Abstract

Over time, people have become increasingly concerned about the ever-present and rapidly expanding global issue of climate change. The more frequent and intense weather phenomena are attributed to climate change, and they will impact the future viability of financial institutions. The financial sector faces a systemic risk from climate change, which demands regulators' greater supervision and mitigation measures to enable a transition towards a greener economy. Climate FinTech is a swiftly evolving industry committed to tackling climate change worries through pioneering financial strategies for a more sustainable and long-lasting future. This study explores the emergence of climate FinTech as a new realm of sustainable investment, its capacity to promote the shift towards a low-carbon economy, and the prospects and challenges it presents for investors, start-ups, and policymakers. The study analyses the current investment trends in FinTech and discusses the implications for sustainable investing. This qualitative research employs the descriptive method and the analysis based on the study of the past literature. The results indicated a significant rise in FinTech investments between 2015 and 2019, but due to the COVID-19 pandemic, the trend declined in 2020. It was found that the Americas were the most sought-after investment destinations, trailed by the EMEA region and Asia-Pacific. Additionally, venture capital investment in FinTech start-ups saw significant growth globally between 2015 and 2021. Our result supported that investing in climate FinTech would help to reduce the combat climate as innovative solutions can be developed to shift to a sustainable future.

Keywords: Climate Change, Investment, Green Technology, Fintech, Sustainability

Introduction

The increasing awareness of the threats brought on by global warming to ecosystems, humanity, and the global economy has sparked an immediate need to take action toward sustainable development and combat climate change, as Samaniego-Rascón et al. (2019) suggested. As a result, conventional investment methods have been scrutinized, and newer methods that prioritize sustainability have been sought after. Climate Fintech, a blend of finance and environmental targets, is critical to addressing climate challenges and achieving sustainable development objectives. Awais et al. (2023) and Bhutto et al. (2023) supported that digital solution is important in mitigating climate change. 2022’s World Economic Forum discussed that incorporating climate technologies in three main sectors, materials, energy and transportation, is expected to reduce at least 20% of GHG emissions. Energy industry emissions account for most global warming gases, according to Jia et al. (2022). It's crucial to boost energy efficiency and use renewable energy.

A global energy transformation is vital to sustainably combat climate change (Jakučionytė-Skodienė et al., 2022). To achieve this, energy efficiency must be improved, renewable energy must be increased, and the energy sector must be completely reformed. Digital technologies improve global energy infrastructure by making it smart, sustainable, interconnected, and reliable. Moreover, digital technologies can also enhance efficiency, streamline production and supply, and potentially increase the use of renewable power sources. Data, analytics, and connectivity innovations are paving the way for an explosion of innovative digital applications. Digitized energy systems have the potential to determine who needs energy, supplying it to them at the optimal time and place and with minimal resource waste in the future.

The manufacturing industry's byproducts negatively impact the environment and human health. More metals, non-metallic minerals, fossil fuels, and biomass will need to be mined and processed, increasing water, air, and soil pollution and significantly contributing to climate change (Jia et al., 2022; Stoddart et al., 2020). Consequently, evaluating the ecological ramifications of renewable energy production assumes paramount importance. For instance, while fossil fuels hold significance in the agricultural and food-producing sectors, their usage has been identified as a primary catalyst for global warming (Benites-Lazaro & Mello-Théry, 2017). In another recent study, Jia et al. (2022) discovered that due to the industry-linked effect, China’s manufacturing sector has many pollution-generating links in its supply chain. Jakučionytė-Skodienė et al. (2022) further assert that mitigating the impacts of climate change and constructing a more sustainable future hinge upon the successful transition to a green energy economy. Thus, to minimize environmental repercussions, manufacturers must embrace cleaner energy sources (Muganyi et al., 2021). Efficient production practices play a crucial role in mitigating the environmental consequences. Reducing the need for frequent extraction of raw materials for product manufacturing is possible by utilizing environmentally friendly technology, such as recycling technologies. Industrial automation, energy management systems, and energy-efficient machinery reduce production's carbon footprint (Jia et al., 2022).

Cars, buses, trains, ships, and planes release greenhouse gases by burning fossil fuels like gasoline and diesel. Transportation sector greenhouse gas emissions cause climate change. According to Khreis et al. (2018), urban areas play a major role in climate change, with transportation-related air pollution harming human health and the environment.To improve the general public's well-being and solve the issue of atmospheric pollution, legislators should enact and implement stringent laws governing automotive fuel economy and emissions (Jia et al., 2022; Jakučionytė-Skodienė et al., 2022). One effective strategy for achieving carbon-neutral transportation involves the widespread adoption of electric vehicles (AbdulRafiu et al., 2022; Jakučionytė-Skodienė et al., 2022). Greenhouse gas emissions will decrease as more people use eco-friendly transportation. Public transportation networks, such as buses and railways, can also reduce carbon emissions with government support. In their study, Jakučionytė-Skodienė et al. (2022) emphasized the significance of enhancing public consciousness regarding climate change to prompt policymakers to motivate individuals to mitigate the adverse environmental impact caused by transportation. Adopting new environmentally friendly standards as part of a comprehensive climate change policy should help spread climate-friendly practices.

In AbdulRafiu et al.'s (2022) study, more than a third of the budget was allocated to climate change adaptation projects, while the rest went toward climate mitigation efforts focused on energy systems and transportation. Ceptureanu et al. (2020) discovered that eco-innovation capability development directly benefits sustainability-driven innovation techniques used in production. Depending on how it is applied, digital technology may be both a friend and an opponent in the fight against climate change. Digital innovation opens new avenues for climate change mitigation and adaptation and increases the ICT sector's carbon footprint (Migozzi et al., 2023). While digital innovation opens up new avenues for climate change mitigation and adaptation, it also amplifies the carbon footprint of the ICT sector. Technological advancements enable a more profound comprehension of ecological hurdles and enhanced exploitation of resources, thus potentially alleviating the issue of global warming. However, the impact of digital platforms on climate change will continue to rise until manufacturers, suppliers, and users embrace more sustainable practices. There were also several issues and challenges found that must be brought to the attention of the regulatory authority and policymakers, prompting their awareness and consideration. As mentioned by Muganyi et al. (2021) and Mirza et al. (2023), companies face various challenges, including financial constraints associated with acquiring expensive equipment compared to conventional alternatives, limited awareness of the benefits of green technology, and a shortage of skilled personnel to handle the complexities of these technologies. In addition, investors could need more compelling incentives to engage in long-term investments for technological development. In a nutshell, this study investigates the emergence of climate FinTech as an emerging domain in sustainable investment, examining the associated challenges and opportunities in utilizing FinTech to address climate change. Moreover, the study analyzes the prevailing investment patterns in Fintech and examines their implications for sustainable investment.

Investment in Fintech Companies

The section delves into the investment landscape in FinTech companies, highlighting the growing interest and the potential impact of these investments on sustainable investing. The emergence of technology has exerted a substantial influence on various aspects of society, the economy, and the environment, thus assuming paramount significance in addressing urgent global challenges such as environmental deterioration, climate change, inadequate food supply, and effective waste control. The Fintech industry is growing in popularity and has experienced rapid expansion and investment, resulting in numerous new companies providing cutting-edge financial services and products from emerging and developed markets (AlHares et al., 2022). The future management of businesses is transforming due to advancements in technology. Notably, the financial industry is undergoing profound changes attributed to the progressions in Fintech (AlHares et al., 2022; Merello et al., 2022; Sahay et al., 2020). Therefore, the capacity to quickly adapt to new developments is increasingly seen as a core value in today's rapidly evolving digital landscape (Bhutto et al., 2023; Merello et al., 2022). Muganyi et al. (2021) highlighted the positive impact of green policies on the rapid advancement of green product development in China, leading to a notable increase in investor confidence. Moreover, there is a discernible inclination among investors to allocate a significant proportion of financial resources towards organizations that adopt environmentally conscious management strategies, aiming for optimal results in terms of environmental sustainability.

The substantial expansion of the Fintech sector primarily stems from its technological advancements in addressing the deficiencies exhibited by traditional banking institutions and other financial service providers, which were profoundly affected by the global financial crisis (Safiullah & Paramati, 2022). Moreover, the COVID-19 pandemic has significantly contributed to the expeditious advancement of the FinTech sector due to the amplified requirement for contactless financial transactions (Bhutto et al., 2023). The outbreak of the pandemic has ushered in a novel avenue for establishing a financially adaptable system, thereby engendering opportunities for FinTech enterprises to expand their horizons and engage in innovative market exploration. According to Safiullah and Paramati (2022) and AlHares et al. (2022), the growing demand for sophisticated financial technologies puts pressure on the banking industry to integrate them into daily operations. Fintech facilitates new and improved methods for managing a company's financial operations and replaces the traditional banking industry's services with the invention of better financial services. Today, many business transactions require modern technology to maintain daily operations effectively, especially in banking and financial institutions. Muganyi et al. (2021) mentioned that to reduce carbon emissions, increase the utilization of resources and promote green consumption, FinTech companies are actively incorporating green financial systems. Similarly, Lee et al. (2021) provided empirical evidence that utilizing Fintech technology in banking operations yields technological enhancements, cost efficiency improvements, and long-term enhancements in firm performance.

The spending and lending methods have shifted drastically towards a cashless world. For instance, customers can now use online banking to transfer funds instead of going to the bank, which is more convenient and makes cash obsolete (Bhutto et al., 2023; Mirza et al., 2023). Customers can securely store their banking information on their mobile devices, which facilitates their utilization of financial technology services across different platforms and gadgets while simultaneously benefiting from the convenience of seamless portability and immediate access to up-to-date financial information. Moreover, users have quick and continuous access to up-to-date financial information, allowing for easy data exchange and increased portability. Digital technology amplifies customer engagement, heightens convenience, and optimizes efficiency. In short, customers and businesses can benefit from the accessibility of the latest Fintech trends and innovations as these technologies can simplify financial management and increase efficiency. Therefore, companies must continue providing more innovative products and services to provide more choices to customers using Fintech services. In addition, the persistent endeavor to develop pioneering digital solutions assumes significance in capitalizing on the prevailing digital transformation and upholding a competitive edge. Market integration and increased innovation have resulted from regulatory shifts encouraging greater competition and participation.

The trend of Investment in FinTech

Over the past decade, FinTech investment has grown. FinTech startups have received significant funding, indicating investor interest in disruptive financial technologies. As climate change becomes a major concern worldwide, investors look for ways to integrate environmental considerations into their portfolios. Investments in climate FinTech, which employs financial technology to mitigate climate risks and encourage environmentally friendly actions, have risen.

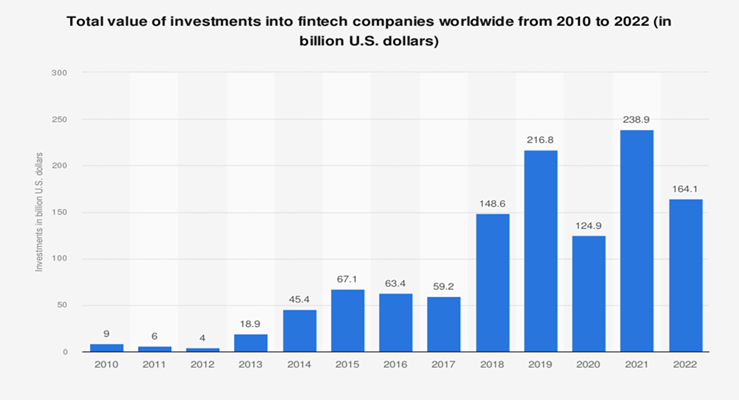

Figure 1 shows the investment trend in FinTech companies worldwide from 2010 until 2022, as reported in KPMG, Pitchbook. Investment in FinTech companies reached a high of US$9 billion in 2010 before dropping to US$6 billion the following year. The Investment value further dropped by US$2 billion in 2012. Most FinTech companies failed during this period due to a lack of funding. To get off the ground, most FinTech companies must raise substantial money from investors. However, FinTech companies may be unable to raise additional funds in time to keep operations going due to the challenging market conditions. The downfall of numerous startup companies can be linked to their lack of capital or delays in receiving it, as it adversely affects their ability to operate profitably. The situation changed in 2013 when there was a massive 100% increase in investments in FinTech, which marked the onset of a period of rapid growth. Total funding grew remarkably from US$4 billion in 2012 to US$18.9 billion in 2013, and this saw many lucrative investments being made in FinTech enterprises by investors, venture capital firms and banks in 2014 and 2015. However, the pace of investment was slightly reduced in the subsequent two years, with a value of US$63.4 billion and US$59.2 billion recorded in 2016 and 2017, respectively. Nevertheless, by 2018 and 2019, the global investment trend in FinTech had improved significantly, reaching a new high of US$216.8 billion. This was attributed to banks and investors increasing their investment, allowing many FinTech firms to strike multi-billion dollar deals with corporate investors. Furthermore, an increase in initial public offerings by FinTech firms reflects the sector's growing confidence.

In 2019 and 2020, the total investments in the FinTech companies were still consistent but slightly lower than the previous year’s. The total investment was US$216.8 billion in 2019 while US$124.9 billion in 2020. This trend shows the industry consolidation phase as the investment focus shifted from early-stage startups to more established fintech companies. Additionally, the pandemic of COVID-19 also contributed to the effect on FinTech Companies. The pandemic has caused some of the industry, such as online banking and digital payments, to experience increased demand and investor interest. Still, some industries also faced challenges due to uncertainty. However, FinTech investment remained resilient, demonstrating the sector's adaptability and value in a digital-first world.

The investment in 2021 has increased to US$239.9 billion a year after the pandemic of COVID-19. The gravity of the COVID-19 pandemic has forced many countries to take actions such as social distancing, quarantine, and lockdowns as prevention spreads. Therefore, this situation has increased the demand and usage of digital financial services during the pandemic. The acceleration of digital transformation and traditional financial institutions' adoption of FinTech solutions were key drivers of this growth. Nowadays, companies and consumers can continue to access their financial services by using mobile apps and maintaining contactless transactions. The pandemic has accelerated the adoption of FinTech services and created new opportunities for digital worlds to evolve. However, the trend changed in 2022, whereby the global investment in FinTech dropped from US$238.9 billion to US$164.1 billion. Global economic uncertainty, rising inflation, and interest rates could cause a decline in investment value. From 2010 to 2022, the overall fintech investment landscape matured and grew significantly. Technological advancement and changing consumer preferences have made the FinTech industry a promising investment. FinTech investment looks promising, given the rapid growth of technology and online financial services.

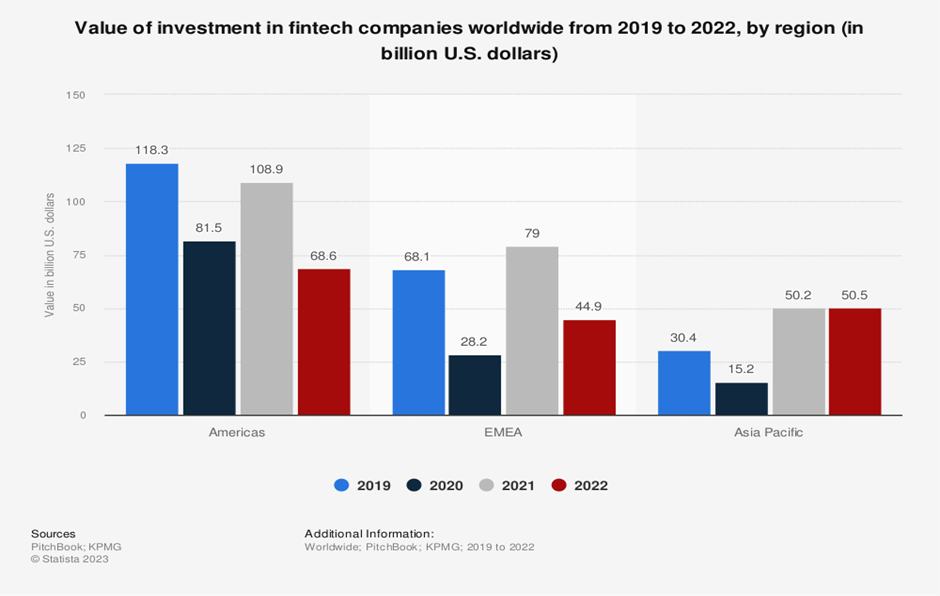

Figure 2 below represents the investment value in FinTech companies by region. Investment in FinTech companies from 2019 to 2022 varied across regions due to investor preferences, regulatory environments and maturity differences. The United States has been a forerunner in terms of FinTech investment. In 2019, the Americas reached a substantial amount of investment in FinTech valued at US$ 118.3 billion. However, due to the pandemic of COVID-19, the total investment has dropped to US$81.5 billion in 2020. Despite the pandemic contributing to a decrease in investment value, there was continued strong investment in the following year. One factor contributing to strong investment is the existence of a FinTech hub in the United States. Similarly, the EMEA region has seen significant growth in investment in FinTech companies from 2019 to 2022, indicating that this sector has good potential to continue growing. In 2019, the total investment in EMEA was US$ 68.1 billion. Furthermore, the well-established fintech ecosystems in Europe play an important role in attracting investment from countries such as Sweden, the United Kingdom, and Germany. Other factors contributing to the expansion of the FinTech sector include an encouraging regulatory climate, novel ideas, and a thriving start-up community.

EMEA received US$28.2 billion in 2020, US$79 billion in 2021, and US$44.9 billion in 2022. The COVID-19 pandemic caused a decline in the trend. As people demand contactless financial services like digital payment and online banking, the pandemic has created new opportunities for FinTech. Finally, Asia-Pacific investment was US$30.4 billion in 2019, US$15.2 billion in 2020, and US$50.2 billion in 2021 and 2022. Between 2021 and 2022, Asia-Pacific FinTech investment was particularly strong, indicating the region's growing importance in the global fintech landscape. Hong Kong, Singapore, and Shanghai are Asia-Pacific FinTech investment hubs. China and India have become top investment destinations due to their large populations, rapid adoption of digital technologies, and robust investment ecosystems.

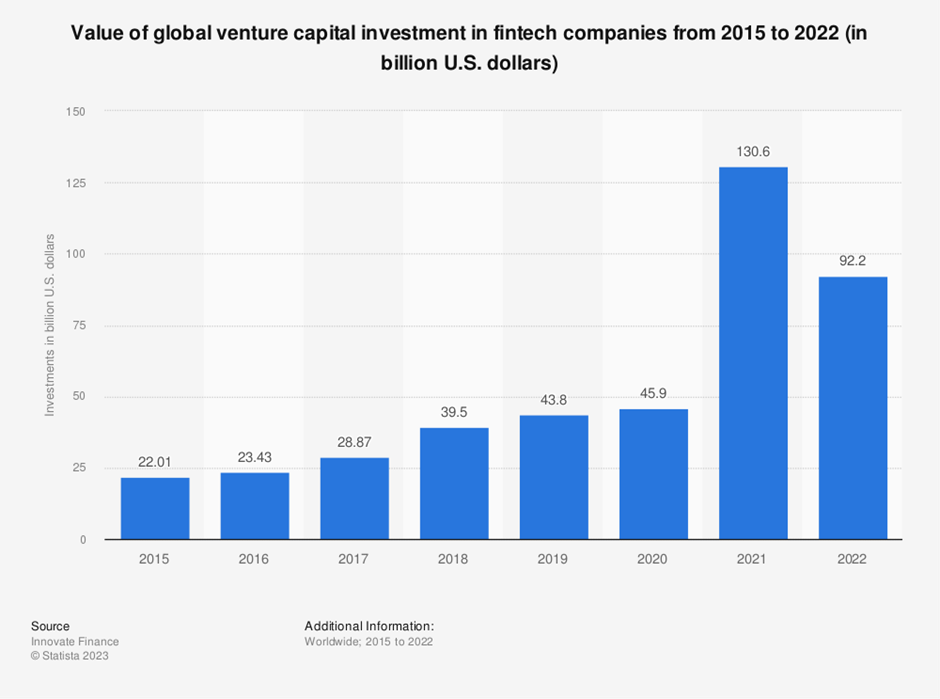

According to the data presented in Figure 3, there was a slight uptick in worldwide venture capital funding for FinTech businesses between 2015 and 2020. Despite the COVID-19 pandemic's adverse impact on global finances in 2020, the FinTech industry experienced an amazing rise in global venture capital financing in 2021. Venture capital companies invested over US$130.6 billion, a significant increase compared to the previous year's investment of US$45.9 billion. Macchiavello and Siri (2022) noted that the COVID-19 pandemic had highlighted the interconnectedness among sustainability, finance, and technology, necessitating a re-evaluation of conventional paradigms and a greater reliance on technology and sustainability measures by nations worldwide. In the year 2022, there was a significant decrease in investments in the FinTech sector; however, the investment volume still exceeded that of 2020 by a substantial margin. To summarise Figure 3, the total venture capital invested in FinTech businesses worldwide increased dramatically between 2015 and 2022. The sector attracted significant funding from venture capital firms, corporate investors, and financial institutions due to its disruptive potential, technological advancements, and shifting consumer preferences. As the FinTech industry develops and innovates, it presents new opportunities for venture capital investment and alters the global financial landscape.

Challenges and Opportunities of the Climate FinTech Industry

Integrating climate considerations in the FinTech industry come across numerous challenges. Primarily, technological advances regularly precede regulatory frameworks, which makes it difficult for financial technology companies to adapt to the intricate landscape of climate-related regulations. Furthermore, issues with climate data availability and quality are significant concerns. Accurate and reliable data is essential for assessing climate risks, modeling financial products, and making informed investment decisions. Furthermore, evaluating and quantifying climate risks remains complex, requiring robust methodologies and models. The lack of standardized approaches and industry-wide guidelines hinders the development and adoption of climate Fintech solutions. Lastly, effective stakeholder engagement is crucial for building trust, aligning incentives, and ensuring the successful implementation of climate Fintech initiatives.

Despite the challenges, integrating climate considerations within FinTech presents significant opportunities. First and foremost, climate FinTech can potentially improve access to sustainable finance. Using technology, it is possible to bring financial services to regions and populations that typically do not have access to them. This can help advance sustainable projects, like renewable energy and resilient infrastructure. Furthermore, climate-focused financial technology can help manage climate risks more effectively through real-time monitoring and analysis. This allows financial institutions to understand better and mitigate the potential impacts of climate change on their portfolios. Moreover, the intersection of climate and FinTech fosters innovation, giving rise to new products and services that address climate adaptation and mitigation. From blockchain-based carbon credit platforms to peer-to-peer green lending, such innovations have the potential to transform the financial landscape and drive sustainable development.

Conclusion

Sustainable investing evaluates environmental conditions to yield long-term competitive financial returns while positively affecting society. The FinTech industry has witnessed significant expansion in investment opportunities, with substantial funding channelled toward innovative startups. The necessity to tackle climate change and the rising demand for sustainable investments have propelled the speedy ascent of climate technology financial investments. Moreover, the COVID-19 pandemic has underlined the need for resilient and sustainable financial systems besides the growing sense of responsibility and the recognition of the social and environmental benefits that climate fintech can bring are also driving factors in the industry's expansion. The increasing count of investments in FinTech solutions aimed towards climate preservation indicates a significant shift in the market towards embracing sustainable development while countering the effects of global warming. The broader acknowledgment of the perils of climate change and the need for durable solutions has led to a rising interest in FinTech companies dedicated to addressing this critical issue. As such, these specialized FinTech firms are envisioned to be financially attractive to potential investors. Investment in this area will be further catalyzed by incorporating climate considerations into conventional finance, forming international partnerships and establishing enabling regulatory frameworks. The growing interest in climate FinTech indicates a widespread movement to use money and technology to fight climate change and improve the world for future generations.

Acknowledgements

Financial support from the Research Management Centre of Universiti Teknologi MARA Malaysia through Myra Research Grant Scheme (600-RMC/GPM SS 5/3 (083/2021) is acknowledged.

References

AbdulRafiu, A., Sovacool, B. K., & Daniels, C. (2022). The dynamics of global public research funding on climate change, energy, transport, and industrial decarbonisation. Renewable and Sustainable Energy Reviews, 162, 112420.

AlHares, A., Dahkan, A., & Abu-Asi, T. (2022). The effect of financial technology on the sustainability of banks in the Gulf Cooperation Council countries. Corporate Governance and Organizational Behavior Review, 6(4, special issue), 359-373.

Awais, M., Afzal, A., Firdousi, S., & Hasnaoui, A. (2023). Is fintech the new path to sustainable resource utilisation and economic development? Resources Policy, 81, 103309.

Benites-Lazaro, L. L., & Mello-Théry, N. A. (2017). CSR as a legitimatizing tool in carbon market: Evidence from Latin America’s Clean Development Mechanism. Journal of Cleaner Production, 149, 218-226.

Bhutto, S. A., Jamal, Y., & Ullah, S. (2023). FinTech adoption, HR competency potential, service innovation and firm growth in banking sector. Heliyon, 9(3), e13967.

Ceptureanu, S. I., Ceptureanu, E. G., Popescu, D., & Anca Orzan, O. (2020). Eco-innovation Capability and Sustainability Driven Innovation Practices in Romanian SMEs. Sustainability, 12(17), 7106.

Jakučionytė-Skodienė, M., Krikštolaitis, R., & Liobikienė, G. (2022). The contribution of changes in climate-friendly behaviour, climate change concern and personal responsibility to household greenhouse gas emissions: Heating/cooling and transport activities in the European Union. Energy, 246, 123387.

Jia, H., Liang, L., Xie, J., & Zhang, J. (2022). Environmental Effects of Technological Improvements in Polysilicon Photovoltaic Systems in China—A Life Cycle Assessment. Sustainability, 14(14), 8670.

Khreis, H., Sudmant, A., Gouldson, A., & Nieuwenhuijsen, M. (2018). Transport Policy Measures for Climate Change as Drivers for Health in Cities. Integrating Human Health into Urban and Transport Planning, 583-608.

KPMG. (2022). Volume of investments in fintech sector worldwide from 2014 to 2021, by investment type (in billion U.S. dollars) [Graph]. In Statista. Retrieved on March 09, 2023, from https://www.statista.com/statistics/1220591/global-capital-invested-by-type-fintech/?locale=en

Lee, C.-C., Li, X., Yu, C.-H., & Zhao, J. (2021). Does fintech innovation improve bank efficiency? Evidence from China's banking industry. International Review of Economics & Finance, 74, 468-483.

Macchiavello, E., & Siri, M. (2022). Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of 'Green Fintech' and 'Sustainable Digital Finance'. European Company and Financial Law Review, 19(1), 128-174. https://doi.org/10.1515/ecfr-2022-0005

Merello, P., Barberá, A., & De la Poza, E. (2022). Is the sustainability profile of FinTech companies a key driver of their value?. Technological Forecasting and Social Change, 174, 121290.

Migozzi, J., Urban, M., & Wójcik, D. (2023). You should do what India does: FinTech ecosystems in India reshaping the geography of finance. Geoforum, 103720.

Mirza, N., Umar, M., Afzal, A., & Firdousi, S. F. (2023). The role of fintech in promoting green finance, and profitability: Evidence from the banking sector in the euro zone. Economic Analysis and Policy, 78, 33-40.

Muganyi, T., Yan, L., & Sun, H.-p. (2021). Green finance, fintech and environmental protection: Evidence from China. Environmental Science and Ecotechnology, 7, 100107.

Safiullah, M., & Paramati, S. R. (2022). The impact of FinTech firms on bank financial stability. Electronic Commerce Research.

Sahay, M. R., von Allmen, M. U. E., Lahreche, M. A., Khera, P., Ogawa, M. S., Bazarbash, M., & Beaton, M. K. (2020). The promise of fintech: Financial inclusion in the post COVID-19 era. International Monetary Fund.

Samaniego-Rascón, D., Gameiro da Silva, M. C., Ferreira, A. D., & Cabanillas-Lopez, R. E. (2019). Solar energy industry workers under climate change: A risk assessment of the level of heat stress experienced by a worker based on measured data. Safety Science, 118, 33-47.

Stoddart, M. C. J., McCurdy, P., Slawinski, N., & Collins, C. G. (2020). Envisioning energy futures in the North Atlantic oil industry: Avoidance, persistence, and transformation as responses to climate change. Energy Research & Social Science, 69, 101662.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Shamsudin, S. M., Rahman, L. A., & Mohamad, M. (2023). Climate Fintech: A New Frontier in Sustainable Investing. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 980-989). European Publisher. https://doi.org/10.15405/epsbs.2023.11.80