Abstract

Enhancing the firm’s value by increasing the share price and a stable dividend payout policy can be seen as one approach to maximizing the shareholder’s wealth. Hence, consideration of management strategy and dividend payout policy is an important aspect of financial management to attract investors and retain their willingness to keep an investment with the firm. Prior studies indicated that the board of directors highly reinforced management commitment to achieve the firm’s goal. In particular, the board composition and diversity influenced firms’ decisions on management strategy and dividend payout policy. The management strategy aimed to improve the firms’ performance and increase organizational efficiency whether for an innovation-oriented strategy or sustaining organizational and operational stability for an efficiency-oriented strategy. Engaging the board management strategy and dividend payout policy to create shareholder value enables the firm to grow, innovate and succeed in a competitive environment. This could be seen as how a firm manages its financial resources to ensure sustainable growth and maximize the shareholders’ wealth in the long run. This study aims to investigate the effect of management strategy on the dividend payout policy moderated by the board composition. It addresses the key variables in the study questions and hypotheses in shaping the firm’s dividend decision and understanding how the management strategy and board composition affect dividend payout policy The contribution of this study shall provide some important insights into devising a dividend policy that responds to a novel variable in management strategy and board composition.

Keywords: Board Composition, Dividend Payout, Management Strategy, Shareholder Wealth, Value Creation

Introduction

The economic uncertainties post covid-19 impacted the economies of most countries. Firms are taking cost-cutting measures, including dividend cuts, for sustainability. Although decisions for a reduction in dividends are not taken lightly, market responses are not encouraging as investors saw it as the firm's sliding performance resulting in a share price drop.

Besides creating value for a firm’s share price, it is necessary for the management strategy to devise an appropriate dividend policy payout to strike a balance between the shareholders’ interests without jeopardizing the company’s future growth and financial stability. Whilst considering the expectation of their shareholders on dividend payout, a meticulous setting of dividend payout policy is required and regarded as an opportunity cost for dividend gainer investors for their willingness to keep their investment with the firm (Nnadi et al., 2013). However, dividend decisions always become controversial when conflicting with investment decisions, especially if the firm is in a growth stage that focuses much on investment opportunities for management strategy. Much effort and cost will be put into research and development (R&D) on a new product, penetration of new markets to expand market share, and capital expenditure spending, particularly for an aggressive innovation-oriented management strategy. This could be seen as shareholder wealth maximization in the long run (Akindayomi & Amin, 2022). However, the higher the firm’s spending on R&D and technological innovation such as carbon risk industries has led to an increase in the degree of earnings uncertainty, financial constraints, and free cash flow that impacted dividend payout level. A previous study by Zhu and Hou (2022) investigates the effect of firm-level carbon risk and the level of dividend policy indicating that when a firm’s capability in innovation is stronger, it has a significant and negative relationship with dividend distribution.

The trade-off between dividend decisions and investment decisions resulted in a firm decreasing the dividend payout to allocate more retained profit for business development. Though a firm may use other alternatives such as capital reserves for dividend distributions, it may affect the firm’s value. The dividend distribution from the capital reserve has a negative response where the market gives a lower evaluation of the distribution of cash dividends from capital reserves when compared to the distribution from retained earnings (Liu & Lee, 2022).

As an important financial decision for firms, corporate dividend policy is determined by firm characteristics and management strategy. A firm that focuses on investment and growth opportunities as management orientation strategies could be linked to a lower dividend payout policy. They are less likely to pay, initiate or increase dividend payments than firms following cost-effective business strategies (Akindayomi & Amin, 2022; Cao et al., 2022; Zhu & Hou, 2022).

The source of dividend distribution, the firm usually pays the dividend from retained earnings but if the retained earnings are insufficient, other sources may be used to distribute the cash dividend such as capital reserves. However, the distribution of cash dividends from capital reserves signaling lower evaluation from investors implies that investors can distinguish the differences between the distribution of cash dividends from capital reserves and the distribution of cash dividends from retained earnings. It is considered an act of buffering mechanisms particularly when the cash dividend payout ratio decreases, investors have a negative evaluation of the companies (Liu & Lee, 2022).

Dividend decisions versus investment decisions are always controversial when companies compete for a limited internal fund for business survival. The trade-off is highly dependent on the company’s management strategy. Companies with research and development (R&D) investments in developed markets usually pay fewer dividends in imperfect capital markets. In contrast, the R&D investment found to have a positive effect in China indicates that companies with more R&D investment but facing internal financing deficit tend to pay more dividends due to regulation imposed by China Government on semi-mandatory dividend policy (SMDP) to get access to the external equity market (Yang et al., 2020).

The board of directors who formulated the management strategies on dividend policy and R&D must carefully consider the mixture balance of these two important decisions. Corporate governance emphasizes that the board is responsible for evaluating a more comprehensive assessment of the management's strategic financial decision and their implications for sustainable growth and long-term success in maximizing the shareholders’ wealth. Previous studies suggest that board composition plays a crucial role in moderating the effect of management strategy on dividend payout policy (Boshnak, 2021; Chintrakarn et al., 2022; Kumpamool & Chancharat, 2022; Lu et al., 2022; Ye et al., 2019; Shehu, 2015).

The study done by Chintrakarn et al. (2022) argued that the board influenced the management strategy. The board puts pressure on management to generate more cash and pay dividends. In view of this, not many studies focus on management strategy and board composition as determinant factors in dividend payout policy. Therefore, this study aims to address this gap and provide insights into formulating effective dividend policies that align with management strategies and board compositions. In addition, there is a need to determine and analyze the specific impact of different management strategies and the moderating effect of board composition on dividend payout decisions. This study also demonstrates the relationship between management strategy and dividend payout ratios as well as to what extent the composition and diversity of the board of directors influence this relationship. Hence, the objectives of this study are to provide insights into the initiatives already in place, as well as determine the moderating effect of board composition and diversity on the relationship between management strategy and dividend payout policy. Finally, the subsequent section of this study provides the literature review, followed by explaining the methodology, and the conclusion section summarises the contribution of this study, provides policy recommendations, and points out the study's limitations.

Literature Review

Management Strategies and Dividend Payout Policy

Prior studies emphasize financial determinants of dividend policies but not much literature on non-financial inclusion such as a business strategy in shaping the firm’s dividend policies. This study uses the terms business strategy and management strategy interchangeably. Based on recent studies by Akindayomi and Amin (2022), management strategy can be represented by innovation strategy through R&D investment in products, technology, and business processes including a financial strategy that can bring economic benefit. The management strategy is aimed to improve the firms’ performance and increase organizational efficiency so that they can survive and compete in the market (Hasan & Uddin, 2022). A higher return demonstrates the firm’s performance and the ability to pay a higher dividend payout. However, previous studies on business strategy and dividend payout policies studied by Cao et al., (2022) indicated that a firm focuses on investment opportunities as its business strategy will prioritize its internal fund for significant capital budgeting expenditures and be less likely to pay dividends than those firms following a cost-effective business strategy. For managers, pressure perceives higher demand on investment strategies, they prefer to reduce the current dividend payout level and reserve more cash for future investments.

The inclusion of business strategy as a non-financial characteristic contributes insight into the underlying determinants of dividend policy. Management strategy is defined as how the firm may utilize its resources whether for an innovation-oriented strategy or sustaining organizational and operational stability for an efficiency-oriented strategy. Both strategies are intended to increase profitability and improve efficiency, which impacts on the level of dividend distribution. Difference management strategies significantly give different impacts on its dividend policy where a firm that focuses on an innovation-oriented strategy pays significantly lower dividends than those following an efficiency-oriented strategy (Cao et al., 2022). Nevertheless, different studies indicated that a firm will likely pay more dividends. The market response may be different when they perceive a firm with an innovation-oriented strategy as a high-risk-taking firm than those that sustain organizational and operational stability (Harakeh et al., 2019).

The government may encourage firms to pay dividends as a strategic incentive through a regulated policy on the sources of funding for the implementation of certain business strategies (Kanakriyah, 2020). In China, a study conducted by Yang et al. (2020), investigates the relationship between business strategy on R&D investment, equity financing needs, and dividend policy. It reported that firms with more R&D investments tend to pay more dividends. This can be explained by the semi-mandatory dividend policy (SMDP) and the equity dependence on R&D investments. Internal financing is limited though inexpensive, and R&D investments are largely financed by external equity markets. Therefore, to access external equity markets, there are strategic incentives for R&D firms to pay dividends, essentially to meet the prerequisite of equity financing, which is called pay-for-financing incentives. The findings indicated that firms with equity dependence on R&D investments positively affect dividend payout and strongly affect firms with lower cash holdings and higher internal financing deficits. This paper contributes to the broad literature on the positive effect of the R&D investment-dividend relationship. But the SMDP enforcement constitutes an extra cost of equity financing and may have adverse impacts on firm value and sustainable growth.

The existing studies largely focus on developed markets, and they find that firms with more R&D investments pay fewer dividends consistent with R&D investments and dividends competing for limited internal funds in an imperfect capital market (Cao et al., 2022; Harakeh et al., 2019; Zhu & Hou, 2022;). Apart from equity financing, the use of leverage as debt financing to implement the management strategy contributes significant factors to dividend policy but has an insignificant and negative effect on firm value (Kanakriyah, 2020; Sugiastuti et al., 2018; Tahir et al., 2020a). Further, when the manager believes the external financing cost is higher, they tend to reduce the current dividend payout level. Obviously, the setting of dividend policy requires careful consideration even though the company may not plan for future investment. The correlation of dividend policy and investment policy should be construed together as an important management strategy.

This study develops this hypothesis:

H1: There is a relationship between management strategy and dividend payout policy.

Board Composition and Dividend Payout Policy

The Board of Directors is the higher authority for the organization. Their duties are to approve the directions of the organization to execute strategic functions including financial matters such as the dividend payout policy. Board composition is used interchangeably with board attributes defined as the characteristics and diversity of the individual who possessed qualities such as expertise, experience, independence, and background to be qualified as a board member appointment (Lu et al., 2022). Discussion on the importance of board composition and attributes affecting dividend payout policy has been studied extensively in the literature. Several studies indicated that the board composition influenced the dividend payout policies (Chen et al., 2017; Chintrakarn et al., 2022; Lee, 2022; Tahir et al., 2020b; Ye et al., 2019). These studies argued that the board of the company forced the management of the company to generate more cash to pay the dividend. These studies unanimously agreed that the board composition influenced the decision to pay dividends within the organization. Tahir et al. (2023) show mixed results on the effectiveness of board composition and attributes compelling dividend payout policy pre- and post-amendment of the Malaysian Code of Corporate Governance (MCCG) in 2012, where some board attributes negatively impact dividend payout policy after the amendment which signaling bad sign for the dividend payout policy and attractiveness of new investment growth of Bursa Malaysia. Thus, there is a suggestion for the respective authorities to strengthen the rules to monitor board composition and attributes for the improvement of dividend payout policy to encourage more investments, especially from a group of dividend gainers investors.

Given that the management strategy orientation affects the dividend payout policies, investors will likely face a potential trade-off between dividend income and capital gain when investing in the equity market. The board composition influenced the management strategy demonstrated by the board decision signaling communication to the individual investors to select high-growth firms that pay a limited dividend or high-dividend income with limited growth prospects into their investment decisions, to suit their investment appetite and existing portfolio (Akindayomi & Amin, 2022; Cao et al., 2022).

However, different studies use different variables as the proxy for the board composition and attributes. The proxy of board composition includes the board independence (Chintrakarn et al., 2022; Lee, 2022; Tahir et al., 2023), ownership structure (Boshnak, 2021; Lee, 2022), board diversity (Chen et al., 2017; Tahir et al., 2023; Ye et al., 2019), board tenure (Tahir et al., 2023), and CEO duality (Tahir et al., 2023). The board independence includes the independent and non-independent directors whilst the board diversity refers to the board gender; male versus female directors sits on the board. The CEO duality is the Chief Executive Office holding the office of the chairperson of the board presumably as the Executive Chairman is the most influential person in the position to veto the decisions made by the other directors (Benjamin & Biswas, 2019). Mixed results on board composition and attributes on dividend payout policy; significant versus insignificant. Few studies indicate that board independence and board diversity significantly impact the dividend payout policy (Chen et al., 2017; Chintrakarn et al., 2022; Shehu, 2015; Tahir et al., 2020b; Ye et al., 2019). In contrast, previous studies show a negative association where board independence did not influence the dividend payout policy (Batool & Javid, 2014; Boshnak, 2021; Mansourinia et al., 2013). A study by Benjamin and Biswas (2019) reveals that board gender composition has a positive association with a firm’s inclination to initiate dividends payment and improved the level of dividend distribution in firms with CEO duality only. Both Tahir et al. (2023) and Chen et al. (2017) examined the CEO duality and board tenure consistently indicating a good sign and a positive relationship with a dividend payout policy and in fact, it is higher in companies with CEO duality. It proposes that the monitoring role of a female in the corporate boards is more significant when there is CEO duality in form.

This study used all the variables as indicators for the board composition. This study develops this hypothesis:

H2: There is a relationship between board composition and dividend payout policy.

Management Strategy and Dividend Payout Policy moderated by Board Composition.

Several studies indicated that the management strategy and dividend policy have an inter-relationship with the board composition. The relationship between management strategy and dividend policy can be moderated by the board composition from various perspectives such as financial expertise, industry-specific knowledge and experience, independence of directors, board diversity, board tenure, corporate governance, and the firm’s strategic planning on short and long-term growth (Lu et al., 2022; Tahir et al., 2020b). These board composition elements can influence the firm to formulate, devise, and implement management strategies that ultimately affect dividend policy. The results of these studies are mixed result with the papers. These studies are stipulated in tax avoidance strategies (Alkurdi & Mardini, 2020; Boussaidi & Hamed-Sidhom, 2021; Dhia Prawati et al., 2022), working capital management (Kumpamool & Chancharat, 2022), organizational goals (Fernandez & Thams, 2019; Hasan & Uddin, 2022), research and development strategies (Akindayomi & Amin, 2022; Cao et al., 2022; Yang et al., 2020; Zhu & Hou, 2022), financial leverage (Kanakriyah, 2020; Sugiastuti et al., 2018; Tahir et al., 2020a).

The result indicated that foreign ownership influenced tax avoidance strategies (Alkurdi & Mardini, 2020; Boussaidi & Hamed-Sidhom, 2021). The organization used more tax avoidance practices to minimize the tax payment to the authorities. This study agreed with the earlier statement indicating that foreign ownership can diversify the board and influence the management's commitment to achieving the goal of the organization (Boshnak, 2021; Fernandez & Thams, 2019). In the case of working capital management, the larger board composition reduces the net working capital (Kumpamool & Chancharat, 2022). For research and development strategies, board composition influenced the strike balance of dividend policy and R&D expenditures. It revolves around how board decisions prioritize earnings allocation on R&D investment and dividend distribution. The use of leverage as debt financing to implement the management strategy contributes significant factors to dividend policy but has an insignificant and negative effect on firm value (Sugiastuti et al., 2018; Tahir et al., 2020a). This study develops this hypothesis:

H3: There is a relationship between Management Strategy and Board Composition.

Previous studies (Alkurdi & Mardini, 2020; Boshnak, 2021; Boussaidi & Hamed-Sidhom, 2021) indicate that the management strategy had influenced board composition and dividend payout policy. The setting of the dividend policy should be aligned with the management strategy whilst considering the interest and expectations of its shareholders. The board actively acts in its role to evaluate and assess the firms’ performance and management strategy for a firm’s long-term success, growth, prospects, and shareholder satisfaction. Existing studies focused much on the board attributes and dividend policy payout but lack on the management strategy and board composition on dividend policy (Boshnak, 2021; Chen et al., 2017; Shehu, 2015; Tahir et al., 2023; Ye et al., 2019). Thus, since the board composition and strategic financial decisions become crucial in shaping the dividend payout policy, it is necessary to study how board composition influences the management strategy and dividend payout policy. Therefore, this study inferred that the board composition moderated the relationship between the management strategy and dividend payout policy. The hypothesis develops as follows:

H4: The Board Composition moderated the relationship between the Management Strategy and dividend payout policy.

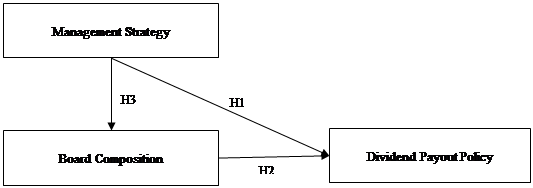

All the hypotheses development led to the following conceptual framework:

Management StrategyBoard CompositionDividend Payout PolicyH1H2H3Management StrategyBoard CompositionDividend Payout PolicyH1H2H3

The conceptual framework outlined in Figure 1 studies the effect of management strategy on dividend payout policy moderated by board composition. It addresses the key variables in the study questions and hypotheses in shaping the firm’s dividend decision. This framework provides a structured approach to understanding how the management strategy and board composition affect dividend payout policy, the relationship between management strategy and board composition, and how the board composition moderates the relationship between the management strategy and dividend payout policy. This study will represent different proxies used for the management strategy, board composition, and dividend payout policy.

Conclusion

As the prior studies indicated there is a direct relationship between management strategy and board composition, therefore, this study reinforced the existing study by examining the moderating effect of board composition on the relationship between management strategy and dividend payout policy. Given that the board may induce the management strategy orientation to affect the dividend payout policies, investors will likely face a potential trade-off between dividend income and capital gain when investing in the equity market. It facilitates an individual investor’s selection of high-growth firms that pay a limited dividend or high-dividend income with limited growth prospects into their investment decisions, to suit their investment appetite and existing portfolio (Akindayomi & Amin, 2022; Cao et al., 2022). Thus, despite recognizing the importance of management strategy and dividend payout policy in enhancing shareholder wealth, there needs to be more understanding of the specific impact of different management strategies and the moderating effect of board composition on firms' dividend decisions. Hence, this study aims to address this gap and provide insights into formulating effective dividend policies that align with management strategies and board compositions, promoting sustainable growth and maximizing shareholders' wealth in the long run.

Acknowledgments

The authors are grateful and acknowledge the financial support from the internal research fund of the Faculty of Accountancy, Universiti Teknologi MARA, Cawangan Selangor, Kampus Puncak Alam Selangor, Malaysia. (Grant No: 600 FPN (RICAEN. 5/2/1).

References

Akindayomi, A., & Amin, M. R. (2022). Does business strategy affect dividend payout policies? Journal of Business Research, 151, 531-550.

Alkurdi, A., & Mardini, G. H. (2020). The impact of ownership structure and the board of directors' composition on tax avoidance strategies: empirical evidence from Jordan. Journal of Financial Reporting and Accounting, 18(4), 795-812.

Batool, Z., & Javid, A. Y. (2014). Dividend policy and role of corporate governance in the manufacturing sector of Pakistan (Vol. 109). Pakistan Institute of Development Economics.

Benjamin, S. J., & Biswas, P. (2019). Board gender composition, dividend policy and COD: the implications of CEO duality. Accounting Research Journal, 32(3), 454-476.

Boshnak, H. A. (2021). The impact of board composition and ownership structure on dividend payout policy: evidence from Saudi Arabia. International Journal of Emerging Markets.

Boussaidi, A., & Hamed-Sidhom, M. (2021). Board's characteristics, ownership's nature and corporate tax aggressiveness: new evidence from the Tunisian context. EuroMed Journal of Business, 16(4), 487-511.

Cao, Z., Chen, S. X., Harakeh, M., & Lee, E. (2022). Do non-financial factors influence corporate dividend policies? Evidence from business strategy. International Review of Financial Analysis, 82, 102211. https://doi.org/10.1016/j.irfa.2022.102211

Chen, J., Leung, W. S., & Goergen, M. (2017). The impact of board gender composition on dividend payouts. Journal of Corporate Finance, 43, 86-105. https://doi.org/10.1016/j.jcorpfin.2017.01.001

Chintrakarn, P., Jiraporn, P., Treepongkaruna, S., & Mook Lee, S. (2022). The effect of board independence on dividend payouts: A quasi-natural experiment. The North American Journal of Economics and Finance, 63, 101836.

Dhia Prawati, L., Millenia, S., & Kristianti, T. (2022). Analyzing The Effects of Business Strategy, Tax Avoidance, and Dividend Policy on Company Value: An Empirical Study. 2022 5th International Conference on Computers in Management and Business (ICCMB).

Fernandez, W. D., & Thams, Y. (2019). Board diversity and stakeholder management: the moderating impact of boards' learning environment. The Learning Organization, 26(2), 160-175.

Harakeh, M., Lee, E., & Walker, M. (2019). The effect of information shocks on dividend payout and dividend value relevance. International Review of Financial Analysis, 61, 82-96.

Hasan, M. M., & Uddin, M. R. (2022). Do intangibles matter for corporate policies? Evidence from organization capital and corporate payout choices. Journal of Banking & Finance, 135, 106395.

Kanakriyah, R. (2020). Dividend Policy and Companies' Financial Performance. The Journal of Asian Finance, Economics and Business, 7(10), 531-541.

Kumpamool, C., & Chancharat, N. (2022). Does board composition influence working capital management? Evidence from Thailand. Corporate Governance: The International Journal of Business in Society, 22(6), 1178-1196.

Lee, Y. K. (2022). The effect of ownership structure on corporate payout policy and performance: Evidence from Korea's exogenous dividends tax shock. Pacific-Basin Finance Journal, 73, 101763.

Liu, Y.-Y., & Lee, P.-S. (2022). Market responses to cash dividends distributed from capital reserves. Finance Research Letters, 46, 102389.

Lu, Y., Ntim, C. G., Zhang, Q., & Li, P. (2022). Board of directors' attributes and corporate outcomes: A systematic literature review and future research agenda. International Review of Financial Analysis, 84, 102424.

Mansourinia, E., Emamgholipour, M., Rekabdarkolaei, E. A., & Hozoori, M. (2013). The effect of board size, board independence and CEO duality on dividend policy of companies. International Journal of Economy, Management and Social Sciences, 2(6), 237–241

Nnadi, M., Wogboroma, N., & Kabel, B. (2013). Determinants of dividend policy: Evidence from listed firms in the African stock exchanges. Panoeconomicus, 60(6), 725-741.

Shehu, M. (2015). Board characteristics and dividend payout: Evidence from Malaysian public listed companies. Research Journal of Finance and Accounting, 6(16), 35-40.

Sugiastuti, R. H., Dzulkirom, M., & Rahayu, S. M. (2018). Effect of Profitability and Leverage Toward Dividend Policy And Firm Value. Russian Journal of Agricultural and Socio-Economic Sciences, 80(8), 88-96.

Tahir, H., Hussain, S., Rahman, M., & Masri, R. (2023). Board attributes and dividend payout policy: pre- and post-MCCG 2012 Malaysian. International Journal of Economic Policy in Emerging Economies, 17(1), 48.

Tahir, H., Rahman, M., & Masri, R. (2020a). Corporate Board Attributes and Dividend Pay-out Policy: Mediating Role of Financial Leverage. Journal of Asian Finance, Economics, and Business, 7(1), 167-181.

Tahir, H., Rahman, M., & Masri, R. (2020b). Do board traits influence firms’ dividend payout policy? Evidence from Malaysia. Journal of Asian Finance, Economics, and Business, 7(3), 87-99.

Yang, B., Chou, H.-I., & Zhao, J. (2020). Innovation or dividend payout: Evidence from China. International Review of Economics & Finance, 68, 180-203.

Ye, D., Deng, J., Liu, Y., Szewczyk, S. H., & Chen, X. (2019). Does board gender diversity increase dividend payouts? Analysis of global evidence. Journal of Corporate Finance, 58, 1-26.

Zhu, B., & Hou, R. (2022). Carbon risk and dividend policy: Evidence from China. International Review of Financial Analysis, 84, 102360.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Ahmad, B., Jamil, M. M., & Hoque, M. N. (2023). Management Strategy on Dividend Payout Policy Moderated by Board Composition. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1064-1073). European Publisher. https://doi.org/10.15405/epsbs.2023.11.87