Abstract

A CEO with executive and supervisory power in the same company is known as a CEO duality, considered a fairly frequent condition in Indonesia. The current research examines the moderating effect of CEO duality on the relationship between two types of corporate reporting, namely CSR disclosures and aggressive financial reporting toward tax aggressiveness in Indonesia. The study used static panel data regression analysis on 133 nonfinancial companies, segregated based on industry classifications. The data from the Indonesia Stock Exchange covered 2016 to 2020. The general finding suggests that CEO duality could strengthen CSR disclosures and tax aggressiveness, which found a negative relationship in most industries while weakening aggressive financial reporting and with a positive tax aggressiveness relationship. These findings support the stewardship theory that the CEO will responsibly serve the company and stakeholders and add to corporate governance strategies knowledge. This study contributes as the first evidence to segregate analysis by industry classification, which examines CEO duality's effect on the relationship between two types of corporate reporting in Indonesia toward corporate tax aggressiveness.

Keywords: CEO Duality, Corporate Reporting, Tax Aggressiveness

Introduction

Tax aggressiveness has become a standard business strategy used worldwide. Although tax revenue is the primary source of state revenue in fulfilling society's needs, many companies engage in tax aggressiveness (Kassa, 2021; Ngelo et al., 2022). The notion that tax aggressiveness can enhance shareholder wealth is supported by the premise that it reduces tax liability, thereby enabling shareholders to preserve a larger proportion of their earnings. Nevertheless, the consequences may encompass harm to the company's reputation, legal penalties, and a public trust decline.

In recent decades, literature has extensively examined the phenomenon of tax aggressiveness due to its potential to pose significant risks for various corporate stakeholders (Arora & Gill, 2022; Kassa, 2021). Ryngaert and Thomas (2012) highlight the possible negative consequences that stakeholders may experience due to a company's engagements with affiliated entities, including its executives, the majority shareholders, and their immediate relatives. Therefore, this study analyses one of the risk mitigation strategies companies can consider regarding decision-making authority: CEO duality.

Chief Executive Officer (CEO) duality occurs when the same person holds both the role of CEO and the position of the Board's Chairman, in addition to their standard managerial responsibilities. Researchers have taken an intense interest in CEO duality because of its potential influence on corporate reporting and tax aggressiveness (Cooray et al., 2020; Malik et al., 2020; Voinea et al., 2022), with varying outcomes reported. The existing literature on the subject presents inconclusive results, with varying outcomes that range from positive to negative. The literature sometimes suggests an insignificant correlation between CEO duality, corporate reporting, and tax aggressiveness.

According to Cooray et al. (2020) and Malik et al. (2020), minimising work duplication between the CEO and the chairman of the board, commonly referred to as CEO duality, is regarded as a positive signal for investors and holds significance in mitigating tax aggressiveness. However, Lassoued and Khanchel (2023) and Wijethilake and Ekanayake (2020) argue that the effectiveness of coordination between the executive and board levels may be enhanced when an individual also holds the positions of CEO and the board's chairman. CEO duality can facilitate a more direct and open conversation between the CEO and the board when making decisions regarding CSR disclosure, financial reporting, and aggressive tax practices. More in-depth discussions may assist in making more appropriate decisions and consider multiple factors, such as tax risks, legal compliance, and reputational effects (Pham & Pham, 2020; Pucheta-Martínez & Gallego-Álvarez, 2020). Previous studies focused primarily on the direct effect of CEO duality on corporate reporting, firm performance, or tax aggressiveness, with inconclusive results. Therefore, increasing our understanding of how CEO duality can moderate or affect the relationship between corporate reporting and tax aggressiveness appears necessary.

This study aims to improve on previous studies by examining CEO duality's potential impact as a moderating variable on boosting or eliminating the association between two types of corporate reporting, namely CSR disclosures and aggressive financial reporting, toward tax aggressiveness. Research indicates that adopting CEO duality as a corporate governance approach remains a subject of debate (Ananzeh et al., 2022; Cao et al., 2021; Hasan et al., 2021). To the best of our understanding, this study represents the initial attempt to examine in depth the moderating impact of CEO duality on the association between corporate reporting and tax aggressiveness, particularly within Indonesia. The present study further distinguishes the analysis of the findings by industry classification, as it assumes that particular industry characteristics may influence decision-making processes concerning corporate reporting and engagement in tax aggressiveness.

Literature Review

Tax Aggressiveness

Indonesia established various tax compliance schemes from 2016 to 2020. These measures include tax amnesty, lowering tax rates for SMEs, boosting taxpayer services, and strengthening audit staff at the Directorate General of Taxation to improve law enforcement. The Financial Transaction Report and Analysis Center (PPATK) states that suspicious financial reports, including probable tax fraud, have gradually increased over the past three years. 2018 had 501 cases, 2019 had 738, and 2020 had 793. From 2016 to 2020, the Indonesian Directorate General of Taxation reported that 20% to 50% of registered companies as taxpayers paid corporate taxes, producing 18% to 19% of total tax income. According to Balakrishnan et al. (2019) and Frank et al. (2009), tax aggressiveness includes legitimate tax planning and fraudulent tax avoidance. Tax aggressiveness lowers income tax. Aggressive corporate tax planning can pass tax savings to shareholders, increasing their wealth (Arora & Gill, 2022; Campbell et al., 2020).

CSR Disclosures, Aggressive Financial Reporting, and Tax Aggressiveness

Tax aggressiveness is often regarded as socially irresponsible and unethical in business and management research. Despite companies' CSR efforts, aggressive tax companies could damage their reputation. Companies are urged to make their tax payments complete through CSR initiatives. According to Chouaibi et al. (2022), Issah and Rodrigues (2021), and Mgbame et al. (2017), taxes from companies fund public services like education, national security, law enforcement, and health care. CSR disclosures and tax aggressiveness relationship is still being debated. Some studies stated that CSR disclosures negatively relate to tax aggressiveness (Chouaibi et al., 2022; Mgbame et al., 2017; Raithatha & Shaw, 2022). They argue that companies with more CSR disclosures are more likely to adopt ethical tax policies to match their public image of social responsibility. In contrast, CSR disclosures and tax aggressiveness are positively correlated in other studies (Abid & Dammak, 2022; Mao, 2019; Rohyati & Suripto, 2021). They suggest companies can use CSR to improve their reputations and offset unfavorable public views from aggressive tax planning.

Adopting aggressive financial reporting strategies and reducing income tax can enable companies to evade tax payments. The relationship between aggressive financial reporting and tax aggressiveness has been the subject of many studies, but no firm conclusions have yet been drawn. Sánchez-Ballesta and Yagüe (2021) identified a pair of compromises between aggressive financial and tax reporting practices. Taxes rise and fall with a company's income. However, Firmansyah (2019), Nugroho et al. (2020), and Rachmawati et al. (2020) stated that no trade-off occurred between aggressive tax planning and financial reporting. Managers employ aggressive financial reporting to increase shareholder value. Management avoids adopting accounting methods that cause earnings increases since it increases income tax liabilities. Managers must aggressively tax to compensate for aggressive financial reporting.

CEO Duality's Effect on CSR Disclosures, Aggressive Financial Reporting, and Tax Aggressiveness

Voinea et al. (2022) show that CEO duality negatively relates to CSR disclosure. They indicate that companies with no CEO duality are the higher-performing organisations that share CSR information more frequently. Ananzeh et al. (2022) and Sun et al. (2022) also confirmed the result. Their findings confirm the legitimacy theory that assumes a company will engage in and publicise socially responsible activities to maintain a good reputation. In contrast, Lassoued and Khanchel (2023) argued that CEO duality streamlines decision-making processes, as the CEO has direct control over the board and can expedite the incorporation of CSR considerations into corporate strategies. CEO duality can result in more effective implementation of CSR initiatives and enhanced CSR disclosure.

Academics and practitioners argue about CEO duality and aggressive financial reporting relationships. Some researchers argue that CEO duality signals an imbalance in the internal monitoring and control system, designed to minimise the possibility of conflicts of interest and facilitate aggressive financial reporting (Gavana et al., 2022; Hasan et al., 2022). However, some researchers (Cudia et al., 2021; Paino & Iskandar, 2021) argue that CEO duality can reduce aggressive financial reporting by improving transparency, accountability, and quality. CEO duality can be held directly accountable for accurate and consistent disclosure.

Cao et al. (2021) and Ezejiofor and Ezenwafor (2021) found that CEO Duality and tax aggressiveness were positively correlated. CEO duality increases board-management interaction, increasing managers' opportunities to get involved in tax aggressiveness. Consequently, a tax aggressiveness strategy can be quickly enacted and executed. However, Chytis et al. (2020) found that businesses with dual CEOs have larger ETRs and, consequently, less tax planning. The findings assume that CEOs with a long-term interest in the company may be more tax cautious. They may prefer to follow tax laws rather than risk legal or reputational consequences.

Hypothesis development

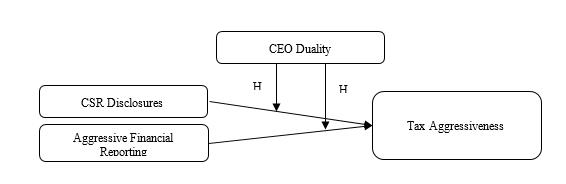

The present study employs the theories of agency, stewardship, and legitimacy to accomplish its research objectives and address its questions. Based on agency theory (Jensen & Meckling, 1976), CEO duality can cause shareholders' and management's conflict of interest because it optimises the management's interests rather than the shareholders'. However, stewardship theory (Davis et al., 1997) assumes that CEO duality tends to be responsible for managing the company and its stakeholders. CEO duality could encourage CSR disclosure and lower tax aggressiveness to protect long-term interests and meet stakeholder expectations. Moreover, CEO duality can affect CSR disclosure and tax aggressiveness in legitimacy theory (Deegan, 2002) to obtain and sustain social legitimacy. CEO duality promotes CSR disclosures and demonstrates social responsibility. Figure 1 summarises the research framework related to CEO duality, corporate reporting, and tax aggressiveness.

Corporate governance involves two structures of decision-making authority concentration: the CEO and the board chairman held by one person (CEO duality) or by a different person. This concentration of decision-making authority may influence the firm's CSR Disclosure, aggressive financial reporting, and tax aggressiveness decisions.

There exist two prevailing theories on this matter. The agency theory promotes separating responsibilities to establish an effective control mechanism over management strategies and policies. In cases where a company exhibits CEO duality, the efficacy of the board members may be endangered due to the potential for the CEO to interfere in board affairs, leading to a potential decline in overall performance. Cooray et al. (2020), Harun et al. (2020), and Malik et al. (2020) believed that separating responsibilities indicates professional supervision, better regulation, and reduced potential for partial revelation, thereby enhancing disclosure quality. The stewardship theory presents an alternative perspective to agency theory, proposing consolidating decision-making authority in a single individual. Advocates of this perspective maintain that improved administration, proactive oversight, reduced interference, and advancement toward organisational goals are possible. According to this theoretical perspective, corporate managers are perceived as safeguarding the organisation's interests and acting in its best interests. Numerous research supports the theory that this perspective is a good signal of decision-making authority (Pham & Pham, 2020; Pucheta-Martínez & Gallego-Álvarez, 2020; Wijethilake & Ekanayake, 2020).

Thus, we hypothesise:

H1:CEO Duality has a moderating effect on CSR disclosures and tax aggressiveness relationships.

H2:CEO Duality has a moderating effect on aggressive financial reporting and tax aggressiveness relationships.

Research Methodology

Population and sample

This study analyses a sample comprising 665 firm-year observations to examine the CEO Duality's moderating effect on the relationship between CSR disclosures and aggressive financial reporting toward tax aggressiveness. The sample is drawn from the population of nonfinancial companies listed on the Indonesian stock exchange from 2016-2020. The selected period for this study spans from 2016 to 2020, as during this period, the Indonesian government actively enforced multiple policies to enhance tax compliance among taxpayers. Therefore, this period is deemed representative of the years of tax enforcement in Indonesia. The selection process for the industry groups involved identifying those exhibiting the highest degree of tax aggressiveness, as determined by the value of their permanent discretionary differences. Specifically, four out of the eight industry groups were ultimately chosen for analysis. This study has examined four industries, namely Infrastructure, Utility, & Transportation/IUTR (consisting of 19 companies), Basic Industry & Chemicals/BCHE (comprising 44 companies), Consumer Goods Industry/CONS (comprising 26 companies), and Property, Real Estate, & Building Construction/PROP (comprising 44 companies). The study's data analysis is categorised based on industry classification, as various features and business cycles are expected to influence decisions regarding tax aggressiveness.

Measurement of instruments

The current study considers tax aggressiveness as the dependent variable. The independent variable is two types of corporate reporting: corporate social responsibility (CSR) disclosures and aggressive financial reporting, and CEO duality is a moderating variable. Additionally, this study incorporated three control variables, specifically return on assets (ROA), leverage, and firm size.

Dependent Variable

This study indicates the dependent variable as tax aggressiveness ( ), which is evaluated through permanent discretionary differences (Frank et al., 2009) and computed utilising the equation below:

(1)

where i is the companies 1-133; t is the period 2016-2020; is total book-tax differences less temporary book-tax differences; is goodwill and other intangible assets; is the changes in net operating loss carryforwards; is one-year lagged ; is permanent discretionary differences as the proxy of . Permanent book-tax differences are better for aggressive tax levels than total effective tax rates, cash ETRs, or other tax metrics. First, distinctions between permanent and transitory income show that aggressive tax shelter activity is distinctive. Permanent differences outweigh total accruals. Finally, temporary differences and cash ETRs could relate aggressive tax reporting to aggressive financial reporting and biasing outcomes.

Independent Variable

CSR disclosures ( )

This study used a checklist to compare 154 disclosure elements from the Global Reporting Initiative (GRI) G.4 index to company CSR disclosures. A CSR disclosure receives 1 point if it matches its index and 0 points if it does not.

Aggressive financial reporting ( )

The current study employs performance-matched discretionary accruals, as proposed by Kothari et al. (2005), to serve as an indicator or proxy for the practice of . The computation below is obtained utilising the Jones model, as expounded by Dechow et al. (1995) as follows:

(2)

where is total; is the changes in company earnings; is the changes in accounts receivables; is fixed assets; is performance-matched discretionary accruals as the proxy of .

Moderating Variable

The dichotomous variable estimates the CEO duality ( ) as a moderating variable, with "0" indicating that the CEO and the Board's Chairman are separate or have no affiliation, and "1" meaning that these roles are merged or have an affiliation (Abdul Wahab et al., 2017; Christian et al., 2019).

Control Variable

This study added ROA, LEV, and SIZE as control variables from a regression model based on several previous studies. Divide a company's average net income by its total assets to get ROA. It evaluates a company's management's profit-making capabilities (Frank et al., 2009; Gupta & Newberry, 1997). LEV measures debt's tax planning impact on company incentives by dividing long-term debt by lagged total assets (Lanis & Richardson, 2018). Finally, SIZE regulates the firm size effect, which is derived using the natural logarithm of the total annual assets of the enterprise (Dang et al., 2018).

Data Analysis

Panel data analysis is performed since this study uses time series and cross-section data. This study used Panel Unit Root (Stationarity) test to verify data stationarity—the Breusch Pagan Lagrange Multiplier (BP LM) test determined panel data poolability. The Hausman test then chooses the best model: random or fixed effect.

Empirical Model

This study uses two multiple regression equations. moderates and relationships (Model 1) in the first equation (3). In the second equation (4), moderates and relationships (Model 2).

Model 1:

(3)

Model 2:

(4)

where is tax aggressiveness; is Corporate Social Responsibility disclosures; is aggressive financial reporting; is CEO Duality; is Return on Assets; is Leverage Ratio, is Firm Size; is the interaction of and ; and is the interaction of and .

Results and Discussion

The findings of the multiple regression analyses will be discussed in this section.

Descriptive Statistics

The descriptive statistics for each industry are presented in Tables 1,2,3, and 4. IUTR has the highest Tax Aggressiveness (TA) relative to the other three industries. Table 1 illustrates this with the mean TA value of 0.1313 and the maximal TA value of 1.0227. In contrast, the PROP industry exhibits the lowest TA value, as evidenced by a mean of 0.0705 and a minimum value of -0.9268, as presented in Table 4. The positive mean value observed in the TA's analysis indicates that most companies operating within the specified four industries employed aggressive tax strategies from 2016 to 2020.

Furthermore, it is observed that the PROP industry has disclosed the most extensive item of CSR activities. This result is supported by the mean CSR disclosure value of 0.4534 and the highest recorded value of 0.6688, as presented in Table 4. According to the GRI G4 index, the maximum value signifies that companies operating in the PROP industry disclose 66.88% of the total disclosure items.

Moreover, it is worth noting that companies operating in the CONS industry exhibited the highest value for the aggressive financial reporting (AFR) variable, specifically at 0.8963, as presented in Table 3. Nevertheless, the mean AFR values observed in the three sectors, namely IUTR, BCHE, and CONS, exhibit negative values. The negative mean values suggest that most companies in the sample were not engaged in aggressive financial reporting.

Additionally, the data on CEO duality, ranging from 0 to 1, indicates the presence or absence of CEO duality within the companies belonging to the four selected industries.

Stationarity Test Results

Since this model is based on panel data analysis, we use the panel unit root test to confirm data reliability. Three-panel unit root tests—Harris-Tzavalis, Breitung, and Hadri LM—show no unit root in any variable, and the data are stationary.

Regression Results

Tables 5 and 6 below show that the diagnostic results for Model 1 and Model 2 were similar. First, four industry multicollinearity tests demonstrate no issues (VIF < 5). Second, the Wooldridge and Modified Wald Statistics tests show autocorrelation and heteroskedasticity in CONS industry data. IUTR, BCHE, and PROP industry data only have heteroskedasticity concerns. This study estimates the robust standard error for random effect models and uses the cluster-by-code command to address heteroskedasticity and serial correlation.

As shown in Table 5, Model 1 used IUTR, CONS, and PROP data in a random-effects panel data regression model. The random effects model is preferred over the combined OLS and fixed effects models because the F test and Breusch-Pagan Lagrange Multiplier (BP-LM) test for the panel data regression model are significant (p-value <0.05), and the Hausman specification test is not (p > 0.05). BCHE used the fixed-effect model since the Hausman specification test p-value < 0.05. In Model 2, the random effect model is appropriate for the four industries (Table 6).

CEO duality's moderating effect on CSR and TAG relationships (Model 1)

Table 5 reveals mixed findings. Four industries had different results. The interaction term's model coefficient between CSR disclosure and CEO duality ( ) positively related tax aggressiveness significantly in the BCHE, PROP (p-value < 0.05), and IUTR industries (p-value<0.10) but not in the CONS industry. The BCHE, PROP, and IUTR results support H1. The significant results show CEO duality enhances the negative relationship between CSR disclosures and tax aggressiveness. The current findings support Lassoued and Khanchel (2023), who claim that a CEO who is also the board chairman may improve decision-making, communication, and board-CEO alignment. As the CEO has more control over the company's reporting methods, CSR disclosures may improve, and tax aggressiveness may decline. CEO duality may improve CEO-board alignment, leading to a stronger CSR commitment and more CSR disclosures. As CEO and the board's chairman, the CEO directly influences strategic decisions, including CSR disclosures and tax aggressiveness.

CEO duality's moderating effect on AFR and TAG relationships (Model 2)

Table 6 also indicates mixed evidence. It shows that the interaction term's model coefficient between aggressive financial reporting and CEO duality ( ) is negatively related to tax aggressiveness significantly in the IUTR, CONS (p-value < 0.05), and the BCHE industry (p-value < 0.10). Thus, the results provide support for H2 in those three industries. The results show CEO duality declines the positive relationship between and . Meanwhile, there is no significant relationship in the PROP industry. These significant results support previous research (Chytis et al., 2020; Cudia et al., 2021), which argued that CEO duality is a sign of effective and successful stakeholder control and leadership.

Conclusion and Recommendation

This study examines CEO Duality's moderating effect on the relationship between CSR disclosures and aggressive financial reporting toward tax aggressiveness among the sample of 131 nonfinancial companies from four industries in Indonesia, with 665 observations from 2016-2020. In most industries (3 of 4), the current study found that a company with CEO duality could enhance the negative andrelationships and impede the positiveand relationships. These findings confirm the stewardship theory, which assumes the CEO will responsibly protect and fulfill the company and stakeholders' best interests. The results also indicate that when a company has a CEO who is also the board's chairman, there could be effective control and monitoring, reduced unfavorable intervention, and better management. Therefore, the study concludes that the interaction of CEO duality and corporate reporting can reduce tax aggressiveness, showing signs of "shine," even though it would be considered "rain" at the beginning.

Policymakers and regulators can use this analysis to identify tax aggressiveness concerns and apply adequate company governance to reduce them. Due to study inconsistencies, proper corporate governance for all companies still cannot be determined. Furthermore, there are limitations: first, this study is only in Indonesia, which may limit its applicability. Future studies can expand by comparing Asian countries. Second, the model only considers corporate reporting, CSR, and firm-specific control factors. It is also important to assess whether macroeconomic variables and megatrends like technology and environment affect corporate tax aggressiveness. Finally, this study employs static panel data analysis. Future studies could use Dynamic Panel Data or Panel ARDL to learn more about tax aggressiveness drivers.

Acknowledgment

The authors are grateful to the Accounting Research Institute, (ARI- HICoE), Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education for providing research funding.

References

Abdul Wahab, E. A., Ariff, A. M., Marzuki, M. M., & Sanusi, Z. M. (2017). Political connections, corporate governance, and tax aggressiveness in Malaysia. Asian Review of Accounting, 25(3), 424–451. DOI:

Abid, S., & Dammak, S. (2022). Corporate social responsibility and tax avoidance: the case of French companies. Journal of Financial Reporting and Accounting, 20(3/4), 618-638. DOI:

Ananzeh, H., Alshurafat, H., Bugshan, A., & Hussainey, K. (2022). The impact of corporate governance on forward-looking CSR disclosure. Journal of Financial Reporting and Accounting. DOI:

Arora, T. S., & Gill, S. (2022). Impact of corporate tax aggressiveness on firm value: evidence from India. Managerial Finance, 48(2), 313–333. DOI:

Balakrishnan, K., Blouin, J. L., & Guay, W. R. (2019). Tax aggressiveness and corporate transparency. The Accounting Review, 94(1), 45–69. DOI:

Campbell, J. L., Guan, J. X., Li, O. Z., & Zheng, Z. (2020). CEO Severance Pay and Corporate Tax Planning. Journal of the American Taxation Association, 42(2), 1–27. DOI:

Cao, Y., Dong, Y., Guo, T., & Ma, D. (2021). Short-sale deregulation and corporate tax aggressiveness: evidence from the Chinese market. The European Journal of Finance, 1–30. DOI:

Chouaibi, J., Rossi, M., & Abdessamed, N. (2022). The effect of corporate social responsibility practices on tax avoidance: an empirical study in the French context. Competitiveness Review, 32(3), 326–349. DOI:

Christian, N., Basri, Y. Z., & Arafah, W. (2019). Analysis of Fraud Pentagon to Detecting Corporate Fraud in Indonesia. International Journal of Economics, Business and Management Research, 3(08). www.ijebmr.com

Chytis, E., Tasios, S., & Filos, I. (2020). The Effect of Corporate Governance Mechanisms on Tax Planning during The Financial Crisis: An Empirical Study of Companies Listed on The Athens Stock Exchange. International Journal of Disclosure and Governance, 17(1), 30–38. DOI:

Cooray, T., Gunarathne, A. D. N., & Senaratne, S. (2020). Does corporate governance affect the quality of integrated reporting? Sustainability (Switzerland), 12(10). DOI:

Cudia, C. P., Cruz, A. L. D., & Estabillo, M. B. (2021). Effect of Firm Characteristics and Corporate Governance Practices on Earnings Management: Evidence from Publicly Listed Property Sector Firms in the Philippines. Vision, 25(1), 77–87. DOI:

Dang, C., (Frank) Li, Z., & Yang, C. (2018). Measuring firm size in empirical corporate finance. Journal of Banking and Finance, 86, 159–176. DOI:

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1), 20–47. DOI:

Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting Earnings Management. The Accounting Review, 70(2), 193–225.

Deegan, C. (2002). Introduction: The legitimising effect of social and environmental disclosures – a theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282–311. DOI:

Ezejiofor, R. A., & Ezenwafor, E. C. (2021). Corporate Governance and Tax Avoidance: Evidence from Nigerian Quoted Food and Beverage Companies. Macro Management & Public Policies, 2(4), 40–47. DOI:

Firmansyah, A. (2019). Financial Constraints, Investment Opportunity Set, Financial Reporting Aggressiveness, Tax Aggressiveness: Evidence from Indonesia Manufacturing Companies. Academy of Accounting and Financial Studies Journal, 23(5).

Frank, M. M., Lynch, L. J., & Rego, S. O. (2009). Tax Reporting Aggressiveness and Its Relation to Aggressive Financial Reporting. The Accounting Review, 84(2), 467-496. DOI:

Gavana, G., Gottardo, P., & Moisello, A. M. (2022). Related party transactions and earnings management in family firms: the moderating role of board characteristics. Journal of Family Business Management. DOI:

Gupta, S., & Newberry, K. (1997). Determinants of the variability in corporate effective tax rates: Evidence from longitudinal data. Journal of Accounting and Public Policy, 16(1), 1-34. DOI:

Harun, M. S., Hussainey, K., Mohd Kharuddin, K. A., & Farooque, O. A. (2020). CSR Disclosure, Corporate Governance and Firm Value: a study on GCC Islamic Banks. International Journal of Accounting and Information Management, 28(4), 607–638. DOI:

Hasan, M. M., Lobo, G. J., & Qiu, B. (2021). Organisational capital, corporate tax avoidance, and firm value. Journal of Corporate Finance, 70. DOI:

Hasan, M. T., Hossain, M. K., Rekabder, M. S., Molla, M. S., & Ashif, A. S. M. (2022). IFRS adoption and real earnings management in Bangladesh: The role of board characteristics. Cogent Business and Management, 9(1). DOI:

Issah, O., & Rodrigues, L. L. (2021). Corporate social responsibility and corporate tax aggressiveness: A scientometric analysis of the existing literature to map the future. Sustainability (Switzerland), 13(11). DOI:

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics. DOI:

Kassa, E. T. (2021). Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers. Journal of Innovation and Entrepreneurship, 10(1). DOI:

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197. DOI:

Lanis, R., & Richardson, G. (2018). Outside directors, corporate social responsibility performance, and corporate tax aggressiveness: An empirical analysis. Journal of Accounting, Auditing and Finance, 33(2), 228–251. DOI:

Lassoued, N., & Khanchel, I. (2023). Voluntary CSR disclosure and CEO narcissism: the moderating role of CEO duality and board gender diversity. Review of Managerial Science, 17(3), 1075-1123. DOI:

Malik, F., Wang, F., Naseem, M. A., Ikram, A., & Ali, S. (2020). Determinants of Corporate Social Responsibility Related to CEO Attributes: An Empirical Study. SAGE Open, 10(1). DOI:

Mao, C. W. (2019). Effect of corporate social responsibility on corporate tax avoidance: evidence from a matching approach. Quality and Quantity, 53(1), 49–67. DOI:

Mgbame, C. O., Chijoke-Mgbame, M. A., Yekini, S., & Yekini, C. K. (2017). Corporate social responsibility performance and tax aggressiveness. Journal of Accounting and Taxation, 9(8), 101–108.

Ngelo, A. A., Permatasari, Y., Harymawan, I., Anridho, N., & Kamarudin, K. A. (2022). Corporate Tax Avoidance and Investment Efficiency: Evidence from the Enforcement of Tax Amnesty in Indonesia. Economies, 10(10). DOI:

Nugroho, R. P., Sutrisno, S. T., & Mardiati, E. (2020). The effect of financial distress and earnings management on tax aggressiveness with corporate governance as the moderating variable. International Journal of Research in Business and Social Science (2147- 4478), 9(7), 167–176. DOI:

Paino, H., & Iskandar, T. I. T. (2021). Governance issues on earning management: A case of manufacturing industry. Universal Journal of Accounting and Finance, 9(6), 1582–1593. DOI:

Pham, D. H., & Pham, Q. V. (2020). The impact of ceo duality on firm performance: examining the life-cycle theory in vietnam. Accounting, 6(5), 737–742. DOI:

Pucheta-Martínez, M. C., & Gallego-Álvarez, I. (2020). Do board characteristics drive firm performance? An international perspective. Review of Managerial Science, 14(6), 1251–1297. DOI:

Rachmawati, N. A., Utama, S., Martani, D., & Wardhani, R. (2020). Do country characteristics affect the complementary level of financial and tax aggressiveness? Asian Academy of Management Journal of Accounting and Finance, 16(1), 45–62. DOI:

Raithatha, M., & Shaw, T. S. (2022). Firm’s tax aggressiveness under mandatory CSR regime: Evidence after mandatory CSR regulation of India. International Review of Finance, 22(1), 286–294. DOI:

Rohyati, Y., & Suripto, S. (2021). Corporate Social Responsibility, Good Corporate Governance, and Management Compensation against Tax Avoidance. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 4(2), 2612–2625. DOI:

Ryngaert, M., & Thomas, S. (2012). Not All Related Party Transactions (RPTs) Are the Same: Ex Ante Versus Ex Post RPTs. Journal of Accounting Research, 50(3), 845–882. DOI:

Sánchez-Ballesta, J. P., & Yagüe, J. (2021). Financial reporting incentives, earnings management, and tax avoidance in SMEs. Journal of Business Finance and Accounting, 48(7–8), 1404–1433. DOI:

Sun, Y., Xu, C., Li, H., & Cao, Y. (2022). What drives the innovation in corporate social responsibility (CSR) disclosures? An integrated reporting perspective from China. Journal of Innovation and Knowledge, 7(4). DOI:

Voinea, C. L., Rauf, F., Naveed, K., & Fratostiteanu, C. (2022). The Impact of CEO Duality and Financial Performance on CSR Disclosure: Empirical Evidence from State-Owned Enterprises in China. Journal of Risk and Financial Management, 15(1). DOI:

Wijethilake, C., & Ekanayake, A. (2020). CEO duality and firm performance: the moderating roles of CEO informal power and board involvements. Social Responsibility Journal, 16(8), 1453–1474. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Kesumaningrum, N. D., Bujang, I., Muda, R., & Gamayuni, R. R. (2023). Does CEO Duality Affect Corporate Reporting and Tax Aggressiveness In Indonesia?. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 683-697). European Publisher. https://doi.org/10.15405/epsbs.2023.11.58