Abstract

This bibliometric analysis provides an overview of the transfer pricing research landscape from 1983 to 2022 for a period of 40 years. The study includes 319 papers from the SCOPUS database and employs a variety of bibliometric indicators, such as citation analysis, co-citation analysis, and keyword analysis. The findings reveal that the number of articles on transfer pricing has steadily increased over the last four decades, with a substantial increase in the last ten years. The analysis lists the most influential journals, authors, and institutions in transfer pricing research. The citation analysis identifies the most prominent papers and authors in the field, whereas the co-citation analysis identifies the major transfer pricing themes and research clusters. The study also analyses the most used keywords and their co-occurrence patterns, which provide insights into the major transfer pricing research themes and trends. Overall, this bibliometric analysis gives a thorough overview of transfer pricing research, highlighting key contributors, themes, and trends in the field. The study's findings may be useful to researchers, practitioners, and policymakers interested in transfer pricing and related topics.

Keywords: Bibliometric Analysis, Co-Authorship, Transfer Pricing

Introduction

Transfer pricing in Malaysia is a form of taxation in which companies are allowed to set the price to transfer goods and services between separate business entities within their own corporate structure. This can be for multiple reasons, such as for sale to third-party customers or facilitating the intercompany transfer of goods and services. The transfer of goods and services between entities of a group can be used for strategic purposes, such as moving profits and losses to a different jurisdiction for various accounting, tax, or legal reasons (Ruggie, 2018). The arm's length principle is used to determine the transfer price of such transactions, so the price charged is based on the hypothetical transaction between unrelated, independent parties.

The Malaysian government has enacted regulations and guidelines to ensure that transfer pricing rules are adhered to. These rules are designed to ensure that multinational enterprises (MNEs) operating in Malaysia do not artificially shift income to low-tax jurisdictions, using transfer pricing (Butarbutar, 2022; Sebele-Mpofu, Korera, et al., 2021). Under Malaysian transfer pricing rules, companies must calculate the arm's length price by comparing the related company's transactions with those that would be made between unrelated companies in similar circumstances (Mazur, 2016).

In addition, there are requirements for the documentation of transfer pricing activities. MNEs operating in Malaysia must create a specific transfer pricing documentation file, which should outline their transfer pricing policies and provide evidence of their application (Sebele-Mpofu, Schwartz, et al., 2021; Sebele-Mpofu, Korera, et al., 2021). The relevant information includes, but is not limited to, detailed information on the corporate group structure, external market conditions, financial information, descriptions, and terms of the inter-company transaction, comparables used, and a detailed economic analysis of the identified transfer pricing issues (Ting, 2014). This information must be kept for at least five years, should there be any request for scrutiny by tax authorities.

Transfer pricing is a significant area for the Malaysian government and has been the focus of their clamp-down on aggressive tax planning and avoidance. Revenue authorities in Malaysia have the power to adjust transfer pricing arrangements and to demand additional tax liabilities, should they find evidence of any transfer pricing deception (Picciotto, 2018; Riedel & Zinn, 2014). It is, therefore, recommended that companies operating in Malaysia ensure they have effective transfer pricing policies and documentation. Meanwhile, they are also encouraged to engage a third-party taxation professional to provide assistance and ensure that their transfer pricing activities remain compliant with Malaysian transfer pricing regulations (Koerner et al., 2022).

This study differs from other studies in that it focuses on the names of the writers who contributed to the body of knowledge about transfer pricing. Aside from that, this study focuses on the co-authorship network trend based on the unit of analysis of authors and countries. Moreover, this study has used VOSviewer software to analyse those elements mentioned earlier. It has examined a total of 319 articles for bibliometric analysis published from 1983 to 2022 in the SCOPUS database-indexed journals. Finally, to the best of our knowledge, this is the first study in the transfer pricing literature to employ bibliometric analysis on the names of authors and co-authorship network which are based on the authors and countries as the unit of analysis in the subject by year, up to the end of 2022.

Literature Review on Transfer Pricing

There are several issues surrounding the topic of transfer pricing. First, to determine the transfer prices among group companies. Transfer pricing policies should be formulated in a way that considers the local laws and regulations in the locations of the group companies, as well as the cost of inputs, the standard prices in the market, the economic situation in each country, and the characteristics of the business, among other factors. Second, overcoming information asymmetry. Despite efforts to reduce information gaps or asymmetries, there is still not enough knowledge of transfer pricing techniques and pricing-related information between trading partners, which often proves to be a hindrance to trade and reduce tax revenue.

Third, establishing transfer prices in multinational enterprises. Multinational Enterprises, or MNEs, operate under different economic and financial conditions than companies based in one country, and establishing transfer prices can be complicated and costly. Fourth, setting up effective transfer pricing mechanisms: Many countries have failed to set up effective transfer pricing mechanisms due to a lack of knowledge about the subject, problems with gathering data, and political opposition in some countries. Fifth, double taxation. Due to discrepancies in the tax laws of various countries, companies can end up being double-taxed due to transfer pricing mistakes or by taking advantage of different rates of taxation in different countries. This has become a major issue, along with the shift to a global economy.

Transfer Pricing in Malaysia

Malaysia is also not left behind with the issues pertaining to transfer pricing. First, multinationals' usage of aggressive tax strategies. Multinationals often establish their holding companies and sales companies in Malaysia and use aggressive transfer pricing policies to lessen the tax liability in Malaysia (Hamid et al., 2016). Second, avoidance of legal tax obligations. Transfer pricing manipulations are often used to move profits abroad, resulting in the avoidance of legal tax obligations (Amidu et al., 2019; Idris et al., 2015; Suffian et al., 2015). Third, limited resources for transfer pricing investigations. With limited resources for transfer pricing investigations and investigations that are limited to only one tax year, identifying violations and preventing tax avoidance can be difficult in Malaysia (Ariff et al., 2023; Sari et al., 2021).

Fourth, weakness in transfer pricing as described in law. The transfer pricing law in Malaysia lacks effective regulations and there is no clear guidance on how and when transfer pricing should be implemented (Nguyen et al., 2019). Fifth, limited auditing capacity. There is a limited capacity for auditing transfer pricing arrangements due to the lack of resources and the high cost of auditing (Sanusi et al., 2017; Sebele-Mpofu, Schwartz, et al., 2021). Furthermore, even if errors are found, the penalties imposed can sometimes be too low.

Issues and Problems with Transfer Pricing

In the world, as global economic and financial activities have become more complex, governments have found it increasingly difficult to effectively monitor international trade between companies and individuals to collect fair revenues from taxation. One concern of governments is the use of transfer pricing strategies to reduce international tax payments. Transfer pricing occurs when two related parties, such as two multinational subsidiaries, buy and sell goods and services from one another (Antić et al., 2015). Misaligned transfer prices can enable the related parties to reduce the amount of taxes they pay in multiple countries. This kind of income redistribution shifts taxable income away from higher-taxed countries to lower-taxed countries, thereby depriving many governments of valuable tax revenue (Prebble & Prebble, 2010).

In Malaysia, transfer pricing has become an important issue, as large transnational corporations increasingly use it to reduce the amount of taxes they pay. Transfer pricing activities can stretch from low-level intra-firm transactions involving goods and services, to high-level activities involving capital transfers and intellectual property rights (Mura et al., 2013). Moreover, large companies can use transfer pricing to unfairly manipulate price structures and circumvent tax regulations, allowing them to take advantage of Malaysian investment incentives and enjoy tax holidays or preferential tax rates (Janský & Prats, 2015). This can disincentivize local companies and businesses from pursuing fair and equitable trade, as well as reduce the value of taxes collected from large multinational companies. To combat the issues of transfer pricing in Malaysia, the Inland Revenue Board (IRB) has begun implementing specific measures such as introducing a Transfer Pricing Documentation (TPD) requirement, enforcing the Transfer Pricing Guidelines issued by the Ministry of Finance, and imposing higher penalties for non-compliance with transfer pricing regulations.

Research Methodology

The bibliometric methodology encapsulates the application of quantitative techniques (i.e., bibliometric analysis – e.g., year, subject, source, country, author, and affiliation. Data was collected from the SCOPUS database. It represents the highest available quality of journals and articles in the field of social sciences and is widely used in conducting studies such as bibliometric analysis (Bergman, 2012). The idea of this method is based on the analysis of database research following to decipher how to target the highest quality articles and reviews on transfer pricing (Archambault et al., 2009). It has been a focus of past researchers to make use of the ‘bibliographic’ web versions of the database (Archambault et al., 2009).

It is critical to the success of our data collection, as the accuracy in picking the right keyword highly affects the results number. To ensure the selection of all or most of the related papers from the SCOPUS database, this study adopted this query which was chosen after careful consideration: TITLE-ABS-KEY ( transfer AND pricing ) AND PUBYEAR > 1982 AND PUBYEAR < 2022 AND ( LIMIT-TO ( DOCTYPE , "ar" ) ) AND ( LIMIT-TO ( LANGUAGE , "English" ) ) AND ( LIMIT-TO ( EXACTKEYWORD , "Transfer Pricing" ) ). The rationale behind using this query is limit the publication year from 1983 until 2022 and all the publications must be written in English Language. This also includes the publication of articles based only on researchers to express this topic. Hence, this query is more likely to bring most of the papers related to this topic, especially when searching in the topic area.

Initially, the articles and reviews on the related field are more than a thousand. However, this study has conducted several ways to exclude and include irrelevant papers. To ensure that the collected data is of direct relation to the designated aim rather than discussing the topic in a non-marginal and non-flimsy way, this study has undergone a careful and cursory examination of the tile and abstract of each article to include or exclude irrelevant papers (Hassan et al., 2023; Suffian et al., 2023). Thus, the final sample of the data in this study is 319 articles and reviews that remain. The final data covers the period of 40 years from year 1983 until 2022.

Findings and Discussion

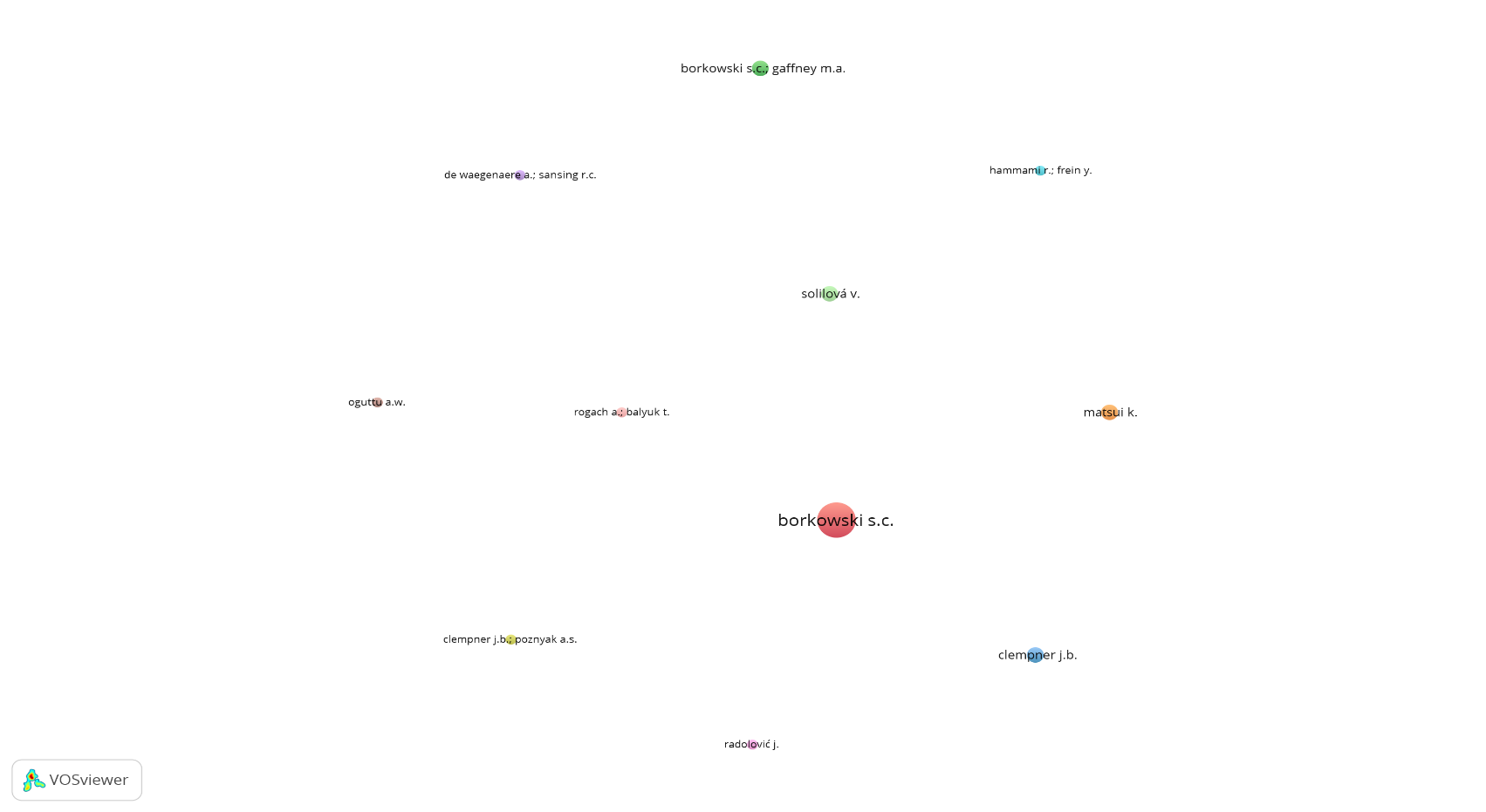

Co-authorship based on Author

According to Figure 1, 11 authors out of 299 authors met the thresholds. It indicates that each author has at least two publications published in SCOPUS journals between 1971 and 2022. According to the analysis, 6 authors have published at least 2 articles; 4 authors with 3 publications; and 1 author with 7 publications. Countries are represented as nodes in the network above, and co-authorship ties are shown as edges. This graphic depiction can provide a clear sense of the overall co-authorship landscape among the countries that have been chosen. According to the figure above, all 11 authors have contributed to the publications in transfer pricing within the dataset. It demonstrates that all the authors chosen are influential and prolific authors who actively participate in research collaborations. Nonetheless, no clusters or subgroups of authors commonly collaborate with one another. As a result, there is a scarcity of possible research networks or theme areas for collaboration. It also reveals the writers' unusual research interests or shared ties.

The study may successfully explain the co-authorship trends among the selected authors based on the minimal document criterion by using this approach. It can discover prolific authors, highlight collaboration clusters, uncover interdisciplinary collaborations, and investigate author partnership dynamics. Such findings can help writers gain a better understanding of research relationships and encourage further study of prospective collaborative prospects.

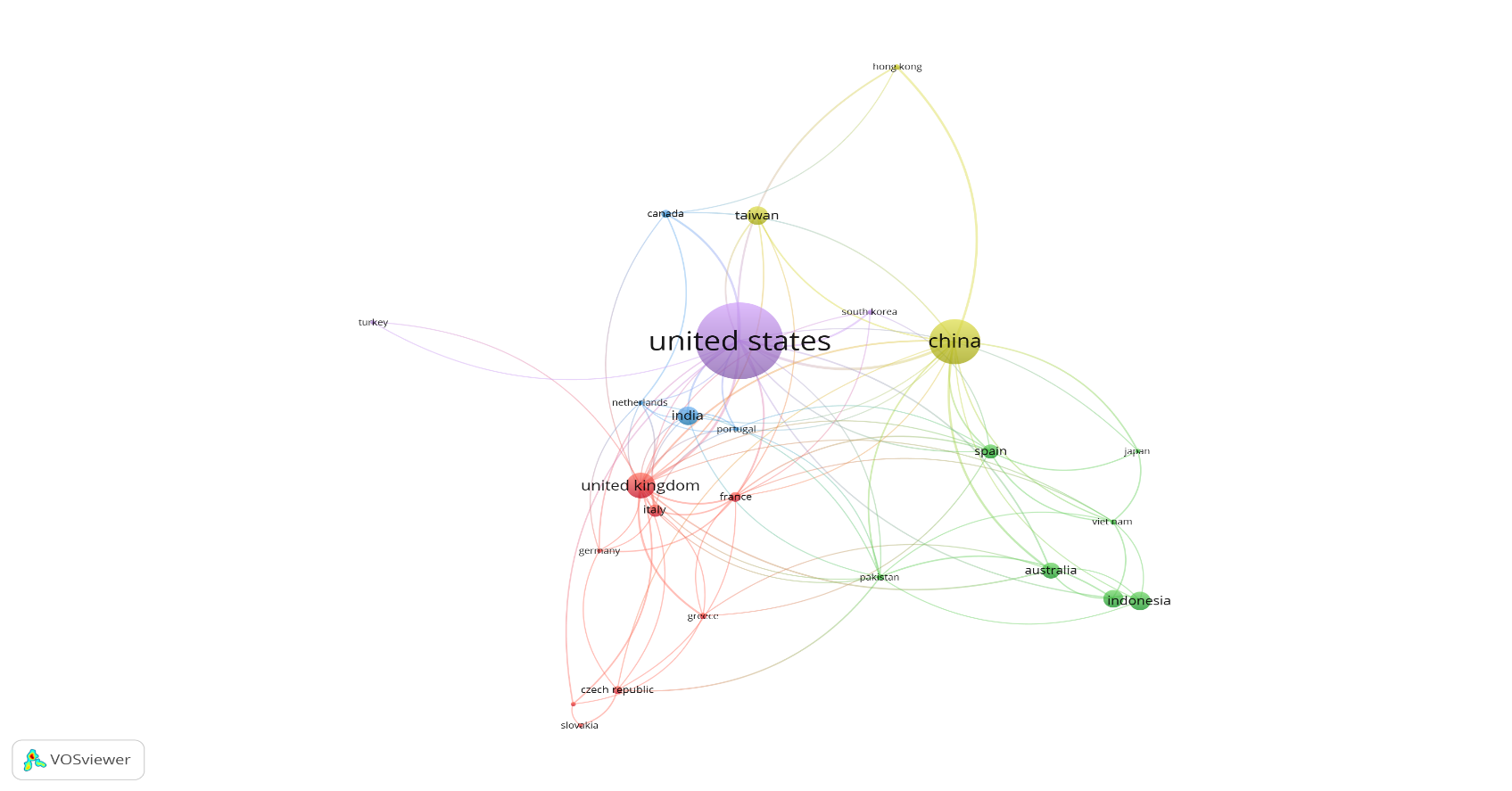

Co-authorship based on Countries

According to Figure 2, there are 18 countries that are linked to one another. Initially, there were 66 countries; however, after limiting to a minimum document of a country of 5, only 18 countries met the thresholds and connected from one to another. Countries are represented as nodes in the network above, and co-authorship ties are shown as edges. It depicts the pattern throughout the 18 countries. This graphic depiction can provide a clear sense of the overall co-authorship landscape among the countries that have been chosen (Robertson et al., 2020).

According to the figure above, the United States has the most collaborations inside the dataset. China and the United Kingdom follow. It demonstrates that these three world powers have already built robust research networks and collaborative alliances. It can also provide insights into the countries that actively participate in international research cooperation.

The analysis can provide a full understanding of co-authorship patterns among countries in the context of the minimal document threshold by presenting and debating these findings. It can provide insights into countries that actively participate in research collaborations, highlight regional or theme patterns, and propose possible areas for more research and collaboration.

Conclusion

In conclusion, this bibliometric analysis on transfer pricing spanning a period of 40 years (1983-2022) provides valuable insights into the research landscape, collaboration patterns, and global trends within the field. The analysis considered both co-authorship on authors and co-authorship on countries, revealing important findings that contribute to our understanding of transfer pricing research.

Regarding co-authorship of authors, the study identified influential authors who have made significant contributions to the transfer pricing of literature over the past four decades. These authors played a crucial role in shaping the research landscape and fostering collaborations within the field. Their expertise and prolific output indicate their impact on advancing knowledge in transfer pricing. The findings highlight the importance of these authors as thought leaders and potential collaborators for future research endeavors.

In terms of co-authorship on countries, the analysis uncovered patterns of collaboration among countries in transfer pricing research. It identified countries that actively engage in research collaborations, suggesting the existence of cross-national partnerships and knowledge-sharing initiatives. The findings also revealed potential regional clusters or thematic groups that display higher levels of collaboration, indicating the influence of regional dynamics on research activities in transfer pricing.

Moreover, this bibliometric analysis provides insights into the evolving research themes and trends within transfer pricing. Key research themes identified include transfer pricing methods, MNE strategies, tax policy implications, transfer pricing documentation, and transfer pricing enforcement. These themes reflect the areas of focus and evolving challenges in the field over the past 40 years. The analysis also sheds light on the evolution of research topics, methodological approaches, and geographic distribution of research contributions, providing a comprehensive understanding of the changing dynamics of transfer pricing research over time.

By incorporating the co-authorship analysis on authors and countries, this study contributes to the identification of influential authors, potential research collaborations, and regional research networks within the transfer pricing field. These insights can guide future research efforts, facilitate cross-disciplinary and cross-national collaborations, and inform policymakers and practitioners on effective strategies and practices in transfer pricing.

However, it is important to acknowledge the limitations of the study. The bibliometric analysis provides a quantitative assessment of research output and collaborations, but it may not capture the full depth and nuances of the transfer pricing literature. Further research that combines quantitative analysis with qualitative approaches, case studies, and empirical research is encouraged to gain a more comprehensive understanding of transfer pricing practices, challenges, and implications in the global business environment.

Overall, this bibliometric analysis provides a valuable foundation for future research, collaboration, and evidence-based decision-making in the field of transfer pricing. The identified influential authors, collaboration patterns, and emerging research themes contribute to the advancement of knowledge and promote a deeper understanding of transfer pricing practices and their implications in the context of international taxation.

Acknowledgments

We would like to extend our gratitude to the Accounting Research Institute and Universiti Poly-Tech Malaysia for funding this research under the Integrating Trustworthy Framework in Digital Auditing Readiness of Public Sector Auditors (100-TNCPI/PRI 16/6/2 (048/2022) grant. We would also like to thank the anonymous reviewers of the International Conference in Technology, Humanities and Management (ICTHM2023), Turkey for their valuable insights and comments.

References

Amidu, M., Coffie, W., & Acquah, P. (2019). Transfer pricing, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime, 26(1), 235-259. DOI: 10.1108/jfc-10-2017-0091

Antić, L., Jovanović, T., & Guduric, J. (2015). Determination of transfer pricing in multinational companies. Facta Universitatis, Series: Economics and Organization, 12(1), 27-39.

Archambault, É., Campbell, D., Gingras, Y., & Larivière, V. (2009). Comparing bibliometric statistics obtained from the Web of Science and Scopus. Journal of the American society for information science and technology, 60(7), 1320-1326. DOI:

Ariff, A., Wan Ismail, W. A., Kamarudin, K. A., & Mohd Suffian, M. T. (2023). Financial distress and tax avoidance: the moderating effect of the COVID-19 pandemic. Asian Journal of Accounting Research, 8(3), 279-292. DOI:

Bergman, E. M. L. (2012). Finding citations to social work literature: The relative benefits of using Web of Science, Scopus, or Google Scholar. The journal of academic librarianship, 38(6), 370-379. DOI:

Butarbutar, R. (2022). Legal Formulation to Overcome Base-Erosion and Profit-Shifting Practices of Digital-Economy Multinational Enterprise in Indonesia. PADJADJARAN JURNAL ILMU HUKUM (JOURNAL OF LAW), 9(3), 323-342. DOI:

Hamid, A. A., Arshad, R., & Pauzi, N. F. M. (2016). The Prediction of Transfer Pricing Manipulation among Public Listed Companies in Malaysia. Management & Accounting Review (MAR), 15(1), 341-361.

Hassan, M. K., Alshater, M. M., Banna, H., & Alam, M. R. (2023). A bibliometric analysis on poverty alleviation. International Journal of Ethics and Systems, 39(3), 507-531. DOI: 10.1108/ijoes-10-2021-0191

Idris, A., Mohd Sanusi, Z., & Mohd Suffian, M. T. (2015). The Influence of Monitoring Mechanisms and Opportunistic Behaviors Toward Earnings Management. In A New Paradigm for International Business: Proceedings of the Conference on Free Trade Agreements and Regional Integration in East Asia (pp. 247-269). Springer Singapore.

Janský, P., & Prats, A. (2015). International profit‐shifting out of developing countries and the role of tax havens. Development policy review, 33(3), 271-292. DOI:

Koerner, S. A., Siew, W. S., Salema, A. A., Balan, P., Mekhilef, S., & Thavamoney, N. (2022). Energy policies shaping the solar photovoltaics business models in Malaysia with some insights on Covid-19 pandemic effect. Energy Policy, 164, 112918. DOI:

Mazur, O. (2016). Transfer pricing challenges in the cloud. BCL Rev., 57, 643.

Mura, A., Emmanuel, C., & Vallascas, F. (2013). Challenging the reliability of comparables under profit-based transfer pricing methods. Accounting and Business Research, 43(5), 483-505. DOI:

Nguyen, H. N., Tham, J., Khatibi, A., & Azam, S. M. F. (2019). Enhancing the capacity of tax authorities and its impact on transfer pricing activities of FDI en-terprises in Ha Noi, Ho Chi Minh, Dong Nai, and Binh Duong province of Vietnam. Management Science Letters, 1299-1310. DOI: 10.5267/j.msl.2019.4.011

Picciotto, S. (2018). Problems of transfer pricing and possibilities for simplification’: ICTD Working Paper 86. Brighton: International Centre for Tax and Development.

Prebble, R., & Prebble, J. (2010). Does the use of general anti-avoidance rules to combat tax avoidance breach principles of the rule of law-a comparative study. Louis ULJ, 55, 21.

Riedel, N., & Zinn, T. (2014). The Increasing Importance of Transfer Pricing Regulations: A Worldwide Overview. Intertax, 42(Issue 6/7), 352-404. DOI: 10.54648/taxi2014038

Robertson, J., Pitt, L., & Ferreira, C. (2020). Entrepreneurial ecosystems and the public sector: A bibliographic analysis. Socio-Economic Planning Sciences, 72, 100862. DOI:

Ruggie, J. G. (2018). Multinationals as global institution: Power, authority and relative autonomy: Multinationals as global institution. Regulation & Governance, 12(3), 317-333. DOI: 10.1111/rego.12154

Sanusi, S., Omar, N., Sanusi, Z. M., & Noor, R. M. (2017). Moderating effect of audit probability on the relationship between tax knowledge and goods and services tax (GST) compliance in Malaysia. Pertanika Journal of Social Sciences and Humanities, 25(11), 231-240.

Sari, D., Utama, S., Fitriany, & Rahayu, N. (2021). Transfer pricing practices and specific anti-avoidance rules in Asian developing countries. International Journal of Emerging Markets, 16(3), 492-516. DOI: 10.1108/ijoem-10-2018-0541

Sebele-Mpofu, F. Y., Mashiri, E., & Korera, P. (2021). Transfer Pricing Audit Challenges and Dispute Resolution Effectiveness in Developing Countries with Specific Focus on Zimbabwe. Accounting, Economics, and Law: A Convivium, 0(0). DOI: 10.1515/ael-2021-0026

Sebele-Mpofu, F., Mashiri, E., & Schwartz, S. C. (2021). An exposition of transfer pricing motives, strategies and their implementation in tax avoidance by MNEs in developing countries. Cogent Business & Management, 8(1). DOI:

Suffian, M. T. M., Rahman, R. A., Tarmizi, M. A., Omar, N., Naomi, P., Akbar, I., & Mayasari, I. (2023). Earnings Management: A Study from Bibliometric Analysis. International Journal of Academic Research in Accounting, Finance and Management Sciences, 13(1). DOI:

Suffian, M. T. M., Sanusi, Z. M., Osman, A. H., & Azhari, M. I. M. (2015). Manipulation of Earnings: The Pressure of Opportunistic Behavior and Monitoring Mechanisms in Malaysian Shariah-compliant Companies. Procedia Economics and Finance, 31, 213-227. DOI:

Ting, A. (2014). iTax-Apple's international tax structure and the double non-taxation issue. British Tax Review, (1).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Suffian, M. T. M., Rashid, M. Z. A., Sanusi, Z. M., Mazlan, M. N., Rentah, F., & Puteh, M. S. (2023). The Bibliometric Analysis on Transfer Pricing: Evidence From the Last 40 Years. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 619-627). European Publisher. https://doi.org/10.15405/epsbs.2023.11.53