Challenges of Evolving Digital Auditing Landscape Among Malaysian Government Accountants and Auditors

Abstract

Digital technologies are changing traditional industries and business models. In the age of digital transformation, governance and control culture are becoming more important as more controls are built into automated systems. Digitising the audit process is letting accountants look at and evaluate more data than ever before. Digital auditing would also improve the risk assessment process and find insights and observations that add value and turn auditing from a duty into an opportunity. Semi-structured interviews were conducted for the study with the respondents who were composed of top management from the audit and accounting departments in Malaysia. The findings of the interviews encourage auditors to continue to conduct their audits virtually and digitally to achieve quality audit performance without compromising on quality. Automation and acquiescence of audit procedures in digital audits accommodate the role of the auditor in promoting the audit objective. This study helps to highlight the importance of digital audit in the public sector auditor's commitment to effective, efficient, and economical data processing.

Keywords: Auditor Performance, Digital Auditing, Digital Landscape, Government Accountants And Auditors

Introduction

In recent years, audit firms have indeed seen a significant growth in the use of digital audit procedures. These processes collect complete evidence of data in vital accounts or electronic transaction files using computerised systems and technology. The use of computerised audit methods is consistent with the recommendations of Statement of Auditing Standards (SAS) No. 316.52, which encourages the use of technology in the audit process to promote efficiency and effectiveness (Butaka, 2022). American Institute of Certified Public Accountants (AICPA) (2006) emphasized that the reliability and quality of data produced by computerised information systems have become increasingly important to accountants and auditors. The information produced by these systems must meet certain criteria, including timeliness, relevance, trustworthiness and freedom from omissions and fraud (Lamboglia et al., 2021; Thottoli & Thomas, 2020).

Digital audit techniques offer several advantages that help improve the quality of audit evidence. By using digital tools, auditors can broaden the range of transactions audited, thereby increasing the scope of the audit. This enhancement enables auditors to extract and modify client data, allowing for a more comprehensive analysis of client information and improved risk identification (Butaka, 2022). Additionally, digital auditing enables auditors to deliver proof quickly, which is essential in today's fast-paced business environment. The sudden transition to remote and flexible work arrangements, accelerated by the COVID-19 pandemic, has increased the need for audit firms to embrace digital transformation and adapt their workflows to meet future challenges (Kostem, 2021). Auditors can perform sophisticated audit processses and use artificial intelligence (AI) for logical and organised audit procedures by utilising digital tools (Tysiac, 2022).

Moreover, the use of technology in auditing goes beyond the private sector. In the management of public finances, especially in the post-pandemic period COVID -19, the use of digital audit techniques becomes essential to ensure the sustainability of society and to achieve the goals of Sustainable Development Goal 8 (SDG 8) - decent work and economic growth for citizens. However, it is worth noting that the use of audit technology, especially in fraud risk assessment, is still relatively low among government auditors and accountants (Rikhardsson & Dull, 2016). The adoption of digital transformation in auditing, both in the private and public sectors, is becoming increasingly important to meet the demands of the modern business world and to ensure the effectiveness of audit processes. To address this gap, the current study focused on assessing and analysing the readiness of public sector auditors and accountants to adopt digital auditing. The main objective is to assess the readiness and willingness to adopt technology into the audit process, taking into account the benefits and potential improvements it can offer in terms of auditor performance and overall effectiveness. It is to answer how digital audit techniques have revolutionised the audit profession and offer numerous benefits in terms of improving the quality of audit evidence, expanding audit scope, providing timely evidence, and improving auditor performance.

The paper starts with an introduction by outlining the study’s background and subsequently, next section focuses on the literature review by discussing the relevance of past studies concerning this current study. Section 3 presents the study’s qualitative research methodology. The discussion of the results and findings is covered in section 4. Lastly, section 5 finally presents the conclusions and recommendations.

Literature Review

Digital Audit Practice

Technological advancements have revolutionised the audit industry and led to the introduction of digital audits in large organisations to support the audit process (Byrnes et al., 2018; Omoteso, 2012). Digital audit systems require a combination of human intervention and critical analysis to enhance the auditor's performance value and reduce audit risk. This integration of technology and human expertise has led to improvements in audit quality, efficiency and effectiveness. Digital audit systems rely on relevant, reliable, complete and beyond reasonable doubt audit evidence from the information captured in the systems, which have significantly reduced the time and resources required for the audit (Kim et al., 2009; Omoteso, 2012). In addition, digital audit techniques have enabled auditors to perform tasks that were previously not possible, such as analysing a large amount of data in a shorter time, resulting in a more comprehensive and accurate audit report (Brown et al., 2007).

The introduction of digital audits has led to an increased use of technology in the audit process and auditors need to have a combination of knowledge, skills, expertise and experience in computer technology to be able to provide an audit opinion (Pathak et al., 2010). The adoption of digital audit systems among government auditors and accountants remains relatively limited, particularly in terms of fraud risk assessment. This represents a significant gap that needs to be addressed. The integration of digital audit systems has enabled auditors to perform their duties more effectively and efficiently, resulting in improved audit quality and reduced audit risk (Chan & Vasarhelyi, 2011; Ravisankar et al., 2011). The use of technology in the audit process is essential to meet the demands of the modern business world and to ensure the effectiveness of audit processes in both the private and public sectors.

The utilisation of Control Objectives for Information and Related Technologies (COBIT) during the audit procedure has been recognised as a mechanism to enhance the quality of audits (Omoteso, 2012; Razi & Madani, 2013). The contemporary business landscape necessitates the availability of up-to-date, accurate, and dependable financial data to facilitate well-informed strategic decision-making, secure funding, and furnish pertinent information to external stakeholders (Chan & Vasarhelyi, 2011). The integration of digital auditing methodologies is anticipated to bring forth numerous advantages that can enhance the auditing field and its methodologies (Omoteso, 2012). The utilisation of digital audits holds promise in enhancing comprehension of audit procedures, promoting knowledge dissemination, and enabling the exchange of expertise among auditors.

The implementation of digital audit technologies has the potential to yield cost savings, mitigate the risk of human error, deter fraudulent activities, facilitate real-time information sharing, and enhance the integrity of information (Bradford et al., 2020; Halbouni et al., 2016). The utilisation of technology enables auditors to optimise their procedures, enhance productivity, and augment the overall efficacy of auditing. Moreover, digital audits have the capability to offer instantaneous access to financial information, enabling auditors to perform more extensive evaluations and promptly detect possible hazards or anomalies.

The incorporation of digital technologies enables auditors to automate the process of data analysis, thereby enhancing the precision and dependability of audit outcomes (Braun & Davis, 2003; Ghani et al., 2017; Mahzan & Lymer, 2014; Wu et al., 2017). The utilisation of technological advancements has facilitated auditors in conducting a more streamlined evaluation of the efficacy of internal controls, as well as in pinpointing potential areas for enhancement (Dagilienė & Klovienė, 2019). The utilisation of digital audit technologies has the potential to enhance the level of collaboration between auditors and clients through the provision of real-time information sharing capabilities. The exchange of data in real-time facilitates transparency, enhances communication, and reinforces the rapport between auditors and their clientele. The utilisation of digital audit methodologies can enhance stakeholder trust in the audit procedure by delivering an elevated degree of assurance concerning the dependability and authenticity of financial data.

Digital Audit Practice and Auditor Performance

The accounting and auditing profession has been notably affected by the rapid progressions in digital audit technology, particularly in the domain of financial reporting (Byrnes et al., 2018; Bradford et al., 2020). As corporations continue to integrate advanced information technology systems, it is imperative for auditors to remain current with technological developments to ensure effective practice (Lamboglia et al., 2021). The acquisition of technological competencies has been highlighted as a critical factor for auditors to fully leverage the contemporary IT tools at their disposal. The adoption and utilisation of diverse computerised tools to facilitate audit procedures is primarily driven by the objective of enhancing productivity among auditors (Ahmi et al., 2016; Bradford et al., 2020; Wu et al., 2017). The utilisation of these tools facilitates the process of auditing, resulting in enhanced productivity and bolstered assurance in the generation of audit reports and dependable outcomes.

The utilisation of digital audit technologies enables auditors to capitalise on the information furnished by the client's internal audit function, thereby facilitating the generation of audit reports of superior quality (Malaescu & Sutton, 2015). Through the integration of sophisticated analytics and meticulous tracking of audit trails, auditors can proficiently detect inconsistencies or possible fraudulent activities within companies during digital audits (Chan & Vasarhelyi, 2011; Johari et al., 2021; Jusoh et al., 2022). The implementation of digital audit tools ensures the provision of high-quality data that is regularly updated through the effective processing of transactional information and convenient availability at all times (Dagilienė & Klovienė, 2019; Ghani et al., 2017; Veerankutty et al., 2018). The accounting and auditing industry is undergoing a substantial shift as a result of the notable impact of technological advancements in digital audit technology.

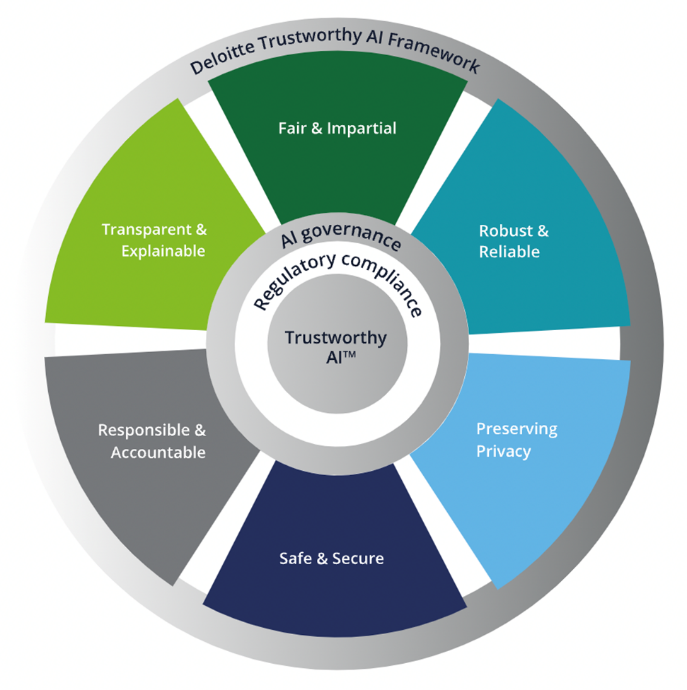

In the Deloitte Report of 2021, Figure 1 displays the Trustworthy Artificial Intelligence (AI) Framework. This framework consists of six key dimensions that, when taken together during the design, development, deployment, and operational phases of implementing an AI system, can help ensure ethical standards and establish a reliable AI strategy. The research findings will be discussed using this framework.

Research Methodology

Research Design

The study involved a semi-structured interview with the public sector auditors. The objective of this study is to elicit the perspectives and insights of auditors in the public sector regarding the extent of adoption of the trustworthy framework. This includes an examination of the obstacles encountered during the adoption process, as well as the advantages derived from the implementation of the trustworthy framework in the context of digital auditing. The utilisation of the qualitative study as a triangulation technique is a means of obtaining input from pertinent stakeholders. The qualitative component of the study involves conducting interviews with pertinent authorities, including the National Audit Department (JAN) and the Accountant General Department of Malaysia (JANM). A total of five (5) individuals were interviewed, with four (4) representing JAN and one (1) representing JANM. They were selected for the study as they involve in daily activities of audit for the public sector in Malaysia. The sample selection will stop until it reaches the saturation level, whereby the more interviews you have done, the same answers given to the provided questions.

This methodology enables active involvement with pertinent stakeholders, thereby allowing for their input on the outcomes of the research. The interview process involves convening representatives from relevant parties to engage in a structured and interactive dialogue pertaining to the subject matter at hand. This exchange takes place in person and is designed to foster a tailored and individualised interaction between the representatives involved. The study utilised semi-structured and open-ended interviews, which included predetermined questions derived from prior research as outlined in Table 1.

An interview technique requires an open, unstructured, and flexible approach to the inquiry with the goal of exploring the range and diversity of the data obtained rather than quantifying the data. The utilisation of semi-structured interviews allows for interviewees to respond to questions in an unrestricted and comprehensive manner. The absence of predetermined answer options and the lack of a binary correct/incorrect dichotomy are notable characteristics of the evaluation. One notable advantage of this approach is the interviewer's flexibility to request any pertinent information necessary for the study in an appropriate manner during the interview.

The interviews are conducted up until the saturation point is reached (Bougie & Sekaran, 2019). The point of theoretical saturation was attained when the interviewee did not furnish any further data concerning the queries that were presented. This study employed thematic analysis, which was operationalized through the use of NVivo software, to analyse semi-structured interview data. The analysis utilised both word-based and code-based approaches, as well as several analytical strategies. The researchers have conducted a digital landscape analysis and identified challenges associated with the implementation of digital auditing based on responses provided by the interviewees in accordance with the guided questions. However, this method has its weaknesses whereby it will not gather larger numbers of respondents for the research scope.

Results

Digital Landscape

The use of digital auditing represents a promising direction for the delivery of audit services. The evolution of auditing practices has led to a shift from conventional methods to more advanced and complicated techniques. Nevertheless, there is an implication to the current situation of the audit task. The effectiveness of digital auditing depends on the involvement of both the auditor and the auditee. The concept of audit encompasses both the internal and external factors of an organisation. Collaborative work and institutional initiatives represent external factors, while internal factors include cultural change, auditor competence and organisational support.

Based on the responses provided by the interviewees, it can be deduced that effective collaboration between relevant stakeholders is essential in the context of the digital landscape. For instance, JAN has a mandate in the Federal Constitution to perform auditing. In a digital environment, working collaboratively is necessary to ensure that the audit quality does not deteriorate. Respondents emphasised the need for robust collaboration to be established between JAN, JANM, Unit Pemodenan Tadbiran dan Perancangan Pengurusan (MAMPU) and other ministries or government agencies. This collaboration holds significance as the custodian of the data is JANM and its affiliated ministries or government agencies keep the data, while JAN needs the data for the purpose of conducting an audit.

One of the interviewees stated that Jabatan Kastam Diraja Malaysia (JKDM) manages indirect taxes management and collections. The JKDM possesses diverse data pertaining to indirect taxes. Conversely, JANM bears the responsibility of government accounting and the meticulous recording of all government revenue, encompassing indirect taxes, within the accounting framework. To fulfil the mandate assigned to JAN, it is imperative that JAN obtains the necessary data from JKDM and conducts a thorough assessment to ensure that the indirect taxes are accurately represented in the financial statement, reflecting a true and fair view. However, owing to the auditor's proficiency in data technicality, it is imperative for JAN to engage in a collaborative effort with MAMPU, wherein an adept data scientist can be employed to devise an algorithm that can effectively compare and match the data obtained from JKDM and JANM. JAN is faced with the challenge of conducting substantive testing through manual means, a task that has become increasingly difficult in the current digital age where technology plays a significant role. The manual execution of substantive tests within a digital context has an impact on the quality of the audit. The interviewee emphasized the importance of collaborative work in achieving success in digital auditing.

Another interviewee mentioned that a multitude of government agencies store their data in digital format on servers, which may contain diverse file formats and fields within the digital environment. The diverse array of file formats and fields presents a challenging obstacle for auditors when conducting digital audits. Hence, the interviewee emphasised the significance of the development of the audit data standard (ADS) initiative in addressing the challenge faced by auditors in conducting digital audits. In fact, the ADS format is commonly utilised as a standard framework for the requisite files and fields that facilitate audit tasks. For instance, MAMPU has implemented the use of Enterprise Architecture (EA) during the system's development process. Therefore, it is imperative for JANM to capitalise on this opportunity by incorporating the trustworthiness framework, which includes principles of fairness, non-bias, safety, security, transparency, and explainability, into the integration of the ADS in EA. The collaboration of MAMPU, JANM, and JAN institutions is crucial in achieving the realisation of ADS, as these entities heavily rely on data to fulfil their respective mandates. The implementation of institutional initiatives aimed at ensuring the availability and reliability of data can facilitate digital auditing processes for ADS.

Challenges of Digital Auditing Practice

During the interviews, participants also provided valuable feedback on the challenges encountered when implementing digital audit practises. The interviewees emphasised several key areas of concern, including digital capacity, audit data analytics, audit innovation, and the capabilities of auditees.

The concept of digital capacity encompasses a multitude of challenges that are encountered by audit teams. Mobilising team members to develop audit methodologies, establish processes, and provide sufficient training for auditing IT is a significant challenge. Achieving this objective necessitates substantial exertion and synchronisation to guarantee that the auditing team is adequately equipped with the essential expertise and knowledge. Furthermore, the execution of performance audits pertaining to nationwide initiatives in the domains of digital transformation, electronic governance, and information security is beset with challenges owing to their intricate nature. The implementation of continuous and comprehensive transaction monitoring is crucial for enhancing recurring audits, albeit posing significant challenges. The utilisation of computer assisted audit techniques (CAATs) is imperative in aiding the audit team in upholding audit quality, security, and efficiency.

Additionally, the implementation of audit data analytics presents a distinct set of obstacles. Organisations frequently encounter difficulties in adjusting to modifications in IT infrastructure and software that are essential for facilitating auditors in handling extensive and sensitive data. The process of replacing or enhancing statistical sampling methods with whole-population audits and analysis, facilitated by bulk data processing and automation, can be a complex and time-consuming effort. The automation of recurring tasks is a crucial factor in enhancing the efficiency of auditors. Nonetheless, this necessitates a substantial investment and unwavering backing from leadership. Another obstacle frequently encountered is the insufficiency of personnel possessing the requisite competencies to proficiently utilise tools for analysing financial audit data. The process of retrieving and verifying financial information in various formats is arduous and time-intensive. Furthermore, auditors are constrained by limited time to engage in trial and evaluation of novel tools in order to secure support from stakeholders.

Furthermore, the development of a secure internal IT environment and the establishment of secure data exchange with auditees are crucial considerations for the implementation of innovative auditing practises. The task at hand is of a multifaceted nature and necessitates the implementation of resilient systems and protocols to safeguard confidential data. In order to enhance public safety, it is imperative to conduct a comprehensive identification of risks and irregularities, while simultaneously promoting best practises. The implementation of automated report generation and visualisation techniques can substantially enhance efficiency and precision in reporting and internal quality control procedures.

The capabilities of auditees play a critical role in the success of digital audits. In order to achieve a smooth collaboration, it is imperative to ascertain the preparedness level of the audited entities for a complete shift to the digital environment. The implementation of e-government programmes comprising of various features such as e-signature, e-documents, e-services, portals, e-archiving, e-procurement, open data and invoicing systems (IGFMAS) has resulted in a more intricate set of capabilities for the audited entities. The presence of organised electronic data and a distinct identification mechanism significantly streamlines the audit procedure. The presence of satisfactory information technology controls at the auditee's location is imperative for upholding the accuracy and reliability of the data. Furthermore, it is imperative that the personnel responsible for information technology within the auditee's organisation possess the requisite expertise and competencies to effectively compile the data that has been requested.

To summarise, the challenges that were identified by the interviewees emphasise the importance of addressing digital capacity, implementing efficient audit data analytics strategies, promoting audit innovation, and taking into account the capabilities of auditees. The optimal utilisation of digital auditing can be achieved through collaborative efforts, which entail investments in technological advancements and skill enhancement.

Conclusions

This study aims to comprehend the awareness of digital audit implementation among Malaysian public auditors and accountants. The conducted interviews have illuminated the current evolution of digital auditing within the government agencies. This evolution is characterised by the establishment of a novel value chain that aims to optimise the value of data and enhance transparency for stakeholders. The extent to which data-enabled technologies are adopted within the digital audit's future generation value chain exhibits variability. The digital auditing landscape is being shaped by various technologies, including natural language processing, voice recognition, virtual or augmented reality, and computer visioning. These technologies are powered by machine learning algorithms and enabled by the vast computational capacity of cloud computing.

The present research makes a noteworthy contribution to the implementation of digital audits in Malaysia, specifically with regard to their adoption by public auditors and accountants. The process of digital auditing necessitates a substantial degree of human involvement, entailing the incorporation of external data and meticulous evaluation to augment the efficacy of auditors and mitigate the possibility of audit-related hazards. The incorporation of trustworthiness within the realm of digital auditing is of paramount importance in order to improve the quality of tasks executed by auditors and accountants.

Furthermore, the effective execution of digital audits is contingent upon the proficiency, aptitude, background, and comprehension of computing technology exhibited by the auditor in shaping audit conclusions. The purpose of automating and standardising audit procedures in digital audits is to simplify the tasks of auditors in accomplishing the audit objective. This objective involves estimation and necessitates professional verification and scepticism to reduce the likelihood of fraudulent activity. The adoption of digital audits is contingent upon various factors, including the performance expectations of the auditor, the support provided by the organisation, and the technical infrastructure available.

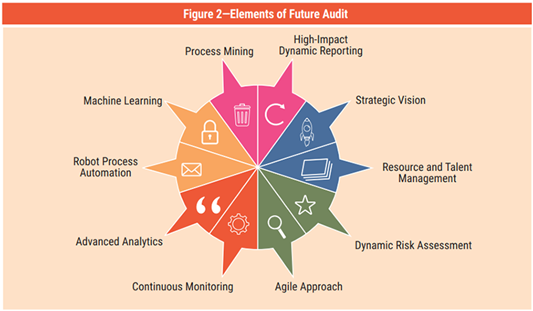

The findings of the study provide insight into the potential requirements for forthcoming audits. The significance of implementing a dynamic auditing approach is emphasised in Figure 2. This approach involves a complex process that incorporates various elements such as impactful reporting, strategic foresight, efficient resource and talent management, risk evaluation, adaptable methodologies, ongoing surveillance, advanced analytical techniques, process automation, machine learning, and process mining. The adoption of a highly advanced procedure has the potential to yield significant advantages for both the JAN and JANM as they strive to transition towards digital auditing. The aforementioned roadmap offers guidance on how to integrate crucial components into one's practices with the aim of improving the efficacy and efficiency of audits.

In general, this research enhances the comprehension of the consciousness and execution of digital audits in Malaysia, providing significant perspectives and suggestions for public auditors and accountants. The Malaysian auditing profession can effectively adapt to the digital era's dynamic landscape by embracing digital auditing and implementing requisite technologies and practices.

This study contributes significantly to the existing literature on digital auditing by incorporating the trustworthy framework to enhance the quality of digital auditing. This effort could provide strong evidence that the auditor’s work performance could be strongly influenced by digital audit efficacy for the digital government (Refer to Figure 3). However, it is important to note that the effectiveness of public auditors and accountants is contingent upon possessing fundamental competencies, access to digital audit infrastructure, and receiving support from upper management. The contribution has the potential to offer benefits to policymakers in their endeavours to formulate and execute crucial policies aimed at enhancing the work performance of auditors, particularly in the context of digital auditing adoption.

The scope of this study is restricted to professionals in the field of auditing and accounting who are employed within the public sector of Malaysia. In light of the aforementioned limitations, it is recommended that forthcoming investigations focus on conducting a cross-sectional inquiry with a larger participant pool across varied occupational settings to furnish a comparative evaluation of digital auditing practises, encompassing additional factors that may impact its implementation. Scholars may prioritise the investigation of digital audits that are commercially accessible and ascertain the presence of a direct or indirect association between their utilisation and specific categories of audits. An interesting avenue for research would be to examine the evolution and current state of digital audit adoption in various countries across the globe, with a view to enhancing audit efficacy among public sector auditors and accountants.

Acknowledgements

The authors would like to extend their gratitude to the Accounting Research Institute and Universiti Poly-Tech Malaysia for funding this research under the Integrating Trustworthy Framework in Digital Auditing Readiness of Public Sector Auditors (100-TNCPI/PRI 16/6/2 (048/2022) grant for supporting this study.

References

Ahmia, A., Saidina, S. Z., Abdullaha, A., & Ahmada, A. C. (2016). IT Adoption by Internal Auditors in Malaysian Public Sector: A Preliminary Finding. European Proceedings of Social and Behavioural Sciences. DOI:

Bougie, R., & Sekaran, U. (2019). Research methods for business: A skill building approach. John Wiley & Sons.

Bradford, M., Henderson, D., Baxter, R. J., & Navarro, P. (2020). Using generalized audit software to detect material misstatements, control deficiencies and fraud: How financial and IT auditors perceive net audit benefits. Managerial Auditing Journal, 35(4), 521–547. DOI:

Braun, R. L., & Davis, H. E. (2003). Computer-assisted audit tools and techniques: Analysis and perspectives. Managerial Auditing Journal, 18(9), 725–731. DOI:

Brown, C. E., Wong, J. A., & Baldwin, A. A. (2007). A Review and Analysis of the Existing Research Streams in Continuous Auditing. Journal of Emerging Technologies in Accounting, 4(1), 1-28. DOI:

Butaka, G. (2022). The Evolution of Audit in the Wake of the Pandemic. ISACA Journal, 1, 1-7. https://www.isaca.org/resources/isaca-journal/issues/2022/volume-1/the-evolution-of-audit-in-the-wake-of-the-pandemic

Byrnes, P. E., Al-Awadhi, A., Gullvist, B., Brown-Liburd, H., Teeter, R., Warren, J. D., Jr., & Vasarhelyi, M. (2018). Evolution of Auditing: From the Traditional Approach to the Future Audit. Continuous Auditing, 285-297. DOI:

Chan, D. Y., & Vasarhelyi, M. A. (2011). Innovation and practice of continuous auditing. International Journal of Accounting Information Systems, 12(2), 152–160. DOI:

Dagilienė, L., & Klovienė, L. (2019). Motivation to use big data and big data analytics in external auditing. Managerial Auditing Journal, 34(7), 750–782. DOI:

Ghani, R., Rosli, K., Ismail, N. A., & Saidin, S. Z. (2017). Application of Computer-Assisted Audit Tools and Techniques ( CAATTs ) in Audit Firms. Journal of Advanced Research in Business and Management Studies, 1(1), 67–74. https://www.akademiabaru.com/submit/index.php/arbms/article/view/1279

Halbouni, S. S., Obeid, N., & Garbou, A. (2016). Corporate governance and information technology in fraud prevention and detection: Evidence from the UAE. Managerial Auditing Journal, 31(6/7), 589-628. DOI:

Johari, R. J., Alam, M. M., & Said, J. (2021). Investigating factors that influence Malaysian auditors' ethical sensitivity. International Journal of Ethics and Systems, 37(3), 406-421. DOI:

Jusoh, Y. H. M., Razak, S. N. A. A., Noor, W. N. B. W. M., Hudayati, A., Puspaningsih, A., & Nadzri, F. A. A. (2022). Audit Committee Characteristics and Timeliness of Financial Reporting: Social Enterprises Evidence. Contemporary Economics, 16(2), 211-226. DOI:

Kim, H.-J., Mannino, M., & Nieschwietz, R. J. (2009). Information technology acceptance in the internal audit profession: Impact of technology features and complexity. International Journal of Accounting Information Systems, 10(4), 214–228. DOI:

Kostem, D. C. (2021). Working models brought about by COVID-19 have hastened the move to a more flexible, technologically aware and diverse auditing profession. Ernst & Young. https://www.ey.com/en_gl/assurance/how-the-auditing-profession-is-transforming-to-meet-future-challenges

Lamboglia, R., Lavorato, D., Scornavacca, E., & Za, S. (2021). Exploring the relationship between audit and technology. A bibliometric analysis. Meditari Accountancy Research, 29(5), 1233-1260. DOI:

Mahzan, N., & Lymer, A. (2014). Examining the adoption of computer-assisted audit tools and techniques: Cases of generalized audit software use by internal auditors. Managerial Auditing Journal, 29(4), 327-349. DOI:

Malaescu, I., & Sutton, S. G. (2015). The Reliance of External Auditors on Internal Audit's Use of Continuous Audit. Journal of Information Systems, 29(1), 95-114. DOI:

Omoteso, K. (2012). The application of artificial intelligence in auditing: Looking back to the future. Expert Systems with Applications, 39(9), 8490–8495. DOI:

Pathak, J., Lind, M., & Abdolmohammadi, M. (2010). E-Commerce Audit Judgment Expertise: Does Expertise in System Change Management and Information Technology Auditing Mediate E-Commerce Audit Judgment Expertise? Informatica Economica, 14(1), 5–20. http://revistaie.ase.ro/content/53/01%20Pathak.pdf

Ravisankar, P., Ravi, V., Raghava Rao, G., & Bose, I. (2011). Detection of financial statement fraud and feature selection using data mining techniques. Decision Support Systems, 50(2), 491–500. DOI:

Razi, M. A., & Madani, H. H. (2013). An analysis of attributes that impact adoption of audit software: An empirical study in Saudi Arabia. International Journal of Accounting & Information Management, 21(2), 170-188. DOI:

Rikhardsson, P., & Dull, R. (2016). An exploratory study of the adoption, application and impacts of continuous auditing technologies in small businesses. International Journal of Accounting Information Systems, 20, 26–37. DOI:

Thottoli, M. M., & Thomas, K. V. (2020). Characteristics of information communication technology and audit practices: evidence from India. VINE Journal of Information and Knowledge Management Systems, 52(4), 570-593. DOI:

Tysiac, K. (2022). Embracing technology in the audit. Journal of Accountancy. https://www.journalofaccountancy.com/issues/2022/feb/embracing-technology-audit.html

Veerankutty, F., Ramayah, T., & Ali, N. (2018). Information Technology Governance on Audit Technology Performance among Malaysian Public Sector Auditors. Social Sciences, 7(8), 124. DOI:

Wu, T.-H., Huang, S.-M., Huang, S. Y., & Yen, D. C. (2017). The effect of competencies, team problem-solving ability, and computer audit activity on internal audit performance. Information Systems Frontiers, 19(5), 1133-1148. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Shafie, N. A., Sanusi, Z. M., Sanusi, S., Isa, Y. M., & Razak, N. A. (2023). Challenges of Evolving Digital Auditing Landscape Among Malaysian Government Accountants and Auditors. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 670-682). European Publisher. https://doi.org/10.15405/epsbs.2023.11.57