Abstract

This study explores the strategic links between structural capital and organisational innovation in Australian SMEs. There are limited studies in the literature that investigate the connection between structural capital and organizational innovation using longitudinal data. Hence, for this study, the Confidentialised Unit Record File (CURF) database from the Australian Bureau of Statistics (ABS), Business Longitudinal Database (BLD) (2013) was used to investigate 2,154 SMEs. The analyses validate that structural capital is essential for achieving organisational innovation. However the relationship declines over time. Managers should be careful in investing in IT and technology in order to facilitate organisational innovation.

Keywords: SMEsStructural CapitalOrganizational InnovationAustralia

Introduction

The study of innovation has been studied extensively by scholars from different background with different aims using various samples of the population (Ravichandran, 1999). Research on innovation started as early as the 1960s that focus on conceptual and theory building (Ravichandran, 1999). The studied on innovation has been expanding since then, offering strategy towards crafting innovative firm. Innovative firms can achieve competitive advantage in the local and global market (Hitt, 1998; Ireland & Hitt, 1999; Subramaniam & Venkatraman, 2001), creating and adapting the changes in the market and customer demands (Amit & Zott, 2001) towards achieving greater performance (Zahra, Ireland, & Hitt, 2000).

According to Schumpeter’s (cited in Narayanan, 2001) SMEs are good in innovation and poor in commercialization. In order for SMEs to survive, they might lose some of the good qualities. The most valued practices that might be forgo, is their flexibility (informality), quick response (less bureaucracy), and innovation (radical innovation) (Temperley, Galloway, & Liston, 2004). These are the tension that small firm need to go through in order to survive and performed. This research attempts to reduce the tension by understanding one of the element of intellectual capital that is structural capital that involved in the process of innovation practices through value, rareness, imitability, and organization (VIRO) framework (Barney, 1991) that will improve firm’s competitive advantage and increases the chances of SMEs survival.

According to

Structural capital (SC) can promote SMEs to be more constructive positions in influencing the adaptability and productivity of the innovation. Further and continuous examination of these connections with regards to SMEs will justify the importance of IT and technology (SC) which results in opportunities for innovation. Therefore, this study filled the gaps by using longitudinal data to overcome the limitations of the overabundance of cross-sectional studies (e.g., Chen, Lin, & Chang, 2006; Jardón & Martos, 2012) and time–lag issues are addressed in this study. The objective of the research is to study whether structural capital significantly improves the association with organisational innovation after one and two-year interval elapses. The focus of lag time due to learning and adjustment is based on the RBV theory (Coff, 1997; Grant, 1996). Therefore, the research question for this study is: Does structural capital have better impact on organizational innovation through time?

Literature Review

The purpose of this section is to review the general literature on SC and organizational innovation constructs, and in particular to define the term SME and identify their general characteristics.

2.1Structural capital

Structural capital is known as the conversion of knowledge from private and tacit knowledge to public and codified knowledge captured in databases, patents, manuals, organizational structures, processes, and information systems (Subramaniam & Youndt, 2005). One of the components of structural capital is knowledge accumulated by the firms in the form of software and databases (Stewart, 1997). This study conceptualizes SC in terms of information technology (IT) and organizational processes. As a result of collective learning, routines represent firm - specific knowledge (Fernandez, Castilla, & Moore, 2000), which contributes to the firm’s memory and simplifies coordination and supports efficiency (Leitner, 2011).

According to the RBV perspective, IT capability is a source of competitive advantage (Bharadwaj, 2000). The obvious advantage in SMEs is that IT is likely to contribute to cost reduction and process improvement (Rivard, Raymond, & Verreault, 2006). Therefore, SC is the combined knowledge that exists within the firm’s routines which helps to simplify the operational processes of the firm.

2.2Organizational innovation in SMEs

Organizational innovation (OI) can be defined as innovation in product, process, administrative and marketing processes (OECD, 2005; Yamin, Mavondo, Gunasekaran, & Sarros, 1997). Innovation and technological development is an important devise for SMEs (Pullen, De Weerd-Nederhof, Groen, Song, & Fisscher, 2009; Varis & Littunen, 2010). Innovation plays an important role in supporting the efficiency of the economy; convey new thoughts and activities to the business sector and permitting the commercialization of new idea (OECD, 2010). SMEs is less bureaucracy, thus these firm can move faster and are more alert than their larger counterparts, and can obtain an advantage for a longer period of time (Schumpeter, 1949).

2.3Development of hypotheses

In the Resource Based View (RBV), firms are understood to have various combinations of resources and routines that can contribute to competitive advantage. In the RBV context, the outcome is gain through unique resources and the combination of knowledge to create innovation and product development (Danneels, 2002). According to (Nonaka, 1994) there are two types of knowledge : tacit and explicit. Tacit knowledge cannot be easily described or transferred. While explicit knowledge is easy to imitate and to share. But, once the knowledge is transferred, it is difficult for the original owner of the knowledge to declare the ownership (Edvinsson & Sullivan, 1996).

The major problem that SMEs are faced with is lack of resources for innovation. In order for SMEs to survive, dealing with limited resources becomes challenging (Kim, Knotts, & Jones, 2008). Competitors that have similar resources will be unable to contribute to superior returns. Thus, resources must be difficult to create, buy, substitute, or imitate (Barney, 1991; Lippman & Rumelt, 1982; Peteraf, 1993). Based on Resource Based View (RBV), a company’s resources – mainly intangible ones – are more likely to contribute to firms’ better performance when they are integrated (Barney, 1991).

2.3.1Structural capital and organizational innovation

Organisational innovation will not be achieved if the firm does not have appropriate working processes and systems to track its activities (Widener, 2006). Recent research suggests that sufficient resources in firms’ operation and commitment have a significant effect on performance (De Brentani & Kleinschmidt, 2004).

According to Persaud (2001), information technology is a medium of obtaining external knowledge. Bontis, Keow and Richardson (2000) in his empirical study has found out that structural capital positively influenced organizational performance in the service industry but not in the non-service industry. A study on chemical companies from 1980 to 1999 indicates that one dollar spent on R&D produces; they will gain two dollars profit after ten years. (Aboody and Lev 2001 cited in Huang and Liu 2005). According to Hsu and Wang (2012) the adoption of IT will keep all the tacit and explicit knowledge in the firm and will contribute to innovation.

Since firms are more and more utilizing advanced technologies to strive in today’s economy, the working processes should be well-managed so that firm performance is accomplished. Hence, analysing this link using longitudinal data would be rewarding.

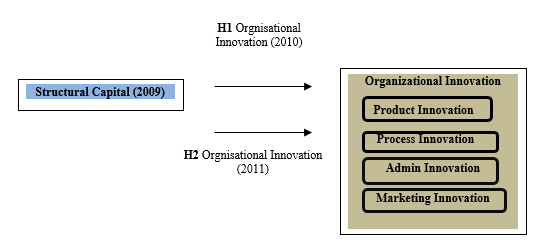

Hypothesis 1 (H1): Structural Capital has a positive and significant relationship with Organisational Innovation after a one-year lagged.

Hypothesis 2 (H2): Structural Capital has a positive and significant relationship with Organisational Innovation after two-year lagged.

Research Method

This section consists of research design which includes data collection; sample selection and measurement of the variables.

3.1Data collection – Business Longitudinal Survey

This recently released Confidentialised Unit Record File (CURF) database from the Australian Bureau of Statistics (ABS), Business Longitudinal Database (BLD) (2013) is used in this study. The database comprises three independent Panels (samples) of SMEs. Every year for a period of five years, each panel is directly surveyed. For the purposes of this research, Panel 3 is used. Panel 3 has the most recent time frame (2007 until 2011). This sample includes 3,075 businesses stratified by business divisions and company size in accordance with ASIC (Australian and New Zealand Standard Industrial Classification) . Data collection in the BLD was done through self-administrated, structured questionnaires, mostly using closed questions. The major strength of this dataset is the full coverage of Australia and high response rate (>90%) (Sawang & Matthews, 2010).

3.2Sample selection

The BLD data used in this analysis was included in a CUFR released by the Australian Bureau of Statistics on Remote Access Data Laboratory (RADL) in December 2011. ABS (2014) defines small business as those employing less than 19 people, and a medium business as 20–199 employees. Therefore, firms with less than 200 employees were chosen for the research. Businesses matching the following criteria were removed from the database: i) Non-employing companies were removed due to the overrepresentation of personal service provider and ii) Missing data on a number of variables. Based on these criteria, 2,154 SMEs were selected for this study from the total of 3,075 firms in BLD Panel 3.

3.3Measures of the variables

The data from BLD used time-lag analyses which apply a one and two-year interval between the SC (2009) and organisational innovation data in the year 2010 and 2011. The measurement method depends on perception measures of both SC and organizational innovation. The consistency between manager’s opinions of performance and objective measures has been evidenced (e.g. Venkatraman & Ramanujam, 1986). Therefore the measurement of structural capital used subjective measures. Most of the variables in BLD were categorical. Therefore all the items in each construct had to be calculated.

In the following section, the main items in each constructs are discussed.

a.Seven items pertaining to structural capital were adapted in terms of investment in Information and Communication Technology (ICT). There are: (i) replacement of IT hardware; (ii) replacement of other equipment or machinery; (iii) upgrade of IT hardware; (iv) upgrade of other equipment or machinery; (v) purchase of additional IT hardware or software; (vi) purchase of additional other equipment or machinery and (vii) purchase of additional assets not related to expansion.

b.Organizational innovation in this research has three dimensions namely product, process, marketing and administrative innovations (OECD, 2005; Yamin et al., 1997). Eleven items taken from BLD are used to measure organizational innovation. The items are (1) new products; (2) new services; (3) new methods of manufacturing; (4) new distribution methods; (5) supporting activities for business operations; (6) other operational processes; (7) new knowledge management processes; (8) new business practices for organizing procedures; (9) new methods of organizing work responsibilities and decision making; (10) significant changes in relational with others and (11) other managerial processes.Firm size: In this study, firm size is measured in terms of the number of employees in the firm. Two dummy variables represent the effects of three different firm sizes: small and medium size firms. Micro firm (0-4 employees) is the baseline for firm size.

d.Industry Type: Four dummy variables represent the effects of five different industries. The baseline for industry variable is primary industry. Each variable is coded 1 if an observation relates to the industry represented by the variable.

Analysis and Result

The objective behind this section is to provide details regarding the outcomes for the examinations that have been tested. STATA version 10 was used to analyse the data. I directed Poisson regression analysis (PRA) to investigate the SC association with organizational innovation. Poisson regression is normally used to analyse count data. The fundamental state of the Poisson distribution is that the mean equals the variance. But, in real life situations, some of the count data reveal overdispersion. Overdispersion happens if the change is bigger than the value of the mean. Overdispersed data lead to wrong consequences and the outcome will be exaggerated and the standard error is underestimated. If the data show there is significant evidence of overdispersion, negative binomial regression analysis (NBRA) is used.

4.1Result of the study

Correlation coefficients as well as means and standard deviations of the variables are displayed in Table

*

PRA was calculated to predict SC with organisational innovation components. However, the goodness-of-fit test indicates that the distribution of organisational innovation in the year 2010 and 2011 incident significantly differs for a Poisson distribution that is the chi-squared of 853.74 on 365 d.f. (

NBRA shows that SC outcome is similar with PRA. Table

Discussion and Conclusions

The purpose of this section is to discuss the major findings and to summarise the result of this study.

Through NBRA, the results indicated that SC’s effect on organisational innovation declines over time. Analysis in the year 2010 detects a 23 percent improvement in organisational innovation rate and after a two-year lag on organisational innovation, 16 percent. The results indicate that SC significantly predicts organisational innovation. However, over time, the NBRA shows that the coefficients and magnitude of the p-value effect of SC and organizational innovation is reduce to 7 percent.

SC does contribute to innovation – but only to a limited extent, a conclusion that is consistent with the findings of Subramaniam and Youndt (2005), Chen et al. (2006) and Wu et al. (2007). Therefore, in order to transfer and share organisational knowledge or information, it is important for the firm to apply reliable and trusted technology. Based on the RBV perspective, IT capability is a source of competitive advantage (Bharadwaj, 2000), and according to Aramburu and Sáenz (2011), IT creates new ideas and shares knowledge. SC can both assist employees and enable firms to adopt organisational innovation (Hsu & Wang, 2012). As mentioned above, organisational innovation shows a significant connection with SC, but the relationship after that takes an inverted-U shape. This is consistence with Dong, He, and Karhade (2013). Through time, SC will bring down the innovation in SMEs. In the short term, SC represents a necessary condition for better innovation but it is inadequate to sustain in the long term since the knowledge stored in SC must be deployed efficiently and effectively in order to gain the benefit. However, RBV theory may not be suitable to explain the connection, since over time; SC might lose its value and uniqueness through time and competitors might imitate the technology. At the same time, SC is costly. Applying dynamic capability view (Teece, Pisano, & Shuen, 1997) would help to understand these issues.

Managers must support codified knowledge in their IT system. SC acts as a guideline in routine work processes and it supports the company’s standard procedures. As stated by Coyte, Ricceri, and Guthrie (2012), internal documentation is important for SC in SMEs. The management must also provide appropriate investment in IT that is user-friendly and reliable so as to transform the firm’s tacit knowledge into explicit knowledge.

References

- Amit, R., & Zott, C. (2001). Value creation in e-business. Strategic Management Journal, 22(6-7), 493-520.

- Aramburu, N., & Sáenz, J. (2011). Structural capital, innovation capability, and size effect: an empirical study. Journal Of Management & Organization, 17(3), 307-325.

- Australian Bureau of Statistics. (2013). Microdata: Business Longitudinal Database, CURF, 2006-07 to 2009-11 Cat. No. 8168.0.55.001. Retrieved 13 March 2014, from http://abs.gov.au/ausstats/abs@.nsf/Latestproducts/8168.0.55.001Main%20Features42006-07%20to%202010-11?opendocument&tabname=Summary&prodno=8168.0.55.001&issue=2006-07%20to%202010-11&num=&view=

- Australian Bureau of Statistics. (2014). Counts of Australian businesses, including entries and exits June 2009 to June 2013. Cat. No. 8165.0. Retrieved 9 June 2014, from http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/8165.0Jun%202008%20to%20Jun%202012?OpenDocument

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99.

- Bharadwaj, A. S. (2000). A Resource-Based Perspective on information technology capability and firm performance: an empirical investigation. MIS Quarterly, 24(1), 169-196. .

- Bigoness, W. J., & Perreault Jr, W. D. (1981). A conceptual paradigm and approach for the study of innovators. Academy of Management Journal, 68-82.

- Bontis, N., Keow, W. C. C., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85-100.

- Chen, Y. S., Lin, M. J. J., & Chang, C. H. (2006). The influence of intellectual capital on new product development performance–the manufacturing companies of Taiwan as an example. Total Quality Management And Business Excellence, 17(10), 1323-1339.

- Coff, R. W. (1997). Human assets and management dilemmas: coping with hazards on the road to resource-based theory. Academy of Management Review, 374-402.

- Coyte, R., Ricceri, F., & Guthrie, J. (2012). The management of knowledge resources in SMEs: an Australian case study. Journal of Knowledge Management, 16(5), 789-807. doi:

- Damanpour, F. (1988). Innovation type, radicalness, and the adoption process. Communication research, 15(5), 545.

- Danneels, E. (2002). The dynamics of product innovation and firm competences. Strategic Management Journal, 23(12), 1095-1121. doi:

- De Brentani, U., & Kleinschmidt, E. J. (2004). Corporate culture and commitment: impact on performance of international new product development programs. Journal of Product Innovation Management, 21(5), 309-333.

- Department of Innovation Industry Science and Research (DIISR). (2009). Innovation and raising Australia's productivity growth. Retrieved 11 October 2012, from <http://www.innovation.gov.au/Innovation/ReportsandStudies/Documents/InnovationandRaisingAustraliasProductivityGrowth.pdf>.

- Dong, J. Q., He, J., & Karhade, P. P. (2013). The Penrose Effect In Resource Investment For Innovation: Evidence From Information Technology And Human Capital. Paper presented at the ECIS.

- Downs Jr, G. W., & Mohr, L. B. (1976). Conceptual issues in the study of innovation. Administrative science quarterly, 700-714.

- Edvinsson, L., & Sullivan, P. (1996). Developing a model for managing intellectual capital. European Management Journal, 14(4), 356-364.

- Fernandez, R. M., Castilla, E. J., & Moore, P. (2000). Social capital at work: networks and employment at a phone center. American journal of sociology, 1288-1356.

- The Global Innovation Index. (2015). 3 Aug 2016, from http://www.globalinnovationindex.org/content.aspx?page=gii-full-report-2013#pdfopener

- Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17(Special Issue), 109-122.

- Hitt, M. A. (1998). Twenty-first-century organizations: Business firms, business schools, and the academy. Academy of Management Review, 23(2), 218-224.

- Hsu, I. C., & Sabherwal, R. (2011). From intellectual capital to firm performance: the mediating role of knowledge management capabilities. Engineering Management, IEEE Transactions 58(4), 626-642. doi:

- Hsu, L. C., & Wang, C. H. (2012). Clarifying the effect of intellectual capital on performance: the mediating role of dynamic capability. British Journal of Management, 23(2), 179-205.

- Ireland, R. D., & Hitt, M. A. (1999). Achieving and maintaining strategic competitiveness in the 21st century. Academy of Management Executive, 13(1), 43-57.

- Jardón, C. M., & Martos, M. S. (2012). Intellectual capital as competitive advantage in emerging clusters in Latin America. Journal of Intellectual Capital, 13(4), 462-481.

- Keupp, M. M., Palmié, M., & Gassmann, O. (2011). The strategic management of innovation: a systematic review and paths for future research. International Journal of Management Reviews, no-no. doi:

- Kim, K. S., Knotts, T. L., & Jones, S. C. (2008). Characterizing viability of small manufacturing enterprises (SME) in the market. Expert systems with applications, 34(1), 128-134. doi:

- Leitner, K.-H. (2011). The effect of intellectual capital on product innovativeness in SMEs. International Journal of Technology Management, 53(1), 1-18.

- Lippman, S. A., & Rumelt, R. P. (1982). Uncertain imitability: an analysis of interfirm differences in efficiency under competition. The Bell Journal Of Economics, 418-438.

- Meyer, A. D., & Goes, J. B. (1988). Organizational assimilation of innovations: a multilevel contextual analysis. Academy of Management Journal, 897-923.

- Narayanan, V. K. (2001). Managing technology and innovation for competitive advantage: Prentice Hall.

- Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 5(1), 14-37.

- Nord, W. R., & Tucker, S. (1987). Implementing routine and radical innovations: Lexington Books.

- OECD. (2005). The measurement of scientific and technological activities: proposed guidelines for collecting and interpreting technological innovation data (3rd ed.). Paris: Commission Eurostat.

- OECD. (2010). SMEs, Entrepreneurship and Innovation. OECD Publishing, Paris.

- Persaud, A. (2001). The knowledge gap. Foreign Affairs, 107-117.

- Peteraf, M. A. (1993). The cornerstones of competitive advantage: a resource‐based view. Strategic Management Journal, 14(3), 179-191.

- Pullen, A., De Weerd-Nederhof, P., Groen, A., Song, M., & Fisscher, O. (2009). Successful Patterns of Internal SME Characteristics Leading to High Overall Innovation Performance. Creativity and Innovation Management, 18(3), 209-223. doi:

- Ravichandran, T. (1999). Redefining orgnizational innovation: Towards theoritical advancements. Journal of High Technology Management Research, 10(2), 243.

- Rivard, S., Raymond, L., & Verreault, D. (2006). Resource-based view and competitive strategy: an integrated model of the contribution of information technology to firm performance. The Journal of Strategic Information Systems, 15(1), 29-50.

- Sawang, S., & Matthews, J. H. (2010). Positive relationships among collaboration for innovation, past innovation abandonment and future product introduction in manufacturing SMEs. Interdisciplinary Journal Of Contemporary Research In Business, 2(6), 106-117.

- Schumpeter, J. A. (1949). Economic theory and entrepreneurial history—change and the entrepreneur postulates and patterns for entrepreneurial history. Cambridge, MA: Harvard University Press.

- Smith, K. G., Collins, C. J., & Clark, K. D. (2005). Existing knowledge, knowledge creation capability, and the rate of new product introduction in high-technology firms. Academy of Management Journal, 48(2), 346-357.

- Stewart, T. A. (1997). Intellectual capital: the new wealth of organizations (1st ed. ed.). New York: Doubleday-Currency.

- Subramaniam, M., & Venkatraman, N. (2001). Determinants of transnational new product development capability: Testing the influence of transferring and deploying tacit overseas knowledge. Strategic Management Journal, 22(4), 359-378.

- Subramaniam, M., & Youndt, M. A. (2005). The influence of intellectual capital on the types of innovative capabilities. The Academy of Management Journal, 48(3), 450-463. doi:

- Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533.

- Temperley, N. C., Galloway, J., & Liston, J. (2004). SMEs In Australia’s High-Technology Sector: Challenges and Opportunities. Canberra, Australia: Australian Electrical and Electronic Manufacturers’ Association (AEEMA) and CSIRO.

- Van de Ven, A. H., Angle, H. L., & Poole, M. S. (2000). Research on the management of innovation: The Minnesota studies. USA: Oxford University Press.

- Varis, M., & Littunen, H. (2010). Types of innovation, sources of information and performance in entrepreneurial SMEs. European Journal of Innovation Management, 13(2), 128-154.

- Venkatraman, N., & Ramanujam, V. (1986). Measurement of business performance in strategy research: a comparison of approaches. The Academy of Management Review, 11(4), 801-814.

- Widener, S. K. (2006). Associations between strategic resource importance and performance measure use: the impact on firm performance. Management Accounting Research, 17(4), 433-457.

- Wu, S.-H., Lin, L.-Y., & Hsu, M.-Y. (2007). Intellectual capital, dynamic capabilities and innovative performance of organisations. International Journal of Technology Management, 39(3), 279-296.

- Yamin, S., Mavondo, F., Gunasekaran, A., & Sarros, J. C. (1997). A study of competitive strategy, organisational innovation and organisational performance among Australian manufacturing companies. International Journal of Production Economics, 52(1), 161-172. doi:

- Zahra, S. A., Ireland, R. D., & Hitt, M. A. (2000). International Expansion by New Venture Firms: International Diversity, Mode of Market Entry, Technological Learning, and Performance. The Academy of Management Journal, 43(5), 925-950.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 November 2016

Article Doi

eBook ISBN

978-1-80296-016-7

Publisher

Future Academy

Volume

17

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-471

Subjects

Business, management, behavioural management, macroeconomics, behavioural science, behavioural sales, behavioural marketing

Cite this article as:

Khan, Y. K. (2016). Impact of Structural Capital on Innovation in the Australian SMEs. In R. X. Thambusamy, M. Y. Minas, & Z. Bekirogullari (Eds.), Business & Economics - BE-ci 2016, vol 17. European Proceedings of Social and Behavioural Sciences (pp. 302-312). Future Academy. https://doi.org/10.15405/epsbs.2016.11.02.28