Abstract

This study applies a literature review and bibliometric analysis to the emerging field of Sustainable and Responsible Investment (SRI) sukuk literature using the Visualization of Similarities software (VOS Viewer). Publications focusing on SRI Sukuk were compiled from the Scopus database, with a total of 27 items spanning the years 2016 to 2022. The most commonly cited keywords, among others, are "Islamic finance," "green sukuk," and "socially responsible investment." This could thus be linked to green sukuk as part of SRI sukuk as a viable Islamic financial instrument, and their structure has been discussed with the application of Shari’ah compliance principles. In conclusion, the findings provided some insightful information, including annual publishing and citation trends, the newest research areas, and the most influential papers. The results of this study shed light on SRI sukuk as a new Islamic financial instrument and can be used as a point of reference for future research.

Keywords: SRI sukuk, green sukuk, Islamic finance, bibliometric

Introduction

The prominence of a country's wealth of natural resources to the nation's rate of economic expansion, albeit at a substantial human and environmental cost, has made sustainable development (SD) a topic of intense interest throughout the globe. Sustainable development is akin to self-sustaining progress that simultaneously prioritises preservation of the environment, social and economic growth. Several trailblazing initiatives, such as environmental, social, and governance initiatives (ESGs), sustainable and responsible investing initiatives (SRIs), and sustainable development goals (SGDs), have paved the way to the desired global sustainability. The mobilisation of capital on a large scale is required in any successful move to a sustainable future. To achieve this, sustainable infrastructures must be developed through new financing pathways to ensure they are socially inclusive, low-carbon, and climate-resilient (Bielenberg et al., 2016). Hence, sustainable or impact investments, in which beneficial effects are pursued in addition to financial gains, considerably aid in the accomplishment of the SD by providing adequate funding and technical assistance (Yesuf & Aassouli, 2020). Consequently, the availability of funds supported by effective capital markets would play an essential role in guaranteeing adequate support for the world's SD requirements (Securities Commission Malaysia [SCM], 2019).

In 2014, the SRI Sukuk frameworks were introduced by SCM, laying the groundwork for sustainable finance, green financing, and social impact financing. Based on adherence to the ASEAN Standards, 19% of all sukuk and bonds were issued in or by Malaysia, which has become generally acknowledged as one of the country’s leading Islamic finances. More recently, this has applied to sukuk offers that accommodate climate friendliness. According to figures from late 2020, the SRI Sukuk framework had been utilised for the issuance of SRI sukuk worth RM5.4 billion. Of this, RM3.1 billion (58%) was recognised as having been issued based on the ASEAN Standards, with bonds worth a further RM635 million issued in accordance with the same Standards. This trend indicates that investors are looking for an asset class that satisfies Shariah requirements as well as those for ethical and sustainable finance (Capital Markets Malaysia2 [CMM2], 2022)

Nonetheless, despite its potential, the literature is still scarce, particularly from Islamic financial perspectives, necessitating more discussion. Given this gap, the purpose of this paper is to augment the SRI Sukuk body of knowledge by conducting an evaluation of the literature relevant to SRI Sukuk and providing a general picture of SRI Sukuk as an innovative and alternative instrument of Islamic finance in which green financing is envisioned. In addition, the current research aims to determine the most influential and fruitful researchers in the field by assessing the most frequently cited articles and authors and by determining the most widely used keywords in the literature.

Literature Review

Definition of sustainable responsible investment (SRI)

Investment decisions were formerly evaluated solely on the basis of their expected rate of return and their risk level. However, beginning in the 1970s, many investors began to consider the ethical implications of their investments (Jonwall et al., 2022). SRI is known by many different names in the investment world, including "green investing," "values-based investing," and "community investing," as well as the more recent terms "environmental, social, and governance (ESG)," "impact investing," "gender lens," and "fossil-fuel free" (Townsend, 2020). Nowadays, SRI is characterised as sustainable, responsible, and impact investing, and it has a real force in the financial services and capital markets (Townsend, 2020).

Sustainable responsible investment (SRI) can be regarded as making investments sustainably by emphasising environmental, social, and governance (ESG) topics or the sustainable development goals (SDGs) (Starr, 2008). These are encompassed by the overall concept of investing in a socially responsible manner. In addition to financial returns, SRI can also incorporate impact investing, which focuses on making a beneficial and measurable contribution to society and the environment. Meanwhile, SRI was defined by the European-SRI2018-Study (2018) as a long-term investment approach that considers and integrates environmental, social, and governance (ESG) topics when making investment decisions. It integrated fundamental research and interaction with an ESG evaluation to reliably reflect the likelihood of investors realising long-term rewards for the interests of society and the environment in determining the firm's performance. Another definition to describe SRI is as an approach to investing that puts social and environmental goals ahead of financial return (Kassim & Abdullah, 2017). According to Moghul and Safar-Aly (2014), the term "SRI" is used to describe an umbrella concept that encompasses any strategy for investing that takes into account both financial returns and ESG. Hence, the common thread across these definitions emphasises that SRI investors prioritise financial returns while incorporating ESG factors into investment decisions.

Overview of SRI sukuk and green sukuk

In Malaysia, the progress of SRI Sukuk was accelerated in 2018 by the formulation of the Green SRI Sukuk Grant Scheme, one of the world’s first incentive structures that supported the issuing of SRI bonds. Through the Scheme, those issuing SRI Sukuk can enjoy tax exemptions. The SRI Sukuk and Bond Grant Scheme became the new name for the Grant Scheme in January 2021, which is currently applicable to every issuance of sukuk within the Sustainable and Responsible Investment (SRI) Sukuk Framework of the SC, as well as the issuance of bonds that follow the ASEAN Green, Social, and Sustainability Bond Standards (ASEAN Standards). Since the introduction of the Sukuk framework and the grant program, Malaysian institutions have been able to start issuing green, sustainable, and social sukuk.

Malaysia presented a global first by debuting green SRI sukuk, also known as "Green SRI Sukuk Tadau". The field of green sukuk has been pioneered by the country. Sustainable responsible investment (SRI) sukuk worth RM250 million was issued in July 2017 by Tadau Energy Sdn Bhd, a Malaysia-based solar power company. This funded the construction of extensive facilities in Kudat, Sabah for generating solar photovoltaic energy. The Sha’riah concepts of Istisna (purchase ordering), Ijarah (leases), and Ijarah Mawsufah fi Zimmah (forward leasing) were the basis for this Sukuk. The Sukuk was solely advised, led, and managed by Affin Hwang Investment Bank Berhad and was assigned an AA3 rating with a stable outlook by RAM Rating Services Bhd. A Sukuk-to-equity ratio of 80:20 was used, and the facility was used for a period of two to sixteen years; all of the proceeds were used toward covering the costs of the project in a way that complies with Shariah law (Abdullah & Keshminder, 2022; Keshminder et al., 2019)

Quantum Solar Park (Semenanjung) Sdn Bhd (QSPM) continued the momentum by issuing the biggest green SRI sukuk in the world, worth RM1 billion (A Malek, 2017). The wholly owned special-purpose vehicle of QSPM used the proceeds to build three 50 megawatt (50MW) solar photovoltaic power plants concurrently in the states of Kedah (Gurun), Melaka (Jasin), and Terengganu (Merchang). Sha’riah contractual agreements were the basis for issuing the QSPM Green SRI Sukuk. This complied with the concepts of Murabahah (cost-plus sales) and Tawarruq (tripartite sales). The principal advisers, lead arrangers, and lead managers were CIMB Investment Bank Berhad, while the co-lead arrangers and managers were Maybank Investment Bank Berhad. Malaysian Rating Corporation Berhad (MRCB) assigned an AA-IS rating to the Sukuk that covers an 18-year period. With a land coverage of 600 acres, this was Southeast Asia’s primary solar power development and would produce a total of 150 MW. The solar power facility was estimated to generate and supply 282,000 MW of electricity per year (A Malek, 2017; Keshminder et al., 2019; IFN Islamic Finance News, 2019). Since the introduction of green SRI sukuk, the concept has become more deeply embedded. Based on the SRI Sukuk framework, Malaysia had seen the issuance of nine green sukuk by the close of 2020. Eight of the nine issuers are private businesses, while the remaining one is a government-owned entity (Liu & Lai, 2021). In accordance with Liu and Lai (2021) and Abdullah and Nayan (2020), the following is a list of SRI Green sukuk (see Table 1).

Overview of green bond

While the GB is a type of debt instrument issued on the financial markets by a private corporation (financial or otherwise) or governmental organisation (city, region, government, development bank, etc.) with the express purpose of funding environmental improvement projects or assets (Lebelle et al., 2020). The EIB, or European Investment Bank, issued the first green bond in 2007, which was first referred to as a "climate awareness bond" (Sertore, 2022). The World Bank issued the inaugural "green-label" bond in 2008 as a means for nations to pool resources and fund low-carbon projects to mitigate climate change and air pollution (Febi et al., 2018). Eventually, it served as the foundation of the Green Bond Principles (GPB) by the International Capital Markets Association (Nanayakkara & Colombage, 2022). Mobilization of GB funds must be used for projects that adhere to the GBP, which may include but is not limited to those that seek to improve access to renewable energy sources; reduce energy consumption; improve waste management practices; protect endangered species; promote eco-friendly modes of transportation; improve the efficiency of natural resource management; or develop strategies for dealing with the impacts of climate change. GBs are a form of debt security similar to other options in this market, such as bonds (interest-bearing or otherwise), notes (with or without a coupon), and mortgage-backed securities (MBS) (Tu et al., 2020).

The Underlying objectives of the Maqasid Al-Shari‘Ah and the Shari’ah principles as the foundation of SRI Green Sukuk

Therefore, intentions of nobility and honour can be fulfilled while remaining compatible with the principles of Islam, due to the concepts of maqasid al-Shari'ah. The Arabic word "Maqasid" is a plural form of "maqsad", whose definition refers to straight paths, just and balanced actions, and specific destinations (Laldin & Furqani, 2013). One translation of "Shari'ah" can mean a water source or the route to such a source. Every aspect of life is governed by the norms, values, and laws established through Islamic teachings, thus exemplifying Shar’iah. That is, through Shari'ah, rules applying to the whole system of belief are established, as are moral and ethical concepts, as well as the relationships mankind has with both God and other men (Laldin & Furqani, 2013). A loose translation of "Maqasid al-Shari'ah" is "the higher objectives of Islam" (Rahman et al., 2020).

Thus, the SRI philosophy signifies corporate activities that went beyond profit, such as environmental protection, employee care, ethical trading, and involvement in the local community (Dusuki & Abdullah, 2007). Therefore, Shari'ah objectives (Maqasid Shari'ah) encompass the philosophy and raison d'etre that is the foundation of economics and finance in Islam, with which socially responsible investment is strongly aligned (Laldin & Furqani, 2013).

Among the most well-known aspects of Islamic finance is its aversion to interest and other forms of excessive profit-seeking activity. All of these prohibitions are grounded in the underlying objectives of improving social fairness and wellbeing (Obaidullah, 2017), which have consistency with the SRI concepts that prioritise social and environmental advantage as claimed by Islamic scholars and financial and environmental professionals (Obaidullah, 2017). More specifically, it is vital to preserve the balance of mizan (the earth’s natural condition), as stipulated by the wasatiyyah philosophy. This means people must abstain from spending wastefully, obtaining luxuries (which are unnecessary), and behaving corruptly. Within the teachings of Islam, fasad (committing unlawful wars or crime) is forbidden, as is any interaction linked to riba (usury/interest), gharar (non-transparentt or dishonest contractual dealings), or maysir (gambling) (Responsible Finance Institute (RFI), 2018). Thus, the principles of Maqasid Shari'ah were embodied, which required investors to follow Islamic principles by doing a good deed for the maslahah of ummah within the boundaries of a sustainable and effective economic system, as well as the required fulfilments of human needs. The Maqasid al-Shariah, especially for the protection of nafs (human life), is the driving force behind Islamic finance. It's not just the physical conditions that need to be protected, but also the environment in which humans live and perform prayers to the Almighty (Khouildi & Kassim,2018). Similarities exist between the tenets of Islamic finance and sustainable finance, including an emphasis on stewardship of the earth and an emphasis on responsible, ethical finance (Noronha,2020).

Due to sharia's prohibition on interest, sukuk are asset-backed and instead of paying interest, investors receive a predetermined percentage of the earnings made on the underlying assets until the principal is repaid at maturity. The developed SRI sukuk framework lay the foundation that bind the commitment of participants. Thus, it could be argued that SRI sukuk structures operate with more efficiency, emphasise transparent dealings, promote cooperation and the sharing of resources, and offer channels through which private-sector firms can engage with socially responsible actions (RAM Ratings, 2015), all of which align with the Maqasid Shari'ah philosophy.

At present, Malaysia implements five principles of Shari’ah when issuing green sukuk in the country: Murabahah (cost-plus sales), Tawarruq (tripartite sales), Wakalah, Istisna, and Ijarah Mawsufah Fi Zimmah (forwards Ijarah). The current study thus defines each of the Shari’ah concepts applicable based on Fincyclopedia (undated). Murabahah (cost-plus sales) is the concept employed most frequently. This principle refers to contracts between buyers and sellers, whereby the latter agree to sell assets or commodities to the former at predetermined prices while incorporating preset profit margins. The profit margin may be expressed as a percentage of the total price or as a fixed total amount. The Murabahah principle is commonly applied together with the principles of Tawarruq (tripartite sales) applied by the SRI sukuk issued by Quantum Solar Park, PNB Merdeka Ventures. UiTM Solar Power Sdn Bhd and Pasukhas Green Assets Sdn Bhd. The Tawarruq is basically a transaction involving buying an asset or commodity from a seller on deferred payment through a musawama or murabaha contract and then selling it to a third party for a predetermined amount in cash. The new price may be greater than or less than the original price (Fincyclopedia, undated).

While Pasukhas Green Asset, Telekosong Hydro One, and Leader Energy applied the Wakalah principles. The concept of Wakalah Sukuk refers to agency certificates that represent interests in particular businesses or projects whose management is conducted based on agency contract terms, or aqd al-wakalah (more precisely, investment agencies or wakalah bil istithmar). Under the principles, for the benefit of the holders of sukuk, the principle (muwakkel) appoints an agent (wakeel) to oversee daily operations (providers of funds). The wakalah bil istithmar is a method of service provided by Islamic banks to their clients that involves the safekeeping of their money. Agency (wakalah) services are rendered in exchange for a fixed percentage of the funds under administration. These charges are usually set in advance and are independent of the funds' performance. Fees might be flat-rate (a predetermined amount) or a proportion of the total amount invested or the net asset value (Fincyclopedia, undated). Tadau Energy's first green sukuk used the Ijarah Mawsufah Fi Zimmah (Forward Ijarah). It’s a future leasing agreement (ijarah) for an unspecified unit of an asset. It’s a lease agreement in which the lessor agrees to deliver a certain service or benefit but does not specify the equipment needed to do so. Even if a component of the asset is lost or malfunctions, the lease will continue as planned as long as the lessor supplies a replacement. (Fincyclopedia, undated). While Istisna refers to the contract of sale (ba’i) is unique in that the underlying commodity is sold before the seller has access to it or takes ownership of it. Typically, this agreement is made between a seller (the manufacturer), referred to as al-sani', and a buyer referred to as al-mustasni'. (Fincyclopedia, undated).

Methodology

The current study analysed the previously published literature on SRI Sukuk frontiers and expanded its search to include literature on Sukuk and green sukuk, with the final outcome limited towards the scientific articles published in Scopus Database and Web of Science (WoS), since both are amongst the world's most comprehensive peer-reviewed databases that provide quality research. Information obtained from the published documents was additionally verified via the Security Commission of Malaysia, Capital Market Masterplan 2, and the Malaysia Sustainable Finance Initiative websites to ensure its accuracy. The literature search was done using the subfields of "Article title," "Abstract," and "Keywords" in order to extract the relevant articles within the research theme with a keyword, title, and abstract search of the literature to exclude potential researchers’ bias with wider coverage. At present, there are only 27 documents available from the Scopus search database that are solely focused on the SRI Sukuk and Green Sukuk using the key search of "SRI Sukuk" or "Green Sukuk". However, a search of the same keywords in the Web of Science (WoS) yielded only 21 documents. whereas a Google Scholar search yielded a larger number of publications (1,010 documents across all publication years). However, discussion on SRI Sukuk and Green Sukuk from literature linked to the notions of Sukuk and green financing such as Islamic financing, social impact bonds, and green bonds is available but remains limited.

While both databases were used for qualitative research, however, only the SCOPUS database was used for the bibliometric study because it contained a more comprehensive list of publications. The outcome of the bibliometric analysis is limited only to the study of keywords and bibliographic couplings. Excel was used to generate the frequency table and graph, and the VOSViewer (VoS) application was utilised to conduct the bibliometric analysis using the bibliometric mapping methodology. The VoS network visualisation instruments were used to produce the bibliographic coupling and word co-occurrence analysis.

Bibliometric Findings

Publication analysis

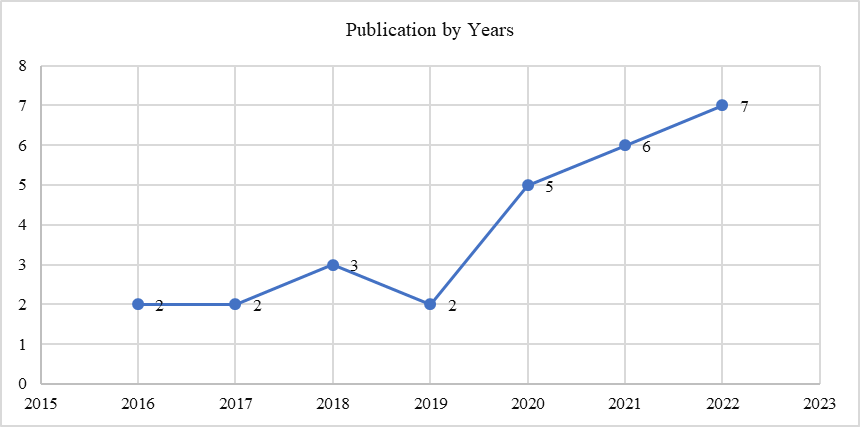

Figure 1 shows an upward trend in the annual number of publications related to SRI sukuk and green sukuk from 2016 until 2022. Only 28 publications from throughout the globe have been indexed in Scopus in the past seven years. However, despite an annual increase beginning in 2019, the volume of publications devoted to SRI sukuk and green sukuk remains low for a financial instrument with such broad potential. Based on the Scopus database, two papers were published in 2016. Syed Azman and Engku Ali (2016) are among the first to address the feasibility of Social Impact Bond (SIB) and Socially Responsible Investment (SRI) sukuk as tools for combating poverty and bolstering economic stability, respectively. Connections between SIB programs are drawn using case studies. Firstly, the SIB samples are provided by the London Homelessness SIB and the Youth Employment and Education SIB in the UK, while SRI sukuk studies regarding vaccine and Ihsan sukuk are also employed. Poverty and economic insecurity are two issues that could be addressed by examining these programs. It has been argued that each type of structure could alleviate the problems of poverty and social and economic instability by enhancing educational security. Key pioneers of Green Sukuk were Alam et al. (2016), who envisaged its potential within new Islamic capital markets. They also proposed investment vehicles that complied with Shariah and financed projects that highlighted environmental considerations, like wind farms, solar parks, and biogas facilities. Their research emphasises the development of green sukuk as a means of resolving Shariah's environmental issues and promoting corporate social responsibility.

Bibliographic coupling

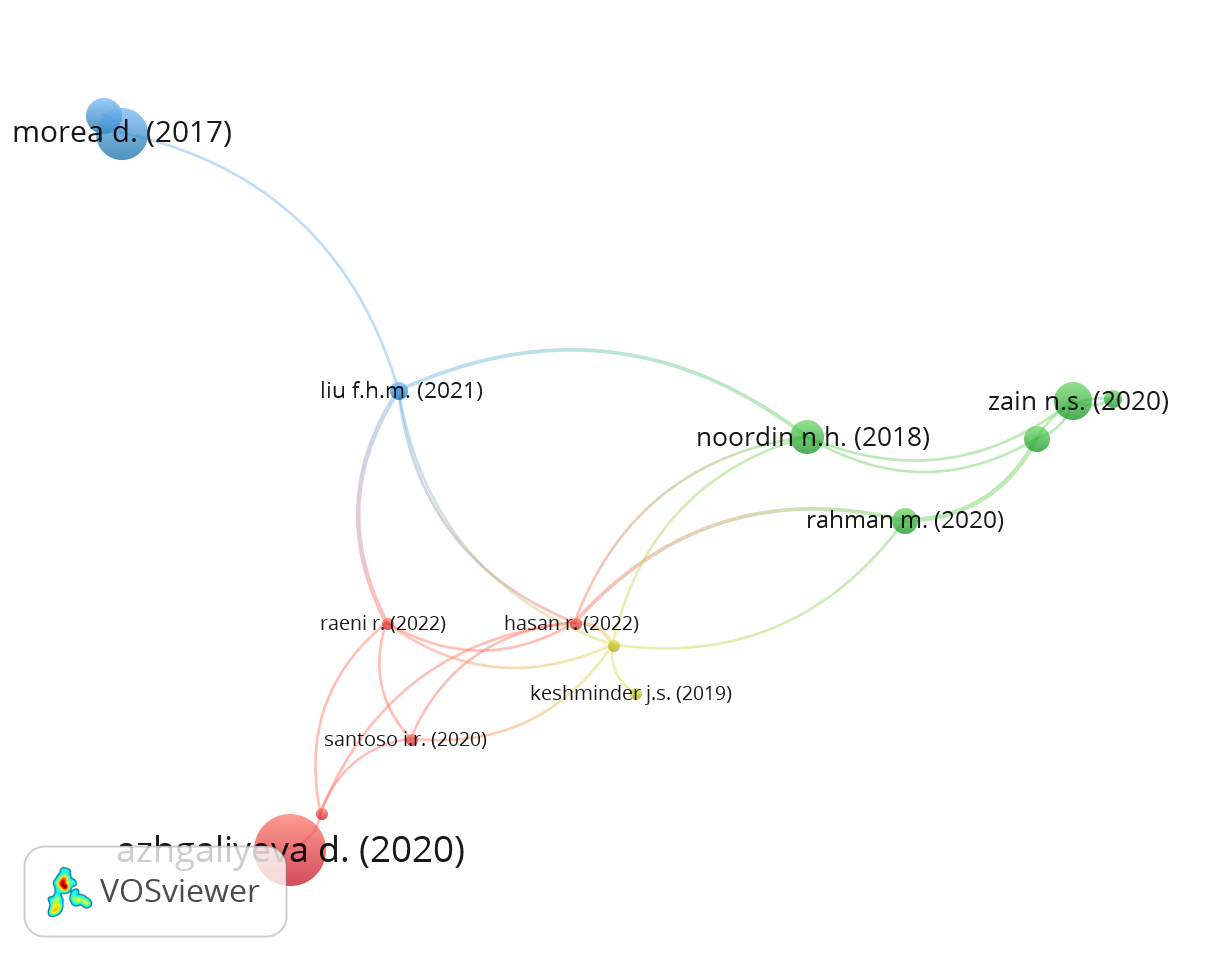

Next, the bibliographic coupling analysis was run to analyses the connectivity of the articles as measured by the basis of the number of references shared amongst the articles. The strength of the connectivity between documents was measured based on the extent of overlap between reference lists (Kessler, 1963). Where numerous references are shared by a pair of documents that explore the same theme, there is more likely to be an overlap. The VOS Viewer network visualizations for bibliographic coupling with documents produced the findings illustrated in figure 2, while a list of papers with at least one citation was reported in table 2. The number of authors for each document was established as a minimum of one, while one citation for each document was fixed as the minimum. Derived results indicate that out of 27 documents, 17 meet the threshold. This enabled a calculation of the overall strength of the bibliographic coupling connections with other works for all 27 documents. A document was only chosen if it had a high overall link strength.

The VoS software results generated 17 connected documents, with the first The SIB Cluster contains the greatest number of documents (five) related to social impact bonds (SIBs), models, and policies. In this cluster, Journal of Sustainable Finance and Investment features the most-cited article, written by Azhgaliyeva et al. in 2020. The work "Policy Review of Green Bond Financing for Renewable Energy and Energy Efficiency in Southeast Asia has been cited 32 times. The second cluster consists of five related documents that mostly examine the potential of SRI Sukuk to fund social impact investment. With their nine citations, Zain and Muhamad Sori (2020) have this collection’s greatest weight. Using the results of a previous study exploring how waqf properties and assets had developed in Malaysia, a sukuk model based on Musharakah was proposed as the model of SRI sukuk that could be introduced most feasibly in the country to develop waqf properties and assets. For the third cluster, there are three interconnected documents that solely focus on green sukuk as a novel Islamic financing instrument. Morea & Poggi's 2017 article in the International Journal of Energy Economics and Policy has received 16 citations under this cluster, making it the second-most-cited paper in the field. Using the Italian 1 MW as a case study, they discuss the technical, economic, and financial viability of wind generating plants. They suggest using Sukuk, a Shari'ah-compliant instrument, as a substitute financial instrument that can restrict the use of leverage. The results of this study showed how incentives were necessary and illustrated that it would be viable to utilize sukuk instruments that complied with Shari'ah in facilitating workable investments in the field of wind energy in the long term.

Conversely, the final cluster contains just two published works discussing contributory factors to green sukuk’s success in Malaysia. Abdullah and Keshminder (2022) study is one of the most recent green sukuk publications on the topic "What drives green sukuk? A leader’s perspective "which is published in the Journal of Sustainable Finance and Investment. They used a qualitative case study with Malaysian green sukuk issuers. Through a qualitative case study conducted with the participation of green sukuk issuers in Malaysia, they revealed that these factors—competition, legitimacy, and ecological responsibility—had an impact on the decision to issue green sukuk. They suggested the green sukuk market may benefit from a proliferation of pro-environmental legislation and practical tactics for promoting and educating the public about environmental issues.

Bibliographic keywords

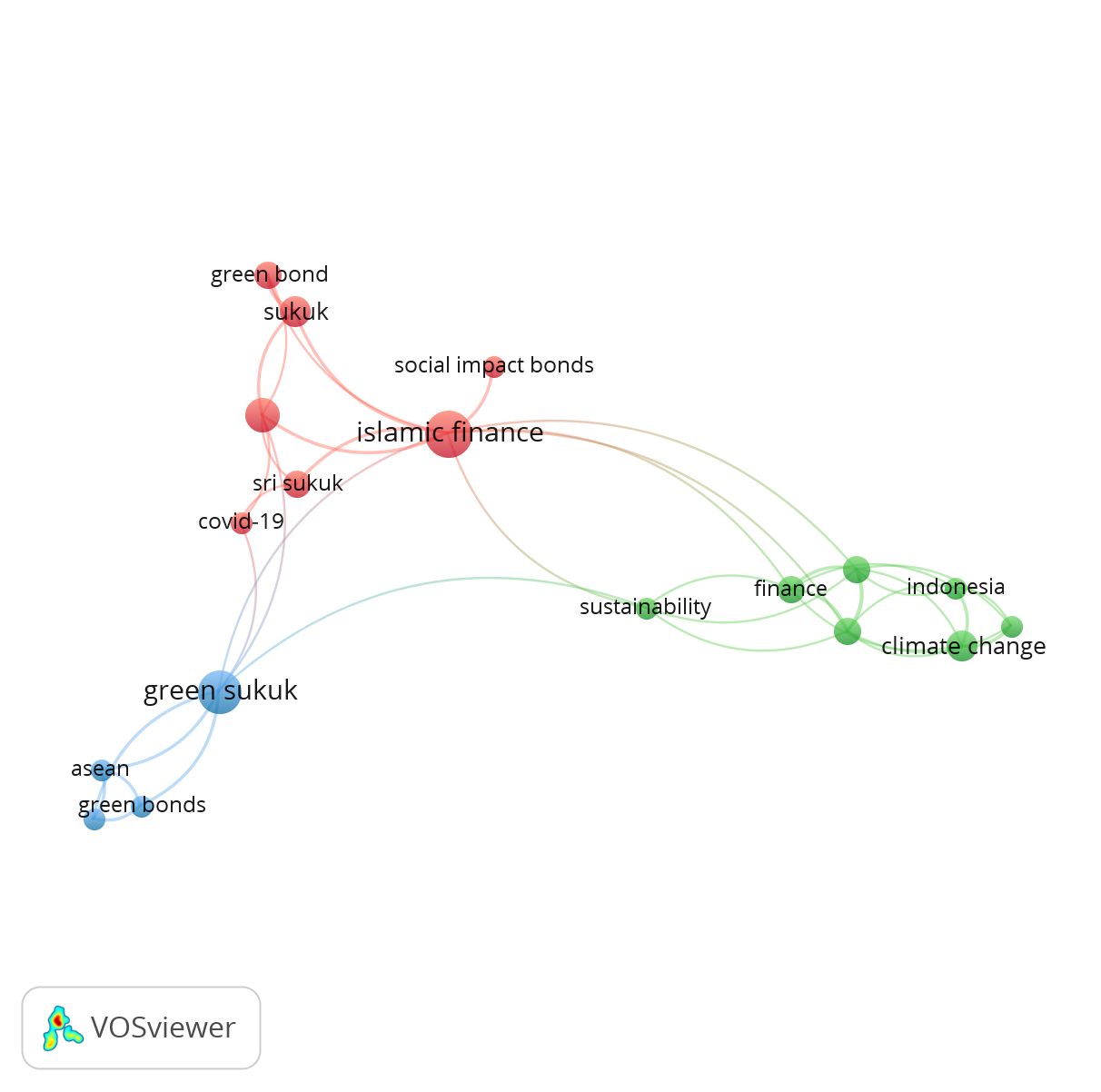

The keyword analysis was used to investigate pre-existing or foreseeable links between themes in the SRI Green Sukuk by focusing on the textual content of the papers included in the dataset of SRI Green Sukuk publications. The author keywords that appeared at least twice in the SCOPUS database were used in the present study. Only 18 of the 108 keywords (represented by 3 clusters) met the threshold. The overall strength of the co-occurrence with the other keywords was determined for each of the total 18 keywords, and only the keywords with the largest total link strength were chosen as depicted in Table 3.

The network visualisation of keywords as depicted in Figure 3 is constructed with 3 main clusters (Red, Green, and Blue) It indicates the relation between one keyword and another. The frequency of keywords' appearance in the abstract and title will determine the size of the circle and letters; more frequency is reflected by the greater size of letters and nodes. As reported in Table 3, the most frequently appeared keywords is "Islamic Finance" under Cluster 1 that occurred 9 times (total link strength of 14), which had a strong link with "Covid-19", "Green bond", "Islamic finance", "Social impact bonds", "Socially responsible investment," "Sri sukuk" and "Sukuk". Followed by "Green Sukuk" for 8 times (total link strength 10) under Cluster 3 that having a strong link to "Asean’, "Green bond", and " Sustainable finance". Cluster 2 is connected by 7 keywords, which are "Climate change", "Correlation analysis", "Finance", "Indonesia", "Planning”, “Sustainability" and "Sustainable development".

Conclusions

This current study presented an overview of the concepts of SRI Sukuk by reviewing the existing literature on SRI Sukuk and also discussed the bibliometric discoveries on SRI Sukuk and green sukuk frontier. Totally, only 27 papers were retrieved from the SCOPUS database covering a time span of 7 years ranging from 2016 to 2022. The evolution of the number of publications along these time intervals shows growing interest, despite the fact that the number of publications is still not reaching more than 10 publications per year. Thus, offering a distinctive research area to be explored in SRI Sukuk and green sukuk frontiers, given the pathways towards sustainable development and investment are evolving. Obviously, based on the keyword analysis, the main keywords that are being highly cited among others are "green sukuk" and "Islamic finance." This might be interrelated since the structure of green sukuk has always been discussed from the Shari’ah compliance Islamic financing instruments. Considering this study expands upon a previously conducted literature on SRI Sukuk, there are still some caveats to be noted. Further study that uses an empirical approach based on in-depth observation of the most crucial components of the development of SRI Sukuk is recommended for future research. By conducting follow-up interviews with shareholders, stakeholders, and the financial expert for each financing mechanism may yield more fruitful insights. Despite certain caveats, the current research sheds light on the emerging field of SRI sukuk as a novel Islamic financial instrument that envision Islamic green financing and can serve as a reference for future study.

References

A Malek, N. H. (2017, October 9). Quantum Solar Park to issue RM1b green SRI sukuk. The Malaysia reverse. https://themalaysianreserve.com/2017/10/09/quantum-solar-park-issue-rm1b-green-sri-sukuk/

Abdullah, M. S., & Keshminder, J. S. (2022). What drives green sukuk? A leader’s perspective. Journal of Sustainable Finance & Investment, 12(3), 985-1005.

Abdullah, N., & Nayan, M. A. (2020). Green Sukuk: Financing the Future to Sustainable Environment. International Journal of Zakat and Islamic Philanthropy, 2(2), 14-23.

Alam, N., Duygun, M., & Ariss, R. T. (2016). Green sukuk: An innovation in Islamic capital markets. Energy and finance (pp. 167-185). Springer, Cham.

Azhgaliyeva, D., Kapoor, A., & Liu, Y. (2020). Green bonds for financing renewable energy and energy efficiency in South-East Asia: a review of policies. Journal of Sustainable Finance & Investment, 10(2), 113-140.

Bielenberg, A., Kerlin, M., Oppenheim, J., & Roberts, M. (2016). Financing change: How to mobilize private-sector financing for sustainable infrastructure. McKinsey Center for Business and Environment, 24-25.

Capital Markets Malaysia2 (CMM2). (2022). Sustainable and Responsible Investment (SRI). https://www.capitalmarketsmalaysia.com/public-sri-sukuk/

Dusuki, A. W., & Abdullah, N. I. (2007). Maqasid alShari'ah. Maslahah, and Corporate Social Responsibility. The American Journal of Islamic Social Sciences, 24(1), 25-44.

Febi, W., Schäfer, D., Stephan, A., & Sun, C. (2018). The impact of liquidity risk on the yield spread of green bonds. Finance Research Letters, 27, 53-59.

Fincyclopedia (undated). Difference between Murabahah and Musawamah, Retrieved on 2022, Decemeber. https://fincyclopedia.net/islamic-finance/tutorials/difference-between-murabahah-and-musawamah

Hasan, R., Velayutham, S., & Khan, A. F. (2022). Socially responsible investment (SRI) Sukuk as a financing alternative for post COVID-19 development project. International Journal of Islamic and Middle Eastern Finance and Management, 15(2), 425-440.

Islamic Finance News (IFN). (2019). Quantum Solar: What happens when green Sukuk falter? Islamic Finance News (IFN): The World’s Leading Islamic Finance News Provider, 16(29), 3-4. http://irep.iium.edu.my/73635/2/July%20IFN.pdf

Jonwall, R., Gupta, S., & Pahuja, S. (2022). Socially responsible investment behavior: a study of individual investors from India. Review of Behavioral Finance, (ahead-of-print).

Kapoor, A., Teo, E. Q., Azhgaliyeva, D., & Liu, Y. (2021). The viability of green bonds as a financing mechanism for energy-efficient green buildings in ASEAN: lessons from Malaysia and Singapore. In Energy Efficiency Financing and Market-Based Instruments (pp. 263-286). Springer.

Kassim, S., & Abdullah, A. (2017). Pushing the frontiers of Islamic finance through socially responsible investment sukuk. Al-Shajarah: Journal of the International Institute of Islamic Thought and Civilization (ISTAC), 187-213.

Keshminder, J. S., Gurmit, B. S., Zainora, A. B., & Syafiq, M. A. (2019). Green sukuk: Malaysia taking the lead. Malaysian Journal of Consumer and Family Economics, 22, 1-22.

Kessler, M. M. (1963). Bibliographic coupling between scientific papers. American documentation, 14(1), 10-25.

Khouildi, M. Y., & Kassim, S. H. (2018). An innovative financing instrument to promote the development of Islamic microfinance through socially responsible investment Sukuk. Journal of Islamic Monetary Economics and Finance, 4(2), 237-250.

Laldin, M. A., & Furqani, H. (2013). Developing Islamic Finance in the Framework of Maqasid al-Shari'ah. International Journal of Islamic and Middle Eastern Finance and Management, 6(4), 278-289.

Lebelle, M., Lajili Jarjir, S., & Sassi, S. (2020). Corporate green bond issuances: An international evidence. Journal of Risk and Financial Management, 13(2), 25.

Liu, F. H., & Lai, K. P. (2021). Ecologies of green finance: Green sukuk and development of green Islamic finance in Malaysia. Environment and Planning A: Economy and Space, 53(8), 1896-1914.

Moghul, U. F., & Safar-Aly, S. H. K. (2014). Green sukuk: The introduction of Islams environmental ethics to contemporary Islamic finance. The Georgetown International Environmental Law Review, 27(1).

Morea, D., & Poggi, L. A. (2017). An innovative model for the sustainability of investments in the wind energy sector: The use of green sukuk in an Italian case study. International Journal of Energy Economics and Policy, 7(2), 53-60.

Nanayakkara, M., & Colombage, S. (2022). Does compliance to Green Bond Principles matter? Global Evidence. Australasian Accounting, Business and Finance Journal, 16(3), 21-39.

Noordin, N. H., Haron, S. N., Hasan, A., & Hassan, R. (2018). Complying with the requirements for issuance of SRI sukuk: the case of Khazanah’s Sukuk Ihsan. Journal of Islamic Accounting and Business Research, 9(3), 415-433.

Noronha, M. (2020). A new shade of green: Sukuk for sustainability, Economist Impact, retrieved from https://impact.economist.com/perspectives/sustainability/new-shade-green-sukuk-sustainability

Obaidullah, M. (2017). Managing climate change: The role of Islamic finance. IRTI Policy Paper, (2017-01).

Oktaviani, Y., Rangkuti, K., Surya, A. P. P., & Puspita, A. (2018). Financial solutions for biodiversity in contributing to the economic development in Indonesia. In E3S Web of Conferences (Vol. 74, p. 01007). EDP Sciences.

Raeni, R., Thomson, I., & Frandsen, A. C. (2022). Mobilising Islamic Funds for Climate Actions: From Transparency to Traceability. Social and Environmental Accountability Journal, 42(1-2), 38-62.

Rahman, M., Isa, C. R., Dewandaru, G., Hanifa, M. H., Chowdhury, N. T., & Sarker, M. (2020). Socially responsible investment sukuk (Islamic bond) development in Malaysia. Qualitative Research in Financial Markets, 12(4), 599-619.

RAM Ratings. (2015). Credit FAQs: Rating Khazanah's Sukuk Ihsan. RAM Holdings

Responsible Finance Institute (RFI) (2018) Environmental Impact in Islamic Finance. Retrieved on 2022, December. http://report.rfi-foundation.org/download.html.

Santoso, I. R. (2020). Green Sukuk and Sustainable Economic Development Goals: Mitigating Climate Change in Indonesia. ARTIKEL, 1(6067).

Securities Commission Malaysia. (2019). Sustainable and Responsible Investment Sukuk Framework-An Overview. Retrieved on 2019, November from https://www.sc.com.my/api/documentms/download .ashx?id=84491531-2b7e-4362-bafb-83bb33b07416

Sertore, S. (2022). From niche to mainstream. European Investment Bank. Retrieved on 2022, December. https://www.eib.org/en/stories/15-years-green-bond

Siswantoro, D. (2018, November). Performance of Indonesian green sukuk (islamic bond): a sovereign bond comparison analysis, climate change concerns? In IOP Conference Series: Earth and Environmental Science (Vol. 200, No. 1, p. 012056). IOP Publishing.

Starr, M. A. (2008). Socially responsible investment and pro-social change. Journal of Economic Issues, 42(1), 51-73.

Syed Azman, S. M. M., & Engku Ali, E. R. A. (2016). Potential Role of Social Impact Bond and Socially Responsible Investment Sukuk as Financial Tools that Can Help Address Issues of Poverty and Socio-Economic Insecurity. Intellectual Discourse, 24. https://journals.iium.edu.my/intdiscourse/index.php/id/article/view/924

Townsend, B. (2020). From SRI to ESG: The origins of socially responsible and sustainable investing. The Journal of Impact and ESG Investing, 1(1), 10-25.

Tu, C. A., Rasoulinezhad, E., & Sarker, T. (2020). Investigating solutions for the development of a green bond market: Evidence from analytic hierarchy process. Finance Research Letters, 34, 101457.

Yesuf, A. J., & Aassouli, D. (2020). Exploring synergies and performance evaluation between Islamic funds and socially responsible investment (SRIs) in light of the Sustainable Development Goals (SDGs). Heliyon, 6(8), e04562.

Zain, N. S., & Sori, Z. M. (2020). An exploratory study on Musharakah SRI Sukuk for the development of Waqf properties/assets in Malaysia. Qualitative Research in Financial Markets.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Mohamad, N. E. A., Saad, N. M., & Mohamed, Z. B. (2023). A Bibliometric Review of Sustainable and Responsible Investment Sukuk Envision Green Financing. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 367-381). European Publisher. https://doi.org/10.15405/epfe.23081.32