Abstract

Although the two-tier system exists in civil law jurisdictions such as the Netherlands, Germany, and many Eastern European nations, the one-tier board system is much more prevalent in common law jurisdictions such as the UK, the US, and Australia. One-tier board systems are more popular than two-tier board systems in several countries. This study employs the SLR method to understand the existing knowledge and research gaps in studying the two-tier board system. The SLR method revealed three main categories: the advantages and disadvantages of the two-tier board system, regulatory settings and the board characteristics attributable to a two-tier board system. One of the advantages of a two-tier system is that it reduces information asymmetries and is more efficient for mitigating agency costs from free cash flow. This study also made specific references to Indonesia. While some countries give the alternative to companies to choose between one-tier or two-tier board systems, in Indonesia, the two-tier board system is mandatory, where the law does not allow companies to choose between one-tier or two-tier board systems for both limited liability companies and public listed companies (PLC). The SLR also revealed that board characteristics such as age, gender and composition also affect the operation and the effectiveness of a two-tier board system.

Keywords: Board of Directors, Corporate Governance, Regulatory Setting, Systematic Literature Review

Introduction

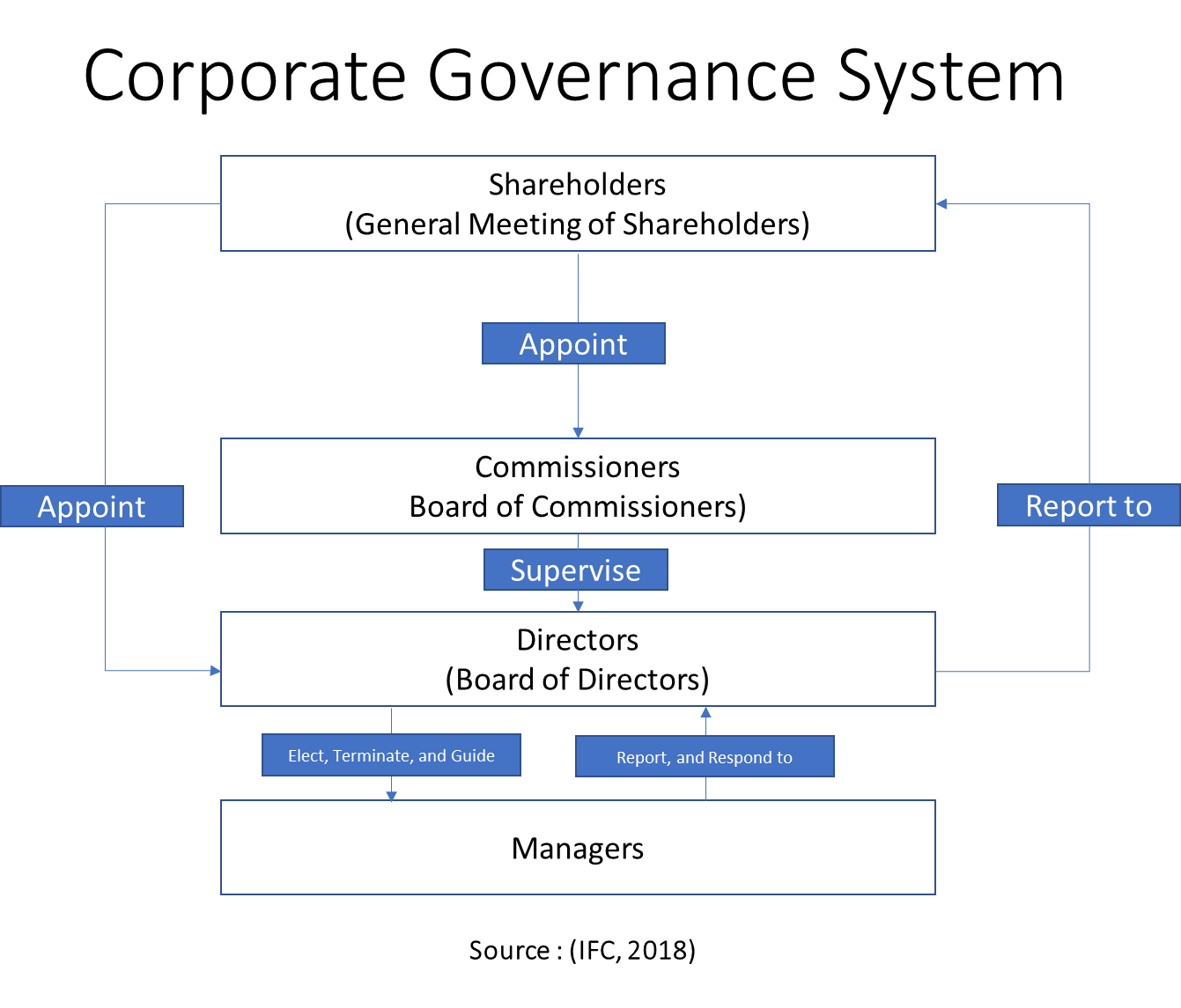

This study will focus on the Strategic Literature Review (SLR) regarding one of the Corporate Governance (CG) Mechanisms: the one-tier and the two-tier Board systems. This research is significant because the SLR can create categories to analyse, review and synthesize the articles regarding one-tier and two-tier board systems which resulted from different regulations between Anglo-Saxon countries that employ a one-tier board system, with civil law jurisdictions such as the Netherlands, Germany, and many Eastern European nations that employ two-tier board system. The one-tier board system is a system that governs the company and consists of both executive and non-executive members. In contrast, a two-tier or dual-board system has separate supervisory and management functions (International Finance Corporation, 2018). Under this arrangement of a two-tier board system, the executive board or the Board of Directors (BOD) is in charge of the day-to-day company management. Meanwhile, the Board of Commissioners, which is a non-executive board, has a supervisory and oversight function over the board of directors (BOD).

In some countries (Khan et al., 2020; Millet-Reyes & Zhao, 2010), one-tier boards are more popular than two-tier boards. Only 22% of European companies have two-tier boards (Millet-Reyes & Zhao, 2010), while three out of fifty Asian nations adopted a one-tier and two-tier board structure, seven adopted a two-tier system, and forty adopted a one-tier board system (Khan et al., 2020). Many countries, especially in Europe, the Netherlands, Germany, several Eastern European nations, China, and Indonesia, have two-tier boards consisting of boards of commissioners and directors. Malta and Cyprus, on the other hand, have hybrid board systems, combining one-tier and two-tier board systems (Belot et al., 2014; De Jonge, 2015; Du Plessis, 2021; International Finance Corporation, 2018; Krisnadewi et al., 2020; Pistor et al., 2002). Overall, the one-tier board system dominates the Asian nations, which are mainly developing nations (Yaacob & Basiuni, 2014).

In addition, even though a few countries have adopted the two-tier board system, the regulation governing the two-tier board system is different from one country to the other. Despite the growing importance of the different board systems between countries, there is still a lack of SLR performed on two-tier boards systems. The outcome of this SLR is expected to focus on studies on good corporate governance, regulatory settings and board characteristics of the two-tier board system.

SLR helps researchers summarise, analyse, and synthesise literature categories (Xiao & Watson, 2019). SLRs go through PRISMA's Identification, Screening, Eligibility, and Inclusion phases (Haddaway et al., 2018; Lu et al., 2022; Wong et al., 2013; Xiao & Watson, 2019). SLR may help researchers find significant categories of findings and establish new research avenues in studying the two-tier system. This research will make a special reference to the two-tier board system adopted by Indonesia.

An SLR addresses these research questions (RQ) on two-tier board structures.

How effective is the two-tier board system in encouraging good corporate governance (GCG)?

How important do the regulatory settings have on the effectiveness of the two-tier board system?

How does the two-tier board system relate to the effectiveness of the board members?

The remainder of this paper's sections are organised as follows.

The literature review is located in Section Two. In the third section, the SLR methodology is explained. The fourth section of the SLR contains its findings. Finally, the fifth section is the conclusion, which identifies the existing discussion and future research directions.

Literature Review

Several countries offer an alternative to choose between two-tier or one-tier board systems (Belot et al., 2014; Pellegrini et al., 2010b). Anglo-Saxon countries such as the United States, the United Kingdom, Canada, and Australia generally implement a single-tier or unitary system (OECD, 2019). Meanwhile, some European nations, including France, allow a one-tier or two-tier board system (Belot et al., 2014). In the Netherlands, where the Dutch company law enables the selection of a two-tier system consisting of a mandatory management board and a non-mandatory supervisory board, showed that there is even an alternative under the two-tier board system (Ottervanger & Pais, 1981; Tumbuan, 2005). Consequently, in Indonesia, a country influenced by the Dutch colonial legal system, all Indonesian limited liability companies have been legally obligated to implement a two-tier board system (Tumbuan, 2005). In other words, Indonesian law takes an authoritative position on the corporate governance system for listed and non-listed companies; hence, all Indonesian companies must have a two-tier board system consisting of a board of commissioners and a board of directors.

Figure 1 shows Indonesia's corporate governance system relating to the board system. The two-tier system has a board of commissioners (BOC) as the supervisory body and a board of directors (BOD) as management. The one-tier or unitary board structure features one board of directors with executive and non-executive members. Civil law countries, including the Netherlands, Germany, and Eastern Europe, use the two-tier system. Common law countries, including the UK, the US, and Australia, employ the one-tier structure (International Finance Corporation, 2018; Krisnadewi et al., 2020). In Indonesia, the rules of this board structure have been stated in the Republic of Indonesia Law No.40/2007.

Besides the ICL, OJK and capital market law are also essential to give the policy of the board's system. This OJK law governs a board structure under OJK regulation No.33/POJK.04 /2014. In addition, in a two-tier board system, the BOC performs an essential role for companies (International Finance Corporation, 2018; KNKG, 2021). The capital market law consists of Indonesia Stock Exchange (IDX), the Indonesian Clearing and Guarantee Corporation (KPEI), and the Indonesia Central Securities Depository (KSEI). According to Rose (2005), the board structure plays an essential role when a company is experiencing financial difficulties or a significant threat that is not typical. The role of the supervisory board includes comparing the financial statement, acting proactively on how BOD directs the corporation's business, allowing for consultation concerning the management board’s policy decisions, ensuring that the management board acts lawfully, and analysing the information it obtains from the management board (Du Plessis, 2021). BOC is the best solution for transparency, ownership, and control separation (Provasi & Riva, 2015). Some study suggests the BOC is fulfilling its oversight responsibilities appropriately. However, the effectiveness of decision-making in a two-tier board system is also contingent upon the legislative reform and quality of board members (Nietsch, 2005). There is a correlation between the regulatory environment and board characteristics in the evolution of a two-tier board system.

Methodology

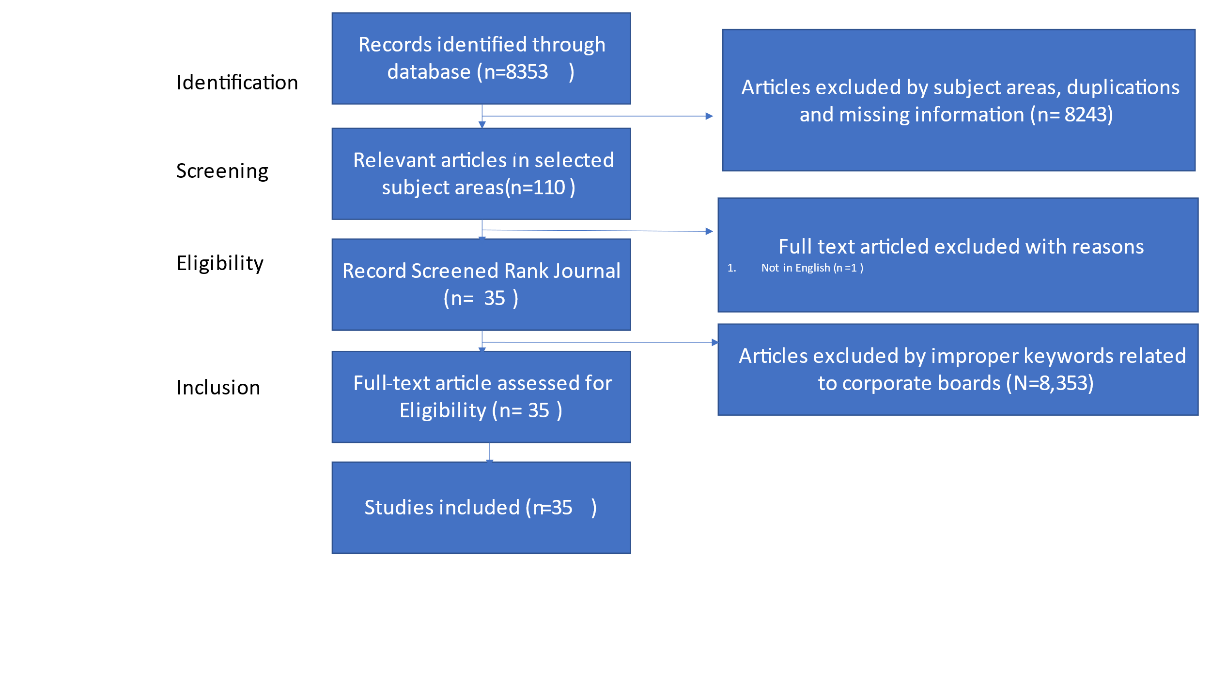

Following the Prizma procedure from (Lu et al., 2022), this research took the subsequent actions for the Strategic Literature Review (SLR). The actions are summarised in Figure 2. First, the researcher reviewed recent Google Scholar citations about the two-tiered board system. In addition, the relevance of each article is determined for each manuscript based on the related title. Next, the researcher reads the most cited article relevant to CG, regulatory settings, and the two-tier board system based on the keywords listed in Table 1 (Chen et al., 2011; Dienes & Velte, 2016; Velte, 2016). The researcher then obtained comprehensive references, including the author's name, year, title, and abstract, and evaluated the information further. In addition to utilising the Web of Science and Scopus, which are frequently used to determine the empirical validity of ranking, the researcher also utilised several other websites to search for relevant literature. Then, the researcher utilises Google Scholar to search for literature concerning related titles.

Second, the data was collected using a sequence of keyword strings from Table 1. Using the keyword string, the researcher then discovered some unrelated topics. Then, the researcher screened the related subject areas associated with these keywords, such as accounting, economics, business, and management.

The researcher then found each keyword's results, as detailed below.

"Two-tier" OR "Two-tier" returns 8,353 results. In the meantime, academicians recognise the significance of the "two-tier board" company board, resulting in 110 articles. On the other hand, the addition of "Indonesia" yields only 17 articles.

The phrases "good corporate governance" AND "corporate governance" yield 1104 articles

The phrase "Regulatory framework or regulatory setting" yields 27,294 articles

The two-tier board structure and "Good corporate governance" OR "GCG" equal six provisions.

The phrases "two-tier board" and "regulatory" or "law" or "policy" equal 38 articles. Then, the researcher found only two articles with the keyword "Indonesia" added.

Then, to construct research in Indonesia, the researcher identified the previously mentioned subject matter within the Indonesian context. The researcher discovered 17 documents with the search terms "two-tier board" AND "Indonesia." In addition, if the researcher used the keywords in Table 1, with the word "Indonesia," only one research article was produced, namely the article by Nadia and Hanafi (2023) related to the gender, which is female board member. Therefore, the lack of literature on Indonesia motivated the researcher to link board characteristics and board diversity, including gender, in 35 articles.

Third, to determine eligibility, the researcher examined the full text and eliminated inappropriate keyword results. Moreover, the researcher did not limit publication dates because they only published 35 articles from 2003 to 2023 in Scopus and 30 studies in WOS. The researcher then conducted a comprehensive literature review by exploring the abstracts and synthesising the literature. This study employs several keywords presented in several PRISMA method procedures.

Four, the researcher screened for inclusion by reading the abstracts of 35 articles to assess their continued relevance to the research topic and quality literature methodology. This study consisted of 35 Scopus articles with the presentation of the keywords in tabular format listed in Figure 2.

Findings

A systematic literature review (SLR) presents a novel way to identify the research themes for the two-tier board system subject. This research discovered categories by identifying keywords based on past studies of the two-tier system. The three main categories can be grouped into comparisons between the one-tier versus two-tier system, regulatory settings, and board characteristics.

The first category, comparing one-tier to two-tier board systems, talked about the advantages and disadvantages of the two-tier system. One of the advantages of a two-tier system is that the two-tier board system reduces information asymmetries because non-executives (BOC) can supervise the management board (BOD) and ensure it acts in the company's and stakeholders' best interests (Bezemer et al., 2014; Jungmann, 2006). In addition, the two-tier board system is more efficient for mitigating agency costs from free cash flow, reducing the company's cash hoarding (Boubaker et al., 2015). According to Provasi and Riva (2015), a two-tier board system provides greater transparency and better separation of ownership and control. Holm and Schøler (2010) found that board independence in the context of a two-tier board member system is an important corporate governance mechanism for companies with widely dispersed ownership. De Jonge (2015) found that a two-tier board system can facilitate structural transparency and cooperative decision-making and foster a working relationship between management and the workforce.

The disadvantages of a two-tier system include increased bureaucracy, lack of flexibility, and lengthy process involved due to the presence of the supervisory board resulting from the organizational layers of the two-tier board system (Bezemer et al., 2014). In addition, the two-tier board system provides less control and coordination than the one-tier system (Pellegrini et al., 2010a). With fewer organisational layers, the one-tier model may create fewer information asymmetries and alleviate bureaucratic hurdles that may hamper the decision-making process of non-executive directors on two-tier boards (Bezemer et al., 2014). Belot et al. (2014) discovered that a company with severe information asymmetry tends to choose a one-tier system. Due to the potential for personal gain, however, corporations typically employ a two-tier board system. Two-tier depends on a nation's laws that empower supervisory boards (Jia & Zhang, 2011). Therefore, the laws of each country influence the effectiveness of two-tier boards in different countries. Two-tier boards should be supported by relevant court precedents when determining directors' liability for inadequate management control.

Moreover, this system necessitates a country's statutory requirements to ensure board independence from controlling shareholders (Dienes & Velte, 2016; Maurovi et al., 2009; Pellegrini et al., 2010b, 2010a; Syvyy, 2017). However, according to De Jonge (2015), in the two-tier board system, the supervisory board is still ineffective in protecting employee interests. Consequently, this condition generates additional systems, such as co-determination. The co-determination model means that the best interests of the corporation are codetermined by the providers of capital (the shareholders) and the providers of labour (the employees) by requiring employee participation at the supervisory board level (Du Plessis, 2021).

The second category of SLR findings emphasised regulatory settings on a two-tier board system. Researchers have previously discussed the two-tier regulatory setting (Braendle & Noll, 2007; Cherkasova & Sosnovskikh, 2020; De Jonge, 2015; Du Plessis, 2021; Jia & Zhang, 2011; Miller, 2000; Mintz, 2005; Nadia & Hanafi, 2023; Nietsch, 2005; Tricker, 2011; Velte, 2010). This category includes regulatory settings related to company cooperation between one-tier and two-tier board systems and alternative regulations of two-tier boards in countries such as China, Germany, and the Netherlands. In these countries, companies are allowed to choose whether to have a one-tier or two-tier board system (Arlt et al., 2003; Du Plessis, 2021; Ottervanger & Pais, 1981; Pellegrini et al., 2010b; Provasi & Riva, 2015; Rose, 2007; Velte, 2010). However, in Indonesia, companies are not allowed to choose (ICL No 40, 2007; International Finance Corporation, 2018). All companies must use the two-tier board system. In addition, some countries, like Germany, allow an additional mechanism of two-tier boards called co-determination (Denisova-Schmidt & Firnhaber, 2021; Du Plessis, 2021; Nietsch, 2005; Rose, 2007; Rühmkorf, 2019). As explained earlier, co-determination requires employee participation at the supervisory board level (Du Plessis, 2021).

Next, the different regulations related to the one-tier and two-tier systems among countries to countries in several studies in this SLR showed that the Italian Legal System by Law No. 6/2003 has been has been consolidated in various models from other two-tier countries like Germany, France, the Nordic, and Japan (Provasi & Riva, 2015). The difference between the two-tier board system in Germany and the one-tier system in the UK lies in the existence of a supervisory board that controls managing directors under the two-tier system. Therefore, it is important to analyse the economic and legal environments based on historical, sociological, and cultural roots to produce board system effectiveness (Jungmann, 2006). Conversely, ineffective CG occurs in many countries due to a difference between CG structure and the concurring board model (Huy, 2015; Jungmann, 2006; Waweru & Prot, 2018). The country's regulatory settings, culture, business, and legal environment, which have one-tier and two-tier rules, may affect the CG structure and model's effectiveness.

Next, the SLR exemplified the different regulations on a two-tier board system that are applicable for different types of companies, for example, the joint stock companies (Dienes & Velte, 2016; Maurovi et al., 2009; Pellegrini et al., 2010b, 2010a; Syvyy, 2017) and Public listed companies (PLC) (Velte, 2010). The previous study compared the company's stock law and CG codes, German and Austrian PLCs, and concentrated on external auditors' ''assisting'' role (Velte, 2010).

In numerous situations, the joint stock companies, Since a one-tier board system in public companies is not recognized by Ukrainian law, therefore, these companies must migrate from Ukraine, setting up their canters of CG in foreign jurisdictions (Syvyy, 2017). Ukraine, which was using a two-tier board, disagreed with the one-tier board legislation. Then, Bellavite Pellegrini et al. (2016) did not find evidence of a significant improvement in performance for companies that have adopted a one-tier or two-tier board system. Therefore, the companies were still maintaining the previous system. Consequently, Pellegrini et al. (2010a) revealed that the Italian reformed Corporate Law, establishing one-tier versus two-tier boards listed and unlisted joint stock companies. The law introduced an alternative CG system. Italian Corporate Law Reform introduced alternative corporate governance systems by establishing one-tier vs. two-tier boards for listed and unlisted joint stock companies.

Alternative regulations of two-tier boards in countries provide a choice or no choice for companies that desire to operate between countries (Arlt et al., 2003; Du Plessis, 2021; Ottervanger & Pais, 1981; Pellegrini et al., 2010b; Provasi & Riva, 2015; Rose, 2007; Velte, 2010). Meanwhile, Arlt et al. (2003), Pellegrini et al. (2010b) discussed maintaining the previous traditional system with one of two alternative systems. According to Arlt et al. (2003), the alternative laws came from the Central and Eastern European laws that authorize various corporate structures, including pure two-tier systems, mixed systems, and systems that choose between one-tier and two-tier systems. In the Netherlands, Dutch company law also equips the option of a two-tier board system with a mandatory management board and a choice supervisory board (Ottervanger & Pais, 1981). According to Pellegrini et al. (2010a), despite alternatives systems being offered by various countries, in Italy, companies with the best sales and capital structure performances and under “control and coordination” in listed and unlisted joint stock companies maintain a traditional system. European company Societas Europaea (SE) allows management to incorporate in another member state due to not result in the equilibrium of a one-tier board system (Rose, 2007). Previous study suggested that an alternative system is not the best choice for having performance in listed and unlisted joint stock companies. Therefore, maintaining the traditional system and previous system still has the best performance and offers equilibrium for companies.

In Indonesia, only a two-tier board is available for PLC and limited liability companies, and no choice to use a one-tier board system (International Finance Corporation, 2018). In addition, in the Co-determination context, Zuhaena and Masita (2015) also noted that Law 13 of 2003 regarding employment lacked a gender perspective and was insensitive to women employees. Despite the incorporation of Law 13 of 2003 into the Omnibus Law, numerous gender-related issues remain (Rizal, 2021). Therefore, Indonesia only uses the two-tier board system, and has not implemented the co-determination.

The next category is board characteristics. This category describes the functions and responsibilities of the supervisory board in two-tier board structures. The definitions, roles, and responsibilities of BOC and BOD are also described in some literature (Böcking et al., 2015; Douma, 1997; International Finance Corporation, 2018; Jia & Zhang, 2011; Jungmann, 2006; Krisnadewi et al., 2020; Sutarti et al., 2021; Tumbuan, 2005). Several studies have concluded that the board of commissioners function has been ineffective (Chen et al., 2011; Kusumastati et al., 2022; Shan, 2013). Chen et al. (2011) argue that several conditions arise when companies cannot mitigate the negative consequences of acquiring controlling shareholders and implementing GCG practices. Shan (2013) concludes that the BOC has not adequately fulfilled its supervisory responsibilities; in truth, such a board was a "rubber stamp" function. In addition, for emerging economic nations, the supervisory board's status and authority in two-tier companies remain low (Chen et al., 2011). The supervisory board's poor performance is also due to the two-tier's ineffective functions and tasks of BOC, such as serving larger Indonesia's political role (Joni et al., 2021; Shi et al., 2018). Several conclusions of SLR’s study indicated that board characteristics and diversity and BOC and BOD duties and responsibilities are related (Lu et al., 2022). As a result of the previous SLR results, board characteristics were included in this study's categories.

Next, the current SLR produces board gender characteristics (Dienes & Velte, 2016; Nadia & Hanafi, 2023) and age (Zhang, 2021). Past research has also addressed board composition (Dienes & Velte, 2016; Du Plessis, 2021; Krisnadewi et al., 2020; Lu et al., 2022; Nadia & Hanafi, 2023; Nietsch, 2005; Rose, 2005). Dienes and Velte (2016) analyse board characteristics and composition regarding gender diversity, expertise, the presence of former managers, meeting frequency, and board size. Krambia-Kapardis et al. (2007) investigate CG variables such as the composition and operation of the board of directors, audit committee, remuneration committee, nomination committee, and other CG policies. Rose (2005) examines Denmark's two-tiered board's financial performance and composition. Du Plessis (2021) observes that there appear to be differences in board system and board composition between jurisdictions. This study's SLR indicates that the development of board characteristics in a two-tier board is dominated by board composition, including board size. In contrast, board characteristics attributes develop in several derivatives of board characteristics, including age, gender, and diversity.

In Indonesia’s context, a prior study discovered that PLCs must have at least three BOC, and most must be "independent" from the company under the two-tier board system for the BOC to perform its duty efficiently. At least 30% of Indonesian commissioners are independent (Samarakoon & Kadapakkam, 2014). ICL also specifies that the number of commissioners in a company is appointed by more than one person, with one commissioner serving as the principal or president commissioner. The board of commissioners comprises an independent board and a non-independent board (ICL No 40, 2007; KNKG, 2021). Board composition is essential to two-tier board system development. However, ICL supported BOC but implied BOD independence. Board size affects this law. The Indonesia Stock Exchange Decree Number: Kep-00183/BEI/12-2018 eliminated independent directors in IDX-listed companies.

Conclusion

This research employs the SLR method for a two-tier board structure with significant factors to compare the one-tier and two-tier systems, regulatory settings, and board characteristics. Thirty-five journals address the two-tier board system, regulatory settings, and CG on PLC from 2003 to 2023. Comparing the two-tier board system to the one-tier system demonstrated different advantages and disadvantages. The regulatory setting category relates cooperation between one-tier and two-tier board systems and alternative two-tier board legislation in countries where corporations may choose. Indonesian corporations cannot choose, unlike other two-tier countries. Then, SLR board characteristics create board gender and age as concerns in two-tier boards and the relevance of board composition for board characteristics features. SLR finds two board gender and one board age articles. At least four SLR articles focus on board composition in two-tier board research. Research on the two-tier board system suggests significant factors. First, the disparity between the CG structure and board model causes two-tier board cooperation challenging (Huy, 2015; Jungmann, 2006; Waweru & Prot, 2018). Board compositions differ in each country (Dienes & Velte, 2016; Du Plessis, 2021; Krisnadewi et al., 2020; Lu et al., 2022; Nadia & Hanafi, 2023; Nietsch, 2005; Rose, 2005). Regulatory settings in PLC companies based on company, OJK, and capital market laws regulate business (ICL No 40, 2007; KNKG, 2021). Second, the literature linking culture and the two-tier board system (Provasi & Riva, 2015) could correspond to the ethnic and religion of board characteristics that help build a two-tier system. Board’s characteristics have numerous antecedents, including gender and age (Nadia & Hanafi, 2023; Zhang, 2021). Due to the antecedent of board characteristics (Lu et al., 2022) in Indonesia, the BOC's functions and responsibilities must be determined by factors other than board politics (Joni et al., 2021; Shi et al., 2018). Future researchers need to comprehend the differences in comparison systems in other countries to support their business models, CG structure, and board composition, which is non-negotiable as a mandated two-tier board practice from the unique ICL legislation in Indonesia. The dominating one-tier structure requires several CG-supporting models and model variations for other business sectors.

Acknowledgment

The authors are grateful to the Accounting Research Institute, (ARI- HICoE), Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education for providing research funding.

References

Arlt, M.-A., Bervoets, C., Grechenig, K., & Kalss, S. (2003). The Status of the Law on Stock Companies in Central and Eastern-Europe: Facing the Challenge to Enter the European Union and Implement European Company Law. European Business Organization Law Review, 4(2), 245-272. DOI:

Bellavite Pellegrini, C., Sergi, B. S., & Sironi, E. (2016). The effect of the adoption of an alternative corporate governance system on firms’ performances: The case of Italian unlisted SMEs. Journal of Management Development, 35(4), 517–529. DOI:

Belot, F., Ginglinger, E., Slovin, M. B., & Sushka, M. E. (2014). Freedom of choice between unitary and two-tier boards: An empirical analysis. Journal of Financial Economics, 112(3), 364-385. DOI: 10.1016/j.jfineco.2014.02.011

Bezemer, P.-J., Peij, S., de Kruijs, L., & Maassen, G. (2014). How two-tier boards can be more effective. Corporate Governance, 14(1), 15-31. DOI:

Böcking, H.-J., Gros, M., & Worret, D. (2015). Enforcement of accounting standards: how effective is the German two-tier system in detecting earnings management? Review of Managerial Science, 9(3), 431-485. DOI:

Boubaker, S., Derouiche, I., & Nguyen, D. K. (2015). Does the board of directors affect cash holdings? A study of French listed firms. Journal of Management & Governance, 19(2), 341-370. DOI:

Braendle, U. C., & Noll, J. (2007). The societas Europaea - a step towards convergence of corporate governance systems? Corporate Ownership and Control, 4(4A), 10–18. https://doi.org/DOI:

Chen, V. Z., Li, J., & Shapiro, D. M. (2011). Are OECD-prescribed “good corporate governance practices” really good in an emerging economy? Asia Pacific Journal of Management, 28(1), 115–138. DOI:

Cherkasova, O., & Sosnovskikh, S. (2020). Legal and social aspects of the state participation in the governance of the large corporations in Russia. E3S Web of Conferences, 222, 06004. DOI:

De Jonge, A. (2015). Designing corporate governance to enhance respect for un Global Compact principles. Advances in Sustainability and Environmental Justice, 16, 61–82. DOI:

Denisova-Schmidt, E., & Firnhaber, P. (2021). Smooth Operator: The Chair as the Drive Belt of the German Governance System. Leading a Board, 211-236. DOI:

Dienes, D., & Velte, P. (2016). The Impact of Supervisory Board Composition on CSR Reporting. Evidence from the German Two-Tier System. Sustainability, 8(1), 63. DOI:

Douma, S. (1997). The Two-tier System of Corporate Governance. Long Range Planning, 30(4), 612–614. DOI:

Du Plessis, J. J. (2021). Board composition: between independent directors, minority representatives and employee representatives. In F. Parisi, O. Wolff, Donnelly, & T. Ginsburg (Eds.), Comparative Corporate Governance. Edward Elgar Publishing. https://doi.org/DOI:

Haddaway, N. R., Macura, B., Whaley, P., & Pullin, A. S. (2018). ROSES RepOrting standards for Systematic Evidence Syntheses: pro forma, flow-diagram and descriptive summary of the plan and conduct of environmental systematic reviews and systematic maps. Environmental Evidence, 7(1). DOI:

Holm, C., & Schøler, F. (2010). Reduction of asymmetric information through corporate governance mechanisms - The importance of ownership dispersion and exposure toward the international capital market. Corporate Governance: An International Review, 18(1), 32–47. DOI:

Huy, D. T. N. (2015). The critical analysis of limited south asian corporate governance standards after financial crisis. International Journal for Quality Research, 9(4), 741–764. DOI:

ICL No 40. (2007). The Indonesian Company Law NUMBER 40 OF 2007 (No. 40), 40, 40. https://cdn.indonesia-investments.com/documents/Company-Law-Indonesia-Law-No.-40-of-2007-on-Limited-Liability-Companies-Indonesia-Investments.pdf

International Finance Corporation. (2018). Indonesia Corporate Governance Manual, Second Edition. DOI:

Jia, M., & Zhang, Z. (2011). Agency costs and corporate philanthropic disaster response: the moderating role of women on two-tier boards - evidence from People's Republic of China. The International Journal of Human Resource Management, 22(9), 2011-2031. DOI:

Joni, J., Widjaja, J. H., Natalia, M., & Salim, I. J. (2021). The value of political independent supervisory boards: Evidence from Indonesian dual board setting. ACRN Journal of Finance and Risk Perspectives, 10(1), 128-138. DOI:

Jungmann, C. (2006). The Effectiveness of Corporate Governance in One-Tier and Two-Tier Board Systems - Evidence from the UK and Germany -. ecfr, 3(4), 426-474. DOI:

Khan, T. M., Nosheen, S., & ul Haq, N. (2020). Corporate governance mechanism and comparative analysis of one-tier and two-tier board structures: evidence from ASEAN countries. International Journal of Disclosure and Governance, 17(2-3), 61-72. DOI:

KNKG. (2021). Pedoman Umum Governansi Korporat Indonesia [General Guidelines for Indonesian Corporate Governance] (PUGKI). Komite Nasional Kebijakan Governansi [National Committee for Governance Policy]. https://knkg.or.id/wp-content/uploads/2022/06/PUGKI-2021-LORES.pdf

Krambia-Kapardis, M., Psaros, J., & Atkins, J. F. (2007). Corporate governance: Rating of the EU member states guidelines. Corporate Ownership and Control, 4(3), 160-172. DOI:

Krisnadewi, K. A., Soewarno, N., & Agustia, D. (2020). Optimum Board Size to Achieve Optimal Performance in Indonesia. The Journal of Asian Finance, Economics and Business, 7(11), 231-239. DOI: 10.13106/jafeb.2020.vol7.no11.231

Kusumastati, W. W., Siregar, S. V., Martani, D., & Adhariani, D. (2022). Board diversity and corporate performance in a two-tier governance context. Team Performance Management: An International Journal, 28(3/4), 260-279. DOI:

Lu, Y., Ntim, C. G., Zhang, Q., & Li, P. (2022). Board of directors' attributes and corporate outcomes: A systematic literature review and future research agenda. International Review of Financial Analysis, 84, 102424. DOI:

Maurovi, L., Božac, M. G., & Grgorini, S. (2009). The One-Tier System On Corporate Governance – Croatian Practice. Economic Research-Ekonomska Istraživanja, 22(1), 114–126. https://hrcak.srce.hr/clanak/60040

Miller, G. (2000). Takeovers: English and American. European Financial Management, 6(4), 533-541. DOI:

Millet-Reyes, B., & Zhao, R. (2010). A Comparison Between One-Tier and Two-Tier Board Structures in France: Comparison Between One-Tier and Two-Tier Board Structures. Journal of International Financial Management & Accounting, 21(3), 279-310. DOI: 10.1111/j.1467-646x.2010.01042.x

Mintz, S. M. (2005). Corporate governance in an international context: Legal systems, financing patterns and cultural variables. Corporate Governance: An International Review, 13(5), 582–597. DOI:

Nadia, L. P., & Hanafi, M. M. (2023). Do women board members affect dividend policy and cash holdings? Evidence from ASEAN emerging economies. Corporate Governance: The International Journal of Business in Society, 23(4), 705-722. DOI:

Nietsch, M. (2005). Corporate governance and company law reform: A German perspective. Corporate Governance: An International Review, 13(3), 368–376. DOI:

OECD. (2019). OECD Equity Market Review ASIA 2019. http://www.oecd.org/daf/ca/oecd-equity-market-review-asia.htm

Ottervanger, T. R., & Pais, R. M. (1981). Employee Participation in Corporate Decision Making: The Dutch Model. International Lawyer, 15(3), 393–410. https://www.jstor.org/stable/40706421

Pellegrini, C. B., Pellegrini, L., & Sironi, E. (2010a). Alternative vs. traditional corporate governance systems in Italy: An empirical analysis. Problems and Perspectives in Management, 8(3), 4–15. https://www.researchgate.net/profile/Carlo-Bellavite-Pellegrini/publication/228293552_Alternative_vs_Traditional_Corporate_Governance_Systems_in_Italy_An_Empirical_Analysis/links/5585bb1b08aeb0cdaddf6a65/Alternative-vs-Traditional-Corporate-Governance-Sys

Pellegrini, C. B., Pellegrini, L., & Sironi, E. (2010b). Why Do Joint Stock Companies Adopt One or Two-Tier Board? The Effect of the Reform of Corporate Governance in Italy. Rivista Internazionale Di Scienze Sociali, 1(1), 3–25. https://www.researchgate.net/profile/Carlo-Bellavite-Pellegrini/publication/265026941_Why_Do_Joint_Stock_Companies_Adopt_One_or_Two-Tier_Board_The_Effect_of_the_Reform_of_Corporate_Governance_in_Italy/links/5585bb1b08ae7bc2f44be5ba/Why-Do-Joint-Stock-Comp

Pistor, K., Keinan, Y., Klellnheisterkamp, J. A. N., & West, M. D. (2002). The evolution of corporate law: a cross-country comparison. University of Pennsylvania Journal of International Law, 23(4), 791. https://heinonline.org/HOL/LandingPage?handle=hein.journals/upjiel23&div=31&id=&page=

Provasi, R., & Riva, P. L. M. (2015). The Italian two-tiers model. Evidence and comparison with some other countries. Corporate Ownership and Control, 12(3), 388-396. DOI:

Rizal, M. (2021). The Influence of The Job Creation Act (Omnibus Law) on Welfare of Women Employees. Jurnal Sekretaris Dan Administrasi Bisnis, V(2), 162–174. https://doi.org/DOI:

Rose, C. (2005). The composition of semi-two-tier corporate boards and firm performance. Corporate Governance: An International Review, 13(5), 691–701. DOI:

Rose, C. (2007). The new corporate vehicle Societas Europaea (SE): Consequences for European corporate governance. Corporate Governance: An International Review, 15(2), 112–121. DOI:

Rühmkorf, A. (2019). Stakeholder Value versus Corporate Sustainability: Company Law and Corporate Governance in Germany. The Cambridge Handbook of Corporate Law, Corporate Governance and Sustainability, 232-245. DOI:

Samarakoon, L. P., & Kadapakkam, P.-R. (2014). The two-tier board system and underpricing of initial public offerings: Evidence from Austria. Corporate Ownership and Control, 12(1), 352-362. DOI:

Shan, Y. G. (2013). Can Internal Governance Mechanisms Prevent Asset Appropriation? Examination of Type I Tunneling in China: Tunneling in China. Corporate Governance: An International Review, 21(3), 225-241. DOI:

Shi, H., Xu, H., & Zhang, X. (2018). Do politically connected independent directors create or destroy value? Journal of Business Research, 83, 82-96. DOI:

Sutarti, S., Syakhroza, A., Diyanty, V., & Dewo, S. A. (2021). Top management team (TMT) age diversity and firm performance: the moderating role of the effectiveness of TMT meetings. Team Performance Management: An International Journal, 27(5/6), 486-503. DOI:

Syvyy, R. (2017). Corporate governance in ukrainian firms: Multiple model selections, their current functioning, and potential future problems. Review of Central and East European Law, 42(4), 364–408. DOI:

Tricker, B. (2011). Re-inventing the Limited Liability Company: Re-Inventing The Limited Liability Company. Corporate Governance: An International Review, 19(4), 384-393. DOI: 10.1111/j.1467-8683.2011.00851.x

Tumbuan, F. (2005). The Two-Tier Board and Corporate Governance in Indonesia. Capital Market and Corporate Governance Issues in Indonesia, September 2005, 8. https://www.oecd.org/daf/ca/corporategovernanceprinciples/35550189.pdf

Velte, P. (2010). The link between supervisory board reporting and firm performance in Germany and Austria. European Journal of Law and Economics, 29(3), 295–331. DOI:

Velte, P. (2016). Women on management board and ESG performance. Journal of Global Responsibility, 7(1), 98–109. DOI:

Waweru, N. M., & Prot, N. P. (2018). Corporate governance compliance and accrual earnings management in eastern Africa: Evidence from Kenya and Tanzania. Managerial Auditing Journal, 33(2), 171-191. DOI:

Wong, G., Greenhalgh, T., Westhorp, G., Buckingham, J., & Pawson, R. (2013). RAMESES publication standards: Meta-narrative reviews. Journal of Advanced Nursing, 69(5), 987–1004. DOI:

Xiao, Y., & Watson, M. (2019). Guidance on Conducting a Systematic Literature Review. Journal of Planning Education and Research, 39(1), 93–112. DOI:

Yaacob, H., & Basiuni, J. (2014). Corporate governance model of a state-owned enterprise: evidence from an Asian emerging market. Corporate Governance, 14(4), 504-514. DOI:

Zhang, S. (2021). Directors’ career concerns: Evidence from proxy contests and board interlocks. Journal of Financial Economics, 140(3), 894–915. DOI:

Zuhaena, F., & Masita, T. E. (2015). Manajemen Co-Determination Berbasis Gender Dalam Sistem Perburuhan Di Indonesia [Gender-Based Co-Determination Management in the Labor System in Indonesia]. Jurnal Riset Manajemen Sekolah Tinggi Ilmu Ekonomi Widya Wiwaha Program Magister Manajemen, 2(2), 141-154. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Warganegara, D. S., Mohamed, N., & Bujang, I. (2023). Regulatory Settings and Corporate Governance of Indonesia’s Two-Tier Board System. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 823-836). European Publisher. https://doi.org/10.15405/epsbs.2023.11.68