Risk Management Practices, Information Technology Capabilities, and Enterprise Resilience: Evidence From Indonesia

Abstract

Changes, crises, and uncertainty have become common traits of business evolution in today's interconnected, complex, and dynamic global business. This high-probability, high-impact prospective adversities emerge frequently, exacerbating businesses' struggles to survive and flourish. Consequently, how firms mitigate risks, remain resilient, and expand facing crises has become a critical problem for business executives. The purpose of this research is to determine the influence of risk management practices (RMPs) and information technology capabilities (ITCs) in enabling Indonesia's State-Owned Enterprises (SOEs) to be resilient in a dynamic environment. However, more research is needed to investigate the relationship between risk management practices, information technology capabilities, and enterprise resilience. Data were analyzed based on 322 online questionnaires from the top management and boards of Indonesia's SOEs using PLS-SEM. The findings show that risk management practices and information technology capabilities significantly strengthen enterprise resilience (ER). Additionally, the findings indicate that organizations' ITCs mediate the relationship between RMPs and ER. These findings indicate that investment in information technology capabilities and proper implementation of risk management practices are crucial for the resilience of SOEs. The findings enrich the knowledge of dynamic capabilities, risk management, and enterprise resilience in public enterprise in the emerging market from a dynamic capability theory point of view and may benefit policymakers and academicians. This research shows the potential for significant research areas in the resilience of SOEs in the context of highly fast-growing developing countries using dynamic capability theory.

Keywords: Crisis, Enterprise Resilience, Indonesia, Information Technology Capabilities, Risk Management Practices, State-Owned Enterprise

Introduction

Indonesia's State-Owned Enterprises (SOEs) face significant problems due to rapid technological advancement, fierce competition, changing regulations, evolving corporate strategies, and shifting consumer preferences. This corporate competitiveness increased the risks to Enterprises and possibly threatened their viability (Camarinha-Matos, 2014). Indonesia's SOEs have to foresee and address these issues or otherwise could cause significant problems, perhaps bringing them to bankruptcy (Aditiasari, 2016; Budiman, 2018; Herdiana, 2019; Kumparan, 2018; Matranews.id, 2018; Suprayitno, 2017). Historically, Indonesian SOEs were granted the privilege of acquiring a secured or captive market or even a monopoly position. However, this comfort zone is now more accessible to other businesses, including foreign enterprises, resulting in stiffer competition. Could Indonesia's state-owned enterprises survive and thrive in this hostile business setting?

In many of the world’s major economies, SOEs play an essential role, and in some, such as China, India, Russia, and Brazil, they are outright dominant (Bałtowski & Kwiatkowski, 2022; Le et al., 2023). According to an IMF study, in the last 10 years, SOEs have increased in importance among the world’s largest corporations, worth $45 trillion, and their assets are now 50 percent of the total global GDP (World Bank, 2022). A recent World Bank note describes how SOEs can play a critical role by bringing relief to the population, staying resilient to shocks, supporting distressed economies, and providing jobs (World Bank, 2022). Due to their vital role in developing or developed countries, authorities prioritize enhancing the performance of SOEs (Heo, 2018; Koch, 2016). It is critical for SOEs to be sustainable and resilient (Garde-Sanchez et al., 2018). They must seek to maintain and improve their flexibility and resilience in today's dynamic, complicated, and volatile corporate atmosphere (Chen et al., 2021; Epstein & Buhovac, 2009; Huang & Farboudi Jahromi, 2021; Miceli et al., 2021; Purnomo et al., 2021; Sarkar & Clegg, 2021; Wieczorek-Kosmala, 2022).

Amidst some notable achievements, many Indonesian SOEs and their subsidiaries confront performance and resilience challenges. Several SOEs have been liquidated due to prolonged periods of low performance for various reasons. Although the government has undertaken several measures to improve the profitability and sustainability of SOEs, many continue to underperform. Indonesia is chosen as a context since it ranks among the world economy's biggest and most active countries. With an almost 280 million population, Indonesia has become a prospective market for various business sectors (https://www.investindonesia.go.id), and the Indonesian economy is heavily dependent on state-owned enterprises. Indonesia’s SOE contribution in the form of dividends, tax, and non-tax state revenue (PNBP) from 2017 to 2019 reached USD 75.33 Billion (6% of GDP) and increased from 2020 to 2022; SOE contribution surged to USD 79.87 Billion (7% of GDP) (Asian Development Bank, 2022).

Given the importance of SOEs, research on how risk is managed and mitigated in SOEs is crucial (Hu & Wu, 2016). SOEs may take excessive risks because they can avoid market (including shareholder) forces requiring strict risk management and disclosure standards. Conversely, SOEs may be more risk-averse than private-sector counterparts due to excessive government control or a lack of clearly defined enterprise goals that allow risk-taking (OECD, 2018). For example, Ferrarini and Hinojales (2018) found that SOE debt in China has become a substantial problem, needing quick policymaker action to manage risks, including significant debt defaults.

Dynamic capabilities are pivotal for companies/organizations to thrive in a dynamic market environment (Barreto, 2010). Through talents, competencies, and resources, dynamic capabilities enable businesses to expand or strengthen their resilience (Conz & Magnani, 2020; Ishak & Williams, 2018; Yu et al., 2019). Information technology capabilities are among these higher-level capabilities that may assist enterprises in obtaining competitiveness and resiliency in coping with adversity. Chen et al. (2014) discovered that increased information technology capabilities directly lower audit fees since fewer business hazards are connected with the usage of information technology, thus lowering the auditor's risk premium. Additionally, information technology capabilities profoundly impact the productivity of internal control.

The research questions of this study are: 1) Do RMPs influence ER; 2) Do ITCs influence ER; 3) Do RMPs influence ITCs; and 4) Do ITCs mediate the relationship between RMPs and ER? These questions will be addressed using four hypotheses to explore the impact of RMPs and ITCs on ER in Indonesia, a developing country with a dynamic market. This study aims to contribute to the corpus of knowledge through the provision of empirical evidence on the relationship between those three variables in the context of Indonesian SOEs and subsidiaries.

Literature Review

In a volatile environment, organizations are susceptible to various unforeseen problems (Ambulkar et al., 2015; Hudakova & Lahuta, 2020). Future catastrophes are anticipated to grow increasingly frequently and are unpredictable (Hudakova & Lahuta, 2020). Often, the repercussions of these adverse events are severe and will worsen if they are not addressed soon. Consequently, the notion of resilience is more significant than ever. Organizational resiliency is a substantial factor in competitive advantage. Academics and industry experts have emphasized the need for companies to handle risk and turbulence in the current, more volatile, and unpredictable world (Parast & Shekarian, 2019; Shekarian & Mellat Parast, 2021). A firm’s long-term growth necessitates that management anticipates risks, manages change, and prevents possible future disasters. The greatest business obstacle is not having the experience and capabilities to deal with and mitigate risk. Risk management facilitates decision-making by anticipating what may occur, how it may occur, and how this may impact the ultimate purpose (Buganova & Simickova, 2020). Within these uncertain and volatile conditions, some companies cultivate resilience to increase their capability to predict, adjust to, and rebound amid disturbances, or to acquire new market competitiveness due to adjustments made when coping with disruption (Morales et al., 2019).

However, businesses usually lack knowledge of when and what dangers or risks they may encounter and the proper reaction (Teece et al., 2016). Incapacity to address crucial business difficulties can negatively impact a company’s financial performance and threaten its viability in the worst-case scenario (Audia et al., 2000). The increased frequency of unknown uncertainty reduces the average duration of firms’ sustainability (Wiggins & Ruefli, 2005). Companies with limited resources and capacities will struggle to evaluate all possible risks (Bromiley, McShane, et al., 2015). As such, Information Technology Capability is crucial to support the extensive information provided by Risk Management practices. Businesses with superior ITCs could anticipate changes and proactively take steps to mitigate adversities (Srinivasan & Swink, 2015).

Businesses must rely on solid information structures and information technology competencies. It is essential in this digital era to be adaptable, agile, and robust (Ciampi et al., 2018). Businesses/organizations require technological help (Cetindamar et al., 2009). Given today’s business world’s inherent complexity and unpredictability, enterprises must invest in information processing capabilities and obtain more high-quality data to meet the contemporary business contexts (Fan et al., 2017). Thus, enterprise resiliency is contingent upon the capacity to collect and utilize resources to withstand unstable environments (Xie et al., 2022) and efficiency in employing information, knowledge, experiences, and other resources (König et al., 2019).

Successful businesses can recover from disruptions and re-establish themselves due to their resilient features and methods (Mohamed & Galal-Edeen, 2018). Companies must exploit available resources, whether internal or external, and reorganize to accommodate an ever-changing environment to maintain competitiveness. Businesses can produce, employ, and protect intangible assets with dynamic capabilities that contribute to enhanced long-term company performance, withstand disruptions, recover, grab emerging opportunities, and ultimately achieve (Teece, 2007). Dynamic capabilities are viewed as a source of long-term competitiveness for businesses working in an environment of rapid change and ambiguity (Griffith & Yalcinkaya, 2010).

According to the dynamic capability theory, the greater success of particular firms or organizations may stem from two distinct organizational capacities: dynamic capabilities and operational (daily routine) capabilities (Cepeda & Vera, 2007; Helfat & Peteraf, 2003). Organizations collectively learn dynamic capabilities (Pisano & Teece, 2007; Winter, 2003). Dynamic capabilities assist organizations in responding to changes or disruptions more rapidly and efficiently (Chmielewski & Paladino, 2007). Resilience involves both low-level (operational) and high-level (dynamic) capabilities, which enable businesses to determine which operational capabilities are required and which require improvement (Teece, 2007). An organization’s dynamic capabilities have evolved due to its procedures, positions, and pathways. These competencies are embedded throughout the organizational structure (Teece et al., 1997). This notion of dynamic capabilities mirrors the concept of resilience: the capacity to endure adversity, overcome and recover from unpleasant circumstances, seize opportunities as they emerge, and succeed (Duchek, 2014). Businesses must be conducted and managed differently to continuously generate something new in a dynamic setting (Eisenhardt & Martin, 2000; Teece et al., 1997).

While Gallopín (2006) characterized resilience as the capacity to adjust, endure adversity, and recover from a crisis or disaster, Sheffi and Rice (2005) define business resilience as the capacity to recover from disturbance. Fiksel et al. (2015a) and Gittell et al. 2006 state that when coping with the same level of uncertainty and disruption, one organization succeeds, and others fail. Therefore, management should construct and sustain resilient businesses to enhance competitiveness (Grillo et al., 2018; Sheffi & Rice, 2005). Resilience is characterized by effective and efficient strategies that help companies quickly overcome obstacles (Lin & Bie, 2016). These strategic initiatives allow a business to retain and adjust to its environment (Kurtz & Varvakis, 2016). Resilience is not static; it is dynamic, functions through complex, interrelated processes, is composed of various inputs, and manifests itself in various ways (Weick & Sutcliffe, 2007). A resilient organization can overcome misfortune and turn it into an opportunity (Kerr, 2015; Seville, 2009).

Theoretical Framework and Hypotheses Development

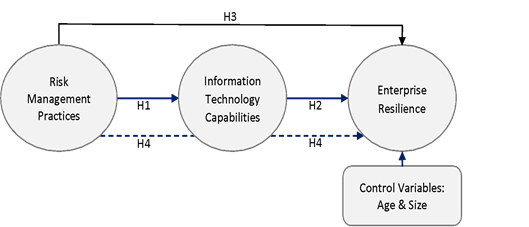

The suggested theoretical framework for this study is depicted in Figure 1. ER and RMPs are the dependent and independent variables, respectively. ITCs serve as the independent and mediating variable. The organization’s size and the corporation’s age are used as controls for the variables. The age is the number of years since the formation of the SOEs, and the size is the average annual revenue for the previous three years.

Because of a lack of data, the majority of research investigating the effects of dynamic capability or business resilience concentrated on publicly listed companies (Bromiley, McShane, et al., 2015). Most prior studies on resilience are conceptual or focus on large enterprises in advanced economies, leaving emerging economies behind (van der Vegt et al., 2015). Most of the studies are done on complex or multinational corporations since those are the types of businesses most likely to benefit from these dynamic capabilities (Barreto, 2010; Kale & Singh, 2007; Teece, 2007; Zollo & Winter, 2002). Nevertheless, Pablo et al. (2007) proposed that these qualities could be beneficial in public sector enterprises, which frequently face rapid policy changes due to election cycles. A few studies on enterprise resilience are based on dynamic capabilities and include risk management (Seville et al., 2015). Thus, this study examines the combined effects of RMPs and dynamic capabilities (Information Technology Capabilities) on enterprise resilience.

Risk Management Practices and Information Technology Capabilities

Risk management is a crucial aspect of risk mitigation (Fiksel et al., 2015a, 2015b). The incorporation of risk into an enterprise’s overall business strategies (Bromiley, Rau, et al., 2015; Slagmulder & Devoldere, 2018) and resilience from an economic viewpoint has not been fully explored and still requires enhancement (Ishak & Williams, 2018; Menéndez Blanco & Montes-Botella, 2017; Parker & Ameen, 2018). Naudé et al. (2009) and Turvey (2007) discovered that the study on enterprise vulnerability and resilience to risks posed by shocks and uncertainty in emerging economies is even more scarce. Even though risk management is vital for SOEs’ resilience to maintain their long-term competitiveness, limited research has investigated the effects of RMPs on developing and enhancing ER. With rapid technological progress, information expands exponentially and causes VUCA situations of volatility, uncertainty, complexity, and ambiguity (Friedman & Lewis, 2021). Numerous novel and unanticipated business concepts, such as Uber and Grab, Traveloka, Alibaba, Amazon, Airbnb, and Netflix, threaten established corporations. It necessitates that the organization and all its members be flexible and adaptable (Friedman & Lewis, 2021). Managing a firm in a VUCA environment requires a robust risk management to support the extensive information provided by Risk Management practices which force companies to invest highly in technology for information gathering, and analysis to mitigate the adverse effects of uncertainties and resilience.

H1: Risk Management Practices significantly influence Information Technology Capabilities

Risk Management Practice and Resilience

IT capabilities enable firms to be more agile and adaptable in order to recognize and seize opportunities as they present themselves (Bakar, 2015). Extensive studies have investigated the impact of ITCs on corporate performance. Those companies that have information technology capabilities will be able to get a competitive advantage and achieve a more excellent company performance (Chircu & Lee, 2003; Chen et al., 2006; Cetindamar et al., 2009; Hassan et al., 2013; Kamal, 2006; Liu, 2013; Oh & Teo, 2009). According to Hassan et al. (2013), organizations can be flexible and agile if they have sufficient technological competency through an effective learning process. According to Cetindamar et al. (2009) study, technology changes constantly. These transformations bring with them dangers as well as possibilities. Companies that successfully capture and reap the benefits of the opportunity could receive assistance from technology capabilities that allow them to mobilize, reorganize, and safeguard their resources throughout and following the crisis. However, limited studies examined information Technology capability on organizational resilience.

Information technology capability created from a long-term learning process has been understood as a crucial factor in either the achievement or demise of an organization, including supporting enterprise resilience. Firms can get an immediate competitive edge and a long-term sustainable competitive advantage by utilizing information technology capabilities (Barney, 1991; Powell & Dent-Micallef, 1997). Improved IT Capability increases the ability of a business to sense and interpret information, enabling it to stay competitive and react to events more swiftly in a constantly changing environment (Ngai et al., 2011). It also improves the firm’s capacity to adapt to unanticipated shifts and disruptions (Dubey et al., 2019; Wamba et al., 2020).

As Mandal (2019) points out, information technology (IT) capabilities are critical to stand out from rivals, raise costs associated with switching and customer loyalty, aggressively explore customer needs, and lower searching expenses and tourist supply chains must build agility and resilience (Chae et al., 2014). High levels of unpredictability in the corporate environment necessitate the need for firms to be agile, and information technology is considered a way to react to a shifting setting swifter. Cai et al. (2019), Mao et al. (2015), and Lu and Ramamurthy (2011) discovered that IT capability is closely associated with flexibility, which contributes to the development or enhancement of organizational resilience (Branco et al., 2019; Sabahi & Parast, 2020).

H2: Information Technology Capabilities significantly influence Enterprise Resilience

Risk Management Practice and Resilience

Due to globalization, increasing consumer demands, environmental uncertainties, and internal and external risk occurrences, businesses are more susceptible to risk in today's world of rapid change (Ivanov et al., 2019; Shekarian & Mellat Parast, 2021). Effort coordination and risk management can contribute to resilience (Leat & Revoredo-Giha, 2013). The enterprise risk management approach is improved over time due to experience and changing circumstances to monitor environmental changes, limit risks, and optimize possibilities. In addition, it offers prompt and decisive responses to problems (Buganova & Simickova, 2020). Risk management is essential for businesses because it enables them to avoid catastrophic losses, produce additional benefits, and achieve remarkable international success (Oehmen et al., 2014).

In an ever-changing business environment, Seville (2009) found that risk management gives a good framework to encourage businesses to be more proactive in dealing with the unforeseen. It helps the company be more alert and, therefore, more resilient. Risk management now focuses on managing deep uncertainty and unknown risk (Teece et al., 2016). Parker and Ameen (2018) discovered that proactive RMPs and the flexibility to modify company assets have more beneficial effects on ER. In today's dynamic environment, a more strategic approach to risk management is needed to achieve an organization's resilience and agility Slagmulder and Devoldere (2018). Hudakova and Lahuta (2020) suggest that risk management must be followed by organizations wanting to be resilient in today's turbulent environment.

Most of the time, firms lack emergency preparedness readiness. Therefore, the application of enterprise risk management constitutes one of the strategies that help in crisis prevention and improving the business's resilience. Companies can become more cautious and hence more resilient by using risk management. Today, managing severe uncertainty and the risk associated with the unknown are the main focuses of risk management (Teece et al., 2016). Thus, risk management practice supports the development of enterprise resilience. Enterprise risk management enables businesses to plan for and mitigate the risks of adverse events that could jeopardize their future Bogodistov and Wohlgemuth (2017). Thus, risk management practice supports the development of enterprise resilience.

H3: Risk Management Practices significantly influence Enterprise Resilience

The mediating effect of Information Technology Capabilities on the relationship between Risk Management Practices and Enterprise Resilience

Numerous firms view ITCs as significant and unique resources that allow them to gain competitiveness (Mikalef & Pateli, 2017; Queiroz et al., 2018). Highly advanced IT capability facilitates the organization to implement comprehensive risk management practices as information can easily be stored, processed, and analyzed using big data and machine learning technology. Subsequently, the practice of risk management supports companies to be more proactive in managing the unexpected (Seville, 2009; Teece et al., 2016). Parker and Ameen (2018) discovered that proactive RMPs and the capacity to repurpose business resources have more beneficial effects on firm resilience. Risk management practice has resulted in a higher reliance on digital technology to reduce risk exposure and increase the capacity to effectively manage unexpected events, recover, and promote subsequent achievement (Florio & Leoni, 2017; Slagmulder & Devoldere, 2018). The study by Van Opstal (2010) stated that organizational resilience is an integral approach to managing uncertainties and anticipating disruptions; thus, the companies/firms could be more prepared and guarantee a faster rebound process when facing disruptive events. Thus, risk management practice supports the use of sophisticated digital technology in enterprises, subsequently increasing resilience. Riley et al. (2016) found that information collected during the critical period could act as a mediator to help relate business competencies to organizations’ recovery abilities which are part of resilience (Hohenstein et al., 2015; Kantur, 2015; Pettit et al., 2013).

H4: Information Technology Capability significantly mediates the relationship between Risk Management Practices and Enterprise Resilience

Methodology

Research Design

This study used a survey-based deductive, cross-sectional quantitative methodology. The study specifically targeted top executives and management of all SOEs and their subsidiaries listed on the websites of each SOE and the Indonesia Ministry of State-Owned Enterprises (https://bumn.go.id/). Since they are the primary decision-makers, they were chosen as respondents. A purposive sample was chosen because the questionnaire stipulated that respondents must meet certain requirements. Due to the lock-down policy during the period of field research, this study adopts an internet-based or online survey to collect data from the study sample. The e-questionnaire was placed in Google Forms, and the respondents were sent a link to access and fill out the questionnaire.

Variables Measurement

This study used indicators from research by (Kantur, 2015; Lee et al., 2013; Prayag et al., 2018; Stephenson, 2010; Stephenson et al., 2010; Whitman et al., 2013) to evaluate Enterprise Resilience (ER) as an endogenous variable. Risk Management Practice (RMP) was an exogenous variable measured using the ERMi – Enterprise Risk Management Index (Maruhun, Atan, et al., 2018) and research by (Farrell & Gallagher, 2015; Lai & A Samad, 2010; Maruhun, Abdullah, et al., 2018). ITCs Measurement was adapted from (Bhatt & Grover, 2005; Benbya et al., 2020; Said et al., 2012; Tippins & Sohi, 2003; Zehir & Tanrıverdi, 2006). For RMP, ITC, and ER, a seven-point Likert scale was employed to measure. Financial resilience questions use a very weak to very strong 7 Likert scale. Three hundred twenty-two valid data from 388 received questionnaires were processed (from a population that consisted of 114 SOEs and 530 subsidiaries in June 2020). The PLS-SEM method was used using Smart-PLS 3 (Ringle et al., 2014).

Results

Common Method Bias

Since the same informant responded to exogenous and endogenous variables, we utilized the common method bias test. Harman’s single-factor analysis was performed, and the total variance retrieved by a single component is 49,341%, which is below the minimum requirement of 50%. That suggests that CMB has no effect on the data and, consequently, the outcomes (Podsakoff et al., 2012).

Descriptive Statistics

Table 1 presents the descriptive statistics for the three variables. The skewness results indicate the data distribution was left-skewed, while the kurtosis results indicate light tails compared to the centre of the distribution.

Table 2 shows the descriptive data of the enterprise. Most enterprises are between 10 - 50 years old, and 51% of enterprise have more than five hundred employees.

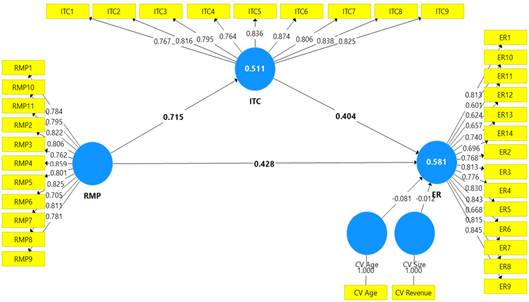

Assessment of Measurement Model

All indicator loadings are greater than 0.60, depicted in Figure 2 for the reflective measuring model. The construct convergent validity, AVE (average variance extracted) values higher than 0.5 imply that the construct explains more than fifty percent of the variance of the indicator, hence giving satisfactory item reliability (see table 3).

Tables 3 and 4 show the assessment of the measurement model. The reliability (CR – Composite Reliability) and validity values (AVE) are satisfactory. The measurement model analysis also assesses discriminant validity, model fit, and multicollinearity. The HTMT values are below the threshold of 0.90. With an SRMR value of 0.065, the fit model results are acceptable. So, the measurement model assessment satisfies all the necessary criteria (Henseler et al., 2015; Hair et al., 2019; Hair et al., 2021).

Table 4 displays the discriminant validity of the study. All HTMT ratios were less than 0.90, which shows that discriminant validity is present and that conceptually distinctive constructs exist (Henseler et al., 2015; Kline, 2018).

Collinearity is not a concern in this study because the VIF values are below 3.0 (Hair et al., 2019) (See Table 5).

Assessment of Structural Model

Table 6 shows the prediction capacities of the model and the relationship between constructs. The R2 value for ITC is 0.511, and the R2 value for ER is 0.581. Thus, RMP and ITC explained 58.1% of the proportion of the variance of ER. The coefficient of determinant ITC and RMP is moderate (Chin, 1998). RMP to ITC has a big effect size (f2 value), RMP to ER has a medium effect size (f2 value), and ITC to ER has a small effect size (f2 value) (Cohen, 1988). More than zero results for the predictive significance of the PLS path model (Q2) indicate the predictive accuracy of the structural model for that construct. Q2 values larger than 0.25 suggest that the PLS path model has a moderate predictive value (Hair et al., 2019).

Hypotheses Testing

The test in Table 7 shows that all hypotheses are supported. Risk Management Practices significantly influence Information Technology Capabilities, as shown in a previous study by (Friedman & Lewis, 2021). Information Technology Capabilities significantly influence Enterprise Resilience, as shown on previous studies (Branco et al., 2019; Dubey et al., 2019; Mandal, 2019; Sabahi & Parast, 2020; Wamba et al., 2020). Risk Management Practices significantly influence Enterprise Resilience, as found in previous research findings (Hudakova & Lahuta, 2020; Leat & Revoredo-Giha, 2013; Parker & Ameen, 2018; Slagmulder & Devoldere, 2018; Teece et al., 2016). Finally, the hypothesis that ITCs significantly mediate the (Bogodistov & Wohlgemuth, 2017) studies (Florio & Leoni, 2017; Riley et al., 2016; Seville, 2009; Slagmulder & Devoldere, 2018; Teece et al., 2016).

Discussions and Conclusions

This study aims to investigate how risk management and IT capabilities (as one type of dynamic capabilities in dynamic capability theory) help Indonesia's State-Owned Enterprises adapt to changing conditions and achieve their resilience. PLS-SEM tests showed that risk management practices and information technology capabilities significantly influence enterprise resilience. The findings also show that Information Technology Capability mediates Risk Management Practices and Enterprise Resilience. Enterprise Resilience was also unaffected by Firm Size and Age.

To remain competitive in a challenging and ever-changing business environment, a company must develop risk management skills. Thus, dynamic capabilities are a concept in risk management (Bogodistov & Wohlgemuth, 2017). This is the ability to consistently avoid, manage, transmit, or consciously accept particular hazards under dynamic conditions. It enables a business to generate value by eliminating or minimizing potentially damaging internal and external events (Bogodistov & Wohlgemuth, 2017). A risk management capability takes into account the environment's dynamics (Teece et al., 1997). In the context of Risk Management Practices, dynamic capabilities reflect variations in resources. Even in such precarious circumstances, resilient organizations are able to satisfy the demands of the job. Safety no longer refers to the absence of intolerable risk but rather to the capacity to succeed in a variety of situations by managing and mitigating risk. This capability requires the ability to react proactively (be prepared to take action), monitor and evaluate (have the standard and be prepared to compare it with the actions taken for development), anticipate (know what to expect), and learn from both successes and failures. Preparedness, adaptability, and resiliency are achieved by cultivating the capacity for reactive, real-time, and proactive performance adjustment (Pariès, J., 2011).

There is virtually no success without risk, peril, or failure. Consequently, security to proceed into the future to accomplish the goals must be ongoing and persistent, active and dynamic, and not a static condition (Wildavsky, 1988). Wildavsky (1988) describes the relationship between risk and resilience as the capacity to deal with unanticipated threats as they arise. To be resilient, one must fail, learn, plan, and cope with unprecedented or unpredictable events, as well as manage current events.

Risk Management Practices are not only dynamic but also require synchronization with the dynamic capability of a company. Dynamic capabilities enhance risk management by emphasizing the prevention of occurrences and bolstering organizational resilience in the face of those that have already occurred. According to Bromiley and Rau (2016), ex-ante risk assessment is either impossible or unfeasible from an economic standpoint. Rather, businesses must have organizational resilience or the capacity to cope with unanticipated events. This is achieved by reconfiguring current assets and capabilities. A dynamic capability is a higher-order procedure that enables the modification of normal procedures in response to changing circumstances, such as when a risk becomes an obstacle (Winter, 2003). In contrast to (enterprise) risk management, which concentrates on risk assessment and ex-ante planning, dynamic capability encompasses the ability to exploit an opportunity and adjust the firm's resource base accordingly (Teece, 2007). Consequently, dynamic capabilities surpass risk prediction by enabling the organization to be resilient to risk. When an unlikely event occurs, the organization can successfully adapt. Strategic risk resilience refers to the capacity of a company's management to detect and reduce risks as early as possible, establish priorities, and address risks in accordance with these goals in the face of changing external and internal conditions.

Business resilience is now more vital than ever. Businesses must be resilient to survive in the challenging environment. Companies must go beyond short-term performance in a volatile commercial climate, especially in the era of technology development and advancement. They must survive in coping with unexpected challenges and emerge stronger. This study fills the theoretical and methodological gaps in risk management, dynamic capabilities, and enterprise resilience research on the public sector in developing countries. Research on the public sector and SOE resilience are still lacking.

The Ministry of SOE as a regulator could use the findings to plan, execute, and monitor each company's IT capability development to improve and strengthen resilience to succeed in business. The findings from this research might be used as a foundation to further investigation of SOE resilience in other emerging nations. This study adds to the literature on Dynamic Capabilities (especially ITCs) and enterprise resilience (Karman & Savanevičienė, 2021; Vargas & Rivera, 2019; Zhou et al., 2019) and dynamic capabilities in the public sector, including SOEs (Bracci & Tallaki, 2021; Mancesti, 2017). This study contributes to the limited research on enterprise resilience and dynamic capabilities theory that incorporates risk management (Bromiley, Rau, et al., 2015; Seville et al., 2015).

Even if some precautions have been taken to ensure the validity of the results, certain issues exist beyond the researcher's control. These limits must be considered when evaluating the results and planning future research. The sample is only SOEs and subsidiaries. Future research could be conducted in other types of companies (such as the private sector) with characteristics that differ from SOEs or are compared with SOEs in other countries. Second, in this study, the criteria were self-assessed. As a result, potential bias associated with the self-report questionnaire should be considered when interpreting the findings of this study. Thus, future research could combine data sources to create a more comprehensive picture. Forum group discussions, in-depth cases, and studies on secondary sources that have already been published could enrich the information gathered. Third, this study investigated using a cross-sectional time horizon. A longer time horizon could offer a comparison. This study focuses only on one of the dynamic capabilities (Information Technology Capabilities) out of many others. Various other elements, such as marketing capabilities, leadership capabilities, and product and service innovation capabilities, could be investigated in future studies. The final drawback is that this study relies on a single informant, a member of the Board of Directors, or a senior manager, as a source of information. Thus, personal bias could occur. Multiple informant resources could help avoid personal bias.

Even considering the drawbacks mentioned above, the findings of this study provide valuable information on the impact of risk practices and dynamic capabilities on enterprise resilience. Future studies may be able to address some of the constraints mentioned above. In conclusion, this study provides new insights into the relationship between Dynamic Capabilities, Risk Management Practices, and Enterprise Resilience in the context of Indonesian State-Owned Enterprises and their subsidiaries. Presumably, the findings of this research will contribute to the body of literature on Dynamic Capabilities, Risk Management Practices, and Enterprise Resilience in SOEs, which will serve as a resource for future research.

References

Aditiasari, D. (2016). Jumlah BUMN Rugi Berkurang di 2015 [Number of BUMN Losses Reduced in 2015]. https://finance.detik.com/berita-ekonomi-bisnis/d-3122212/jumlah-bumn-rugi-berkurang-di-2015

Ambulkar, S., Blackhurst, J., & Grawe, S. (2015). Firm's resilience to supply chain disruptions: Scale development and empirical examination. Journal of Operations Management, 33-34(1), 111-122. DOI:

Asian Development Bank. (2022). Unlocking the Economic and Social Value of Indonesia’s State-Owned Enterprises. DOI:

Audia, P. G., Locke, E. A., & Smith, K. G. (2000). The Paradox of Success: An Archival and a Laboratory Study of Strategic Persistence Following Radical Environmental Change. Academy of Management Journal, 43(5), 837-853. DOI:

Bakar, Z. b. A. (2015). The Moderating Effect of Information Technology Capability on The Relationship Between Business Continuity Management Factors and Organizational Performance. Universiti Utara Malaysia. http://etd.uum.edu.my/5402/

Bałtowski, M., & Kwiatkowski, G. (2022). State-Owned Enterprises in the Global Economy. DOI:

Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99-120. DOI:

Barreto, I. (2010). Dynamic Capabilities: A Review of Past Research and an Agenda for the Future. Journal of Management, 36(1), 256-280. DOI:

Benbya, H., Nan, N., Tanrıverdi, H., & Yoo, Y. (2020). Complexity and information systems research in the emerging digital world. Mis Quarterly, 44(1), 1-17. DOI:

Bhatt, G. D., & Grover, V. (2005). Types of Information Technology Capabilities and Their Role in Competitive Advantage: An Empirical Study. Journal of Management Information Systems, 22(2), 253-277. DOI:

Bogodistov, Y., & Wohlgemuth, V. (2017). Enterprise risk management: a capability-based perspective. The Journal of Risk Finance, 18(3), 234-251. DOI:

Bracci, E., & Tallaki, M. (2021). Resilience capacities and management control systems in public sector organisations. Journal of Accounting & Organizational Change, 17(3), 332-351. DOI:

Branco, J. M. P., Ferreira, F. A. F., Meidutė-Kavaliauskienė, I., Banaitis, A., & Falcão, P. F. (2019). Analysing determinants of small and medium-sized enterprise resilience using fuzzy cognitive mapping. Journal of Multi-Criteria Decision Analysis, 26(5-6), 252-264. DOI:

Bromiley, P., & Rau, D. (2016). A Better Way of Managing Major Risks: Strategic Risk Management. IESE Insight(28), 15-22. DOI:

Bromiley, P., McShane, M., Nair, A., & Rustambekov, E. (2015). Enterprise Risk Management: Review, Critique, and Research Directions. Long Range Planning, 48(4), 265-276. DOI:

Bromiley, P., Rau, D., & McShane, M. K. (2015). Can Strategic Risk Management Contribute to Enterprise Risk Management? A Strategic Management Perspective. SSRN Electronic Journal. DOI:

Budiman, A. (2018). BUMN Sakit terancam ditutup [BUMN Sick is threatened with closure]. https://bisnis.tempo.co/read/1055733/bumn-sakit-terancam-ditutup/full&view=ok

Buganova, K., & Simickova, J. (2020, April). Increasing the organization's resilience through project risk management. In Economic and Social Development (Book of Proceedings), 52nd International Scientific Conference on Economic and Social Development (p. 163).

Cai, Z., Liu, H., Huang, Q., & Liang, L. (2019). Developing organizational agility in product innovation: the roles of IT capability, KM capability, and innovative climate: Developing organizational agility in product innovation. R&D Management, 49(4), 421-438. DOI:

Camarinha-Matos, L. M. (2014). Collaborative Networks: A Mechanism for Enterprise Agility and Resilience. In: K. Mertins, F. Bénaben, R. Poler, & J. P. Bourrières (Eds.), Enterprise Interoperability VI. Proceedings of the I-ESA Conferences (Vol. 7). Springer, Cham. DOI:

Cepeda, G., & Vera, D. (2007). Dynamic capabilities and operational capabilities: A knowledge management perspective. Journal of Business Research, 60(5), 426-437. DOI:

Cetindamar, D., Phaal, R., & Probert, D. (2009). Understanding technology management as a dynamic capability: A framework for technology management activities. Technovation, 29(4), 237-246. DOI:

Chae, H. C., Koh, C. E., & Prybutok, V. R. (2014). Information Technology Capability and Firm Performance: Contradictory Findings and Their Possible Causes. MIS Quarterly, 38(1), 305-326. DOI:

Chen, R., Xie, Y., & Liu, Y. (2021). Defining, Conceptualizing, and Measuring Organizational Resilience: A Multiple Case Study. Sustainability, 13(5), 2517. DOI:

Chen, Y. N., Chen, H. M., Huang, W., & Ching, R. K. H. (2006). E-Government Strategies in Developed and Developing Countries: An Implementation Framework and Case Study. Journal of Global Information Management, 14(1), 23-46. DOI:

Chen, Y., Smith, A. L., Cao, J., & Xia, W. (2014). Information Technology Capability, Internal Control Effectiveness, and Audit Fees and Delays. Journal of Information Systems, 28(2), 149-180. DOI:

Chin, W. W. (1998). Commentary Issues and Opinion on Structural Equation Modeling. MIS Quarterly, 22(1). http://www.jstor.org/stable/249674

Chircu, A., & Lee, D. (2003). Understanding IT Investments in the Public Sector: The Case of E-Government, in AMCIS 2003 Proceedings, 69–72. http://aisel.aisnet.org/amcis2003/99

Chmielewski, D. A., & Paladino, A. (2007). Driving a resource orientation: reviewing the role of resource and capability characteristics. Management Decision, 45(3), 462-483. DOI:

Ciampi, F., Marzi, G., & Rialti, R. (2018). Artificial intelligence, big data, strategic flexibility, agility, and organizational resilience: A conceptual framework based on existing literature.

Cohen, J. (1988). Statistical Power Analysis for the Behavior (2nd Ed.). Lawrence Erlbaum Associates, Publishers.

Conz, E., & Magnani, G. (2020). A dynamic perspective on the resilience of firms: A systematic literature review and a framework for future research. European Management Journal, 38(3), 400-412. DOI:

Dubey, R., Gunasekaran, A., Childe, S. J., Blome, C., & Papadopoulos, T. (2019). Big Data and Predictive Analytics and Manufacturing Performance: Integrating Institutional Theory, Resource-Based View and Big Data Culture. British Journal of Management, 30(2), 341-361. DOI:

Duchek, S. (2014). Growth in the Face of Crisis: The Role of Organizational Resilience Capabilities. Academy of Management Proceedings, 2014(1), 13487. DOI:

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: what are they? Strategic Management Journal, 21(10-11), 1105-1121. DOI: 10.1002/1097-0266(200010/11)21:10/11<1105::aid-smj133>3.0.co;2-e

Epstein, J. M., & Buhovac, A. R. (2009). Performance Measurement of Not-For-Profit Organizations. The Society of Management Accountants of Canada and the American Institute of Certified Public Accountants. http://www.ef.uni-lj.si/docs/osebnestrani/Not-for-Profit.pdf

Fan, H., Li, G., Sun, H., & Cheng, T. C. E. (2017). An information processing perspective on supply chain risk management: Antecedents, mechanism, and consequences. International Journal of Production Economics, 185, 63-75. DOI:

Farrell, M., & Gallagher, R. (2015). The Valuation Implications of Enterprise Risk Management Maturity. Journal of Risk and Insurance, 82(3), 625-657. DOI:

Ferrarini, B., & Hinojales, M. (2018). State-Owned Enterprises Leverage as a Contingency in Public Debt Sustainability Analysis. ADB Economics Working Paper Series. DOI:

Fiksel, J., Poliviou, M., Pettit, T. J., & Croxton, K. (2015a). Embracing Change: From Risk to Resilience. MIT Sloan Management Review, Winter, 1–18. https://www.researchgate.net/publication/283463392

Fiksel, J., Poliviou, M., Pettit, T. J., & Croxton, K. (2015b). From Risk to Resilience: Learning to Deal with Disruption. MIT Sloan Management Review, 56(2), 79–86. https://sloanreview.mit.edu/article/from-risk-to-resilience-learning-to-deal-with-disruption/

Florio, C., & Leoni, G. (2017). Enterprise risk management and firm performance: The Italian case. The British Accounting Review, 49(1), 56-74. DOI:

Friedman, H., & Lewis, B. J. (2021). The Importance of Organizational Resilience in the Digital Age. Academia Letters. DOI:

Gallopín, G. C. (2006). Linkages between vulnerability, resilience, and adaptive capacity. Global Environmental Change, 16(3), 293-303. DOI:

Garde-Sanchez, R., López-Pérez, M., & López-Hernández, A. (2018). Current Trends in Research on Social Responsibility in State-Owned Enterprises: A Review of the Literature from 2000 to 2017. Sustainability, 10(7), 2403. DOI:

Griffith, D. A., & Yalcinkaya, G. (2010). Resource-advantage theory: a foundation for new insights into global advertising research. International Journal of Advertising, 29(1), 15-36. https://www.researchgate.net/profile/Michael-Harvey-17/publication/5222964_A_Resource_Perspective_of_Global_Dynamic_Capabilities/links/0fcfd50900b8b66391000000/A-Resource-Perspective-of-Global-Dynamic-Capabilities.pdf

Grillo, C., Ferreira, F. A. F., Marques, C. S. E., & Ferreira, J. J. (2018). A knowledge-based innovation assessment system for small- and medium-sized enterprises: adding value with cognitive mapping and MCDA. Journal of Knowledge Management, 22(3), 696-718. DOI:

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to Use and How to Report the Results of PLS-SEM. European Business Review, 31(1), 2-24. DOI:

Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., Danks, N. P., & Ray, S. (2021). Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R. Classroom Companion: Business. DOI:

Hassan, N. H. B., Arshad, N. I. B., Mustapha, E. E. B., & Jaafar, J. B. (2013). A literature review: Exploring organizational learning orientation as antecedent of Information Technology (IT) infrastructure capability to achieve organizational agility. 2013 International Conference on Research and Innovation in Information Systems (ICRIIS). DOI:

Helfat, C. E., & Peteraf, M. A. (2003). The dynamic resource-based view: capability lifecycles. Strategic Management Journal, 24(10), 997-1010. DOI:

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115-135. DOI:

Heo, K. (2018). Effects of Corporate Governance on the Performance of State-Owned Enterprises. DOI:

Herdiana, D. (2019). Melawan Disrupsi, inilah Potret Bisnis Pos Indonesia [Against Disruption, this is the Business Portrait of Pos Indonesia]. http://jabar.tribunnews.com/2019/05/29/melawan-disrupsi-inilah-potret-bisnis-pos-indonesia

Hohenstein, N.-O., Feisel, E., Hartmann, E., & Giunipero, L. (2015). Research on the phenomenon of supply chain resilience: A systematic review and paths for further investigation. International Journal of Physical Distribution & Logistics Management, 45(1/2), 90-117. DOI:

Hu, L., & Wu, H. (2016). Exploratory study on risk management of state-owned construction enterprises in China. Engineering, Construction and Architectural Management, 23(5), 674-691. DOI:

Huang, A., & Farboudi Jahromi, M. (2021). Resilience building in service firms during and post COVID-19. The Service Industries Journal, 41(1-2), 138-167. DOI:

Hudakova, M., & Lahuta, P. (2020). Risk management as a tool for building a resilient enterprise. Economic and Social Development: Book of Proceedings, 248-258. https://www.esd-conference.com/upload/book_of_proceedings/Book_of_Proceedings_esdPorto2020_Online.pdf

Ishak, A. W., & Williams, E. A. (2018). A dynamic model of organizational resilience: adaptive and anchored approaches. Corporate Communications: An International Journal, 23(2), 180-196. DOI:

Ivanov, D., Tsipoulanidis, A., & Schönberger, J. (2019). Supply Chain Risk Management and Resilience. Springer Texts in Business and Economics, 455-479. DOI:

Kale, P., & Singh, H. (2007). Building firm capabilities through learning: the role of the alliance learning process in alliance capability and firm-level alliance success. Strategic Management Journal, 28(10), 981-1000. DOI:

Kamal, M. M. (2006). IT innovation adoption in the government sector: identifying the critical success factors. Journal of Enterprise Information Management, 19(2), 192-222. DOI:

Kantur, D. (2015). Measuring Organizational Resilience: A Scale Development. Pressacademia, 4(3), 456-456. DOI:

Karman, A., & Savanevičienė, A. (2021). Enhancing dynamic capabilities to improve sustainable competitiveness: insights from research on organisations of the Baltic region. Baltic Journal of Management, 16(2), 318-341. DOI:

Kerr, H. (2015). Organizational Resilience: Harnessing experience, embracing opportunity [White paper]. British Standards Institution. https://www.bsigroup.com/en-US/our-services/consulting/resources/whitepapers/organizational-resilience/

Kline, R. B. (2018). Response to Leslie Hayduk's Review of Principles and Practice of Structural Equation Modeling, 4th Edition. Canadian Studies in Population, 45(3-4), 188. DOI:

Koch, S. (2016). The secret to successful state-owned enterprises is how they’re run. Reuter. http://theconversation.com/the-secret-to-successful-state-owned-enterprises-is-how-theyre-run-53118

König, M., Ungerer, C., Baltes, G., & Terzidis, O. (2019). Different patterns in the evolution of digital and non-digital ventures' business models. Technological Forecasting and Social Change, 146, 844-852. DOI:

Kumparan. (2018). Dulu Pasok 40% Gelas Coca Cola, Sekarang BUMN Ini Memprihatinkan. https://kumparan.com/@kumparanbisnis/dulu-pasok-40-gelas-coca-cola-sekarang-bumn-ini-memprihatinkan-27431110790546935

Kurtz, D. J., & Varvakis, G. (2016). Dynamic Capabilities and Organizational Resilience in Turbulent Environments. Competitive Strategies for Small and Medium Enterprises, 19-37. DOI:

Lai, F. W., & A Samad, F. (2010). Enterprise risk management framework and the empirical determinants of its implementation. International Conference on Business and economics Research, 1, 340–344.

Le, T.-H., Park, D., & Castillejos-Petalcorin, C. (2023). Performance comparison of state-owned enterprises versus private firms in selected emerging Asian countries. Journal of Asian Business and Economic Studies, 30(1), 26-48. DOI:

Leat, P., & Revoredo-Giha, C. (2013). Risk and resilience in agri-food supply chains: the case of the ASDA PorkLink supply chain in Scotland. Supply Chain Management: An International Journal, 18(2), 219-231. DOI:

Lee, A. V., Vargo, J., & Seville, E. (2013). Developing a Tool to Measure and Compare Organizations' Resilience. Natural Hazards Review, 14(1), 29-41. DOI:

Lin, Y., & Bie, Z. (2016). Study on the Resilience of the Integrated Energy System. Energy Procedia, 103, 171-176. DOI:

Liu, H. (2013). A Critical Review of the Impact of IT on Organisational Flexibility. AUT University.

Lu, Y., & Ramamurthy, K. (Ram). (2011). Understanding the Link Between Information Technology Capability and Organizational Agility: An Empirical Examination. MIS Quarterly, 35(4), 931–954. DOI:

Mancesti, M. (2017). Why being alert is not enough to beat VUCA and disruption, IMD Research & Knowledge. https://www.imd.org/research-knowledge/articles/why-being-alert-is-not-enough-to-beat-vuca-and-disruption/

Mandal, S. (2019). Exploring the influence of IT capabilities on agility and resilience in tourism: Moderating role of technology orientation. Journal of Hospitality and Tourism Technology. DOI:

Mao, H., Liu, S., & Zhang, J. (2015). How the effects of IT and knowledge capability on organizational agility are contingent on environmental uncertainty and information intensity. Information Development, 31(4), 358-382. DOI:

Maruhun, E. N. S., Abdullah, W. R. W., Atan, R., & Yusuf, S. N. S. (2018). The Effects of Corporate Governance on Enterprise Risk Management: Evidence from Malaysian Shariah-Compliant Firms. International Journal of Academic Research in Business and Social Sciences, 8(1). DOI: 10.6007/ijarbss/v8-i1/3893

Maruhun, E. N. S., Atan, R., Yusuf, S. N. S., & Said, J. (2018). Developing Enterprise Risk Management Index for ShariahCompliant Companies. Global Journal Al Thaqafah, 8(1), 189-205. DOI:

Matranews.id. (2018). Menyulap Balai Pustaka Menjadi Kekinian [Transforming Balai Pustaka into a modern one]. https://matranews.id/menyulap-balai-pustaka-menjadi-kekinian/

Menéndez Blanco, J. M., & Montes-Botella, J.-L. (2017). Exploring nurtured company resilience through human capital and human resource development: Findings from Spanish manufacturing companies. International Journal of Manpower, 38(5), 661-674. DOI:

Miceli, A., Hagen, B., Riccardi, M. P., Sotti, F., & Settembre-Blundo, D. (2021). Thriving, Not Just Surviving in Changing Times: How Sustainability, Agility and Digitalization Intertwine with Organizational Resilience. Sustainability, 13(4), 2052. DOI:

Mikalef, P., & Pateli, A. (2017). Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. Journal of Business Research, 70, 1-16. DOI:

Mohamed, H. A. H., & Galal-Edeen, G. H. (2018). A Business Enterprise Resilience Model to Address Strategic Disruptions. Enterprise Risk Management, 4(1), 15. DOI:

Morales, S. N., Martínez, L. R., Gómez, J. A. H., López, R. R., & Torres-Argüelles, V. (2019). Predictors of organizational resilience by factorial analysis. International Journal of Engineering Business Management, 11, 184797901983704. DOI:

Naudé, W., Santos-Paulino, A. U., & McGillivray, M. (2009). Vulnerability in Developing Countries. United Nations University Press. https://archive.unu.edu/unupress/sample-chapters/Vulnerablity_in_Developing_Countries_sample.pdf

Ngai, E. W. T., Chau, D. C. K., & Chan, T. L. A. (2011). Information technology, operational, and management competencies for supply chain agility: Findings from case studies. The Journal of Strategic Information Systems, 20(3), 232-249. DOI:

OECD. (2018). Privatisation and the Broadening of Ownership of State-Owned Enterprises, OECD. Privatisation-and-the-Broadening-of-Ownership-of-SOEs-Stocktaking-of-National-Practices.pdf (oecd.org)

Oehmen, J., Olechowski, A., Robert Kenley, C., & Ben-Daya, M. (2014). Analysis of the effect of risk management practices on the performance of new product development programs. Technovation, 34(8), 441-453. DOI:

Oh, L., & Teo, H. (2009). Enterprise Risk Management an Empirical Study of IT-enabled Enment and Organizational Resilience. CONF-IRM 2009 Proceedings [Preprint].

Pablo, A. L., Reay, T., Dewald, J. R., & Casebeer, A. L. (2007). Identifying, Enabling and Managing Dynamic Capabilities in the Public Sector*. Journal of Management Studies, 44(5), 687-708. DOI:

Parast, M. M., & Shekarian, M. (2019). The Impact of Supply Chain Disruptions on Organizational Performance: A Literature Review. Springer Series in Supply Chain Management, 367-389. DOI:

Pariès, J. (2011). Resilience and the Ability to Respond. In E. Hollnagel, J. Pariès, D. Woods, & J. Wreathall (Eds.), Resilience Engineering in Practice: A Guidebook (pp. 3-8). CRC Press. DOI:

Parker, H., & Ameen, K. (2018). The role of resilience capabilities in shaping how firms respond to disruptions. Journal of Business Research, 88, 535-541. DOI:

Pettit, T. J., Croxton, K. L., & Fiksel, J. (2013). Ensuring Supply Chain Resilience: Development and Implementation of an Assessment Tool. Journal of Business Logistics, 34(1), 46-76. DOI:

Pisano, G. P., & Teece, D. J. (2007). How to Capture Value from Innovation: Shaping Intellectual Property and Industry Architecture. California Management Review, 50(1), 278-296. DOI:

Podsakoff, P. M., MacKenzie, S. B., & Podsakoff, N. P. (2012). Sources of Method Bias in Social Science Research and Recommendations on How to Control It. Annual Review of Psychology, 63(1), 539-569. DOI:

Powell, T. C., & Dent-Micallef, A. (1997). Information technology as competitive advantage: the role of human, business, and technology resources. Strategic Management Journal, 18(5), 375-405. DOI: 10.1002/(sici)1097-0266(199705)18:5<375::aid-smj876>3.0.co;2-7

Prayag, G., Chowdhury, M., Spector, S., & Orchiston, C. (2018). Organizational resilience and financial performance. Annals of Tourism Research, 73, 193-196. DOI:

Purnomo, B. R., Adiguna, R., Widodo, W., Suyatna, H., & Nusantoro, B. P. (2021). Entrepreneurial resilience during the Covid-19 pandemic: navigating survival, continuity and growth. Journal of Entrepreneurship in Emerging Economies, 13(4), 497-524. DOI:

Queiroz, M., Tallon, P. P., Sharma, R., & Coltman, T. (2018). The role of IT application orchestration capability in improving agility and performance. The Journal of Strategic Information Systems, 27(1), 4-21. DOI:

Riley, J. M., Klein, R., Miller, J., & Sridharan, V. (2016). How internal integration, information sharing, and training affect supply chain risk management capabilities. International Journal of Physical Distribution & Logistics Management, 46(10), 953-980. DOI:

Ringle, C. M., Wende, S., & Becker, J.-M. (2014). SmartPLS 3,. Bonningstedt. Retrieved on January 7, 2021, from https://www.smartpls.com

Sabahi, S., & Parast, M. M. (2020). Firm innovation and supply chain resilience: a dynamic capability perspective. International Journal of Logistics Research and Applications, 23(3), 254-269. DOI:

Said, J., Wee, S. H., Othman, R., & Taylor, D. (2012). Strategic management accounting and information technology competency on customer service process performance in local government agencies. Management & Accounting Review (MAR), 11(1), 1-32.

Sarkar, S., & Clegg, S. R. (2021). Resilience in a time of contagion: Lessons from small businesses during the COVID-19 pandemic. Journal of Change Management, 21(2), 242-267. DOI:

Seville, E. (2009). Resilience: Great Concept, But What Does it Mean for Organizations?. US Council on Competitiveness Workshop, Risk and Resilience. Wilmington. https://www.researchgate.net/publication/29489555

Seville, E., Van Opstal, D., & Vargo, J. (2015). A Primer in Resiliency: Seven Principles for Managing the Unexpected. Global Business and Organizational Excellence, 34(3), 6-18. DOI: 10.1002/joe.21600

Sheffi, Y., & Rice, J. B., Jr. (2005). A Supply Chain View of the Resilient Enterprise. MIT Sloan Management Review, 47(1), 41-48. https://www.proquest.com/scholarly-journals/supply-chain-view-resilient-enterprise/docview/224969684/se-2

Shekarian, M., & Mellat Parast, M. (2021). An Integrative approach to supply chain disruption risk and resilience management: a literature review. International Journal of Logistics Research and Applications, 24(5), 427-455. DOI:

Slagmulder, R., & Devoldere, B. (2018). Transforming under deep uncertainty: A strategic perspective on risk management. Business Horizons, 61(5), 733-743. DOI:

Srinivasan, R., & Swink, M. (2015). Leveraging Supply Chain Integration through Planning Comprehensiveness: An Organizational Information Processing Theory Perspective. Decision Sciences, 46(5), 823-861. DOI:

Stephenson, A. (2010). Benchmarking the Resilience of Organisations. University of Canterbury.

Stephenson, A., Vargo, J., & Seville, E. (2010). Measuring and comparing organisational resilience in Auckland. Australian Journal of Emergency Management, 25(2), 27-32.

Suprayitno, D. (2017). Daftar 24 BUMN yang masih rugi dan sakit [List of 24 BUMNs that are still losing money and are sick]. https://nasional.kontan.co.id/news/ini-daftar-24-bumn-yang-masih-rugi-dan-sakit

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533. DOI: 10.1002/(sici)1097-0266(199708)18:7<509::aid-smj882>3.0.co;2-z

Teece, D. J. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319-1350. DOI:

Teece, D., Peteraf, M., & Leih, S. (2016). Dynamic Capabilities and Organizational Agility: Risk, Uncertainty, and Strategy in the Innovation Economy. California Management Review, 58(4), 13-35. DOI:

Tippins, M. J., & Sohi, R. S. (2003). IT competency and firm performance: is organizational learning a missing link? Strategic Management Journal, 24(8), 745-761. DOI: 10.1002/smj.337

Turvey, R. (2007). Vulnerability Assessment of Developing Countries: The Case of Small Island Developing States. Development Policy Review, 25(2), 243-264. DOI:

van der Vegt, G. S., Essens, P., Wahlström, M., & George, G. (2015). Managing Risk and Resilience. Academy of Management Journal, 58(4), 971-980. DOI:

Van Opstal, D. (2010). Why enterprise resilience matters. Council of Competitiveness & Deloitte https://www.usresilienceproject.org/wp-content/uploads/2014/09/report-Transform_The_Resilient_Economy.pdf

Vargas, S., & Rivera, H. A. (2019). Business Resilience a Dynamic Capability to Overcome Extreme Adversity. Espacios, 40(February), 5. https://repository.urosario.edu.co/handle/10336/23989

Wamba, S. F., Dubey, R., Gunasekaran, A., & Akter, S. (2020). The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. International Journal of Production Economics, 222, 107498. DOI:

Weick, K. E., & Sutcliffe, K. M. (2007). Managing the unexpected: resilient performance in an age of uncertainty (2nd Ed.). John Wiley & Sons, Inc. DOI:

Whitman, Z. R., Kachali, H., Roger, D., Vargo, J., & Seville, E. (2013). Short-form version of the Benchmark Resilience Tool (BRT-53). Measuring Business Excellence, 17(3), 3-14. DOI:

Wieczorek-Kosmala, M. (2022). A study of the tourism industry's cash-driven resilience capabilities for responding to the COVID-19 shock. Tourism Management, 88, 104396. DOI:

Wiggins, R. R., & Ruefli, T. W. (2005). Schumpeter's ghost: Is hypercompetition making the best of times shorter? Strategic Management Journal, 26(10), 887-911. DOI:

Wildavsky, A. (1988). Searching for Safety: Social Theory and Social Policy. Routledge Taylor & Francis Group.

Winter, S. G. (2003). Understanding dynamic capabilities. Strategic Management Journal, 24(10), 991-995. DOI:

World Bank. (2022). The world bank in Indonesia – Overview. https://www.worldbank.org/en/country/indonesia/overview

Xie, X., Wu, Y., Palacios-Marqués, D., & Ribeiro-Navarrete, S. (2022). Business networks and organizational resilience capacity in the digital age during COVID-19: A perspective utilizing organizational information processing theory. Technological Forecasting and Social Change, 177, 121548. DOI:

Yu, W., Jacobs, M. A., Chavez, R., & Yang, J. (2019). Dynamism, disruption orientation, and resilience in the supply chain and the impacts on financial performance: A dynamic capabilities perspective. International Journal of Production Economics, 218, 352-362. DOI:

Zehir, C., & Tanrıverdi, H. (2006). Impact of learning organizations’ applications and market dynamism on organizations’ innovativeness and market performance. The Business Review, Cambridge, 6(2), 238. https://www.researchgate.net/publication/322917712

Zhou, S. S., Zhou, A. J., Feng, J., & Jiang, S. (2019). Dynamic capabilities and organizational performance: The mediating role of innovation. Journal of Management & Organization, 25(5), 731-747. DOI:

Zollo, M., & Winter, S. G. (2002). Deliberate Learning and the Evolution of Dynamic Capabilities. Organization Science, 13(3), 339-351. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Lisdiono, P., Lustrilanang, P., Said, J., & Yusoff, H. (2023). Risk Management Practices, Information Technology Capabilities, and Enterprise Resilience: Evidence From Indonesia. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 767-787). European Publisher. https://doi.org/10.15405/epsbs.2023.11.64