Digital Technology Skills and Fraud Risk Judgement Performance With Auditors’ Competencies Mediation

Abstract

The credibility of auditors' professional abilities has suffered due to the rising instances of their inability to identify and report significant errors in annual reports. According to the ACFE survey, only 16% of fraudulent cases were uncovered by auditors, a notably low figure when compared to the 48% of cases that were first brought to light by whistle-blowers. The elements that impact auditors' effectiveness in assessing fraud risk are still not fully understood. This research seeks to investigate whether digital technology skills and individual capabilities impact the ability of external auditors to carry out their duties effectively. A series of surveys using questionnaire were sent to audit firms based in the Klang Valley region, affiliated with the Malaysian Institutes of Accountants. We collected 150 responses and analysed those using Smart-PLS 4.0 softweare. The findings confirm that digital technology skills and individual capabilities play a significant role in the auditor's proficiency in detecting fraud. Furthermore, the study revealed that familiarity with digital technology aids individuals in enhancing their own skills, thereby augmenting their accuracy in evaluating fraud risk. This research contributes to the understanding of factors influencing auditors' efficacy in spotting fraud, benefiting researchers, auditors, and educators alike. The outcomes emphasize the necessity for auditors to gain proficiency in digital technology and employ suitable software tools to effectively uncover fraudulent activities.

Keywords: Auditors, Competencies, Digital Technology Skills, Fraud Detection

Introduction

The expansion of information technology has significantly impacted how today's business stakeholders collect, store, process, and disseminate data (Damasiotis et al., 2015). As a result, audit evidence has shifted from paper records to digital databases, as stated by Oldhouser (2016). Global stability is threatened by environmental, geopolitical, economic, and social pressures. According to the World Economic Forum (2023), combating fraud and other economic crimes is more challenging due to the prevalence of ambiguity. While businesses quickly adapt to new circumstances, fraudsters search for security flaws through which to earn a quick buck. External auditors only identified 8% of fraud in the Asia Pacific area in 2018, said ACFE. When compared to the 48% of fraud cases that were discovered in 2017 as per whistleblowers indication, this ratio is startlingly low (Association of Certified Fraud Examiners, 2018).

At the outset of an audit, determining the likelihood of fraud is difficult. Certain types of employees with skill sets are necessary for fraud risk judgement to decrease the likelihood of missed fraud effectively. The causes of corporate fraud are dynamic, posing a severe risk to the global economy. There has been no indication of relief from the devastating repercussions of Malaysia's dangerously high prevalence of corporate fraud. PwC found that the percentage of people who have fallen victim to corporate fraud rose sharply from 28% in 2016 to 43% in 2020 in their Global Economic Crime and Fraud Survey. Since 1Malaysia Development Bhd (1MDB) failed to file an audited financial statement for two years running (2013 and 2014) and instead issued a "emphasis of matters" and qualified statement, the company has been losing public trust (Abd Razak et al., 2015; Jones, 2020). The auditing business in Malaysia has been portrayed adversely in the media due to recent financial scandals.

Due to their inability to prevent fraud, investors no longer place their faith in the opinions of external auditors that financial statements are honest and correct. Auditors need to be retrained and reskilled to conduct fraud risk assessments, especially in areas of digital technology like data analysis (Rakipi et al., 2021; Sihombing et al., 2023) and the adoption of IT-based rather than manual auditing. Auditors should understand the IT environment and control systems to comply with ISA 315 (International Auditing and Assurance Standards Board, 2013). It has been shown that IT capabilities affect audit performance (Thottoli & Thomas, 2022), however the specific nature of the connection between digital technology skills and audit performance as influenced by IT competences is not yet known. Examining how competency mediates the connection between digital technology capabilities and audit performance and the quality of fraud risk judgement made by external auditors is the primary subject of this research. The following sections discuss the study's methodology, conclusions, and implications. They also investigate the related literature.

Literature Review and Hypothesis Development

Digital Technology Skills and Competency

In a large-scale information technology setting, fraud is more difficult to detect because of its complexity. Without state-of-the-art technology, it can be next to impossible to catch fraudsters who stay in a company's databases (Vona, 2017). More and more auditors are putting time and effort into learning about IT to meet the growing demand for auditors with data mining skills. The use of technology has a highly beneficial influence on encouraging professional growth among independent auditors. (Abiola, 2014; Barman et al., 2016; Grandstaff & Solsma, 2019; Mohammadi et al., 2020; Ngai et al., 2011; Yue et al., 2007; Yao et al., 2018) provide evidence that IT skills positively affect other competences necessary to carry out audit responsibilities efficiently. Academics have applied it to the fields of detection (Castro, 2013; Fullerton & Durtschi, 2004), risk assessment (Payne & Ramsay, 2005), and probability evaluation (Carpenter et al., 2002). Thus, it is hypothesized that:

H1: Digital Technology Skills positively influence external auditors competencies

Competency and Fraud Risk Judgement Performance

Auditors need to be well-versed in assessing audit evidence and proficient at doing so to do their jobs effectively (Franzel, 2013). Having a firm grasp of pertinent IT is essential for auditors to accomplish their tasks efficiently, as noted by several authors (Bassellier et al., 2001; Ku Bahador & Haider, 2012; Thottoli, 2021; Tarjo et al., 2021). Professionals in today's technological era are understandably sceptical. Conventional auditing methods have become defunct due to the rise of information technology (Héroux & Fortin, 2013; Madani, 2009; Rakipi et al., 2021; Wicaksono et al., 2018). As a result of this issue, audits are shifting away from using paper records in favour of digital database evidence (Oldhouser, 2016; Rakipi et al., 2021). Zakaria et al. (2013) and Pagalung and Habbe (2017) found that information technology (IT) significantly boosted fraud detection.Through the use of a highly technical audit system and the expertise of an external auditor, a precise estimate of fraud risk can be produced (Thottoli & Thomas, 2022). Hence, it is hypothesized that:

H2: Competency positively influences fraud risk judgement performance.

Mediating Effect of Competency on the Relationship between Digital Technology Performance and Skills in Fraud Risk Judgement

Evidence for the mediating role of skills was found by Trivellas et al. (2015), who looked at the relationship between job satisfaction and knowledge sharing. The research of Naim and Lenka (2017), which found that competences mediate the connection between information sharing and the affective commitment of Generation Y workers, provides further evidence for the mediating effect of competences. It is hypothesised that digital technology skills involve intermediary aspects rather than leading directly to results like performance enhancement (Naim & Lenka, 2017; Trivellas et al., 2015). In light of the foregoing, it is postulated that external auditors' effectiveness in analysing fraud risk could benefit from the acquisition of digital technology skills. Data mining is only one area where external auditors who have mastered digital technology (such as audit software and data analytics) could have an advantage over their peers. By doing so, they will be better able to evaluate potential for fraud (Carpenter et al., 2002; Castro, 2013; Fullerton & Durtschi, 2004; Payne & Ramsay, 2005). Thus, we hypothesize:

H3: Competency mediates the relationship between digital technology skills and fraud risk judgement performance.

Methodology

The Malaysian Institute of Accountants (MIA)'s external auditors were surveyed and for this purpose we, randomly selected the state of Selangor because it is home to the most audit firms in Malaysia. International Auditing and Assurance Standards Board (2013) states that auditors are the first line of defense in ensuring that financial statements are free from substantial misrepresentation due to fraud or error, making MIA members the primary audience for this research. The MIA website claims a total membership of 33,315; 13,714 are in Selangor. The developed questionnaire was pilot tested before the final data collection; thus, the results can be believed.

Measurement of Variables

Fraud Risk Judgement Performance

The auditors were tested on their ability to link six different occurrences or transactions with one of six different forms of risk that could arise from them. The success rate of fraud detection was the focal point of this type of study. Adjustments were made to test items from Razali (2019). Because it enables respondents to identify potential fraud risks that might materialise throughout the audit process, this instrument is perfect for studying fraud risk assessment. Risks and their corresponding occurrences are listed in Table 1. To link each event or transaction in Table 2 with the risk in Table 1, represented by a specific letter, we asked respondents to describe the risk type for each event or transaction.

Competency

Auditors need to be able to be familiar with fraudulent activity. According to Siriwardane et al. (2014), competency of auditors is demonstrated by the auditor's capacity to demonstrate knowledge and expertise in each task of auditing performed steadily to satisfy the auditing goals. Competency can be gauged in several ways, including by looking at things like experience, education, qualifications, job title, and how often fraud detection techniques have been employed in investigations. Respondents are given a choice between seven Likert scales (strongly disagree = 1, somewhat disagree = 2, slightly disagree = 3, Neutral = 4, slightly agree = 5, somewhat agree = 6, and strongly agree = 7) to express their level of disagreement or agreement with the statement. It is essential to investigate the extent to which respondents feel they can apply broad auditing abilities to their situations. Clements (2020) Personality Qualities Common to Fraud Investigators is the source for all the questions included in the inventory, and they gauge character and skill. To complete auditing duties, an auditor must demonstrate the eleven abilities (skills and knowledge) listed in Table 3.

Digital Technology Skills

Skills necessary for IT include organising and carrying out evaluations of accounting and reporting systems and communicating assessment results and follow-up (International Auditing and Assurance Standards Board, 2013). This questionnaire section has been revised to account for the unique context of external auditors' work and the definition of the relevant variables employed here. Among the criteria are the ability to use IT to organise and execute an audit, to communicate the results and to take corrective action, and to evaluate the overall IT control and environment. Participants are requested to express their degree of agreement with the statement by choosing a value from the seven-point Likert scale (where 1 is very incapable, 2 is moderately incapable, 3 is slightly incapable, 4 is neutral, 5 is reasonably competent, 6 is highly capable, and 7 is extremely capable). The respondents' level of computer literacy must be examined. These survey questions depicted in Table 4 are based on the Cangemi (2015) Global Internal Audit Common Body of Knowledge, although with minor adjustments.

Data Analysis

Descriptive Analysis

The SurveyMonkey database recorded 150 replies, or 32.96%, of the 455-survey links that were distributed by email, WhatsApp, and Telegram. Albaum et al. (1985) claim that attaining a response rate of 5% to 10% has come to be seen as the industry standard. Table 5 presents the demographics of the respondents.

There were 100 female respondents (66.7%) and 50 male respondents (33.3%), as shown by the results. The majority of responses (70.7%) are between the ages of 21 and 30, with 106 people falling into that age range. Among the responders, 114 (or 76%) have at least a bachelor's degree, 21 (or 14%) have additional qualifications like A-levels or vocational certifications, and the remaining 15 (or 10%) also have a degree.

Fourty-four percent, or sixty-six respondents, identified as either a senior or an audit associate. The least amount of audit experience reported was less than 10 years, with 52 responses (or 34.7%). Next comes service lengths of 11-20 years, with 8 responses (5.3%), then service lengths of 21+ years, with just 3 responses (2.0%). The remaining 87 respondents, or 58%, chose to remain neutral in their supplied feedback. 58.7 percent of respondents (88 people) said they have credentials beyond those offered by ACCA and CPAs, such as MICPA-CAANZ and ICAEW. Thirty-five people (or 34 percent) said they made less than RM5,000 monthly on average. The most significant percentage ever recorded.

Data Analysis

Because survey research data often deviates from a normal distribution (Chin et al., 2003), we utilized partial least squares (PLS) analysis employing SmartPLS version 4.0.9 (Ringle et al., 2020) to assess both the measurement and structural aspects of the model. Following the two-step approach outlined by Anderson and Gerbing (1988), we subjected the constructed model to rigorous testing. Once we formulated a hypothesis, we adhered to the guidelines set forth by Hair et al. (2019) and Ramayah et al. (2018), conducting an in-depth evaluation of the measurement model to ascertain the validity and reliability of our methodologies.

Measurement Model

Through these computations, we have gained insights into the model's loadings, AVE, and CR. In a sequential manner, the desirable benchmarks for Load, AVE, and CR are 0.5, 0.5, and 0.7 respectively. According to the data in Table 6, all AVEs and CRs exceed 0.5, with the majority surpassing 0.7. Moreover, the loadings turned out to be higher than anticipated, with only a minor subset falling short of the satisfactory threshold of 0.708 set by Hair et al. (2019). These findings underscore the constructs' validity, dependability, and convergence. Subsequently, we applied the HTMT criterion, introduced by Franke and Sarstedt (2019) and refined by Henseler et al. (2015), to appraise the discriminant validity. The HTMT values should ideally be 0.85 for the more rigorous criterion and 0.90 for the more lenient one. Notably, all HTMT values tabulated in Table 7 were beneath the stringent 0.85 criterion, indicating a clear differentiation among the three concepts in the minds of the respondents. When amalgamating the outcomes of these two validity assessments, they collectively establish the instruments' dependability, precision, and aptitude for measurement.

Structural Model

To generate the route coefficients, standard errors, t-values, and p-values for the structural model, we adhered to the guidance provided by Hair et al. (2019). We adopted the re-sample bootstrapping approach with a sample size of 5,000, as suggested by Ramayah et al. (2018) In light of the argument that p-values alone are insufficient for determining the significance of a hypothesis, Hahn and Ang (2017) have advocated for a comprehensive approach incorporating various criteria like p-values, confidence intervals, and effect sizes. The criteria utilized to assess the hypotheses we formulated are summarized in Table 8.

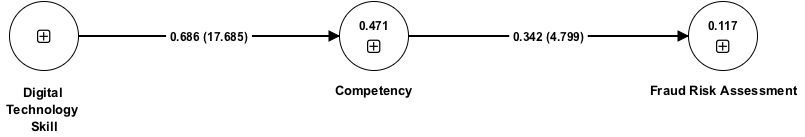

We began by analysing the factors contributing to success using digital tools. The correlation between the two variables explains 47.1% of the variation in skill level (R2 = 0.471). This correlation is statistically significant (= 0.686, p0.01), lending credence to H1. The second evaluation looked at how Competency impacted Fraud Risk Judgement accuracy. Competency was responsible for 11.7% of the variation in Fraud Risk Judgement Performance, as measured by the R2 value of 0.117. Competency was positively associated with Fraud Risk Judgement Performance (r = 0.342, p 0.01). The schematic representation can be shown in Figure 1.

In line with the recommendations put forth by Preacher and Hayes (2008), we employed bootstrapping to analyze the indirect effect and assess the mediation hypotheses. The presence of a negative confidence interval suggests a noteworthy mediation effect. As presented in Table 9, the relationship between competence and performance in digital technologies was indeed statistically significant (β = 0.100, p < 0.01). Bolstering our findings, the bias-corrected 95% confidence intervals do not encompass a value of 0. This provides substantial support for the validity of H3.

Discussion and Implication

External auditors have lost the public's confidence due to their history of missing fraudulent activity in financial accounts. Therefore, auditors must use digital technologies like data analysis (Rakipi et al., 2021; Sihombing et al., 2023) to go above and beyond fraud risk assessment. This research lends credence to the premise that digital literacy on the part of external auditors could boost the quality of their assessments. It's important to note that the study supports the notion that external auditors can improve their skills and abilities to identify potential fraud with proper training in digital technologies. Because of this, it's more important than ever to learn how to use today's cutting-edge digital tools. To provide a sufficient analysis of fraud risk, external auditors and external audit firms must invest in upskilling and reskilling operations. In this case, the Malaysian Institute of Accountants (MIA), which governs the accounting profession in Malaysia, should take the lead in the country's "digital transformation."

Acknowledgments

Financial Disclosure: The authors would like to thank the Accounting Research Institute (HICoE) the Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education, Malaysia for providing the necessary financial assistance for this study.

References

Abd Razak, S. N. A., Wan Mohamad Noor, W. N. B., & Zakaria, M. (2015). Breaking the Silence: The Efficacy of Whistleblowing in Improving Transparency. Scientific Research Journal (SCIRJ), 3(4), 35–39.

Abiola, J. (2014). The Impact of Information and Communication Technology on Internal Auditors' Independence: A PEST Analysis of Nigeria. Journal of Scientific Research and Reports, 3(13), 1738-1752.

Albaum, G., Alreck, P. L., & Settle, R. B. (1985). The Survey Research Handbook. Journal of Marketing Research, 22(4), 470.

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411-423.

Association of Certified Fraud Examiners. (2018). 2018 Global Study on Occupational Fraud and Abuse.

Barman, S., Pal, U., Sarfaraj, M. A., Biswas, B., Mahata, A., & Mandal, P. (2016). A complete literature review on financial fraud detection applying data mining techniques. International Journal of Trust Management in Computing and Communications, 3(4), 336.

Bassellier, G., Reich, B. H., & Benbasat, I. (2001). Information Technology Competence of Business Managers: A Definition and Research Model. Journal of Management Information Systems, 17(4), 159-182.

Cangemi, M. P. (2015). Staying a step ahead: Internal audit’s use of technology. The Global Internal Audit Common Body of Knowledge (CBOK), 16.

Carpenter, T., Durtschi, C., & Gaynor, L. M. (2002). The Role of Experience in Professional Skepticism, Knowledge Acquisition, and Fraud Detection.

Castro, G. S. (2013). Internal Auditors Skepticism in Detecting Fraud: A Quantitative Study. Capella University.

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A Partial Least Squares Latent Variable Modeling Approach for Measuring Interaction Effects: Results from a Monte Carlo Simulation Study and an Electronic-Mail Emotion/Adoption Study. Information Systems Research, 14(2), 189-217.

Clements, L. H. (2020). Personality traits common to fraud investigators. Journal of Financial Crime, 27(1), 119–129.

Damasiotis, V., Trivellas, P., Santouridis, I., Nikolopoulos, S., & Tsifora, E. (2015). IT Competences for Professional Accountants. A Review. Procedia - Social and Behavioral Sciences, 175, 537-545. https://doi.org/10.1016/j.sbspro.2015.01.1234

Franke, G., & Sarstedt, M. (2019). Heuristics versus statistics in discriminant validity testing: a comparison of four procedures. Internet Research, 29(3), 430-447.

Franzel, J. M. (2013). Auditor Objectivity and Skepticism. American Accounting Association Annual Meeting, Anaheim, CA.

Fullerton, R., & Durtschi, C. (2004). The Effect of Professional Skepticism on the Fraud Detection Skills of Internal Auditors. SSRN Electronic Journal.

Grandstaff, J. L., & Solsma, L. L. (2019). An Analysis of Information Systems Literature: Contributions to Fraud Research. Accounting and Finance Research, 8(4), 219.

Hahn, E. D., & Ang, S. H. (2017). From the editors: New directions in the reporting of statistical results in the Journal of World Business. Journal of World Business, 52(2), 125-126.

Hair Jr, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2019). Multivariate Data Analysis (8th Ed.). Cengage.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115-135.

Héroux, S., & Fortin, A. (2013). The Internal Audit Function in Information Technology Governance: A Holistic Perspective. Journal of Information Systems, 27(1), 189-217.

International Auditing and Assurance Standards Board. (2013). International Auditing and Assurance Standards Board Handbook of International Quality Control, Auditing, Review , Other Assurance , and Related Services Pronouncements 2013 Edition: Vol. I.

Jones, D. S. (2020). 1MDB corruption scandal in Malaysia: a study of failings in control and accountability. Public Administration and Policy, 23(1), 59-72. https://doi.org/10.1108/pap-11-2019-0032

Ku Bahador, K. M., & Haider, A. (2012). Information Technology Competencies for Malaysian Accountants – An Academic’ s Perspective. 23rd Australasian Conference on Information Systems, 1–12.

Madani, H. H. (2009). The role of internal auditors in ERP-based organizations. Journal of Accounting & Organizational Change, 5(4), 514-526.

Mohammadi, M., Yazdani, S., Khanmohammadi, M. H., & Maham, K. (2020). Financial reporting fraud detection: An analysis of data mining algorithms. International Journal of Finance & Managerial Accounting, 4(16), 1-12.

Naim, M. F., & Lenka, U. (2017). Linking knowledge sharing, competency development, and affective commitment: evidence from Indian Gen Y employees. Journal of Knowledge Management, 21(4), 885-906. https://doi.org/10.1108/jkm-08-2016-0334

Ngai, E. W. T., Hu, Y., Wong, Y. H., Chen, Y., & Sun, X. (2011). The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature. Decision Support Systems, 50(3), 559-569.

Oldhouser, M. C. (2016). The Effects of Emerging Technologies on Data in Auditing.

Pagalung, G., & Habbe, A. H. (2017). The Effects of Audit Experience, Trust and Information Technology on the Professional Skepticism and Ability in Detecting Fraud by Internal Bank Auditors in Jakarta, Indonesia.

Payne, E. A., & Ramsay, R. J. (2005). Fraud risk assessments and auditors' professional skepticism. Managerial Auditing Journal, 20(3), 321-330.

Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40(3), 879-891.

Rakipi, R., De Santis, F., & D'Onza, G. (2021). Correlates of the internal audit function's use of data analytics in the big data era: Global evidence. Journal of International Accounting, Auditing and Taxation, 42, 100357.

Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial Least Square Structural Equation Modeling (PLS-SEM) using SmartPLS 3.0 An Updated and Practical Guide to Statistical Analysis (2nd Ed.). Pearson.

Razali, F. M. (2019). The Effect of Individual and Environmental Factors on Internal Auditor’s Risk Judgment Performance. Universiti Teknologi Mara, Shah Alam, Malaysia.

Ringle, C. M., Sarstedt, M., Mitchell, R., & Gudergan, S. P. (2020). Partial least squares structural equation modeling in HRM research. The International Journal of Human Resource Management, 31(12), 1617-1643.

Sihombing, R. P., Narsa, I. M., & Harymawan, I. (2023). Big data analytics and auditor judgment: an experimental study. Accounting Research Journal, 36(2/3), 201-216.

Siriwardane, H. P., Kin Hoi Hu, B., & Low, K. Y. (2014). Skills, Knowledge, and Attitudes Important for Present-Day Auditors. International Journal of Auditing, 18(3), 193-205.

Tarjo, T., Sanusi, Z. M., Prasetyono, P., Alim, M. N., Yuliana, R., Anggono, A., Mat-Isa, Y., Vidyantha, H. V., & Imron, M. A. (2021). Current Views on Issues and Technology Development in Forensic Accounting Education of Indonesia. Advances in Science, Technology and Engineering Systems Journal, 6(1), 78-86.

Thottoli, M. M. (2021). Impact of Information Communication Technology Competency Among Auditing Professionals. Accounting. Analysis. Auditing, 8(2), 38-47.

Thottoli, M. M., & Thomas, K. V. (2022). Characteristics of information communication technology and audit practices: evidence from India. VINE Journal of Information and Knowledge Management Systems, 52(4), 570–593.

Trivellas, P., Akrivouli, Z., Tsifora, E., & Tsoutsa, P. (2015). The Impact of Knowledge Sharing Culture on Job Satisfaction in Accounting Firms. The Mediating Effect of General Competencies. Procedia Economics and Finance, 19, 238-247. https://doi.org/10.1016/s2212-5671(15)00025-8

Vona, L. W. (2017). Fraud Data Analytics Methodology: The Fraud Scenario Approach to Uncovering Fraud in Core Business System. John Wiley & Sons Inc.

Wicaksono, A., Laurens, S., & Novianti, E. (2018). Impact Analysis of Computer Assisted Audit Techniques Utilization on Internal Auditor Performance. 2018 International Conference on Information Management and Technology (ICIMTech).

World Economic Forum. (2023). The Global Risks Report 2023 18th Edition. www.weforum.org

Yao, J., Zhang, J., & Wang, L. (2018). A financial statement fraud detection model based on hybrid data mining methods. 2018 International Conference on Artificial Intelligence and Big Data (ICAIBD).

Yue, D., Wu, X., Wang, Y., Li, Y., & Chu, C.-H. (2007). A Review of Data Mining-Based Financial Fraud Detection Research. 2007 International Conference on Wireless Communications, Networking and Mobile Computing.

Zakaria, N. B., Yahya, N., & Salleh, K. (2013). Dysfunctional Behavior among Auditors: The Application of Occupational Theory. Journal of Basic and Applied Scientific Research, 3(9), 495-503.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Pramano, A. J., Razali, F. M., Said, J., Khalid, N., & Suffian, M. T. M. (2023). Digital Technology Skills and Fraud Risk Judgement Performance With Auditors’ Competencies Mediation. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 837-848). European Publisher. https://doi.org/10.15405/epsbs.2023.11.69