Abstract

The tax is an essential part of the budget process, as it determines the distribution of financial resources at the federal level. This study examines the level of corporate tax planning among public listed companies in Malaysia following the 2017 Malaysian Code of Corporate Governance (MCCG) reforms. The study sample is based on 490 firm-year observations from 2012 to 2016 (pre-MCCG) and from 2017 to 2021 (post-MCCG). The panel data consists of trading and services industry data retrieved from Thomson Reuters Datastream. The objective of the study was to assess the level of corporate tax planning before and after the MCCG reforms. It also aims to provide empirical data on whether corporate governance affects corporate tax planning. The results show a significant difference in the effective tax rate pre-MCCG compared to post-MCCG. The study provides insights into the MCCG phases to identify the financial indicators that affected corporate tax planning during this period, thus providing information for upcoming research.

Keywords: Corporate tax planning, effective tax rate, Malaysian code of corporate governance, statutory tax rate

Introduction

Corporate governance has been regarded as the most significant tool in measuring and evaluating the efficiency of financial reporting. In addition, the relevant mechanisms are considered a fundamental part of monitoring the actions of managers. After the 1997 financial crisis, Malaysia introduced several corporate governance systems modelled on those employed in developed Western countries to improve the quality of financial reporting and enhance investor confidence. The Malaysian Securities Commission took a significant step to improve the governance standards of Malaysian publicly traded companies by introducing the MCCG. This was introduced in 2000 to improve financial reporting standards (Ismail et al., 2021). The introduction of the MCCG marked a new milestone in the development of effective corporate governance practices in Malaysia.

Malaysian Code of Corporate Governance

Malaysia initiated corporate governance reforms in the aftermath of the 1997 Asian financial crisis which had damaged public confidence in the country. As a result, the MCCG was developed in 2000 to restore public trust. The MCCG established the fundamentals as well as the proposed guidelines of good corporate governance for public listed companies (Lim et al., 2013). Corporate governance is a key factor in the success or failure of a company. Poor corporate governance not only has a negative impact on the company itself but also on the country's economy as a whole. Therefore, with the introduction of the MCCG in 2000, the code became a mandatory listing requirement for Bursa Malaysia in 2001 (Aris et al., 2019).

The MCCG in Malaysia has gone through various stages of reformation since it was first introduced in 2000. Some changes were made to the MCCG in 2007, 2012, 2017, and 2021, to ensure that it remains relevant and supports the development of effective corporate governance culture and practices. The 2007 MCCG continued the integration between the government and various industries to further strengthen boards of directors and audit committees and ensure that these boards and committees are effectively fulfilling their respective roles and responsibilities (MCCG, 2007). These actions were intended to reinforce the importance of the MCCG and ensure its conformity with the ever-evolving market needs. The 2012 MCCG focused on the structure of boards and the fiduciary duties of directors (Ram et al., 2019).

In addition, the 2017 MCCG requires all public listed companies to have board members who possess an appropriate level of expertise, competence and technical skills. Under the 2017 MCCG, a majority of non-executive, independent directors on the board are essential for strong corporate governance. This change represents a positive step toward trustworthy and high-quality financial information. Recent reforms to the MCCG have included the protection of minority rights as well as transparency and timely disclosure of information (Lim et al., 2013). The 2017 version of the MCCG was the fourth revision to strengthen corporate cultures and thus promote corporate accountability and transparency.

Furthermore, the 2017 MCCG emphasises three basic principles of boards: Leadership and Effectiveness, Effective Audit and Risk Management, and Integrity of Corporate Reporting. Since the MCCG is mainly implemented through an agency relationship between managers and shareholders, the need for the board of directors as a monitoring tool is strongly emphasised (Haron et al., 2020). Based on agency theory, managers should protect the interests of their shareholders by maximising the value of the firm. In fact, due to opportunistic behaviour and access to the firm's assets, managers serve their interests rather than those of their shareholders. Therefore, it is the board's responsibility to monitor the actions of managers.

Corporate Tax Reporting in Malaysia

Taxes are one of the tools the government uses to boost the country's economy. The Income Tax Act of 1967 sets the rules that govern corporate income tax in Malaysia. Tax calculations are based on chargeable income rather than accounting income. The company's financial statements must be prepared in conformity with accepted accounting principles, to provide financial information that is reliable and valuable to users. Therefore, it is important to have high-quality financial reporting that is free from accounting manipulation to ensure the correct payment of taxes.

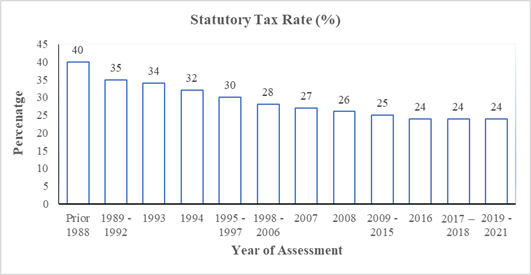

A company must pay taxes based on the statutory tax rate (STR) issued by the Inland Revenue Board of Malaysia (IRBM). The IRBM has reduced the tax rate from 40% in 1988 to 24% in 2021 to improve tax compliance. The declining trend of STR in Malaysia is shown in Figure 1. According to a study by Azlan Annuar et al. (2018), consistent STR reductions have had a positive impact on the expansion of the Malaysian economy. Otherwise, a high STR would have discouraged foreign investors from investing in Malaysia, which would have slowed the country's economic growth.

For tax reporting purposes, companies adjust their pre-tax net income based on tax treatment, i.e., double deductions, allowable expenses, non-allowable expenses, taxable income, non-taxable income, and tax-exempt income. Tax incentives result in actual tax payments being much lower than the STR (Vržina et al., 2020). According to Mgammal and Ku Ismail (2015), companies use different approaches to minimise their tax liability; therefore, they use tax planning strategies to reduce their tax burden. Therefore, the level of corporate tax planning for companies will vary depending on the tax incentives provided by governments and the accounting treatment chosen by managers in preparing their financial and tax reporting.

Corporate Tax Planning

Agency Theory provides an explanation for the hypothesized connection that exists between corporate tax planning and corporate governance. According to agency theory, boards of directors ought to align the interests of managers and shareholders (Jensen & Meckling, 1976). According to this notion, a manager (agent) abuses his position to benefit himself rather than the shareholder (principal). Agency conflicts arise because the manager has more information than the shareholder and has the discretionary power to decide on behalf of the principal. Similarly, managers abuse their position to engage in aggressive tax planning that can create room for creative accounting strategies. Because taxes are viewed as a cash outflow, firms engage in tax planning by identifying ways to reduce these costs (James Kimea & Mkhize, 2021). Corporate taxpayers will benefit from tax savings by paying a lower tax than STR.

In most cases, the primary objective of managers and shareholders is to achieve a positive accounting income while reducing the amount of taxable income in order to avoid paying a large amount of tax. Therefore, management is encouraged to falsify financial statements to minimise tax liability and maximise cash flow to achieve a lower tax liability. A review of the relevant literature by Kovermann and Velte (2019) found that good corporate governance practices influence the level of corporate tax planning. Thus, agency conflicts could be reduced through effective corporate governance procedures. As noted by Desai and Dharmapala (2007), good corporate governance contributes to greater transparency, which would indirectly discourage managers from engaging in aggressive tax planning. Credible financial statements would also improve tax reporting.

Problem Statement

Corporate scandals are often associated with deficiencies in corporate governance that do not curb opportunistic behaviour and dishonesty. The collapse of Enron and WorldCom drew attention on corporate governance issues globally. Strengthening corporate governance by regulators would therefore reduce the incidence of financial manipulation and consequently curb aggressive tax planning. Recently, numerous studies have been conducted on the relationship between corporate governance and corporate tax planning (Kovermann & Velte, 2019). Hence, the objective of this study is to understand that corporate governance plays an important role in the preparation of financial statements, which may affect the level of corporate tax planning of Malaysian companies. In this study, it was hypothesised that there is a significant relationship between effective tax rates (ETR) before and after the implementation of the 2017 MCCG.

Research Questions

Following the MCCG reforms, a deluge of research on Malaysian corporate governance appeared in academic journals. These empirical studies have revealed a wide range of research areas. Financial reporting quality can be improved through board monitoring by preventing earning manipulation, thereby reducing the prevalence of aggressive tax planning strategies among public listed companies in Malaysia. This study, therefore, attempted to answer the following question:

To what extent did the trading and service sectors of Malaysian listed companies engage in corporate tax planning before and after the introduction of the revised MCCG in 2017?

Purpose of the Study

Despite the mixed results of previous work and the growing interest in this topic, few studies have been conducted on corporate tax planning in the context of MCCG regulations. It would be interesting to investigate whether these adjustments affect the level of corporate tax planning of Malaysian listed companies. Therefore, the objective of this study was to examine the level of corporate tax planning in the context of the 2017 MCCG reforms.

Research Methods

This study examines the impact of the MCCG on the level of corporate tax planning among trading and service companies in Malaysia. Financial data from Thomson Datastream for the period 2012 to 2021 was used to validate the research objective. The study sample includes financial information from 2012 to 2016 (pre-MCCG 2017) and from 2017 to 2021 (post-MCCG 2017). The balanced panel data analysis was based on 490 firm-year observations. The study used the effective tax rate to evaluate tax planning strategies. According to Salawu (2017), ETR is the appropriate metric to measure the efficiency of tax planning and indicates the amount of taxes paid by a company.

In line with previous research in the field of taxation, this study examines the viability of corporate tax planning using the ETR. The ETR was calculated as the ratio of a firm's tax expense to its pre-tax profit (Hanlon & Heitzman, 2010). Thus, in this study, ETR was calculated as follows:

ETR = Current Tax Expense

Profit Before Tax

The first criterion for selecting the sample for this study was that the companies had to have positive pre-tax income. Therefore, companies with negative pre-tax income were excluded. ETR was measured by calculating current tax expense divided by pre-tax income, so negative pre-tax income was meaningless. Second, the sample had to include trading and services companies listed on Bursa Malaysia during the study period. This is due to the fact that the MCCG has been a mandatory listing on Bursa Malaysia since 2001. Therefore, companies that had been delisted at any time were excluded. Finally, companies with incomplete financial information were excluded from the analysis to ensure a high balance of data and to avoid inaccurate conclusions due to missing data.

Findings

All The data stream primarily included a population of 191 companies from the trading and services industries listed on Bursa Malaysia between 2012 and 2021. After excluding companies with negative pre-tax earnings, only 77 companies remained in the sample. In addition, companies that are no longer listed on Bursa Malaysia and companies that changed their accounting year between 2016 and 2021 were excluded. Finally, the sample was reduced by an additional 26 companies due to missing data. By eliminating these outliers, the final sample resulted in 49 companies with 490 firm-year observations, as shown in Table 1.

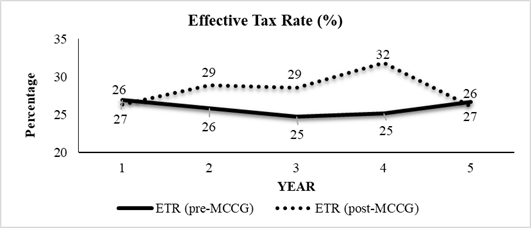

Figure 2 shows the mean ETR values for the pre-MCCG (2012 - 2017) and post-MCCG (2017-2021) periods. A comparison of ETR from both periods shows that the post-MCCG ETR was higher than the pre-MCCG ETR. The results show an increasing ETR during the post-MCCG period. A higher ETR indicates a decrease in tax avoidance activity and vice versa, suggesting that companies were conducting less aggressive tax planning strategies.

Table 2 presents the descriptive statistics of the final sample. The E-Views statistical tool was used to analyse data from several companies over time. A higher ETR signifies that the companies had a higher tax liability during post-MCCG compared to pre-MCCG 2017. The level of ETR for the 49 companies pre-MCCG ranged from 7% to 71%; meanwhile, for the post-MCCG, the rate ranged from 2% to 97%. The mean value for ETR post-MCCG was 26% and increased to 28% during the post-MCCG period.

A t-test was then conducted to determine the difference in corporate tax planning in the trading and service companies listed in Bursa Malaysia before and after the 2017 MCCG revision. The mean ETR values for the periods 2012 to 2016 and 2017 to 2021 were compared, as shown in Table 3. The p-value of 0.0026 shows a significant difference in the ETR of trading and service companies listed on Bursa Malaysia between the periods before and after MCCG 2017. The study shows that the amendment of MCCG 2017 had a positive impact on ETR, which is a positive sign of higher tax collection by tax authorities. This result suggests that the MCCG reforms would curb and combat aggressive tax planning by the Malaysian trading and services industry.

Conclusion

This research scrutinised the impact of the MCCG reforms on the level of corporate tax planning (proxied by ETR) in Malaysian trading and services companies listed on Bursa Malaysia. By analysing 490 firm-year observations from the ten years between 2012 and 2021, this study found a significant difference between the pre-MCCG ETR and the ETR post-MCCG 2017. Although the initiatives behind the MCCG reforms were not directly aimed at improving corporate tax reporting, this study empirically demonstrated that a corporate governance mechanism significantly affects ETR levels. The results show a substantial relationship with ETR before and after the 2017 MCCG, which adds to the literature and understanding of the impact of corporate governance on the level of corporate tax planning. Furthermore, regulators can use the information to decide on best governance practices to improve tax collection. The information collected in this study could help market participants understand the role of corporate governance in monitoring the aggressiveness of corporate tax planning activities.

However, this study has its limitations. First, the study was limited to trading and service companies listed on Bursa Malaysia; future studies could expand the sample to other sectors and compare the extent of corporate tax planning in different industries. The current results cannot be extrapolated to other sectors, as the latter may have different characteristics and more effective corporate governance. In addition, future studies could examine how the impact of financial characteristics might affect differences in ETR before and after the release of the 2017 MCCG.

References

Aris, N. M., Yusof, S. M., & Wen, L. J. (2019). Analysis of Corporate Governance and Bank Performance: Empirical Evidence from Malaysian Banking Industry. Journal of Public Administration and Governance, 9(3), 82-99. DOI:

Azlan Annuar, H., Isa, K., Ibrahim, S. A., & Solarin, S. A. (2018). Malaysian corporate tax rate and revenue: the application of Ibn Khaldun tax theory. ISRA International Journal of Islamic Finance, 10(2), 251-262. DOI:

Desai, M. A., & Dharmapala, D. (2007). Taxation and Corporate Governance: An Economic Approach. SSRN Electronic Journal. DOI:

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2-3), 127-178. DOI:

Haron, R., Othman, A. H. A., Nomran, N. M., & Husin, M. M. (2020). Corporate Governance and Firm Performance in an Emerging Market: The Case of Malaysian Firms. Handbook of Research on Accounting and Financial Studies, 208-226. IGI Global. DOI: 10.4018/978-1-7998-2136-6.ch010

Ismail, I., Shafie, R., & Ku Ismail, K. N. I. (2021). CFO attributes and accounting conservatism: evidence from Malaysia. Pacific Accounting Review, 33(4), 525-548. DOI:

James Kimea, A., & Mkhize, M. (2021). A longitudinal analysis of tax planning schemes of firms in East Africa. Investment Management and Financial Innovations, 18(3), 194-203. DOI:

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. DOI: 10.1016/0304-405x(76)90026-x

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance—A literature review. Journal of International Accounting, Auditing and Taxation, 36, 100270. DOI: 10.1016/j.intaccaudtax.2019.100270

Lim, K. P., Ismail, H., & Eze, U. C. (2013). Corporate governance and financial performance of public listed companies: Pre and post implementation of the Malaysian code of corporate governance. Corporate Ownership and Control, 10(4), 355-376. DOI:

MCCG. (2007). Malaysian Code on Corporate Governance. Securities Commission.

MCCG. (2017). Malaysian Code on Corporate Governance. Securities Commission.

Mgammal, M. H., & Ku Ismail, K. N. I. (2015). Corporate Tax Planning Activities: Overview of Concepts, Theories, Restrictions, Motivations and Approaches. Mediterranean Journal of Social Sciences. DOI:

Ram, B. R., Hassan, A. N., & Ting, T. T. (2019). The Influence of Corporate Governance Attributes Over The Intellectual Capital Disclosure of Malaysian Public Listed Companies Pre And Post of MCCG 2017 Implementation. International Journal of Law, Humanities & Social Science, 3(6), 85-114,

Salawu, R. O. (2017). Corporate governance and tax planning among non-financial quoted companies in Nigeria. African Research Review, 11(3), 42-59. DOI:

Vržina, S., Obradović, V., & Bogićević, J. (2020). Financial reporting on income tax in Serbia and Croatia: An empirical analysis. Ekonomika preduzeca, 68(5-6), 330-340. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Nasir, N. E. M., Rashid, N., Kamarudin, S. N., & Yaacob, N. M. (2024). Nexus of Corporate Tax Planning In Malaysia's Trading and Services. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 412-419). European Publisher. https://doi.org/10.15405/epsbs.2024.05.34