Abstract

The financial system as a subsystem of the global economic system plays an essential role in the efficient functioning of the global economy. Some of the main features of the financial sector of the Republic of Macedonia are the low degree of inter-sectoral integration and the limited intercross ownership among the separate financial segments. The aim of this paper is to prove the influence of the financial institutions on the macro economy in the Republic of Macedonia through savings of the population correlated with the importance of knowledge of the ethics in savings. A surveying research was conducted on a statistical sample of 1250 respondents, where the analyzed data obtained with the basic statistical parameters of 7 variables were estimated measures of variability (Std. Dev., Skewness, Kurtosis and KV%). As it is obvious in the above-mentioned research, we can conclude that in Macedonia the amount of savings of the population is generally low. The respondents were mainly insufficiently acquainted with the financial conditions and the possibilities of the market and the financial institutions. People do not have any knowledge about ethics in savings in order to increase savings. In this direction, in the conclusion of this paper, some new measures for increasing of the savings in other financial institutions will also be offered.

Keywords: financial institutionssavingsethicsmeasures

1. Introduction

The development of the financial markets and institutions is of essential meaning for the process of

growth of the economy and the society. There are empirical proofs that the level of financial

development is a good indicator of the future rates of economic growth and the accumulation of assets

and technological changes. Furthermore, comparative analyses point out that the time intervals when

the financial system was not sufficiently developed were also reflected in a serious weakening of the

economic development. Lucas (1988) claims that the role of the banking sector in the economic growth

is overemphasized. According to Levine (1997), the efficiency of the functioning of the financial

institutions in the framework of the financial system has a great impact on the living standard and the

well-being of each individual in the society. The financial institutions collectivize the savings of the

population and allocate them within the economic agents with profitable investment possibilities, thus

increasing productive capacity of the economy. Financial institutions also enable the economic agents

to postpone their current expenses into future ones (stimulating their savings). Efficient functioning of

the financial system and the financial institutions and their effectuating to economies of circumference

as well as at lower operational (informational and transactional) expenses in the financial market gives

the possibility for acceleration of the economic growth. On the contrary, the improper functioning of

the financial institutions and the financial system as their surrounding leads to insufficient mobilization

of the financial means, reduction of spending, reduction of production, insufficient utilization of the

available resources, reduction of employment and eventually - to decrease of the living standard.

In 2004, in the framework of their research, Rioja and Valev (2004) underlined that finances

accelerate the growth in the rich countries mainly through increase of the growth of productivity, while

in the poorer countries it is done through increase of the accumulation of the assets. In 2001, Benhabib

and Spiegel (2003) found that the indicators of the financial intermediation are correlated with the

factors of growth of the total productivity, while the accumulation of the assets is correlated with the

material and human assets. In 1998, Rousseau found that the permanent reduction of the spreading of

banks by 1% is related to the increase of the financial depth by 1,7% to almost 4% as well as that

financial innovations also increase financial depth, which is closely related to the economic growth

(Rousseau, 1998). Consistently with it, Levine, Zervos (1998), Bekaer, Harvey and Lundblad (2000) all

show that financial liberalization accelerates economic growth through improvement of the allocation

of the resources and the rate of investment. Rajan and Zingales (1996) sublime that the more developed

financial intermediaries and financial markets are, the more they facilitate the access to additional

external financing of the companies and support the growth of the companies as well as the economic

growth.

The development of the financial sector in the transitional economies is especially important, mainly

because of its influence of the rapid and successful implementation of the transitional process. In

conditions of non-market economy, even though dominant, the banking sector was totally ruined. State

ownership was dominant, and there was high percentage of delinquent loans in relation to the total

banking assets. This reflected on the price of finances from the aspect of interest rates with high

margins as a difference between the active and the passive interest), with high bank concentration and

concentration within the separate sectors and departments, with situations where the beneficiaries of

the loans are also members of the supervisory and managerial bodies of the banking institutions, etc.

The financial system of the Republic of Macedonia is characterized by a relatively simple structure

and underdevelopment from the aspect of the type of financial institutions and the range of products

and services which they offer, as well as by insufficient international integration. It is bank oriented

system which was showed that has positive side and one of the main factors in the global economic

crisis. Bank-oriented systems allow tо companies а long-term and relatively stable method of funding.

Banking sector provides alternative opportunities for household savings, businesses and public

authorities through their savings deposits. Thus performs a very important role and impact on the

overall national saving, initiating the growth of the натионал economies.

In this paper we will analyze the efficiency of the financial markets; then we will point out that the

development of the financial sector in the transitional economies is especially important. For the

purposes to estimate the savings in the financial institutions in Macedonia, a surveying research will be

presented in order to set the hypothesis that the level of saving within the population of the Republic of

Macedonia is at an insufficiently low level. We will also show the importance of ethics in savings and

point out that people are not familiar with the rules of ethics in savings.

2.Materials and Methods

For the purpose of this paper, Macedonian banks and their ethical standards were analyzed. The

importance and the need of a well-functioning, developed and integrated financial system and financial

institutions reflect on the enhancement of competitiveness, quality, and type of the offered financial

services and instruments. They also reduce the expenses for financial intermediation, which on the

other part motivates saving in the country as a potential for further investment activity. The low level

of financial intermediation, the conservativeness of the banks, and the cautious loan policy control the

influence of the financial crisis in the national economy in a significant part. The banks, with

participation of 88,7% in the total financial assets in 2009 and 88,5% in 2012, were dominant financial

institutions in the Republic of Macedonia. Compared to these numbers, the participation of the non-

deposit financial institutions in the total financial assets is 10,2% in 2009 and 10,8% in 2012. The

relative insufficient development and integration and the shallowness of the financial system in

Macedonia were the best protection in the times of the global economic crisis.

3.Ethical standards

Furthermore, awareness of the costumers of the financial institution for the ethical standards will

lead to increase of the savings. All financial institutions according to their public documents have

approximately 6 ethical standards in common. These are: transparency: transparent information both to the customers and the general public, as well as to the employees. For example, cater customers fully understand the terms of the contracts they sign with banks and engage in financial education in order to increase public awareness about the dangers of non-transparent financial offers;

a culture of open communication: fair and constructive in communication with each other, a

conflict at work in a professional manner, working together to find a solution; social responsibility and tolerance: giving advice based on solid foundation. Before offering loans to customers, they assess their economic and financial situation, as well as their business potential and repayment capacity in order to evade their indebtedness and allow appropriate financial services. In addition, all customers and employees treat them with respect and fair access, regardless of their origin, skin color, language, sex, or religion. Also, it is essential to make sure that requests for loans to customers are dealt with in accordance with the ethical business practices. No loans are issued to enterprises or citizens if they suspect that such customers use practices which are unsafe, harmful to the environment, or moral forms of exploitation of human labor and in particular of child labor; service oriented: every client should be served in a friendly, competent, and courteous manner.

Employees are committed to providing excellent customer service, regardless of their background and size of their business; high professional standards: employees take personal responsibility for the quality of their work and always strive to improve professionalism; high degree of personal integrity and commitment: all employees in the financial institutions expect full commitment and honestly and sincerely carry out their duties (Clerck, 2015).

4.Methods

In order to prove that savings, as well as the knowledge of people about the ethics in savings in

Macedonia are at a low level, a surveying research on a random statistical sample of 1250 respondents

was conducted. Thus, the researchers proved the set hypothesis that the level of saving within the

population of the Republic of Macedonia (as a dominant source of the activities of the domestic

financial institutions) is at an insufficiently low level, and the knowledge of ethical saving is very low.

Hence, the influence of the financial institutions implies a low level of economic growth and

development. The questions were elaborated in the Statistical program SPSS 19 and on the place of 7

questions, 7 variables were defined (Table

descriptive statistical procedures. In the space of the descriptive statistics for each of the variables, the

basic measures of central tendency and dispersion were estimated, and the results were grouped in

classes (frequency analysis). Analyzing the data where the basic statistical parameters of 7 variables

were given, we can state that the distribution of the results in most variables is mainly in the normal

margins of distribution. Certain declination from the normal distribution is related only to the variables

6 and 7, due to the content of the 5th variable - it is not in favor of saving, as well as to the 7 modules

of responding within the variable 6. The estimated measures of variability (Std. Dev., Skewness,

Kurtosis and KV%) with only a few exceptions show a relatively high degree of homogeneity in

relation to the average values in each variable.

5.Results

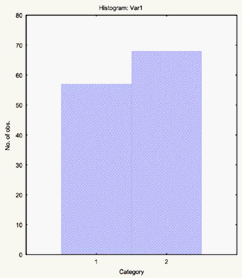

Through statistical elaboration of the data we came to a result that: as to the first question presented

in figure

households save. This is shown in the diagram in which it is obvious that 45,6 % of the respondents

save, and the other 54,4 % do not save.

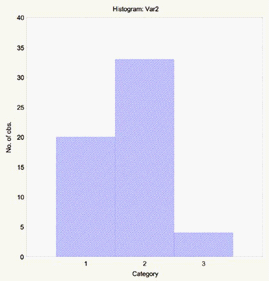

The purpose of the second question or the second given variable is to estimate the percentage of

savings in the total income. Through statistical elaboration of the data we came to a result which shows

that 26% of the total number of respondents save from 10% to 25% of their personal income (Figure

The valid distribution of the percentage of the answers of people who save is as follows: 35,1% save

under 10%, 57,9% save from 10% to 25%, and 7% of the respondents save from 25% to 50%. In the

essence, this variable is homogenous to the previous one and supports the hypothesis that savings are at

a low level.

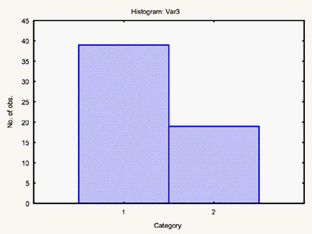

In order to estimate the share of the respondents who save which is invested in financial institutions

and the share which they keep “under the pillow”, the variable 3 was taken into consideration (Figure

2). Here, it was stated that 31,2% of the respondents invested their saving in the financial institutions,

15,2% do not invest their saving in the financial institutions and the rest 53,6% do not possess any

savings. Precisely, the valid percentage of people who save and who would invest in the financial

institutions is as follows: 67,2% from the respondents invest their savings in the financial institutions

and 37,8% of the respondents do not invest.

The question or the variable 4 has been created with the aim to show the amount of people who are

acquainted with ethical standards of banks and their behavior in cases of successful saving (whether

they will invest in the financial institutions if they have knowledge of the ethics of saving which are

benefits, did someone present the ethical standards of banks, etc.). Here, the valid percentage

implications of the answers show that 66,7% of the respondents who do not possess savings, in case

they possessed they would invest it in the financial institutions (if someone presented the ethics

standards of financial institutions and banks), and 33,3% of them would not invest in the financial

institutions even in case when ethical standards are shown to them, because of their conservative views.

6.Discussion

The researches show that almost 96% of the activities of the Macedonian banks are related to

domestic deposits, and only 3 to 4% are financed through foreign loan lines. The economic theories

and analyses suggest that the economic agents with sufficient financial means (a sector which saves

and creates the deposit accumulation) usually come from the sector of population. On the other part, in

the framework of the sector of enterprises, the financially deficient economic agents are usually

dominant. The total amount of investments of the financial non-deposit institutions in the banks

comprises only 0,6% of the total assets of the banks. In the sectorial structure of the deposits, the

deposits of the population strengthen their dominant position as a main source of financing of the

activities of the domestic banks. In 2010 they form up to 86,7% from the total annual growth of the

deposits as it is stated in the National Bank of the Republic of Macedonia (2011). A mutual feature of

the analyzed variables is that their average values are somewhat more moved towards the zone of the

lower values. This defines the attitude of the respondents related to saving, i.e. the conclusion that the

savings are low and the reason for this will come from the rest of the variables. The illustrated state of

the variables provides a solid implication for further elaboration of the obtained results, because it

gives the possibility of answering the needs of the research. In the following table and figures we will

show the data of the method of grouping of the results in classes (frequency analysis) for all the applied

variables.

On the other side, ethics in savings is a very important chain in the increase of the population that

saves. Ethics insure safety saving and confidence in banks of the people who save. From the aspect of

knowledge of ethics, it is important to point out three goals for ethical spending and saving: 1. Ethics

are standards that help determine what is good, right, and proper. 2. Ethical implies acting in a way that

is good, right, and proper. 3. Ethical spending and saving is spending and saving money in a way that is

reasonable or wise. The aim is to contribute not only in the aspect of the target groups that banks serve

and the quality of the financial services they provide, but also to contribute in the aspect of business

ethics.

According to the analyses of the ethical standards of all financial institutions in Macedonia we can

say that all six values or ethical principles in the financial institutions make up the backbone of the

financial institutional culture and the banks. They are reflected in the Code of Conduct which

transforms the Group's ethical principles into practical guidelines for all staff.

7.Conclusions

The development of the financial markets and institutions is of essential meaning for the process of

growth of the economy and the society. The theory suggests that financial instruments, financial

institutions, and financial markets are socially existent to reduce informational and transactional

expenses in economy. On the other part, this evokes increase of the rate of saving, strengthens

investment decisions and technological innovations, and provides a long-term growth and

development. The relative underdevelopment, shallowness and insufficient integration of the financial

system of the Republic of Macedonia were the best protection in the flushes of the global economic

crisis. Taking into consideration the domination and the role of the banking system as a subsystem of

the financial system, we underline that the conservativeness of the banks as classical loan-depositary

institutions, the absence of financial instruments in their portfolios, and restrain from investment

banking were strong defensive pillars against the crisis of the financial system. The resistance of the

banking system in the transitional economies is due to their structural underdevelopment and the

relatively low indebtedness, and Macedonian banks are a typical example of this phenomenon.

If we take into consideration the fact that about 96% of the bank resources come from deposits of

the residents - the domestic savers, the banks are still conservative and traditional in their working. In

conditions of insufficient saving this also brings to insufficiently developed financial institutions, a

small loan potential and a low level of financial intermediation for servicing of the real sector, i.e. of

the economic growth and development in the Republic of Macedonia.

As it can be seen from the mentioned research, we can see that in Macedonia, the amount of the

savings of the population is generally small. The respondents are mainly not sufficiently acquainted

with the financial conditions and the possibilities of the market and the financial institutions. This

leaves space for creation and implementation of educational and promotional campaigns with the aim

of increasing the awareness and education of the economic agents in the sphere of conditions,

possibilities, and comparative advantages for investing offered by the financial institutions and

instruments, especially the non-banking. Ethics in savings is very important in the sense of increasing

the population that saves. Yet, people are not acquainted with the fact that banks have bank ethics that

include rules for safety savings. In Macedonia, besides the low interest rates in savings, people do not

have confidence in the banking system. Here, the main purpose would be modernization, development,

and deepening of the financial system.

References

- Lucas, R.E.Jr. (1988). On the mechanics of economic development. Journal of monetary economics, 3-42.

- Available online at: http://www.parisschoolofeconomics.eu/docs/darcillonthibault/lucasmechanicseconomicgrowth.pdf (25.04.2015) Levine, R. (1997). Financial development and economic growth: views and agenda. Journal of economic literature, XXXV, 688-726. Available online at: http://pascal.iseg.utl.pt/~aafonso/eif/pdf/Levine.pdf (25.04.2016) Rioja, F., & Valev, N. (2004). Finance and the Sources of Growth at Various Stages of Economic Development. Economic Inquiry, Western Economic Association International, 42(1), 127-140.

- Benhabib, J., & Spiegel, MM. (2003). Human capital and technology diffusion. Working Paper Series 2003-02, Federal Reserve Bank of San Francisco.

- Rousseau, P.L. (1998). The permanent effects of innovation on financial depth: Theory and US historical evidence from unobservable components models. Journal of Monetary Economics, 42, 387–425.

- Levine, R., & Zervos, S. (1998). Stock Markets, Banks, and Economic Growth. American Economic Review, 88(3), 537-558.

- Bekaert, G., & Harvey, C.R., Lundblad, C.T., & Siegel, S. (2000). Political risk spreads. Journal of International Business Studies, 45(4), 471-493.

- Rajan, G.R., & Zingales, L. (1996). Financial Dependence and Growth. NBER Working Papers 5758, National Bureau of Economic Research, Inc.

- Clerck, F. (2015). Ethical banking. Available online at: http://www.socialbanking.org/fileadmin/isb/Artikel_und_Studien/de_Clerck_Ethical_Banking.pdf (25.05.2015) National Bank of the Republic of Macedonia (2011). Report on the financial stability in the Republic of Macedonia for 2010.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

04 October 2016

Article Doi

eBook ISBN

978-1-80296-014-3

Publisher

Future Academy

Volume

15

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1115

Subjects

Communication, communication studies, social interaction, moral purpose of education, social purpose of education

Cite this article as:

Mojsoska, S., Dujovski, N., & Nikolovska, D. (2016). Savings and Ethics of the Population in the Republic of Macedonia. In A. Sandu, T. Ciulei, & A. Frunza (Eds.), Logos Universality Mentality Education Novelty, vol 15. European Proceedings of Social and Behavioural Sciences (pp. 633-640). Future Academy. https://doi.org/10.15405/epsbs.2016.09.80