Abstract

This study's goal is to investigate the connection between Malaysian companies' corporate performance and the environmental related Sustainable Development Goals (SDGs). The study looks at how 320 listed companies in Malaysia are involved with the SDGs. Financial and SDGs information was appropriately pulled from the corporate annual report for the year 2020 using content analysis to obtain the data. However, the results show that none of the SDGs connected to the environment significantly impact business performance. The findings also indicate that only 31% of Malaysian corporations participated in SDGs linked to the environment and declared this information in their annual reports. The most frequently engaged SDG by the companies was SDG12 which is Responsible Consumption and Production. Meanwhile, the proportion of engagement by the environmentally sensitive industry increased when we classified the corporations into environmentally sensitive and non-environmentally sensitive industries. This study provides information to regulators and governments in outlining practical frameworks for encouraging SDG engagement by companies.

Keywords: Sustainable development goals, environmental-related SDGs, corporate performance, Malaysia

Introduction

All United Nations members have endorsed the Sustainable Development Goals (SDGs), a sustainable development agenda. By 2030, the goals of the agenda that was announced in 2015 should have been met. The 17 objectives of this agenda are depicted in Figure 1.

The 11th Malaysian Plan (2016-2020) and the 12th Malaysian Plan (2021-2025), both emphasise Malaysia's commitment to the SDGs. As a result, the programmes are integrated into every aspect of the nation's development. All parties, including businesses in the private sector, are required to contribute to the projects in addition to the government. The 11th Malaysian Plan has been in place for five years, but company participation in SDG efforts is still quite low. Only 22.4% of Malaysian listed firms, according to a study by Buniamin et al. (2020), participated in SDG reporting. They also noted that businesses in the industrial products and services (IPNS) sector reported the highest levels of SDGs activity engagement.

Problem statement

The economic requirements of a nation are frequently traded off with environmental sustainability. Since sustainability factors are typically not included in firms' key performance indicators, they are frequently overlooked by businesses (Hristov & Chirico, 2019). On the other hand, disregarding environmental sustainability would eventually lead to human catastrophes. One effect of disregarding environmental sustainability is the regular occurrence of flash floods in Malaysia. According to a report by the Rimba Disclosure Project (RDP), an independent watchdog group for forest monitoring, forests in Peninsular Malaysia the size of Singapore have been designated for removal (The Star, 2022). If this scenario is not watched closely, it could result in a more significant environmental disaster in the future.

The government and non-profit organisations are not the only ones with a duty to protect natural resources. The participation of business corporations is also essential because they typically carry out the actions that put the sustainability of the environment in danger. Compared to non-listed businesses, public listed companies are viewed as huge organisations and as such, should contribute to environmental preservation. To get corporations to participate in environmental sustainability initiatives, however, is a difficult challenge given that businesses are by nature profit-focused. The following goals have been established for this study by focusing on SDGs that relate to the environment:

- To identify the existence of environmental-related goals initiatives among Malaysian public listed companies.

- to investigate any relationships between environmental goals and corporate performance of Malaysian public listed companies.

Literature Review

An in-depth review of previous literature is discussed in three sub-subsections. The first section is conducted using a simple bibliometric analysis using VOSviewer. This section uses a bibliographic coupling analysis with the aim to see when the period of this topic which the environmental-related SDGs is mostly debated and vice versa. It also to shows the number of articles produces, the authors, countries, and the connection between literature within the area. On the other hand, the second section discusses previous literatures on companies’ engagement in environmental-related SDGs. Finally, the third section discusses the Sustainable Development Goals (SDGs) and firm performance, and lastly, the development of hypotheses for the study.

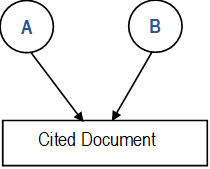

A bibliographic coupling on environmental related SDGs and corporate performance

A bibliographic coupling analysis is conducted to networks of connection between two and more articles. Bibliographic coupling is one of the most important analyses in bibliometrics, alongside co-authorship analysis, co-occurrence of keywords, citation analysis, and co-citations analysis. Bibliographic coupling includes more than two connected articles. Figure 2 displays bibliographic coupling in a graphical format to illustrate the concept's significance. Briefly, bibliographic coupling refers to the manner in which two related articles are referenced (Ahmi, 2021). According to Van Eck and Waltman (2014), when the co-citation relationship between two publications gets stronger, the more publications one publication is mentioned in the other.

Source: Ahmi (2021)

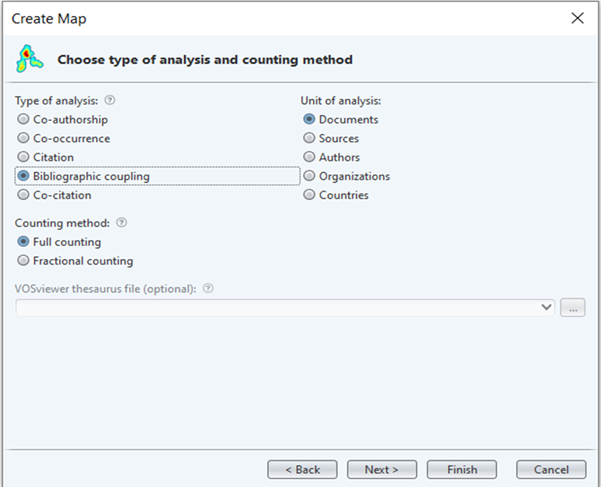

As the matter of procedure, before bibliographic coupling can be done and completed, one need to set certain criteria in the VOSviewer. Figure below shows one should choose the type of analysis they want to conduct; in this case it is the bibliographic coupling. In VOSviewer, there are five unit of analysis that can be used to visualize the bibliographic coupling which are documents, sources, authors, organizations and countries. Based on Figure 3, for the purpose of this review, document will be the unit of analysis used.

Source: VOSviewer

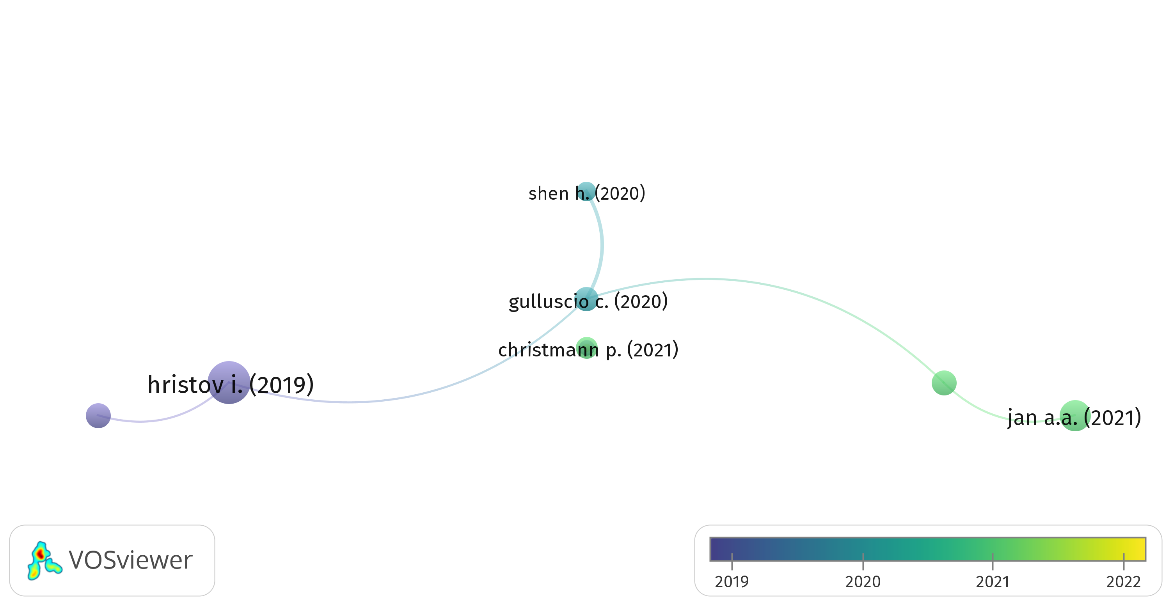

Using SCOPUS database as the primary and reliable sources for this analysis, the studies of Environmental Related SDGs and Corporate Performance captured 11 articles across the database.

Source: VOSviewer

According to Figure 4, the gap between two labels roughly reflects their relationship or relatedness in terms of the bibliographic coupling link. Ahmi (2021) opined the close the label, the stronger their relatedness. In other words, the strength of bibliographic coupling link is represented by the line between the two labels. This explanation is also applied to the different unit of analysis in bibliographic coupling such as sources, authors, organisations and countries. In order to visualize the bibliographic coupling by documents, this analysis has set 3 minimum number of citations of a document in which 8 documents meet the threshold out of 11 documents. Out of 8, 6 documents connected to each other. Figure 3 gives us an illustration of the timeline in which publication in Environmental Related SDGs and Corporate Performance is mostly cited which in the range of 2019 until 2021. In other words, this topic become the most debated issue in this range of years. The discussion grows further until recent years.

Based on the analysis of bibliographic coupling, Hristov & Chirico (2019) is the most cited article. This study focuses on the importance of sustainability elements in the process of value generation by Italian enterprises. The study suggests that businesses worldwide must integrate environmental, social, and economic dimensions into their strategies. This is challenging at the moment because sustainability considerations are frequently unrelated to business strategies, and it has become more challenging to quantify sustainable development by choosing the right set of key performance indicators (KPIs). Both document analysis and a survey of Italian managers were employed to collect data for the investigation of sustainability issues. Ultimately, the study offered a model in which the incorporation of sustainability characteristics into company’s strategy would provide strategic alignment in order to obtain a competitive edge and to generate sustainability value.

Companies’ engagement in environmental related SDGs

Previous studies demonstrate that there is still a lack of corporate participation in the SDGs that relate to the environment. This is due to the fact that businesses must balance contributing to society and increasing shareholder value (Dyllick & Muff, 2015). According to van der Waal and Thijssens (2020), the main reason why most companies are reluctant to significantly engage in these activities is the absence of evidence on the win-win situation and advantage received by the corporations if they engage in environmental-related SDGs. Additionally, a lack of participation in SDGs pertaining to the environment was caused by the lack of a connection between sustainability initiatives and corporate strategies (Hristov & Chirico, 2019). Additionally, Hristov and Chirico (2019) noted that these actions are not included in the organisations' KPIs. However, it is crucial for businesses in making sure that goods are produced and consumed ethically in order to maintain the sustainability of the environment, according to Cohen and Murphy (2001). This is due to increased debate about the detrimental effects of industrial pollutants on health or the effects of population and economic expansion (Cohen & Murphy, 2001).

SDG6 (clean water and sanitation), SDG7 (affordable and clean energy), SDG12 (responsible consumption and production), SDG13 (climate action), SDG14 (life below water), and SDG15 (life on land) are the six SDGs that are classified as environmental-related SDGs (Khan et al., 2021). Engagement in environmental SDGs is typically more pronounced in ecologically sensitive companies and contentious industries like gambling, tobacco, alcohol, and guns (Emma & Jennifer, 2021). Ramos et al. (2022) revealed that the types of environmental SDGs that companies engage in may vary dependent on industry. This survey found that among insurance businesses, SDG13 has the highest level of engagement. The survey also discovered that businesses in the real estate investment and services industries are emphasising on SDG7, SDG12, and SDG13.

Sustainable development goals (SDGs) and corporate performance

According to van der Waal and Thijssens (2020), one of the reasons for limited engagement in environmental-related SDGs is the absence of evidence regarding the benefits obtained by the companies. Therefore, it is crucial for studies to show a connection between participation in SDGs connected to the environment and company’s performance. Recent research has discovered a significant relationship between business performance and involvement in SDG-related activities. 96% of the research found a favourable correlation between SDGs engagement and company’s success, according to Muhmad and Muhamad (2020). According to a review of the literature by Alshehhi et al. (2018), 78% of the research revealed a favourable correlation between business success and SDG engagement. Faisal et al. (2020) discovered that environmental disclosure has a favourable association with company’s performance among SMEs in Indonesia. Guidry and Patten (2010) also noted a favourable correlation between environmental disclosure and corporate performance in the United States. Meanwhile, Cormier and Magnan (2014) discovered that environmental efforts may be linked to a higher share price in their analysis of 29 banks listed on the Nepal Stock Exchange (NEPSE).

Fatemi et al. (2018) however, express their concern that investors would see the disclosure of environmental efforts unfavourably as an instance of "greenwashing." According to García-Meca et al. (2015), most corporations' participation in SDG-related activities is more symbolic than substantive. In other words, participation in sustainability reporting and practices is limited to dealing with questions of legitimacy and caving into stakeholders’ pressure. It is reinforced by Ramos et al. (2022), who found no conclusive link between business performance and SDG engagement. This study seeks to determine whether there is any meaningful connection between corporate performance of the companies and environmental-related SDGs as described by Khan et al (2021). As a result, the study makes the following hypotheses:

H1: There is a significant relationship between engagement in SDG6 and corporate performance.

H2: There is a significant relationship between engagement in SDG7 and corporate performance.

H3: There is a significant relationship between engagement in SDG12 and corporate performance.

H4: There is a significant relationship between engagement in SDG13 and corporate performance.

H5: There is a significant relationship between engagement in SDG14 and corporate performance.

H6: There is a significant relationship between engagement in SDG15 and corporate performance.

Research Methods

Using Excel's random number generator, 320 businesses were selected at random from the 783 publicly traded companies that were listed on the Main Board of Bursa Malaysia as of July 2021. Utilizing content analysis, the information was taken from the corporation annual report for the year 2020. Only 98 businesses were found to have addressed particular SDGs in their 2020 annual reports. The return on equity (ROE) metric of business financial performance serves as the study's dependent variable (ROE). One of the metrics most frequently utilised in the literature as a stand-in for CFP was ROE (Endrikat et al., 2014; Galant & Cadez, 2017). Additionally, accounting-based measures capture arbitrary company characteristics related to SDGs through corporate social reporting (van der Laan et al., 2008). In the meantime, the independent variables are SDGs disclosure, which only included SDGs relating to the environment. SDG6, SDG7, SDG12, SDG13, SDG14, and SDG15 are the six SDGs that are classified as environmental-related SDGs, according to Khan et al. (2021).

Findings & Discussions

According to Table 1, only 98 out of the 320 corporations in the study, or 31% of the sample, reported their SDGs engagement in corporate annual reports. Despite the fact that this study reveals that Malaysian PLCs still have a low level of SDG disclosure standards, it does include specific SDGs, suggesting that the companies have at least made an effort to choose the SDGs that are most pertinent to their business and societal value. When it comes to disclosure by industry, the environmental-intensive industry had more companies report at least one SDG than the non-environmentally sensitive industry.

Table 2 presents the extent of seven environmental-related SDGs disclosure among Malaysian PLCs. With 62.2% (61 companies) of corporations reporting SDG12-Responsible Consumption & Production, it ranks highest in the environment category (61 companies). It is true that many businesses still place greater emphasis on the triple bottom line than on the financial bottom line, and that a culture of sustainability practices is yet to be implemented significantly (Nichita et al., 2020). Companies are starting to give higher priority to objectives that perceived to be pertinent and significant, including their actions that have an impact on society and the environment. According to PricewaterhouseCoopers (PWC) (2019), some goals, such as SDG14 and SDG15, seem to be of utmost importance for various industries in general, but they aren't currently receiving the attention they require. Only 23.5% of 23 companies and 27.6% of 27 companies, respectively, mentioned engagement of SDG14 and SDG15 in their corporate annual reports.

Table 3 presents environmental-related SDG disclosure according to two categories of industry, environmentally sensitive and non-environmentally sensitive industry.

As shown in Table 3, the number of disclosed companies is more than the number of companies in the environmental sensitive industry for the overall environmental-related SDG. According to the SDG Challenge Report, most businesses in the other industries, with the exception of those in environmentally sensitive sectors, have not yet developed an environmental strategy. This finding is consistent with PricewaterhouseCoopers (PWC) (2019). The results also showed that SDG 6 and SDG 14 were the top SDGs, supported by more than 70% of businesses in the environmentally sensitive sector. The t-test was used to demonstrate that there is no significant different between environmentally sensitive and non-sensitive companies in terms of SDG disclosure (results not presented here). SDG 13, SDG 8, SDG 7, SDG 9, and SDG 12 were among the highest SDGs declared by companies in the energy industry, according to PwC (2019). Additionally, SDG 8, SDG 9, and SDG 13 were the SDGs that corporations in the energy industries most frequently addressed, according to Izzo et al. (2020).

The findings of the regression analysis used to assess each hypothesis are shown in Table 4. The investigation focused at the connection between corporate performance and environmental-SDG involvement.

According to the results, there is no relationship between corporate performance and the environmental SDGs. The adjusted R square value of 0.003 percent shows that only 0.3 percent of the variation in corporate performance can be explained by the variables in the research equation. The findings are consistent with Ramos et al. (2022) who did found no evidence of any significant relationship between SDG engagement and corporate performance. The finding demonstrates that companies do not perform their financial success through SDGs, despite evidence to the contrary showing that companies that perform well in terms of for example sustainability aspects have superior financial performance and generate more value (Alshehhi et al., 2018) for their stakeholders over the long term. A possible explanation on the insignificant impact is that companies could decide to concentrate their efforts on a limited SDGs of highly effective objectives. They might concentrate especially on SDGs that are more directly related to their main business. Practicing SDGs is not a simple process; hence, companies should consider about the long-term effects. Therefore, in this study, all the hypotheses are not accepted.

Conclusions

This study's main objective is to examine any relationships between corporate performance and participation in SDGs related to the environment. The study also wants to determine how much these corporations are participating in SDGs that are relevant to the environment. The findings indicate that none of the six SDGs linked to the environment significantly related with corporate performance. Meanwhile, in terms of engagement, SDG12 which is Responsible Consumption and Production is the most frequently engaged SDG by the companies. In contrary, SDG15, which is Life on Land is the least engaged environmental related SDG among Malaysian listed companies. The findings are consistent with Ramos et. al. (2022), who did not find any significant relationship between engagement in SDGs and corporate performance.

This study contributes to the corpus of knowledge on SDGs engagement, specifically on environmental-related SDGs. This is consistent with the country’s aspiration in the Malaysian Plans, especially in the 12th Malaysian Plan, where one of the themes in this plan is Advancing Sustainability. The research may also aid regulators and governments in outlining practical frameworks for encouraging SDG engagement as a framework for company’s strategic model.

Acknowledgments

The authors thankfully acknowledge Ministry of Higher Education Malaysia for Fundamental Research Grant Scheme (FRGS), Grant Code.: FRGS/1/2020/SS01/UNITEN/02/1 (20200104FRGS).

References

Ahmi, A. (2021). Bibliometric Analysis for Beginners: A starter guide to begin with a bibliometric study using Scopus dataset and tools such as Microsoft Excel, Harzing’s Publish or Perish and VOSviewer software. Malaysia. Harzing’s Publish or Perish and VOSviewer software.

Alshehhi, A., Nobanee, H., & Khare, N. (2018). The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability (Switzerland), 10(2).

Buniamin, S., Jaffar, R., Ahmad, N., & Johari, N. H. (2020). Exploring the Involvement of Malaysian Companies in Sustainable Development Goals (SDGs). Global Business and Management Research: An International Journal, 12(4), 201–213.

Cohen, M., & Murphy, J. (2001). Exploring Sustainable Consumption: Environmental Policy and the Social Sciences. Pergamon.

Cormier, D., & Magnan, M. (2014). The Impact of Social Responsibility Disclosure and Governance on Financial Analysts’ Information Environment. Corporate Governance, 14(4), 467–484.

Dyllick, T., & Muff, K. (2015). Clarifying the Meaning of Sustainable Business : Introducing a Typology From Business-as-Usual to True Business Sustainability. Organization & Environment, 1–19.

Emma, G. M., & Jennifer, M. F. (2021). Is SDG reporting substantial or symbolic? An examination of controversial and environmentally sensitive industries. Journal of Cleaner Production, 298, 126781.

Endrikat, J., Guenther, E., & Hoppe, H. (2014). Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. European Management Journal, 32(5), 735–751.

Faisal, F., Situmorang, L. S., Achmad, T., & Prastiwi, A. (2020). The role of government regulations in enhancing corporate social responsibility disclosure and firm value. Journal of Asian Finance, Economics and Business, 7(8), 509–518.

Fatemi, A., Glaum, M., & Kaiser, S. (2018). ESG performance and firm value: The moderating role of disclosure. Global Finance Journal, 38, 45–64.

Galant, A., & Cadez, S. (2017). Corporate Social Responsibility and Financial Performance Relationship: A Review of Measurement Approaches. Economic Research-Ekonomska Istraživanja, 30(1), 676–693.

García-Meca, E., García-Sánchez, I. M., & Martínez-Ferrero, J. (2015). Board Diversity and Its Effects on Bank Performance: An International Analysis. Journal of Banking & Finance, 53, 202-214.

Guidry, R. P., & Patten, D. M. (2010). Market reactions to the first time issuance of corporate sustainability reports. Sustainability Accounting, Management and Policy Journal, 1(1), 33–50.

Hristov, I., & Chirico, A. (2019). The role of sustainability key performance indicators (KPIs) in implementing sustainable strategies. Sustainability, 11(20), 5742.

Izzo, M. F., Ciaburri, M., & Tiscini, R. (2020). The challenge of sustainable development goal reporting: The first evidence from italian listed companies. Sustainability (Switzerland), 12(8).

Khan, P. A., Johl, S. K., & Akhtar, S. (2021). Firm Sustainable Development Goals and Firm Financial Performance through the Lens of Green Innovation Practices and Reporting: A Proactive Approach. Journal of Risk and Financial Management, 14(12), 605.

Muhmad, S. N., & Muhamad, R. (2020). Sustainable business practices and financial performance during pre- and post-SDG adoption periods: A systematic review. Journal of Sustainaible Finance and Investment, 11, 291–309.

Nichita, E.-M., Nechita, E., Manea, C.-L., Manea, D., & Irimescu, A.-M. (2020). Reporting on Sustainable Development Goals. A score-based approach with company-level evidence from Central-Eastern Europe economies. Journal of Accounting and Management Information Systems, 19(3), 501–541.

PricewaterhouseCoopers (PWC). (2019). SDG Challenge 2019: Creating a strategy for a Better World.

Ramos, D. L., Chen, S., Rabeeu, A., & Rahim, A. B. A. (2022). Does SDG Coverage Influence Firm Performance? Sustainability (Switzerland), 14(9).

The Star. (2022). Peninsula to lose forested area nearly the size of Singapore, says watchdog group, url: https://www.thestar.com.my/news/nation/2022/04/21/peninsula-to-lose-forested-area-nearly-the-size-of-singapore-says-watchdog-group

van der Laan, G., van Ees, H., & van Witteloostuijn, A. (2008). Corporate Social and Financial Performance: An Extended Stakeholder Theory, and Empirical Test with Accounting Measures. Journal of Business Ethics, 79, 299–310.

van der Waal, J. W. H., & Thijssens, T. (2020). Corporate involvement in Sustainable Development Goals: Exploring the territory. Journal of Cleaner Production, 252, 1–10.

Van Eck, N. J., & Waltman, L. (2014). Systematic Retrieval of Scientific Literature based on Citation Relations: Introducing the CitNetExplorer Tool. BIR@ECIR, 13–20.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Ahmad, N., Buniamin, S., Johari, N. H., & Zainuddin, S. A. (2023). The Environmental-Related SDGs and Corporate Performance of Malaysian Companies. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 52-62). European Publisher. https://doi.org/10.15405/epfe.23081.5