Abstract

This paper delves into the resilience dimensions of Islamic banks within the Malaysian context, with an emphasis on maintaining stability. A thorough literature review, incorporating case studies, theoretical frameworks, and empirical research, explores the elements that contribute to the resilience of Islamic banks. This review examines vital dimensions like risk management, regulatory frameworks, governance structures, financial performance, and customer trust to comprehend the mechanisms that support resilience. The study further investigates the unique features of the Islamic banking sector in Malaysia, including regulatory frameworks, policy initiatives, and market conditions. By considering the specific challenges and opportunities faced by Islamic banks in Malaysia, this paper provides valuable insights into the dynamics of resilience within the country’s Islamic banking industry. Moreover, this research pinpoints future research avenues for Islamic banking resilience. It emphasises the importance of studying emerging areas such as technology-driven disruptions, environmental and social sustainability, digital transformation, and the impact of global economic shifts on the resilience of Islamic banks. By outlining these research directions, this paper urges scholars and practitioners to enhance their knowledge of the evolving dynamics of Islamic banking resilience. To sum up, this article presents a comprehensive review of the resilience dimensions of Islamic banks within the Malaysian context. It consolidates current literature, provides insights of the challenges confronted by Malaysian Islamic banks, and identifies different research opportunities. The findings of this paper are important to policymakers, regulators, and practitioners looking to strengthen the resilience and stability of Islamic banks in an evolving global financial landscape.

Keywords: Bank Resilience, Bank Stability, Financial Stability, Malaysia Context, Safeguarding Stability

Banking sector: Conventional and Islamic Banks

The banking sector is just one of several industries that have been significantly impacted by the dynamics of the global economy. In a case involving Malaysia, the country’s banking industry played a significant part in financing through indirect means while also encountering issues resembling those of similar Asian nations grappling with the financial crisis. The decline of the economy and the bust of the stock and real estate markets are the immediate causes of the issues (OECD, 2009). State-directed credit policies, a lack of rivalry, as well as a shortage of prudent rules, however, are the more important causes.

There are two types of banks in Malaysia: conventional banks and Islamic banks. According to a study by Bank Negara (BNM) released in 2021, the total assets of the banking sector comprised 42.5%, or RM886.6 billion of Islamic banking assets. Accordingly, funds under Islamic banking assets are currently accounting for more than a third of the assets in Malaysia’s banking sector (Alfian, 2022). Islamic banking is undoubtedly expanding quickly, and as a result, so is the effect that it has on the Malaysian economy.

In addition, while opposing any practise that violates the Shariah, such as riba, gharar and and maysir, Islamic banking places an emphasis on Islamic virtues such as honesty, transparency, and others. In contrast to conventional financing, Islamic banking’s most recent endeavours focus on Islamic social finance through the use of zakat, waqf, and sadaqah funds. Through these initiatives, facilities are provided with reduced profit requirements and a greater focus on the needs of the customer. Islamic banking aids shield customers from unjust business practises since Islam places a high value on universal principles, preserving their ability to participate in the Islamic banking industry (Alfian, 2022).

Islamic banking has an effect on economic activity because it is not a primary provider of commodities and services in the economy as a whole. Islamic banking rather has a significant impact in the accumulation of capital and productivity (Gani & Bahari, 2021). First, household and commercial deposits are accepted by Islamic banks. The banks become more liquid as a result, making more money accessible for credit to other consumers. The ability of more consumers to use the funds would boost the efficiency of capital. In conclusion, the Malaysian economy is positively and significantly impacted by Islamic banking financing and deposits. Islamic banking has undeniably become a crucial component of Malaysia’s economy and financial system, and it is safe to assume that it will continue to expand rapidly in the coming years, strengthening Malaysia’s position in the world of Islamic banking.

According to Furqani and Mulyany (2009), the conventional system is unsteady due to the weak basis upon its foundation was created, which has caused bubble expansion and a consistent stream of accompanying crises. The need to be aware of measures for sustaining financial stability is one fundamental lesson that can be learned from the global financial crisis. According to a report from Narodna Bank Slovenska (2002), Maurice Allias suggested a lower the tax rate to around 2 percent and controlling the interest rate to 0 percent are the two elements that can maintain security in the country’s economy and financial markets. His idea is in line with Islamic banking and finance, which supports an interest-free economic system and charges Zakat at a rate of 2.5 percent on the rich faithful.

There is no denying that the development of Islamic finance has proven quite remarkable. This constant rise is the result of various factors. Derbel et al. (2011) list a few of these, including the growing Muslim population’s strong need for financial goods that adhere to Shariah; another is the effectiveness and commendable achievement of Islamic banks. Additionally, according to the study, is the fact that Islamic banking is a framework built around strict moral principles that does not support speculation and therefore only permits investments in real assets while forbidding prohibited investment activities like interest, speculation, alcohol, gambling, pork, pornography, and prostitution.

Numerous studies have proven that Islamic banks have a history of stability, providing the foundation upon which Islamic banking is positioned. According to specific theories, Islamic banks are stable since they don’t do business using Gharar and Maysir interactions that are based on riba. According to Ali (2012), managing a bank using the profit-and-loss method achieved through Islamic banking boosts its financial stability. Many previous studies discussed the stability between conventional and Islamic banks through empirical studies. They also include the factors that contribute to the stability of those banks. The elements consist of credit risk (Ferhi, 2017), economic uncertainty (Huseyin Bilgin et al., 2020.), corporate governance (Mollah et al., 2017), competition (González et al., 2017), and others. A lot of studies focused on other countries as samples, such as Middle East or North Africa (MENA) countries. Very few studies discussed the theoretical or non-empirical area of Islamic banks’ stability, which concentrated in Malaysia. Hence, this study will delve deeper into this area.

Islamic banking in Malaysia is quite extensive and growing, resulting in more research on this area. there are many conceptual papers, empirical studies, and published reports on various aspects of Islamic finance. Malaysia is one of the leading contributors and players in the Islamic finance industry worldwide, the potential for research in this field to continue to grow is very high. It is expected that more concept papers and empirical studies will be published in this field in the context of the Malaysian area.

The objective of this study is to explore the factors that contribute to the stability or resilience of Islamic banks worldwide. It also looks into the measurement type used in past studies, which is the most common one using the Z-score metric. In addition, throughout this study, we aimed to find out whether sripapers. Apart from the above, since this paper wants to focus on the Malaysian situation of Islamic banks, we will also include the current state of the Malaysian Islamic banks’ performance through the stability report discussed by Bank Negara Malaysia (BNM). This discussion will help the readers to identify better and understand the stability of Islamic banks in Malaysia and how it is essential to the country’s economy.

This paper will continue as follows. First, we will look deeper into the factors that contributed to the resilience of Islamic banks from past literature. From this section, readers will also understand whether Islamic banks’ resilience differs from conventional banks in certain situations, such as during the economic or global crisis. Next, this study will focus on the Malaysian Islamic banks’ position and will show whether this industry in Malaysia is stable enough o provide to benefit the economy. This study will end with a conclusion and outline this paper’s limitations. Moreover, suggestions for future research will also be discussed at the end of this study.

The Resilience of Islamic Banks

Central banks’ regulatory responsibilities mainly focus on preserving financial stability. In the case of Malaysia, the BNM’s series of financial stability reports, the phrase “financial stability” has been used since 2007. According to BNM’s 2015 report, stable financial markets and strong institutions protect and maintain domestic financial stability. According to the report, banks, in particular, have demonstrated high steady income in the face of more challenging economic conditions, enabling them to maintain sizeable buffers through cautious retention of earnings practises. The financial sector is in good shape, with solid financial institutions and significant cushions to withstand potential shocks in high-stress situations, according to BNM’s 2017 report.

While it represents a modest portion of the global financial sector, Islamic finance has expanded quickly. Many of the nations members of the International Monetary Fund (IMF) have seen a growth in the penetration of the Islamic banking sector. This trend is anticipated to persist, driven in particular by robust economic expansion in nations with sizable Muslim populations still largely unbanked. The IMF has long been interested in the effects of Islamic financing on macroeconomic and financial stability, reflecting the practice’s significance for many of its members. Though it makes up a small portion of global banking, Islamic finance is expanding quickly and offers a huge upside. The Islamic banking industry is now critical to the stability of the economy. Islamic banking also has an opportunity to promote higher levels of financial inclusion and intermediary service, particularly among Muslim countries that may not receive adequate assistance from conventional banks, and to make financing small- and medium-sized businesses easier. Due to the importance of Islamic banks to the economy and how it has been a rising trend in the finance industry, many studies have discussed the factors that contributed to the stability and resilience of Islamic banks. Most studies also compare the stability level between Islamic and conventional banks in their research.

Odeduntan et al. (2016) assert that Islamic banks are stable, financially viable, and capable of withstanding economic shocks. In the interim, they employed Z-score as a predictive metric, and the outcome might be relevant for the following two years. Islamic banks become significantly more efficient amid economic crises in Middle Eastern and non-middle-eastern nations. The research by Cihak and Hesse (2008) concurred with the results, although they also noted that Islamic banks operate more steadily on a smaller scale than on a larger scale. The study also discovered that Islamic banks could manage their NPF, which results in a good Z-score. In their research, Sehrish et al. (2012) supported the findings of this work by asserting that Islamic banks have a superior capacity for absorbing financial losses and managing NPF.

Furthermore, the high loan-to-deposit ratio shows that Islamic banks are under additional financial strain due to their excessive lending. This sends a risky message to Islamic banks, and an intervention is urgently needed before things spiral out of control. Malaysia’s Islamic banks are strong, reliable, and able to endure any financial catastrophe. They can also govern their NPFs, although they have poor liquidity and loan-to-deposit ratios. They will face significant financial obstacles as a result of this in the future.

Additionally, a study from Bahemia (2019) intends to compare the effectiveness of Islamic and conventional banking systems in the aftermath of a crisis and examine the conceptual and historical distinctions between them. The study is mainly focused on how financial institutions in the Middle East and North Africa (MENA)—both Islamic and non-Islamic—were able to recuperate from the Great Recession and examines how various banking institutions fared in 2014 under the oil crisis. The study’s goal is to evaluate how well-equipped and resilient Islamic banks are to survive various financial shocks. The study shows that Islamic banks tend to be more resilient after a crisis and see less profitability declines than conventional banks. The findings reveal that Islamic banks operate in a less hazardous manner and are better equipped than conventional banking institutions to withstand crises and emerge stronger from them.

The two studies mentioned above demonstrated that Islamic banks were well-resilient amid economic shocks. The recent Covid-19 outbreak had a significant impact on the economy as well. It began in January 2020, and since then, the banking industry has suffered greatly all around the world. From March to September 2020, S&P Global Ratings reduced the ratings of about 335 banks and nonbank financial companies. The main banking sectors worldwide are only expected to recover to pre-Covid-19 levels in 2023 or later. Theoretically, Shariah-compliant Islamic banks are more likely to withstand negative shocks due to equity-like contracts with both depositors and borrowers, which give them the strong risk-sharing on both the liability- and assets-sides of the balance sheet (Beck et al., 2013). However, some authors contend that there are no real differences between the products provided by Islamic financial institutions and those provided by their conventional counterparts due to the significant differences within the fundamentals of Islamic Banking and Finance and its practices. Others have criticised the Islamic banking model for being more complicated and inefficient because it requires more work to understand and analyse better investment opportunities, as well as a higher degree of confidence and openness between depositors, banks, and investors (Beck et al., 2013; Bourkhis & Nabi, 2013).

In a paper published in 2021, Ashraf et al. (2022) analyse the resilience of Islamic banks to regular banks during the Covid-19 financial crisis. They discovered that investors in the stock market did not perceive Islamic banks to be better to conventional banks during the Covid-19 market crisis by using daily stock prices data of listed banks of GCC member nations over the period of 6 months of 2020. In particular, they discovered that the heated time in 2020, government social distance laws, and Covid-19 verified cases all had a detrimental effect on stock returns for both Islamic and traditional banks. The findings, however, imply that investors evaluated banks in different ways according to them before the pandemic balance sheet features. Because of their naturally higher cost structures as compared to normal banks, the effect is even stronger for Islamic banks. The findings imply that Islamic banks are sometimes vulnerable to shocks. Due to the unique characteristics of the COVID-19 epidemic, where companies suffered as a result of lockdowns and social isolation, Islamic banks had similar, if not somewhat worse, losses than their conventional counterparts because of their generally higher operating expenses. The equities of Islamic banks may have done better during the Global Financial Crisis (GFC) due to the considerable differences between the Covid-19 and GFC shocks’ natures (Beck et al., 2013). Due to their comparatively greater operational costs when compared to conventional banks, Islamic banks suffered similarly, if not worse, during the Covid-19 shock. According to the findings, authorities should take into account the fact that Islamic banks cannot always be regarded as being safer than regular banks.

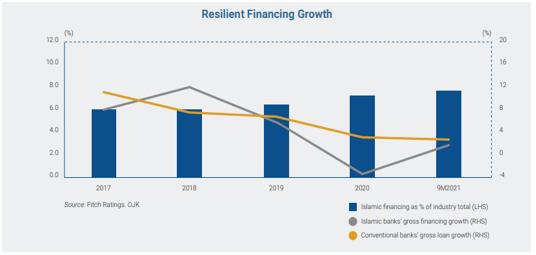

To add, by referring to Figure 1 below, the Islamic Financial Services Industry Stability Report (2022) shows the growth of the resilient in the financing sector all around the world, that comprises from year 2017 to the third quarter of 2021. To compare with the conventional banks’ growth performance, it can be seen that the Islamic banks performance has reduced more that the conventional banks’ during Covid-19 phase. This is one of the alarming event to the Islamic financial service sector.

Factors Influencing the Resilience of Islamic Banks

Many factors could influence the resilience of Islamic banks. This study will analyse some previous literature and outline the idea behind those factors. A survey from Mollah et al. (2017) discussed the governance and risk-taking management of the Islamic banks, and how it impacted the banks’ performances and stability. They looked at whether Islamic banks’ risk-taking and performance differed from conventional banks’ due to differences in governance arrangements. They draw the conclusion that the structure of governance in Islamic banks, which differs from conventional banks, has a major influence in risk taking and financial performance. In particular, they demonstrate how Islamic banks’ governance structures enable them to take bigger risks and perform better due to the complexity of their products and transactional processes. However, in comparison to conventional banks, Islamic banks continue to retain a greater capitalisation. These findings confirm the studies on Islamic risk-taking and investment. The study’s findings regarding Islamic banks’ risk-taking behaviour are generally supported by a number of regulating criteria, including inflation rate, capital sufficiency, income fluctuation, insurance for deposits, and country-level bank guidance.

Next, the regulatory framework is another factor that influences Islamic banks’ resilience rate. One of the essential bank regulations is relative to its capital structure. A paper from Korbi and Bougatef (2017) used countries from MENA as their sample with a period of concentration from 1999 to 2014. The study substantiates the claim that regulatory capital is crucial in preserving financial stability. The level of specialisation and amount of fraud harm bank stability, whereas intermediation margins lower the risk of collapse. The stability of conventional banks was found to be negatively impacted by the liquidity ratio and credit risk, whereas the financial health of Islamic banks was not significantly impacted. Because Islamic banks can transmit losses to their customers according to the profit-and-loss model, this conclusion suggests they do not have to amass significant reserves. Lastly, the size of the bank, particularly for Islamic banks, turns out to be a determinant of instability. This finding shows that Islamic banks cannot conduct extensive business, or it might harm the stability.

In addition to the above discussions, gaining customers’ trust might as well influence the resilience of the banks. Customers will trust banks when they can provide them with high-quality financial information. Some institutions might use earnings management to ensure their financial information shows good performance and profit. However, this may affect the quality of the earnings and hence the stability of banks. Abdelsalam et al. (2016) investigated the effect of organisational religiosity on the financial performance of listed Middle Eastern and North African banks. They examine and contrast Islamic financial organisations with their conventional counterparts, which operate under rigorous religious regulations and extensive accountability requirements. They discovered that Islamic banks follow more cautious accounting practices and are less inclined to manage earnings. Based on these data, they contend that moral responsibility restraints and religious standards significantly impact the accuracy of financial reporting and agency costs in these organisations.

Financial performance is another interesting area to be studied as to how it impacts the banking industry’s stability. Pessarossi et al. (2020) investigate whether significant profit impacts when bank trouble occurs in Europe. They discovered that increased profitability had little bearing on the frequency of bank crises. Contrarily, they found scant evidence that increased profitability can cause more of these occurrences. Therefore, their findings refute the idea that bank stability should be supported by encouraging bank profitability.

Malaysia Focus – Islamic Banks’ Current State

As the economic recovery quickens (2022F GDP growth: 6.5%, 2021E: 3.6%) and asset quality becomes more apparent as COVID-19 epidemic relief measures are drawn down, Fitch Ratings anticipates a moderate increase in Islamic financing in Malaysia in 2022. The credit profiles of Islamic banks should remain stable thanks to adequate loss-absorption buffers and further profitability improvement. The sector will also continue to be supported in 2022 by a sizable public demand for Islamic goods and long-standing governmental and regulatory backing. Islamic financing remained the main driver of the banking sector’s expansion in Malaysia in 2021, growing faster than conventional loans (8.3% vs. 2.3%). Mortgages and other household financing were the main drivers of growth, and as the economy has recovered, so too has demand for working-capital lending across sectors. We anticipate that this trend will continue in 2022.

The Financial Sector Blueprint 2022-2026 of Bank Negara Malaysia (BNM) aims to increase the use of sustainable finance, commonly known as value-based intermediation (VBI) financing in Malaysia, which to be achieved within the stipulated years. With 26% of all Islamic financing granted between 2017 and 2020 approved by VBI-aligned financing, Islamic banks have taken the lead in this market. We anticipate that the proportion will rise in step with the public’s increased interest in VBI. In addition, several Islamic financial institutions adopted sustainability-related plans and frameworks in order to maintain high stability. The sustainable and responsible investment (SRI) sukuk and Bond Grant Scheme by Malaysia’s Securities Commission (SC) covers the costs incurred by issuers for independent review of sukuk issuances under the SC’s SRI sukuk framework and bond issuances under the ASEAN Green, Social and Sustainability Bond Standards. Malaysia also has a number of other well-established incentives in place to encourage green financing. Under the SRI Framework, issuers are also given a tax benefit for the expenditures associated with issuing sukuk. These programmes have helped Malaysian corporations issue a sizable amount of green and SRI sukuk. Malaysia has made great strides in securing its place as a leading worldwide hub for Islamic finance during the past 30 years. Malaysia has a prestigious track record for cutting-edge Islamic finance products and services as a result of the nation positioning Islamic finance as a primary focus area. The Islamic finance sector in Malaysia has developed from a locally driven business to a significant international hub thanks to the combined efforts of numerous stakeholders, including the government, financial regulators, and industry participants.

The above discussions show how Malaysian Islamic banks are rising despite the global pandemic starting in 2020 (Covid-19). The introduction of Sukuk in the financial industry has significantly impacted the stability of Islamic banks in Malaysia and worldwide. The Islamic version of bonds, known as sukuk, resembles asset-backed securities and is unique from traditional bonds in various aspects. Sukuk must be constructed in a way that assures there is a foundational asset, the principal amount cannot be insured, and the amount returned to investors is correlated with the outcome of the actual assets, as opposed to ordinary bonds, which are promises to repay loans with an agreed-upon rate of interest. This is an exciting area to be studied in the future as the growth of Islamic banks keeps increasing, and we may see how Sukuk could benefit the economy. It might threaten the conventional bond position in the industry.

Conclusions

Financial institutions are essential to the overall health of an economy. The banking sector will be less stable due to the financial crisis, which will destabilise the economy. This study aims to fill the information gap in the literature, considering the small number of papers on the resilience of financial stability that focused on Islamic banks published related to Malaysian banks. Much previous literature discussed how well Islamic banking can operate well and showed better resilience than conventional one. However, there are some pieces of evidence, especially in the context of the Covid-19 pandemic, that Islamic banks’ resilience was worse than that of conventional banks. Islamic banks did better during Covid-19 compared to other global financial crises. In addition, Islamic banks play a huge role in Malaysia’s economy, and the sector is increasing due to its unique characteristics. This will be an exciting area to be discussed as related to any part of the economic issue. There has been a shortage of research in this field up to this point, and the findings have been mixed. Researchers must delve more into this subject because doing so might contribute to the body of literature.

This study has been conducted for Islamic banks by considering the stability of the banks and focusing on the Malaysian situation. Due to the rising of Islamic banks in the economy, future research may include the other vital elements in Islamic banking, such as what has been mentioned earlier in this paper – Sukuk. This study could not touch much on that as we focused more on stability as a whole, which is one of the limitations of this study. However, we believe that this kind of element in Islamic banks will enhance the resilience of the banks in the long run. Therefore, it is one of the exciting elements to be discussed in the future. Due to the limited previous studies on the resilience of Islamic banks also restricts this paper from including the essential elements of discussions that could strengthen the body of its literature.

Acknowledgments

Financial support from the Research Management Centre of Universiti Teknologi MARA Malaysia through Myra Research Grant Scheme (600-RMC/GPM SS 5/3 (083/2021) is acknowledged.

References

Abdelsalam, O., Dimitropoulos, P., Elnahass, M., & Leventis, S. (2016). Earnings management behaviors under different monitoring mechanisms: The case of Islamic and conventional banks. Journal of Economic Behavior & Organization, 132, 155-173.

Alfian, H. (2022). How Does Islamic Banking Really Work To The Real Economy Of Malaysia. Money Learning Centre. https://www.imoney.my/articles/how-does-islamic-banking-work

Ali, S. (2012). Efficiency in Islamic Banking During a Financial Crisis-An Empirical Analysis of Forty-Seven Banks. Journal of Applied Finance & Banking, 2(3), 163–197.

Ashraf, B. N., Tabash, M. I., & Hassan, M. K. (2022). Are Islamic banks more resilient to the crises vis-à-vis conventional banks? Evidence from the COVID-19 shock using stock market data. Pacific-Basin Finance Journal, 73, 101774. https://doi.org/10.1016/j.pacfin.2022.101774

Bahemia, N. (2019). The Resilience of Islamic Banks in the Wake of Crises: Comparing Islamic and Conventional Banks in the MENA Region [dissertation].

Beck, T., Demirguc-Kunt, A., & Merrouche, O. (2013). Islamic vs. Conventional Banking. Policy Research Working Paper. The World Bank.

Bourkhis, K., & Nabi, M. S. (2013). Islamic and conventional banks' soundness during the 2007-2008 financial crisis. Review of Financial Economics, 22(2), 68-77.

Cihak, M., & Hesse, H. (2008). Islamic Banks and Financial Stability: An Empirical Analysis. SSRN Electronic Journal.

Derbel, H., Bouraoui, T., & Dammak, N. (2011). Can Islamic Finance Constitute A Solution to Crisis? International Journal of Economics and Finance, 3(3).

Ferhi, A. (2017). Credit Risk and Banking Stability: A Comparative Study between Islamic and Conventional Banks. Intellectual Property Rights: Open Access, 5(3),

Furqani, H., & Mulyany, R. (2009). Islamic Banking and Economic Growth: Empirical Evidence from Malaysia. Journal of Economic Cooperation and Development, 30(2), 59–74.

Gani, I. M., & Bahari, Z. (2021). Islamic banking’s contribution to the Malaysian Real Economy. ISRA International Journal of Islamic Finance, 13(1), 6–25. https://doi.org/10.1108/ijif-01-2019-0004

González, L. O., Razia, A., Búa, M. V., & Sestayo, R. L. (2017). Competition, concentration and risk taking in Banking sector of MENA countries. Research in International Business and Finance, 42, 591–604.

Huseyin Bilgin, M., Danisman, G., Demir, E., Tarazi, A., & Ozturk Danisman, G. (2020). Economic uncertainty and bank stability: Conventional vs. Islamic banking. https://hal-unilim.archives-ouvertes.fr/hal-02964579

Islamic Financial Services Industry Stability Report. (2022), Resilience Amid a Resurging Pandemic. Islamic Financial Services Board, Level 5, Sasana Kijang, Bank Negara Malaysia. Retrieved on 23 September 2022 from https://www.ifsb.org/download.php?id=6571&lang=English&pg=/sec03.php

Korbi, F., & Bougatef, K. (2017). Regulatory capital and stability of Islamic and conventional banks. International Journal of Islamic and Middle Eastern Finance and Management, 10(3), 312-330.

Mollah, S., Hassan, M. K., Al Farooque, O., & Mobarek, A. (2017). The governance, risk-taking, and performance of Islamic banks. Journal of Financial Services Research, 51(2), 195–219.

Narodna Bank Slovenska. (2002). Maurice Allais and His Attempt at Rigour in Economic Science. BIATEX, Volume X, 5/2002.

Odeduntan, A. K., Adewale, A. A., & Hamisu, S. (2016). Financial Stability of Islamic Banks: Empirical Evidence. Journal of Islamic Banking and Finance, 4(1).

OECD. (2009). Policy Responses to the Economic Crisis: Investing in Innovation for Long-Term Growth. Organisation for Economic Co-Operation and Development.

Pessarossi, P., Thevenon, J. L., & Weill, L. (2020). Does high profitability improve stability for European banks? Research in International Business and Finance, 53.

Sehrish, S., Saleem, F., Yasir, M., Shehzad, F., & Ahmed, K. (2012). Financial performance analysis of Islamic banks and conventional banks in Pakistan: A comparative study. Interdisciplinary Journal of Contemporary Research, 4, 186–200.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Faizdnor, F., & Mohamad, M. (2023). Safeguarding Stability: A Conceptual Note of the Resilience Dimensions in Islamic Banks. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 990-999). European Publisher. https://doi.org/10.15405/epsbs.2023.11.81