Abstract

The system of quality management (SOQM) for the public accounting firms is affected by the International Standard of Quality Management 1 (ISQM1), International Standard of Quality Management 2 (ISQM2) and revised International Standard on Auditing 220 (ISA220). The SOQM prescribes drivers of audit quality at the engagement and firm levels; and in ensuring successful adoption of these standards, an understanding of the factors affecting audit quality at both levels is critical. This study examines the direct and indirect effects of engagement-level factors (i.e., audit task engagement and engagement complexity) and firm-level factor (i.e., firm establishment) on audit quality. Data gathered via questionnaires from 114 randomly selected auditors were analyzed to gauge their perspectives on factors influencing audit quality. The results show a positive significant relationship between audit task engagement and firm establishment with audit quality. Further findings show a moderated effect between audit task engagement and audit quality when engagement is more complex, implying an interaction that can be potentially considered to boost audit quality in a more difficult engagement. This study offers contemporary knowledge on audit quality in view of the latest revisions of the standards that will augment the value offers by the accounting profession. This study provides insights into the recent adoption of ISQM1, ISQM2 and revised ISA220 as part of the holistic framework of SOQM which will derive a new perspective in achieving good quality audit.

Keywords: Audit Quality; Audit Engagement, Quality Management

Introduction

Performing quality audit is a requisite for the auditors to be accountable in carrying out their job and be answerable to the stakeholders (Carp & Istrate, 2021; Masood & Afzal, 2016). However, the cases of audit firms being inflicted with alleged accusation of bad quality audit reveal that the quality of audit work is still much in doubt (Shan, 2014; Svanberg & Öhman, 2019). Previous incidences of audit failures signaling audit deficiencies are prevalent which are indicative of quality control issues at the engagement level and firm level (Azizkhani et al., 2018; Gunn et al., 2019). The firms and the auditors are both accountable for audit quality of which the policies and procedures at the firm level will in turn shape the audit quality at the engagement level. The auditors play a crucial role in representing the public in the accounting profession which includes increasing the transparency of management, improving the trust of investors, and making financial reporting more convincing. Good quality audit is perceived to reduce the asymmetry of accounting information and to mitigate the residual loss of financial reporting management opportunities (Husain, 2020). The quality of work performed by the auditors will impact the auditors’ judgement and influence the decisions made by parties outside the business who are depending on the auditors’ opinion.

The importance of audit quality management has called for the International Auditing and Assurance Standards Board (IAASB) to issue the International Standard of Quality Management 1 (ISQM1), International Standard of Quality Management 2 (ISQM2) and revised International Standard on Auditing 220 (ISA220) which are collectively known as system of quality management (SOQM). These standards came into effect on 15 December 2022. SOQM effectively replaces the previously primary standards for audit quality i.e., International Standards on Quality Control (ISQC1). These standards establish the measurement that defines audit quality which both the auditors and firms should comply with. Essentially, the auditors and the firms should focus on enhancing auditors’ capability and improve the work process in performing the audit so that the quality of audit work increases. Although it seems that the deadline to implement these standards is still a while from now, the efforts to fully embrace SOQM shall start immediately to ensure its successful implementation. Accounting firms, particularly the Big-4, are now gearing up to proactively develop their implementation plan to ensure they are fully ready when the time comes.

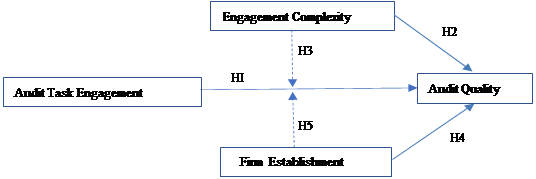

In migrating towards SOQM, it is crucial to understand audit quality and the factors that can affect it. Many previous studies have examined various factors affecting audit quality, but limited studies have examined the interaction effects of the engagement- and firm-level factors. From the perspectives of the auditors, this study examines the factors at the engagement level (i.e., audit task engagement and engagement complexity), and firm level (i.e., firm establishment) in influencing audit quality. These are among the key factors that can play an important role in shaping the quality standard of audit services. This study offers evidence that can redefine the accounting and audit landscape requirements that can potentially augment the credibility of financial statements. The remaining part of the paper presents the contextual structure of the integrated SOQM, followed by literature review and hypothesis development, research methodology, empirical results and data analysis, and discussions and conclusions.

Integrated System of Quality Management for Public Accounting Firms

There have been constant efforts by the IAASB to enhance audit quality, starting with the adoption of ISQC1 and ISA200 in December 2009. The ISQC1 outlines audit firm’s responsibilities for its system of quality control while ISA220 outlines the specific responsibilities of the auditors regarding quality control procedures for an audit engagement. The ISQC1 and ISA220 have common elements of audit quality control, albeit from two different perspectives i.e., the firm level and engagement level respectively. The key elements are leadership responsibilities, ethical requirements, acceptance and continuance of client, human resource, engagement performance, monitoring, and documentation (note: documentation is only applicable for ISA220).

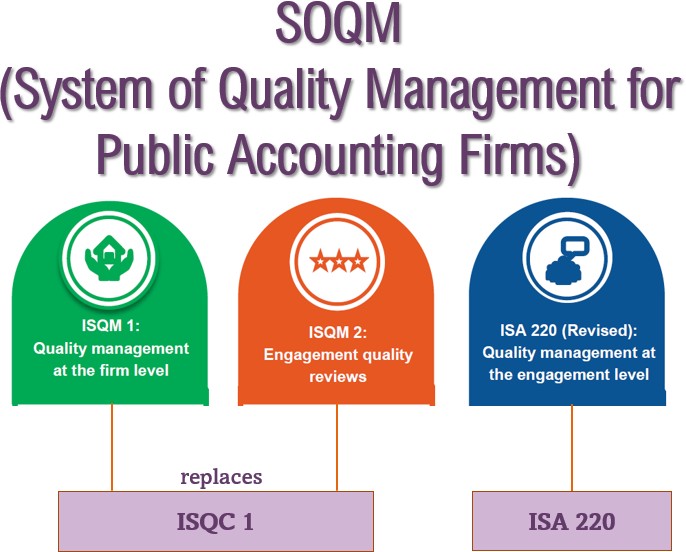

In 2019, the IAASB has mooted for an integrated quality management approach that reflects upon audit quality on a more holistic basis. A framework for an integrated system of quality management (SOQM) was then introduced, outlining a mechanism that creates an environment which enables and supports engagement teams in performing quality audit. The SOQM helps the firm in achieving consistent audit quality as it focuses on how the firm manages the quality of audit work performed at both the firm and engagement levels. Under SOQM, the IAASB has curated for ISQM1 and ISQM2 to replace ISQC1, while ISA200 is maintained with necessary revisions (as shown in Figure 1).

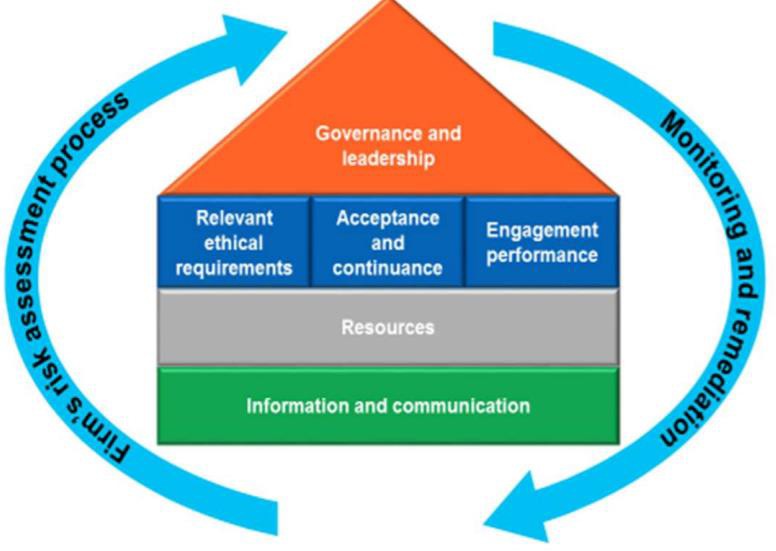

The ISQM1, which largely replaces ISQC1, requires the firms to design, implement and operate SOQM for audits or reviews of financial statements, or other assurance or related services engagements. The ISQM1 is a risk-based rather than one- size-fits-all approach. This addresses the issue commonly raised with ISQC1 in which the quality control procedures require all firms to follow regardless of their size and nature. ISQM 1 aims to enhance the robustness of the firms’ SOQM that is customised to the nature and circumstances of the firms and the audit engagements. The ultimate responsibility for SOQM lies with the firms, although the implementation and operations are executed at the engagement level. The ISQM1 comprises eight interrelated elements that deal with the key aspect of the SOQM as shown by Figure 2. The elements of ISQM1 are aligned to the elements of ISQC1 and include two additional elements i.e., the firm’s risk assessment process and information and communication.

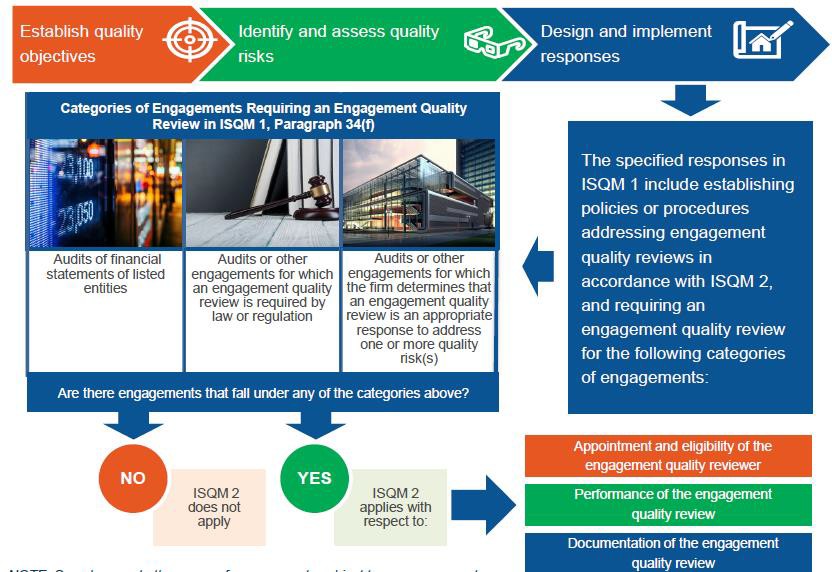

The ISQM2, on the other hand, is an addendum that specifically caters to the requirements for engagement quality reviews, which are formerly prescribed in both ISQC1 and ISA220. With ISQM2, a separate standard for engagement quality reviews will place greater emphasis on the importance of engagement quality reviews, as well as enhance the robustness of the requirements for the eligibility of engagement quality reviewers. The ISQM2 will also provide a mechanism to differentiate the responsibilities of the firms and the engagement quality reviewers more clearly. Figure 3 shows that ISQM2 is applicable to all categories of engagements prescribed under paragraph 34(f) of the ISQM1, including the requirements for appointing an engagement quality reviewer, performance and documentation of engagement quality review.

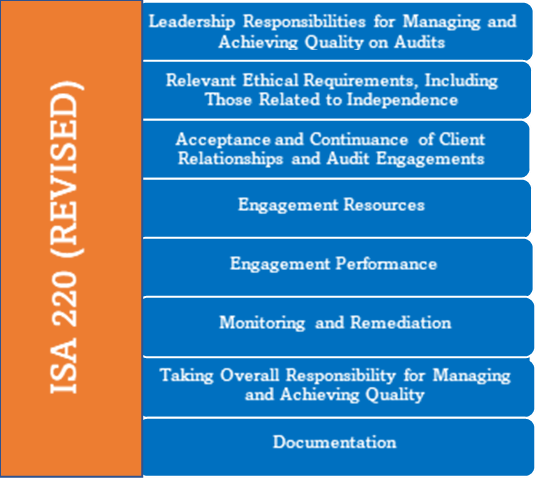

The revised ISA220 deals with the specific responsibilities of the auditor regarding quality management at the engagement level for an audit of financial statements and the related responsibilities of the engagement partner. The revised standard clarifies and strengthens the key elements of quality management at the engagement level. This is achieved by focusing on the critical role of the engagement partner in managing and achieving quality on the audit engagement and reinforcing the importance of quality to all members of the engagement team. Among the key revision of ISA220 is the increased emphasis on the engagement partner’s overall responsibility to manage and achieve quality on the engagement which is demonstrated through sufficient and appropriate involvement throughout the audit engagement. The significant role of the engagement partner calls for greater responsibility for monitoring quality at the engagement level, including supervision and review of the overall audit execution. The revised ISA220 emphasizes on involvement of the engagement partner as a strong basis for the auditor in taking overall responsibility on the audit engagement. The revised standard also seeks to encourage total quality management at the engagement level, as well as keeping the standard appropriate for a more complex audit environment, advocating for greater internalization of professional skepticism and enhancing the auditor’s judgments. As shown in Figure 4, the revised ISA220 maintains all existing elements of original ISA220 and introduces one new element, i.e., taking overall responsibility for managing and achieving quality, to add up to eight elements in total.

In December 2020, the IAASB released the final pronouncement for ISQM1, ISQM2 and ISA220 (Revised) and the accounting firms are expected to comply with these standards by December 15, 2022. With ISQM1, ISQM2 and revised ISA220, the objective to achieve an integrated system of audit quality management can be approached with better strategies. In embracing the migration towards an integrated SOQM, it is even more crucial to understand the determinants of audit quality, more so on how these determinants at the level of individual, engagement and firm levels could have interacted in influencing audit quality.

Literature Review and Hypotheses Development

Audit Quality

The IAASB describes audit quality as an integration of a number of key elements that create an environment which maximizes the likelihood that an acceptable standard of audit work is performed on a consistent basis (IAASB, n.d.). The key elements include input, process, output, key interactions within the financial reporting supply chain and other contextual factors relevant to audit. De Angelo (1981) defines audit quality as the market-assessed joint probability that a given auditor will both detect material misstatements in the client's financial statements and report the material misstatements. While compliance with the auditing standards is the foundation of audit quality, audit work has not always been practiced as what is expected by the auditing standards (Christensen et al., 2016; Gao & Zhang, 2019). Widely reported cases of corporate collapses that have concomitantly dragged down accounting firms (such as Enron-Arthur Andersen and Parmalat-Deloitte and Touche and Grant Thornton) have stimulated contentions about quality of audit work performed by the auditors.

The currently adopted ISQC1 and ISA220 outline six key elements of audit quality - leadership responsibilities, ethical requirements, acceptance and continuance of client, human resource, engagement performance and monitoring. Apart from these elements, previous studies and publications by the professional bodies have recognised other drivers that could influence audit quality. For instance, the Institute of Chartered Accountants in England and Wales (ICAEW, 2021) identifies five influences that could drive audit quality i.e., leadership, people, working processes, quality management practices, and customer relationships. The Financial Reporting Council (FRC, 2008) released its Audit Quality Framework and described many other factors that could influence audit quality i.e. the atmosphere of an audit firm, the qualifications and personal attributes of audit partners and employees, the efficiency of the audit process, the reliability and usefulness of audit reporting, and factors beyond the control of auditors (such as interactions with audit clients and audit committees).

The IAASB subsequently published a systematic structure recognizing five integrating elements that influence audit quality i.e. inputs (audit principles, expertise, qualifications, and experience of auditors), operation (audit process of the firm, audit methods, and quality management procedures), outputs (auditors’ reports to various groups), relationships (supporting positions of other main stakeholders), and contextual factors (business practices, audit regulation, and financial reporting framework). With the introduction of SOQM as explained in Section 2.0, it is posited that all of these elements are now being integrated as a structured mechanism that could provide a more holistic approach in preserving audit quality. For the purpose of this current study, these elements of audit quality are classified into two different levels – engagement-level and firm-level determinants.

Audit Task Engagement

At the engagement level, auditors’ work is shaped by the audit methodologies and internal review. These elements are important in the execution of audit task at the engagement level. Audit methodologies are procedures taken up on audit work, i.e. the methodological approaches by the firms to ensure that the audit work runs smoothly and complies with the auditing standards, relevant laws and regulations, and the audit firms’ quality control procedures (Al-Khaddash et al., 2013). With proper audit methodologies, auditors would be clearer on what they are supposed to do in an audit and how they should perform the audit procedures. Audit methodologies would assist the auditor to be more prepared and adaptive to assess the risk of material misstatements, including the relevant method to be adopted in the audit (Brown et al., 2016; Plumlee et al., 2015). With clear and proper audit methodologies, auditors would be able to perform audit with better due care, hence enhancing audit quality. A study by Solichin et al. (2022) also posited that auditor who are more competent would perform better in highlighting weaknesses of internal control that could lead to fraud. In an audit engagement, the internal review scrutinizes the audit preparation, critical analysis of the audit deliverables, and imposing oversight on the audit work done to foster efficiency within the audit engagement (Oktavianto & Suryandari, 2018). The internal review has a role to play in helping firm to accomplish its goals through the review of control deficiencies and the conduct of risk evaluations (Kilgore et al., 2011). It largely describes the effective and efficient internal oversight from upper-level management toward audit work performed. Besides, it also elaborates the review which relates to audit procedures performed by the auditors. According to Zahmatkesh and Rezazadeh (2017), with proper internal review from audit planning stage until completion of audit work, auditors are in better grasp of what they should improve on for any recommended actions proposed by the reviewer. Thus, the following hypothesis is proposed in examining the relationship between audit task engagement and audit quality:

H1: Audit task engagement positively influences audit quality.

Engagement Complexity

The complexity of an audit engagement is based on the auditors’ perception of the difficulties of an audit task. Complexity in conducting an audit engagement often relates to the auditors having to complete complicated tasks, multiple tasks at once, and different tasks which are interrelated with each other (Endri, 2020). Auditors face different level of complexity in conducting the audit engagement could have due to various factors such as type and size of clients and availability of audit aids. Some auditors perceive audit tasks as high complexity and difficult, while other auditors perceive them as easy. Complexity of the engagement is ambiguously defined and difficult to measure objectively. Audit environment is important to study the task complexity because the task complexity can have an impact on audit judgment performance, and complexity comprehension of different audit tasks can help managers improve assignments and training in decision making (Bonner, 1994).

Bonner (1994) asserts that engagement complexity has three dimensions: component complexity (number of information cues and different actions), coordinative complexity (type and number of relationships between actions and cues), and dynamic complexity (changes in actions and cues and relationships in between them). Complex tasks require more personal resources (for example, attention resources, information processing capacity, effort, and perseverance) that will be expanded to implementation. Sanusi et al. (2018) argues that higher task complexity makes people to use non-compensation strategies to lead to lower quality judgment and decisions. Thus, the following hypotheses are proposed in examining the relationship between the direct and indirect relationship of engagement complexity with audit quality:

H2: Engagement complexity negatively influences audit quality.

H3: The relationship between audit task engagement and audit quality is moderated by engagement complexity.

Firm Establishment

From the point of view of firm level, this study relates how size of firm establishment which is proxied on firm size influences audit quality. According to Sawan and Alsaqqa (2013), the bigger the size, the greater the motivation for the firms to preserve audit quality as they have bigger stake that they need to care for. For example, for firms to practice substandard quality in their work would expose them to reputational and regulatory risks that will jeopardize their establishment. Hence, bigger firms are motivated to perform their audit more accurately, which would be wasted if they offer incorrect results. Furthermore, relative to the smaller firms, the large-scale firms have greater leverage on their resources in order to ensure good audit quality (Suseno & Nofianti, 2018). This argument explains that the size of firms is inseparable from the achievement of efficiencies and effectiveness of audit. It is deemed that sizeable firms can deliver higher audit quality than smaller firms given the stronger financial capital that allows them to take advantage of technical advances, perform required analysis and employ more experienced auditors.

A study by Davidson and Neu (1993) found that larger firms are likely to generate better firm establishment because they have more collective experiences, consultation partners, and greater skills than the small ones to spot content misstatements. On the other hand, Choi et al. (2010) investigated the effect of audit firm scale on audit efficiency and the result indicates a positive effect on audit results as large firms have more opportunity to exchange insights, understanding, and expertise amongst employees on the corporate growth of both clients and the internal control system. In addition, research by Sirois and Simunic (2011) reinforces this by demonstrating that large firms have the potential to conduct technology-based audits that are more precise and faster than small ones. Thus, the following hypotheses are proposed in examining the relationship between the direct and indirect relationship of firm establishment with audit quality:

H4: Firm establishment positively influences audit quality.

H5: The relationship between audit task engagement and audit quality is moderated by firm establishment.

Based on the arguments and hypotheses presented above, the conceptual framework for this study is depicted by Figure 5. It outlines five hypotheses for the direct and indirect path relationships between three independent variables (audit task engagement, engagement complexity and firm establishment) on audit quality.

Research Methodology

This study used questionnaire in gathering responses from randomly selected respondents. Quantitative method relies on capturing and using numerical data to recognize the findings across groups of individuals or to explain a pattern or action in a certain context. A number of previous studies used a quantitative method to examine audit quality (Aronmwan et al., 2013). In this study, the unit of analysis was the individual auditors working in accounting firms in Malaysia, of whom their perceptions were gathered to represent the audit quality practices. Based on the statistics and records from Malaysia Institute of Accountant (MIA), the population of registered auditors in Malaysia is approximately 35,976 (MIA website). Data from MIA also show that around 85% of the auditors reside in Peninsular Malaysia and mostly in Klang Valley, which is the basis on the choice of the sample location considering the scale of audit clients being audited are larger compared to other states in Malaysia.

According to Wilson Van Voorhis and Morgan (2007), there is a fair sample size of 50 when looking at interactions between one component and another. Accordingly, Fidell and Tabachnick (2003) proposed using the formula "50 + 8m" to assess the sample size where "m" is the number of independent variables. Hence, as this study examined three independent variables, the minimum number of samples needed for this analysis was 74 respondents (i.e., 50 + (8)(3)). Meanwhile, the measurement for audit quality and audit task engagement are primarily adopted and adapted with modification from the previous studies, whilst measurement for engagement complexity and firm establishment are based on the demographic information provided by the respondents. As shown in Table 1, for the measured variables, Likert scale of 1-5 was used, with ‘1’ representing “strongly disagree” and ‘5’ as “strongly agree”.

Empirical Results and Data Analysis

In this study, the samples selected were auditors in audit firms located in the Klang Valley. A total of 200 questionnaires were distributed via online using Google Form. As this study was conducted during the Covid-19 pandemic, online platform was deemed the best and most efficient way to distribute the questionnaires to the respondents. From the results, there were a total of 120 respondents participated in this survey out of 200 questionnaires issued, which accounted for 60% response rate. Based on the result of t- test, there was no response bias on the questionnaires received. Six unusable questionnaires were identified in the running of the preliminary analysis and these were omitted during the running of the statistical analysis, resulting in a final number of 114 respondents being included in this study. The unusable questionnaires were omitted due to incomplete responses received from the respondents.

Demographic Analysis of Respondents

Table 2 shows that out of 114 study participants, 49 are female (43.0%) and 65 are male (57.0%). Hence, the results show that male respondents are the dominant population. The profile also indicated that out of 114 respondents, 69 of them are between 24 to 28 years old (60.5%), followed closely by 38 respondents under the age group 29 to 33 years old (33.3%), and four respondents from the age group 34 to 38 years old (3.5%). The balance of three respondents is from the age group of over 38 years old (2.6%). According to the overall years of experience in the audit practice descriptive summary, most employees were observed to have less than three years of audit practice which made up to 47 of the respondents (41.2%), followed by 30 respondents with experience between five to seven years (26.3%), and 29 of the respondents with three to five years of audit experience (25.4%). Audit experience group with more than seven years of practice was observed to have the least response rate with only eight respondents (7.0%). Approximately 58 of the respondents (50.9%) spent more than 50% time in different types of audits in non-listed companies, as compared to 49 respondents (43.0%) who spent time on different types of audits but in listed companies. A summary statistics analysis on number of audit partners in the firm revealed that majority 71 respondents were observed to indicate more than 20 audit partners (62.3%), then followed by 31 respondents to have less than 5 audit partners (27.2%), and number of audit partners group in between 11 to 20 and 5 to 10 audit partners with 6 respondents (5.3%) each.

Correlation and Regression Analysis

Correlation test is usually performed to examine association between two variables. The analysis aimed at evaluating the relationship between the dependent variable and the various independent variables – audit quality, audit task engagement, engagement complexity and firm establishment. Based on Table 3, there is a significant relationship between audit quality and audit task engagement (r = 0.158, p < 0.01), engagement complexity (r = 0.322, p < 0.01), and firm establishment (r = 0.447, p < 0.05).

A multiple linear regression analysis was performed in examining the relationship between dependent variable and the independent variables. The multiple linear regression model was performed across a sample of size n = 114. A coefficient of determination (R2) was produced in aid to explain the variation of audit quality as affected by the various predictor variables. The coefficient of determination was generated adjusted R2 = 0.771, revealing that approximately 77.1% of the variability in audit quality was explained by the independent variables. The remaining 22.9% represents variation from co-founding factors (factors beyond control).

Based on Table 4, the regression analysis illustrates that two of the independent variables are significant in influencing audit quality which are audit task engagement and firm establishment. However, engagement complexity in itself does not prove a significant relationship with audit quality. To examine the level of effect contribution towards audit quality, standardized coefficient (Beta) for the predictor variables is applied. The analysis depicts that firm establishment has the most contribution to audit quality (0.271), followed by audit task engagement (0.117). The unstandardized coefficient was used in predicting the regression model equation.

Firstly, the regression model shows that audit task engagement has a significant positive linear relationship with audit quality [β = 0.117, p = 0.021] – therefore, hypothesis H1 is supported. Thus, we can conclude that a unit increase in the level of audit task engagement brings about 0.117 units increment in the audit quality. The result also indicates that firm establishment has a significant positive linear relationship with audit quality [β = 0.271, p = 0.000] – therefore, hypothesis H3 is supported. Thus, we can conclude that a unit increase in the firm size brings about 0.271 units increment in audit quality. The regression model, however, reveals that engagement complexity has insignificant relationship with audit quality [β = -0.066, p= 0.395] – therefore, hypothesis H2 is rejected. Thus, we can conclude that there is not enough evidence to prove that a single unit change in engagement complexity would bring about any significant change in audit quality. As for the interaction effects, it is proven that engagement complexity moderates the relationship between audit task engagement and audit quality [β = 0.309, p = 0.000] – therefore, hypothesis H4 is supported. Nevertheless, there is no significant interaction effect of firm establishment on the relationship between audit task engagement and audit quality [β = -0.537, p = 0.462] – therefore, hypothesis H5 is rejected.

Discussions and Conclusions

Given the results of this study, auditors have a central role in maintaining good quality audit, and the synergy between the auditors and the firm should be reinforced to ensure that audit quality at the engagement as well as firm level could be improved. This study focuses on three factors that could influence audit quality which are audit task engagement, engagement complexity and firm establishment. The engagement-level factors consist of audit task engagement and engagement complexity, while firm-level factor is firm establishment.

At the engagement level, the results from this study show that audit task engagement is significant to contribute to audit quality. This is consistent with previous research by Oktavianto and Suryandari (2018) which shows that one aspect, which is quality management of an audit quality, would depend on the internal review performed on the audit work done. In compliance with the ISCQ1, the firms especially the Big 4, have performed peer internal reviews and released their transparency reports to demonstrate their adherence to quality management and improve their transparency to stakeholders. Apart of that, this study is in line with Zahmatkesh and Rezazadeh’s (2017) work, where higher audit line leadership, tasked to review the audit timeframe, follow up on the final audit work and address all the problems posed by the audit work are highly crucial in contributing to good quality audit.

It is also important that audit firms carry out the internal review successfully and discuss the conclusions of the review with the auditors in order to strengthen the audit processes as a whole. The finding is also consistent with Kilgore et al. (2011) who found that audit methodologies are among the important attributes that enhance audit quality. It is presumed that the auditors’ ability to successfully plan and execute audit methodologies in a specific audit area of clients to detect material misstatement would result in a higher quality of audit performed. Additionally, auditors’ independence in determining the audit methodologies is important in ensuring good audit quality as auditors should have an impartial judgement in performing the audit. These circumstances place the auditors on track to better execute the audit processes to identify material misstatements in an audit of financial records, to make decisions in the audit process, and to prepare the final report to produce a good quality audit.

At the firm level, this study found that the size of the firm establishment has a significant influence on audit quality. This could be contributed by the fact that the larger firm size, the greater its capacity to employ qualified human capital and build equipment and technologies to ultimately deliver better performing audits. Furthermore, big firms have better and bigger pool of audit partners with wealth of experiences in steering the way audit is conducted. This finding is supported by previous research conducted by Sawan and Alsaqqa (2013) and Choi et al. (2010), which found that larger firms are likely to generate better audit quality because they have more collective experiences, consultation partners, and greater skills than the small firms to spot potential misstatements in the financial statements. The finding also indicates that audit quality has a positive effect on a public accountant's image considering bigger firms are more reputable. Consequently, the higher audit quality provided by a public accountant firm, the lower the risk for the public accountant firm to suffer from audit failure consequences.

Hence, it could be concluded that engagement-level and firm-level factors are important in influencing audit quality. Although not all variables examined under these dimensions show significant influence towards audit quality, it could be derived that at least one of the variables under each of the dimensions shows a likely influence toward audit quality. Thus, in ensuring good audit quality, the individual auditors as well as the firms should play their specific roles particularly in complying with the requirements of ISQC1 and ISA220. With the adoption of SOQM in December 2022, it is even more crucial for auditors to maintain good quality audit. Through time, the profession is upscaling the requirements for audit quality considering the changes that are taking effect in the business environment as a whole. Shareholders and other stakeholders now are more aware of their reliance on audited financial statements; hence, they would expect that auditors are discharging their duties according to the standards.

The findings of this study has provided further evidence on the importance of audit quality with the function of auditors toward audit clients. It further strengthens the separation of responsibility and interest of the auditors and the shareholders. Auditors must always work for the best interest of the shareholders, and maintaining good quality audit is one of the ways in which this can be accomplished. The auditors’ role provides some certainty and comfort that the management and those charged with governance would have a parallel aim in ensuring maximized returns to the shareholders. Auditors should be mindful of areas where possible conflicts of interest can occur and should be prepared to test these areas in the light of their work. Auditors should work based on independence and transparency, to ensure that they could deliver the expectation of the shareholders.

References

Al-Khaddash, H., Al Nawas, R., & Ramadan, A. (2013). Factors affecting the quality of auditing: The case of Jordanian commercial banks. International Journal of Business and Social Science, 4(11).

Aronmwan, E. J., Ashafoke, T. O., & Mgbame, C. O. (2013). Audit firm reputation and audit quality. European Journal of Business and Management, 5(7), 66-75.

Azizkhani, M., Daghani, R., & Shailer, G. (2018). Audit Firm Tenure and Audit Quality in a Constrained Market. The International Journal of Accounting, 53(3), 167-182.

Behn, B. K., Carcello, J. V., Hermanson, D. R., & Hermanson, R. H. (1997). The determinants of audit client satisfaction among clients of Big 6 firms. Accounting Horizons, 11(1), 7.

Bonner, S. E. (1994). A model of the effects of audit task complexity. Accounting, Organizations and Society, 19(3), 213-234.

Brown, V. L., Gissel, J. L., & Gordon Neely, D. (2016). Audit quality indicators: perceptions of junior-level auditors. Managerial Auditing Journal, 31(8/9), 949-980.

Carp, M., & Istrate, C. (2021). Audit Quality under Influences of Audit Firm and Auditee Characteristics: Evidence from the Romanian Regulated Market. Sustainability, 13(12), 6924.

Choi, J.-H., Kim, C. F., Kim, J.-B., & Zang, Y. (2010). Audit Office Size, Audit Quality, and Audit Pricing. AUDITING: A Journal of Practice & Theory, 29(1), 73-97.

Christensen, B. E., Glover, S. M., Omer, T. C., & Shelley, M. K. (2016). Understanding Audit Quality: Insights from Audit Professionals and Investors. Contemporary Accounting Research, 33(4), 1648-1684.

Davidson, R. A., & Neu, D. (1993). A note on the association between audit firm size and audit quality. Contemporary accounting research, 9(2), 479-488.

De Angelo, L. E. (1981). Auditor Size and Quality Audit. Journal of Accounting and Economics, 3, 183-199.

Endri, E. (2020). The effect of task complexity, independence and competence on the quality of audit results with auditor integrity as a moderating variable. International Journal of Innovation, Creativity and Change, 12(12).

Fidell, L. S., & Tabachnick, B. G. (2003). Preparatory data analysis. Handbook of psychology: Research methods in psychology, 2, 115-141.

FRC. (2008). The Audit Quality Framework. https://www.frc.org.uk/getattachment/46582304-32b1-43bb-b614-90318b295f28/The-Audit-Quality-Framework-Feb-2008.pdf

Gao, P., & Zhang, G. (2019). Auditing Standards, Professional Judgment, and Audit Quality. The Accounting Review, 94(6), 201-225.

Gunn, J. L., Kawada, B. S., & Michas, P. N. (2019). Audit market concentration, audit fees, and audit quality: A cross-country analysis of complex audit clients. Journal of Accounting and Public Policy, 38(6), 106693.

Husain, T. (2020). Mapping Evolution of Audit Quality Measurement. European Journal of Business and Management Research, 5(3).

IAASB. (n.d.). ISQC1: Quality control for firms that perform audits and reviews of historical financial information, and other assurance and related services engagements. SAICA Members' Handbook.

ICAEW. (2021). Audit Quality: How to Raise the Bar. https://www.icaew.com/insights/viewpoints-on-the-news/2021/april-2021/audit-quality-how-to-raise-the-bar

Kilgore, A., Radich, R., & Harrison, G. (2011). The Relative Importance of Audit Quality Attributes: The Relative Importance of Audit Quality Attributes. Australian Accounting Review, 21(3), 253-265.

Masood, A., & Afzal, M. (2016). Determinants of audit quality in Pakistan. Journal of Quality and Technology Management, 13(II), 25-49.

Oktavianto, D. D., & Suryandari, D. (2018). The factors affecting the audit quality with the understanding on information systems as the moderating variable. Accounting Analysis Journal, 7(3), 168-175.

Plumlee, R. D., Rixom, B. A., & Rosman, A. J. (2015). Training Auditors to Perform Analytical Procedures Using Metacognitive Skills. The Accounting Review, 90(1), 351-369.

Sanusi, Z. M., Iskandar, T. M., Monroe, G. S., & Saleh, N. M. (2018). Effects of goal orientation, self-efficacy and task complexity on the audit judgement performance of Malaysian auditors. Accounting, Auditing & Accountability Journal, 31(1), 75-95.

Sawan, N., & Alsaqqa, I. (2013). Audit firm size and quality: Does audit firm size influence audit quality in the Libyan oil industry? African Journal of Business Management, 7(3), 213-226.

Shan, Y. G. (2014). The impact of internal governance mechanisms on audit quality: a study of large listed companies in China. International Journal of Accounting, Auditing and Performance Evaluation, 10(1), 68-90.

Sirois, L. P., & Simunic, D. A. (2011). Auditor size and audit quality revisited: The importance of audit technology. https://www.zbw.eu/econis-archiv/bitstream/11159/98562/1/EBP073435813_0.pdf

Solichin, M., Sanusi, Z. M., Johari, R. J., Gunarsih, T., & Shafie, N. A. (2022). Analysis of Audit Competencies and Internal Control on Detecting Potential Fraud Occurrences. Universal Journal of Accounting and Finance, 10(1), 171-180.

Sukriah, I., & Inapty, B. A. (2009). Pengaruh Pengalaman Kerja, Independensi, Obyektifitas, Integritas dan Kompetensi Terhadap Kualitas Hasil Pemeriksaan [The Effect of Work Experience, Independence, Objectivity, Integrity and Competency on the Quality of Audit Results]. Simposium Nasional Akuntansi, 12, 3-9.

Sulaiman, N. A. (2018). Attributes and Drivers of Audit Quality: The Perceptions of Quality Inspectors in the UK. Asian Journal of Accounting and Governance, 10, 23-36.

Suseno, N. S., & Nofianti, L. (2018). Empirical evidence of audit firm size toward audit quality and reputation of public accounting firm. Advanced Science Letters, 24(5), 3327-3331.

Svanberg, J., & Öhman, P. (2019). Auditors' issue contingency of reduced audit quality acts: perceptions of managers and partners. International Journal of Accounting, Auditing and Performance Evaluation, 15(1), 57-88.

Wilson Van Voorhis, C. R., & Morgan, B. L. (2007). Understanding Power and Rules of Thumb for Determining Sample Sizes. Tutorials in Quantitative Methods for Psychology, 3(2), 43-50.

Zahmatkesh, S., & Rezazadeh, J. (2017). The effect of auditor features on audit quality. Tékhne, 15(2), 79-87.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Mat-Isa, Y., Borhan, M. S., Mohd-Sanusi, Z., Mohd-Razali, F., & Tobing, D. L. (2023). Interaction Effects of the Engagement and Firm-Level Factors on Audit Quality. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1015-1029). European Publisher. https://doi.org/10.15405/epsbs.2023.11.83