Abstract

Sustainability is defined as the continual improvement of business operations to ensure long term resource availability through environmental, socially-sensitive, and transparent performance as it relates to consumers, business partners, and the community. In September 2022, Bursa Malaysia issued its enhanced sustainability reporting requirements for publicly listed companies with the aim to elevate sustainability practices and disclosures. This paper aims to investigate the readiness of the common sustainability matter reporting by Malaysian energy companies listed on the main market from 2018 to 2021 and whether such matters have an impact on company values. The disclosure requirement by Bursa Malaysia and management on such matters include anti-corruption, community/society, diversity, energy management, health and safety, labour practices and standards, supply chain management, data privacy and security, and water. Therefore, it is important as this study employs secondary data from corporate governance reports taken from 32 public listed energy companies. Panel unit root test and panel cointegration are used in this study. Sustainability reports are a source of information about the effectiveness of companies in non-financial areas that are related to economic, environmental, and social efficiency. The sustainability of the energy sector is crucial as it determines the strength of national economies and the possibility of their growth.

Keywords: Disclosure, Environment, Governance, Reporting, Sustainability

Introduction

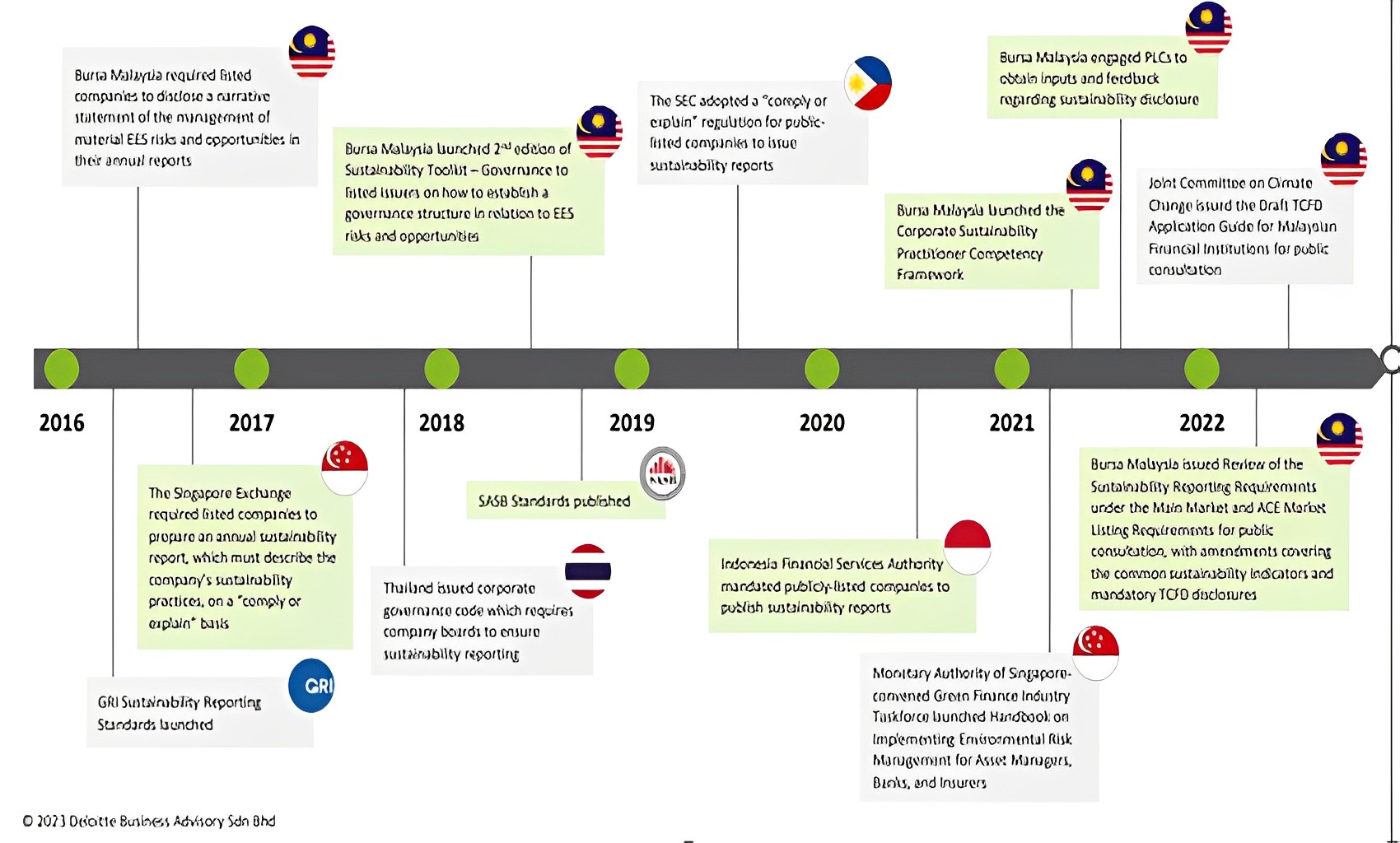

Gas's proportion in Malaysia's power mix has decreased from 67% in 2005 to 47% in 2015 as a result of the country's intentions to shift to coal in response to diminishing domestic gas supply. A large amount of Southeast Asia's fossil fuel deposits are located in this country. For over a decade now, America has been in the midst of a sustainability revolution. To help foster an environment conducive to advancing sustainable and responsible SRI investment and issuing, the government developed the Green Technology Financing Scheme in 2010 and the Sustainable and Responsible Investment (SRI) Sukuk Framework in 2012. The disclosure requirements under the framework are transparent and in line with international best practises and standards.

A new index, the FTSE4Good Bursa Malaysia Index, was launched at a later date. Investors are progressively incorporating Environmental, Social, and Governance (ESG) concerns into fundamental benchmarks and passive investments. FTSE Russell provides approximately two decades' worth of ESG expertise in the form of data analytics, scores, and indexes covering thousands of companies throughout the world. Assisting investors in 1) managing ESG exposures, 2) meeting mandated stewardship requirements, 3) incorporating ESG data into the analysis of securities and portfolios, and 4) implementing investment strategies based on ESG are all possible thanks to FTSE Russell's ESG Scores and data model.

Energy savings of 52,233 GWh (8.0%) and a reduction in greenhouse gas emissions of 37,702 ktCO2 equivalent are two of the goals of Malaysia's National Energy Efficiency Action Plan. These objectives will be attained through the plan's four key strategic thrusts: 1) implementing the energy efficiency plan; 2) strengthening the institutional framework, capacity development, and training for implementing energy efficiency initiatives; and 3) creating sustainable funding mechanisms for implementing

The key initiatives cover the following three sectors: 1. Equipment: Advancing 5-star appliances and campaigning for refrigerator and air conditioner labelling comparisons. Establishing Minimum Energy Performance Standards (MEPS) for EE lighting and motors. 2. Industrial: Auditing and management of energy in large- and medium-sized industries. Promoting cogeneration in industries and commercial buildings. 3. Buildings: Auditing and management of energy in buildings. Designing energy-efficient buildings with the objective of turning the voluntary energy efficiency building standard (MS1525:2014) mandatory.

In 2015, Khazanah Nasional launched the world's first social impact sukuk with a "target-linked" component, and in the same year, Bursa Malaysia mandated sustainability reporting for all listed companies. In order to promote sustainability in Malaysian society and show their dedication to doing so, the government has created tax incentives for SRI Sukuk issuers.Tadau Energy entered the sustainability landscape and was regarded by the World Bank as a truly pioneering initiative because it was the first company in the world to issue a Green Sukuk worth RM250 million and earn the highest "Dark Green" certification from Norway's Centre for International Climate and Environmental Research (CICERO). Awards were given to TESB from all around the world, including the Green Bond Pioneer Award from London's Climate Bonds Initiative and the Green Bond Award from New York's Environmental Finance.

The Securities Commission (SC) of Malaysia initiated a review of the Malaysian Code of Corporate Governance and published the Guidelines on SRI Funds in 2017. The next year, the SC unveiled the SRI Sukuk Grant Scheme. With the expansion of the Sustainable and Responsible Investment (SRI) Sukuk and Bond Grant Scheme (Grant), organisations are given more support as they seek to issue sukuk to fund their long-term operations. The SRI-linked Sukuk Framework (the "Framework") was implemented by the SC in June 2022, making SRI-linked sukuk issued under the Framework also eligible for the Grant for the updated Grant, qualifying SRI-linked sukuk issuers can now apply for up to RM300,000 to cover up to 90% of their external review costs for each offering.This development is consistent with the third phase of Malaysia's Capital Market Masterplan, which seeks to facilitate transition finance in support of Malaysia's vow and ambition to move towards a low-carbon and climate-resilient economy. It hopes to encourage companies in carbon-intensive sectors to issue SRI-linked sukuk as part of their efforts to adopt more environmentally friendly procedures.

In 2018, Bank Negara made an appearance and published the VBI Implementation Guide. The goal of the Implementation Guide is to make it simpler for Islamic Banking Institutions (IBIs) to adopt VBI by doing the following things: i) increasing the reach of successful banking techniques driven by impact creation; ii) outlining a four-stage implementation process that demonstrates a gradual shift towards the ideal financial landscape; and iii) analysing the most significant implementation challenges and problems, as well as practical solutions.

In March 2018, Bank Negara Malaysia completed and issued a Strategy Paper on Value-based Intermediation ("the Strategy Paper") in collaboration with the VBI Community of Practitioners (CoP) members. VBI is defined as an intermediary role that accomplishes the goals of Shariah by actions, products, and services that have beneficial and long-lasting effects on the economy, society, and environment in accordance with the interests of shareholders. The Strategy Paper not only detailed how VBI would be put into action, but also elaborated on its key ideas. The Islamic banking industry is currently promoting VBI as the next strategic path. The Bank facilitates VBI by offering essential enablers such as the Community of Practise, the VBI Network, the VBI Scorecard, and a set of Guidance. The Bank also promotes proactive disclosure on the optimal mix of facts to elicit the desired response (market discipline) from key stakeholders regarding existing banking practises and products.

According to data published on May11, 2020, Axiata Group Bhd in Malaysia secured $800 million in multi-currency Islamic finance agreements for its sustainability-related efforts. Maybank Islamic Bank Bhd and MUFG Bank (Malaysia) Bhd were both lenders in the financing arrangement supervised by OCBC Al-Amin Bank Bhd, a subsidiary of Oversea-Chinese Banking Corporation Limited. However, in 2020, PETRONAS launched its Pathway to Net Zero Carbon Emissions 2050. Datuk Tengku Muhammad Taufik, President and Group CEO of PETRONAS, said that the Pathway contains growth targets for cleaner energy options and addresses emissions from the company's operations. Using information from 2019, PETRONAS has set an intermediate aim of reducing emissions from operations in Malaysia by 25% by 2024, with an additional 25% absolute reduction by 2030. The business climate, national rules, global frameworks, and robust scientific agreement on climate change that underpin the aspirational goals stated in the Paris Agreement all contribute to the success of this endeavour. In addition, the CEO emphasised that PETRONAS is taking bold, realistic, and strategic steps towards establishing clear and measurable goals for reducing emissions caused by business operations and strengthening the company's stability. As a separate line of business, PETRONAS will produce cleaner energy solutions with the same attention to safety, dependability, cost-effectiveness, and lack of emissions as its primary line of business. The energy company will focus on reducing emissions by decreasing venting and flaring. To facilitate the company's growth and expedite the introduction of lower-carbon solutions for its customers, they will also continue to invest in technology and innovation. Carbon capture and storage technology initiatives are another area of focus for PETRONAS; these efforts will employ eco-friendly climate solutions to reduce and balance emissions that are particularly challenging to control, all while supporting the conservation of biodiversity and the natural world.

When Bank Negara Malaysia released its Policy Document on Climate Risk Management and Scenario Analysis in December 2022, it had a greater impact on encouraging sustainable practises among financial institutions and intermediaries. To strengthen the financial sector's resistance to climate-related risks and to facilitate a just and orderly transition to a low-carbon economy, this policy document provides principles and standards relating to climate risk management and scenario analysis for financial institutions. The policy document and its companions were released at the same time: The Bank has released two documents to assist with the implementation of the new guidelines: 1) a feedback statement that outlines the Bank's answers to the significant industry feedback during the consultation period, and 2) a supplemental guidance document that provides case studies and reference materials on climate risk management and scenario analysis.

In 2022, Bursa Malaysia also published the third edition of the Sustainability Reporting Guide ("Guide"), which provides an overview of the business rationale for integrating sustainability and practical guidance on how to do so. To help companies create sustainability statements that are in line with Bursa Malaysia's Listing Requirements ("LR"), the exchange provides extensive guidelines on what information should be included. The second goal of the Guide is to help businesses a) understand how sustainability facilitates, supports, and drives corporate and social values; b) become more cognizant of sustainability risks and opportunities; c) recognise and respond to the needs of stakeholders by addressing key sustainability issues; d) enhance the quality and depth of sustainability disclosures in order to b).

The lack of sustainability reporting by companies in the energy sector can lead to negative impacts on the environment and society. - The implementation of sustainability reporting by companies in the energy sector is challenging due to various factors such as lack of resources, lack of awareness and lack of regulatory support. - The negative impact of carbon emissions and waste management on company performance highlights the need for companies to improve their environmental sustainability practices. The effect of the sustainability audit matter reporting on company values within the energy sector will be further explored in this research study. The following research questions are listed to resolve the various research issues. Is there a relationship between the Anti-Corruption, Community or Society, Diversity, Energy management, Health and safety, Labour Practices and Standards, Supply Chain Management, Data Privacy and Security, Water and the CV?

Literature Review

According to the Global Reporting Initiative, businesses and organisations are obligated to report annually on their social, environmental, and financial impacts. Organisational values, a clear chain of command, and a commitment to a global economy built on sustainability should all be spelt out in the report. Businesses can improve their goal-setting, change management, measurement, understanding, and communication of their economic, environmental, social, and governance performance through the use of sustainability reporting.

All publicly traded companies in Malaysia are required to report on sustainability as of 2016 (Lian et al., 2018). Because there has not been much discussion regarding the impact of organisational resources on the quality of reporting, especially in the aforementioned setting, this research attempts to understand the effects of the recently adopted statutory requirement. Therefore, the fundamental purpose of this research is to examine how businesses report on sustainability from several vantage points, such as compliance and impression management techniques. Using institutional theory and resource-based theory, a research framework is created that suggests a connection between organisational factors like the sustainability committee, sustainability agenda, financial resources, and environmental management system, and the quality of a sustainability report. Information was gathered from annual reports and analysed with structural equation modelling. Malaysian authorities hope to gain insight into the effectiveness of the new rule and the necessary steps towards more accountability and openness from the study's findings.

According to Sadq et al. (2020), a reporting framework that precisely describes the value creation of an organisation over a given period by integrating financial, social, environmental, and governance factors. Company accountability and stewardship will be improved, and holistic decision-making will be encouraged. As part of its plan to fortify the Malaysian capital market, the Malaysian Investment Association (MIA) is vigorously bolstering the quality of reporting and the drive towards integrated reporting.

The rise of integrated reporting could be explained, in part, by the stakeholder theory and the stewardship philosophy. One of the biggest challenges of implementing integrated reporting is finding the best way to generate integrated reporting while simultaneously guaranteeing that financial reports are useful to stakeholders. According to the findings, the majority of respondents think that integrated reporting is a good way to boost corporate transparency and boost an organization's bottom line. Stakeholders, according to them, can also benefit from integrated reporting. These findings are consistent with the findings of Lee and Yeo (2016), who found a positive correlation between integrated reporting and the form valuation of listed firms in South Africa. This research examined the readiness for integrated reporting in a developing nation and gave an in-depth discussion of the concept of integrated reporting.

Companies should be willing to disclose information and reduce information asymmetries voluntarily, as proposed by Benvenuto et al. (2023), but only if the benefits outweigh the costs and if the enhancement of reputation reduces the need for investment. This is because sustainability reporting adoption and implementation is a process that requires a great deal of data. According to this argument, businesses that do better for the environment will also be more inclined to share factual information that can be independently verified, while those who do poorly for the environment will provide data that is harder to interpret and verify. Organisations are more likely to reveal more information as a signal since doing so is related to lowering information asymmetries, meeting stakeholder expectations, optimising finance costs, and raising enterprise value.

According to Qaderi et al. (2022), larger boards are associated with increased disclosure of IR-related information and higher quality disclosure in the Malaysian market. The study also claimed that a better IR degree and quality are connected with the number and proportion of female directors on the board, and that the use of IR strategy by firms is positively and significantly correlated with the presence of independent directors. In addition, there is a favourable and significant correlation between IR and board meetings in the Malaysian market. Last but not least, the compensation of non-executive directors is positively and strongly connected with the degree and quality of corporate IR. However, having several directors on the board does not improve the usage of IR-related practises or the transparency of IR-related information. Board composition is demonstrated to be an important determinant of IR reporting in Malaysia. Ismail and Latiff (2019) back this up when discussing the importance of diversity on boards and how it relates to sustainability. This research drew its conclusions from an assessment of existing literature on sustainability reporting procedures. Meanwhile, Moses et al. (2020) looked at Sustainability Reporting Quality (SRQ) to see how board qualities affect SRQ among Malaysia's publicly traded companies. This method was used to confirm the SRQ of businesses and the impact of board quality. Based on many ideas and the knowledge gained from previous studies, this study discovered a favourable association between the examined board governance aspects and SRQ.

Meanwhile, Osman and Kadri (2022) determined the reporting style and generic structure of reports to analyse the plantation company's discursive disclosure practises. The results show that the disclosure is in line with the listing standards, and that the discourse employs contemporary rhetoric, a method of persuasion that is both subtle and supported by data. Therefore, it is safe to say that the claims made in sustainability reports are more than just lip service. Pranugrahaning et al. (2020) conducted research in the field of telecommunications and came to the following conclusions with regards to Digi Malaysia and its parent company. Three distinct but interconnected parts of a CSR report are the sustainability governance framework, the sustainability performance measurement, and the sustainability reporting. There are very few empirical studies on both CSAs and MNEs operating in developing markets, so this study provided novel insights into two essential characteristics of MNEs to comprehend the interaction between home- and host-country settings and the industrial sector in which the MNE is operating.

In the contexts of Indonesia and Malaysia, Afrizal et al. (2023) discovered that firm size and leverage significantly affected carbon emissions disclosure. Profitability and company age have no bearing on carbon emissions disclosure in Indonesia. However, in Malaysia, both of these factors considerably improve openness about carbon emissions. There was no correlation between corporate size and sustainability reporting in Indonesia, however there was a negative correlation in Malaysia. While Malaysia revealed no correlation between leverage and sustainability reporting, Indonesia indicated a large and favourable effect. Next, when looking at the impact on profits, Indonesia and Malaysia both revealed significant and favourable effects from sustainability reporting. Investor reactions in Indonesia are unaffected by firm size, while in Malaysia they are significantly negatively affected. There was no correlation between the leverage, profitability, or age of the company and the reactions of investors. Investor reactions to carbon emissions disclosure are significantly and favourably affected in Indonesia, but no effect was shown in Malaysia. Evidence suggests that investor reactions are significantly influenced by sustainability reports.

From 2008 to 2011, Darus et al. (2016) analysed data from 20 different Malaysian financial institutions. Content analysis of annual and sustainability reports was used to evaluate the CSR reporting of financial organisations. Their research revealed that the quality of CSR disclosure matters more than its quantity because it was the only significant predictor of value generation for enterprises. Balabanis et al.'s (1998) analysis of British firms indicated a correlation between CSR disclosure and concurrent financial performance, thus their findings are consistent with that. The gross profit to sales ratio, in particular, has a positive effect on transparency, the same study found. It was also found that a company's bottom line can benefit from both strong CSR performance and extensive disclosure. On the other hand, strategies that involved low CSR disclosure alongside good CSR performance or high CSR disclosure together weak CSR performance were found to have negative effects on economic performance. We found that even subpar CSR performance combined with low levels of transparency outperformed the other combinations in the short term (concurrent period). However, it seems that this effect weakens over time (i.e., across successive seasons).

The significance of financially intensive CSR projects is still another important consideration. However, Lau (2019) found that companies with higher BSI levels have higher firm market value (proxied by Tobin Q), lower cost of equity, and lower cost of debt. Moreover, there was evidence to suggest that enterprises' profitability is negatively affected by BSI, rather than positively affected.

Overall sustainability reporting and one of its components, economic sustainability reporting, was found by Shad et al. (2020) to reduce the cost of debt and the cost of equity.

However, there is no impact on equity costs from environmental sustainability reporting. According to social sustainability reporting, the cost of debt or equity has a negligible effect. Companies' size, profitability, and reputation were employed as controls in the study. Recent research by Fedorova et al. (2023) has revealed that these factors all play a role in how the market values the largest Russian companies. The regression analysis showed that the disclosure of a company's altruistic charitable endeavours (such as corporate giving in the fields of culture, education, and science) has less of an impact on the investment appeal of the company than the disclosure of the company's commercially motivated charitable endeavours (such as athletics, healthcare, child protection, and youth policy).

Using panel data analyses of energy and energy institutions in Brazil, Russia, India, and China, Ates (2023) concludes that a strong signal of Corporate Social Performance is the reporting of CSR within a global initiative framework. The rating also indicates a positive correlation between the quality of CSR reporting and CSP among businesses. Board characteristics, board size, independence, activity, and gender diversity on integrated reporting disclosure in Malaysian commercial banks were studied by Halid et al. (2021). The level of disclosure employed in the International Integrated Reporting Council Framework was also taken into account in this analysis. The research, which used data from a selection of commercial banks between 2013 and 2017, uncovered a negative correlation between board size and integrated reporting disclosure. Integrated reporting disclosure was not affected by any of the other board criteria.

The impact of the audit committee (AC) on the disclosure of GHG emissions by public listed firms in Malaysia was then analysed by Salleh et al. (2022). It is the responsibility of the AC to report on GHG emissions as part of corporate reporting. The 43 plantation firms trading on Bursa Malaysia's public market had their annual and sustainability reports content-analyzed using a sustainability reporting guide (SRG) checklist to determine whether or not they disclosed their greenhouse gas (GHG) emissions for the years 2016 through 2019. Company size, profitability, debt, board size, and board independence were used to gauge the AC's efficacy, which was then regressed against the level of disclosure. The efficiency of ACs was shown to be essential in guaranteeing adequate disclosure of GHG emissions. Beyond its customary purpose of monitoring the financial reporting process, this research shed light on AC's larger roles. The study also provided data to back up the claim that ACs can improve corporate disclosure practises.

224 ASEAN enterprises from Thailand, Singapore, Indonesia, and Malaysia were analysed by Pratama et al. (2022) for their Environmental, Social, and Governance (ESG) scores. Governance (GOV), Strategy (STR), Risk (RSK), and Goals and Metrics (MTR) were the four criteria used to create a disclosure quality matrix. First, the research showed that most businesses disclosed all material information required by law for GOV, STR, and RSK but not for MTR. Second, the level and quality of disclosure varies widely among countries and sectors. Third, when dividing the 224 companies into the four groups, 94 fall into the best clusters, while just 12 fall into the worst. The results of this research highlight the importance of continuing to work towards enhancing sustainability reporting, particularly with regards to narrowing the gap in disclosure quality and breadth that exists between nations and sectors.

According to the EU-expert research on Sustainability Finance, the signing of the Paris Agreement on 12 December 2015 marked a watershed moment for the world and the global economy. The European Union (EU) is moving towards a low-carbon society characterised by widespread use of smart technologies and widespread use of renewable energy sources that boost living standards, stimulate the economy, and create new jobs without negatively impacting the environment. More than 170 countries have now ratified the Paris Agreement, signalling that the low-carbon transition is here to stay. The European Union (EU) is already ahead of the curve thanks to its pledge to reduce CO2 emissions by 40% across all economic sectors by 2030. In order to help European businesses adapt to a more sustainable, resource-efficient, and circular business model, the EU is gradually enacting the necessary legislation. There is still a lot of ground to cover. An additional €180 billion per year is needed to fund initiatives across the European Union (EU) such as energy-efficient building retrofits, renewable energy generation and transmission, and low-carbon mobility. The investment challenge is much larger than the government can manage on its own. In order to attract the necessary investments, the European Union is providing enormous encouragement. The European Fund for Strategic Investments (EFSI) has previously invested about €250 billion. In 2017, about a third of budget allocations went towards environmental protection, resource conservation, and social infrastructure. With the EFSI 2.0, the Fund's lifespan has been extended to the year 2020, and the target amount for investments has been raised to €500 billion, with at least 40% of new investments going towards realising the aims of the Paris Agreement.

The materiality of disclosure, according to Ngu and Amran (2021), is heavily influenced by board activities and board independence. They also found that factors including the size of the board, firm profitability, leverage, and industry played no role in determining whether or not disclosure was material. Findings suggest that most Malaysian listed businesses disclose some level of material sustainability information, albeit at a low level.

Muhamad et al. (2022) argue that there is still a large gap and overlap between ESG and Maqasid Shari'ah, despite the growing complementarity between the two approaches. In addition, Islamic finance pays less attention to some aspects of good governance and environmental protection. There is still a low degree of ESG adoption in the Islamic banking sector, which makes it difficult to analyse the risks and repercussions of ESG due to the complexity of the ESG framework and how unsuited it is to different businesses. It is expected that Islamic banks' risk-adjusted performance in financing and investments will improve as a result of the link between ESG and Shari'ah screening [1]. Unfortunately, Islamic institutions do not have a uniform ESG disclosure standard or guideline to use as a starting point. In order to achieve the SDG 2030 target of promoting sustainability through financial activity, this study provides guidance on how to incorporate ESG concepts into the evaluation of Islamic banking performance.

Darus et al. (2019) analysed the variables that led to the adoption of integrated reporting and determined whether or not its components were present. The effects of both internal and external pressure are examined, from the perspectives of both agency and stakeholder theories. One hundred of the largest Malaysian companies' annual reports from 2014 were analysed for content. Results showed a positive relationship between integrated reporting components and risk/opportunity assessment and mission/vision statements in the annual reports. The positive correlations demonstrate that businesses will be more proactive in implementing integrated reporting if strategic initiatives are aligned with the company's mission and vision and if measures are taken to address the risks and opportunities facing the business. In the absence of studies on the impact of certain determinants on the tendency of enterprises in developing countries to create integrated reports, the results give empirical data on the expansion of integrated reporting in these countries.

Energy and water management, workplace safety, and gender diversity are all factors that Khieukhajee, et al. (2023) found to have a beneficial effect on corporate success. The performance of businesses is hampered by issues related to carbon emissions and waste management. In addition, the unfavourable associations between energy consumption, water management, workplace safety, and corporate performance are tempered by the moderating effect of gender diversity. While waste management has a detrimental impact on a company's worth, water management and workplace safety have the opposite effect. It was also found that the correlation between sustainability reporting and business value is not tempered by gender diversity. These findings are helpful for upper management since they suggest an increase in sustainability reporting, particularly in the areas of water management and workplace safety, which might boost both company performance and value.

Hamad et al. (2020) developed a conceptual framework to investigate the moderating influence of sustainability reporting on the relationship between corporate governance procedures and IR disclosure in the context of Malaysian PLCs, bringing together the stakeholder theory and the agency theory. In order to collect IR data and other characteristics, this study analysed the content of the most recent annual reports of the largest 100 Malaysian PLCs by market capitalization. This study laid the groundwork for future empirical research by developing a conceptual framework for investigating the moderating impact of SR in affecting the link between the MCCG 2017 call and the BOD in regards to the IR material disclosed by Malaysian PLCs. There was some proof from prior research that SR and IR had beneficial effects and advantages.

Corporate environmental reporting (CER) practises in Malaysia have increased dramatically in response to institutional pressures related to climate change, as reported by Jaaffar et al. (2018). CER practises involving several environmental initiatives used by the enterprises over a period of 5 years are described in a review of the annual reports, sustainability reports, and websites of 209 ESPLCs in Malaysia. The results show that several environmental strategies, such as the pursuit of sequential development from non-compliance to compliance and beyond, have been set out in response to external forces including institutional constraints and concerns about climate change. The extent and quality of CER practises followed by Malaysian ESPLCs reflects this shift.

Finally, Jamil et al. (2022) found that Shariah-compliant businesses in Malaysia and Indonesia improved their sustainability reporting after implementing the Human Governance (HG) Index and the IT Usage Index. However, research conducted in both nations found that Shariah-compliant businesses' sustainability reporting was unaffected by Islamic Corporate Governance.

Research Methodology

The post-positivist ideology that informs the study's approach and overarching premise can be found in Plano Clark and Creswell (2008). In order to test hypotheses that explain the connection between deductive reasoning will be used in the quantitative research design to safeguard against bias, generalise results, and replicate the outcome; this thesis will use methods for social science quantitative research based on post-positivism. This analysis used annual panel data from 2021-2018 collected from 29 Malaysian oil and gas firms. Each and every bit of data was culled directly from Bursa Malaysia.

In this study, we sampled the entire population. By using TPS, all people who meet the study's inclusion criteria (such as those with a certain set of skills or years of experience) are surveyed.

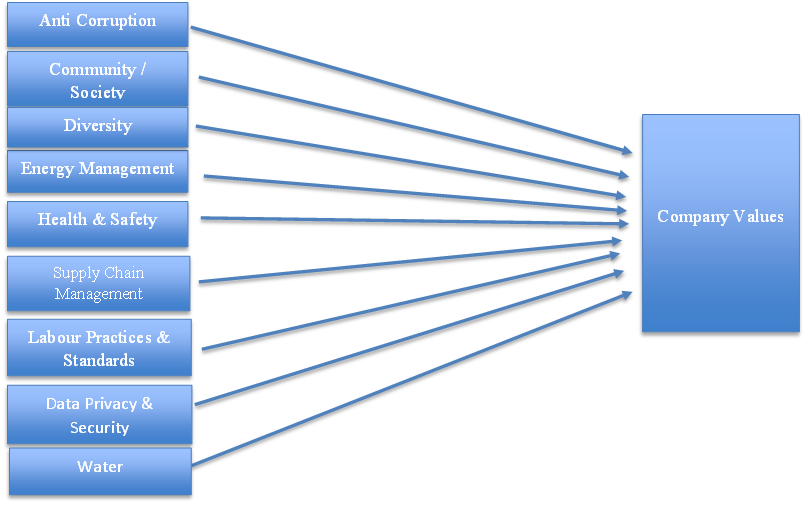

According to Bursa Malaysia website, the oil and gas industry in Malaysia has 32 publicly traded companies in 2023. However, only 29 were chosen for this study because of the information available from these businesses. Figure 1 shows the overarching framework for this study. Anti-corruption (IV1), community/society (IV2), diversity (IV3), energy management (IV5), health and safety (IV6), labour practises and standards (IV7), supply chain management (IV8), data privacy and security (IV9), and water (IV9) are independent variables, and the CVs of listed oil and gas companies are the dependent variable. Since we relied solely on secondary quantitative data for our analysis, all of the data presented here are numbers (Sekaran & Bougie, 2016). Annual panel data from the 29 Malaysian oil and gas companies were used in this investigation. The time period covered was from 2021 to 2018. Each and every bit of data was culled directly from Bursa Malaysia.

This study uses a deductive methodology, as the author has developed a series of hypotheses that must be tested and shown correct or incorrect. The deductive approach to research involves developing hypotheses about the impact of standard sustainability reporting topics on firm valuations and then testing those hypotheses. Figure 2 presents the conceptual framework for CV and common sustainability matter reporting.

Signalling Theory (Connelly et al., 2011) DV-IVs (Khin et al., 2022)

The original form of the model specification is provided in

Equation (1): CVti = β0 + β1 EAti + β2 EPti + β3 IDti + εti (1)

Where:

CV = Company Value, measured by share price RM per share.

AC = Anti Corruption measured by dummy variable for the application of anti corruption policies in the company 1 and 0 otherwise

CS = Community or Society measured by dummy variable for the application of community or society activities/ policies organized by the company 1 and 0 otherwise.

D= Diversity is measured by dummy variable for the application of diversity policies in the company 1 and 0 otherwise

EM = Energy Management measured by dummy variable for the application of Energy Management policies in the company 1 and 0 otherwise

HS = Health and Safety is measured by dummy variable for the application of Health and Safety policies in the company 1 and 0 otherwise.

LPS = Labour Practices and Standards measured by dummy variable for the application of Labour Practices and Standards policies in the company 1 and 0 otherwise.

SCM = Supply Chain Management measured by dummy variable for the application of Supply Chain Management policies in the company 1 and 0 otherwise

DPS = Data Privacy and Security measured by dummy variable for the application of Data Privacy and Security policies in the company 1 and 0 otherwise

W = Water measured by dummy variable for the application of water policies in the company 1 and 0 otherwise

ti = 2018 to 2021 yearly panel data from the 29 listed companies in the oil and gas industry in Malaysia.

Nine hypotheses are developed for this study as follows:

Hypothesis 1: H1: There is a relationship between the AC and the CV.

Hypothesis 2: H2: There is a relationship between the CS and the CV.

Hypothesis 3: H3: There is a relationship between the D and the CV.

Hypothesis 4: H4: Thereis a relationship between the EM and the CV.

Hypothesis 5: H5: There is a relationship between the HS and the CV.

Hypothesis 6: H6: There is a relationship between the LPS and the CV.

Hypothesis 7: H7: There is a relationship between the SCM and the CV.

Hypothesis 8: H8: There is a relationship between the DPS and the CV.

Hypothesis 9: H9: There is a relationship between the W and the CV

Table 1 shows the descriptions of the variables included in the study.

Panel Data Analysis

Panel data analysis is at the watershed of time series and cross-section econometrics. While the identification of time series parameters traditionally relied on notions of stationarity, predeterminedness and uncorrelated shocks, cross-sectional parameters appealed to exogenous instrumental variables and random sampling for identification. By combining the time series and cross-sectional dimensions, panel datasets have enriched the set of possible identification arrangements, and forced economists to think more carefully about the nature and sources of identification of parameters of potential interest (Arellano & Honoré, 2001). There are numerous reasons to use panel data analysis. Panel data has generally been favoured by academics over cross-sectional data due to many advantages of the former. In general, panel data can provide more precise model parameter inferences, a larger capacity to reflect the complexity of human behaviour, and more streamlined computing and statistical inference.

Even though there were 9 IVs we wanted to test, we managed to run health and safety (HS), Earnings Management (EM), Supply Chain Management (SCM) and Data Protection and Security (DPS). This is an unbalanced fixed panel with 29 companies tested Redundant Fixed Effects.

Panel Model Selection

The researcher used a redundant fixed effect test to examine whether Panel Ordinary Least Square (POLS) or fixed effect model (FEM) is suitable for the analysis. If the p-value is less than α = 0.05, it means the null hypothesis is rejected and FEM is preferred according to Khin et al. (2022)

Test Hypothesis P-value Conclusion

Redundant Fixed Effect Test

HO: POLS is preferred.

HA: FEM is preferred. 0.0000 < α = 0.05 Reject HO. FEM is preferred.

Hausman Test HO: REM is preferred.

HA: FEM is preferred. 0.0000 < α = 0.05 Reject HO. FEM is preferred.

Results and Discussion

All figures and tables should be referred to in the text and numbered in the order in which they are mentioned.

Panel Model Selection

Firstly, the redundant fixed effect test was used to determine whether the POLS or FEM is suitable for analysis. The probability values for the redundant fixed effect test were smaller than alpha = 0.05. Therefore, null hypothesis (Ho) is rejected and the fixed effects model (FEM) is preferred. For this study, the p value was 0.0060. Thus, if they are different (sig- p value is 0.0000 < α0.05), Reject Ho, then the fixed effects model is preferred.

When employing panel data, no standard model (OLS models, logit models, probit models, Poisson models, etc.) is immune to biases caused by unobserved heterogeneity (in general), particularly time-varying unobserved heterogeneity. POLS models, as demonstrated in the preceding section, require the FE-consistency assumption in addition to the assumption of time-constant unobserved heterogeneity. As a result, if the FE model findings are biased, so are the POLS model results. As a result, researchers would argue that FE models are more robust to biases than other models because linear FE models continue to provide consistent estimation results when the conditional mean is correctly specified, whereas other models, such as logit or probit models, also require distributional assumptions to be met and require an estimate of the conditional mean.

Panel Model Equation

The panel model equation was formed as in the equation below to show the relationship between the dependent variable and independent variables. The model is stated as:

ln CVt = 1.125497 + -0.610467 SCMt

std.error 0.0807 0.21892

t-stat [13.9433ns] [-2.78849]

R2 = 0.9473; Adjusted R2 = 0.9249

Note: Statistically significant at α = 0.01 level (***), at α = 0.05 level (**), and at α = 0.10 level (*).

Based on Model 1, R2 = 0.9473 indicated that the explanatory variable accounted for about 94.73% of the variation in the model. The adjusted R2 = 0.9249 indicated that approximately 92.49% of the company value in Malaysian energy sector is explained by the explanatory variables after taking the degree of freedom into account.

R Square: is the magnitude of the influence or ability of predictor variables simultaneously in describing the response variable. If the value is more than 0.5 then the ability of the predictor variable is strong in explaining the response variable. While vice versa if the value is less than 0.5 then the ability of the predictor variable is not strong in explaining the response variable. In this panel data regression example, the R Square value is 0.9473, which means that the predictor variable is very strong in explaining the response variable.

Adjusted R Square: is the magnitude of the influence or ability of predictor variables simultaneously in explaining the response variable by observing the standard error. The explanation is the same as R Square but this value has been corrected with standard error.

Table 2 shows the period fixed effects test equation.

From the results, only supply chain management is significant where its P value is less than 0.05.

Conclusion

This investigation contains nine hypotheses. Four of the nine hypotheses were tested using panel data with success. The remaining five sustainability issues (IVs) contained errors during testing. None of the 29 businesses had a water management policy. Conversely, all 29 businesses have anti-corruption policies, community/society policies, diversity policies, and labour practises policies.

Study results show a positive correlation between supply chain management and company value, but no correlation between environmental accounting and company value. As environmental consciousness grows around the world, it is imperative that businesses in Malaysia follow suit. When looking to expand into the Western market, ESG reports will be crucial. Bank Negara Malaysia first adopted VBF five years ago, and now it's time to assess its progress and find ways to improve it across the board. The emphasis on sustainability has become a key issue to address to shareholders and stakeholders, and as such, the SC listing standards need to take this into account. The future of sustainable green energy on a local level lies in green energy.

The impact of social media on sustainability reporting is an area that could use more research in the future. Said et al. (2023) looked at how tone at the top affected the relationship between big data analytics capabilities (BDAC) and sustainability reporting disclosure on Facebook (SRDF). One hundred social media-using PLCs in Malaysia were utilised as a sample for this study conducted in 2019. This study used a positivist research paradigm and a quantitative approach to gather data, and the results showed that implementing BDACs has a significant effect on SRDF, as measured by the structural equation modelling (SEM) method. This study, grounded in the idea of dynamic capabilities view (DCV), acknowledges the importance of dynamic capabilities like BDAC and a certain tone at the top, such certainty, in boosting sustainability reporting on social media. The strength of national economies and the possibility of their growth are directly tied to the sustainability of the energy sector, so it is recommended that businesses use BDAC and convey assurance in the tone at the top to improve sustainability reporting on social media, especially Facebook.

If the limitation could be surmounted, the research would be enhanced. The ESG report is a novel requirement, and many businesses have yet to provide information regarding their initiatives in sustainable practises. Due to time constraints, the study's findings could not be compared to other sectors' compliance in Bursa Malaysia and the same sectors listed on foreign exchanges.

Acknowledgments

The authors are mainly thankful to Dr. Aye Aye Khin from the Universiti Tunku Abdul Rahman for her guidance in adopting the panel data analysis.

References

Afrizal, D., Utama, S., Hildawati, H., Yuhardi, Y., & Sofyan, S. (2023). Factors Influencing The Intention of Businesses Actor To Adopt Online Applications: An Empirical Evidence In Indonesia. Golden Ratio of Marketing and Applied Psychology of Business, 3(1), 66-75.

Arellano, M., & Honoré, B. (2001). Panel Data Models: Some Recent Developments. Handbook of Econometrics, 3229-3296. https://doi.org/10.1016/s1573-4412(01)05006-1

Ates, S. (2023). The credibility of corporate social responsibility reports: evidence from the energy sector in emerging markets. Social Responsibility Journal, 19(4), 756-773.

Balabanis, G., Phillips, H. C., & Lyall, J. (1998). Corporate social responsibility and economic performance in the top British companies: are they linked? European Business Review, 98(1), 25-44.

Benvenuto, M., Aufiero, C., & Viola, C. (2023). A systematic literature review on the determinants of sustainability reporting systems. Heliyon, 9(4), e14893.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling Theory: A Review and Assessment. Journal of Management, 37(1), 39-67.

Darus, F., Mad, S., Nejati, M., & Yusoff, R. (2016). When Quality Matters! CSR Disclosure and Value Creation. International Journal of Economics and Management, 10(S2), 285-302.

Darus, F., Safihie, S. F. M., & Yusoff, H. (2019). Propagating Transparency and Accountability Through Integrated Reporting: An Empirical Insight From a Developing Country. International Journal of Financial Research, 10(5), 92.

Fedorova, E., Demin, I., & Silina, E. (2023). Impact of expenditures and corporate philanthropy disclosure on company value. Corporate Communications: An International Journal, 28(3), 425-450.

Halid, S., Mahmud, R., Zakaria, N. B., & Rahman, R. A. (2021). Does Board Monitoring Affect Integrated Reporting Disclosure for Better Transparency and Sustainability? Universal Journal of Accounting and Finance, 9(5), 1049-1057.

Hamad, S., Draz, M. U., & Lai, F.-W. (2020). The Impact of Corporate Governance and Sustainability Reporting on Integrated Reporting: A Conceptual Framework. SAGE Open, 10(2), 215824402092743.

Ismail, A. M., & Latiff, I. H. M. (2019). Board Diversity and Corporate Sustainability Practices: Evidence on Environmental, Social and Governance (ESG) Reporting. International Journal of Financial Research, 10(3), 31.

Jaaffar, A. H., Amran, A., & Rajadurai, J. (2018). The Impact of Institutional Pressures of Climate Change Concerns on Corporate Environmental Reporting Practices: A Descriptive Study of Malaysia's Environmentally Sensitive Public Listed Companies. SAGE Open, 8(2), 215824401877483.

Jamil, N. N., Haron, H., Ramli, N. M., Abd Aziz, S., Sulaiman, S., & Gui, A. (2022). The Relationship between Islamic Corporate Governance, Human Governance and Sustainability Reporting of Shariah Compliant Companies in Malaysia. International Journal of Academic Research in Accounting, Finance and Management Sciences, 12(2).

Khieukhajee, J., Rojana-udomsart, A., Srisarakorn, P., Wongsurit, T., & Aungsumart, S. (2023). Cognitive Impairment and Risk Factors in Post-COVID-19 Hospitalized Patients. Dementia and Geriatric Cognitive Disorders Extra, 13(1), 18-27.

Khin, A. A., Khai, K. G., & Chiek, A. N. (2022). Company Values of Malaysian Listed Companies' Sustainability for Palm Oil Industry: Financial Panel Data Model Approach. Acc. Fin. Review, 6(4), 01–16.

Lau, C. K. (2019). The economic consequences of business sustainability initiatives. Asia Pacific Journal of Management, 36(4), 937-970.

Lee, K.-W., & Yeo, G. H.-H. (2016). The association between integrated reporting and firm valuation. Review of Quantitative Finance and Accounting, 47(4), 1221-1250.

Lian, K. P., Dayana, J., & Chong, C. W. (2018). Mandatory Sustainability Reporting in Malaysia: Impact and Internal Factors; Business Sustainability and Innovation.

Moses, E., Che-Ahmad, A., & Abdulmalik, S. O. (2020). Board governance mechanisms and sustainability reporting quality: A theoretical framework. Cogent Business & Management, 7(1), 1771075.

Muhamad, S. F., Zain, F. A. M., Samad, N. S. A., Ab. Rahman, A. H., & Yasoa’, M. R. (2022). Measuring Sustainable Performance of Islamic Banks: Integrating the principles of Environmental, Social and Governance (ESG) and Maqasid Shari'ah. IOP Conference Series: Earth and Environmental Science, 1102(1), 012080.

Ngu, S. B., & Amran, A. (2021). Materiality Disclosure in Sustainability Reporting: Evidence from Malaysia. Asian Journal of Business and Accounting, 14(1), 225-252.

Osman, H., & Kadri, A. (2022). Compliance and Rhetoric in Sustainability Reports Published by A Malaysian Plantation Company. Pertanika Journal of Social Sciences and Humanities, 30(4), 1895-1916.

Plano Clark, V. L., & Creswell, J. W. (2008). Student study guide to accompany Creswell's Educational research: planning, conducting, and evaluating quantitative and qualitative research/prepared by Vicki L. Plano Clark. (No Title).

Pranugrahaning, A., Denis Donovan, J., Topple, C., & Kordi Masli, E. (2020). Corporate Sustainability Assessments in the Information Communication Technology Sector in Malaysia. Sustainability, 12(21), 9271.

Pratama, A., Jaenudin, E., & Anas, S. (2022). Environmental, Social, Governance - Sustainability Disclosure Using International Financial Reporting Sustainability Standards S1 in Southeast Asian Companies: A Preliminary Assessment. International Journal of Energy Economics and Policy, 12(6), 456-472.

Qaderi, S. A., Ghaleb, B. A. A., Hashed, A. A., Chandren, S., & Abdullah, Z. (2022). Board Characteristics and Integrated Reporting Strategy: Does Sustainability Committee Matter? Sustainability, 14(10), 6092.

Sadq, Z. M., Ahmad, B. S., Saeed, V. S., Othman, B., & Mohammed, H. O. (2020). The relationship between intellectual capital and organizational trust and its impact on achieving the requirements of entrepreneurship strategy (The case of Korek Telecom Company, Iraq). International Journal of Advanced Science and Technology, 29(2), 2639-2653.

Said, F., Zainal, D., & Abdul Jalil, A. (2023). Big data analytics capabilities (BDAC) and sustainability reporting on Facebook: Does tone at the top matter? Cogent Business & Management, 10(1).

Salleh, Z., Seno, R., Alodat, A., & Hashim, H. (2022). Does The Audit Committee Effectiveness Influence The Reporting Practice Of Ghg Emissions In Malaysia? Journal of Sustainability Science and Management, 17, 204-220.

Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach. John Wiley & Sons.

Shad, M. K., Lai, F.-W., Shamim, A., & McShane, M. (2020). The efficacy of sustainability reporting towards cost of debt and equity reduction. Environmental Science and Pollution Research, 27(18), 22511-22522.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Zulkifli, R., Khai, K. G., Fernandez, A. A., & Kandasamy, S. (2023). Common Sustainability Matter Reporting Affect on Company Values in the Energy Sector. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1174-1192). European Publisher. https://doi.org/10.15405/epsbs.2023.11.95