Abstract

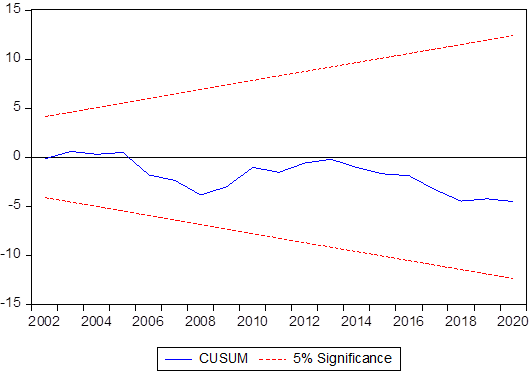

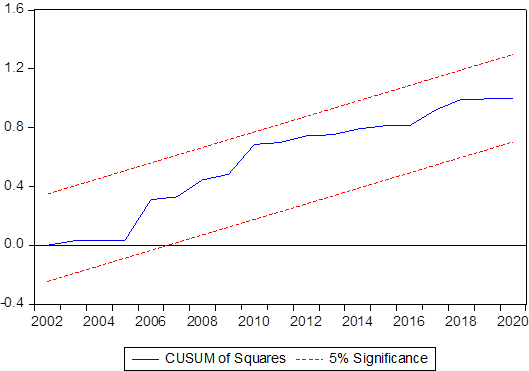

This study examines the determinants of the unemployment rate in Afghanistan using time series data from 1991-2020. More specifically, this research investigates the relationship and impact of GDP, FDI, LF and EX on unemployment in Afghanistan in the long run. The data in this research has been used from the World Bank and United Nations Databases. Auto Regressive Distributed Lag (ARDL) bounds testing approach has been applied for the investigation of the long-run relationship between the dependent variable (Unemployment) and the independent variables (GDP, FDI, Labour Force and Export). The findings indicate that FDI, Labour Force (LF) and Export (EX) have a negative and insignificant relationship with unemployment (UN). On the other hand, GDP has a negative and significant relationship with unemployment in the long run. Furthermore, several diagnostic tests are conducted to check the model's stability. The CUSUM and USUMSQ test results showed that this method is stable and has parameters.

Keywords: Afghanistan, Export, FDI, GDP, Unemployment, Labour Force

Introduction

According to the World Bank, Unemployment refers to the Labour Force percentage who currently do not have a job and searching for one. In other words, a typical description of jobless people includes people who have recently been looking to be employed, are currently looking for a job, have lost their job, or have chosen to leave their current job.

Additionally, based on the International Labor Organization (ILO), unemployed people are those who are without a job, searching for a job, and have wanted a job in the last recent four weeks and are currently available to start working in the next two weeks or have found a job and are awaiting to start it in the next two weeks but are unemployed.

The measurement of the unemployment rate in Afghanistan is the people who actively search to get a job as a member of the Labour Force. In addition, the unemployment rate in Afghanistan increased in 2021 by 13.30 percent, as it was 11.20 percent in 2021 (World Bank, 2023).

The economic situation in Afghanistan has been going through major challenges since the fast withdrawal of international security forces and international institutions between 2012 and 2014. In particular, it has influenced significantly on reducing foreign assistance and investment. The policymaker described the transition during this period of significant changes to the nation’s security and financial infrastructure (World Bank, 2012).

Collier (2009) investigated that the role of employment is complex in a conflict or post-conflict setting in a country like Afghanistan, and it requires a more sophisticated understanding. He described the uniqueness of the economic measures needed to promote post-conflict rehabilitation.

In many ways, Afghanistan is exceptional, not the least of which is its terrain and history. The country's backbone is the Hindu Kush, a vast mountain range that forms the western stub of the Himalayas. Afghanistan, which encompasses the Pamir Mountains and the plains and hills south and north of them, is described as "the meeting place of four ecological and cultural areas: the Middle East, Central Asia, the Indian Subcontinent, and even the Far East" due to the Pamir Mountains' encroachment into Chinese Sinkiang (Dupree, 2014).

Foreign direct investment (FDI) in a country has a significant role in providing the capital necessary for domestic investment and job creation and providing managerial and technological allocation, as it plays a vital role in the economic growth and development of the country. However, reducing foreign direct investment caused a country to seek other alternatives, negatively impacting economic growth and employment opportunities (Haidery, 2020).

For all developing and emerging nations, FDI has been increasingly important during the past three decades for boosting economic growth. Numerous studies demonstrate how FDI advances technology, fosters the development of human capital and employment opportunities, promotes trade integration, improves the business environment's competitiveness, boosts income growth, and ultimately leads to economic development in both the host and home countries and it can reduce unemployment in the host countries (Dunning, 2000; United Nations Conference on Trade and Development, 2002).

Certain macroeconomic factors influence unemployment in a country; however, in this study, the variables focused on are FDI, GDP, Labour Force, and Export influences in Afghanistan. Some empirical analysis shows that foreign direct investment (FDI) influences a country's productivity and GDP growth more than domestic investment. Therefore, FDI plays a crucial role in reducing poverty as it helps the country experience high economic growth, improve economics, and reduce unemployment. Furthermore, besides economic advantages, FDI is critical to helping the host country with social and environmental improvements and creating job opportunities to reduce unemployment (Haidery, 2020).

Moreover, studies on the impact of export on unemployment found different results. For example, Gocer et al. (2013) and Doğan (2012) indicated a negative relationship between export and unemployment. On the other hand, Ozughalu and Ogwumike (2013) and Aktar et al. (2009) investigated that export has no impact on unemployment.

Literature Review

The impact of macroeconomic variables on unemployment in a country represents a direct threat to the stability of a nation socially and economically (Abouelfarag & Qutb, 2021). Furthermore, the unemployment rate is affected by many macroeconomic factors. Therefore, this study used specific macroeconomic variables such as GDP, FDI, Labour Force and Exports to determine the relationship between these variables and the unemployment rate in Afghanistan.

Unemployment has been considered one of the most critical problems in macroeconomics and is one of the challengeable matters to overcome. Moreover, the impact of FDI on unemployment has gained even more significance in light of the nation's important macroeconomic indicators during the world's financial and economic crisis. Therefore, the government must adopt a better policy to provide a business environment and a suitable marketplace for foreign capital, which will impact job creation and reduction of unemployment (Nikolaev & Stancheva, 2013).

Malley and Molana (2007) indicated that the relationship between unemployment and GDP is generally believed to be governed by Okun’s law. Furthermore, Adanu (2005) points out that Arthur Okun (1962) examined an inverse relationship between unemployment and output using the U.S. GNP data. Okun’s law describes the relationship between GDP, and this law is the most famous idea in macroeconomic theory. Okun discovered in his original research that a 3% rise in GDP growth rate (above the typical rate) was projected to cut the unemployment rate by one percentage point (Altig et al., 1997; Walterskirchen, 1999).

Moreover, Okun’s law investigated the relationship between GDP and unemployment. Okun's law examines the statistical correlation between a nation's unemployment rate and its rate of economic expansion. Okun discovered that a 1% drop in unemployment was linked to a 3% rise in output. The 3 to 1 ratio has come to be known as Okun's law (Blanchard & Fischer, 1989).

Furthermore, Rigas et al. (2011) investigated Okun’s law which applies to the current economic environment. This study used data on unemployment and the GDP from 1960-2007 in three countries, including Greece, Spain and France. According to the findings of this research, the connection between unemployment and GDP is negative. However, due to the rise in Greece's unemployment, there will be a less severe loss in economic output.

Higher levels of unemployment are frequently associated with labour market institutions that are more rigid and may prevent the development of new jobs, according to several ideas and prior empirical investigations on the relationship between unemployment and the labour force (Cain, 1967).

Aqil et al. (2014) investigated how GDP growth, inflation, FDI, and population increase affected Pakistan's unemployment rate. According to the analysis, neither GDP growth nor inflation significantly affects unemployment. However, there is a significant and adverse impact of FDI and population growth on unemployment. This situation means the country's unemployment rate will decrease due to increasing FDI and population growth.

Gocer et al. (2013) examined the influence of export and foreign direct investment on unemployment using data from 2000 – 2011 in Turkey. The empirical finding shows that over the long run, export and foreign direct investments have a decreasing impact on unemployment, and export has a greater significant influence.

Additionally, Foreign Direct Investment (FDI) significantly increased in the 1980s by 20 percent per year and 40 percent during the 1990s (United Nations Conference on Trade and Development, 2003). During the mid-2000s, the largest amount of FDI was seen. The foreign capital is still flowing despite the subprime mortgage crisis, with the mid-2000s witnessing the highest FDI levels ever (United Nations Conference on Trade and Development, 2009).

Furthermore, the unemployment rate is one of the detrimental challenges in Afghanistan. While there is no exact up-to-date data on unemployment in the country, some ground studies indicated an approximate unemployment rate is 60% in Afghanistan (Akbari, 2019). In addition, the International Labour Organization (2022) reported that since the collapse of the previous government of Afghanistan and the Taliban takeover of the country, more than a half million people have lost or been pushed out of their jobs.

Based on the Economic Ministry of Afghanistan report on 2021, economic growth has slowed down during the past five years compared to an average of nearly two-digit growth rates between 2002 and 2014. The average growth rate from 2015 through 2020 was 1.5%. Before the COVID-19 shock, the growth rate rose to 4% in 2019 from 1.3 percent in 2015 before declining to -2 percent in 2020. According to the Income Expenditure and Labour Force Survey 2020, 17.2 million people in Afghanistan are working age, with 8.6 million men and 8.7 million women. According to estimates, the unemployment rate will be 18.6% in 2020, more significant than the 15.2% for men and 32% for women.

There have been conducted certain studies regarding unemployment in Afghanistan, however, this study has used different variables and the most recent years with updated data therefore, this study is the key to understanding unemployment in Afghanistan and the impacts of mentioned variables on unemployment in Afghanistan.

Research Questions

Afghanistan is a developing country. There are not many research studies to investigate and explore the determinants of unemployment and the relationship of unemployment with the Labour Force in this country, hence this paper aims to fill the gap in that research area. In addition to the theories and past studies reviewed above, this study has been tested based on the following questions:

What is the connection between (UN) and (GDP) in the long run?

What is the relationship between (UN) and (FDI) in the long run?

What is the relationship between (UN) and (LF)?

What is the impact of (UN) and (EX)?

Research Objectives

To examine the long-run relationship between GDP (GDP) and the unemployment rate.

To investigate the long-run relationship between FDI (FDI) and the unemployment rate.

To examine the long-run impact of LF (LF) and the unemployment rate.

To analyze the long-run relationship between EX (EX) unemployment rate.

Methodology

This paper used annual data from time series between 1991-2020 in order to explore the determinants of the unemployment rate in Afghanistan. The data have been used in this study are from World Bank and United Nations databases. The study used the variables with the natural log. Autoregressive Distributed Lag (ARDL) model is used to discover the long-run association between the dependent variable which is the unemployment rate (UN), and independent variables such as gross domestic product (GDP), foreign direct investment (FDI), the labour force (LF) and exports (EX). Below is the econometrics model:

LN_UN = β0 + β1 LN_GDP + β2 LN_FDI + β3 LN_LF + β4 LN_EX + εt

UN = Unemployment rate

GDP = Gross domestic product

FDI = Foreign direct investment

LF = Labour Force

EX = Export

Results

To determine the long-run relationship of the variables (dependent and independent), the Autoregressive Distributed Lag (ARDL) model is used. Lag 2 was chosen as the maximum lag. The lag is typically chosen to be 1 or 2 for annual data, but it is up to the researcher to choose a longer lag length for data that occur more frequently (such as quarterly or monthly data) (Bakhshi & Ebrahimi, 2016). The length of optional lags for the ARDL method has been chosen for use in the Akaike Information Criterion (AIC).

Moreover, to eliminate inaccurate regression and confirm that no variables are integrated I (2), by utilizing the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests, the unit root test was conducted to determine whether the order of integration between the variables used in the study is level I (0) or I (1). The result of both Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests show that LF is stationary at level I (0); however, UN, GDP, FDI, and EX are stationary in the first difference I (1).

Test of Bounds for Cointegration

The empirical result of the bounds test in Table 1 depicts that at a 1% significance level, the estimated F-statistics value surpasses the upper bound critical value. The lesser and higher bound have critical values of 3.81 and 4.92, respectively, at a 1% significant level. Nevertheless, the computed F-statistic is 5.509, greater than the upper bound value. Therefore, this study does not refute the alternative hypothesis, which assumes that there is cointegration among variables. Thus, this research has a long-run relationship between the study variables since this study verifies the bounds test of cointegration and the long-run relationship between variables. Hence, the ARDL model is used to estimate the values of the long-run coefficients.

Long-run Relationship

Table 2 displays the finding of ARDL in the long run. Based on the long-run result, there is a negative and significant relationship between LUN and LGDP. A 1 % increase in GDP per capita will decrease the unemployment rate by 0.29 in the long run in Afghanistan. Okun’s law supports this result. However, LFDI, LLF and LEX have a negative and insignificant association with LUN.

Diagnostic, QUSUM and QUSUMSQ tests

To evaluate the stability of the method, QUSUM and QUSUMSQ tests and numerous diagnostic tests (serial correlation, model specification, residual normality, and heteroscedasticity) have been conducted. The result of diagnostic tests which is illustrated in Table 3 describes that model is correctly specified, it is homoscedastic, does not have a serial correlation problem and all of the residuals are normally distributed. As well as the result of CUSUM and CUSUM of Squares confirms the stability of the model. Figures (1) and (2) below exhibit the results of CUSUM and CUSUMQS, respectively.

Conclusion and Recommendations

This study aims to indicate the impact of macroeconomic variables on the unemployment rate in Afghanistan. Unemployment is one of the world's most complex debates and economic problems. The variables in this study have been used are GDP, FDI, LF, EX and unemployment rate. Based on the findings of the study a raise in GDP decreases unemployment at a significant level in Afghanistan. This result is in line with Okun’s law. However, FDI, labor force and export have a negative relation with the unemployment rate but do not have a significant impact.

Based on the result we can investigate that the FDI has negative and insignificant. Therefore, the FDI must be justified to create more job opportunities in Afghanistan, and the policymakers must consider investigating more rural development as the majority of the Afghan population is living in rural areas on the World Bank (2021).

In Afghanistan, most economic growth factors depend on international investors. Therefore, the policymakers may focus more on exports to open opportunities for internal investors and connect the people with the international market to seek jobs and export goods to other countries. It will help the country to create more job opportunities and connections to the international market.

The Afghan government and policymakers should also encourage investors to develop new projects to focus production on exports, fuelled by the market, to create more job opportunities. This will help address the issue of unemployment. Furthermore, enhancing economic expansion and raising labour productivity will lower unemployment.

The government of Afghanistan has to invest in some particular sectors, for example agriculture sector as the majority of the population works on it. Therefore, the government should have some policies to encourage and develop the agriculture sectors to help people increase their household income and reduce the unemployment rate.

For future and further researchers in this area, it is recommendable that may choose different variables and methods of research because of the data limitation and data collection, therefore, in future studies it is important to consider the method and data with different variables.

References

Abouelfarag, H. A., & Qutb, R. (2021). Does government expenditure reduce unemployment in Egypt? Journal of Economic and Administrative Sciences, 37(3), 355-374. DOI:

Adanu, K. (2005). A cross-province comparison of Okun's coefficient for Canada. Applied Economics, 37(5), 561-570. DOI: 10.1080/0003684042000201848

Akbari, M. Z. (2019). The cause and consequences of unemployment in Afghanistan. http://www.outlookafghanistan.net/topics.php?post_id=25164

Aktar, İ., Demirci, N., & Öztürk, L. (2009). Can unemployment be cured by economic growth and foreign direct investment? Sosyal Ekonomik Araştırmalar Dergisi, 9(17), 452-467.

Altig, D., Fitzgerald, T. J., & Rupert, P. (1997). Okun's law revisited: should we worry about low unemployment? Economic Commentary.

Aqil, M., Qureshi, M. A., Ahmed, R. R., & Qadeer, S. (2014). Determinants of Unemployment in Pakistan. International Journal of Physical and Social Sciences, 4(4), 676-682.

Bakhshi, Z., & Ebrahimi, M. (2016). The effect of real exchange rate on unemployment. Marketing and Branding Research, 3(1), 4-13. DOI:

Blanchard, O., & Fischer, S. (1989). Lectures on macroeconomics. MIT Press.

Cain, G. G. (1967). Unemployment and the Labor-Force Participation of Secondary Workers. Industrial and Labor Relations Review, 20(2), 275. DOI: 10.2307/2520793

Collier, P. (2009). Post-conflict Recovery: How Should Strategies Be Distinctive? Journal of African Economies, 18(Supplement 1), i99-i131. DOI:

Doğan, T. T. (2012). Macroeconomic variables and unemployment: the case of Turkey. International Journal of Economics and Financial Issues, 2(1), 71-78.

Dunning, J. H. (2000). The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review, 9(2), 163-190. DOI:

Dupree, L. (2014). Afghanistan (Vol. 818). Princeton University Press.

Gocer, I., Mercan, M., & Peker, O. (2013). Export, foreign direct investment and unemployment: The case of Turkey. Business and Economics Research Journal, 4(1), 103-103.

Haidery, J. (2020). Determinants of FDI Inflow in Afghanistan During 2002-2016. International Journal of Economics, Commerce and Management, VIII, 1, 35-49.

International Labour Organization. (2022), ILO estimates underscore Afghanistan's employment crisis. https://www.ilo.org/asia/media-centre/news/WCMS_834527/lang--en/index.htm

Malley, J., & Molana, H. (2007). The Relationship between Output and Unemployment with Efficiency Wages. German Economic Review, 8(4), 561-577. DOI:

Nikolaev, R., & Stancheva, V. (2013). The effect of foreign direct investment on unemployment in Bulgaria. IZVESTIA–Journal of the University of Economics. –Varna, 14-24.

Okun, A. M. (1962). Potential GNP: Its measurement and significance. Proceedings of the Business and Economics Section: American Statistical Association. Washington.

Ozughalu, U., & Ogwumike, F. (2013). Can economic growth, foreign direct investment and exports provide the desired panacea to the problem of unemployment in Nigeria? Journal of Economics and Sustainable Development, 4(1), 36-51.

Rigas, J., Theodosiou, G., Rigas, N., & Blanas, G. (2011). The Validity of the Okun’s Law: An Empirical Investigation for the Greek Economy. Journal of European Economy, 10(1), 16-38.

United Nations Conference on Trade and Development. (2002). World Investment Report: Transnational Corporations and Export Competitiveness. New York. https://unctad.org/system/files/official-document/wir2002_en.pdf

United Nations Conference on Trade and Development. (2003). World Investment Report 2003: FDI Policies for Development. New York, Geneva. https://unctad.org/system/files/official-document/tdr2003_en.pdf

United Nations Conference on Trade and Development. (2009). World Investment Report 2009: Transnational Corporations, Agricultural Production and Development. New York, Geneva.

Walterskirchen, E. (1999). The Relationship between Growth, Employment and Unemployment in the EU. European Economists for an Alternative Economic Policy (TSER Network), Workshop in Barcelona, 16 to 18 September 1999.

World Bank. (2012). World Development Report 2013: jobs. World Bank. https://openknowledge.worldbank.org/handle/10986/11843

World Bank. (2021). Food Relief for Poor Afghans Amid COVID-19. https://www.worldbank.org/en/news/feature/2021/05/04/food-relief-for-poor-afghans-amid-covid-19

World Bank. (2023). The collection of development indicators is compiled from officially recognized sources. Afghanistan, Labour force. https://thedocs.worldbank.org/en/doc/210d5f24dc33a3460beff3447fceadcf-0310012023/original/Afghanistan-Development-Update-20231003-final.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Barna, E. A., Raofi, N., Mohamed, N., Shafie, N. A., & ., D. (2023). Economic Indicators and Unemployment Trends in Afghanistan: A Time Series Analysis. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 595-603). European Publisher. https://doi.org/10.15405/epsbs.2023.11.51