Abstract

This research explores the use of business sustainability performance in Telecommunication Companies to understand the driving force of financial performance and non-financial Environment Social Governance performance. It explains the use of Shareholder and Stakeholder Models to understand the relationship between financial and non-financial ESG sustainability and firm performance. It describes that the ultimate goal of maximization of a firm’s value is driven by improved and non-financial ESG sustainability performance. The inter-working among these variables will lead to reduced cost of capital, hence acting as protection against future economic shocks caused by a pandemic or financial crisis. The sustainability models provided by shareholder wealth maximization and stakeholder welfare maximization can create both synergies and conflicts simultaneously; hence, finding the optimal balancing act in determining the investment appetite into the firm, known as ESG investing, is key. The findings will provide firms with the right tools to attract a good flow of investment at cheaper rates into the company. In addition, companies with positive business sustainability performance will increase ESG investing appetite as they see their investment protected from future economic shocks caused by the future crisis.

Keywords: Business sustainability, ESG investing, cost of capital, shareholder wealth, stakeholder welfare

Introduction

Corporate social innovation (CSI) has become increasingly relevant in today's business landscape as more companies seek to balance economic growth with social and environmental responsibility (Gibbs & Hertzman, 2018). However, implementing CSI within an organization can be challenging, particularly when producing innovative and marketable products for the community. Two crucial aspects that can affect an organization's capacity to deploy CSI successfully are innovation intention and market orientation. The desire and drive of organizations to innovate and adopt innovative solutions is referred to as innovation intention (Jayakumar, 2017). In contrast, market orientation (MO) refers to the organization's focus on the demands and preferences of consumers and other stakeholders (Prifti & Alimehmeti, 2017). Both characteristics can have a substantial impact on an organization's culture and its capacity to attain CSI since they dictate employees' willingness and ability to embrace social and environmental concerns while remaining profitable.

The desire to innovate is critical in fostering corporate social innovation in Malaysia. Organizations with a strong desire to innovate are more likely to accept and execute novel solutions to social and environmental problems (Auriac, 2010). This is especially true in Malaysia, where the government has established lofty sustainability targets through initiatives such as the Sustainable Development Goals (SDGs). Corporate social innovation is a crucial part of attaining these goals, and organizations that are eager to innovate are more likely to contribute to long-term development. While the desire to innovate is crucial, some organizations may have the desire to innovate but lack the requisite knowledge or resources to properly adopt creative solutions. Therefore, understanding how the intention to innovate impacts CSI can significantly add value to the existing literature on CSI in Malaysia.

MO is a major driver of CSI in Malaysia. Market-oriented organizations are more likely to recognize and respond to market needs, including social and environmental problems, by implementing innovative solutions (Mahmoud et al., 2017). Such organizations use a customer-centric approach, which allows them to understand the requirements and preferences of their customers and other stakeholders, and this knowledge may be used to lead their social innovation activities (Alhakimi & Mahmoud, 2020). Furthermore, market-oriented organizations are more likely to respond to shifting market trends and demands, which can lead to the identification of new chances for social innovation. While MO is necessary, some organizations may have a strong MO but may not prioritize social and environmental concerns due to a focus on short-term profit maximization. This cultural trait can sometimes conflict with MO, as MO emphasizes individualism, competition, and the pursuit of profit. Therefore, while MO is necessary, the MO is less understood for Malaysian organizations due to the diversity of their business practices and values, which tend to prioritize MO that contribute to CSI in Malaysia (Didonet et al., 2016). In this context, the study is to reveal the relationship between MO and innovation, especially CSI. Secondly, the study also identifies the relationship between innovation intention and CSI.

Problem Statement

In the current business landscape, a novel dimension of competition has emerged, centered around bolstering organizational resources and creating innovative, marketable products. This situation brings forth a specific problem. Firstly, there is a challenge in developing innovative products that align with evolving trends and technologies. Secondly, there exists a need to grasp societal requirements and simultaneously enter untapped markets, while making a constructive contribution to both social and environmental welfare. However, a significant gap exists in understanding the impact of innovation intention and market orientation on corporate social innovation. This research aims to strike a harmonious equilibrium between financial objectives and the imperative of fulfilling social and environmental responsibilities.

Research Question

Does market orientation influence corporate social innovation?

Does innovation intention influence corporate social innovation?

Literature Review

Corporate social innovation (CSI)

Corporate Social Innovation (CSI) has become an increasingly popular topic in both academic and public discourse in recent years. Kanter (2012) introduced the concept of CSI, distinguishing it from social innovation, which refers to innovation at the societal level. Conversely, CSI refers to the application of innovation at the business level (Dionisio & de Vargas, 2020). While previous studies have shown that corporate social responsibility (CSR) can improve the sustainability of businesses and provide them with a competitive edge by offering new services, practices, and methods (Esen & Eyiusta, 2019; Mirvis et al., 2016), CSI is distinct from CSR initiatives (Kanter, 2012; Mirvis et al., 2016) and focuses on society, while CSR is primarily concerned with a company's reputation (Amran et al., 2021).

However, the literature on CSI remains underdeveloped and immature (Benneworth & Cunha, 2015). Previous research has shown that the concept of CSI is still in its infancy (Mustapha et al., 2021; van der Have & Rubalcaba, 2016), and there has been little research on the use of social innovations as a specialized strategy to influence companies' business. The lack of empirical data on CSI and the absence of a united set of metrics to accurately reflect the breadth and scope of CSI pose significant challenges to researchers (Mihci, 2020).

Several studies have identified determinants of CSI, such as shared value creation, social empathy, stakeholder involvement, management commitment, organizational structure, and culture (Esen & Eyiusta, 2019; Mihci, 2020). However, these studies have relied primarily on qualitative research, and there is a need for empirical data through quantitative analysis to test the reliability of the concept. Păunescu (2013) noted the limitations of the social innovation index, which only examines the policy and institutional framework, financing, entrepreneurship, and society as key factors influencing social innovation in companies. This research was limited to 45 countries-G20 and OECD nations, with a focus on only 19 countries and the European Union (EU). As a result, there is a need for new research to analyze the perspective of Malaysia.

Despite these challenges, the use of CSI processes has become increasingly necessary due to stakeholder demands, minimal business growth, and the failure of CSR to effectively address social and environmental issues (Mirvis et al., 2016). Consumers' preference for environmentally and socially responsible products has also influenced how businesses develop innovative new products, reinforcing the idea that CSI is essential for reducing environmental risks and promoting long-lasting social change (Auriac, 2010). By implementing CSI processes, businesses can improve their supply chains, recognize and cater to green consumers, and reduce the risks they face from environmental and social issues.

A more in-depth investigation of the concept is required to fully comprehend the possibilities of CSI in Malaysia. Previous study has highlighted the scarcity of empirical evidence on CSI as well as the field's heterogeneity, making it difficult to reach scholarly consensus (van der Have & Rubalcaba, 2016). Furthermore, the limitations of the social innovation index highlight the need for further research that particularly addresses the factors impacting CSI in Malaysia. Despite the obstacles of evaluating and implementing CSI, it is obvious that enterprises that focus on tackling social and environmental problems via innovation can gain a competitive edge while simultaneously contributing to constructive societal change. More research should concentrate on building a more complete understanding of the determinants of CSI in Malaysia, as well as investigating the possible advantages and disadvantages of applying CSI processes in various business scenarios.

Market orientation (MO)

While MO has been well researched in the literature, several opponents have highlighted questions regarding its implementation and effectiveness. In this literature review, we investigate the idea of MO, its theoretical foundations, empirical evidence, and previous investigations. Based on these sources, we then outline three objections to the concept of MO.

MO is founded on the premise that businesses should focus on their customers' wants and requirements and then utilize that information to create products and services that suit those needs. This idea has grown in importance in today's corporate environment, where client preferences and expectations are continually changing. MO has its theoretical roots in the work of Narver and Slater (2012), who stated that a market-oriented corporation focuses on creating higher customer value by integrating customer information into all elements of the organization. Customers are frequently focused on through competitor sensing, market sensing, customer connection, and customer service.

MO can result in a competitive advantage, according to empirical research. For instance, Fakhreddin et al. (2021) found that MO positively encourages product innovation, which results in higher financial success. MO affects customer loyalty and happiness, two key factors in determining a company's performance, according to Hernández-Linares et al. (2021). According to Alhakimi and Mahmoud (2020), MO improves a company's success in emerging markets. Despite these positive results, the idea of MO has come under fire. The first criticism is that MO is challenging to implement in daily life. MO requires a significant time, financial, and resource commitment and may not be feasible for all organizations, claims Bozpolat and Seyhan (2020). Additionally, gathering and evaluating consumer data can be complicated and time-consuming, making it challenging for businesses to adapt to changing customer preferences.

The second issue is that MO does not always translate into better performance. Market-oriented innovation can be a powerful instrument for building a competitive advantage, but it might not always be enough to deliver superior performance, claim Prifti and Alimehmeti (2017). Other factors, like operational effectiveness and cost control, may also determine a firm's performance. The third issue is that not all firms or situations may benefit from MO. MO may be less beneficial in businesses where client preferences are constant and predictable, claim Cheng and Chen (2017). In these cases, it may be preferable for businesses to concentrate on operational effectiveness and cost control. Additionally, buyers in emerging countries may have less disposable income and be less receptive to novel goods and services (Alhakimi & Mahmoud, 2020), making MO less effective.

Finally, MO is an essential idea in modern business philosophy that emphasizes the relevance of client requirements and aspirations. Empirical evidence supports the notion that MO can lead to a competitive advantage. However, there are some criticisms of the concept, such as implementation issues, potential constraints of market-oriented innovation, and the concept's applicability for all industries and situations. While MO is a strong tool for organizations seeking to remain competitive, it is critical to consider these concerns while implementing the concept.

Innovation Intention (II)

The idea of innovation intention is essential in the field of organizational behaviour and management because it encourages socialization and builds an innovative culture inside organizations. According to Hanifah et al. (2020), underlying ideas, values, and presuppositions that operate as behavioral cues, such as valuing creativity, risk-taking, independence, cooperation, and value-seeking, drive innovation intention. Furthermore, a creative culture develops respect and trust while responding fast to decisions. Management can employ corporate concepts that encourage experimentation, risk-taking, and collaboration to drive social innovation. When operational and organizational processes allow co-creation, social innovation is more likely to generate economic advantage in structurally democratic countries (Herrera, 2015).

To encourage innovation intention, it is critical to ensure that employees are linked with the broader strategy of the organization by having a clear purpose and vision. Employee participation in the innovation imperative, as well as internal comparisons of values, equity, and organizational contributions, are important indications of innovation intention. Employees in organizations with clear precise rules and instructions are more likely to respond promptly, especially when task demands alter (Hanifah et al., 2020).

The empirical study on innovation intentions that has been done is a further source of debate. Some studies have yielded contradictory findings, suggesting that there may be less of a connection between innovation intention and behavior than previously believed (Alshwayat et al., 2022). These results suggest that the idea of innovation intention might not be a reliable indicator of inventive behavior. The second issue is raised by past studies that looked into innovation intention. Numerous studies have focused on individuals' personal characteristics and cognitive abilities as they relate to innovation intention. Though some academics disagree (Jahanmir et al., 2020), they claim that innovation intention is a complicated phenomenon influenced by a range of psychological, organizational, and environmental factors. This criticism suggests that future research should investigate the idea of innovation intention in a more thorough manner.

Finally, innovation intention is a key idea in encouraging socialization and developing an innovative culture within organizations. However, the concept has been criticized in a number of areas, including its theoretical underpinning, empirical backing, and earlier research. To address these criticisms, research should investigate the concept of innovation intention and its relationship with innovation behavior in a more comprehensive manner.

Theoretical and hypotheses development

Market orientation influence corporate social innovation

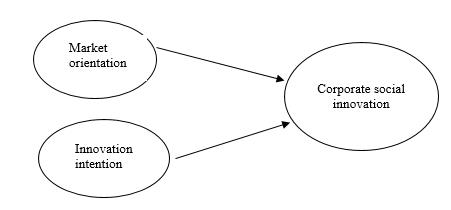

An increasing corpus of empirical evidence supports the concept that MO influences CSI. Alshanty and Emeagwali (2019) discovered a substantial relationship between MO and CSI. Their study suggests that companies with a stronger MO are more likely to engage in CSI activities. Secondly, Yang and Zheng (2022) found a positive correlation between proactive market approaches and innovation on social networks, indicating that companies with a stronger MO are more likely to engage in innovative activities related to social networks. Thirdly, Prifti and Alimehmeti (2017) investigated the separate effects of market-orientation aspects on innovation results and found that market-orientation factors had a beneficial impact on innovation outcomes. Based on the above empirical evidence, we can suggest the following hypothesis (figure 1):

H1: There is a positive relationship between MO and CSI.

Innovation intention influences corporate social innovation

Several studies have investigated the relationship between innovation intention and CSI. For example, Arachchi and Samarasinghe (2023) found an indirect relationship between purchase intention and corporate social responsibility (CSR), including CSI. Another study by Ratajczak and Szutowski (2016) found that innovation positively influences CSR, which in turn positively affects financial performance. Similarly, Bahta et al. (2021) found that CSR has positive effect innovation capability, which in turn positively affects customer loyalty. Based on these studies, we can suggest the following hypothesis:

H2: There is a positive relationship between II and CSI.

Research Methodology

This study's approach was quantitative in nature, with a cross-sectional survey design. The survey data was analyzed using IBM SPSS software for preliminary analysis, and the study model was tested using Partial Least Squares-Structural Equation Modelling (PLS-SEM). The PLS-SEM method was chosen because it does not necessitate the assumption of normalcy, which is frequently violated in survey research. After assessing the measurement model's validity and reliability, the structural model was used to test the hypotheses using the bootstrapping approach.

This study's sample selection criteria were based on a concentration of R&D organizations, and the survey was circulated to 171 of these organizations to obtain the necessary data using stratified random sampling. This study's research technique allowed for hypothesis testing and provided useful insights into the linkages between CSI, MO, and innovation intention in R&D organizations. Since 0.607 and 0.458 is less than 0.85, it can be concluded that there is discriminant validity between the scales measuring MO and II and CSI. As shown in Table 2, the instruments measure conceptually distinct constructs.

Findings

This study aims to examine the connection between MO, CSI, and innovation intention. The results show a significant relationship between innovation intention and CSI, suggesting that innovation should be incorporated into a company's mission, vision, or values. This supports past studies that found performance is influenced by innovation goals. In line with past studies that found insufficient evidence to support a connection between MO and innovation, the study also revealed no conclusive relationship between CSI and MO.

In order to inspire employees to act creatively and innovatively, organizations should concentrate on integrating innovation into their vision and values, according to the discovery that innovation intention has a significant impact on CSI. This is in line with the idea that innovative businesses have a higher success rate. By proving that organizations with a clear vision and goal are more likely to investigate problems and take preventative measures, Mai et al. (2019) further support this notion.

Contrarily, the study's finding that MO had no significant impact on CSI calls into question the idea that MO is necessary for innovation. The relationship between MO and innovation has been the subject of conflicting findings in prior study. Some scholars assert that there is no meaningful connection between MO and innovation, while others assert that MO has a more favorable impact on company innovation. The study by Sinimole and Saini (2021) supports the idea that MO is not very important in R&D organizations, as the focus in such organizations is on productivity rather than MO. This finding is also consistent with the idea that focusing too much on consumers' requirements may hinder innovation. Therefore, this study suggests that businesses should prioritize innovation by integrating it into their vision and values. The study's finding that there is no significant relationship between MO and CSI implies that MO may not be as important for innovation as previously thought. Future research could explore other factors that may impact CSI, such as organizational culture or leadership style.

Conclusion

This study looked at the relationship between a firm's II and MO in relation to the CSI from an RBV standpoint. Testing several hypotheses across a sample of 132 Malaysian R&D businesses helped us validate the model. From the analysis, not all hypotheses were supported. First, there is a connection between II and CSI. Our findings are consistent with the previous studies on the importance of the connection between II and CSI as shown in Table 1. It is widely acknowledged that II works to guarantee a company's continuous innovation performance by providing a clear organizational goal.

Secondly, our results indicate that MO has no significant impact on CSI performance as shown in Table 1. This result is unexpected in relation to our previous understanding of the role of MO on CSI. Our findings that MO plays no significant role in CSI are in line with earlier studies. There is an argument in the previous studies which argued MO is not very important in R&D organizations.

Future research

Future research should assess the integrated approach in more industries. Despite the fact that this study was carried out in Malaysia, further research can be done in other sectors in other underdeveloped or developed nations. Future research should assess the II, MO, and CSI integrated model in different industries.

References

Alhakimi, W., & Mahmoud, M. (2020). The impact of market orientation on innovativeness: evidence from Yemeni SMEs. Asia Pacific Journal of Innovation and Entrepreneurship, 14(1), 47-59. DOI:

Alshanty, A. M., & Emeagwali, O. L. (2019). Market-sensing capability, knowledge creation and innovation: The moderating role of entrepreneurial-orientation. Journal of Innovation & Knowledge, 4(3), 171–178. DOI:

Alshwayat, D., Elrehail, H., Shehadeh, E., Alsalhi, N., Shamout, M. D., & Rehman, S. U. (2022). An exploratory examination of the barriers to innovation and change as perceived by senior management. International Journal of Innovation Studies, 7(2), 159–170. DOI:

Amran, A., Yon, L. C., Kiumarsi, S., & Jaaffar, A. H. (2021). Intellectual human capital, corporate social innovation and sustainable development: a conceptual framework. International Journal of Innovation and Sustainable Development, 15(1), 75. DOI:

Arachchi, H. A. D. M., & Samarasinghe, G. D. (2023). Influence of corporate social responsibility and brand attitude on purchase intention. Spanish Journal of Marketing - ESIC, 27(3), 389-406. DOI:

Auriac, J. (2010). Corporate social innovation. OECD Observer, 279, 31–32.

Bahta, D., Yun, J., Islam, M. R., & Ashfaq, M. (2021). Corporate social responsibility, innovation capability and firm performance: evidence from SME. Social Responsibility Journal, 17(6), 840–860. DOI:

Benneworth, P., & Cunha, J. (2015). Universities' contributions to social innovation: reflections in theory & practice. European Journal of Innovation Management, 18(4), 508-527. DOI:

Bozpolat, C., & Seyhan, H. (2020). Impact of market orientation on innovation. Acikerisim.nevsehir.edu.tr. http://acikerisim.nevsehir.edu.tr/handle/20.500.11787/1739

Cheng, T.-Y. D. J., & Chen, C.-H. V. (2017). Does service innovation matter? An empirical study on market orientation and supply chain performance. South African Journal of Business Management, 48(1), 11-22. DOI:

Didonet, S. R., Díaz, G., & Machado, A. M. (2016). Market Orientation and Sources of Knowledge to Innovate in SMEs: A Firm Level Study. Journal of technology management & innovation, 11(3), 1-10. DOI:

Dionisio, M., & de Vargas, E. R. (2020). Corporate social innovation: A systematic literature review. International Business Review, 29(2), 101641. DOI:

Esen, A., & Eyiusta, C. M. (2019). Delineating the concept of corporate social innovation: toward a multidimensional model. International Journal of Entrepreneurship and Innovation Management, 23(1), 23. DOI:

Fakhreddin, F., Foroudi, P., & Rasouli Ghahroudi, M. (2021). The bidirectional complementarity between market orientation and launch proficiency affecting new product performance. Journal of Product & Brand Management, 30(6), 916-936. DOI:

Gibbs, A., & Hertzman, C. (2018). Improving child health equity: what has been learned from action on the social determinants of health? Future Child, 28(2), 1-19.

Hanifah, H., Halim, H. A., Ahmad, N. H., & Vafaei-zadeh, A. (2020). Emanating the key factors of innovation performance: leveraging on the innovation culture among SMEs in Malaysia, 13(4), 559–587.

Hernández-Linares, R., Kellermanns, F. W., & López-Fernández, M. C. (2021). Dynamic capabilities and SME performance: The moderating effect of market orientation. Journal of Small Business Management, 59(1), 162-195. DOI:

Herrera, M. E. B. (2015). Creating competitive advantage by institutionalizing corporate social innovation. Journal of Business Research, 68(7), 1468-1474. DOI:

Jahanmir, S. F., Silva, G. M., Gomes, P. J., & Gonçalves, H. M. (2020). Determinants of users' continuance intention toward digital innovations: Are late adopters different? Journal of Business Research, 115, 225-233. DOI:

Jayakumar, T. (2017). Corporate social innovation: an Indian moving company drives industry change. Journal of Business Strategy, 38(6), 59-68. DOI:

Kanter, R. M. (2012). How Great Companies Think Differently? NHRD Network Journal, 5(1), 1–12. DOI:

Mahmoud, M. A., Blankson, C., & Hinson, R. E. (2017). Market orientation and corporate social responsibility: towards an integrated conceptual framework. International Journal of Corporate Social Responsibility, 2(1). DOI:

Mai, A. N., Vu, H. V., Bui, B. X., & Tran, T. Q. (2019). The lasting effects of innovation on firm profitability: panel evidence from a transitional economy. Economic Research-Ekonomska Istraživanja, 32(1), 3417-3436. DOI:

Mihci, H. (2020). Is measuring social innovation a mission impossible? Innovation: The European Journal of Social Science Research, 33(3), 337-367. DOI:

Mirvis, P., Herrera, M. E. B., Googins, B., & Albareda, L. (2016). Corporate social innovation: How firms learn to innovate for the greater good. Journal of Business Research, 69(11), 5014-5021. DOI:

Mustapha, N. D., Jali, M. N., & Muhamad, N. (2021). An Overview of Corporate Social Innovation (CSI). International Journal of Academic Research in Business and Social Sciences, 11(7). DOI:

Narver, J., & Slater, P. (2012). Market Orientation Effect on Business Orientation. Marketing Journal, 6(3), 67-72.

Păunescu, C. (2013). Towards a Conceptualization of Social Entrepreneurship in Higher Education. https://www.econstor.eu/handle/10419/97880

Prifti, R., & Alimehmeti, G. (2017). Market orientation, innovation, and firm performance—an analysis of Albanian firms. Journal of Innovation and Entrepreneurship, 6(1). DOI: 10.1186/s13731-017-0069-9

Ratajczak, P., & Szutowski, D. (2016). Exploring the relationship between CSR and innovation. Sustainability Accounting, Management and Policy Journal, 7(2), 295–318. DOI:

Sinimole, K. R., & Saini, K. M. (2021). Performance evaluation of R&D organisations: an Asian perspective. International Journal of the Economics of Business, 28(2), 179-196. DOI:

van der Have, R. P., & Rubalcaba, L. (2016). Social innovation research: An emerging area of innovation studies? Research Policy, 45(9), 1923-1935. DOI:

Yang, Y., & Zheng, X. (2022). Stimulating Brand Innovation Strategy via Knowledge Acquisition, Market Orientation, and Strategic Capability Using Social Media Within China's Online Technology Industry. Frontiers in Psychology, 13. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Karim, M. N. A., Yasin, I. M., & Latiff, A. R. A. (2024). Environment Social Governance Investing and Firm Performance in Telecommunication Industry. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 1-10). European Publisher. https://doi.org/10.15405/epsbs.2024.05.1