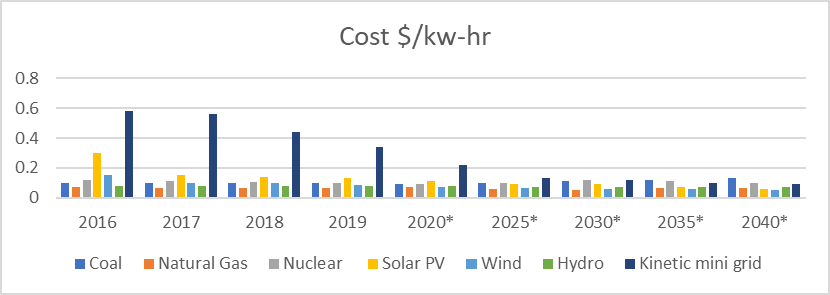

As shown in table

*estimates based on past performance, energy demand, and cost of technologies done by the author.

As we can clearly see based on the table above, the average LEC of renewables becomes cheaper as the years go by, almost reaching parity in 2040 as seen in figure

As seen in Fig.

Methods

It is not surprising that each method of power generation has its pros and cons (Klessmann et al., 2008). From an economic point of view, the upfront cost of RE implementation, development, and delivery is extremely high (Menanteau et al., 2003; Burgholzer, & Auer, 2016). But unlike traditional non-renewables, they do not require fossil fuels to work that are very volatile and depend mostly on the market condition and supply (Cabrera, & Schulz, 2016). Nonetheless, fossil fuels are currently more effective at producing energy than renewables, except for hydroelectric plants that can work at full capacity during peak times without added cost. As seen in table

The table above assumes that legislation and regulation will have a positive price impact on renewable energies, as was the case once the Paris Agreement of 2015 that pushes countries to limit greenhouse gas emissions was signed. Consequently, more investment and government support will be given to renewable sources of energy (Brown, & Hess, 2016).

Tax breaks and subsidies play an important role in the pricing of energy (Andor, & Voss, 2016). The impact variation is mainly because of how the tax breaks and subsidies are allocated in each country and/or region. e.g.: The European Union has more tax breaks incentives and subsidies for wind farms (González, & Lacal-Arántegui, 2016). Australia places most of its subsidies and incentives to solar PV plants (Chandel et al., 2016).

Technological advancements affect the industry because of operational cost. Moreover, production practices and technologies get cheaper with time and supply and demand (Kammen, & Sunter, 2016).

Technological effectiveness/ improvements play a vital role, mainly in the price of renewable energy except for hydro plants that can convert as much as 90% of the available energy they produce into electricity. Currently, the best fossil fuel based plants are about 50% efficient and solar plants in average are about 18% effective.

Market competition will add pressure across the energy markets, that will help to keep prices low and competitive begin a positive factor for all sources of energy.

Fuels prices have a significant impact on coal, natural gas, and nuclear plants, that are dependent on non-renewable fuel sources to generate energy. In addition, their prices aren’t stable and can vary widely depending on market conditions. In contrast, renewables do not have such a cost and they are unlimited (Watkins, & McKendry, 2015).

Results

Weather conditions based on averages can have a negative and positive impact on energy prices, but more importantly consumer demand.

Economic conditions affect mostly renewables, because of the high upfront cost of building the power plants and the available disposable income of individual users that can invest into building mini-grids in their houses (Inglesi-Lotz, 2016).

The total provides at-a-glance average of reduction or increase in prices of dollar/kWh based on the presented factors.

End-users and their role in renewable energy prices

End-users in present time have the ability (disposable income) and incentives from their government in terms of financing and installing renewable (solar) mini-grids in their homes (Rao et al., 2015). That makes their home more energy efficient, affordable and smarter (Jiang, & Fei, 2015). If the trend continues at the current rate (25% year over year) and technology as well as wall mounted batteries, that are the biggest problem for renewables at the current moment, become more affordable and effective for individuals in the future, the LEC for new renewable and fossil fuels plants alike will see a reduction because the end-users unused energy will join the conventional grid creating an energy supply glut that will have a backward domino effect which might disrupt the industry and the economy of fossil fuels as we have seen in the past years.

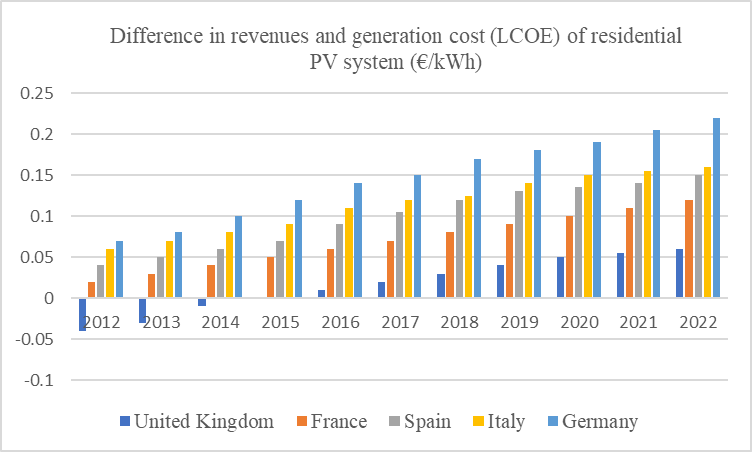

As pointed out by the DG ENER and the EPIA response (2012); PV(photovoltaic) mini-grid is increasing competitiveness, and it creates a huge window of opportunity to invest in energy storage solutions (batteries) for the consumer market. They go as far as saying that a network of residential storage systems combine with a PV plant could well increase the ratio of self-consumed PV electricity to around 70% and subsequently the price for energy production will see a reduction. They also agree that energy storage makes economic sense for PV systems owners when the investment cost in a storage system is outweighed by the revenues generated by an increase in self-consumption, EPIA response to DG ENER (2012).

As describe by EPIA, the increasing PV competitiveness across the EU will make it possible to invest between 0.05 €/kWh and 0.19 €/kWh in a complementary storage system by 2020 as seen in fig.

In addition, it is important to note that the psychology of a conventional user plays a vital role in its decisions (Werff, & Steg, 2016). Therefore, if incentives and mainly promotion of these systems are absent or non-existent then the current trend in development and usage of mini-grid will come to a halt.

Conclusion

Assuming governments will remind firmed in their stand of curving greenhouse gasses emissions, subsidies and tax breaks continue to help the construction, delivery and research of new technologies that can advance the effectiveness of harvesting, storing and delivering energy. If also, individual users continue to install and invest in mini-grids as technology becomes more affordable and there is a good psychological necessity for them and good promotion from governments as well as companies, the levelized cost of renewable plants should eventually come to parity with those of fossil-based fuel because of the factors seen and analyzed in this paper by the year 2040. This will mainly have two consequences; the energy market will be very competitive with a wide range of energy production in the near future and we will eventually curve the co2 emissions.

References

- Andor, M., & Voss, A. (2016). Optimal renewable-energy promotion: Capacity subsidies vs. generation subsidies. Resource and Energy Economics, 45, 144-158.

- BP. (2016, June). Retrieved from https://www.bp.com/content/dam/bp/pdf/energyeconomics/statistical-review-2016/bp-statistical-review-of-world-energy-2016-full-report.pdf

- Brown, K. P., & Hess, D. J. (2016). Pathways to policy: Partisanship and bipartisanship in renewable energy legislation. Environmental Politics, 25(6), 971-990.

- Burgholzer, B., & Auer, H. (2016). Cost/benefit analysis of transmission grid expansion to enable further integration of renewable electricity generation in Austria. Renewable Energy, 97, 189-196.

- Cabrera, B. L., & Schulz, F. (2016). Volatility linkages between energy and agricultural commodity prices. Energy Economics, 54, 190-203.

- Chandel, S. S., Shrivastva, R., Sharma, V., & Ramasamy, P. (2016). Overview of the initiatives in renewable energy sector under the national action plans on climate change in India. Renewable and Sustainable Energy Reviews, 54, 866-873.

- González, J. S., & Lacal-Arántegui, R. (2016). A review of the regulatory framework for wind energy in European Union countries: Current state and expected developments. Renewable and Sustainable Energy Reviews, 56, 588-602.

- EPIA response to DG ENER (2012) Working Paper “The future role and challenges of Energy Storage”

- Inglesi-Lotz, R. (2016). The impact of renewable energy consumption on economic growth: a panel data application. Energy Economics, 53, 58-63.

- Jiang, B., & Fei, Y. (2015). Smart home in smart microgrid: A cost-effective energy ecosystem with intelligent hierarchical agents. IEEE Transactions on Smart Grid, 6(1), 3-13.

- Kammen, D. M., & Sunter, D. A. (2016). City-integrated renewable energy for urban sustainability. Science, 352(6288), 922-928.

- Kang, M. H., &Rohatgi, A. (2016). Quantitative analysis of the levelized cost of electricity of commercial scale photovoltaics systems in the US.Solar Energy Materials and Solar Cells, 154, 71-77

- Kennedy, S. (2016). Corporate Sustainability & Green Cities.

- Klessmann, C., Nabe, C., & Burges, K. (2008). Pros and cons of exposing renewables to electricity market risks—A comparison of the market integration approaches in Germany, Spain, and the UK. Energy Policy, 36(10), 3646-3661.

- Levelized cost and levelized avoided cost of new generation resources in the Annual Energy Outlook 2015. (June, 2015) Retrieved from http://www.eia.gov/forecasts/aeo/electricity_generation. cfm

- Levelized cost and levelized avoided cost of new generation resources (August, 2016) Retrieved from http://www.eia.gov/forecasts/aeo/electricity_generation.cfm

- Merz, M. (2016). An Introduction to Economic Growth Theory and the Oil Market. Scarce Natural Resources, Recycling, Innovation, and Growth, X, 3-9.

- Menanteau, P., Finon, D., Lamy, M. L. (2003). Prices versus quantities: choosing policies for promoting the development of renewable energy. Energy policy, 31(8), 799-812.

- Rao, N. D., Agarwal, A., Wood, D. (2015). A comparative study of electricity supply and benefits from microgrids, solar home systems and the grid in rural South Asia. Micro Perspectives for Decentralized Energy Supply: Proceedings of the International Conference (2015, Bangalore), 117.

- Saidur, R., Rahim, N. A., Islam, M. R., Solangi, K. H. (2011). Environmental impact of wind energy. Renewable and Sustainable Energy Reviews, 15(5), 2423-2430.

- Stephens, J. C. (2014). Time to stop investing in carbon capture and storage and reduce government subsidies of fossil fuels. Wiley Interdisciplinary Reviews: Climate Change, 5(2), 169-173.

- Van der Werff, E., & Steg, L. (2016). The psychology of participation and interest in smart energy systems: Comparing the value-belief-norm theory and the value-identity-personal norm model. Energy Research & Social Science, 22, 107-114.

- Watkins, P., & McKendry, P. (2015). Sustainable Energy Technologies and Assessments.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 July 2017

Article Doi

eBook ISBN

978-1-80296-025-9

Publisher

Future Academy

Volume

26

Print ISBN (optional)

Edition Number

1st Edition

Pages

1-1055

Subjects

Business, public relations, innovation, competition

Cite this article as:

Mitchell, J. W., Maksimova, N. G., & Bay, D. S. (2017). The Future Cost And The Key Factors Of Energy Generation. In K. Anna Yurevna, A. Igor Borisovich, W. Martin de Jong, & M. Nikita Vladimirovich (Eds.), Responsible Research and Innovation, vol 26. European Proceedings of Social and Behavioural Sciences (pp. 661-666). Future Academy. https://doi.org/10.15405/epsbs.2017.07.02.85