Abstract

In recent years, Malaysia has faced challenges with market sentiment, which has been further worsened by the global Covid-19 pandemic. Various authorities, including Deloitte, have provided strategies for Malaysian businesses to navigate the post-crisis landscape. This paper aims to delve into the trajectory of mergers and acquisitions (M&A) in Malaysia, spanning from 1985 to the year 2020, which was significantly affected by the Covid-19 pandemic. Over the course of the past three decades, Malaysia has experienced a transformative shift in M&A dynamics. The early years saw a surge in privatization initiatives, which had a profound impact on the M&A environment. State-owned enterprises were divested, allowing private entities to enter various sectors. Noteworthy transactions during this period include Malaysia Aviation Group's acquisition of Malaysia Airlines and the consolidation of the banking sector through mergers. The paper extensively examines the intricate relationship between M&A activities and Malaysia's real GDP growth. By analyzing data from both pre-pandemic and post-pandemic periods, we aim to explore the reciprocal influence between M&A transactions and economic growth. We assess whether M&A deals stimulated economic expansion or were influenced by broader economic trends. Post-Covid-19, the M&A landscape in Malaysia underwent significant transformations. Our study contributes to a deeper understanding of M&A dynamics in emerging markets and offers valuable insights for businesses and policymakers navigating the post-pandemic terrain.

Keywords: Covid-19, Mergers and Acquisitions, Malaysia, Growth, Market condition, Pandemic

Introduction

Mergers and acquisitions (M&A) are the processes of integrating two or more businesses into a single entity or purchasing one business from another (Ptashchenko, 2021; Yang et al., 2021). The primary purpose of M&A is for huge corporations to extend their operations, grow, and become more dominant and offers benefits like heightened market share, cost savings, and entry into new technologies and markets; nevertheless, it also poses challenges such as high expenses, cultural disparities, and regulatory obstacles, with the achievement of successful outcomes contingent upon factors like strategic alignment, the rigour of due diligence, and the effectiveness of post-merger integration (Ptashchenko, 2021). According to Aggarwal and Garg (2022), the effectiveness of M&A can be measured based on the motives for the merger and its realisation in the future. For example, M&A can help managers address complex issues in the firm's environment, expand product lines and markets, enter new businesses, and maximise their financial capabilities (Barney, 1991). Nevertheless, it also poses challenges such as high expenses, cultural disparities, and regulatory obstacles, with the achievement of successful outcomes contingent upon factors like strategic alignment, the rigour of due diligence, and the effectiveness of post-merger integration. Even though bidders of financial constraint targets normally pay lower acquisition premiums but there is insignificant wealth transfer to bidder shareholders (Mohamad et al., 2019).

This paper is organised as follows. Section II is about the growth of M&A deals in Malaysia. Section III explains the M&A and Malaysia's real GDP growth (%). Section IV explains the recent review of M&A trends and issues in Malaysia, and lastly, section VI is the discussion and conclusions.

The Growth Of M&A Deals in Malaysia

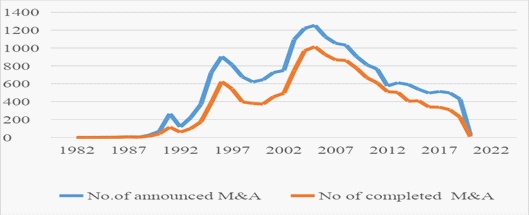

Figure 1 shows the growth of M&A deals in Malaysia for the past four decades, from 1982 until 2020. These deals are from various industries reported in the Thomson Reuters database. The figure shows that the number of announced M&A moves symmetrically with the completed M&A deals. However, the gap between both lines shows that not every announced deal is successfully merged and acquired. When the deals were announced, the number of completed deals was lower than expected. This has been supported by Aggarwal and Garg (2022) and Bari et al. (2019), who found that there is a fluctuation in failure rate in M&A deals.

It is spotted that there was a slow movement from early 1982 until 1991. No peculiar movement during this period as companies started to adapt to merge as their financing strategies. It started with Biwater Shellabear (Biwater Ltd) in 1982, a machinery company that successfully merged, followed by one company from the electricity industry in 1984. Unfortunately, their deal status is unknown, as reported by Thomson. It kept on increasing until 1991.

The M&A landscape in Malaysia has witnessed several noteworthy trends that shed light on the evolving nature of corporate strategies and economic dynamics. The Malaysian M&A market is seeing a growing number of deals in the technology sector. This is driven by the rapid growth of the Malaysian technology industry and the increasing demand for technology solutions from businesses across all sectors PriceWaterhouseCoopers (2022). The acquisition of technology startups and e-commerce platforms, as seen in the Grab-Uber deal, exemplifies this trend.

Further, Malaysian companies are increasingly looking to expand their businesses overseas through M&A. In 2021, cross-border M&A deals accounted for 40% of the total value of M&A deals in Malaysia (PriceWaterhouseCoopers, 2022). This is indicative of the globalisation of business operations. Notable deals, such as the acquisition of Axiata Group's assets by Telenor Group, underscore the increasing interest of multinational corporations in expanding their foothold in the Malaysian market. Nevertheless, Malaysian businesses are increasingly looking for M&A to achieve their sustainability goals. This includes deals in the renewable energy, green technology, and water sectors.

M&A And Malaysia Real GDP Growth (%)

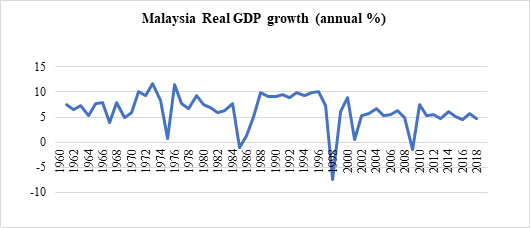

Reflecting this with Malaysia’s economy, according to Yusoff et al. (2000), a lot was going on in the market, such as trade and financial liberalisation to accelerate the process of globalisation in the 1980s and 1990s, recession in 1985 with negative growth of GDP (refer Figure 2), and the dampened demand and prices for all Malaysian major export commodities. The unfavourable GDP growth during the period also affected the movement of M&A deals. It is observed that a slight increase in GDP in 1982 – 1984 has not urged the company to get involved in M&A. However, after the recession in 1985, with a GDP of (-1.03%), the growth rapidly spiked to 9.94% in 1988. As the growth remained stable in the next few years, this also slowly increased the number of completed M&A deals from 1 (1982) to 14 deals (1991). It is because, during the recession, FDI fell sharply, resulting in Malaysia introducing the Promotion Investment Act of 1986 to replace the Investment Act of 1968 with a more attractive opportunity to invest in the manufacturing, agriculture, and services sectors (Yusoff et al., 2000).

Yusoff et al. (2000) found that Malaysia experienced rapid economic growth for more than a decade, following the recession of 1985 and the financial crisis of 1997, with an annual growth of 7.32%. There was a slight decrease in completed deals during the 1998 recession, but it rapidly increased until 2005 at 1015 deals. The number continuously drops until today. The significant drop in completed deals indicates that companies could not perform a complete deal after they announced it.

A study found that the retention of current management in the context of acquisitions of privately owned Malaysian companies is more likely to result in performance improvement. This holds true regardless of the line of business relatedness. Additionally, it was observed that a high degree of relatedness between the target and bidder businesses, as well as payment by shares, have a notable positive influence on post-acquisition control-adjusted performance (Abdul Rahman, 2002).

Mirroring the poor market sentiment, the apparent fall was due to the global financial crisis of 2008 triggered by the bursting of a speculative bubble in the US housing market, which affected the rest of the world's capital flows, trade flows and commodity prices (Athukorala, 2010). Although Malaysia has performed many strategies to recover from the 2009 recession and improved and stabilised the GDP growth, the number of completed deals is still unfavourable.

It was because of the current state of political crisis, the changes of government, oil price issues, and the 1MDB scandal (The Star, 2018, December 11). The politics in the country also had become more volatile where there was no more one dominant party to rule and conquer the Parliament. Frequent changes of ministers and Prime Ministers might affect the growth stability. The following section is a detailed explanation of the recent issues relating to the poor growth of M&A from 2014 until 2020.

The Recent Review of Mergers and Acquisitions (M&A) Trends and Issues in Malaysia

According to PriceWaterhouseCoopers (2022), merger and acquisition activities (mergers, acquisitions, joint ventures, divestments) are high. M&A deals are now higher than those fuelled by cheap credit during the 1999-2001 internet boom and the 2004-2007 M&A era. Asian M&A has contributed to this development, especially in and out of China, while European M&A is still below previous peak rates.

This developed a concern about whether M&A in Malaysia faces the same growth or otherwise. Looking at the growth of M&A earlier, the Malaysian economy has been very challenging. Reflecting the poor market expectations, Malaysia's number of completed M&As decreased significantly from 2014 to 2016. Although there was a slight increase in M&A in 2017, the number eventually dropped in 2018. According to Duff and Phelps Singapore Pte Ltd in The Edge Markets highlights, the jump in 2017 is due to a higher number of transactions that year by Saudi Arabia's Aramco and S P Setia Bhd's purchases of I&P Group Sdn Bhd (The Edge Market, 2017).

“The two largest M&A transactions in 2017 for Malaysia were the acquisitions of 50% stakes in refinery and petrochemical integrated development (Rapid) and PRPC Polymers Sdn Bhd, both by Saudi Arabia’s Aramco,” (Managing Director, Srividya C Gopalakrishnan). Nonetheless, in 2018 The Star announced that Malaysia's transaction operations have decreased significantly since Duff & Phelps claimed that they could be due to political shifts and businesses taking a wait-and-see attitude to strategic development strategies (The Star, 2018, December 11). The modest corporate M&A behaviour has been verified by Bain & Co. in the press, which suggests that it is mainly due to global and political uncertainty in the run-up to the election. Although there was a drop in the number of acquisitions, the demand for M&A remained competitive that year; growth was led by a spike in high-value outbound sovereign wealth fund (SWF) transactions from Singapore, supported by domestic M&A activities in the area (The Star, 2018, December 11).

However, the perception has turned differently because of the latest Covid-19 pandemic. Zainul (2020) recently reported in The Star News that merger and acquisition (M&A) activities are likely to slow down in the short term as market uncertainty contributes to the disparity in valuations. Yap Kong Meng, Deloitte Malaysia's executive director, said M&A would stay soft as long as the country's borders remain closed as the deal-making sector starts showing some life after the movement control order (MCO). He also highlighted those M&A activities triggered by the mismatch valuation, especially for the assets directly impacted by the coronavirus (Covid-19) pandemic. A survey by Herndon and Bender (2020) of Harvard Business Review assesses the effect on existing deals in the pipeline at the time of the recession, which found that 51% of the respondents suggested a "temporary pause" in the current transaction activity to allow time to assess the future market recovery period or to postpone planned deals at the early stage of the transaction, such as a letter of intent or preliminary due diligence. This supported Mr Yap Kong Meng's statement that “Sellers are looking at the historical output of the assets and may be reluctant to meet buyers’ valuation as they are still evaluating the impact of the Covid-19 crisis.

Companies are therefore encouraged to adjust to a new reality by identifying opportunities and redefining strategies to cope with the crisis with courage, as 2020 is likely to go down in history as a year of change, and the current coronavirus intensified the normal speed of transition (Kennedy, 2020)

Conclusion

M&A growth in Malaysia has dropped in the last 14 years, from 2006 to Jan 2020. Although the number of announced and completed deals moves symmetrically, it is observed that the number of completed deals is much lower than the announced deal. When we compare the growth and the market conditions in Malaysia as well as with the country’s GDP, it seems that the low growth was because of the poor market sentiment of the country and the country's GDP.

Nevertheless, there is various issue of mergers and acquisitions in Malaysia that has been widely reported in every media platform, which includes newspapers, television as well as on the internet. The reported cases involving companies in the industry, the most recent one being the world pandemic Covid-19, have highlighted and suggested how vital mergers and acquisitions are in Malaysia. Indirectly, this issue harms the country's growth as the credibility of Malaysia's foreign direct exchange in terms of M&A is damaged to the public.

The trends highlight the complex and diverse characteristics of M&A in Malaysia, which are shaped by global economic forces, improvements in technology, and the strategic objectives pursued by both local and international entities. Comprehending these patterns holds significant importance for firms, politicians, and scholars alike as they traverse the intricate terrain of M&A in Malaysia.

It is, therefore, important for companies to develop a key strategy, system and structure that can enable their strength to grow and bring long-term benefits to organisations. Hence, future researchers suggested analysing the growth of M&A from different perspectives to broaden the scope and help the government to improve the trend of M&A transactions in Malaysia.

Acknowledgements

The authors would like to express sincere gratitude to Universiti Teknologi MARA (UiTM), Malaysia, for funding this research project through the DUCS-Faculty Grant Scheme (600-UiTMSEL PI. 5/4 (094/2022).

References

Abdul Rahman, R. (2002). Effects of Acquisition Characteristics on the Post-acquisition Performance of Malaysian Companies. Asian Review of Accounting, 10(1), 49-76. DOI:

Aggarwal, P., & Garg, S. (2022). Impact of Mergers and Acquisitions on Accounting-based Performance of Acquiring Firms in India. Global Business Review, 23(1), 218-236. DOI:

Athukorala, P. (2010). Working Papers in Trade and Development Malaysian Economy in Three Crises.Working Paper 2010/12. Arndt-Corden Department of Economics Crawford School of Economics and Government ANU College of Asia and the Pacific. https://crawford.anu.edu.au/acde/publications/publish/papers/wp2010/wp_econ_2010_12.pdf

Bari, M. W., Abrar, M., Bashir, M., Baig, S. A., & Fanchen, M. (2019). Soft Issues During Cross-Border Mergers and Acquisitions and Industry Performance, China-Pakistan Economic Corridor Based View. SAGE Open, 9(2), 215824401984518. DOI:

Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99-120. DOI:

Herndon, M., & Bender, J. (2020, June 10). What M&A Looks Like During the Pandemic. Retrieved on September 5, 2020, from https://hbr.org/2020/06/what-ma-looks-like-during-the-pandemic

Kennedy, V. (2020, June 11). Covid-19: The post-outbreak M&A scenario. Retrieved on September 5, 2020, from https://www2.deloitte.com/br/en/pages/strategy-operations/articles/covid-19-fusoes-aquisicoes-pos-crise.html

Mohamad, M., Rakesh Jory, S., & Madichie, N. (2019). Acquisitions of Financially Constrained Targets. The Journal of Social Sciences Research (SPI 1), 1-10. DOI:

PriceWaterhouseCoopers. (2022). Malaysia M&A Outlook: What's the deal in 2023? https://www.pwc.com/my/en/perspective/mna/230329-malaysias-mna-outlook-whats-the-deal-in-2023.html

Ptashchenko, O. V. (2021). Features of «Mergers» and «Acquisitions» of Companies in International Business. Business Inform, 1(516), 34-39. DOI:

The Edge Market. (2017). Malaysia’s deal value is a record in five years. https://www.theedgemarkets.com/article/malaysias-deal-value-record-five-years

The Star. (2018, December 11). Malaysia deal activity falls significantly in 2018. The Star. https://www.thestar.com.my/business/business-news/2018/12/11/malaysia-deal-activity-falls-significantly-in-2018/

Yang, Y., Ba, Y., & Huang, J. (2021). Analysis on the Motivation of Internet Enterprise Strategic Mergers and Acquisitions and Financial Synergies. Proceedings of the 2020 International Conference on Modern Education Management, Innovation and Entrepreneurship and Social Science (MEMIESS 2020). DOI:

Yusoff, M. B., Hassan, F. A., & Jalil, S. A. (2000, December 1). Globalisation, Economic Policy, and Equity: Case of Malaysia. Retrieved on April 28, 2021, fromhttps://www.oecd.org/countries/malaysia/2682426.pd

Zainul, I. F. (2020). M&A activity seen softening in near term. The Star. https://www.thestar.com.my/business/business-news/2020/06/29/ma-activity-seen-softening-in-near-term

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Zakaria, N. N., Mohamad, M., Azero, M. A., & Yahya, N. (2023). Reshaping the Malaysian Market: Analysing Mergers and Acquisitions Amidst Covid-19. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 802-808). European Publisher. https://doi.org/10.15405/epsbs.2023.11.66