Abstract

The current literature on Operational Shari'ah Auditing (OSA) reveals that there is a significant theory-practice gap, which results in considerable uncertainty regarding the effectiveness of OSA. This study utilizes international research on the practice of OSA and applies the Islamic agency perspective to a systematic literature review of the current literature to create new insights into the challenges generating the theory practice gap of OSA implementation. These perspectives of Islamic Agency Theory will be applied as the foundation for the development of a new conceptual model of key factors. Based on the conducted analysis, it has been determined that there is a concern regarding the clarity of the OSA concept, the function of Internal Shariah Audit (ISA), and the organisational structure and culture. Accordingly, the research offered a conceptual framework of important key factors to support successful practical shari'ah auditing practise. These findings contribute to OSA research and have important implications for OSA integrated practice guidelines. The study also suggests future research to corroborate the findings.

Keywords: Accountability, Islamic Bank, Internal Shari’ah Audit, Islamic Governnance, Operational Shari’ah Audit

Introduction

The necessity for confidence in shari’ah compliance including its operational has resulted in the establishment of a new audit function, termed shari’ah auditing. A shari'ah audit has multiple scopes, including a financial statement audit, an operational audit, and lastly an information technology audit (Febrian, 2019). Shari’ah auditors (external or internal) must guarantee that all Shari'ah standards and regulations are observed by businesses (Haniffa, 2010). Shari’ah audit plays an important role in assuring the accountability of financial accounts and conformity with shari’ah features in this scenario (Rizqiani & Yulianto, 2020; Yaacob & Donglah, 2012). However, some studies indicates that accountability related to comply the shari’ah principles has become one of the main issue in Islamic Banks (Hanif, 2018). In Bangladesh, for example, although 97% respondents believe that Islamic banks are established to offer Shari’ah based banking services to their customers, most respondents agreed that 100% shari’ah compliance in operational banks is not possible in Bangladesh as the economy is interest based (Md. Rezaul & Samia Afrin, 2020). According to a study of IFI accountability in the Gulf countries and Malaysia, existing Shari’ah Supervisory Board (SSB) audit reporting falls significantly short of stakeholder expectations based on the AAOIFI criteria (Aribi et al., 2019). Moreover, similar result of low shari’ah compliance also reported in Pakistan (Saqib et al., 2016), Sudan (Mansour, 2019) as well as in Indonesia (Jusri & Maulidha, 2020; Kusumaningrum et al., 2021; Muchlis, 2021).

Good corporate governance guarantees that the board and management implement a variety of governance control mechanisms designed to improve the efficiency, effectiveness, and economy (3Es) of their respective organizations' operations. In terms of Shari’ah Corporate Governance (SCG), IBs should revolutionize the notion of performance audits by including Islamic ethical norms as an essential component of the concept (Khan, 1998). Therefore, the Internal Shari’ah Audit (ISA) as the IAF in Islamic Financial Institutions has a broader control mechanism that supports the BOD and management in ensuring governance control systems are in place in order to accomplish the organization's 4Es (Efficiency, Effectiveness, Economy and Ethics). However, some previous studies revealed that the absence of proper guidance on the structure of Shari’ah Audit becomes a serious problem in the SA including Operational Shari’ah Audit (OSA) implementation (Algabry et al., 2021; As-Salafiyah & Rusydiana, 2020; Isa et al., 2020; Khalid & Sarea, 2021; Mohd Ali et al., 2020; Puad & Shafii, 2019). An audit practices should be regulated by the effective implementation of a Shari’ah Principles framework or guideline. Furthermore, the availability of a framework is critical for establishing efficiency and aiding in the definition of work, authority, and reporting levels (Isa et al., 2020).

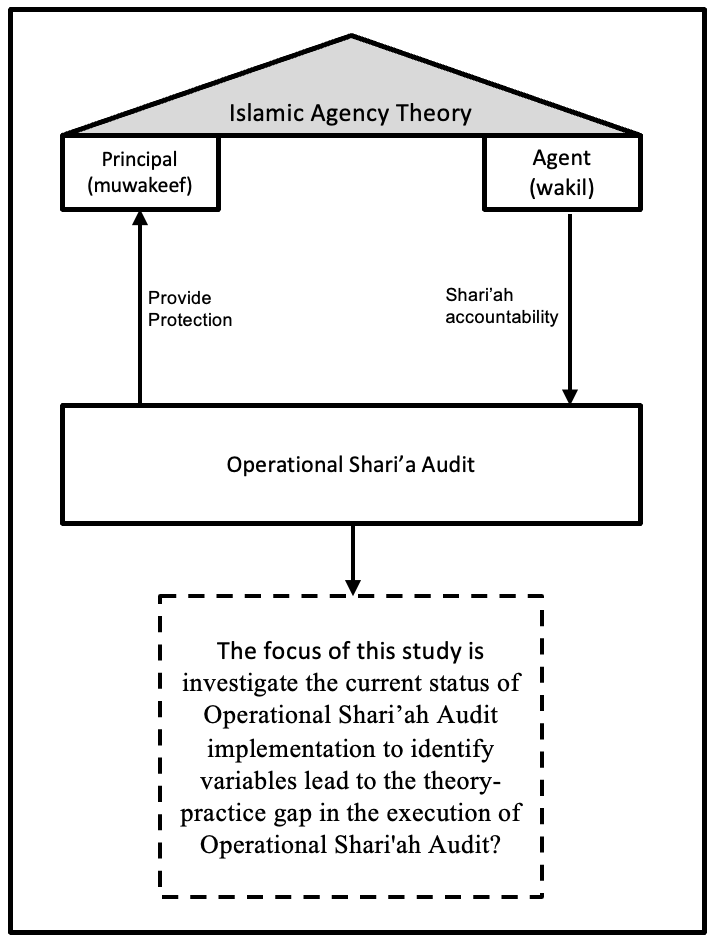

Fiteni (2020) discovered that the objectives of the IAF have remained mostly unchanged over the years except for being broadened to enhance organizational value. Similarly, Baldacchino et al. (2021) stated that the IAF's primary objectives have remained essentially unaltered over the years, with the exception of being enlarged to enhance organizational value, satisfy expanding client demands, and closely correlate with professional advances. As a consequence, the IAF's reputation among stakeholders changed from one of being invasive and undesired to one of being generally respected and appreciative (Baldacchino et al., 2021; Fiteni, 2020). However, there are still limited studies that examined OSA within ISA context, particularly for Islamic Banks. More knowledge of OSA would provide a better guideline for 4Es performance of IBs. Furthermore, a discrepancy between operational audit theory and practise has been identified in the implementation of OSA, prompting inquiries into the extent to which ISAs are proficiently utilising OSA as an auditing mechanism in order to attain the goal of implementing shari’ah governance. The existence of a gap between theory and practise is of great significance as it is imperative that standards and training are informed by theory and evidence, thereby facilitating the adoption of a more evidence-based approach to practise. The objective of this study is to address the knowledge gap by conducting a critical review of literature to identify novel insights pertaining to the operational scope of the issues. Additionally, a conceptual framework of enabling factors will be developed to tackle the problems. The subsequent questions for this study are as follows: (1) What is the current status of Operational Shari’ah Audit implementation?, and (2) What variables lead to the theory-practice gap in the execution of Operational Shari'ah Audit?

This research employs the theory of Islamic Agency perspective to examine various international studies on OSA and the potential issues that may arise from its implementation. The sources employed in this study encompass a variety of published research that have utilised both quantitative and qualitative research methodologies. This study utilizes a methodical approach to scrutinise the literature and uncover new insights and subject matters that shed light on the challenges inherent in the implementation of OSA. Such insights and subject matters serve as compelling evidence of the issues associated with OSA practice. This study also entails an analysis of the disparity between theory and practise in the subsequent domains: the concept of OSA, which furnishes a structure for scrutinising the identification, planning, and execution of fieldwork; the structural and functional configurations that enable the performance of the audit at the ISA function level; and the backing and acknowledgment of the audit outcomes by the auditee at the organisational level. An increasing number of researchers are utilising the research methodology of incorporating emerging subject matters from scholarly publications as a valuable contribution to the advancement of published research (Berry et al., 2009). The study's outcomes are anticipated to provide valuable insights to policymakers in the field of Islamic banking and the ISA profession. Specifically, these insights will aid in the development or enhancement of an integrated practise guideline pertaining to OSA implementation.

The order of the remaining paper is as follows. First, a brief introduction to the OSA concept is given. A critical review of the published literature on the issues inhibiting the effective application of OSA is then discussed, after which the theoretical framework that guides the study is discussed. The review is then employed as a foundation for creating a conceptual model of key factors. The discussion of the results and the conclusion come at the paper's conclusion.

The Concept of Operational Shari’ah Audit

Classic Operational Audit has been defined differently by many organizations and researchers. The definitions that have been presented so far make it abundantly clear that the framework of economy, efficiency, and effectiveness (3Es) lies at the very centre of performance auditing (Broadbent et al., 2009; Dang et al., 2019; Daujotaitė & Mačerinskienė, 2008; Fonseca et al., 2020; Vafaei, 2016). Paape (2007) extended the existing definition of OA by considering it as an assurance activity (Paape, 2007; Shah, 2007).

Compared to the conventional bank system, the objectives behind the introduction of the Islamic financial and banking system were the eradication of capitalist banking interests, the exploitation of the poor segment of society, and the establishment of an economic system that could lead to the maintenance of a balanced economic order and social justice (Umiyati et al., 2020). These objectives necessitate a revision of the existing paradigm of operational audit. The Islamic banks should revolutionize the notion of operational audits by including Islamic ethical norms as a fundamental component (Barr & Christie, 2015; Khan, 1998). It implies that Islamic banks, in embracing operational audits as a tool for research and evaluation, should embrace Islamic economic values in addition to economy, effectiveness, and efficiency. Hence, in the Islamic Banking perspective the paradigm of OA defined as a process reviewing 4Es to asses.

The process of Shari'ah supervision is conventionally overseen by autonomous Shari'ah scholars, who are not affiliated with the management or Board of Directors of Islamic Financial Institutions (IFIs) (Haniffa, 2010; Malkawi, 2013; Zainal Abidin et al., 2021). These scholars are responsible for issuing religious verdicts (fatwas) based on the principles and regulations of Shari'ah, which are then conveyed to the Shari'ah Control Department (SCD) and executive management for approval or disapproval of new products. Following the endorsement of the product by Shari'ah scholars, SCD proceeds to assess the application of fatwas in the course of executing the product. The SCD ensures that the Shari'ah scholars are kept apprised of the management progress throughout the entire transaction until its ultimate completion. According to Puad and Shafii (2019), when an entity operator offers only Islamic products and services, this becomes the main reason for integrating the Shari’ah audit with operational audit (Puad & Shafii, 2019). The auditors believe that there is a redundancy issue with the Shari’ah review function, which is why there are no separate Shari’ah audit personnel. When conducting an operational audit, the auditor will first conduct a review based on the functions of each department before examining any Shari’ah-related issues.

Theoretical Framework of Study

Islamic agency theory serves as the foundation for this paper's discussion of operational shari'ah auditing. Islamic banks and their conventional counterparts share a similar agency relationship because both are a part of the banking industry. Due to the ownership and control being separated in Islamic banks, there is a risk that managers or agents will put their own interests ahead of those of the shareholders. However, Islamic banks' agency structures differ significantly from those of conventional banks due to the need to adhere to Shariah principles (Safieddine, 2009).

Operational auditing is a type of evidence of information accumulation and evaluation that is used to assess and report the degree of conformity between information and predetermined criteria (Alharasis et al., 2020; Defond et al., 2021). According to ASOBAC (A Statement of Basic Auditing Concepts), auditing is a systematic process of dispassionately reviewing and assessing the evidence supporting claims regarding a range of economic actions and events in order to assess the degree to which those claims correspond with predetermined criteria and communicating the findings to audit report users. As a result, the definition of OSA for IBS is an accounting system that is used to evaluate or verify the suitability between management operations and the criteria, which are established Shari'ah Principles. A control system that lessens information asymmetry and conflicts of interest between principals and agents is operational audit. As a result, agency issues within an organisation are decreased by a framework that supports an effective practise of OSA.

Agency theory suggests that Islamic banks may face agency problems due to the division between ownership and control. This situation can potentially incentivize agents or managers to prioritise their own interests over the interests of shareholders. The OSA (Operational Suitability Assessment) for IBS (Islamic Banking and Finance) is an accounting system utilised to evaluate the compatibility of management operations with established Shari'ah Principles. The presence of OSA can be seen as an embodiment of the agent's obligation to the principal. The majority of organisations rely on the theoretical framework of governance and ISA to establish their internal audit function and utilise the OSA as a tool (Nurhadi, 2019; Wahyuni et al., 2020). However, the lack of compulsory guidelines for OSA implementation among IBs does not ensure their successful implementation. Figure 1 represents the application of Islamic Agency Theory in the OSA implementation in IBs.

A comprehensive analysis was conducted, spanning from September 2022 to March 2023, with the objective of comprehending the concept of Operational Shari'ah Audit. This review also identified the factors crucial for the effective implementation of OSA. The scope of the review was restricted to scholarly articles published between the years 1995 and the present. The databases utilized in this study included ProQuest, Science Direct, Google Scholar, Springer, Neliti, Rebsco, and DOAJ. The search terms employed encompassed the topics of operational audit on Islamic banks, performance audit on Islamic banks, the effectiveness of performance audits, the effectiveness of operational audits, and Shari'ah audit.

Critical Review: Factors Contribute To The Theory-Practice Gap Associated with OSA

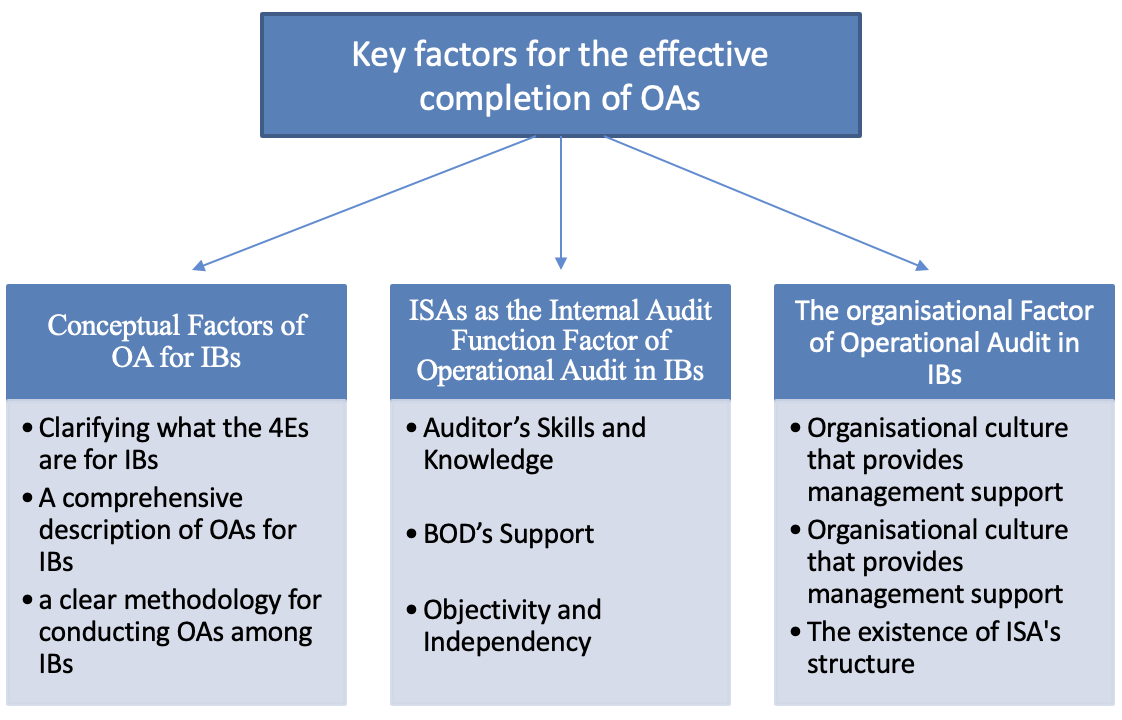

The literature has revealed problematic factors that can be categorised into three main categories. This section provides a comprehensive analysis and detailed discussion of the aforementioned topics. The primary issue pertains to challenges linked to the conceptual factor of OSA, which implies that the audit's extent is significantly subjective and lacks specific outcomes. The second issue pertains to challenges at the ISA function level, particularly in terms of service delivery. Lastly, the third issue pertains to challenges that arise at the organisational level, which may impact the facilitation and acceptance of service.

Conceptual factors of Operational Audit in Islamic Banks

The existing body of research reveals that there is a wide variety of definitions for OA, some of which were outlined earlier (Broadbent et al., 2009; Dang et al., 2019; Dufresne, 1980; Flesher & Zarzeski, 2002; Vafaei, 2016; Verschoor, 2011). As discussed previously, one of the most important aspects of OA for IBs is the evaluation of the 4Es of an organization's operations. This idea emerges as a distinct topic from the definitions that have been provided among conventional banks industry. Economy, efficiency, and effectiveness are concepts that are primarily associated with one another. Since IBs need a complete Code of Ethics based on Islamic law principles, shari’ah compliance should become part of the evaluation in OA. Despite the fact that the primary emphasis of this Practice Guide is on audits of efficiency, it acknowledges the fact that performance audits frequently incorporate elements of effectiveness, economy and Islamic ethics as well. However, existing studies of the ISA’s role is more often involved in reviewing compliance issues and organizational procedures (Algabry et al., 2020; Islam & Bhuiyan, 2021; Khalid et al., 2017; Khalid, 2020; Khalid, Hussin, et al., 2021; Khalid & Sarea, 2021; Khalid, Sarea, et al., 2021). According to the foregoing discussion, the idea that auditors struggle to determine their audit scope and the associated audit output suggests that there is a need to determine in explicit terms what constitutes the 4Es for IBs. To be more specific, additional work needs to be done to establish a clear framework of the expected inputs (economy) in order to achieve a set of outputs (efficiency) for addressing a set of predetermined objectives (effectiveness) regarding the audit target and the conformity of Islamic banks to the principles of Islamic law (Ethics).

According to the literature, the country of application and the industry/sector of the economy have influenced the application of various OSA concepts. For example, the term "value for money" is argued to be used in the public sector (Chezue, 2013; Dahanayake & Jacobs, 2008) and the term "performance audit" has been widely cited as also being used in the Australian public sector (Funnell et al., 2016; Rana et al., 2022; Wood et al., 2005). In the United States, the original word "Operational Audit," from which the other terms arose, has been linked with both the corporate and public sectors (Allegrini, 2011; Dufresne, 1980; Verschoor, 2011). It is recommended that the term "OA" be used universally and that its definition be refined to establish clearly the expected Shari'ah Compliance (Ethics), inputs (economy) to achieve, and a set of outputs (efficiency) for addressing a set of predetermined objectives (effectiveness) about a program, function, activity, or department that is being audited. In addition, it is recommended that the term "OA" be used universally (Vafaei, 2016). In addition, in light of the information now available to us, to date there is no clear and consistent methodology for conducting OSA within IBs. This part not only highlights the problems that are linked with the vague and ambiguous notions of the 4Es and the phrases that are used to describe OSA, but it also reveals the problems that are associated with the lack of methodology that is used to conduct OSA within IBs (Febrian, 2019).

ISAs as the Internal Audit Function Factor of Operational Audit in IBs

The ISAs who are in charge of performing operational audits are under a lot of pressure to finish the process as quickly as possible since the audit report, which is the end result of the OSA process, needs to be acted on as quickly as possible in order for it to be effective. Given the breadth and depth of an OSA, it is imperative that ISAs engage in continuous training in order to remain current on all operational concerns (Khalid et al., 2017; Khalid et al., 2018; Mohd Ali et al., 2020). However, it has been noticed that this is not always the case in actual practice. These challenges have an effect on the efficiency with which OSA can be carried out. It is on the basis of these variables that it is determined whether or not they are factors that enable the effective conduct of OSA.

The proper positioning of an ISAs department is also essential to effective IBs practise, as in the case of internal audits, where it was determined that the department's hierarchical position can guarantee its independence through an efficient reporting structure. According to Algabry et al. (2020) it is imperative that the Shari'ah auditor be granted complete independence in examining all pertinent documents, contracts, and agreements without any exemptions, while receiving unwavering support from both the Shari'ah committee and the Board of Directors. Independence and objectivity have been incorporated into the framework for internal auditors by the IIA standards. Both terms were distinguished and defined by the IIA (Algabry et al., 2020). According to the International Standards for the Professional Practice of Internal Auditing, objectivity is when an auditor's assessments and judgements are not influenced by any pressure and remain impartial. Independence refers to the state of being free from any circumstances that may pose a threat to the impartial execution of responsibilities by the internal audit activity.

Organizational Factor of Operational Audit in Islamic Banks

Cooperation between auditees and auditors is essential for good performance audits (Van Loocke & Put, 2011). Morin discovered that in the course of his research on the various governmental organizations in Quebec, the acceptance of auditors' recommendations was positively influenced by the quality of their working relationships with the organizations' management (Morin, 2004). However, this cultural variation is not consistent across different organizations (Dellai & Omri, 2016; Sawan, 2013). To achieve an effective internal Shari’ah audit, the role of management extends beyond providing the necessary resources and human capital. In addition, the bank's management must commit to implementing the audit's recommendations to confirm Shariah compliance in all of the institution's operations (Khalid et al., 2017). Therefore, it is expected that the support of management will have a substantial impact on the effectiveness of Internal Shari’ah Auditors (ISAs) in Islamic Banks.

The success of the OSA process is contingent upon the implementation of OSA recommendations. A positive interaction between auditors and auditees is hypothesised to facilitate the acceptance of OSA recommendations (Morin, 2004; Van Loocke & Put, 2011; Weets, 2011). In a similarly, Vries (2001) emphasised the significance of positive social interactions between auditees and auditors in the OA process in order to enhance its effectiveness (Vafaei, 2016; Vries, 2001). In order to carry out auditing in a manner that is both efficient and effective, the internal Shari'ah auditor needs to have ISA’s structure covering ISAs references, audit charter, audit plan as well as ISA’s audit manual (Algabry et al., 2021). A comprehensive Shariah references should be made available to them so that they can consult these references whenever they need to while they are working (Algabry et al., 2020). Accordingly, the acceptance of operational audit recommendations by management is influenced by the "evaluation culture" of the organization (Van Loocke & Put, 2011).

In order to conduct a performance audit, it is imperative to incorporate certain essential elements such as a well-defined organizational structure, a culture that is cognizant of costs, and governance guidelines that are sufficient (van der Knaap, 2011). The BNM guidelines state that the Shari’ah auditor charter is significant because it details the tasks, responsibilities, purpose, and authority of the internal Shari’ah auditor in the form of formally written and comprehensive documents that have been approved by the Shari’ah committee (Algabry et al., 2021). The Board of Directors ought to give its approval to the Shari'ah auditor charter in order to ensure that all tiers of bank management are aware of the internal role played by the Shari'ah auditor (Bodnar & Hopwood, 2016).

Discussion and Conclusion

The objective of this study was to overcome the challenges that has emerged from the current body of literature, which pertains to a gap between theory and practise in the implementation of OSA. The present study undertook a critical review of the existing literature to identify the factors that contribute to the gap. Subsequently, the study employed these new insights to construct a conceptual model of enabling factors that can facilitate the effective practise of OSA.

The extant literature reveals that the practise of OSA is contextualised within the 4Es framework. This framework entails that operational auditing is primarily focused on furnishing the board and management with an impartial assessment of whether the organization's operations are being efficiently, effectively, economically managed and following Ethical in Islamic values. The analysis of existing literature has provided a new practical perspective on the disparity between theory and practise. The issues have been scrutinised and identified as being linked to multiple challenges that arise across three distinct subject matters at different stages of the OSA implementation.

Initial subject matter is the concept of OSA. This paper analyses ISA's difficulties assessing the 4Es due to their ambiguity. Due to the aforementioned issues, some OSA entities tend to focus solely on a specific aspect of the broader context or have adopted a completely different perspective, according to research. The fact that entities are subject to a unique set of external factors that shape their governance system and limit the scope of the 4Es subject to audit compounds the issue (Puspitasari & Muhammad, 2019). Therefore, internal shari’ah auditors must determine these levels prior to auditing. Open access publications use multiple terminologies, which complicates matters. Diverse terminologies have made OSA input and output ambiguous. After these issues, OSA standards and methods are unclear. The presence of diverse criteria can be attributed to ambiguity surrounding the inputs and deliverables. These criteria have been established through both internal auditors and external entities. Diverse sets of standards have resulted in the development of various approaches. The argument posits that in order to conduct effective OSA, it is imperative to establish a well-defined concept of OSA, along with the development of clear input processes that serve as criteria for achieving a distinct set of outcomes that address the 4Es.

The second subject matter is operational shari’ah audits' pragmatic challenges. Based on review of literature, it has been discovered that inadequate support from the audit committee can lead to challenges for certain Internal Audit functions. Operational Audits through an audit charter or audit plan are hindered by this. Research also shows that OSA execution requires an advisory methodology that involves engaged partnership and consultation with leadership. Internal shari’ah auditors' suggestions are questioned due to the above issues. Pragmatic issues that affect OSA execution and validity are covered in this theme.

The third subject matter addresses organisational issues that impact OSA execution and results. This paper emphasises management support as essential to OSA success. The necessity of ensuring high levels of data security, privacy, and confidentiality is essential. OSA intrusions may affect employee employment status, emphasising their importance. Certain personnel may oppose audits due to unfavourable implications. Terefore these audits require management support. This theme highlights a poor auditee-auditor interactions can lead to management rejection of recommendations in organisations with a weak "evaluation culture". In this culture, implementing OSA recommendations is difficult. The empirical findings indicate that uniform protocols for auditor-auditee interaction and managerial support for organisational assessments are needed. The issues identified across the three subject matters provide a new perspective on the challenges impeding the successful implementation of OSA initiatives that require attention. The three subject matters that have been delineated to describe the problematic factors have served as the foundation for the development of a conceptual model of key factors that can promote an integration of OSA implementation. Figure 2 depicts the model that has been developed.

The practise of OSA is associated with a broader issue, which is supported by the problematic factors identified across the three subject matters. The origin of this issue can be traced back to the non-obligatory nature of internal shari’ah auditing, which lacks legal backing. Membership in the Shariah Supervisory Board (SSB) and adherence to its professional standards and best practise guidelines are not compulsory for internal shari’ah auditors. The implementation of Internal Shari’ah Audit Function within IBs has typically been impacted by corporate governance regulations and/or recommendations that are considered to be the most effective.

In conclusion, this study has generated a new pragmatic perspectives through a meticulous examination of existing scholarly works on the challenges related to the efficient implementation of OSA. The paper has devised a conceptual framework of key enabling factors to facilitate the effective practise of operational shari’ah auditing (as shown in Figure 2), in order to tackle the theory-practise gap that arises from these issues. As an initial endeavour in constructing a framework for the proficient execution of OSA, it is recognised that additional investigation is necessary to validate and/or enhance the components of the framework. The primary aim of this paper is to initiate discussion along with additional investigation in order to address the current gap between theory and practice in successful implementation of OSA. The study's findings hold significant implications for the ISA profession, specifically the IIA of Shari'ah Banks, as well as governance policy makers. These implications pertain to the need to address each of the factors that facilitate effective OSA and to develop a new or improved standard for its implementation.

References

Algabry, L., Alhabshi, S. M., Soualhi, Y., & Alaeddin, O. (2020). Conceptual framework of internal Sharīʿah audit effectiveness factors in Islamic banks. ISRA international journal of Islamic finance, 12(2), 171-193. DOI: 10.1108/IJIF-09-2018-0097

Algabry, L., Alhabshi, S. M., Soualhi, Y., & Othman, A. H. A. (2021). Assessing the effectiveness of internalSharīʿahaudit structure and its practices in Islamic financial institutions: a case study of Islamic banks in Yemen. Asian Journal of Accounting Research, 6(1), 2-22. DOI: 10.1108/ajar-04-2019-0025

Alharasis, E. E., Prokofieva, M., Alqatamin, R. M., & Clark, C. (2020). Fair Value Accounting and Implications for the Auditing Profession: Historical Overview. Accounting and Finance Research, 9(3), 31. DOI: 10.5430/afr.v9n3p31

Allegrini, M. (2011). What's next for internal auditing? : report 4. Institute of Internal Auditors Research Foundation.

Aribi, Z. A., Arun, T., & Gao, S. (2019). Accountability in Islamic financial institution: The role of theShari'ahsupervisory board reports. Journal of Islamic Accounting and Business Research, 10(1), 98-114. DOI: 10.1108/jiabr-10-2015-0049

As-Salafiyah, A., & Rusydiana, A. S. (2020). Sharia audit problems in zakat institutions: evidence from indonesia. Jebis (Jurnal Ekonomi dan Bisnis Islam), 6(2), 324-336. DOI:

Baldacchino, P. J., Fiteni, L., Bugeja, F., & Grima, S. (2021). The Evolution of Internal Auditing at a Central Bank: The Maltese Experience. European Research Studies Journal, XXIV(Issue 2B), 628-654. DOI: 10.35808/ersj/2255

Barr, J., & Christie, A. (2015). Improving the practice of Value for Money Assessment. CDI Practice Paper 12, Brighton.

Berry, A. J., Coad, A. F., Harris, E. P., Otley, D. T., & Stringer, C. (2009). Emerging themes in management control: A review of recent literature. The British accounting review, 41(1), 2-20. DOI:

Bodnar, G. H., & Hopwood, W. S. (2016). Accounting Information System (9th Ed), Pearson Education Inc.

Broadbent, J., English, L., Guthrie, J., & Laughlin, R. (2009). Some thoughts on a system for the performance audit of the operational stage of long term partnerships with the private sector for the provision of public sector services. Accounting and Finance Association of Australia and New Zealand Conference.

Chezue, B. B. (2013). Benefits of value for money in public service Rojects the case of National Audit Office Of Tanzania. Mzumbe University.

Dahanayake, S., & Jacobs, K. (2008). New public management (NPM), managerialism, and Value for Money (VFM) audit: A review of empirical literature with special reference to Australia. AFAANZ Conference Paper. http://www.afaanz.org/openconf/afaanz/papers.php

Dang, T. H., Nguyen, T. D. T., & Tran, M. D. (2019). Research on Criteria for Operational Audit of Expenditure from State Budget in Vietnam, Vol 10 (10), 158-165

Daujotaitė, D., & Mačerinskienė, I. (2008). Development of performance audit in public sector. The 5th International Conference of Business and Management, Vilnius, Lithuania.

Defond, M. L., Zhang, F., & Zhang, J. (2021). Auditing research using Chinese data: what’s next? Accounting and Business Research, 51(6-7), 622-635.

Dellai, H., & Omri, M. A. B. (2016). Factors affecting the internal audit effectiveness in Tunisian organizations. Research Journal of Finance and Accounting, 7(16), 208-211.

Dufresne, P. A. (1980). A Model for an Operational Audit of United States Coast Guard Non-Appropriated Fund Activities.

Febrian, D. (2019). Problematika Audit Syariah Pada Lembaga Bisnis Di Indonesia [Sharia Audit Problems in Business Institutions in Indonesia]. Jurnal Istiqro, 5(2), 154-164.

Fiteni, L. (2020). The development of internal auditing at the Central Bank of Malta: a study University of Malta.

Flesher, D. L., & Zarzeski, M. T. (2002). The roots of operational (value-for-money) auditing in English-speaking nations. Accounting and Business Research, 32(2), 93-104. DOI:

Fonseca, A. d. R., Jorge, S., & Nascimento, C. (2020). The role of internal auditing in promoting accountability in Higher Education Institutions. Revista de Administração Pública, 54(2), 243-265. DOI: 10.1590/0034-761220190267x

Funnell, W., Wade, M., & Jupe, R. (2016). Stakeholder perceptions of performance audit credibility. Accounting and Business Research, 46(6), 601-619. DOI:

Hanif, M. (2018). Sharīʿah-compliance ratings of the Islamic financial services industry: a quantitative approach. ISRA international journal of Islamic finance, 10(2), 162-184. DOI: 10.1108/IJIF-10-2017-0038

Haniffa, R. (2010). Auditing Islamic financial institutions.

Isa, F. S., Ariffin, N. M., & Abidin, N. H. Z. (2020). Shariah audit practices in Malaysia: moving forward. Journal of Islamic Finance, 9(2), 42-58.

Islam, K. M. A., & Bhuiyan, A. B. (2021). Determinants of the Effectiveness of Internal Shariah Audit: Evidence from Islamic Banks in Bangladesh. The Journal of Asian finance, economics, and business, 8(2), 223-230. DOI: 10.13106/jafeb.2021.vol8.no2.0223

Jusri, A. P. O., & Maulidha, E. (2020). Peran Dan Kompetensi Auditor Syariah Dalam Menunjang Kinerja Perbankan Syariah [The Role and Competency of Sharia Auditors in Supporting Sharia Banking Performance]. JAS (Jurnal Akuntansi Syariah), 4(2), 222-241. DOI:

Khalid, A. A. (2020). Role of Audit and Governance Committee for internal Shariah audit effectiveness in Islamic banks. AJAR (Asian Journal of Accounting Research) (Online), 5(1), 81-89. DOI: 10.1108/AJAR-10-2019-0075

Khalid, A. A., & Sarea, A. M. (2021). Independence and effectiveness in internal Shariah audit with insights drawn from Islamic agency theory. International Journal of Law and Management, 63(3), 332-346. DOI: 10.1108/IJLMA-02-2020-0056

Khalid, A. A., Haron, H. H., & Masron, T. A. (2017). Relationship between internal Shariah audit characteristics and its effectiveness. Humanomics, 33(2), 221-238. DOI:

Khalid, A. A., Haron, H., & Masron, T. A. (2018). Competency and effectiveness of internal Shariah audit in Islamic financial institutions. Journal of Islamic accounting and business research, 9(2), 201-221. DOI: 10.1108/JIABR-01-2016-0009

Khalid, A. A., Hussin, M. Y. M., Sarea, A., & Bin Mohamed Shaarani, A. Z. (2021). Development of effective Internal Shariah audit framework using Islamic agency theory. Asian economic and financial review, 11(8), 682-692. DOI: 10.18488/JOURNAL.AEFR.2021.118.682.692

Khalid, A. A., Sarea, A. M., & Mohd Hussin, M. Y. (2021). The performance of internal Shariah auditor in islamic financial institutions. Turkish journal of computer and mathematics education, 12(3), 646-652. DOI: 10.17762/turcomat.v12i3.769

Khan, M. A. (1998). Performance auditing for Islamic banks. Islamic Economic Studies, 5(1).

Kusumaningrum, D., Yusrifal, M., PH, N. M., & Fuad, Y. (2021). Urgensi Penerapan Kepatuhan Syariah Pada Perbankan Syariah [The Urgency of Implementing Sharia Compliance in Sharia Banking]. Dinamika Ekonomi-Jurnal Ekonomi dan Bisnis, 14(2), 403-415.

Malkawi, B. H. (2013). Shari'ah Board in the Governance Structure of Islamic Financial Institutions. The American Journal of Comparative Law, 61(3), 539-578. DOI: 10.1093/ajcl/61.3.539

Mansour, I. H. F. (2019). Customers’ perceptions of selection criteria used by Islamic bank customers in Sudan: The importance of Shariah compliance. Journal of Research in Emerging Markets, 1(4), 20-32. DOI: 10.30585/jrems.v1i4.363

Md. Rezaul, K., & Samia Afrin, S. (2020). Level of Shariah Compliance in the Operation of Islamic Banks in Bangladesh: An Empirical Study. Uluslararası İslam ekonomisi ve finansı araştırmaları dergisi, 6(3), 293. DOI: 10.25272/ijisef.755679

Mohd Ali, N. A., Shafii, Z., & Shahimi, S. (2020). Competency model for Shari’ah auditors in Islamic banks. Journal of Islamic accounting and business research, 11(2), 377-399. DOI: 10.1108/JIABR-09-2016-0106

Morin, D. (2004). Measuring the impact of value‐for‐money audits: a model for surveying audited managers. Canadian Public Administration, 47(2), 141-164. DOI:

Muchlis, M. (2021). Persepsi Nasabah Terhadap Bank Syariah di Indonesia [Customer Perceptions of Sharia Banks in Indonesia]. Jurnal Ilmiah Ekonomi Islam, 7(3), 1793-1798.

Nurhadi, N. (2019). The Importance of Maqashid Sharia as a Theory In Islamic Economic Business Operations. International Journal of Islamic Business and Economics (IJIBEC), 3(2), 130-145. DOI:

Paape, L. (2007). Corporate governance: The impact on the role, position, and scope of services of the internal audit function.

Puad, N. A. M., & Shafii, Z. (2019). Shari’ah Audit Process in Takaful Industry. Emerald Publishing Limited. DOI: 10.1108/978-1-78973-007-420191013

Puspitasari, L. L., & Muhammad, R. (2019). Perumusan Konsep Shariah Governance di Indonesia: Evaluasi Model Pengawasan Syariah di Sektor Perbankan [Formulation of the Shariah Governance Concept in Indonesia: Evaluation of the Shariah Supervision Model in the Banking Sector]. Muqtasid: Jurnal Ekonomi dan Perbankan Syariah, 10(1), 1. DOI: 10.18326/muqtasid.v10i1.1-16

Rana, T., Steccolini, I., Bracci, E., & Mihret, D. G. (2022). Performance auditing in the public sector: A systematic literature review and future research avenues. Financial Accountability & Management, 38(3), 337-359. DOI:

Rizqiani, D., & Yulianto, A. (2020). The implementation of sharia audit process, implication of sharia regulatory and human resource aspects. Journal of Islamic Accounting and Finance Research, 2(1), 51-68. DOI: 10.21580/jiafr.2020.2.1.5220

Safieddine, A. (2009). Islamic financial institutions and corporate governance: New insights for agency theory. Corporate Governance: An International Review, 17(2), 142-158. DOI:

Saqib, L., Farooq, M. A., & Zafar, A. M. (2016). Customer perception regarding Sharī‘ah compliance of Islamic banking sector of Pakistan. Journal of Islamic accounting and business research, 7(4), 282-303. DOI: 10.1108/JIABR-08-2013-0031

Sawan, N. (2013). The role of internal audit function in the public sector context in Saudi Arabia. African Journal of Business Management, 7(6), 443-454.

Shah, A. (2007). Performance accountability and combating corruption. World Bank Publications.

Umiyati, U., Laila, M., & Mustafa, K. (2020). Islamic Corporate Governance And Sharia Compliance On Financial Performance Sharia Bank In Indonesia. Al-Iqtishad : Jurnal Ilmu Ekonomi Syariah, 12(1). DOI: 10.15408/aiq.v12i1.15053

Vafaei, E. (2016). Operational auditing within Australian internal audit departments: developing a framework. Curtin University.

van der Knaap, P. (2011). Sense and complexity: Initiatives in responsive performance audits. Evaluation, 17(4), 351-363. DOI: 10.1177/1356389011423551

Van Loocke, E., & Put, V. (2011). The impact of performance audits: A review of the existing evidence. Performance Auditing. DOI:

Verschoor, C. C. (2011). The Operational Auditing Handbook: Auditing Business And It Processes (2nd Ed.). Thomson Reuters (Tax & Accounting) Inc.

Vries, G. d. (2001). Beleidsdynamica als sociale constructie. Een onderzoek naar doorwerking van beleidsevaluatie en beleidadvisering [Policy dynamics as a social construction. A study into the impact of policy evaluation and policy advice].

Wahyuni, S., Pujiharto, P., & Hartikasari, A. I. (2020). Sharia Maqashid Index and Its Effect on The Value of The Firm of Islamic Commercial Bank in Indonesia. Riset Akuntansi dan Keuangan Indonesia, 5(1), 36-45. DOI:

Weets, K. (2011). Impact at local government level: A multiple case study. Performance Auditing. Edward Elgar Publishing.

Wood, D. F., Moreo, P. J., & Sammons, G. (2005). Hotel housekeeping operational audit: A questionnaire approach. International journal of hospitality & tourism administration, 6(3), 1-10. DOI:

Yaacob, H., & Donglah, N. K. (2012). Shari’ah audit in Islamic financial institutions: the postgraduates’ perspective. International journal of economics and finance, 4(12), 224-239. DOI:

Zainal Abidin, N. H., Mat Yasin, F., & Zainal Abidin, A. (2021). Independence from the perspective of the Shari'ah committee. Asian Journal of Accounting Research, 6(2), 196-209. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Sulistyowati, S., Daud, D., & Kasim, E. S. (2023). Recognizing the Current State of Operational Shariah Audit of Islamic Banks. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 419-431). European Publisher. https://doi.org/10.15405/epsbs.2023.11.35