Abstract

The transition of the society to a more progressive techno-economic paradigm (technological wave) is impossible without a sound long-term strategy for innovative development of the tax system. From the point of view of the systemic approach, it must be treated as a complex system which is open, dynamic, and non-reflex. Therefore, the authors first used the Networked Readiness Index to discover the pressure points and proposed some measures to address the challenges involved in bridging the gap between the Russian tax system and the global standards and scientific and technological development in this sphere in the situation when the resources are limited. Thereafter, the current state of taxation and tax administration in Russia is analyzed from the point of view of digital economy. The article gives special consideration to the development of creative personnel as the basis for the transition of the Russian economy and its tax system to a new and progressive technological environment. The authors suggest that the core triad for the development is personnel–information–technology, and the tool to be used for the implementation of the concept of lifelong learning is the Personal Learning Environment. In general, the findings of the study lead to the conclusion that in the context of an ever-growing arsenal of Internet applications and social services, a specialist's personal learning environment should evolve together with the specialist’s development, both professional and personal, in order to comply with the realities of the complicated and constantly changing world.

Keywords: Techno-economic paradigmwave of innovationinformation and communications technologynetworked readiness indexe-taxationpersonal learning environment

Introduction

The irregular pace of scientific and technological progress is determined by the change of the prevailing techno-economic paradigms, or waves of innovation, in the country. The theoretical basis of such opinions was provided by Kondratiev (1935) and Schumpeter (1911), and their further justification was presented in the works of the scholars who gave the wording to the concept of

Six technological paradigms have been described, each of which includes several interrelated generations of technology that replace each other and implement a common technological principle in their evolutionary succession. The core of the fifth technological paradigm includes: software, optoelectronics, telecommunications, robotics, computer science; the basis of the sixth wave includes biotechnology, nanotechnology, photonics, optoelectronics, artificial intelligence, and quantum technology. As for the sixth wave of innovation, it is based on the concept of Web 2&3.

In 2010, the initiative in introducing progressive paradigms was intercepted by the United States: the share of production forces of the fourth technological paradigm was 20%, while those of the fifth accounted for 60%, and the sixth already had a share of 5%. In Russia, the technologies of the fifth paradigm had a share of about 10%, more than 50% of technologies belonged to the fourth paradigm, and nearly a third even represented the third one. To become one of the leading nations within the next 10 years, Russia has to skip a stage, i.e., the fifth technological paradigm (Kablov, 2010). This problem also directly affects the modernization of the tax system, raising the issue of a quantum leap which would mentally transform the relations between the state and its taxpayers, business processes of tax administration and tax proceedings.

Methods

The purpose of this study is to identify the problems and to suggest ways of improvement of the Russian tax system in the environment where innovative information and communication technologies are used. The research was based on the system-wide approach, the general scientific methods of analysis and synthesis; the author relies on the results of research performed by well-known international organizations.

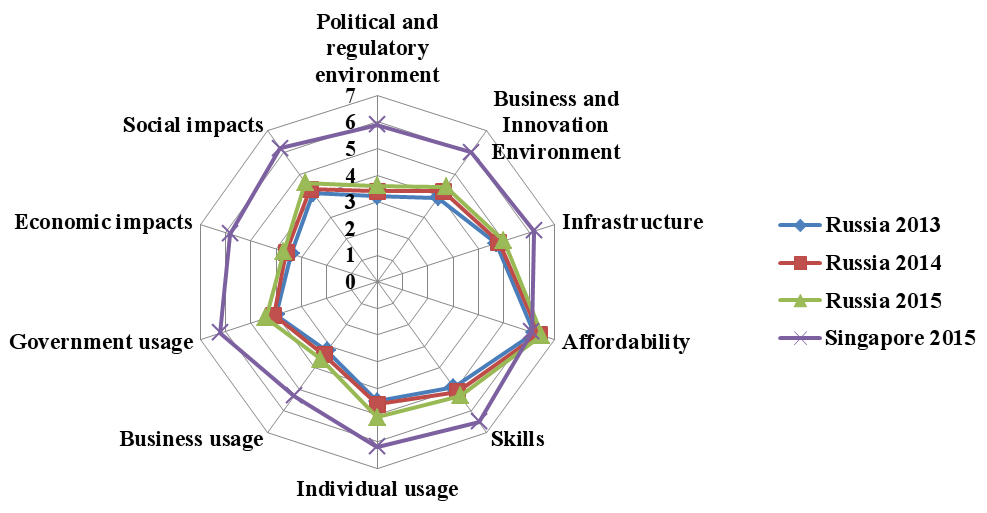

To achieve the goal set by the authors, the following studies have been carried out. In order to understand the level of digital economy development in Russia, the authors processed the data of two ratings: the 2015 ICT Development Index published by the United Nations International Telecommunication Union, and the Networked Readiness index for 2013-2015 issued by the World Economic Forum. In the second case, the comparison was made with Singapore, the leader of 2015 rating. We performed a factor analysis of ICT development in Russia in the period under consideration. This made it possible to prove the impact of modern technologies on the object of the research, which is e-taxation, and to analyze its current state from the point of view of two aspects, 1) informative; and 2) organizational and managerial. According to the hypothesis advanced in the article, the main role in this process belongs to creative personnel specialized in finance and taxation. In this connection, the article outlines the global trends in education and shows Personal Learning Environment as an instrument for professional training and retraining. The findings of the study, which are based on the analysis and synthesis of various data, are reflected in the conclusion of the article.

Results

Informatization of the Russian society

Intensive work is now going on in our country for the establishment of the legislative framework in the field of informatization. Documents approved in this area include the State Program of the Russian Federation "Information Society (2011-2020)", the Strategy for the Development of Information Technology Industry in the Russian Federation for 2014–2020 and Prospective Development up to 2025, and the Forecast of Scientific and Technological Development of the Russian Federation for the period up to 2030. In these regulations, information and telecommunication technologies are considered to be the key element in the development of the society and its structural entities.

Information and Communications Technology (ICT) have brought fundamental changes not only to the ideology of tax administration and the performance of the taxpayer's obligations, but also introduced innovations in the philosophy of the entire tax system. New categories of taxpayers emerge: these are entities operating in the sphere of high technologies, electronic commerce and other forms of online entrepreneurship. Their proportion among taxpayers is growing steadily. New approaches to taxation are established at both fiscal and regulatory levels: taxes change, and so do their elements objects of taxation, tax incentives, tax rates and the tax base.

This phenomenon is characteristic for tax systems of many developed countries. They establish new approaches to taxation at both fiscal and regulatory levels: taxes change, and so do their elements objects of taxation, tax incentives, tax rates and the tax base.

For example, Luxembourg, Ireland and the Netherlands have a "Google tax" (tax on profits of major digital companies). South Korea has introduced VAT at the rate of 10% for e-services of foreign operators. The tax is applied to services such as gaming, voice files, video files, electronic documents and software supplied through ICT networks. Portugal has introduced a tax on online gambling. France has expanded the scope of businesses subject to tax incentives to include video games. Spain, following other EU member states, has recognized virtual currency (bitcoin) as a financial service which is VAT exempt. In many countries, there are substantial preferences for knowledge-intensive industries.

However, in our opinion, such innovations do not take into account the whole range of online transactions which involve sales of goods, works and services, and which have an impact on certain areas of business and make it necessary to update the ideology of the tax system and construct its simulated model with due account for the context of the transition to the sixth technological paradigm. That is, they are not systemic in nature and do not take into account in a proper manner the interests of business, government and society. In the first case, the changes are aimed at stimulating the priority development areas of the e-economy by lowering the tax burden and introducing fully automated tax procedures; in the second, the focus is on the improvement of the efficiency of tax administration in the context of the development of technologies; in the third case, the goal is to enhance the quality of life of the individuals in the society.

These problems are also characteristic of the Russian tax system. From the systemic point of view, the situation with the use of ICT in the country is best characterized by international indexes.

The top ten in the list of countries sorted by the

Although the dynamics of the indicators during the period under review is positive, as a whole, there is a serious system lagging behind the leading country. This applies to almost all the aspects of NRI, except for affordability. For example, a serious deviation from the benchmark can be seen in the formation of the political and regulatory environment (absence of independent judiciary power, inefficiency of the legal system in resolving disputes, poor protection of intellectual property), as well as the business and innovation environment: lack of latest technologies, the high total tax rate level, low quality of education in management schools, limited public procurement of advanced technologies (Table

Russia also has problems in the sphere of infrastructure development. It is necessary to note the following points here: insufficient area of mobile network coverage per capita, weak competition in the field of Internet and telephony services, poor quality of the educational system. The above-mentioned shortcomings definitely have a negative impact on the development of e-taxation and need to be addressed in a systemic way.

E-taxation in Russia

As a result of digital innovations, national tax systems, as well as any other public systems, are transformed in two ways: 1) their contents change due to the introduction of new tax payments, tax units, categories of payers, types of tax benefits, etc.); 2) the management of tax assessment is modernized at the state, corporate and personal levels.

As regards Russia, the first direction has not been adequately systematized and defined in theoretical and practical terms, it is generally focused on the short term and does not reflect the trends of the long-term development of the tax system with due account of the development of the society. Currently, there are only some fragmentary measures in the sphere of taxation which support the development of the high tech sector. For instance, tax privileges have been set in respect of investments into innovations for the income tax and corporate property tax, and companies in the sphere of information technologies enjoy preferences in respect of insurance premiums paid to social funds; the so-called Google tax has been introduced. However, no concept has been developed yet for taxation in the context of the use of information and communication technologies, which would take into account the global trends, the long-term public policy, the interaction between fiscal and regulatory functions of taxation and some other aspects.

Unlike the first one, the second direction in the sphere of tax administration has specific outcomes and reference points for the future. Today, the taxpayers whose invoices issued to their clients include VAT as a separate item must submit a tax return in respect of VAT electronically, as a tax return in a hard copy shall be considered invalid. In 2015 the OECD noted the leading positions of the Federal Tax Service of Russia in the development of electronic services for taxpayers, the automated VAT control system (ACS "VAT-2"), the creation of data centers with a high level of security and fault tolerance, etc. These technological solutions are advanced and attract certain interest on the part of foreign experts in ICT in the tax field. It is because implemented projects also provide an opportunity to create a single repository for the Russian tax data, which will enable fast comparison and analysis of the data.

However, at the level of economic entities e-taxation mechanisms have not been used for the transition to the advanced paradigm, because the enormous potential of the Internet has not been sufficiently explored and adopted by financial and tax professionals yet This can be explained by the lack of the theoretically substantiated strategy for the training of such personnel in the context of breakthrough scientific and technological development in the country. Here, the overriding problem is the transition to the concept of lifelong education, which should be based on the establishment of personal learning environments formed by the learners themselves and evolving along with the development of the learner.

However, at the level of economic entities the huge potential of the Internet has not been sufficiently explored yet, and it remains underused by financial and tax specialists. In this connection, it becomes crucial to address

Personal Learning Environment (PLE) as a tool for personnel training in tax-related areas

The modern concept of education involves the transition from the knowledge approach to the competence approach, where the students (and the teachers) become sovereign active subjects of cognitive activity and have to be able to build their own personalized knowledge system. For all the reasons listed above, it becomes necessary to create PLEs both for educators and for students. The methodology of PLE development has to take into consideration the global trends of development from the very beginning.

Therefore, the transition to the new progressive technological paradigm in the sphere of education should be effected in several system-based areas: the potential of the Internet, cloud computing, mobile learning, massive open online courses (MOOC), continuous professional education, Personal Learning Environment, Smart structures. The logic of the development is as follows: from Web 1.0 to Web 2.0, from computers to cloud and mobile technologies, from closed courses to MOOC, from discontinuous to life-long education, from group learning techniques to the creation of PLEs, from traditional teaching to Smart education. Other system components of the society are also changing: economic, social and cultural. The key problem in the context of this development, in any field of knowledge, is training and further education of personnel.

The solution of this problem is related to the following tasks:

transition to life-long professional education, because due to the rapid development of technology, the subject must be always ready to embrace changes in order to address one's personal and professional tasks;

creation of computer-mediated communication, development of the pedagogy of cooperation: teacher, colleagues, academics, practitioners, students;

integration of online networks and services in order to make the learning process more efficient, productive and motivating, replacement of passive consumption of information with interactive learning process;

the shift from Learning Management Systems (LMS) and Virtual Learning Environments (VLE) to the development of Personal Learning Environment (PLE), where the student builds their own learning environment (tools, services, communications, resources) for the personalized learning process.

All this provides opportunities not only for the creation of the personalized position of a partner in a discourse, but also for embarking on successful implementation of the overall technological principle of the advanced technological paradigm. Therefore, it is necessary to analyze the phenomenon of independently arranged PLEs created by the subjects of cognitive activity. For the purpose of better understanding of the establishment of PLEs in the society, we have provided definitions of the concept under consideration (Table

It is easy to see that in a broad sense, a PLE is a complex system (open, dynamic, non-reflexive) intended to find acceptable forms of social arrangements in the context of current global challenges and ongoing changes, as well as to support the development of educational strategies and technologies. Such a system

Contemporary pedagogic theory has developed the concept of self-driven cognitive activity of students in an online environment and has evaluated the professional competence of the university teacher in the digital world. It is necessary to modernize professional education in the field of tax-related subjects on the basis of the pedagogical approaches listed above.

Conclusions

Russia has progressed at the macro level in terms of current e-tax administration. However, the mechanisms of tax forecasting, planning and management of the entire tax system for its transition to the new technological paradigm have remained unused. This is explained by the lack of scientifically grounded concepts of taxation in the context of the development of world trends and technologies. It is necessary to develop a long-term forecast of scientific and technological development, a well-conceived system-based innovative development strategy in the context of limited market of creative personnel This is due to the fact that besides computer and information literacy necessary to navigate in the modern digital environment they need to be able to make full use of online resources and use the state-of-the-art communication technology. In this sense, the tax system should be seen as complex: open, dynamic, and non-reflex.

The focus should be on the key triad of development: human resources — information — technologies. Here the prominent directions include lifelong continuous education of specialists in the fields of finance and taxation, providing training in the framework of the system of Massive Open Online Courses (MOOC), and the formation of a personalized learning environment (PLE). It is feasible to shift the focus here from computer and media technologies to communication and cooperation, full and all-encompassing use of the technology and the social services of Web 2&3.

Thus, the problems listed above substantiate the need to review the legal, financial, educational, technological and other matters necessary for the development of the Russian tax system, as well as the updating of the tax policy and, eventually, the formation of the techno-economic paradigm in taxation. It is possible to use the methodological approaches to the calculation of NRI as the basis for constructing an innovative tax system model.

References

- Dosi, G. (1982). Technical Paradigms and Technological Trajectories: A Suggested Interpretation of the Determinants of Technical Change’, Research Policy, 2 (3), 147–162.

- Eggink, M.E. (2013). The Change in post 1980 Economic Development and Innovation Studies towards Evolutionary Economics, Journal of Economics Studies and Research. Retrieved from http://ibimapublishing.com/articles/JESR/2013/702172/702172.pdf

- Freeman, C. (1994). The Economics of technical change’, Cambridge Journal of Economics, 18, (5), 463-514.

- ITU. Measuring the Information Society Report; 2015, Geneva.

- Kablov, E. (2010). The sixth technological way, Science and life, (4), 2-7.

- Kondratiev, N.D. (1935). The Long Waves in Economic Life, Review of Economic Statistics, 17 (6), 105-115.

- Lvov, D. & Glazyev, S. (1986). Theoretical and applied aspects of management scientific and technical progress, Economics and mathematical methods, (5), 793-804.

- Nelson, R.R. & Winter, S.G. (1982). An Evolutionary Theory of Economic Change, Cambridge, MA, Harvard University Press, 72-136.

- Perez, C. (2009). Technological revolutions and techno-economic paradigms: in Working Papers in Technology Governance and Economic Dynamics, Tallinn: Norway and Tallinn University of Technology, 20.

- Pishdad, A., Haider, A. and Koronios A., (2012). Technology and Organizational Evolution: An Institutionalisation Perspective, Journal of Innovation & Business Best Practices. Retrieved from http://ibimapublishing.com/articles/JIBBP/2012/655615/655615.pdf

- Schumpeter, J.A. (2008). The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle. Trans. from the German by Redvers Opie, New Brunswick (U.S.A) and London (U.K.): Transaction Publishers. (Original work published 1911).

- World Economic Forum. The Global Information Technology Report; 2013, 2014, 2015, Geneva.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 July 2017

Article Doi

eBook ISBN

978-1-80296-025-9

Publisher

Future Academy

Volume

26

Print ISBN (optional)

Edition Number

1st Edition

Pages

1-1055

Subjects

Business, public relations, innovation, competition

Cite this article as:

Viktorova, N., & Evstigneev, E. (2017). Russian Tax System in the Context of Innovative Technology Development. In K. Anna Yurevna, A. Igor Borisovich, W. Martin de Jong, & M. Nikita Vladimirovich (Eds.), Responsible Research and Innovation, vol 26. European Proceedings of Social and Behavioural Sciences (pp. 993-1001). Future Academy. https://doi.org/10.15405/epsbs.2017.07.02.128