Abstract

The purpose of this research is to investigate and analyse how various aspects of corporate governance, such as foreign ownership, executive incentives, and transfer pricing, affect tax evasion. The study focuses on conventional banks in Indonesia that were publicly traded on the Indonesia Stock Exchange (IDX) between 2015 until 2019. To achieve the objectives of this study, a purposive sampling method was employed, and a total of 17 banks that met the study's criteria of having foreign ownership and no losses during the study year were selected. The findings of this study reveal that foreign ownership has positive effect on tax avoidance, whereas executive incentives have a negative impact on tax avoidance. In contrast, transfer pricing was found to have no significant impact on tax avoidance among the banks analysed in this study. These results highlight the importance of corporate governance factors in determining tax avoidance practices in conventional banks, as well as the need for further research to better understand the complex interplay between these factors.

Keywords: Foreign Ownership, Mangement Incentives, Tax Avoidance, Transfer Pricing

Introduction

Large funds are needed by the government of a country for regional development from all aspects. Therefore, the government needs to obtain more sources of funding to increase development. Likewise in Indonesia, which is one of the emerging countries in the Asian region, the government is trying to increase revenue from several sources, one of which is taxes. Taxes are one of the largest sources of funding for the government. Based on data from the Ministry of Finance of the Republic of Indonesia in 2016, tax revenues in 2016 contributed 82.72 percent of total state revenues of up to Rp. 1,500 trillion. Taxes are used as a source of funds in the administration of government, public services, and national development.

Based on the Law of the Republic of Indonesia Number 17 of 2003 concerning Indonesian State Finances "Taxes are mandatory contributions to the state by individuals or entities that are coercive and do not receive any direct compensation and are used for the purposes of the state and the prosperity of the people", so taxes are revenue the state originating from tax revenues, non-tax state revenues, and grants from within and outside the country. It is clear that tax revenues will be the main source of revenue for the State Budget (APBN). Although the Indonesian government targets tax revenues in 2019 to be IDR 1.577 trillion, the actual realized amount is IDR 1.332 trillion, or 84.44 percent. Compared to the previous year, the percentage of realization also decreased.

There are several reasons why the tax target was not realized, according to Yustinus Prastowo, Executive Director of the Center for Indonesia Taxation Analysis (CITA) in 2019. These include: 1) the decline in commodity prices is influenced by global economic conditions. 2) Increase in non-taxable income and the amount of government tax benefits, such as tax holidays and tax allowances. 3) Due to the political year in Indonesia, the state was forced to suspend access to further data and information, as well as delay the collection of taxes by various departments.

The decrease in government revenue originates from tax revenues, one of which is due to corporate taxpayers (companies) applying various tax tactics to reduce their tax burden. Likewise, the banking industry, especially in Indonesia, the banking sector contributes significantly in improving people's living standards and progressing the country's economy. This is in accordance with the role of the bank, where the bank is a financial institution whose main business activity is collecting and distributing funds to the wider community, namely the bank functions as an intermediary between parties with excess funds (surplus units) and those in need of deficit units.UK Finance reports around £27.7 billion in tax revenue contributions from their banking sector. However, when compared to the previous year, there was a decrease of 5.8%. One of the reasons is that tax revenues from corporate income taxes and bank levies have decreased.

The banking industry is responsible for all financial and business transactions. This implies that the transaction will provide multiple streams of tax revenue. The potential for tax avoidance in the banking sector is expected to emerge as a result of (i) banks acting as actors in tax avoidance through various schemes; and (ii) a bank that acts as a conduit for third parties to evade tax. Because many business actors avoid paying taxes, the government as a policymaker continues to improve knowledge and public compliance in paying taxes.

One of the government's efforts to anticipate tax avoidance in the banking sector was the abolition of Bank Indonesia Regulation Number: 2/19/PBI/2000. This rule relates to banking secrecy, in which the bank has the right and is obliged to keep all information related to customer deposits. This policy is considered to be an obstacle for the government to obtain banking data information. This is an asymmetric information scenario that generates a moral hazard for banking taxpayers to avoid paying taxes. The Government Regulation in Lieu of Law (PERPU) Number 1 of 2017 was then ratified, allowing banks consumers access to financial information. Because this PERPU is for tax purposes, the tax authorities now have the ability to seek tax revenue targets.

Tax avoidance is a form of tax planning that occurs legally by exploiting loopholes in the tax law system in a country (Armstrong et al., 2015; Crabtree & Maher, 2005; Desai & Dharmapala, 2006; Salihu et al., 2015). Tax avoidance is one of several taxation strategies used by companies or individuals to reduce the tax burden owed without violating existing tax regulations. And it is undeniable that tax avoidance also occurs in banks and financial institutions which are one of the largest sources of tax revenue in every country (Ebi, 2018; Frank et al., 2009; McLaren, 2008). Banks and financial institutions are considered to be able to support the economic activities of a country, which has an impact on increasing tax revenues. However, the development of the banking sector and financial institutions is also recognized as an indicator of economic growth, demand for goods and services so that new investment increases, which also has an impact on tax revenues. So it can be concluded that banks and financial institutions contribute directly or indirectly to tax revenue (Desai & Dharmapala, 2006).

The interest of foreign investors to join commercial banks in Indonesia is increasing. In the last five years from the news that was reported by https://id.investing.com/, there were six national banks that were acquired by foreign parties, including PT Bank BTPN Tbk which was taken over by Sumitomo Mitsui Bank Corporation (SMBC) Japan and PT Bank Danamon Tbk 2018 also joined with the Bank of Japan namely MUFG. In addition, several other national banks have recently received capital from foreign investors, such as PT Bank Bukopin Tbk by Kookmin Bank of South Korea (South Korea) and PT Bank Agris Tbk. Their shares were bought by the Industrial Bank of Korea (IBK).

Gaertner (2014) argues that ownership structure is an important factor that can influence corporate tax avoidance, and therefore requires further research from this perspective. Executives in a company are those who are at the top management level. Top management, which consists of commissioners, managing directors, and directors, is the party with the authority to make decisions. Avoiding tax payments by reducing the amount of the tax burden is usually not done by chance. And executives are directly involved in making tax decisions. Executive incentives are executive behavior that transfers company assets and profits for their own interests, namely in the form of high executive compensation costs, in addition to being beneficial for executives and also beneficial for the company because the tax burden is reduced.

Transfer pricing is one of the company's efforts to manipulate taxes by transferring the price of goods, services, or the selling price of intangible assets to its subsidiaries or related parties or having special relationships in various countries. Transfer pricing is basically indicated as a fair transaction applied between affiliated companies in determining the transfer price. However, in reality, companies deliberately transfer profits to companies affiliated with special relationships in countries that impose low tax rates (Putri, 2019) this makes transfer pricing seen as a negative connotation because it can harm the state. Regarding tax avoidance practices that are carried out aggressively by companies using transfer pricing, there are studies that have been conducted to obtain evidence regarding the effect of transfer pricing on tax avoidance. Treaty shopping is a tax avoidance strategy employed by multinational corporations in addition to transfer pricing. This is also thought to be one of the potential tax avoidance loopholes. The majority of governments do so by levying withholding taxes on foreign affiliates' income and interest payments. To prepare for this, the Indonesian government passed Taxation Law No. 36 of 2008, which for the first time raised the rate on dividends earned by domestic individual taxpayers to 10%. In addition, the Indonesian government has terminated tax treaties with tax haven countries. The government anticipates that applying this strategy will narrow the tax gap between enterprises and people.

One of the transfer price cases was PT. Adaro Energy Tbk, which decided to transfer pricing to one of its Singapore subsidiaries, Coaltrade Service International. Adaro's transfer pricing policy lasted from 2009 to 2017. Based on the calculation that Adaro can pay Rp. 1.75 trillion at a rupiah exchange rate of Rp. 14.000,-, or US$125 million less, Adaro regulates this procedure so that they can pay less taxes in Indonesia than they should. According to Global Witness, Adaro's transfer pricing strategy involves tax fraud through the establishment of a foreign company. Adaro exploits legal snares to sell coal to its company, Coaltrade Service International, at a lesser price than it would to other businesses. Coal is resold to foreign countries at greater prices through its companies. As a result, since Adaro declares earnings that are lower than real profits, taxable income in Indonesia is lower. Despite the fact that Adaro collects resources in Indonesia, their contribution to the country is insufficient, and they are often neglected. Despite the numerous regulations that strictly govern everything from operating licenses to profit sharing, existing regulations still have shortcomings, one of which is due to overlapping regulations and legal loopholes that can be exploited for tax fraud, as demonstrated by the case of PT. Adaro. However, when it comes to assessing taxes, the tax authorities still lack monitoring, which means that tax challenges initiated by the tax authorities typically fail in tax court.

The Indonesian government through the ministry of finance in Law no. 36 of 2008 cut the corporate tax rate from 28 percent to 25 percent in the hope that taxpayers, especially business actors, will be more obedient and adhere to their commitments. However, this does not have an impact on people's willingness to pay taxes. Because there are various ways/loopholes for business people to avoid paying taxes without violating the law, one of which is transfer pricing. Indonesia's tax collection system is based on self-assessment. One of the causes of tax evasion is that this system is a gap for taxpayers to do tax evasion. Self-assessment was implemented on January 1, 1984, based on Law Number 6 of 1983 covering General Provisions and Tax Procedures. Law No. 28 of 2007 is a modification of Law Nos. 9 of 1994 and 16 of 2000. The taxpayer decides the amount of tax payable, pays it directly to the registered tax service office, and reports it under this procedure. Because the tax authorities are not directly involved in the process of computing the taxpayer's income tax, the taxpayer can adjust the income data and the amount of tax to be paid using this self-assessment system.. This is one of the reasons why Indonesia fails to meet its tax revenue target from year to year.

There are so many phenomena of tax avoidance that also occur in various countries in the world. In 2012, tax avoidance is estimated to have cost EU members 1 trillion euros (Rp. 12,000 trillion), with the European Union bearing the brunt of the expense. Tax avoidance is a well-organized operation, as the British experience has shown. HMRC (HM Revenue and Customs) of the United Kingdom investigated the tax reporting of many multinational corporations in late 2012.

Another case in point is that of a coffee shop franchisor from the United States (US). The British Parliament cited the franchisor's financial reports, which reveal a loss of 112 million pounds from 2008 to 2010, as well as the fact that he did not pay corporate income tax in 2011. The franchisor generated a turnover of 1.2 billion pounds between 2008 and 2010, according to investor reports (18 trillion rupiah). Financial statements made as if the corporation was losing money in three ways characterize this franchisor approach. First, it paid royalties to its Netherlands operations for offshore licensing of designs, recipes, and logos. Second, in other nations, paying extremely high interest rates on debt is utilized to expand coffee shops. Third, purchasing raw materials from its Swiss affiliate. However, commodities delivered straight from the manufacturer's nation do not enter Switzerland.

Jihene and Moez (2019) presented contrasting findings, suggesting a positive effect of CEO compensation on tax avoidance. Their research proposed that higher CEO compensation may incentivize executives to engage in aggressive tax planning strategies to reduce tax liabilities and boost their compensation.

Literature Review

Stakeholder Theory

Stakeholder Theory recognizes the importance of considering the interests of all stakeholders in decision-making processes, and this theory can be applied to the banking industry to understand the impacts of executive incentives, foreign ownership, and tax avoidance. With regards to variable research on executive incentives, foreign ownership, and tax avoidance in the banking industry, Stakeholder Theory suggests that these factors can have a significant impact on the interests and outcomes of different stakeholders.

For instance, a study by Javid and Jamil (2021) found that executive incentives had a positive impact on bank performance, but also led to higher risk-taking and potentially negative consequences for other stakeholders. Additionally, foreign ownership can have an impact on stakeholders, as demonstrated by Chen et al. (2018) study, which found that foreign ownership had a positive impact on bank performance but also led to higher agency costs and potentially lower benefits for other stakeholders. Finally, tax avoidance strategies can impact the interests of society and government, potentially leading to negative externalities and costs for other stakeholders.

The company's goal is to balance the interests of all stakeholders in order to survive and compete. This is in line with the application of stakeholder theory. One of the stakeholders is the government. Especially in terms of taxation. When a company follows its tax commitments, the state benefits greatly. Consequently, as a stakeholder, it can assist the government in obtaining tax revenues to fund the country's growth (Freeman et al., 2010)

Positive Accounting Theory

The theory of agency is to assign responsibility for the company's strategic decisions, the principal enters into a contract with another person (agent) (Jensen & Meckling, 1976). The separation of ownership by the Principal and control by the Agent commonly leads to agency difficulties between the two parties in a firm. The principal, as a capital owner, wants to see the value of the company's shares increase as a result of his investment, while the management, whom he has entrusted with its management, wants to be appropriately compensated. This contrast between welfare-seeking goals is crucial.

The basic reason for corporate tax avoidance is alleged to be agency theory. This contributes to the development of knowledge related to tax avoidance practices in Indonesia and the current implementation of corporate governance. It also shows how the government, as a policymaker, can anticipate taxpayer behavior that can affect state revenues from the sector. tax. Income tax is one of the state's biggest revenue sources. When it comes to paying taxes, taxpayers typically aim to reduce their tax burden; this effort is referred to as tax planning.

Tax Avoidance

According to Graham et al. (2014), Tax Avoidance is a business planning approach implemented by management to attain firm objectives. Tax Avoidance is defined by Payne and Raiborn (2018) as the endeavor to exploit tax law uncertainties for the company's benefit. Wang et al. (2019) defines tax avoidance as the legal violation of tax laws to reduce the corporate tax burden through the use of tax rules. Various indicators have been used in the past to measure Tax Avoidance, according to previous research. Effective Tax Rate is one of these (ETR). ETR is deemed capable of measuring the extent of Tax Avoidance if a company's ETR is lower than the industry average ETR. ETR is the ratio of a company's tax liability to its pretax income, calculated by dividing tax expense by pretax income.

Foreign Ownership

In Indonesia, the ownership structure is concentrated in a few owners, giving rise to agency conflicts between majority and minority shareholders (Francis et al., 2017). Dominant shareholders, often known as controlling shareholders, have the capacity to advise top management in making choices that only benefit them and harm the interests of minority shareholders. Management is encouraged to conduct tunneling that is detrimental to minority shareholders with a concentrated ownership structure. Company Ownership, Governance, and Tax evasion: An Interactive Effects (Annuar et al., 2014) examined the factors of company tax evasion, ownership structure, corporate governance, and foreign ownership. According to the findings of his study, board composition may have an interacting effect on government and foreign ownership as possible predictors of business tax evasion.

Tax avoidance in the context of foreign foreign ownership is based on the agency theory, which asserts that businesses with foreign ownership cheat taxes at a higher rate than those without foreign ownership (Salihu et al., 2015). Foreign ownership is meant to promote company governance and prevent tax evasion. The lower the tax avoidance, the bigger the percentage of foreign shares (Fuest & Riedel, 2009).

Executive Incentives

Executive incentives are allegedly compensation to top management or other executives who have contributed to a company to take steps in accordance with the authority entrusted by the employer. These incentives can be in the form of annual bonuses, honorariums, allowances or future career opportunities from company owners. Based on positive accounting theory, both principals and agents have interests and desires to achieve their respective goals. Therefore, executive incentives are expected to provide solutions to agency problems in the form of preventing asymmetric information (information asymmetry) and conflicts of interest (conflict of interest).

Companies that evade taxes as a result of management decisions. Executives will benefit from higher incentives if it is related to tax avoidance, which will push them to improve the company's performance even more. One of these strategies is to engage in tax avoidance actions in order to improve tax payment efficiency.

Research conducted with research variables are tax aggressiveness, tax avoidance; CEO incentives; corporate governance (Annuar et al., 2014). The results show that corporate governance tends to reduce very high levels of tax avoidance and increase superficial levels of tax avoidance, which may be symptoms of over investment by managers. The executives play an important role in determining the level of corporate tax avoidance (Dyreng et al., 2008). The magnitude of the executive's economic influence on tax avoidance is enormous

According to agency theory and positive accounting theory, both the principal and the agent have interests and aim to achieve their respective goals. As a result, executive incentives are designed to address issues such as unequal information agency (information asymmetry) and conflict of interest (conflict of interest).

Transfer Pricing

By shifting the price of products, services, and intellectual property to subsidiaries or associated parties in different states, transfer pricing is one method for manipulating the real tax (Horngren et al., 2012). Transfer pricing is defined as fair transactions between linked entities that are used to produce transfer prices. In reality, firms deliberately shift their revenues to businesses with connections to those in low-tax nations (Richardson et al., 2013). Because it could be detrimental to the state, transfer pricing carries a negative connotation.

Transfer pricing is described in the traditional accounting literature as a method for allocating expenses and revenues among divisions, subsidiaries, and joint ventures in a group of linked organizations (Putri, 2019). Transfer pricing methods are responsive to the opportunity to set value in a consequential way to increase private profits while avoiding paying public taxes. Multinational Enterprises (MNEs) have a tendency to shift profits from high-tax jurisdictions to lower-tax countries (Putri, 2019).

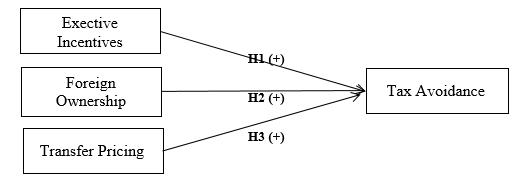

The company uses the transfer price mechanism, among others, to transact goods and services between divisions at unreasonable prices. Then, transfer tax obligations from high-tax countries to low-tax countries. Transfer pricing is defined as fair transactions between linked entities that are used to determine transfer prices. Companies, on the other hand, intentionally move revenues to companies linked with special relationships in countries with low tax rates (Richardson et al., 2013). Because transfer pricing can harm the state, it is associated with a negative connotation. There have been research carried out to acquire evidence regarding the influence of transfer pricing on tax avoidance activities that are carried out aggressively by companies using transfer pricing. Prior study conducted by Sikka and Willmott (2010) revealed how firms in both developing and developed nations use transfer prices to avoid paying taxes. Figure 1 presents the framework of the research.

Framework

Research Method

This study's focus is Indonesian conventional banking firms that go public. The financial statements of banking businesses from 2015 to 2019 were used in this investigation. Purposive sampling was used as the sample methodology. A sampling method that takes into account certain criteria is called purposeful sampling. The following criteria were used to choose the samples: a). Banking is the subject of this study object, which is listed on the Indonesia Stock Exchange from 2015 to 2019; b). The banking firms analyzed did not incur losses throughout the observation period; b) The banking companies studied are held by foreign corporations with an ownership proportion of 20% or more.

The Operational Definition of Variables

This study examines the connections between tax avoidance and three distinct variables: executive incentives, foreign ownership, and transfer pricing. The goal of the study is to determine how the three independent factors affect tax avoidance, which serves as the dependent variable. To aid in a thorough analysis, a thorough description of each independent variable and the dependent variable will be given. Table 1 provides the operational definition of the variables.

Analysis and Discussion

After filtration, only 17 financial institutions satiated all the requirements for this deliberate sampling approach. Table 2 presents the quantity of samples obtained from the study's participants.

Descriptive statistics

The descriptive statistics for each research variable are included in Table 3, together with their mean, maximum and lowest values and standard deviation. Based on the processed model, the following statistics were calculated:

Foreign Ownership (FOR)

Foreign Ownership has a mean value of 0.67997 and a standard deviation of 0.258067. This indicates that the data for this variable are evenly distributed because the mean value is bigger than the standard deviation.

Executive incentives (INS)

INS variable has an average value (mean) of 0.067851 and a standard deviation value of 0.055726, according to data processing using Eviews 9 software. This means that the average value (mean) is higher than the standard deviation, indicating that the data for this variable is evenly distributed.

Transfer Pricing (TP)

The transfer pricing variable has an average value (mean) of 0.021044 and a standard deviation of 0.048214. This shows that the mean value, or average value, is lower than the standard deviation, showing that the data for this variable is not uniformly distributed.

Panel Data Regression Analysis

To select the best acceptable model to use in the inquiry from the common effect model, fixed effect model, and random effect model.

The Chow Test

The research model's usage of the common or fixed effect is decided by the Chow test. The Chi-Square cross-section has a probability value of 0.0131 as a result of the probability value. The equation regression findings in this study were based on a fixed-effect model and the Hausman test was used since this value is less than 0.05.

The Hausman Test

The Hausman test is used to determine whether a random effect or fixed effect probability value of 0.4827 will be employed in the research model. Because this number is more than 0.05, the regression equation results in this study were based on a random effect model.

Lagrange Test

The Breusch-Pagan cross-section has a probability value of 1.79 according to the Lagrange test of the processed data. This figure exceeds the 0.05 threshold of significance. We may draw a conclusion from the Common Effect Model, the suitable regression model employed in this study.

Normality Test

A normality test determines whether the study sample has a normal distribution. For a good regression model, the study data should be consistently distributed with a significant probability of 0.05 or 5%. Because one of the requirements for completing panel data regression analysis is that the data be distributed in a regular manner. According to the results of data processing using Eviews 9, all variables are normally distributed. The fact that the Jarque-Bera probability value is greater than 5%, exactly 0.164379. Based on these findings, it can be claimed that the data are normally distributed with a total of 65 observations.

Heteroscedasticity Test

To determine if the regression model identified a correlation between the independent variables, the heteroscedasticity test is used. The regression model is homoscedastic if the probability value is bigger than 0.05. The data were examined using the eviews 9 program and the Glejser test, and neither method revealed any probability coefficients with values less than 0.05. As a result, it may be said that the data are heteroscedastic-free.

The Multicollinearity Test

The multicollinearity test checks if a correlation between the independent variables was found by the regression model. In a good regression model, there should be no connection between the independent variables. It is possible to see the issue of multicollinearity in a variable using the correlation matrix. The results of this multicollinearity test show that there is no multicollinearity between the independent variables since the coefficient value between variables is less than 0.80.

The Autocorrelation Test

In a linear regression model (previous), the autocorrelation test is used to determine whether there is a connection between the error in period t and the confounding error in period t-1. The Durbin Watson statistic value is 1.611319, which means that this research does not have autocorrelation issues since it satisfies the conditions (dLDW4-dU). The dU value is 1.7311 and the dL value is 1.4709. The Durbin Watson statistic value is between the dL and 4-dU values.

Panel Data Regression Analysis

This study includes regression analysis panel data from 17 companies with a total of 5 years of observations, for a total sample size of 85. However, because the data is not regularly distributed, an outlier analysis is done on the study data, resulting in a data set of 65 with the equation below :

ETR i,t = α0 +β1FORi,t +β2INSi,t + β3TPi,t + e

Description :

ETR : Tax Avoidance

α0 : Constant

β : Regression coefficient

FOR : Foreign Ownership / Foreign Ownership

INS : Executive Incentives

TP : Transfer Pricing

E : Error term

ETR i,t = 0.3830 - 0.618527FORi,t + 1.35023INSi,t - 0.325519TPi,t + e

The regression equation's results in Table 4 are interpreted as follows:

1. In the event when foreign ownership or the independent variable are both constant, the resultant Effective Tax Rate (ETR) is zero.

2. An rise in foreign ownership is linked to a fall in the effective tax rate (ETR), according to the regression analysis, which reveals that foreign ownership (FOR) has a negative coefficient of -0.618527. The ETR is predicted to fall by 0.61852 for every one unit increase in foreign ownership.

3. A higher transfer pricing predicts a lower effective tax rate (ETR) in Indonesia's conventional banks, according to the regression analysis of transfer pricing, which shows a negative coefficient value of -0.325519. More specifically, the ETR is predicted to fall by 0.325519 for every unit rise in transfer pricing.

4. The regression analysis of Transfer Pricing indicates a negative coefficient value of -0.325519, suggesting that an increase in Transfer Pricing is associated with a decrease in Effective Tax Rate (ETR) in conventional banks in Indonesia. Specifically, for every one-unit increase in Transfer Pricing, the ETR is expected to decrease by 0.325519.

Hypothesis Test

Partial Test (t Test)

To determine if the influence induced by the dependent variable, independent variable, moderating variable, and control variable had a significant or negligible effect (0.05), the test was run using the value of = 5%. Table 5 provides a summary of the panel data regression results.

The following conclusion can be drawn from the partial t hypothesis testing findings in Table 5:

The first hypothesis (H1) of this study examines the impact of foreign ownership on tax avoidance in conventional banks in Indonesia. The regression analysis results in Table 5 indicate that the p-value for foreign ownership is 0.000, which is below the significance level of 0.05, and the regression coefficient is -0.618427. Therefore, H1 is supported, suggesting that foreign ownership has a significant effect on the Effective Tax Rate (ETR) and contributes to tax avoidance in the banking sector in Indonesia.

The second hypothesis (H2) of this study investigates the relationship between executive incentives and tax avoidance in conventional banks in Indonesia. The regression analysis in Table 5 indicates that the p-value for executive incentives is 0.0037, which is below the significance level of 0.05, and the regression coefficient is 1.350238. Hence, H2 is supported, suggesting that executive incentives have a significant positive impact on the Effective Tax Rate (ETR) and contribute to reducing tax avoidance in the banking sector in Indonesia.

The third hypothesis (H3) of this study examines the relationship between transfer pricing and tax avoidance in the banking sector in Indonesia. The regression analysis in Table 5 indicates that the p-value for transfer pricing is 0.5724, which is above the significance level of 0.05, and the regression coefficient is -0.315519. Thus, the evidence suggests that H3 is not supported, indicating that transfer pricing does not significantly affect the Effective Tax Rate (ETR) and does not contribute to reducing tax avoidance in the conventional banks in Indonesia during the period of 2015-2019.

Coefficient of Determination Test (Adjusted R2)

The study's capacity of the model to describe the suitable relationship between the fluctuation of the dependent variable and the independent variable is measured by the coefficient of determination (R2). Value at Adjusted R2 ranges from 0 to 1. The outcomes of panel data regression are shown in the following Table:

Based on Table 6 above, it can be concluded that the adjusted R2 0.378825 or 37.8825%. This shows that the ownership structure variables, Foreign Ownership (FO), Executive Incentives (EI) and Transfer Pricing are able to influence Tax Avoidance by 0.378825 or 37.8825%. while the remaining 62.1175% is explained by other variables that are not used in this study.

Research Result Analysis

The Effect of Foreign Ownership on Tax Avoidance

The table 7 shows the results for the effect of foreign ownership (FO) on tax avoidance in banking companies listed on the Indonesia Stock Exchange for the 2015-2019 period the results of testing the Foreign Ownership have a negative effect on the effective Tax Rate. This result is evidenced by the regression coefficient value of the Foreign Ownership of -0.618427 and the probability value of Foreign Ownership 0.0000 < 0.05. So it can be concluded that H1 is, so the hypothesis stating that Foreign Ownership has a negative effect on the Effective Tax Rate means that if foreign ownership increases, there will be tax avoidance, meaning that H1 is accepted. This happens because Foreign Owners who own majority shares are generally more oriented towards the welfare of shareholders, and because they are not Indonesian citizens, their level of tax awareness is low. The results of this study are in line with research conducted by (Salihu et al., 2015), that foreign ownership has a positive effect on tax avoidance. Salihu et al. (2015) examined the interest of foreign investors in tax avoidance in companies in Malaysia, found a positive effect of foreign ownership structure on tax avoidance.

The Effect of Executive Incentives on tax avoidance

The test results above show the effect of Executive Incentives (INS) on tax avoidance in banking companies listed on the IDX for the 2015-2019 period is Executive Incentives affect the effective tax rate. This result is evidenced by the regression coefficient value of the Executive Incentives of -1.350238 and the probability value of executive incentives 0.0037 < 0.05. It can be concluded that H2 accepted. so that the hypothesis stating that Executive Incentives (INS) has a positive effect on the Effective Tax Rate, this means that if executive incentives increase, tax avoidance decreases.

The findings of this study agree with those of Gaertner (2014), who found that executive incentives have a negatives impact on tax avoidance.

The Effect of Transfer Pricing on Tax Avoidance

The test results show the effect of transfer pricing on Tax Avoidance as proxy by the Effective Tax Rate, in banking companies listed on the Indonesia Stock Exchange for the 2015-2019 period is transfer pricing has no effect on the Effective Tax Rate. This result is evidenced by the probability value of transfer pricing 0.5724 > 0.05. This means that H3 is rejected.

The results of this study are in line with research conducted by Putri (2019) which state that transfer pricing has no effect on tax avoidance.

Conclusions and Recommendations

The primary objective of this research is to investigate how foreign ownership, executive incentives, and transfer pricing influence tax avoidance practices in conventional banks publicly traded on the Indonesia Stock Exchange. The sample for this study consisted of 17 banking firms. Based on the findings, it can be concluded that foreign ownership has a negative association with tax avoidance, executive incentives have a positive correlation with tax avoidance, while transfer pricing does not have a significant impact on tax avoidance practices in the Indonesian banking sector during the period of 2015-2019.

Limitations and Suggestions

This research study offers valuable insights into the relationship between foreign ownership, executive incentives, transfer pricing, and tax avoidance in the banking sector companies listed on the Indonesia Stock Exchange from 2015 to 2019. However, it is essential to acknowledge some limitations that may guide future researchers in obtaining more precise findings and advancing the field of study. Firstly, one of the limitations of this study is its narrow scope, which focused solely on the banking sector. This resulted in a small sample size of only 17 companies, selected using purposive sampling. To enhance the generalizability of the findings, future researchers can consider expanding the sample to include non-bank financial institutions and companies from other industries. This broader approach would provide a more comprehensive understanding of the relationship between the variables across various sectors. Secondly, the study concentrated only on foreign ownership, executive incentives, and transfer pricing as independent variables with a mediation role in tax avoidance. The adjusted R-squared of these three variables was 37.88%, indicating that other factors may be involved in influencing transfer pricing and tax avoidance behaviors. Therefore, future research could incorporate additional corporate governance variables, such as managerial ownership, institutional ownership, independent commissioner composition, and audit quality, as independent variables. Including these variables in the analysis would provide a more holistic view of the factors influencing tax avoidance practices.

Contribution of Study

Theoretical Contribution:

Despite its limitations, this study makes a significant theoretical contribution to the understanding of tax avoidance behaviors in the Indonesian banking industry. The investigation of foreign ownership, executive incentives, and transfer pricing as independent variables sheds light on the complex interplay of factors that influence tax planning strategies within the banking sector. By exploring the mediation role of these variables in tax avoidance, the study provides valuable insights into how ownership structure and executive motivations may impact decisions related to taxes. Furthermore, the examination of the adjusted R-squared and the potential involvement of other variables in transfer pricing and tax avoidance suggests that tax behavior is a multifaceted phenomenon influenced by various aspects of corporate governance. This underscores the need for future research to include additional governance variables, such as managerial ownership, institutional ownership, independent commissioner composition, and audit quality. Incorporating these variables would contribute to a more comprehensive theoretical framework that better explains the underlying mechanisms behind tax avoidance practices in the banking industry.

Practical Contribution:

In a practical context, this study's findings hold implications for policymakers, regulators, and financial institutions in Indonesia. By identifying factors related to tax avoidance, such as foreign ownership and executive incentives, the study offers valuable insights into potential areas of concern for policymakers aiming to enhance tax compliance and transparency. Understanding how these variables influence tax planning can guide the development of targeted policies and regulations that promote responsible tax behavior among banking institutions. Moreover, the call for future research to incorporate additional corporate governance variables emphasizes the importance of effective governance mechanisms in curbing tax avoidance practices. Financial institutions can utilise these insights to strengthen their governance structures and practices, ensuring greater accountability and integrity in decision-making processes related to taxes.

Acknowledgments

The Authors thank the support from Accounting Research Institute HICoE of Universiti Teknologi MARA;

References

Annuar, H. A., Salihu, I. A., & Obid, S. N. S. (2014). Corporate Ownership, Governance and Tax Avoidance: An Interactive Effects. Procedia - Social and Behavioral Sciences, 164, 150-160. DOI:

Armstrong, D. J., Kirk, J., Lam, K. W. F., McCormac, J., Osborn, H. P., Spake, J., Walker, S., Brown, D. J. A., Kristiansen, M. H., Pollacco, D., West, R., & Wheatley, P. J. (2015). K2 variable catalogue–II. Machine learning classification of variable stars and eclipsing binaries in K2 fields 0–4. Monthly Notices of the Royal Astronomical Society, 456(2), 2260-2272.

Chen, C., Chen, Q., Xu, J., & Koltun, V. (2018). Learning to See in the Dark. 2018 IEEE/CVF Conference on Computer Vision and Pattern Recognition. DOI:

Crabtree, A. D., & Maher, J. J. (2005). Earnings Predictability, Bond Ratings, and Bond Yields. Review of Quantitative Finance and Accounting, 25(3), 233-253. DOI:

Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145-179. DOI:

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2008). Long‐run corporate tax avoidance. The Accounting Review, 83(1), 61-82. DOI:

Ebi, B. O. (2018). Financial sector development and tax revenue in Nigeria. International Journal of Economics, Commerce and Management, 6(6), 93-109. http://ijecm.co.uk

Francis, B. B., Ren, N., & Wu, Q. (2017). Banking deregulation and corporate tax avoidance. China Journal of Accounting Research, 10(2), 87-104. DOI:

Frank, M. M., Lynch, L. J., & Rego, S. O. (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting. The accounting review, 84(2), 467-496. DOI: 10.2308/accr.2009.84.2.467

Freeman, R. E., Harrison, J. S., Wicks, A. C., Parmar, B. L., & De Colle, S. (2010). Stakeholder theory: The state of the art. Cambridge University Press.

Fuest, C., & Riedel, N. (2009). Tax evasion, tax avoidance and tax expenditures in developing countries: A review of the literature. Report prepared for the UK Department for International Development (DFID), 44.

Gaertner, F. B. (2014). CEO After-Tax Compensation Incentives and Corporate Tax Avoidance. Contemporary Accounting Research, 31(4), 1077-1102. DOI:

Graham, J. R., Hanlon, M., Shevlin, T., & Shroff, N. (2014). Incentives for Tax Planning and Avoidance: Evidence from the Field. The Accounting Review, 89(3), 991-1023. DOI:

Horngren, C., Harrison, W., Oliver, S., Best, P., Fraser, D., & Tan, R. (2012). Financial accounting. Pearson Higher Education AU.

Javid, A. Y., & Jamil, K. (2021). Executive incentives, risk-taking, and bank performance: Evidence from Pakistan. International Journal of Finance & Economics, 26(1), 909-927.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. DOI:

Jihene, S., & Moez, F. (2019). CEO compensation and tax avoidance. International Journal of Business and Management, 14(6), 21-35.

McLaren, J. (2008). The distinction between tax avoidance and tax evasion has become blurred in Australia: Why has it happened. J. Australasian Tax Tchrs. Ass'n, 3, 141. https://ro.uow.edu.au/buspapers/51/

Payne, D. M., & Raiborn, C. A. (2018). Aggressive Tax Avoidance: A Conundrum for Stakeholders, Governments, and Morality. Journal of Business Ethics, 147(3), 469-487. DOI:

Putri, V. R. (2019). Analisis Faktor Yang Mempengaruhi Transfer Pricing Pada Perusahaan Manufaktur Di Indonesia [Analysis of Factors That Influence Transfer Pricing in Manufacturing Companies in Indonesia]. Jurnal Manajemen Dayasaing, 21(1), 1-11. DOI:

Richardson, G., Taylor, G., & Lanis, R. (2013). The impact of board of director oversight characteristics on corporate tax aggressiveness: An empirical analysis. Journal of Accounting and Public Policy, 32(3), 68-88. DOI:

Salihu, I. A., Annuar, H. A., & Sheikh Obid, S. N. (2015). Foreign investors' interests and corporate tax avoidance: Evidence from an emerging economy. Journal of Contemporary Accounting & Economics, 11(2), 138-147. DOI: 10.1016/j.jcae.2015.03.001

Sikka, P., & Willmott, H. (2010). The dark side of transfer pricing: Its role in tax avoidance and wealth retentiveness. Critical Perspectives on Accounting, 21(4), 342-356. DOI:

Wang, Y., Yin, W., & Zeng, J. (2019). Global Convergence of ADMM in Nonconvex Nonsmooth Optimization. Journal of Scientific Computing, 78(1), 29-63. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Putri, V. R., Zakaria, N. B., & Said, J. (2023). Corporate Governance's Role in Tax Avoidance: Indonesian Banks Study. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 544-560). European Publisher. https://doi.org/10.15405/epsbs.2023.11.47