Abstract

Financial statement fraud can result in significant losses for stakeholders including investors, creditors, and the government. As a result, the auditor is crucial in identifying and stopping such fraud. The auditor's professional skepticism and sense of self-efficacy are two aspects that might affect their capacity to spot fraud. Among the firms listed on the Indonesia Stock Exchange, this study intends to investigate the impact of professional skepticism and self-efficacy on identifying financial statement fraud. A total of 147 respondents participated in the quantitative research approach, which employed a purposive sample strategy. Data was gathered through questionnaires delivered to respondents who participated in the company's auditing procedure. A multiple linear regression analysis was used to examine the data that had been gathered. The study's findings indicate a substantial relationship between professional skepticism and self-efficacy and the ability to identify financial statement fraud. Identifying financial statement fraud is specifically positively and significantly impacted by professional skepticism and self-efficacy. These findings can significantly contribute to practitioners' and academics' abilities to identify situations of fake financial statement.

Keywords: Auditor, Detection of Financial Statement Fraud, Professional Skepticism, Self-Efficacy

Introduction

Companies must ensure their financial reports are accurate and trustworthy if they want investors to take them seriously. However, there are instances of deception in reported financial results. Thus, it is essential to have the company's financial accounts independently audited to assure their accuracy and credibility. The capacity of the auditor to spot fraudulent activity in the financial statements is a crucial part of any audit. Several characteristics can affect an auditor's capacity to spot fraud, including their level of professional scepticism and their sense of self-efficacy (Atmaja & Sukartha, 2021; Braun, 2000; Syed Mustapha Nazri et al., 2023; Zager et al., 2016) in particular.

Stakeholders including investors, creditors, and the government might lose much money if a company's financial reports are falsified (Apriliana & Agustina, 2017; Yulianti et al., 2019). That's why it's the auditor's job to sniff out and prevent fraud of this sort (Yu & Rha, 2021). Unfortunately, there are times when not even certified auditors can prevent fraud from occurring in a company's books. The auditor's level of professional scepticism and their belief in their own ability to detect fraud are two factors that could influence detection success (Ghani et al., 2019). Auditors should maintain a healthy dose of professional scepticism when conducting audits, which has been shown to make auditors better at detecting fraud (Suryandari & Yuesti, 2017; Said & Munandar, 2018). Conversely, self-efficacy refers to a person's belief in his or her ability to carry out a task, which might influence motivation to do so (Atmaja & Sukartha, 2021; Bandura, 2012). According to the ACFE's (2020) Report on the Activity of Certified Fraud Examiners, professional scepticism is crucial in identifying false financial statements. Professionally sceptical auditors are more able to spot red flags that indicate financial statement fraud. Sceptical auditors are known to be more thorough in their investigations of red flags and their evaluations of audit data. Therefore, it is vital to investigate how auditor self-efficacy and professional scepticism influence the auditor's ability to detect fraud in a company's financial statements. This study has the potential to give academics and practitioners new insights on improving audit quality and preventing fraud in corporate financial statements.

Detecting financial statement fraud is critical for safeguarding investors, creditors, and other stakeholders and maintaining the credibility of financial reporting (Jan, 2018). Through their audits, external auditors are educated to spot signs of financial statement fraud (Humpherys et al., 2011; Roszkowska, 2021). Financial accounts, supporting documents, and internal control systems are all examined by external auditors looking for red flags and abnormalities. When it comes to a company's financial performance, it's the job of external auditors to ensure the numbers add up. When a corporation willfully exaggerates its financial performance or position, it is committing financial statement fraud (Ikbal et al., 2020; Tsegba & Upaa, 2015). Revenue overstatement, expense understatement, asset inflation, and liability concealment are all forms of financial statement fraud (Kiymaz, 2020). Financial statement fraud is a complicated and difficult crime to uncover because the information supplied is often crafted to deceive even the most thorough external auditors (Rezaee, 2010). An external auditor's job is to evaluate a firm's financial statements without bias or influence from within the organisation (Alzeban, 2019; Balkaran, 2008; Dzikrullah et al., 2020). To detect discrepancies and verify the absence of major misstatements in the financial accounts, external auditors must use their best judgement and a healthy dose of scepticism. The risk of fraud must also be taken into account by the external auditor when assessing the effectiveness of the company's internal controls (Saputra & Yusuf, 2019; Shukurullaevich, 2020; Syed Mustapha Nazri et al., 2023; Tunji, 2013).

The purpose of this research is to analyse how an auditor's level of professional scepticism and confidence in their own abilities affects their ability to spot fake financial statements. Self-efficacy refers to an individual's confidence in his or her own capacity to carry out a task, while professional scepticism refers to the critical attitude carried by the auditor during the assessment. Stakeholders can suffer considerable losses due to fraudulent financial statements. Therefore, the auditor's ability to spot signs of fraud is crucial. Researchers hope these findings will help boost public trust in audits and the reliability of financial statements.

Literature Review

Professional Skepticism

Professionals, especially auditors, are expected to approach their work with professional skepticism, which is an attitude of uncertainty, questioning, and critical thinking (Nolder & Kadous, 2018; Shirzad et al., 2020). This involves keeping an inquiring mind and being alert to potential bias, misrepresentation and fraud in the information and data being examined. Professional skepticism also involves a willingness to challenge assumptions and evidence, seek alternative explanations, and independently verify information. This is an important aspect of professional behavior in fields that require objective assessment, such as accounting, auditing, and finance (Glover & Prawitt, 2014; Jaya et al., 2016; Kusumawati & Syamsuddin, 2018). Professional skepticism is a key concept in understanding independent auditors. This emphasizes the importance of skeptical and critical behavior by the auditor in assessing the audit evidence obtained during the audit process. This theory emphasizes that auditors must be skeptical and not too easily accept claims or evidence provided by the entity being audited (Fabiianska et al., 2021; Harber & Marx, 2020; Koswara et al., 2023). By adopting professional skepticism, professionals can help ensure the accuracy and reliability of information presented, and detect any inconsistencies or fraudulent activity that may occur.

Research by Amlayasa and Riasning (2022), Dimitrova and Sorova (2016) states that professional skepticism has a significant positive relationship with detection of financial statement fraud. This is because professional skepticism allows auditors to approach their work with a critical mindset and question the information provided to them. By being skeptical, auditors are more likely to identify inconsistencies or anomalies in financial information that may indicate fraudulent activity (Mubako & O'Donnell, 2018). In addition, professional skepticism can help the auditor to identify areas that require further investigation, and to remain alert to potential red flags that might indicate fraudulent activity. This increased awareness can help the auditor to detect fraudulent activity that may go unnoticed (Hogan et al., 2008).

Professional skepticism is considered an important factor in supporting auditors' detection of financial statement fraud (Agustina et al., 2021; Iskandar et al., 2022). It is important for auditors to maintain a healthy level of skepticism throughout their work, and to be alert to potential red flags that might indicate fraudulent activity. Therefore, the first hypothesis in this study is concluded as follows:

Hypothesis 1: Professional Skepticism influences the Detection of Financial Statement Fraud

Self-Efficacy

To have self-efficacy is to have confidence in one's own abilities to perform a task or accomplish an objective (Marzuki et al., 2017). It's a subjective evaluation of one's own knowledge, skill, and aptitude for a given endeavour. A person's level of desire, effort, and tenacity in pursuit of their goals can be influenced by their sense of self-efficacy. High self-efficacy is associated with a positive outlook on adversity, the recognition of difficulties as learning experiences, and the ability to keep going despite setbacks (Atmaja & Sukartha, 2021; Ghani et al., 2019). The self-efficacy theory proposed by Amlayasa and Riasning (2022) states that an individual's confidence in his own abilities has a direct impact on his actions and the level of effort he puts into achieving his goals. When an auditor believes in his or her own competence to spot fake financial accounts, he or she is prone to put in extra effort, work steadily, and make sound auditing judgements.

The auditor's sense of self-efficacy can have an impact on his performance and his ability to spot fake financial statements during an audit. Studies by Djaddang and Lysandra (2022), Lee et al. (2016) found that auditors' confidence in their own abilities correlated positively with their success at uncovering fake financial statements. Self-confident auditors are more likely to look deeply into possible cases of fraud, follow up on leads consistently, and put in extra time and energy overall. So, they are better at spotting financial statement fraud than auditors who don't believe in their own abilities. But auditors who don't believe in themselves are more likely to second-guess their competence, avoid making tough calls, and slack off on the job (Mohd Sanusi et al., 2018; Su et al., 2016). Their capacity to identify instances of false accounting could be hampered by the aforementioned problems. The confidence an auditor has in his or her own abilities to do a good job and spot signs of financial statement fraud is important. Self-efficacy, or the belief that one can accomplish a goal or task successfully, is crucial for auditors (Agustina et al., 2021; Kawisana & Yudiastra, 2022; Pawitra & Suhartini, 2019).

Auditors' confidence in their own abilities to spot fake financial reports is a key variable in this context. When compared to auditors with lower self-efficacy levels, individuals with higher levels are more likely to detect fraudulent activities and perform better overall. As a result, auditors need to cultivate and sustain a high level of self-efficacy if they want to be more successful in their work and in identifying fake financial statements. As a result, the following is drawn about the study's second hypothesis:

Hypothesis 2: Self Efficacy has an effect on Fraud Detection of Financial Statements

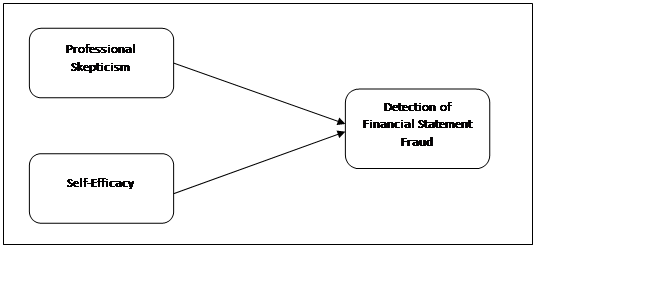

The figure 1 presents the framework for this research which is constructed as follows:

Research Method

This study employs quantitative techniques to collect data on auditors of public accounting firms who examined a company listed on the Indonesia Stock Exchange and to evaluate the relationship between professional scepticism, self-efficacy, and the finding of financial statement fraud. This research employed a purposive sample strategy for its sampling process. There were a total of 170 questionnaires sent out, however 17 were never returned and 6 were only partially filled out. As a result, data from as many as 147 participants was collected. The experts chosen as responders in this study, auditors in public accounting firms, are those who perform the actual audit of the company's financial statements. Thus, these auditors are a good sample for studying how professional scepticism, self-efficacy, and the detection of financial statement fraud are related. In addition, the Indonesia Stock Exchange is home to numerous enterprises operating in the country's bustling financial sector. Since characteristics like professional scepticism and self-efficacy can affect whether or not fake financial statements are uncovered, doing so is crucial in the business world. In this study, information was gathered by the use of a questionnaire tailored to the factors of interest. The independent variables in this study are professional scepticism and self-efficacy, both of which are presented on a quantitative scale. The dependent variable is the detection of fraud in financial statements, which may be measured in the same way. Linear regression is the chosen method of analysis for this investigation. Financial reporting fraud was employed as the dependent variable in a linear regression analysis of professional scepticism and self-efficacy as independent variables. In order to analyse the data and get results that are relevant and statistically interpretable, the analysis was performed using statistical software like SPSS (Statistical Package for the Social Sciences).

Result and Discussion

The first analytical test carried out in this study was to test the measurement instrument or questionnaire using 2 methods, namely the validity test and the reliability test. The validity test is carried out to ensure that the measurement instrument or questionnaire used can actually measure the construct or variable in question accurately and validly. The measurement instrument or questionnaire can be said to be valid if the total 2-tailed significance of each variable gets a value of <0.05. It must be more than r table 0.135 (Pearson, df = (, n-2)) or by comparing the value of r count (Pearson Correlation). Table 1 below shows the findings of this study's validity test:

As can be seen in Table 1 above, the professional scepticism variable received a r count (Pearson Correlation) of 0.822, which is already greater than r table (0.135), as part of the validity test. The resulting 2-tailed p-value is 0.000 (0.05). The r count for PS2 was 0.754, which was higher than the r table value of 0.135% and had a 2-tailed significance of 0.000 (0.05). With a 2-tailed significance level of 0.000 (0.05), PS3's calculated r value of 0.846 was higher than the r table's value of 0.135. Finally, PS4 calculates a r value of 0.770, which is larger than the r table value of 0.135% and yields a 2-tailed significance value of 0.000 (0.05). The computed 2-tailed significance value for PS5 is 0.000 (0.05), but the r count value is > 0.135. These results lend credence to the reliability and accuracy of the professional scepticism survey as an assessment instrument.

The self-efficacy variable's r count value was 0.806 (> r table 0.135), and SE1 returned a 2-tailed significance value of 0.000 (0.05). Using SE2, we get a 0.000 (0.05) 2-tailed significance value and a r count of 0.797 (more than the r table value of 0.135). SE3 has a value of 0.860 (> r table 0.135) and a 2-tailed significance level of 0.000 (0.05). The calculated r value of 0.610 with a 2-tailed significance value of 0.000 (0.05) provided by SE4 is more reliable than the r value of 0.13 provided by the r table. SE5 similarly yielded positive results, with a 2-tailed significance of 0.000 (0.05) and a r count of 0.871 (> r table 0.135). Therefore, it might be argued that the questionnaire or other measuring tool used to assess self-efficacy is reliable and accurate. With a r count of 0.824 (> r table of 0.135), the FSF1 questionnaire for detecting financial statement fraud achieved a 2-tailed significance value of 0.000 (0.05). The r count for FSF2 is 0.731, which is larger than the r table value of 0.135% and yields a 2-tailed significance level of 0.000 (0.05). FSF3 calculates an r-value of 0.737 (> r table 0.135), which is statistically significant at the 0.000 (0.05) level. In contrast to the r table's value of 0.135, the estimated r value for FSF4 was 0.736, yielding a 2-tailed significance level of 0.000 (0.05). FSF5's r count was 0.713 (more than r table's 0.135), and the significance level at the lower of the two tails, 0.05, was 0.000. These results provide evidence that the variable in the questionnaire used to detect financial statement fraud is valid.

Researchers also conduct reliability tests on the tools and questionnaires they use to collect data, making sure they consistently and reliably measure the same variable across multiple occasions and contexts. According to Ghozali (2001), when a variable's Cronbach's alpha is more than 0.7, it can be argued that a measuring instrument or questionnaire is dependable. Table 2 below displays the findings from the study's reliability analysis:

According to the reliability test findings in the table above, the Cronbach's alpha value for the professional skepticism variable was 0.842. Cronbach's alpha values for the self-efficacy and financial statement fraud detection variables are 0.850 and 0.798, respectively. From the results of the reliability test, it shows that the Cronbach's alpha value of the variable professional skepticism, self-efficacy and detection of financial statement fraud is more than 0.7, therefore it can be concluded that the measurement instruments or questionnaires used in research are consistent and reliable or reliable.

A determination analysis test was then conducted to ascertain the association between two or more independent variables (professional skepticism, self-efficacy) and the dependent variable (recognition of financial statement fraud) at the same time. This coefficient demonstrates the extent to which the independent factors simultaneously affect the dependent variable. The determination analysis test findings are shown in table 3 below based on the regression analysis results:

The table presents the outcomes of the determination analysis test which indicate a correlation coefficient (R) of 0.827, denoting a strong relationship between the variables. The coefficient of determination (R Square) value of 0.684 suggests that the impact of independent variables (professional skepticism and self-efficacy) on the dependent variable (detection of financial statement fraud) is 6.84%. Consequently, the study concludes that there is a significant positive relationship between professional skepticism and self-efficacy, and the detection of financial statement fraud. This signifies that higher levels of professional skepticism and self-efficacy among auditors enhance their ability to uncover fraudulent activities in a company's financial statements.

The study also conducted an F-test analysis to determine whether the independent variables (professional skepticism and self-efficacy) collectively exert a significant impact on the dependent variable (detection of financial statement fraud). Additionally, this test aims to ascertain if the regression model can predict the dependent variable effectively. A significance value of <0.05 indicates a significant influence of the independent variables on the dependent variable. Table 4 displays the F-value obtained from the regression analysis:

The results in the above table demonstrate that the calculated F-value is 155.547, with a significance level of 0.000, which is less than 0.05. Therefore, it can be inferred that the independent variables (professional skepticism and self-efficacy) significantly influence the dependent variable (detection of financial statement fraud). Additionally, a partial regression coefficient test (t-test) was conducted to determine whether the independent variables (professional skepticism and self-efficacy) partially exert a significant impact on the dependent variable (detection of financial statement fraud) in the regression model. Table 5 displays the results of the regression analysis output.

The results of the partial regression coefficient test (t-test) presented in Table 5 indicate that the first hypothesis, which postulates that professional skepticism influences the detection of financial statement fraud, obtains a t-value of 4.558, exceeding the t-table value of 1.976, and obtains a significance value of 0.000, which is less than 0.05. Thus, it can be concluded that the first hypothesis is supported, implying that professional skepticism has a significant and positive impact on detecting financial statement fraud. The second hypothesis, which suggests that self-efficacy affects the detection of financial statement fraud, obtains a t-value of 7.048, surpassing the t-table value of 1.976, and attains a significance value of 0.000, which is less than 0.05. Hence, it can be inferred that the second hypothesis is also supported, indicating that self-efficacy has a substantial and positive influence on detecting financial statement fraud. The study findings reveal that individuals with higher levels of professional skepticism and self-efficacy possess greater capabilities to identify fraudulent financial statements.

The study's data analysis and processing results indicate that the two independent variables, namely professional skepticism and self-efficacy, have a significant and positive simultaneous impact on detecting financial statement fraud. This implies that auditors possessing higher levels of professional skepticism and self-efficacy exhibit greater capabilities in detecting financial statement fraud. The individual analysis reveals that professional skepticism and self-efficacy also have a significant and positive effect on detecting financial statement fraud. These findings suggest that professional skepticism and self-efficacy are crucial factors in detecting financial statement fraud. The results of this study align with previous research conducted by Ghani et al. (2019) and Agustina et al. (2021), which indicate that professional skepticism and self-efficacy play vital roles in detecting financial statement fraud. A skeptical auditor will likely scrutinize information provided and seek additional evidence to verify its accuracy.

Conclusion

Research shows that accountants' level of scepticism and confidence in their own abilities both play a role in whether or not financial statement fraud is uncovered. These results suggest that auditors' capacity to spot fraud in financial accounts increases in tandem with their level of professional scepticism and confidence in their own abilities as auditors. Companies and auditing firms would do well to consider these characteristics when hiring and educating auditors if they want to improve audits' ability to prevent and detect fraud in the accounting records. The findings of this research might help businesses prioritise the competence of their auditors and the reliability of their accounting records. Furthermore, authorities might use this study as a reference for formulating new audit standards to enhance audit efficiency in identifying financial statement fraud. Companies, and particularly those listed on the Indonesian Stock Exchange, can benefit from this study. Companies can help their auditors spot fake financial statements by nurturing traits like professional scepticism and self-efficacy. The findings of this study can also be utilised as a guide by supervisory agencies, regulators, and educators to raise auditing education and certification benchmarks. More investigation is needed to find other elements that can influence the auditor's capacity to recognise fraud in financial accounts, yet these variables were not evaluated in this study.

References

ACFE. (2020). 2020 Report to the Nations: Global Study on Occupational Fraud and Abuse. https://acfepublic.s3-us-west-2.amazonaws.com/2020-Report-to-the-Nations.pdf

Agustina, F., Nurkholis, N., & Rusydi, M. (2021). Auditors' professional skepticism and fraud detection. International Journal of Research in Business and Social Science (2147-4478), 10(4), 275-287. DOI:

Alzeban, A. (2019). The impact of audit committee, CEO, and external auditor quality on the quality of financial reporting. Corporate Governance: The International Journal of Business in Society, 20(2), 263-279. DOI:

Amlayasa, A. A. B., & Riasning, N. P. (2022). The Role of Emotional Intelligence in Moderating the Relationship of Self Efficacy and Professional Skepticism towards the Auditor's Responsibility in Detecting Fraud. International Journal of Scientific and Management Research, 05(11), 01-04. DOI:

Apriliana, S., & Agustina, L. (2017). The Analysis of Fraudulent Financial Reporting Determinant through Fraud Pentagon Approach. Jurnal Dinamika Akuntansi, 9(2), 154-165. DOI:

Atmaja, I. W., & Sukartha, I. M. (2021). The influence of self-efficacy, professional skepticism, and gender of auditors on audit judgment. American Journal of Humanities and Social Sciences Research, 5(1), 643-650. https://www.ajhssr.com/wp-content/uploads/2021/01/ZZW21501643650.pdf

Balkaran, L. (2008). Two sides of auditing: Despite their obvious similarities, internal auditing and external auditing have an array of differences that make them distinctly valuable. Internal Auditor, 65(5), 21-23.

Bandura, A. (2012). Cultivate Self-efficacy for Personal and Organizational Effectiveness. Handbook of Principles of Organizational Behavior. DOI:

Braun, R. L. (2000). The effect of time pressure on auditor attention to qualitative aspects of misstatements indicative of potential fraudulent financial reporting. Accounting, Organizations and Society, 25(3), 243-259. DOI:

Dimitrova, J., & Sorova, A. (2016). The role of professional skepticism in financial statement audit and its appropriate application. Journal of Economics, 1(2). https://js.ugd.edu.mk/index.php/JE/article/view/1596/1420

Djaddang, S., & Lysandra, S. (2022). Self-efficacy, professional ethics, and internal audit quality. Jurnal Ekonomi dan Bisnis, 25(2), 401-414. DOI: 10.24914/jeb.v25i2.3794

Dzikrullah, A. D., Harymawan, I., & Ratri, M. C. (2020). Internal audit functions and audit outcomes: Evidence from Indonesia. Cogent Business & Management, 7(1), 1750331. DOI:

Fabiianska, V., Kutsyk, P., Babich, I., Ilashchuk, S., Voronko, R., & Savitska, S. (2021). Auditor's professional skepticism: a case from Ukraine. Independent Journal of Management & Production, 12(3), s281-s295. DOI:

Ghani, E. K., Respati, H., Darsono, J. T., & Yusoff, M. M. (2019). The Influence of Professional Scepticism, Self-Efficacy and Perceived Ethical Climate on Internal Auditors' Ethical Judgment in Public Sector Management. Polish Journal of Management Studies, 19(2), 155-166. DOI:

Ghozali, I. (2001). Aplikasi Analisis Multivariate bagi Program SPSS [Multivariate Analysis Application for the SPSS Program]. Badan Penerbit UNDIP.

Glover, S. M., & Prawitt, D. F. (2014). Enhancing Auditor Professional Skepticism: The Professional Skepticism Continuum. Current Issues in Auditing, 8(2), 1-10. DOI:

Harber, M., & Marx, B. (2020). Auditor independence and professional scepticism in South Africa: Is regulatory reform needed? South African Journal of Economic and management Sciences, 23(1). DOI: 10.4102/sajems.v23i1.2912

Hogan, C. E., Rezaee, Z., Riley, R. A., Jr., & Velury, U. K. (2008). Financial Statement Fraud: Insights from the Academic Literature. AUDITING: A Journal of Practice & Theory, 27(2), 231-252. DOI:

Humpherys, S. L., Moffitt, K. C., Burns, M. B., Burgoon, J. K., & Felix, W. F. (2011). Identification of fraudulent financial statements using linguistic credibility analysis. Decision Support Systems, 50(3), 585-594. DOI:

Ikbal, M., Irwansyah, I., Paminto, A., Ulfah, Y., & Darma, D. C. (2020). Explores the specific context of financial statement fraud based on empirical from Indonesia. Universal Journal of Accounting and Finance, 8(2), 29-40. DOI:

Iskandar, R., Ramadhan, M. S., Mansyuri, M. I., & Ramadhan, R. (2022). Determinants of Auditor's Ability to Detect Fraud: Internal and External Factors. International Journal of Science, Technology & Management, 3(1), 179-195. DOI: 10.46729/ijstm.v3i1.452

Jan, C. L. (2018). An effective financial statements fraud detection model for the sustainable development of financial markets: Evidence from Taiwan. Sustainability, 10(2), 513. DOI:

Jaya, T. E., Irene, C., & Choirul, C. (2016). Skepticism, Time Limitation of Audit, Ethics of Professional Accountant and Audit Quality (Case Study in Jakarta, Indonesia). Review of Integrative Business and Economics Research, 5(3), 173-182. http://www.sibresearch.org/uploads/3/4/0/9/34097180/riber_b16-105_173-182.pdf

Kawisana, P. G. W. P., & Yudiastra, P. P. (2022). The Effect of Compensation on the Relationship between Professional Skepticism, Ethics, Personality Type, Auditor's Experience and Fraud Detection. International Journal of Multidisciplinary Research and Publications (IJMRAP), 5(1), 1-3. http://ijmrap.com/wp-content/uploads/2022/06/IJMRAP-V4N12P150Y22.pdf

Kiymaz, H. (2020). Types of corporate fraud. In Corporate Fraud Exposed. Emerald Publishing Limited. DOI:

Koswara, M. K., Kustiani, L., & Harmono, H. (2023). Effect of Audit Fees, Auditor Competency, Professional Ethics and Professional Skepticism on Audit Quality. Journal of Economics, Finance and Management Studies, 6(2), 807-819. https://ijefm.co.in/v6i2/25.php

Kusumawati, A., & Syamsuddin, S. (2018). The effect of auditor quality to professional skepticsm and its relationship to audit quality. International Journal of Law and Management, 60(4), 998-1008. DOI:

Lee, S.-C., Su, J.-M., Tsai, S.-B., Lu, T.-L., & Dong, W. (2016). A comprehensive survey of government auditors' self-efficacy and professional development for improving audit quality. SpringerPlus, 5(1). DOI:

Marzuki, M., Subramaniam, N., Cooper, B. J., & Dellaportas, S. (2017). Accounting academics’ teaching self-efficacy and ethics integration in accounting courses: A Malaysian study. Asian Review of Accounting, 25(1), 148-170. DOI: 10.1108/ARA-09-2015-0088

Mohd Sanusi, Z., Iskandar, T. M., Monroe, G. S., & Saleh, N. M. (2018). Effects of goal orientation, self-efficacy and task complexity on the audit judgement performance of Malaysian auditors. Accounting, Auditing & Accountability Journal, 31(1), 75-95. DOI:

Mubako, G., & O'Donnell, E. (2018). Effect of fraud risk assessments on auditor skepticism: Unintended consequences on evidence evaluation. International Journal of Auditing, 22(1), 55-64. DOI:

Nolder, C. J., & Kadous, K. (2018). Grounding the professional skepticism construct in mindset and attitude theory: A way forward. Accounting, Organizations and Society, 67, 1-14. DOI:

Pawitra, D. A. K., & Suhartini, D. (2019). The influence of individual behavioral aspects toward audit judgment: the mediating role of self-efficacy. Journal of Economics, Business, & Accountancy Ventura, 22(2), 264-273. DOI:

Rezaee, Z. R. R. (2010). Financial Statement Fraud-Prevention and Detection. John &Wiley Sons.

Roszkowska, P. (2021). Fintech in financial reporting and audit for fraud prevention and safeguarding equity investments. Journal of Accounting & Organizational Change, 17(2), 164-196. DOI:

Said, L. L., & Munandar, A. (2018). The influence of auditor’s professional skepticism and competence on fraud detection: the role of time budget pressure. Jurnal Akuntansi dan Keuangan Indonesia, 15(1), 6. DOI:

Saputra, I. G., & Yusuf, A. (2019). The role of internal audit in corporate governance and contribution to determine audit fees for external audits. Journal of Finance and Accounting, 7(1), 1-5. DOI:

Shirzad, B., Nikomaram, H., & Vakilifard, H. R. (2020). Professional socialization and professional skepticism in auditing: The theory of social identity. Journal of Management Accounting and Auditing Knowledge, 9(36), 1-18. https://jmaak.srbiau.ac.ir/article_16926.html?lang=en

Shukurullaevich, K. N. (2020). Audit of financial statements: Directions for evaluation of internal control system. SAARJ Journal on Banking & Insurance Research, 9(4), 57. DOI: 10.5958/2319-1422.2020.00022.3

Su, J.-M., Lee, S.-C., Tsai, S.-B., & Lu, T.-L. (2016). A comprehensive survey of the relationship between self-efficacy and performance for the governmental auditors. SpringerPlus, 5(1). DOI:

Suryandari, N. N. A., & Yuesti, A. (2017). Professional scepticism and auditors ability to detect fraud based on workload and characteristics of auditors. Scientific Research Journal (SCIRJ), 5(9), 109-115.

Syed Mustapha Nazri, S. N. F., Zahba, I. H., Zolkaflil, S., & Zainuddin, N. (2023). The influence of professional skepticism on fraud detection: the case of malaysian non-big 4 auditors. Management and Accounting Review (MAR), 22(1), 205-232. https://web.p.ebscohost.com/

Tsegba, I. N., & Upaa, J. U. (2015). Consequences of Financial Statement Fraud: A Developing Country Perspective. International Journal of Business and Management, 10(8). DOI:

Tunji, S. T. (2013). Effective internal controls system as antidote for distress in the banking industry in Nigeria. Journal of economics and international business research, 1(5), 106-121. http://www.projournals.org/JEIBR

Yu, S.-J., & Rha, J.-S. (2021). Research Trends in Accounting Fraud Using Network Analysis. Sustainability, 13(10), 5579. DOI:

Yulianti, Y., Pratami, S. R., Widowati, Y. S., & Prapti, L. (2019). Influence of fraud pentagon toward fraudulent financial reporting in Indonesia an empirical study on financial sector listed in Indonesian stock exchange. International Journal of Scientific and Technology Research, 8(8), 237-242. https://repository.usm.ac.id/files/journalint/B263/20190827013816-Fraud-Pentagon.pdf

Zager, L., Malis, S. S., & Novak, A. (2016). The role and responsibility of auditors in prevention and detection of fraudulent financial reporting. Procedia Economics and Finance, 39, 693-700. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Dewi, N. S., Faiza, S. N., Tobing, D. L., Said, J., & Julian, L. (2023). Professional Skepticism and Self-Efficacy on the Detection of Financial Statements Fraud. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 357-368). European Publisher. https://doi.org/10.15405/epsbs.2023.11.29