Abstract

The article proves that it is possible to achieve wellbeing if there is an improvement of both the pension system and change in the citizen’s attitude towards retirement income. The calculations (dynamics of the percentage of the working retirees, both in Russia and TPU, and the average salary) show that the increase in the ratio of the number of retirees and working people can’t lead to the deficit of the budget of the Russian Pension Fund. It is proved that the key way to overcome the deficit is to remove payments, which are not or little connected with earned income (disability and loss of a breadwinner pension, long service pension, and early retirement pension) and save only one function – compensation for loss of earnings. Refusal of the territorial rent (pension’s peg to the minimum of subsistence of a retiree in the region) will also balance the financial state of the Pension Fund. It is mathematically proved that the wellbeing of retirees can be reached if they participate in the compulsory and voluntary pension insurance programs, which are not necessary governmental.

Keywords: Wellbeingsocial statepension fund deficitpension system management

Introduction

In Russia during the last three years pension savings of citizens were “frozen”. There was no pension indexation for the working retirees in 2016. The reason for that is the deficit of the Pension Fund, resulted by the increasing of the ratio of retirees and working people.

Since 1981 the global bank makes an assessment of the ratio of the number of retirees and working people on a regular basis (World Bank indicators, 2016). At the beginning of the nineties a global research of the problems of population aging and pension support was conducted under the bank auspices. These problems were caused by the progressive growth of the life expectancy (in terms of «birth» and «endowment period»). In Russia in 2010 the endowment period was 14, 3 years for 60 years old men and 23, 9 years for 55 years old women (World Bank Policy Research Report, 1994); the ratio of the number of working people and retirees has increased from 18% in 2011 to 19% in 2014. In the in 2013 the expected endowment period was 18 years for men and 20, 5 years for women [The Annual USA report, 2014]. In technologically developed countries life expectancy at birth has increased by 2 years over the decade and by 1 year for 65 years old (Dormont B. and all, 2011).

All these have led to the growth of the percentage of senior citizens and population itself, and what’s important, working-age population. There is an increase of pressure on national budgets, especially in social-oriented countries, and pension systems, most of which are joint and based on a “pay-as-you-go” principle. In Russia the strategic goals are: providing a socially accepted level of pensions; reaching a long-term financial stability and balance of the Pension Fund budget, suitable for current economic development; conforming to international standards (Long-term development strategy, 2012). During 2013-2016 (according to a forecast) the Pension Fund deficit may increase by 32 times, from 9, 84 to 317, 54 billion rubbles (The Russian’s Pension Fund budget, 2015).

The problem of the Pension Fund deficit is becoming more popular not only in Russia (Searching for a new silver age in Russia, 2015), but also in many other countries. The need to overcome the deficit of the Pension and Insurance Fund is a part of Greece government plan, where the Prime Minister stated that the pension reform is needed, because otherwise «we wouldn’t be able to pay pensions in 5 years» (Melnic G., 2016). In China, thanks to its’ Constitution, there is an inability of the pension fund deficit [13]. In the USA in 2013 retirement and loss of a bread-winner payments were 672, 1 billion $, whereas in payments were 620,8 billion $, so the deficit was 51,3 billion $ (7,6%). In 2000 there was a surplus (in payments = 433 billion $, payments = 352, 7 billion $). The same situation took place in the Disability Insurance Fund. In 2013 the deficit was 34, 7 billion (28, 4%). To solve this problem two funds of social insurance should become off-budget, while Medicare should remain budget (The USA Annual report, 2014).

Decrease of the budget pressure is declared as the aim of the pension system reform carried out in many countries. But there are other, such as rational for providing longer, happier life; reservation of pension rights; providing enough pension payments when retire (Developing a funded pension system in Russia, 2013). Although, there is no international standard of wellbeing conditions for the retirees (Global Age Wath Index 2015). As for Russia there are almost apocalyptic scenario: all the National Wellbeing Fund (NWF) resources will be enough to finance the deficit of the Pension Fund only for one year (Searching for a new silver age in Russia, 2015).

That’s why it is important to answer the following questions:

Methodology and Data

An insurance principle of labour pension financing (personified recognition of the insurance in payments during an employee’s work life) means that the size of a pension should be determined by the aggregate value of insurance in payments to the Pension Fund of the Russian Federation. The assessment of the model and the level of savings in the working age population and the progress expenses in the elderly population may provide advanced understanding of how management of the Pension Fund impacts on its financial status and pensioner’s wellbeing. Let’s use the following data of the two management levels to asses the effect of the Pension Fund management on the financial status (surplus/shortage/balance) of the Pension Fund. These data are:

As the rate of the insured pension account is a function of:

We can predict the influence of these factors on the possible pension rate. We will use the least square method to find an unknown index by using Microsoft Excel 2016. The time series will be from 2006 to 2015 (inflation – from 1993), as we have all the data; the forecast period will be from 2016 to 2050; a,b are unknown factors and we will use the trend form, as it visually describes data most correctly. We will use the data from Rosstat (Russian Federal State Statistics Service) (table

(1)

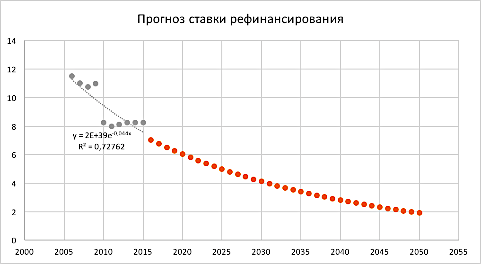

As a result, we will have estimated coefficients: a= 2E+39, b = -0,044. With that, determination coefficient equals R2= 0, 73, which indicates an average quality of the model. The trend shape is an exponential curve (figure

(2)

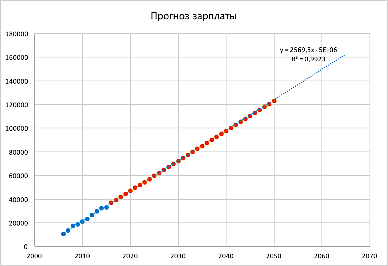

As a result, we will have estimated coefficients: a = 2569, 3 b = 5E+6. The trend shape is a linear curve. The determination coefficient equals R2= 0, 99, which says about the high quality of the regression model (picture 2).

(3)

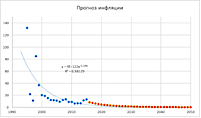

As a result, we will have estimated coefficients: a=4E+122 b = -0,139. The trend shape is an exponential curve. The determination coefficient equals R2= 0, 58, which says about the average quality of the regression model (picture 3).

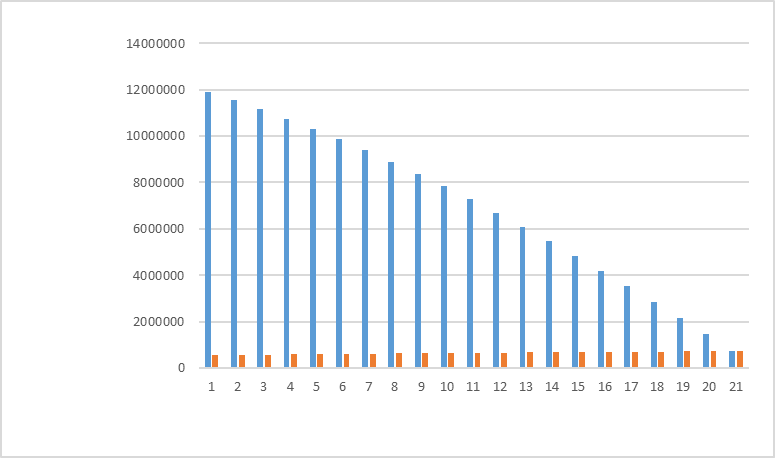

Using the regression models, let’s describe a hypothetical situation of individual pension account expenditure, when work experience equals 34 years, the beginning of work activity is in 2016, in payments to the Pension Fund are at the rate of 22%, endowment period equals 21 years. It is assumed that the inflation rate, the refinancing rate and the average salary will change according to the regression models. The amount of the individual account will be 11 890 656, 79 rubbles for 34 years (by 2050). We assume, that the expenditure can be described by the diagram (figure

The calculations prove that with these regression models there can’t be any budget deficit.

Let’s examine the data of TPU for the period of 2009-2015 to prove that the stable number of working retirees and the amount of average income, approximately equal to the regional level, should not create a burden for the Pension Fund (table

The percentage of the retirement age employees is stable and equals 26-27%. In Russia the percentage of working retirees was 23% in 2011 and 22, 3% in 2014 (Duration of work experience, 2011, 2014). Thus, every fourth retiree supports himself. The ratio of working population and retirees should not be the reason for the deficit, as their payments continue to arrive to the Pension Fund.

Discussion

We will use the basis of the definition of ‘How’s life’ (How Was Life? Global Well-being since 1820, 2014) and our previous publications (Eremina S.L. at all, 2015, Kudelina O. at all, 2015, Eremina S.L. at all, 2015) to understand and rate “wellbeing”. Within a framework of this research we talk about material wealth, such as maintaining living standards, which depends on the financial condition of the pension system and the individual efforts. Although, the modern conception of wellbeing takes into consideration psychological rather than material (Sen A. The Quality of Life, 1993) needs and motives (such as self realization, social status and so on).

The understanding of the ‘age’ timeline changes as a result of the growth of the average life expectancy. Now assessment of potential problems and possibilities of longer lifetime are only appearing. Life-cycle hypothesis (Modigliani F. Brumberg R., 1954) states that people smooth down their consumption by collecting assets during their working life and then spending it in the elderly age. One of the main missions of social insurance (Pestieau P. (2006), Feldstein M. (2005). Bonoli G. (2003). Hindriks J. at all (2003)) is a redistribution of income during lifetime, for example, by reducing disposable income from employment by the amount of insurance payments or by increasing disposable income during unemployment by the amount of insurance payments.

A lot of papers (Lee R., 2009; Pensions at a Glance, 2011) are devoted to the assessment of population aging on economic growth and government debt, which is assumed to increase to 585% of GDP [35] by 2050, although it is only correcting case of the lack of changes in individual behaviour or state policy (Searching for a new silver age in Russia, 2015). The problem of whether the elderly wellbeing is a state priority (Burns M.J., 2014, Siniavskaya O., 2010) is also widely discussed. Total savings will decrease with the growth of the senior citizens rate (Searching for a new silver age in Russia, 2015). That’s why we need special methods of developing and regulating the funded pension system (Developing a funded pension system in Russia, 2013) as a part of social safety net.

Depending on the purpose of organization and the source of funding, we can distinguish three models of the pension system (table

In distributive system senior citizen’s well-being depends mainly on the state of economy and federal budget. And it can be different. Even in arguably fat years, distributive pension system wasn’t capable of providing an adequate standard of living. An average pension barely reaches the third part of an average salary countrywide (Hmelev M., 2014), not drawing to the 40% of salary level claimed as the standard. In Russia over a period of 1991-2015 different ratio between the average salary and the average pension was recorded which depended on inflation compensation rate. If pension indexation was in advance, the gap reduced. If wages adjusted according to index, the gap increased.

Analysis of the financial condition of the pension system requires the assessment of income and outcome budget items of the Pension Fund.

In Russia during 2000-s several pension system reforms were conducted which led to numerous changes in the tariff rate. It reflects industry (extra-duty assignments, usually harmful conditions) and territorial (cold weather conditions) characteristics as well as year of birth. Besides, the payroll basis of pension payments was also changing. It consisted of the assessment of the ‘pension insurance record’ and the annual salary which every year adjusted according to the index (table

Let’s start with the income of the Pension Fund of the Russian Federation. Here we can distinguish actual income and income as the result of cost savings. According to the insurance model of the pension formation, the main income source of the Pension Fund is the contributions of the employers and investment income, and in case of deficiency - subsidies from the state budget. The income of the Fund is a function of a tariff wage fund and it varies depending on the year of birth. The year 1967 is considered to be a starting point in Russia (table

Now let’s talk about what can and reduces the expenses of the Fund.

They can be reduced by at least 35% by controlling an endowment period of those who was born before 1967 (Age survival, 2015). For example, a citizen retires in 2013. We will use the formula of the monthly pension calculations (precisely, the insurance part of the old age retirement pension):

(4)

where, PC-pension capital, ‘earned’ by the citizen during his work life; B-fixed basic amount of the insurance part of the old age retirement pension; T-number of months of the expected period of labour retirement pension payments - the endowment period, which was 19 years (228 months) in 2013 and beginning in 01.01.2014 is 21 years (252 months). The longer the endowment period is, the smaller the monthly pension is. According to Goskomstat the real lifetime after retirement is 4-6 years for men and 17-18 years for women. Taking into consideration the gender difference, we can assume that the average lifetime is 12 years. Now we will calculate the amount of monthly pension at different endowment periods. If B=3610.31 rubbles and pension capital=1 200 000 rubbles, then in case of endowment period of 12 years (taken by Rosstat data) the pension will be 11 944 rubbles. If the endowment period is 228 months, the pension will be only 8 873 rubbles (8 372 rubbles if the endowment period is 252 months). So the difference is 3 071 rubbles or 35%. If we take into consideration 2 million new senior citizens, the unpaid amount will be more than 130 billion rubbles per month. In that case we talk not only about the deficit of the Pension Fund budget, but also about the reducing the level of the retired wellbeing.

Another way of calculating the pension size is using the replacement rate formula. It means that the maximum pension size, which is limited by the amount of income that can’t be over the average salary in the region, multiplied by 1, 6, is determined. If the salary of the future retiree is above this value, the pension will still be calculated as “the average salary in the region multiplied by 1.6”. Let’s take as an example a senior citizen living in Tomsk region. In 2015 the average salary in the region was 31 727 rubbles. Multiplying this amount by 1.6 we will get an answer=50 763.2 rubbles, which will make 609 158.4 rubbles in a year. If the salary of the citizen is more than 50 763,2rubles per month, for example, 70 000 rubbles (840 000 rubbles per year), his annual payment to the Pension Fund will be: 670 000*22%+170 000*10 % = (147 400+17 000) = 164 400 rubbles (13 700 rubbles per month). If we take into consideration that the real work experience (35 years) exceeds the endowment period (21 years) by 1.7, there shouldn’t be any Fund deficit. Thus, the pension system doesn’t perform the task of an adequate income replacement when people retire. This system condemns the middle class to the sharp drop of income when they retire.

Now back to the expenses. In our opinion, here are three key reasons for the deficit of the Pension Fund from the position of “expenses”:

Funded pensions can be the solution to these problems. The economy is interested in them, as they are long money, which are needed to finance investment projects. Also they allow government to replace possible employer taxes by the payments of citizens (Nabiulina E., 2016). They are needed for the citizens, as from 2013 more than 50% of citizens appeared to funded pension. Firstly, it is impossible to solve investment problems using pension money. Secondly, the main purpose is to provide safety and reliability of the pension savings. Funded pension part should be half the pension to be tangible for the retirees. According to forecast, this can be reached not earlier than in 2035. The plan of Gore (Lebedeva L.F., 2014) contained the idea that the funded part should be a part of the improvement of the pension system and an additional source of investment resources to the economy.

Conclusion

As a result, we can conclude that the Pension Fund is a basic source of material wellbeing of the retirees, the budget of which is deficit due to different reasons. The conducted assessment allows us to assume that the reasons for this are not only economic and demographic, but also organizational, including:

The following actions can be taken to overcome the budget deficit:

the combination of three components (state compulsory, compulsory funded and voluntary funded) in the pension system allows to the wellbeing of the retirees, as diversification reduces the risks.

References

- About Insurance Pensions (2013) art. 15, 21-22 Federal Law 28.12.2013 N 400-FL (id. 29.12.2015) Retrieved from http://www.consultant.ru/document/cons_doc_LAW_156525/

- Age survival (2015) Retrieved from http://www.45-90.ru/news/razmyshlenija-o-vozraste-dozhitija.html

- Aging population - 2010: Russian Federation. (2011) Retrieved from http://pensionreform.ru/1042

- Averting the old age crisis: policies to protect the old and promote growth. (1994) World Bank Policy Research Report, Oxford: Oxford University Press Retrieved from http://documents.worldbank.org/curated/en/1994/09/698030/averting-old-age-crisis-policies-protect-old-promote-growth

- Bonoli G. (2003). Social Policy through Labour Markets: Understanding National Differences in the Provision of Economic Security to Wage Earners. Comparative Political Studies. Vol. 36.N 9.P. 1007–1030. doi: 10.1177/0010414003257099;

- Burns M.J. (2014) Improving retirement security in the United States. A dissertation presented by to the school of public policy & urban affairs Retrieved from https://repository.library.northeastern.edu/downloads/neu:336798?datastream_id=content

- Developing a funded pension system in Russia international evidence and recommendations (2013) Retrieved from http://www.oecd.org/pensions/Russa Funded Pension System 2013.pdf

- Dormont B., Martins J., Pelgrin F., Suhrcke M. (2011) Transitory vs. Permanent Gemografic Shocks. From Ageing to Longevity, University Press Scholarship Online, p. 12-15 doi:10.1093/acprof:oso/9780199587131.003.0003

- Duration of work experience after the appointment of old-age pension and type in Russia, 2011, 2014 (2014) Retrieved from http://www.gks.ru/free_doc/new_site/population/generation/tab-st-tr_st.htm

- Eremina S.L., Sun Fu, Kudelina O.V., Babaeva F.G. (2015) Russian National Social Security System as the Condition of Pensioners’ Well-Being. Vol. VII. P. 215-226. DOI: 10.15405/epsbs.2016.02.30

- Eremina S.L., Sun Fu, Kudelina O.V., Velichko K.S. (2015) Well-being of Pensioners. A Subjective Assessment of the Life`s Quality (By the Example of China and Russia) - P. 227-235. Wellbeing in the World WELLSO 2015 (18-22 May 2015). - 2016. - Vol. VII DOI: 10.15405/epsbs.2016.02.31

- Feldstein M. (2005). Rethinking Social Insurance. The American Economic Review. Vol.95, N1. P. 1–24 doi: 10.3386/w11250;

- Help Age International: Global AgeWath Index (2015) 28.09.2015. Retrieved from http://gtmarket.ru/news/2015/09/28/7245

- Hmelev M. (2014) Pension manoeuvres. Why Russian pensioners will never be rich Retrieved from http://b-mag.ru/2014/regulation/pensionnyiy-manevr/

- How Was Life? Global Well-being since 1820 (2014) Retrieved from http://www.oecd.org/statistics/how-was-life-9789264214262-en.htm

- Kardanova Z.R. (2013) Actuarial forecasting the development of the mandatory pension insurance system Retrieved from http://www.pfrf.ru/branches/adygea/news/~2013/03/21/3044

- Kudelina O., Eremina S., Engelbrecht R., Golovkina J. (2015) Healthcare Effectiveness as a Wellbeing Factor. Workforce. The European Proceedings of Social & Behavioural Sciences. Vol. VII P. 22-30 DOI:

- Lebedeva L.F. (2014) The Federal Program of Pension system in USA. Russia and America in XXI century. Electronic journal, №2 Retrieved from http://www.rusus.ru/?act=read&id=413

- Lee R. (2009) New Perspectives on Population Growth and Economic Development. Plenary Session: After Cairo Issues and Challenges for a new Population and Development Agenda Retrieved from http://www.unfpa.org/events/xxvi-iussp-international-population-conference.

- Long-term development strategy of the pension system of the Russian Federation. Section I. The main results of the functioning of the pension system (in Russian) (2012) Retrieved from http://base.garant.ru/70290226/#block_15#ixzz40d23oJky

- Melnic G. (2016) The Greek Government presents the plan of Pension system’s reform Retrieved from http://ria.ru/world/20160104/1354654052.html

- Modigliani, Franco (1966). The Life Cycle Hypothesis of Saving, the Demand for Wealth and the Supply of Capital. Social Research. 33 (2): 160–217. JSTOR 40969831

- Nabiulina E. (2016) Russians will be obliged to save for old age. The meeting of heads of central banks of the world, Shanghai // Retrieved from http://www.pensiamarket.ru/AllNews.aspx?type=companynews&id=2789

- New stage of pension system’s development: is a paradigm shifts? Proceedings of the V Congress of the Russian Pension. Laboratory of Pension reform (2014) Retrieved from http://pensionreform.ru/61876

- On Amendments to Certain Legislative Acts of the Russian Federation (2014). Federal Law 21.07.2014 N 216-FL (id. 04.11.2014), art. 17 (in Russian) Retrieved from http://www.consultant.ru/document/cons_doc_LAW_165815/

- On labour pensions in the Russian Federation (2013), \ art. 2. Federal Law 17.12.2001 N 173-FL, art. 5. (id. 28.12.2013, with change from 19.11.2015) Retrieved from http://www.consultant.ru/document/cons_doc_LAW_34443/

- On Mandatory Pension Insurance in the Russian Federation (2015) Federal Law 15.12.2001 N 167-FL (id.14.12.2015), art.22, p.2.1. Retrieved from https://www.consultant.ru/document/cons_doc_LAW_34447/.

- Pension system’s models. Classification Retrieved from http://pension-npf.ru/index.php?src=153

- Pensions at a glance 2011: Retirement-income systems in OECD countries. (2011). Retrieved from http://www.oecd-ilibrary.org./finance-and-investment/pensions-at-a-glance-2011_pension_glance-2011-en.

- Pestieau P. (2006). The Welfare State in the European Union. New York: Oxford University Press, 184 p.; Hindriks J. and Donder Ph. De (2003). The Politics of Redistributive Social Insurance. Journal of Public Economics. Vol. 87.P. 2639–2660. Retrieved from http://www.econ.qmul.ac.uk/papers/doc/wp444.pdf

- Refinancing rate (2016) Retrieved from http://www.cbr.ru/pw.aspx?file=/statistics/credit_statistics/refinancing_rates.htm

- Searching for a new silver age in Russia: the drivers and impacts of population aging. Overview report Public Disclosure Authorized. (2015) 49p. Retrieved from http://documents.worldbank.org/curated/en/851101467995634363/pdf/99487-WP-P151617-P143250-PUBLIC-Box393203B-silver-aging-web-final.pdf

- Sen A. (1993) The Quality of Life oxford scholarship online November 2003 doi:

- Siniavskaya O. (2010) The History of Pension System in Russia Retrieved from http://www.ru-90.ru/content/B8P

- The 2014 Annual report of the board of trustees of the federal old-age and survivor’s insurance and federal disability insurance trust funds. U.S. government printing office Washington: 2014 Retrieved from https://www.ssa.gov/oact/tr/2014/tr2014.pdf

- The average monthly nominal wage of employees in Russia, 1991-2015 (2015) Retrieved from http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/wages/

- The level of Inflation in Russia, 1993 - 2016 (2016) Retrieved from http://bankirsha.com/uroven-inflyacii-v-rossiyskoy-federacii-po-godam.html

- The Russian’s Pension Fund budget. Official site of Ministry of Finance (2015) Retrieved from http://info.minfin.ru/pf.php

- Wang L., Béland D., Zhang S. (2014) Pension financing in China: Is there a looming crisis? China Economic Review Volume 30, September, Pages 143–154 Retrieved from http://www.sciencedirect.com/science/article/pii/S1043951X14000625

- World Bank indicators (2016). Age dependency ratio, old is the ratio of older dependent-people than 64-to the working ages 15-64 Retrieved from http://data.worldbank.org/indicator/SP.POP.DPND.OL

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 January 2017

Article Doi

eBook ISBN

978-1-80296-018-1

Publisher

Future Academy

Volume

19

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-776

Subjects

Social welfare, social services, personal health, public health

Cite this article as:

Eremina, . S., Achelov, E., Fu, S., & Lakhmanova, A. (2017). Pension System as Wellbeing Institute. In F. Casati, G. А. Barysheva, & W. Krieger (Eds.), Lifelong Wellbeing in the World - WELLSO 2016, vol 19. European Proceedings of Social and Behavioural Sciences (pp. 170-182). Future Academy. https://doi.org/10.15405/epsbs.2017.01.23