Abstract

This study delves into the critical interplay between Management Accounting Systems (MASs) and Blockchain Technology (BT) in the context of SMEs in Iraq, with a specific focus on how these elements can collectively augment Sustainable Financial Reporting (SFR). SMEs represent a significant portion of Iraq's economic landscape, and their financial transparency is crucial for economic growth and investor confidence. To investigate this intricate relationship, the study gathered data from 580 Iraqi SMEs employing a comprehensive questionnaire. Employing the Partial Least Squares Structural Equation Modeling (PLS-SEM) approach, the study meticulously analyzed the connections between MAS, BT, and SFR. Additionally, it explored the mediating role of BT in the relationship between MAS and SFR. The findings of this research uncover the substantial potential for enhancing SFR within SMEs by integrating effective MASs and BT. This discovery carries profound implications for policymakers, emphasizing the importance of creating a supportive ecosystem to facilitate the seamless adoption of these technologies within the SME sector. Furthermore, the study extends its significance by providing actionable insights for SMEs in Iraq, enabling them to navigate the complex landscape of financial reporting more effectively. As a call to action, the article urges future research endeavors to further explore and expand upon the evolving role of emerging technologies, like blockchain, in advancing SFR practices among SMEs. In doing so, it contributes to the broader body of knowledge surrounding the dynamic relationship between technology and sustainable financial reporting in the context of SMEs.

Keywords: Blockchain Technology, Management Accounting Systems, PLS-SEM, Sustainable Financial Reporting, SMEs, Smart-PLS 4

Introduction

SMEs (Small and medium-sized enterprises) are the backbone of the Iraqi economy, contributing to economic growth and job creation (Bapir, 2023). However, these businesses face numerous challenges, including limited access to finance and a lack of transparency and accountability in financial reporting (ALasdy & Mahmoud, 2019). To overcome these challenges, SMEs in Iraq need to adopt sustainable financial reporting practices that promote transparency, accountability, and long-term viability. The absence of transparent financial reporting practices hinders Iraqi SMEs' ability to attract investment, secure credit, and form partnerships (Ahmad et al., 2021). Through investigating the influence of blockchain technology on the adoption of sustainable financial reporting practices, this study seeks to offer insights into the role of blockchain technology in promoting transparency and accountability (Joshi et al., 2021). Additionally, understanding how sustainable financial reporting practices impact work motivation and overall performance can shed light on the potential benefits for SMEs, motivating them to embrace these practices (Stubbs & Higgins, 2018).

Sustainable financial reporting practices are critical for SMEs because they provide stakeholders with information about the financial performance and sustainability of the business (Baah et al., 2021). This information can be used to make informed decisions about investing in the business, providing credit, or entering into partnerships (Lee & Shin, 2018). By adopting sustainable financial reporting practices, SMEs in Iraq can improve their reputation and credibility, which can lead to increased access to finance and opportunities for growth.

The primary objective of this research is to examine the correlation between management accounting systems and sustainable financial reporting in SMEs in Iraq. The study specifically investigates the mediating role of blockchain technology in this relationship. The research holds significance due to the urgent need for Iraqi SMEs to adopt sustainable financial reporting practices, which can contribute to enhanced transparency, accountability, and long-term viability of these businesses (Al-Wattar et al., 2019). Additionally, the study recognizes the potential of blockchain technology to improve the accuracy, reliability, and security of financial reporting data, ultimately enhancing the quality of financial reporting and facilitating SMEs' access to financing (Saleh et al., 2023).

The use of blockchain technology as a mediator in enhancing sustainable financial reporting is particularly significant in Iraq because it can address some of the challenges faced by SMEs in the country (Ronaghi & Mosakhani, 2022). Blockchain technology provides a secure and transparent platform for recording and sharing financial data, which can improve the accuracy and reliability of financial reporting (Anwar et al., 2019). Additionally, blockchain technology can reduce the cost and time associated with traditional financial reporting methods. This can be particularly beneficial for SMEs with limited resources, it has increasingly been recognized for its potential in enhancing transparency and trust in various industries, including finance and accounting (Soni et al., 2022).

In the context of sustainable financial reporting in Iraqi SMEs, blockchain technology can serve as a mediator in improving the reliability and accuracy of financial reporting data. By providing a secure and transparent platform for recording financial transactions, blockchain technology can help to prevent data manipulation or falsification, which can be a significant challenge in traditional financial reporting systems (Yu et al., 2018).

Besides, blockchain technology can enable real-time access to financial data, which can enhance the speed and efficiency of financial reporting processes (Handoko et al., 2022). This can be especially beneficial for Iraqi SMEs, which often face limited resources and expertise in financial reporting. Another potential benefit of blockchain technology in financial reporting is the ability to streamline auditing processes. Blockchain-enabled financial reporting can facilitate real-time auditing, which can reduce the time and cost associated with traditional auditing methods (Hossain, 2023).

However, there are also challenges and limitations to the use of blockchain technology in financial reporting, including the need for specialized technical expertise, the potential for data privacy breaches, and the risk of data loss or corruption (Dyball & Seethamraju, 2022).

The upcoming section of the paper will examine the existing literature, present a theoretical framework, and research hypothesis. The paper will also discuss the methodology used for data analysis and present the findings. Finally, the conclusion will summarize the paper and recognize its limitations, while also suggesting several areas for future research.

Literature Review

Management Accounting System (MAS)

The management accounting system (MAS) plays a crucial role in business management as it provides decision-making information, performance evaluation, and planning and control of resources (Mohammed et al., 2022b). The literature emphasizes the importance of integrating financial and non-financial information, aligning organizational goals with individual objectives, and utilizing a bundle of practices (Endenich & Trapp, 2020). However, Iraqi SMEs face significant challenges in implementing management accounting systems, such as a lack of awareness of the benefits, resources, and skilled labour (Mohammed et al., 2022a). Future research should identify the specific challenges facing Iraqi SMEs and develop strategies to overcome them.

Al-Baghdadi et al. (2021) argue that management accounting systems have evolved to encompass both financial and non-financial indicators, such as customer and employee satisfaction and environmental sustainability, driven by changes in the business environment. Additionally, Suarez (2022) suggest that management accounting systems can be viewed as a bundle of practices, including budgeting, performance measurement, and cost management, whose coherence and alignment affect their effectiveness.

Iraqi SMEs encounter obstacles in implementing cost management practices, such as a lack of skilled labour, access to technology, and awareness of the benefits, according to Qader et al. (2022). Cost management practices are vital to the survival and growth of Iraqi SMEs. Moreover, Al-Hattami et al. (2021) highlight that performance measurement practices are also essential for the success of Iraqi SMEs, providing feedback on business strategy effectiveness. However, these practices face similar challenges, such as a lack of skilled labour, financial resources, and awareness of their benefits.

Sustainable Financial Report (SFR)

Sustainable financial reporting has become an important issue for businesses, as stakeholders demand greater transparency and accountability for the social and environmental impacts of their operations (Markota Vukić et al., 2018). The literature on sustainable financial reporting emphasizes the importance of integrating financial and non-financial information, aligning organizational goals with sustainability objectives, and utilizing a variety of reporting tools (Cosma et al., 2022).

Borodin et al. (2019), sustainable financial reporting involves the disclosure of environmental and social performance information in addition to financial performance information. This type of reporting is important because it enables stakeholders to assess the sustainability of a company's operations and its impact on society and the environment. Additionally, Stocker et al. (2020) argued that sustainability reporting can help companies to identify areas where they can improve their sustainability performance and communicate their efforts to stakeholders.

In the context of Iraqi SMEs, sustainable financial reporting is still a developing area. However, some studies have examined the challenges faced by Iraqi SMEs in implementing sustainable financial reporting. Mohammed et al. (2022a) found that Iraqi SMEs face several challenges in implementing sustainable financial reporting, including a lack of awareness of the importance of sustainability reporting, a lack of resources, and a lack of regulatory frameworks. The authors suggested that training programs and government support could help to overcome these challenges.

Additionally, Salameh et al. (2022) examined the extent of sustainable financial reporting in Jordanian and Iraqi SMEs. The authors found that Jordanian SMEs had a higher level of sustainable financial reporting than Iraqi SMEs. The authors suggested that the low level of sustainable financial reporting in Iraqi SMEs could be due to a lack of awareness of the importance of sustainability reporting and a lack of resources. Sustainable financial reporting is still a developing area, and several challenges need to be addressed (Stubbs & Higgins, 2018). Thus, with the right support and resources, Iraqi SMEs could benefit from implementing sustainable financial reporting practices.

Blockchain Technology (BT)

The utilization of Blockchain technology (BT) has the potential to play a significant role in enhancing sustainable financial reporting among SMEs of developing countries, especially in Iraq (Mohammed et al., 2022a). As a decentralized and distributed ledger, BT can offer a secure and transparent platform for financial reporting data, which can prevent the manipulation or falsification of data (Joshi et al., 2021). Furthermore, it can promote real-time access to financial data, which can enhance the speed and efficiency of financial reporting processes (Borhani et al., 2021). Consequently, BT can help to streamline financial reporting procedures, which can reduce the time and cost associated with traditional reporting approaches (Bakarich et al., 2020). SMEs can leverage BT to enable real-time reporting and data analysis, which enables quick identification and resolution of financial issues and supports informed business decisions.

Nevertheless, the use of BT in financial reporting presents some challenges. One of the major obstacles is the lack of regulatory frameworks and standardization of blockchain-based financial reporting (Hossain, 2023). This makes it difficult for SMEs to comply with regulatory requirements and for investors to compare financial information across different companies. Furthermore, the technical complexity of BT can make it challenging for SMEs to implement and use effectively (Schletz et al., 2020). Additionally, the costs related to BT may be prohibitive for some SMEs, particularly those with limited financial resources (Sekabira et al., 2023).

BT as Mediator Role Between MAS and SFR

BT has the potential to act as a mediator between MAS and SFR. By offering a secure and transparent method for recording financial transactions and exchanging information BT can facilitate the integration of MAS and SFR (Al-Zaqeba et al., 2022). This technology provides a reliable platform that ensures the accuracy and transparency of financial data, contributing to the seamless alignment between MAS and SFR. For example, BT provides a decentralized, transparent, and tamper-proof system that can help ensure the accuracy and transparency of financial transactions (Ahmad et al., 2021). By using BT, organizations can create a permanent record of financial data that is immutable and can be easily audited. Besides, BT can provide real-time information on financial transactions, which can help organizations make informed decisions about their sustainability performance (Ibrahim et al., 2023; Park & Li, 2021). This can help organizations to identify areas where they can improve their sustainability performance and make data-driven decisions about their future business operations.

A smart contract, on the other hand, is a self-executing contract in which the conditions of the agreement between the buyer and seller are directly encoded into lines of code (Nanayakkara et al., 2019). BT may facilitate the implementation of smart contracts. Smart contracts may be used to streamline processes, save costs, and boost MAS effectiveness (Dal Mas et al., 2020). By doing away with intermediaries like banks and other financial organisations, BT can also lower transaction costs. As a result, businesses may be able to cut back on transaction costs and other related costs (Sekabira et al., 2023). BT may also boost the security of financial transactions by encrypting and securing data using cryptography. This can aid businesses in lowering the risk of fraud and other types of financial crime (Joshi et al., 2021).

Therefore, by providing a secure and transparent platform for recording financial transactions and sharing information, BT can facilitate the integration of MAS and SFR. This can help organizations to improve their sustainability performance and make informed decisions about their future business operations.

Research Model and Hypotheses

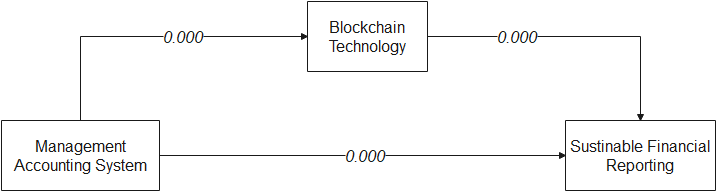

Figure 1 presents the conceptual framework positive relationships that encompass the constructs of management accounting system (MAS), sustainable financial reporting (SFR) and blockchain technology (BT).

MAS that provides accurate and timely information on sustainability-related costs, risks, and opportunities can help organizations make more informed decisions and take actions that enhance their sustainability performance (Mohammed et al., 2022b). By using such information, organizations can also better track and report their sustainability performance and outcomes, leading to more transparent and reliable sustainable financial reporting (Cosma et al., 2022).

The public disclosure of sustainability-related information can create pressure on organizations to improve their SFR. In response, organizations may invest in more sophisticated MAS that allow them to track and report on sustainability-related costs, risks, and opportunities more accurately and effectively (Endenich & Trapp, 2020).

The design and implementation of a management accounting system can affect an organization's sustainability performance and reporting, but SFR can also provide feedback that informs the design and refinement of the MAS (Sekabira et al., 2023). Therefore, the first hypothesis posits:

H1. Management accounting system has a significant positive influence on sustainable financial reporting.

BT can enhance the transparency, reliability, and security of SFR by providing a tamper-proof and decentralized platform for recording and verifying sustainability-related transactions and information (Joshi et al., 2021). Furthermore, BT can also improve the efficiency and accuracy of the MAS by automating data collection and analysis processes, reducing the potential for errors and biases, and enabling real-time reporting (Al-Zaqeba et al., 2022).

BT can increase the traceability and auditability of sustainability-related data and information, making it easier for internal and external stakeholders to monitor and verify an organization's sustainability performance and reporting (Borodin et al., 2019). By providing a transparent and trustworthy platform for managing sustainability-related data and information, BT can also enhance stakeholder confidence and trust in an organization's sustainability reporting (Schletz et al., 2020).

The implementation of BT may require significant investments in terms of time, resources, and skills, which may not be feasible or desirable for all organizations, especially SMEs (Papathanasiou et al., 2020). Moreover, the impact of BT on SFR may depend on the industry-specific regulations and standards, stakeholder expectations, and other external factors that influence an organization's SFR (Türegün, 2019). Therefore, the second hypothesis posits:

H2. Blockchain technology mediates the relationship between management accounting system and sustainable financial reporting.

Research Methodology

Sample and Design

A quantitative approach was adopted in this study, and a survey was used to collect responses from SMEs in Iraq. Data for this research was gathered from a sample of 580 SMEs in Iraq. As indicated by Afthanorhan et al. (2021), a sample size of at least 200 firms is considered acceptable when employing the PLS-SEM Path Model. The sample have been selected using a purposive sampling technique, with a focus on SMEs operating in the Iraqi context. The sample size have been determined using the minimum sample size required for statistical significance, with a confidence level of 95% and a margin of error of 5%. Data was collected through the questionnaire have been analyzed using Smart-PLS software. Smart-PLS is a statistical software package that is specifically designed for structural equation modelling (SEM), which is a commonly used statistical technique for testing hypotheses in quantitative research.

The researchers collected data for this study by randomly distributing questionnaires among 790 high-level managers and department leaders in Iraqi SMEs. The email addresses of the respondents were obtained through coordination between the Iraqi Ministry of Planning (IMP) and the Training and Development (TD) departments of these companies. The authors applied filtering techniques to ensure that only managers filled out the questionnaire, excluding employees and workers. Out of the 760 managers who responded, eight questionnaires were excluded due to incomplete responses, resulting in a final dataset of 752 respondents. This represents a response rate of over 95.18% of the total questionnaires distributed, which is considered acceptable in quantitative research (Makel et al., 2021).

To mitigate issues of bias and subjectivity, the study used confidential information and employed a Likert scale, which consists of five response options ranging from "Strongly Disagree" to "Strongly Agree" (Weijters et al., 2021). Data collection took place between March 24th and May 1st, 2023. The sample included 74% (558) males and 26% (194) females. Among the respondents, 12% were single, 60% were married with children, and 28% were married without children. The age of the participants ranged from 32 to 60 years, with an average age of 46 years. In terms of educational levels, 22% had a diploma, 68% had a bachelor's degree, and 10% had a master or PhD (Afthanorhan et al., 2021; Makel et al., 2021; Weijters et al., 2021). Please see Table 1.

Measurement

The effectiveness of the MAS in any organization is often measured through four main elements: scope, timeline, integration, and aggregation (Mohammed et al., 2022b). These elements assist organizations in gathering, organizing, analyzing, and storing basic data or information from other subsidiary information systems in the facility for the purpose of producing financial or non-financial information that helps management in planning, controlling, and decision-making (Rashedi & Dargahi, 2019). Therefore, the literature putted 14 questions (items) to develop them (Pedroso & Gomes, 2020).

The quality and sustainability of financial reports are measured through several essential elements, including assets, profits, liabilities, costs, equity, and revenues (Salameh et al., 2022). Multiple factors, including market fluctuations, inflation, production expenses, and market competition, influence these components (Stocker et al., 2020). These elements are essential for investors, managers, and financial analysts to understand a company's performance and make appropriate investment decisions. Thus, this study therefore considered these main elements in the questionnaire and organized 13 questions (items) for improve them (Tran et al., 2021)

The literature on BT identifies six elements for measuring this technology, such as transparency, decentralization, tracing, authentication, security, and unchangeability. BT can help to address issues such as fraud, error, and data manipulation by providing a transparent and immutable record of financial transactions (Dal Mas et al., 2020). This can help to improve the quality and reliability of financial reports, while also reducing the risk of fraud and enhancing investor confidence. Additionally, BT can facilitate real-time reporting by allowing for the instantaneous recording and sharing of financial data across a decentralized network (Park & Li, 2021). This can provide more up-to-date information to stakeholders and enable more timely decision-making. Thus, this study therefore, considered these six main elements for BT and developed 14 questions (items) to develop them (Philsoophian et al., 2022). To ensure the accuracy and clarity of the questionnaire, its credibility and reliability were evaluated by a panel of seven experts. Among the experts, five specialized in the research field, while the remaining two were language and grammar experts. This meticulous assessment aimed to effectively convey the intended meaning to the respondents.

Research Analysis and Results

The data collected in this study were analyzed using the Smart-PLS 4.0 software, which applies the Partial Least Squares (PLS) technique (Mia et al., 2022). Smart-PLS is a software tool commonly used for Structural Equation Modeling (SEM), which is a statistical technique utilized to analyze intricate relationships between variables (Memon et al., 2021). It is particularly useful for researchers working with non-normal data or small sample sizes (Abu Talib et al., 2022). Smart-PLS employs the PLS algorithm, a type of SEM, to analyze the data.

In the analysis process using Smart-PLS, several steps are followed. Firstly, the measurement model's reliability and validity need to be ensured. This involves assessing factors such as factor loadings, convergent validity, and discriminant validity (Abu Talib et al., 2022; Memon et al., 2021). Once the measurement model is validated, the subsequent step is to analyze the structural model. This includes examining the path coefficients, which represent the relationships between variables in the model, and assessing the significance of these relationships (Mia et al., 2022). Additionally, it is important to explore potential moderation and mediation effects in the model. Situations where the strength or direction of a relationship between two variables is influenced by a third variable are referred to as moderation (Al Halbusi et al., 2021). Conversely, when the relationship between two variables is explained by a third variable, it is known as mediation (Sarstedt et al., 2020). Therefore, Smart-PLS proves to be a robust tool for analyzing complex relationships between variables, enabling researchers to gain insights into the relationships within their data and test hypotheses about these relationships.

Measurement model

Before testing hypotheses in the structural model, it is crucial to establish the construct validity of the measurement model, which encompasses the connections among the latent variables and their indicators. Ensuring that the indicators accurately reflect their underlying constructs (latent variables) is imperative for construct validity. In order to achieve this, adequate convergent and discriminant validity must be demonstrated by the items in the measurement model. To evaluate convergent validity, factor loadings, composite reliability, and average variance extracted (AVE) were utilized in accordance with the recommendation of Abu Talib et al. (2022). All items included in the model, along with their corresponding indicator loadings/weights, reliabilities, and AVE, as shown in Table 1.

Table 2 presents the results of a reflective measurement model used to assess three constructs: Management Accounting System, Blockchain Technology, and Sustainable Financial Reporting. The measurement of each construct involves multiple items (MAS1-MAS14, BT1-BT14, and SFR1-SFR13). The table presents the factor loading, composite reliability (CR), and average variance extracted (AVE) for each item.

Factor loading signifies the correlation between the construct and the specific items employed to measure it. As outlined by Johani et al. (2021), a factor loading of 0.6 or higher is considered significant for a well-established item. In this table, all the items exhibit factor loadings surpassing 0.65, indicating a robust relationship between the construct and the respective items.

Composite reliability (CR) measures the internal consistency of the items used to measure the construct. In quantitative studies, values of CR above 0.70 is acceptable, while in more advanced stage the value have to be higher than 0.70 (Hair et al., 2021). However, the values that are more than 0.95 is deemed not desirable because this indicate "it is measuring the same phenomenon, thus likely to be invalid measure of the construct" In this table, all constructs have a CR above 0.95, indicating a high level of internal consistency.

Average variance extracted (AVE) measures the amount of variance in the construct captured by the items used to measure it. According to Afthanorhan (2013), an AVE of at least 0.50 is highly recommended. That been said, an AVE less than 0.50 means your items explain more errors than the variance in your constructs. In this table, all constructs have an AVE above 0.58, indicating that the items used to measure the construct are explaining more than half of the variance in the construct. Therefore, the results of this reflective measurement model suggest that the items used to measure the constructs MAS, BT and SFR are reliable and valid measures of these constructs.

The correlation matrix between the study's latent variables, as well as the findings of the discriminant validity analysis based on Smart-PLS, are displayed in Table 3. The diagonal elements of the matrix represent the square roots of the average variance extracted (AVE) for each construct. These values indicate the proportion of variation in each construct that is captured by its measured indicators (Johani et al., 2021). According to Hair et al. (2021), the AVEs for individual constructs should be greater than the correlation coefficients for all the constructs. Discriminant validity is achieved when the bolded diagonal value in the matrix is higher than the values in its respective row and column. This indicates that the constructs are distinct and can be accurately evaluated without overlap.

More specifically, the table shows that the square root of the AVE for MAS (0.836) in its area is higher than the correlation coefficients between BT and SFR (0.762 and 0.752). Similarly, the square root of the AVE for BT (0.785) in its area is higher than the correlation coefficients between MAS and SFR (0.762 and 0.681). Finally, the square root of the AVE for SFR (0.783) in its area is higher than the correlation coefficients between BT and MAS (0.681 and 0.752).

Structural model

The structural model includes the assumed relationship between the external and internal variables in the proposed model. According to Streukens and Leroi-Werelds (2016), the structural model can be determined through certain statistical values, including T-values, P-values, as well as the original sample and standard deviation. These values are used to determine the indirect and total effects of the hypotheses, which will be discussed in the following steps.

Table 4 represents the results of a statistical analysis that investigates the relationships between three variables which are MAS, BT, and SFR through Smart-PLS. Specifically, the table shows the strength and statistical significance of the relationships between two of these variables at a time through T and P values. The T-values and P-values provide information about the statistical significance of the path coefficients. A high T-value means that the path coefficient is statistically significant, indicating that there is a strong relationship between the variables (Johani et al., 2021). A low P-value means that the path coefficient is statistically significant, indicating that there is a low probability that the relationship between the variables is due to random chance (Afthanorhan, 2013).

In this table, we can see all of the T-values are high, indicating strong relationships between the variables, and all of the P-values are 0, indicating that there is a very low probability that the relationships are due to random chance. Thus, this table provides information about the relationships between these variables and suggests that there are statistically significant and meaningful relationships between MAS, BT, and SFR.

Table 5 shows the R-Square () values for two endogenous latent variables, which are BT and SFR.is a statistical measure that indicates the proportion of variance in the dependent variable that can be explained by the independent variables in the model. Chin (1998) suggested that when the value ofis higher than 0.67, the latent variable is considered to have a high effect. When the value ofis between 0.33 and 0.67, the dependent variable has a medium effect. Additionally, when thevalue is between 0.19 and 0.33, it is considered weak, and anyvalue less than 0.19 is considered unacceptable. In this table, thevalues for BT and SFR are 0.699 and 0.574, respectively. This means that 69.9% of the variance in BT and 57.4% of the variance in SFR can be explained by the independent variables in the model. Therefore, the results indicating that the effect size of BT on the endogenous latent variable is high, while the effect size of SFR is medium. This suggests that BT has a stronger effect on the endogenous latent variable than SFR.

Table 6 is about a hypothesis (H1) that suggests that the MAS has a positive effect on SFR. The researchers wanted to test if this hypothesis is true or not.

To do this, they collected data from different samples and calculated the indirect effect of the MAS on SFR. The indirect effect refers to the impact that the MAS has on sustainable financial reporting through some other factor.

In this case, the researchers found that the indirect effect of the MAS on SFR was 0.505 and the P-value was 0. This means that the MAS has a positive relationship with SFR. They then compared this indirect effect to the expected effect under the null hypothesis (i.e., the hypothesis that there is no relationship between the management accounting system and sustainable financial reporting). They found that the observed effect was much higher than the expected effect.

Based on this analysis, the researchers concluded that the hypothesis (H1) was supported. In other words, they found evidence that the management accounting system has a positive effect on sustainable financial reporting.

*Path A= Original sample of Management Accounting System -> Blockchain Technology

*Path B= Original sample of Blockchain Technology -> Sustainable Financial Reporting

*LL= Lower Level, UL= Upper Level

Table 7 presents the findings of a statistical analysis that focused on testing hypothesis H2, which posits that BT mediates the relationship between the MAS and SFR.

Analysis used a mediation model to estimate the direct effect of MAS on BT (Path A), the direct effect of BT on SFR (Path B), and the indirect effect of MAS on SFR through BT (The Indirect Effect). The standard deviation column shows the variability in the estimate of the indirect effect. The t-value in the "T value" column measures the significance of the indirect effect, with larger values indicating greater statistical significance (Al Halbusi et al., 2021). The "95% LL" and "95% UL" columns show the lower and upper bounds of the 95% confidence interval of the effect, respectively (Sarstedt et al., 2020).

Therefore, we conclude the hypothesis (H2) is supported because the indirect effect is statistically significant (T value of 14.026), and the confidence interval does not include zero. This means that there is evidence to suggest that the relationship between MAS and SFR is partially mediated by BT.

Discussion

The results of this study provide light on how MAS and BT might improve SFR in Iraqi SMEs. The study specifically attempts to look into the interaction between MAS, BT, and SFR as well as the mediating role that BT plays in this relationship.

The extent to which MASs are employed by Iraqi SMEs and their effect on SFR are revealed via the analysis of the data gathered through the questionnaire and the application of the PLS-SEM technique. Additionally, how much BT Iraqi SMEs use and how that affects SFR. Additionally, these results examined the mediating role of BT in the association between MAS and SFR and company size.

The findings of this study interpreted in relation to the research objectives , to provide a comprehensive understanding of the role of MASs and BT in enhancing SFR in Iraqi SMEs. The findings found that the study aims to contribute to the development of best practices and guidelines for the use of MASs and BT in SFR in SMEs, and to provide insights into the challenges and opportunities for the adoption of these technologies in the Iraqi context, and this is what we covered in the next section.

Research implications

The findings of this study have several implications for practice and policy in Iraqi SMEs and management accounting in general. First, the study highlights the importance of MASs in enhancing SFR in SMEs. It suggests that SMEs in Iraq need to adopt effective MASs that align with their business strategies to achieve financial reporting practices. Second, the study reveals that BT can play a crucial role in enhancing SFR in Iraqi SMEs. The findings suggest that the use of BT can increase transparency, accountability, and trust in financial reporting, thereby improving the financial performance and sustainability of SMEs.

Third, the study encourages that policymakers in Iraq should create an enabling environment for the adoption of MASs and BT in SMEs. This could include providing financial and technical support to SMEs to facilitate the implementation of these technologies and creating regulatory frameworks that promote the use of transparent and reliable financial reporting practices. Finally, the study suggests that the findings can be generalized to other contexts beyond Iraq, particularly in developing countries where SMEs face similar challenges in adopting effective MASs and financial reporting practices. Thus, the findings of this study have practical implications for SMEs in Iraq and can provide guidance for policymakers and practitioners in enhancing sustainable financial reporting practices through the adoption of management accounting systems and blockchain technology.

Research Recommendations

Based on the findings of this study, there are several recommendations for future research in this area: First, investigating the role of other emerging technologies, such as artificial intelligence and big data analytics, in enhancing SFR practices in SMEs. Second, exploring the potential challenges and barriers that SMEs in Iraq may face in adopting MASs and BT. Third, conducting a comparative study of the adoption and impact of MASs and BT on SFR practices in SMEs across different countries and regions.

Fourth, examining the relationship between the adoption of MASs and BT and other organizational outcomes, such as innovation, competitiveness, and profitability. Finally, conducting longitudinal studies to assess the long-term impact of MASs and BT on SFR practices and SMEs' financial performance. Accordingly, these recommendations can help to expand the existing literature on the role of MASs and emerging technologies in enhancing SFR practices in SMEs, and provide insights for policymakers, practitioners, and researchers to improve the financial performance and sustainability of SMEs.

Conclusion

This paper examines the role of management accounting systems in enhancing sustainable financial reporting in Iraqi SMEs, using blockchain technology as a mediator. The importance of sustainable financial reporting for SMEs in the current economic climate of Iraq is highlighted, and the potential benefits of blockchain technology in enhancing financial reporting practices are discussed. Key terms and concepts related to management accounting, sustainable financial reporting, and blockchain technology are defined, and the research methodology used in the study, including the research design, data collection methods, and data analysis techniques, are described. The findings of the study are interpreted and related to the research objectives and questions, and the implications of the findings for practice and policy in Iraqi SMEs and management accounting in general are discussed. Recommendations for future research in this area are also provided. Overall, this study is important in promoting the adoption of sustainable financial reporting practices and emerging technologies in SMEs, which could lead to increased competitiveness, profitability, and sustainability in the long run.

References

Abu Talib, A. A., Muhamad Ariff, N. R., Hasim, M. S., & Hanafiah, M. H. (2022). Sustainable Facilities Management (SFM) initiatives in Malaysia hotel industry: reliability and validity analysis using Smart-PLS. IOP Conference Series: Earth and Environmental Science, 1067(1), 012079. https://doi.org/10.1088/1755-1315/1067/1/012079

Afthanorhan, A., Awang, Z., Aimran, N., & Arifin, J. (2021). An Extensive Comparison Between CBSEM and Consistent PLS-SEM On Producing the Estimates of Construct Correlation in Applied Research. Journal of Physics: Conference Series, 1874(1), 012083. https://doi.org/10.1088/1742-6596/1874/1/012083

Afthanorhan, W. M. A. B. W. (2013). A comparison of partial least square structural equation modeling (PLS-SEM) and covariance based structural equation modeling (CB-SEM) for confirmatory factor analysis. International Journal of Engineering Science and Innovative Technology, 2(5), 198-205.

Ahmad, R. W., Salah, K., Jayaraman, R., Yaqoob, I., Ellahham, S., & Omar, M. (2021). The role of blockchain technology in telehealth and telemedicine. International Journal of Medical Informatics, 148, 104399. https://doi.org/10.1016/j.ijmedinf.2021.104399

Al Halbusi, H., Williams, K. A., Ramayah, T., Aldieri, L., & Vinci, C. P. (2021). Linking ethical leadership and ethical climate to employees' ethical behavior: the moderating role of person-organization fit. Personnel Review, 50(1), 159-185. https://doi.org/10.1108/pr-09-2019-0522

ALasdy, S. M. H., & Mahmoud, B. I. (2019). The Implications of the Shift towards Standard Financial Reporting Specialist for Small and Medium-Sized Companies to Attract Foreign Investment in the Iraqi Environment. OALib, 06(02), 1-21.

Al-Baghdadi, E. N., Alrub, A. A., & Rjoub, H. (2021). Sustainable Business Model and Corporate Performance: The Mediating Role of Sustainable Orientation and Management Accounting Control in the United Arab Emirates. Sustainability, 13(16), 8947. https://doi.org/10.3390/su13168947

Al-Hattami, H. M., Hashed, A. A., & Kabra, J. D. (2021). Effect of AIS success on performance measures of SMEs: evidence from Yemen. International Journal of Business Information Systems, 36(1), 144-164. https://doi.org/10.1504/IJBIS.2021.112399

Al-Wattar, Y. M. A., Almagtome, A. H., & Al-Shafeay, K. M. (2019). The role of integrating hotel sustainability reporting practices into an Accounting Information System to enhance Hotel Financial Performance: Evidence from Iraq. African Journal of Hospitality, Tourism and Leisure, 8(5), 1-16.

Al-Zaqeba, M. A. A., Jarah, B. A. F., Ineizeh, N. I., Almatarneh, Z., & Jarrah, M. A. A. (2022). The effect of management accounting and blockchain technology characteristics on supply chains efficiency. Uncertain Supply Chain Management, 10(3), 973-982. https://doi.org/10.5267/j.uscm.2022.2.016

Anwar, S., Shukla, V. K., Rao, S. S., Sharma, B. K., & Sharma, P. (2019). Framework for Financial Auditing Process Through Blockchain Technology, using Identity Based Cryptography. 2019 Sixth HCT Information Technology Trends (ITT). https://doi.org/10.1109/itt48889.2019.9075120

Baah, C., Opoku-Agyeman, D., Acquah, I. S. K., Agyabeng-Mensah, Y., Afum, E., Faibil, D., & Abdoulaye, F. A. M. (2021). Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: Evidence from manufacturing SMEs. Sustainable Production and Consumption, 27, 100-114. https://doi.org/10.1016/j.spc.2020.10.015

Bakarich, K. M., Castonguay, J. J., & O'Brien, P. E. (2020). The Use of Blockchains to Enhance Sustainability Reporting and Assurance*. Accounting Perspectives, 19(4), 389-412. https://doi.org/10.1111/1911-3838.12241

Bapir, A. K. (2023). The Influence Government in Supporting Small Businesses to Revitalize the Economy: The Case Studies of 220 Owners Various Small Businesses in Kurdistan Region of Iraq. Polytechnic Journal of Humanities and Social Sciences, 4(1), 61-69.

Borhani, S. A., Babajani, J., Raeesi Vanani, I., Sheri Anaqiz, S., & Jamaliyanpour, M. (2021). Adopting blockchain technology to improve financial reporting by using the technology acceptance model (TAM). International Journal Of Finance & Managerial Accounting, 6(22), 155-171.

Borodin, A., Shash, N., Panaedova, G., Frumina, S., Kairbekuly, A., & Mityushina, I. (2019). The impact of the publication of non-financial statements on the financial performance of companies with the identification of intersectoral features. Entrepreneurship and Sustainability Issues, 7(2), 1666-1685. https://doi.org/10.9770/jesi.2019.7.2(61)

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern methods for business research, 295(2), 295-336.

Cosma, S., Leopizzi, R., Nobile, L., & Schwizer, P. (2022). Revising the non-financial reporting directive and the role of board of directors: a lost opportunity?. Journal of Applied Accounting Research, 23(1), 207-226. https://doi.org/10.1108/JAAR-04-2021-0102

Dal Mas, F., Dicuonzo, G., Massaro, M., & Dell'Atti, V. (2020). Smart contracts to enable sustainable business models. A case study. Management Decision, 58(8), 1601-1619. https://doi.org/10.1108/MD-09-2019-1266

Dyball, M. C., & Seethamraju, R. (2022). Client use of blockchain technology: exploring its (potential) impact on financial statement audits of Australian accounting firms. Accounting, Auditing & Accountability Journal, 35(7), 1656-1684. https://doi.org/10.1108/AAAJ-07-2020-4681

Endenich, C., & Trapp, R. (2020). Ethical Implications of Management Accounting and Control: A Systematic Review of the Contributions from the Journal of Business Ethics. Journal of Business Ethics, 163(2), 309-328. https://doi.org/10.1007/s10551-018-4034-8

Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., Danks, N. P., & Ray, S. (2021). Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R. Classroom Companion: Business.

Handoko, B. L., Arfianti, F., & Marlinda, S. (2022). The Utilization of Blockchain Technology on Remote Audit to Ensure Audit Data Integrity in Detecting Potential Fraudulent Financial Reporting. 2022 6th International Conference on Software and e-Business. https://doi.org/10.1145/3578997.3579001

Hossain, M. Z. (2023). Transforming Financial Reporting Practices in Bangladesh: The Benefits and Challenges of Implementing Blockchain Technology. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4428469

Ibrahim, I., Mohammed, A., Abdulaali, H. S., Mohammad, M. M., & Ali, K. (2023). Does Digital Balanced Scorecards Lead To The Sustainable Performance Amongst The Jordanian SMEs? International Journal of Professional Business Review, 8(7), e02173.

Johani, F. H., Shah, S. A., & Safian, N. (2021). Validity and Reliability of Biopsychosocial-Related Measurement Scales Among Low-Income Malaysian Smoker. Global Journal of Public Health Medicine, 3(1), 301-314. https://doi.org/10.37557/gjphm.v3i1.79

Joshi, C., Arya, K. V., Shukla, A. K., Shree, R., Pandey, R. P., Shukla, V., & Dhadwal, M. K. (2021). An Overview of Emerging Updates in Blockchain Technology. Blockchain in Digital Healthcare, 1-14. https://doi.org/10.1201/9781003133179-1

Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35-46. https://doi.org/10.1016/j.bushor.2017.09.003

Makel, M. C., Hodges, J., Cook, B. G., & Plucker, J. A. (2021). Both Questionable and Open Research Practices Are Prevalent in Education Research. Educational Researcher, 50(8), 493-504. https://doi.org/10.3102/0013189x211001356

Markota Vukić, N., Vuković, R., & Calace, D. (2018). Non-financial reporting as a new trend in sustainability accounting. Journal of accounting and management, 7(2), 13-26.

Memon, M. A., Ramayah, T., Cheah, J. H., Ting, H., Chuah, F., & Cham, T. H. (2021). PLS-SEM statistical programs: a review. Journal of Applied Structural Equation Modeling, 5(1), 1-14. https://doi.org/10.47263/JASEM.5(1)06

Mia, M. M., Zayed, N. M., Islam, K. M. A., Nitsenko, V., Matusevych, T., & Mordous, I. (2022). The Strategy of Factors Influencing Learning Satisfaction Explored by First and Second-Order Structural Equation Modeling (SEM). Inventions, 7(3), 59. https://doi.org/10.3390/inventions7030059

Mohammed, A., Sulaiman, S., & Zin, N. M. (2022). Exploring the agile-adaptive balanced scorecard benefits towards improving the management accounting system: a case study of Iraqi SMEs. Social and Management Research Journal (SMRJ), 19(2), 139-168. https://doi.org/10.24191/smrj.v19i2.19711

Nanayakkara, S., Perera, S., & Senaratne, S. (2019, June). Stakeholders’ perspective on blockchain and smart contracts solutions for construction supply chains. In CIB World Building Congress (pp. 17-21). Hong Kong SAR China.

Papathanasiou, A., Cole, R., & Murray, P. (2020). The (non-) application of blockchain technology in the Greek shipping industry. European Management Journal, 38(6), 927-938. https://doi.org/10.1016/j.emj.2020.04.007

Park, A., & Li, H. (2021). The effect of blockchain technology on supply chain sustainability performances. Sustainability, 13(4), 1726. https://doi.org/10.3390/su13041726

Pedroso, E., & Gomes, C. F. (2020). The effectiveness of management accounting systems in SMEs: a multidimensional measurement approach. Journal of Applied Accounting Research, 21(3), 497-515. https://doi.org/10.1108/JAAR-05-2018-0059

Philsoophian, M., Akhavan, P., & Namvar, M. (2022). The mediating role of blockchain technology in improvement of knowledge sharing for supply chain management. Management Decision, 60(3), 784-805.

Qader, K. S., Jamil, D. A., Sabah, K. K., Anwer, S. A., Mohammad, A. J., Gardi, B., & Abdulrahman, B. S. (2022). The impact of Technological acceptance model (TAM) outcome on implementing accounting software. International Journal of Engineering, Business and Management, 6(6), 14-24.

Rashedi, H., & Dargahi, T. (2019). How influence the accounting information systems quality of internal control on financial reporting quality. Journal of Modern Developments in management and Accounting, 2(5).

Ronaghi, M. H., & Mosakhani, M. (2022). The effects of blockchain technology adoption on business ethics and social sustainability: evidence from the Middle East. Environment, Development and Sustainability, 24(5), 6834-6859. https://doi.org/10.1007/s10668-021-01729-x

Salameh, R. S., Kalbouneh, A. Y., Alnabulsi, Z. H., Al-Sohaimat, M., & Lutfi, K. M. (2022). The effectiveness of disclosing sustainability accounting-related information in small and medium-sized enterprises (SMEs) in raising the reliability of financial reports. Academy of Strategic Management Journal, 21(1), 1-117.

Saleh, I., Marei, Y., Ayoush, M., & Abu Afifa, M. M. (2023). Big Data analytics and financial reporting quality: qualitative evidence from Canada. Journal of Financial Reporting and Accounting, 21(1), 83-104.

Sarstedt, M., Hair, J. F., Jr., Nitzl, C., Ringle, C. M., & Howard, M. C. (2020). Beyond a tandem analysis of SEM and PROCESS: Use of PLS-SEM for mediation analyses!. International Journal of Market Research, 62(3), 288-299. https://doi.org/10.1177/1470785320915686

Schletz, M., Cardoso, A., Prata Dias, G., & Salomo, S. (2020). How can blockchain technology accelerate energy efficiency interventions? A use case comparison. Energies, 13(22), 5869. https://doi.org/10.3390/en13225869

Sekabira, H., Tepa-Yotto, G. T., Ahouandjinou, A. R. M., Thunes, K. H., Pittendrigh, B., Kaweesa, Y., & Tamò, M. (2023). Are digital services the right solution for empowering smallholder farmers? A perspective enlightened by COVID-19 experiences to inform smart IPM. Frontiers in Sustainable Food Systems, 7. https://doi.org/10.3389/fsufs.2023.983063

Soni, G., Kumar, S., Mahto, R. V., Mangla, S. K., Mittal, M. L., & Lim, W. M. (2022). A decision-making framework for Industry 4.0 technology implementation: The case of FinTech and sustainable supply chain finance for SMEs. Technological Forecasting and Social Change, 180, 121686. https://doi.org/10.1016/j.techfore.2022.121686

Stocker, F., Arruda, M. P., Mascena, K. M. C., & Boaventura, J. M. G. (2020). Stakeholder engagement in sustainability reporting: A classification model. Corporate Social Responsibility and Environmental Management, 27(5), 2071-2080. https://doi.org/10.1002/csr.1947

Streukens, S., & Leroi-Werelds, S. (2016). Bootstrapping and PLS-SEM: A step-by-step guide to get more out of your bootstrap results. European management journal, 34(6), 618-632. https://doi.org/10.1016/j.emj.2016.06.003

Stubbs, W., & Higgins, C. (2018). Stakeholders' Perspectives on the Role of Regulatory Reform in Integrated Reporting. Journal of Business Ethics, 147(3), 489-508. https://doi.org/10.1007/s10551-015-2954-0

Suarez, J. (2022). The Hallmarks of Strategic Management Accounting: seeking to support decision making processes. Journal of Business Management, 20, 79-99. https://doi.org/10.32025/jbm22007

Tran, Y. T., Nguyen, N. P., & Hoang, T. C. (2021). The role of accountability in determining the relationship between financial reporting quality and the performance of public organizations: Evidence from Vietnam. Journal of Accounting and Public Policy, 40(1), 106801. https://doi.org/10.1016/j.jaccpubpol.2020.106801

Türegün, N. (2019). Impact of technology in financial reporting: The case of Amazon Go. Journal of Corporate Accounting & Finance, 30(3), 90-95. https://doi.org/10.1002/jcaf.22394

Weijters, B., Millet, K., & Cabooter, E. (2021). Extremity in horizontal and vertical Likert scale format responses. Some evidence on how visual distance between response categories influences extreme responding. International journal of research in marketing, 38(1), 85-103. https://doi.org/10.1016/j.ijresmar.2020.04.002

Yu, T., Lin, Z., & Tang, Q. (2018). Blockchain: The introduction and its application in financial accounting. Journal of Corporate Accounting & Finance, 29(4), 37-47.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Mohammed, A., Sulaiman, S., & Zin, N. M. (2023). The Role of Management Accounting System to Enhance the Sustainable Financial Reporting. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1193-1210). European Publisher. https://doi.org/10.15405/epsbs.2023.11.96