Abstract

Listed companies face challenges in standardising Environment, Social and Governance (ESG) disclosures, resource constraints, reputation and regulatory risks, and investor pressure while seeking to reap the benefits of ESG disclosure of financial performances. Hence, the study’s objective is to meta-analytically review the overall effect of ESG disclosure on listed companies’ financial performances. PRISMA protocol was applied as guidelines, and 32 articles were included and reviewed quantitatively based on coefficient correlation results for each article. This study’s finding indicated that ESG disclosure significantly and negatively influenced listed companies’ financial performances. Despite the negative relationship concluded, the overall effect is still weak. This finding contributes towards the body of knowledge in terms of methodology, whereby meta-analysis is an alternative to analyse and summarise quantitative findings. In addition, this study also contributes towards the existing literature on presenting three applied theories – agency theory, signalling theory, and salient stakeholder theory. However, this study will have several limitations and future research directions.

Keywords: ESG, ESG Disclosure, Financial Performances, Listed Companies, Meta-Analysis

Introduction

Listed Companies face various obstacles and considerations regarding ESG disclosures and their impact on firm performance (Al Hawaj & Buallay, 2022). In their efforts to satisfy investor expectations, regulatory requirements, and stakeholder demands, these companies face both opportunities and complexities presented by the changing landscape of sustainability practices and reporting standards (O’Dwyer & Unerman, 2020). They need more time to disclose comprehensive and reliable ESG information, a significant obstacle. Institutional investors are increasingly incorporating ESG factors into their investment decisions, focusing on the sustainability practices of companies and their alignment with global objectives such as the Sustainable Development Goals (SDGs) of the United Nations. 81% of respondents to a CFA Institute survey believed that ESG factors have a material impact on investment performance. This increased investor scrutiny requires listed companies to disclose ESG information transparently and meaningfully to attract investment capital and maintain stakeholder trust (Lipton, 2020). In addition, regulatory frameworks and reporting standards for ESG disclosures continue to evolve and vary by jurisdiction (Ho & Park, 2019). As a result, companies operating in multiple regions must navigate a patchwork of regulations, guidelines, and reporting frameworks, which can create complications and difficulties in ensuring compliance and consistency. For instance, the Non-Financial Reporting Directive (NFRD) and Sustainable Finance Disclosure Regulation (SFDR) of the European Union impose specific ESG disclosure requirements on European listed companies. In contrast, other regions may have their reporting guidelines. This fragmented environment necessitates that public companies develop comprehensive ESG reporting strategies that consider the various regulatory frameworks in which they operate (Sulkowski & Jebe, 2022).

A significant obstacle is the need for precise and trustworthy data to support ESG disclosures. In non-financial metrics, accumulating, verifying, and reporting ESG-related information is challenging for many publicly traded companies (Chueca Vergara & Ferruz Agudo, 2021). The absence of standard methodologies and metrics for ESG data collection and reporting can reduce the comparability and dependability of disclosed information. This difficulty is addressed by initiatives such as the Task Force on Climate-related Financial Disclosures (TCFD) and industry collaborations to establish common metrics and reporting standards. In addition, there is an ongoing concern regarding the possibility of greenwashing. As ESG disclosures acquire prominence, there is a risk that companies will exaggerate or misrepresent their sustainability practices to create a positive image without actions to back it up (Vanclay & Hanna, 2019). This phenomenon undermines the credibility and integrity of environmental, social, and governance (ESG) disclosures and creates difficulties for investors and stakeholders seeking genuine and trustworthy information (Linnenluecke, 2022). Robust governance, independent verification, and transparency measures are essential to address these concerns. In a comprehensive study conducted in 2021, the Index Industry Association (IIA) highlighted the challenge of inadequate ESG disclosure faced by listed companies worldwide. Although ESG is a high priority for 85 per cent of managers, an astounding 64 per cent are concerned about the dearth of disclosure and transparency (Vitali, 2023).

Inadequate ESG disclosure has far-reaching effects on various aspects of a company’s performance and has far-reaching implications. On the one hand, Alsayegh et al. (2020) and Xie et al. (2019) suggested that enhancing ESG disclosure can result in cost reductions and improved stock performance. On the other hand, studies by Antoncic (2021) and Whelan et al. (2021) indicated that insufficient ESG disclosure may result in poor capital and asset performance, potentially impacting the company’s overall financial health.

Given the contradictory findings and the significance of ESG considerations in the contemporary business environment, it is imperative to conduct a comprehensive meta-analysis. This study seeks valuable insights into the overall effect of ESG disclosure on listed companies’ financial performances. The meta-analysis will assist in elucidating the extent to which transparent reporting and communication of ESG factors influence financial and operational outcomes, allowing businesses to make more informed decisions and improve their sustainability practices. Since this study is lean towards evidence-based, hence the proposed, tested hypotheses as per Figure 1 are as follows:

H0 = There is no significant relationship between ESG disclosures and listed companies’ Financial Performances.

H1 = There is a significant relationship between ESG disclosure and listed companies’ Financial Performances.

The following paper structure is as follows. The second section focuses on the Meta-Analysis protocol and analysis. The third section presents the results and findings, mainly from the meta-analysis. The fourth section discusses the findings in-depth. Section five expresses the implications of the study. Finally, this study provides conclusions, limitations, and future research directions.

Method

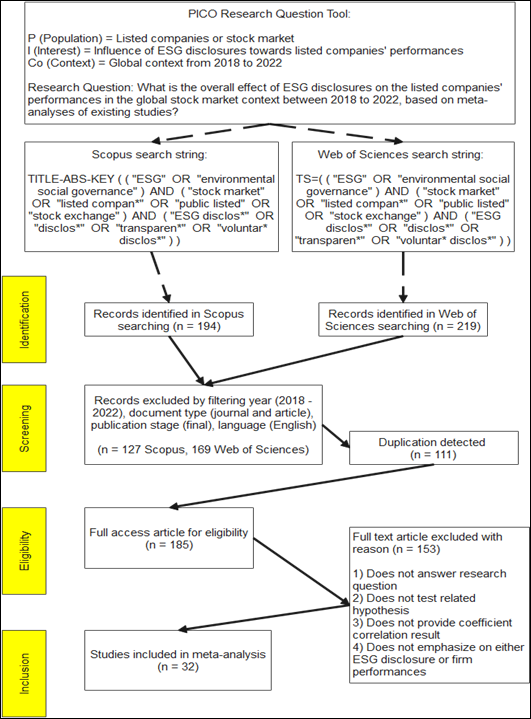

This study applies the Meta-Analysis methodology to comprehensively explore the influence of ESG disclosure and the firm performance of listed companies in a global context. The advantage of meta-analysis is that it can evaluate critically and statistically combine the results of comparable or empirical studies (Fagard et al., 1996), unlike systematic literature review, which requires a qualitative narrative review. This Meta-Analysis methodology was guided using PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) protocol, developed by Moher et al. (2009). Figure 2 displays the summary of this study methodology using the PRISMA protocol. Meta-analysis is a statistical technique for combining the findings from independent studies (Crombie & Davies, 2009).

The PICo (Population, Interest, and Context) tools are utilised in this study to formulate the research question. This study focuses on the listed companies or stock market as a population (P). Specifically, it aims to conclude the overall effect of ESG disclosures on financial performance (I). The study’s context encompasses a global perspective from 2018 to 2022 (Co). Hence, the research question proposed in this study is as follows: “What is the overall effect of ESG disclosures on the listed companies’ financial performances in the global stock market context between 2018 to 2022, based on meta-analyses of existing studies?”

Database Selection and Identification

The first phase of the PRISMA protocol is identification, whereby this study selects two databases and performs a search string after the research question has been developed and proposed. Based on Figure 1, Scopus and Web of Sciences have been selected as the main databases relied on in this study. Scopus and Web of Sciences have different search strings, as shown in the figure, but they still applied the same keywords during the search. Three keyword groups have been identified based on a research question. The first keyword is ESG or Environmental Social and Governance. The second group of keywords consist of the stock market, listed company, public listed and stock exchange. Finally, the third group of keywords is ESG disclosure, disclosure, transparent and voluntary disclosure. Both databases searched All three keyword groups using field codes based on title, abstract, and keywords. As a result, Scopus and Web of Sciences retrieved 194 and 219 documents, respectively.

Screening and Eligibility

The second and third phase in the PRISMA protocol is screening and eligibility. In the screening phases, filtration was made in both databases. It ensures that the journal articles are the only documents qualified to be systematically reviewed. Another purpose is to meet the context of the year timeline between 2018 to 2022. English language documents have also been considered due to language proficiency, and in the publication stage, final documents are filtered. Therefore, the number of documents after screening for Scopus and Web of Sciences are 127 and 169, respectively. In addition, the meta-data identified 111 duplications detected because 111 articles were indexed in both databases.

The third phase in the PRISMA protocol is eligibility. After removing the duplication, 185 full-access articles are available in this phase. In this phase, the authors will review and select the articles by evaluating the title, abstract, and keywords. During this phase, 153 full-text articles were excluded, mainly because the article was not related to the research question and did not test the hypothesis related to ESG disclosure and firm performances. In addition, those were excluded because the article does not provide coefficient correlation results.

Inclusion

The fourth and final phase in the PRISMA protocol is inclusion. 32 articles are qualified based on the authors’ consensus, and the article meets the research question. Hence, all 32 articles will be meta-analysed to answer the conclusive findings of the research question. However, the author conducted some descriptive analysis of the selected articles.

Results and Findings

Descriptive Results

Table 1 displays the breakdown statistics of 32 studies based on the country’s number of studies as a Decision Making Unit. India dominated the studies by 12.5%, equivalent to 4 articles focusing on the Bombay and Delhi Stock Exchange. Seven countries have shared an equal of studies by having two articles. Those countries are China (Shanghai Stock Exchange), European nations (combination of stock indices among Europe), France (Euronext Paris), Gulf Countries (combination of Gulf countries’ stock market), Saudi Arabia (Tadawul), Thailand (Stock Exchange of Thailand), and USA (New York Stock Exchange). The rest countries contributed one study on ESG disclosure and listed companies’ financial performances.

Meanwhile, Table 2 explains the descriptive statistics of 32 studies based on the Financial Performance Indicator used in respective studies. It indicates that Return on Asset (ROA) is scholars’ most frequent financial performance indicator, with 17 studies or 53.1%. Then, it was followed by Return on Capital Employed (ROCE), sometimes known as Return on Equity (ROE), by four studies or 12.5%. The stock return makes it the top three by three studies or 9.4%. The rest contributes to two studies, or 6.3%, represented by Tobin’s Q, Value Added Intellectual Capital (VAIC), Bonds’ rating, and Firms’ growth rate.

Meta-Analysis Results

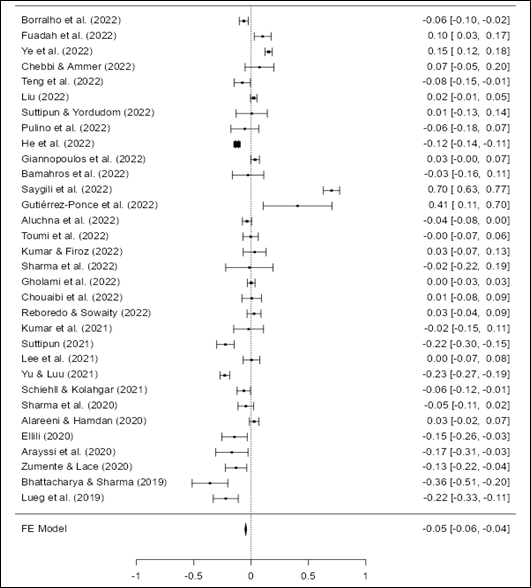

32 studies were meta-analysed and summarised via the Fixed Effect Model, as presented in. The intercept estimate value is -0.0473, which refers to the average coefficient correlation based on the Fixed Effect Model with a 95% confidence interval. The fixed effect model minimum and maximum bound are -0.055 and -0.039, respectively. In addition, the Z value of -11.6 and p < 0.001 shows that the average outcome differs significantly from zero. If the average outcome is near zero or falls to zero, it will show no conclusive effect of the tested hypothesis.

Earlier, the intercept estimate value of -0.0473 with p-value < 0.001 indicates that overall, 32 studies summarised that there is a significant and negative relationship between ESG disclosure and listed companies’ financial performances. Therefore, H1 is accepted, and H0 is rejected.

Meanwhile, Table 4 presents the heterogeneity statistics. The purpose of heterogeneity statistics is to understand the extent of heterogeneity among the included studies comprehensively. Tau and Tau2, the estimated between-study variation or heterogeneity parameter, is provided as 0.000. The estimated variance is near zero, which shows little variability among the studies. The tau-squared value, calculated as the square of tau, is presented as 0 (SE = NA), indicating that there is no significant heterogeneity or that it is exceedingly low. The I2 statistic reveals how much of the total variability among studies can be ascribed to heterogeneity. The I2 value in this situation is stated as 96.78%. This high score indicates strong heterogeneity, indicating that differences between studies account for a large fraction of the total variation in the study outcomes rather than random fluctuation.

Furthermore, the H2 value of 31.057 implies that approximately 31.057% of the total variability can be attributed to heterogeneity. Meanwhile, the heterogeneity test has 31.000 degrees of freedom (df), the number of independent pieces of information available for estimating heterogeneity. Next is the Q-statistic, which compares observed variability to anticipated variability under homogeneous conditions, 962.759. The corresponding p-value is reported as “0.001,” suggesting that the observed heterogeneity is statistically significant.

Hence, the presented heterogeneity statistics provide two conclusions. First, the relationship between ESG disclosures and listed companies’ financial performances may vary across different contexts of study characteristics. Second, factors beyond ESG disclosure alone may contribute to the observed heterogeneity.

Figure 3 refers to the meta-analysis forest plot diagram. The purpose of the forest plot is to visually summarise the selected studies that investigate the same tested hypothesis, which in this case is the ESG disclosure effect towards listed companies’ financial performances. 32 studies were visualised through forest plots, and there are differences in correlation coefficients and the confidence interval (CI)’s lower and upper bound. Several findings can be explained in this forest plot analysis.

First, He et al. (2022) study shows the thickest box plot. It shows that this study delivers the largest weight, compared with the rest, by at least three times. Therefore, it indicates its significant impact on the overall pooled estimate. It also suggests that the findings of this study carry substantial weight and heavily influence the conclusion drawn from the meta-analysis. In other words, He et al. (2022) carry the largest influence, leading to the conclusive effect on the acceptance of H1. There is a significant relationship between ESG disclosure and listed companies’ Financial Performances.

Second, Gutiérrez-Ponce et al. (2022), Sharma et al. (2022), and Bhattacharya and Sharma (2019) provides the widest gap of confidence interval lower bound and upper bound, by 0.59, 0.41, and 0.30 (59, 41 and 30 points), respectively. It indicates significant uncertainty and variability in the estimated effects of ESG disclosure towards listed firms’ financial performances. In addition, the tested hypothesis for those three studies is not well-established. It varies from the rest of the studies, which will be further investigated and discussed on the contextual factors leading towards it in the later section.

Third, there are 18 studies with negative coefficient correlations and 14 with positive coefficient correlations. Hence, the meta-analysis is conducted to draw conclusive findings on the tested hypothesis. The fixed effect model result concludes a significant and negative relationship (intercept estimate = -0.0473 and p-value < 0.001) between ESG disclosures and listed companies’ financial performances. However, the value of -0.0473 is considered close to zero, deemed a weak relationship. Hence, the further section will discuss the contextual factors leading towards a weak relationship.

Theories applied in this study

This section explained the theories applied by some of the 32 studies concerning the relationship between ESG disclosures and listed companies’ financial performances. The three theories are 1) agency theory, 2) signalling theory, and 3) stakeholder salience theory.

First, agency theory is a conceptual framework for understanding the underlying relationships between principals and their agents. Schiehll and Kolahgar (2021) applied and tested this theory in this study. In the context of the influence of ESG disclosure on listed businesses’ financial performance, the principal indicates a stakeholder who heavily relies on an agent to execute specific financial decisions and transactions, potentially leading to volatile consequences. The theory delves into two major issues: A) the presence of conflicts of interest between principals and agents and B) the difficulties connected with encouraging agents to behave in the best interests of the principals. As a result, when investigating the impact of ESG disclosure on the financial performance of publicly traded companies, the use of agency theory provides valuable insights into the intricate dynamics between the stakeholders involved. It sheds light on the factors that may affect their interactions and outcomes.

Secondly, Pulino et al. (2022) also applied and tested the signalling theory in this study. This theory seeks to explicitly demonstrate that individuals within a publicly traded company, particularly corporate insiders such as officers and directors, have superior knowledge of the company’s current state and prospects when compared to outside parties such as investors, creditors, and even governmental entities, not to mention shareholders. This theory is regarded as one of the core theories in financial management. In broad terms, a signal is a communication launched by the company’s management to external parties, typically investors, to transmit relevant information. Applying signalling theory is invaluable in comprehending how businesses effectively communicate their ESG-related actions and outcomes to external stakeholders.

Third, the Stakeholder salience theory is applied and tested by Aluchna et al. (2022), whereby this theory provides a conceptual framework for understanding the complex interactions between a publicly traded corporation and its stakeholders. It claims that while making choices, companies should prioritise the interests of all stakeholders rather than just shareholders. This idea is crucial in the context of ESG disclosure’s impact on listed companies’ financial performance. It distinguishes three types of stakeholders: primary, secondary, and tertiary. Employees, customers, and suppliers are primary stakeholders, as are those who have direct contact with the organisation. Secondary stakeholders, such as the media and government, indirectly relate to the corporation. Finally, tertiary stakeholders have no direct or indirect ties to the organisation but are heavily impacted by its actions. Thus, within the context of ESG disclosure, stakeholder salience theory provides a solid foundation for listed firms to consider the interests and concerns of primary, secondary, and tertiary stakeholders.

Discussions

The authors highlight four areas for further discussion. First, the biggest influence among 32 studies is He et al. (2022)’s “Corporate ESG performances and manager misconduct: Evidence from China”. This article’s findings indicated that ESG disclosure negatively influences listed companies’ financial performances. It is deemed the biggest influence due to the higher manager misconduct in ESG disclosure, the lower the financial performance will be. Hence, it is recommended to monitor manager misconduct to ensure that the ESG disclosure can be more transparent and potentially improve financial performance.

Secondly, the overall heterogeneity results presented earlier suggested an issue of uncertainty and variability in the estimated effects of ESG disclosure towards listed companies’ financial performances. It means there is a lack of consistency or mixed pattern in how ESG disclosure affects listed companies’ financial performances. Hence, it raises another question: to see what factors contribute to the inconsistencies. As per Figure 3, the three widest gaps in the forest plot belong to the study of Gutiérrez-Ponce et al. (2022), Sharma et al. (2022), Bhattacharya and Sharma (2019). The attributes that lead towards the widest gap in ESG disclosure influence listed companies’ financial performance due to poor web transparency and wise debt management in Spain’s listed companies (Gutiérrez-Ponce et al., 2022), the triple-bottom-line approach to enhancing ESG disclosure in Gulf Countries’ listed companies (Sharma et al., 2022), and creditworthiness and governance score in India’s listed companies (Bhattacharya & Sharma, 2019). Hence, the wider gap suggested that those factors identified are still inconclusive, as further research needs to be conducted to obtain a better coefficient correlation.

Third, as per earlier findings, 18 studies provide a negative coefficient correlation, and 14 studies provide a positive coefficient correlation. Since there is mixed evidence of the results, it raises the question, “What factors contribute to the variation in the impact for further investigation?”. The authors identified five possible factors that lead towards mixed evidence: 1) ownership structure (Ellili, 2020; Fuadah et al., 2022), 2) environmental practices and policies (Alareeni & Hamdan, 2020; Yu & Luu, 2021), 3) better governance (Chebbi & Ammer, 2022), 4) stakeholder engagement (Aluchna et al., 2022; Teng et al., 2022), and 5) board diversities and size (Bamahros et al., 2022; Suttipun, 2021; Toumi et al., 2022). Hence, those possible factors were identified as the drivers towards ESG disclosure in influencing listed companies’ financial performance. Furthermore, not only are mixed results derived from five possible factors, but also there are some considerations, such as differences in listed companies’ financial performance indicators (ROA, ROCE, Tobin’s Q, etc.) and geographical differences, whereby some studies used micro level (one country’s stock market). Some studies used the macro level (combination of multi-countries’ stock markets).

Fourth, the main findings indicated that ESG disclosure negatively affects financial performance. Four potential reasons lead towards this conclusive finding. The first reason is that ESG disclosures were perceived as high costs for companies to produce and maintain, negatively impacting financial performances (Zeidan, 2022). Then the second reason is ESG disclosures can signal declining investors’ confidence due to the company not performing well (Alsayegh et al., 2020). The third reason is the pressure companies face due to regulatory requirements in ESG disclosure, in which financial performance can be ignored, but compliance is prioritised (Al-Ahdal et al., 2023; Zhou et al., 2023). Finally, the fourth reason is that no standardised framework in ESG disclosures leads to confusion and inconsistencies in financial reporting, making it difficult for investors to compare companies' financial performances (Dye et al., 2021; El-Hage, 2021).

Implications

The meta-analysis’ fixed effect model result concluded that ESG disclosure significantly and negatively affects listed companies’ financial performance. It provides permutation. The increased ESG disclosure will decrease listed companies’ financial performance and vice versa. Although the relationship is negative, the effect is still weak because the value is close to zero. Hence, it shows that the relationship is still inconclusive and can go the other way.

There are four practical implications if the increase in ESG disclosure will decrease listed companies’ financial performances. First, increased ESG disclosure may influence investors’ perceptions. It is because they will not have confidence towards the invested company, potentially leading to a diminished view of the companies’ financial viability and profitability. Hence, it can result in reduced access to capital or incur a high cost of capital. Secondly, companies that prioritise ESG disclosure may face a competitive disadvantage compared to competitors that ignore ESG disclosure. Hence, it will increase the cost of implementing sustainable practices and policies. Therefore, it will decrease market share, profitability and overall performance.

Third, increased ESG disclosure exposes listed companies to additional regulatory enforcement and risk exposure. Examples of regulatory enforcement such as additional fines for breaching ESG policies. Hence, if the listed company is deemed not complying with ESG policies, reporting requirements or evolving standard procedure, there will be potential reputational harm. It can further impact the financial performance due to additional expenses in paying penalties and affecting cash flow performance. Finally, negative perceptions resulting from poor financial performance relative to increased ESG disclosure may harm companies’ reputations, leading to customer churn, missed business opportunities, and difficulties in attracting and retaining talented employees, all of which can have long-term effects on their financial performance.

Conclusions, limitations and future research directions

This study’s background refers to the impact of transparent reporting and communication of ESG on the financial outcomes of the listed companies. Weak ESG disclosures can reduce costs, boost stock market performances, or lead to poor capital and asset performance. With mixed phenomena present at the moment, this study’s objective is to meta-analytically examine the overall effect of ESG disclosure towards listed companies’ financial performances. 32 articles from 2018 to 2022 were selected to be meta-analytically reviewed. The main findings indicated that ESG disclosure significantly and negatively influenced listed companies’ financial performances. Despite the negative relationship concluded, the overall effect is still weak. This finding contributes towards the body of knowledge in terms of methodology, whereby meta-analysis is an alternative to analyse and summarise quantitative findings. In addition, this study also contributes towards the existing literature on presenting three applied theories – agency theory, signalling theory, and salient stakeholder theory. However, this study will have several limitations and future research directions.

The first limitation is that this study does not address enough ESG disclosure influence on listed companies’ financial performance. Due to the claim made by the author that in the PRISMA protocol, 153 articles were excluded and only 32 articles were included in this study. The factors leading to massive exclusion do not address ESG disclosure and financial performance and do not provide coefficient correlation results. Hence, the future research direction is to extend the study on ESG disclosure’s influence on listed companies’ financial performances into other countries, such as South America, Oceania, and Africa. This recommendation is required to enhance the robustness of meta-analysis results in the future.

The second limitation is that this result’s fixed effect model value (-0.0473) is close to zero. This value indicates that it will expose the risk of having no conclusive effect when it is almost close to zero. Since this study uses Scopus and Web of Sciences as databases, perhaps it is recommended to extend the meta-analysis data to Google Scholar in the hope of a more accurate conclusive result.

The third limitation is that this study only tested one hypothesis: ESG disclosure significantly influences listed companies’ financial performances. It may not deem to be adequate. However, while the authors conduct this study, some moderating variables are tested by other scholars, either strengthening or weakening this hypothesis. The tested moderating variables were the audit committee (Fuadah et al., 2022), reformation of corporate governance (Almici, 2023; Chebbi & Ammer, 2022), investors’ diversity (Chen & Xie, 2022), social and ethical practices (Chouaibi et al., 2021), and industry sensitivity (Qureshi et al., 2020). Hence, there will be a requirement to conduct future research by testing all listed moderating variables.

Acknowledgements

The authors would like to thank the Universiti Poly-Tech MARA grant code: 100-TNCPI/PRI 16/6/2 (051/2022), Accounting Research Institute (HICoE), Universiti Teknologi MARA and Ministry of Higher Education, Malaysia for providing the necessary financial assistance for this research.

References

Al Hawaj, A. Y., & Buallay, A. M. (2022). A worldwide sectorial analysis of sustainability reporting and its impact on firm performance. Journal of Sustainable Finance & Investment, 12(1), 62-86. DOI:

Al-Ahdal, W. M., Farhan, N. H. S., Vishwakarma, R., & Hashim, H. A. (2023). The moderating role of CEO power on the relationship between environmental, social and governance disclosure and financial performance in emerging market. Environmental Science and Pollution Research, 30(36), 85803-85821. DOI:

Alareeni, B. A., & Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. Corporate Governance: The International Journal of Business in Society, 20(7), 1409-1428. DOI:

Almici, A. (2023). Does sustainability in executive remuneration matter? The moderating effect of Italian firms' corporate governance characteristics. Meditari Accountancy Research, 31(7), 49-87. DOI:

Alsayegh, M. F., Abdul Rahman, R., & Homayoun, S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability, 12(9), 3910. DOI:

Aluchna, M., Roszkowska-Menkes, M., Kamiński, B., & Bosek-Rak, D. (2022). Do institutional investors encourage firm to social disclosure? The stakeholder salience perspective. Journal of Business Research, 142, 674–682. DOI:

Antoncic, M. (2021). Is ESG investing contributing to transitioning to a sustainable economy or to the greatest misallocations of capital and a missed opportunity? Journal of Risk Management in Financial Institutions, 15(1), 6–12.

Bamahros, H. M., Alquhaif, A., Qasem, A., Wan-Hussin, W. N., Thomran, M., Al-Duais, S. D., Shukeri, S. N., & Khojally, H. M. A. (2022). Corporate Governance Mechanisms and ESG Reporting: Evidence from the Saudi Stock Market. Sustainability, 14(10), 6202. DOI:

Bhattacharya, S., & Sharma, D. (2019). Do environment, social and governance performance impact credit ratings: a study from India. International Journal of Ethics and Systems, 35(3), 466–484. DOI:

Chebbi, K., & Ammer, M. A. (2022). Board Composition and ESG Disclosure in Saudi Arabia: The Moderating Role of Corporate Governance Reforms. Sustainability, 14(19), 12173. DOI:

Chen, Z., & Xie, G. (2022). ESG disclosure and financial performance: Moderating role of ESG investors. International Review of Financial Analysis, 83, 102291. DOI:

Chouaibi, S., Rossi, M., Siggia, D., & Chouaibi, J. (2021). Exploring the Moderating Role of Social and Ethical Practices in the Relationship between Environmental Disclosure and Financial Performance: Evidence from ESG Companies. Sustainability, 14(1), 209. DOI:

Chueca Vergara, C., & Ferruz Agudo, L. (2021). Fintech and Sustainability: Do They Affect Each Other? Sustainability, 13(13), 7012. DOI:

Crombie, I. K., & Davies, H. T. (2009). What is meta-analysis? Evidence Based Medicine, Second Edi(April), 1–8.

Dye, J., McKinnon, M., & der Byl, C. (2021). Green gaps: Firm ESG disclosure and financial institutions’ reporting Requirements. Journal of Sustainability Research, 3(1).

El-Hage, J. (2021). Fixing ESG: Are Mandatory ESG Disclosures the Solution to Misleading ESG Ratings? Fordham J. Corp. & Fin. L., 26, 359.

Ellili, N. O. D. (2020). Environmental, Social, and Governance Disclosure, Ownership Structure and Cost of Capital: Evidence from the UAE. Sustainability, 12(18), 7706. DOI:

Fagard, R. H., Staessen, J. A., & Thijs, L. (1996). Advantages and disadvantages of the meta-analysis approach.Journal of Hypertension, 14(Supplement 2), S9-S13. DOI:

Fuadah, L. L., Mukhtaruddin, M., Andriana, I., & Arisman, A. (2022). The Ownership Structure, and the Environmental, Social, and Governance (ESG) Disclosure, Firm Value and Firm Performance: The Audit Committee as Moderating Variable. Economies, 10(12), 314. DOI:

Gutiérrez-Ponce, H., Chamizo-González, J., & Arimany-Serrat, N. (2022). Disclosure of Environmental, Social, and Corporate Governance Information by Spanish Companies: A Compliance Analysis. Sustainability, 14(6), 3254. DOI:

He, F., Du, H., & Yu, B. (2022). Corporate ESG performance and manager misconduct: Evidence from China. International Review of Financial Analysis, 82, 102201. DOI:

Ho, V. H., & Park, S. K. (2019). ESG disclosure in comparative perspective: Optimising private ordering in public reporting. University of Pennsylvania Journal of International Law, 249.

Linnenluecke, M. K. (2022). Environmental, social and governance (ESG) performance in the context of multinational business research. Multinational Business Review, 30(1), 1–16. DOI:

Lipton, A. M. (2020). Not everything is about investors: the case for mandatory stakeholder disclosure. Yale J. on Reg., 37, 499.

Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2009). Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. PLoS Medicine, 6(7), e1000097. DOI:

O'Dwyer, B., & Unerman, J. (2020). Shifting the focus of sustainability accounting from impacts to risks and dependencies: researching the transformative potential of TCFD reporting. Accounting, Auditing & Accountability Journal, 33(5), 1113-1141. DOI:

Pulino, S. C., Ciaburri, M., Magnanelli, B. S., & Nasta, L. (2022). Does ESG Disclosure Influence Firm Performance? Sustainability, 14(13), 7595. DOI:

Qureshi, M. A., Kirkerud, S., Theresa, K., & Ahsan, T. (2020). The impact of sustainability (environmental, social, and governance) disclosure and board diversity on firm value: The moderating role of industry sensitivity. Business Strategy and the Environment, 29(3), 1199–1214. DOI:

Schiehll, E., & Kolahgar, S. (2021). Financial materiality in the informativeness of sustainability reporting. Business Strategy and the Environment, 30(2), 840-855. DOI:

Sharma, R. B., Lodha, S., Sharma, A., Ali, S., & Elmezughi, A. M. (2022). Environment, Social and Governance Reporting and Firm Performance: Evidence from GCC Countries. International Journal of Innovative Research and Scientific Studies, 5(4), 419–427. DOI:

Sulkowski, A., & Jebe, R. (2022). Evolving ESG Reporting Governance, Regime Theory, and Proactive Law: Predictions and Strategies. American Business Law Journal, 59(3), 449-503. DOI:

Suttipun, M. (2021). The influence of board composition on environmental, social and governance (ESG) disclosure of Thai listed companies. International Journal of Disclosure and Governance, 18(4), 391–402. DOI: 10.1057/s41310-021-00120-6

Teng, X., Ge, Y., Wu, K.-S., Chang, B.-G., Kuo, L., & Zhang, X. (2022). Too little or too much? Exploring the inverted U-shaped nexus between voluntary environmental, social and governance and corporate financial performance. Frontiers in Environmental Science, 10. DOI:

Toumi, N. B. F., Khemiri, R., & Makni, Y. F. (2022). Board directors’ home regions and CSR disclosure: evidence from France. Journal of Applied Accounting Research, 23(2), 509–539. DOI:

Vanclay, F., & Hanna, P. (2019). Conceptualizing Company Response to Community Protest: Principles to Achieve a Social License to Operate. Land, 8(6), 101. DOI:

Vitali, T. (2023). ESG Investing Statistics. Investing in the Web. https://investingintheweb.com/education/esg-investing-statistics

Whelan, T., Atz, U., Van Holt, T., & Clark, C. (2021). ESG and financial performance. Uncovering the Relationship by Aggregating Evidence From, 1, 2015–2020.

Xie, J., Nozawa, W., Yagi, M., Fujii, H., & Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Business Strategy and the Environment, 28(2), 286–300. DOI:

Yu, E. P.-y., & Luu, B. V. (2021). International variations in ESG disclosure - Do cross-listed companies care more? International Review of Financial Analysis, 75, 101731. DOI:

Zeidan, R. (2022). Why don’t asset managers accelerate ESG investing? A sentiment analysis based on 13,000 messages from finance professionals. Business Strategy and the Environment, 31(7), 3028–3039. DOI:

Zhou, R., Hou, J., & Ding, F. (2023). Understanding the nexus between environmental, social, and governance (ESG) and financial performance: evidence from Chinese-listed companies. Environmental Science and Pollution Research, 30(29), 73231-73253. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Mustaffa, A. H., Muda, R., Bahrudin, N. Z., & Malik, H. K. A. (2023). A Meta-Analysis of ESG Disclosure and Listed Companies’ Financial Performance. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 655-669). European Publisher. https://doi.org/10.15405/epsbs.2023.11.56