Abstract

Prior research has demonstrated that financial literacy significantly influences the investment decisions of individuals. It remains unclear how knowledge of finances and money management affects the ability of retired individuals to identify investment schemes. In addition, there is a dearth of research examining the factors that influence retirees' awareness of investment schemes. Given that retirees are regarded as a vulnerable group and an easy target for con artists, an investigation into the factors that influence their awareness of investment frauds is highly warranted. The purpose of this study is to determine how retirement-age individuals' awareness of investment schemes is affected by their financial knowledge and behaviour. By administering a survey to 200 retirees, the researchers were able to collect 53 responses and gather data. In addition, there is a dearth of research examining the factors that influence retirees' awareness of investment schemes. The data were then examined using PLS-SEM version 3 software. The results revealed that retirees who are well-versed in financial matters tend to recognize investment scams better. Moreover, this connection is even stronger for retirees who demonstrate careful financial behaviour. This study emphasises the significance of enhancing retirees' financial knowledge and habits in order to prevent them from falling prey to scams.

Keywords: Financial Literacy, Financial Behaviour, Investment Scams, Retirees

Introduction

The global financial sector faces serious challenges due to investment fraud. According to UK Finance, British victims of investment scams lost a staggering £170 million in 2021, and the trend has only been escalating since then. In 2023 (Razali, 2023), a fraudulent investment syndicate in Malaysia defrauded 150 investors out of an estimated RM830 million. They did it by predicting a return of between 15 and 17 percent. Investors that are well-informed have a lower risk of being scammed. Gaining financial literacy allows one to evaluate investment options more objectively (Chariri et al., 2018). There is a link between education about money and understanding of investment fraud, according to the available data. People who are financially savvy are better able to spot and avoid investment frauds, according to research by Lusardi and Mitchell (2014). Similarly, Yu et al. (2022) finds that those who are financially literate are less likely to become victims of investment fraud.

Another hot topic in the world of academia right now is how one's own financial habits can influence one's sensitivity to investment scams. To name only a few examples of financial habits, Rahman et al. (2021) cite saving, investing, and sticking to a strict budget. A 1998 study by Chen and Volpe found that increased financial literacy was associated with more prudent financial behavior. Their research suggests that people with sound financial practices, such as frequent saving and investing, are more able to identify and steer clear of investment frauds. Elderly investment fraud awareness and financial literacy have been correlated, but research on how financial behavior can moderate these relationships has gotten less attention. Pensioners are particularly vulnerable to falling for scams, hence additional protections are necessary (Gamble et al., 2013). Fraud costs 22,000 government pensioners in Malaysia RM850 million in 2023, according to the country's Deputy Finance Minister (Chan, 2023). This highlights the need to provide pensioners with access to financial literacy training. The study's goal is to find out if and how senior citizens' financial literacy affects their awareness of investment scams.

Review of literature and Development of Hypotheses

The literacy level in finance and awareness level in investment-scam

Numerous studies have looked into how financial literacy and the capacity to detect investment frauds are related. The likelihood of preventing or recognizing investor fraud is higher for those who have a thorough grasp of financial concepts (Lusardi & Mitchell, 2014). According to Chariri et al. (2018), a person's level of financial literacy is inversely connected to their ability to detect investment fraud. There is, however, evidence that suggests the reverse. According to (Mottola & Kieffer, 2017), investors with a better level of financial understanding may be more susceptible to investment fraud due to their heightened confidence. Researchers, doctors, and politicians take preventative measures every year since scammers prey on retirees like them due to variables including loneliness, emotional fragility, cognitive impairment, and impaired mental capacity (Fenge & Lee, 2018). As a result, there is little proof that seniors' awareness of investment fraud and their level of financial literacy are associated. In light of the debate that has come before, it is assumed that:

H1: Among retirees, financial literacy significantly affects their awareness of investment fraud.

Financial behaviour and investment scam awareness

Past research has indicated that investors who possess strong financial habits are more likely to stick to their investment goals (Bunyamin & Wahab, 2022). The significance of good financial habits in enhancing an individual's financial security has been underscored in earlier studies, as noted by Rahman et al. (2021). While it's recognized that investor behavior can influence awareness of investment fraud, this connection remains unclear. Moreover, the interplay between investment fraud awareness, individuals' financial behaviors, and levels of financial knowledge lacks comprehensive exploration. Notably, older adults exhibit distinct financial behaviors compared to younger individuals, as observed by Silinskas et al. (2021). Thus, it becomes crucial to delve into how financial behavior relates to seniors' awareness of investment fraud. Drawing from prior discussions, the underlying assumption is that:

H2: The association between financial literacy and awareness of investment frauds among retirees is moderated by financial behaviour.

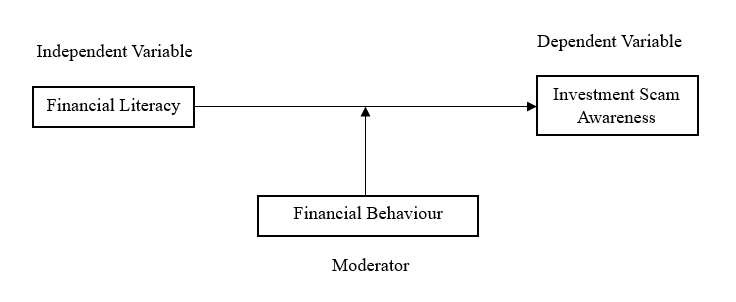

Figure 1: Study framework

Methodology

To efficiently and easily distribute their online survey to a large group of individuals, the researchers utilized Google Forms (Nayak & Narayan, 2019). The measurement tool used in this study is adapted from scales created by Rahman et al. (2021) and Padil et al. (2021), with certain adjustments made. Changes to constructs and items were guided by the study's objectives, research questions, and participant characteristics. The survey was organized into five sections. At the survey's outset, participants provided basic demographic details. In Sections B to D, participants used a five-point Likert scale to rate their knowledge, financial literacy, and money management behaviors.

Retirees from the public and private sectors in Selangor, Kuala Lumpur, and Putrajaya in central Malaysia were mailed questionnaires that would later be used to fill out an online poll. Early study (see, for instance, Graham, 2014) indicated that this region's urban areas had higher population densities and more significant financial resources, therefore it was selected. These factors increase the likelihood that investment offers will be interested in the region.

All of the people who took part in this survey are either currently retired or planning to do so within the next few years. Participants in the study are prospective retirees because it is expected that they will investigate investment options as part of their retirement preparations. Evidently argued by Wu et al. (2022) that targeting a more narrow and well-defined audience can increase the number of people who respond to online surveys. Therefore, we kindly asked people who were already retired or nearing retirement to fill out the survey. Of the 200 seniors in central Malaysia who were selected as the study's sample, 53 responded to the survey.

After collecting the data, it was entered into the Social Sciences Statistical Package for Windows (SPSS) version 21. To provide clarity, numeric values were used to present descriptive statistics about the participants' characteristics. To validate the accuracy of the gathered data and explore the expected relationships among different factors, Hair et al. (2019) utilized PLS-SEM (Partial Least Squares Structural Equation Modeling). In this approach, two key criteria, namely validity and reliability, were employed to gauge the quality of the PLS-SEM method. The researchers also assessed the overall consistency of the data to ensure the dependability of the research design's components.

Result and Discussion

Demographic profile of respondents

The Google Form platform was utilized in order to distribute the self-administered survey. Retirees from the public and private sectors who lived in Malaysia's Central Region were the survey's intended participants. This area includes the states of Selangor and Kuala Lumpur and Putrajaya, both of which are Federal Territories. The demographic characteristics of the study's participants are shown in Table 1.

According to the data presented in Table 1, a significant proportion of the participants, specifically 40%, have already retired. The remaining respondents are in the process of nearing retirement, with a notable concentration falling within the age range of 50 to 55 years. The predominant demographic characteristics of the respondents were female gender, Malay ethnicity, and marital status being married. A significant majority, specifically 91%, of the individuals possess tertiary education, whereas 65% of them have been employed in government positions. About 47% of the individuals taking part in the research come from households with earnings ranging from 5,000 to 10,000 RM.

Model Of measurement

The measuring approach is used to assess how well the items capture necessary and relevant attributes. Reliability and validity are the primary criteria for evaluating the measurement model in Partial Least Squares Structural Equation Modelling (PLS-SEM), according to (Hulland, 1999; Hair et al., 2017; Ramayah et al., 2011).

Test of validity

The Average Variance Extracted (AVE) measurement is used to make sure that different parts share similar features, as suggested by Henseler et al. (2009) and Hair et al. (2013). For each part of the structure, the average should be over 0.50. Hair et al. (2014) suggests removing data points below 0.50 to improve the quality of data. When the value reaches 0.50, it shows that the characteristic explains 50% of the variations in the signs (Hair et al., 2013, 2017). Since all values in the AVE dataset are above 0.50 (as shown in Table 2), it supports the notion that the features come together appropriately.

The Fornell-Larcker test improves the average variance extracted (AVE) measure's validity. This study compares the average variance extracted (AVE) with the square root of the Fornell-Larcker criterion in order to determine discriminant validity. Table 3 lists the findings of this investigation in detail.

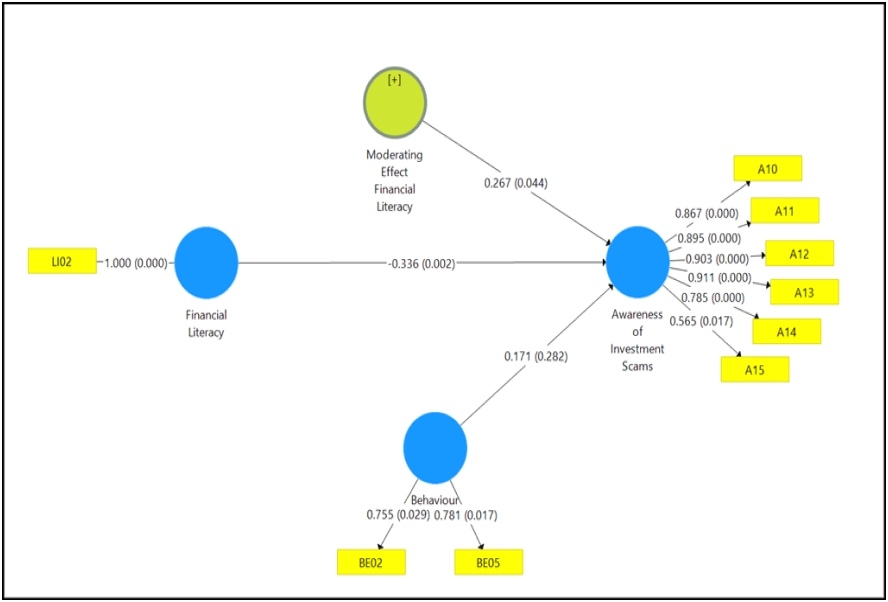

The findings displayed in Table 3 indicate that AIS has a cross-load value of 0.830, whereas behavior and financial literacy exhibit cross-loads of 0.768 and 1.000, correspondingly. Moreover, financial literacy has a more prominent effect, as demonstrated by its cross-load value of 1.000. The assessment of cross-loading for differentiation among characteristics is provided in the following section, as specified in Table 4.

According to Table 4's discriminant validity cross-loading findings, all six of the AIS variables under investigation had values more than 0.500. This result demonstrates the suitability of the data used in the current inquiry for factor analysis. When sample numbers are small, it is noted that the standard value can range from 0.565 to 0.911. The literacy variables have a value of 1.000 for one tenth. Above the threshold of 0.700, the measured values for the moderating behavior components fell between 0.755 and 0.781.

Test of reliability

Durability pertains to an instrument's capability to consistently offer accurate measurements. Having faith that a certain variable or group of variables will consistently yield the desired results when utilized in computations is referred to as dependability, according to Hair et al. (2017). We evaluate the consistency of measurements across several variables to determine reliability, frequently using Cronbach's Alpha, a method widely used to determine the dependability of data (Coakes et al., 2010). The percentage that represents the fluctuation among indicators demonstrates the dependability of the measurement model's components. According to the study by Hair et al. (2017), a minimum Cronbach's Alpha value of 0.70 is advised for reliability. However, 0.60 can also be considered to be a respectable value. Table 5 presents the findings of the reliability evaluations.

Referring to the data presented in Table 5, all variables, except for the behavior variable, exhibited Cronbach's Alpha values surpassing the established limit of 0.70. Nonetheless, all measurements demonstrate a satisfactory level of reliability. The durability scores for the different variables' composites fall within the range of 0.742 to 1.000, indicating good reliability.

Structural model

Direct hypothesis testing

To delve into the different associations within the model, three hypotheses were developed. The bootstrapping method within the SmartPLS 3.0 software was utilized to evaluate the importance of direct relationships. The Partial Least Squares (PLS) technique is frequently employed to determine the path coefficient. The results of the hypothesis testing are outlined in Table 6.

The results indicate a noteworthy and negative link between financial literacy and investment fraud awareness, which supports Hypothesis 2 (H2). The pathway coefficient in the initial sample is supported by the outcomes of the Partial Least Squares (PLS) technique. The path coefficient (O) stands at -0.336, with a p-value of 0.002. The corresponding T statistic is 3.084 (above the critical value of 1.96), and the significance level is set at 0.05. Thus, the findings affirm H2, as they demonstrate that at a 5% significance level, the null hypothesis is rejected. According to the study, retirees who possess higher financial literacy are less prone to falling victim to investment fraud. Although most retirees have commendable financial management skills, this has led to a lowered concern about investment scams. This tendency might arise from an excessive confidence in making sound investment decisions, a pattern seen in the observations of Mitchell and Lusardi (2022).

However, the outcomes of Hypothesis 2 (H2) reveal a robust positive connection between the extent of investment fraud awareness and the impact of financial literacy on individuals' actions. The outcomes derived from the Partial Least Squares (PLS) algorithm reveal that the path coefficient for this association in the original sample is 0.267. The T statistics value of 2.017, surpassing the threshold of 1.96, indicates statistical significance. Additionally, the p-value is 0.044, which is below the significance threshold of 0.05, further underlining the significance of this link. H2 is validated by a statistically significant factor. Therefore, the outcomes of this study offer a basis for dismissing the null hypothesis at a 5% significance level. As supported by Chariri et al. (2018), a positive connection can be observed between an individual's level of financial literacy and their capability to detect investment frauds. Consequently, those possessing deeper understanding and expertise in financial matters are better positioned to make informed investment decisions. This arises from their comprehension of the significance of fiscal prudence, particularly in the context of saving for retirement, and their skill in allocating resources toward financial assets to enhance future wealth.

The diagram illustrating the structural model is depicted in Figure 2.

The primary aim of this research was to investigate the connection between financial literacy and recognition of investment fraud, considering the role of financial behavior as a potential influencing factor. This study demonstrates that people who have had more exposure to financial education are more likely to be aware of investment frauds. When monetary behaviour is factored in as a moderator, however, the strength of the association is much diminished. Those who are financially literate and continuously practise good fiscal discipline are in a better position to identify questionable investment opportunities and refrain from pursuing them. Our research confirms what others have found: that financial literacy and fraud awareness go hand in hand. Those with increased financial literacy could spot and avoid frauds targeting their cash.

Our study also uncovered important evidence that personal financial behaviour considerably moderates the association between financial literacy and awareness of investment frauds. Those with solid financial habits nevertheless exhibited superior capacity to recognise and avoid investment fraud, even after accounting for financial expertise. Evidence like these implies that people's personal financial habits play a significant part in shielding them from investment scams, and that promoting sound money management practises could be an effective addition to efforts to increase people's financial literacy. The findings also have significant implications for programmes that teach people about money and work to reduce fraud. Some experts argue that cultivating strong financial habits such as consistent saving and investment holds greater significance than simply educating people about money management. This approach could lead to better financial decision-making, consequently lowering the likelihood of individuals becoming targets of financial fraud.

Conclusions

The main aim of this study is to examine the relationships among financial literacy, mindset, and behavior. The results uncover a link between an individual's capability to recognize and avoid investment frauds and their level of financial literacy. Additionally, financial behavior has an impact on moderating the influence of financial literacy on recognizing investment frauds. Those with a strong understanding of financial matters tend to be better at identifying investment scams. This connection is particularly prominent among individuals with good financial skills. By fostering financial knowledge and appropriate financial behavior, people can assess the pros and cons of different investment opportunities. Consequently, it can be argued that individuals' existing financial habits significantly lower their susceptibility to investment frauds. It has been suggested that promoting ethical financial practices may assist combat fraud in addition to financial literacy training. The consequences of these findings for policymakers and financial educators working to increase financial literacy and decrease fraud could be substantial. The authors suggest that protecting investors against fraud necessitates both more financial knowledge and the promotion of financially responsible practises. Efforts to promote regular saving and investment practises may include financial education programmes that emphasise the value of honest financial behaviour in deterring dishonest interactions. There are some caveats to this study that need to be taken into account when planning future research on the relationship between financial literacy, financial activity, and awareness of investment scams. In particular, we focused our research on the central area of Malaysia. More variables and environments could be considered in future studies.

Acknowledgement

Authors thank Universiti Teknologi MARA and Universiti Poly-Tech Malaysia (UPTM) for financial support through KUPTM URG Research Grant (100-TNCPI/PRI 16/6/2 (047/2022)).

References

Bunyamin, M., & Wahab, N. A. (2022). The Influence of Financial Behaviour on Financial Risk Tolerance In Investment Decision: A Conceptual Paper. International Journal of Industrial Management, 14(1), 529-542. DOI:

Chan, D. (2023, June 20). 22,000 govt pensioners lost RM850,000 to scammers: Ahmad Maslan. New Straits Times. https://www.nst.com.my/news/crime-courts/2023/06/922324/22000-govt-pensioners-lost-rm850000-scammers-ahmad-maslan

Chariri, A., Sektiyani, W., Nurlina, N., & Wulandari, R. W. (2018). Individual Characteristics, Financial Literacy and Ability in Detecting Investment Scams. Jurnal Akuntansi Dan Auditing, 15(1), 91-114. DOI:

Chen, H., & Volpe, R. P. (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107-128. DOI:

Coakes, S. J., Steed, L., & Ong, C. (2010). SPSS: Analysis without Anguish: Version 17 for Windows: John Wiley & Sons Australia.

Fenge, L.-A., & Lee, S. (2018). Understanding the Risks of Financial Scams as Part of Elder Abuse Prevention. The British Journal of Social Work, 48(4), 906-923. DOI:

Gamble, K. J., Boyle, P., Yu, L., & Bennett, D. (2013). Aging, Financial Literacy, and Fraud. SSRN Electronic Journal. DOI: 10.2139/ssrn.2165564

Graham, W. (2014). A quantitative analysis of victims of investment crime. Financial Conduct Authority.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. Long Range Planning, 46(1-2), 1-12. DOI:

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2-24. DOI:

Hair, J., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM). Sage Publications.

Hair, J., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review, 26(2), 106-121. DOI:

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. Advances in International Marketing, 277-319. DOI:

Hulland, J. (1999). Use of partial least squares (PLS) in strategic management research: a review of four recent studies. Strategic Management Journal, 20(2), 195-204. DOI: 10.1002/(sici)1097-0266(199902)20:2<195::aid-smj13>3.0.co;2-7

Lusardi, A., & Mitchell, O. S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature, 52(1), 5-44. DOI:

Mitchell, O. S., & Lusardi, A. (2022). Financial Literacy and Financial Behavior at Older Ages. SSRN Electronic Journal. DOI: 10.2139/ssrn.4006687

Mottola, G. R., & Kieffer, C. N. (2017). Understanding and Using Data From the National Financial Capability Study. Family and Consumer Sciences Research Journal, 46(1), 31-39. DOI:

Nayak, M. S. D. P., & Narayan, K. A. (2019). Strengths and weaknesses of online surveys. Technology, 6(7), 0837-2405053138.

Padil, H. M., Kasim, E. S., Muda, S., Ismail, N., & Zin, N. M. (2021). Financial literacy and awareness of investment scams among university students. Journal of Financial Crime, 29(1), 355-367. DOI: 10.1108/jfc-01-2021-0012

Rahman, M., Isa, C. R., Masud, M. M., Sarker, M., & Chowdhury, N. T. (2021). The role of financial behaviour, financial literacy, and financial stress in explaining the financial well-being of B40 group in Malaysia. Future Business Journal, 7(1). DOI:

Ramayah, T., Samat, N., & Lo, M.-C. (2011). Market orientation, service quality and organizational performance in service organizations in Malaysia. Asia-Pacific Journal of Business Administration, 3(1), 8-27. DOI:

Razali, S. A. (2023). 150 people lose RM830 million in investment syndicate scam. New Straits Times.

Silinskas, G., Ranta, M., & Wilska, T. A. (2021). Financial Behaviour Under Economic Strain in Different Age Groups: Predictors and Change Across 20 Years. Journal of Consumer Policy, 44(2), 235-257. DOI: 10.1007/s10603-021-09480-6

Wu, M.-J., Zhao, K., & Fils-Aime, F. (2022). Response rates of online surveys in published research: A meta-analysis. Computers in Human Behavior Reports, 7, 100206. DOI: 10.1016/j.chbr.2022.100206

Yu, L., Mottola, G., Barnes, L. L., Valdes, O., Wilson, R. S., Bennett, D. A., & Boyle, P. A. (2022). Financial fragility and scam susceptibility in community dwelling older adults. Journal of Elder Abuse & Neglect, 34(2), 93-108. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Kasim, E. S., Awalludin, N. R., Shukri, N. H. A., Ismail, A., & Zainal, N. (2023). The Scam-Proof Investor: Financial Literacy, Financial Behaviour and Investment Scam Awareness. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 493-503). European Publisher. https://doi.org/10.15405/epsbs.2023.11.42