Abstract

Sustainability reporting had been made compulsory reporting for all listed companies in Malaysia. CED is part of the sustainability reporting which in this study explores the disclosure of Malaysian listed manufacturing companies from year 2016 until year 2021. This paper aims to investigate the Corporate Environmental Disclosure (CED) in the annual report of Malaysian manufacturing public listed companies which is a significant contributor to the Malaysian economy. The population of this study is Malaysian public listed companies, and this study consists of all energy companies as a sample. The initial sample size is 385 companies for the year 2016 until 2021. This study excluded companies with no annual reports, which resulted in a final sample of 268 companies. The study applied Content analysis. On average, the disclosure had only slight improvement from reporting descriptive only to quantitative. Findings showed that only 13.1 percent of companies had disclosed extraordinary results. This study has several implications for managers, investors and regulators. Future research may extend the study to other industries and can be conducted to provide stronger evidence on the disclosure of Malaysian listed companies. Furthermore, a comparative study with a larger sample of firms in developing countries could be examined.

Keywords: Annual Reports, Corporate Environmental Disclosure, Manufacturing Companies, Malaysia

Introduction

Climate change, natural resource constraints, and other socio-environmental problems have pushed Corporate Environmental Disclosure (CED) to the forefront of business decision-making and communication (Albitar et al., 2020; Cho & Patten, 2007; Gerged et al., 2020; Talbot & Barbat, 2020). As stakeholders such as investors, customers, regulators, and nonprofit organisations expect greater transparency and accountability, CED has become an increasingly essential aspect of sustainability reporting (Baumüller & Sopp, 2022; Sulkowski & Waddock, 2013). Environmental disclosure enables businesses to communicate with stakeholders about their environmental practices, impacts, and performance, allowing them to make informed decisions and minimise the environmental impacts (Tang et al., 2018). It may be communicated to the public in a variety of ways, including through sustainability reports, annually. reports, environmental impact statements, or other types of public communications. Therefore, the disclosure of environmental information can aid businesses in obtaining the trust of stakeholders and enhancing their reputation as environmentally responsible companies (Banerjee, 2018).

In ensuring the environmental disclosure is comprehensive, consistent, and relevant to stakeholders, many businesses adhere to the guidelines and frameworks established by organisations like the Global Reporting Initiative (GRI) and the Carbon Disclosure Project (CDP). The GRI's sustainability reporting standards provide a framework for companies to report on their environmental, social, and governance performance, whereas the CDP's platform enables companies to report on their carbon emissions as well as the risks and opportunities posed by climate change (CDP, n.d.; GRI, 2023).

Shen et al. (2019) investigated the impact of mandatory environmental disclosure on the environmental performance of Chinese companies. The researchers discovered that mandatory disclosure laws improve companies' environmental performance as measured by energy consumption, carbon emissions, and waste production. Firms subject to mandatory disclosure regulations, in particular, tend to reduce their environmental impact and better their environmental performance in reaction to regulatory requirements.

Moreover, according to a study by KPMG (2020), companies that disclose climate-related information in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are more likely to be regarded favourably by investors. The research also discovered that companies that disclose environmental information have a lower cost of capital and better financial performance. Sri and Arief (2018) discovered a positive correlation between environmental disclosure and company’s financial performance among the largest Australian listed companies. Similarly, Jusoh et al. (2023) discovered that the disclosure of environmental by Malaysian firms has a positive effect on firms' financial performance, indicating that companies can profit financially by demonstrating their commitment to sustainability. Furthermore, according to a study conducted by Bernaciak et al. (2021), businesses of construction industry face difficulties in adopting environmental disclosure practices due to a lack of internal resources and expertise.

In the study of Zhao et al. (2018), environmental disclosure in China has a positive effect on firm market value and stock returns. Furthermore, Al-Tuwaijri et al. (2004) discovered that environmental disclosure practices differ across countries, with firms in more environmentally regulated nations reporting more environmental information on average. Recent studies have suggested that voluntary reporting initiatives like the Global Reporting Initiative can encourage businesses to disclose more environmental information and improve their environmental performance (Dissanayake et al., 2021).

On the other hand, the effect of environmental disclosure on the financial and non-financial performance of firms is not always clear. The effect of environmental disclosure on financial performance depends on the type of environmental information disclosed and the level of stakeholder involvement in the disclosure process, according to a study conducted by Elshabasy (2018). Furthermore, Xia et al.'s (2023) study indicates that firms may engage in "greenwashing," or the selective disclosure of positive environmental information, in order to improve their reputation without actually improving their environmental performance. According to Malaysian research on environmental disclosure, while there is an increasing trend towards sustainability reporting among listed businesses, the quality and consistency of disclosure remains a challenge.

Cheng et al. (2017), discovered that companies prefer to disclose more positive environmental information than negative environmental information or implying selective disclosure. This is where, "greenwashing," may be an issue. Furthermore, smaller businesses and those in industries with a high environmental impact disclose less environmental information, emphasising the importance of targeted disclosure initiatives and regulatory oversight (Al-Tuwaijri et al., 2004; D'Amico et al., 2016). Despite these challenges, there have been some good developments in Malaysian environmental disclosure. According to a study conducted by Abdul Rahman and Alsayegh (2021), firms that engage in sustainability reporting have superior environmental performance as measured by greenhouse gas emissions and energy consumption. In addition, the study discovered that sustainability reporting can have a positive effect on firms' financial performance, indicating that disclosure can be beneficial for both companies and their stakeholders.

Several aspects of corporate environmental disclosure are investigated in the previous studies. However, no study has been conducted in Malaysia to examine the overall reporting depth of manufacturing listed companies as, according to D'Amico et al. (2016), the reporting of corporate environmental disclosure by companies varies as bigger or larger companies disclosed the detailed information while smaller companies did not. This study is required to see the depth of corporate environmental disclosure given that the manufacturing sector has the highest spending for environmental protection, which is RM2.9 billion in 2019 (Compendium of Environment Statistics Malaysia, 2021).

Corporate Environmental Disclosure

Corporate Environmental Disclosure is defined as the process of communicating a company's business-related environmental impact. Stakeholders benefit from CED as it provides them access to the information they need for determining a company's environmental performance and make wise decisions (Baalouch et al., 2019; Utomo et al., 2020). Recent research has emphasised the importance of CED as a key component of sustainability reporting (García-Sánchez et al., 2021; Lin & Qamruzzaman, 2023). CED entails the dissemination of information regarding a company's environmental performance, activities, and financial consequences as a result of management decisions (Belhaj & Ayadi, 2011).

As sustainability becomes an increasingly critical concern for stakeholders, companies are facing increasing pressure to provide comprehensive environmental disclosure and transparency. Baalouch et al. (2019) and Zhao et al. (2018) have demonstrated the regulatory requirements, competitive advantage, and stakeholder confidence that can be achieved through effective environmental disclosure. However, it is crucial to consider more than just the benefits that corporations can gain from transparent disclosure. According to research by Albitar et al. (2020) and Baalouch et al. (2019) the quality and quantity of a company's environmental disclosure can impact its financial performance and reputation, emphasising the importance of companies prioritising environmental disclosure in their sustainability reporting efforts.

It is important to note, however, that effective CED should not be limited to environmental information alone. To accomplish this, businesses must go beyond simply giving environmental data and incorporate broader sustainability considerations into their reporting efforts. Numerous studies have been conducted to assess the quality and the scope of CED. Lee (2015) conducted a study that analysed CED in the Australian mining and metals industry using both quantity and quality data. According to the study, larger companies disclosed more environmental information, but the quality of disclosure varied significantly. The report recommended that authorities focus on improving the quality of disclosure rather than merely increasing the number to increase the quality of CED. The study developed a five-point scale for measuring the company's environmental reporting using van Staden and Hooks' (2007) five-point scale.

Similarly, Khan et al. (2019) created a CED index of environmental information that took into account both the quantity and quality that was reported by Pakistani publicly traded companies. The study discovered that larger organisations with higher profitability and better corporate governance tend to provide higher-quality environmental information. These studies demonstrate the significance of CED in terms of both quality and quantity, as well as the necessity to incorporate larger sustainability considerations into corporate reporting efforts.

Dissanayake et al. (2021) discovered that when companies in Sri Lanka face significant environmental pressure from stakeholders, they tend to release more environmental information. Furthermore, Johnson (2020) discovered that firms with better CED ratings have a reduced cost of capital, indicating a beneficial impact on financial performance. Shabbir and Wisdom (2020) discovered a positive association between corporate environmental responsibility and financial performance. Furthermore, Loh et al. (2017) demonstrated that the amount of CED had a beneficial impact on a firm's financial performance, corporate transparency and promote stakeholder engagement. Similarly, Zhang et al. (2021) discovered that firms with better CED ratings have a reduced cost of capital, indicating a beneficial impact on financial performance.

In contrast, Sulaiman et al. (2014) examined 164 listed Malaysian companies and found that the correlation between corporate level and leverage and environmental disclosure quality is significantly positive. According to Baalouch et al. (2019), the quality of corporate environmental disclosure improves over time. Additionally, van Staden and Hooks (2007) compared the environmental reporting practices of 60 significant US firms in the chemical, pharmaceutical, and oil industries using a 5-point scale. The study found that corporations' environmental disclosure practices and responsiveness to stakeholders' environmental concerns differed. Companies that were more aggressive in responding to stakeholder concerns disclosed more environmental information voluntarily.

Based on previous studies, this study will use a 5-point scale as in Table 1. The 5-point scale is based on van Staden and Hooks (2007) and Lee (2015), and it is used to evaluate the quality of environmental disclosures provided by companies in their reports. The scale provides a standardised approach for assessing disclosure quality, which can assist stakeholders in evaluating the company's environmental performance and effect. The scale enables easy comparison between companies and to identify trends and changes in the disclosure practises. A higher score on the scale indicates better disclosure quality, which can highlight the commitment of company to towards the sustainability reporting and transparency.

Hence, analysing CED is critical since it provides stakeholders with pertinent information regarding the company's environmental performance. CED levels vary according to criteria such as environmental risk, industry type, and business characteristics. CED quality and quantity are critical for boosting a company's reputation, recruiting and retaining personnel, and improving financial performance. As a result, to meet stakeholder expectations and regulatory requirements, businesses must adopt transparency and accurate CED practices.

Research Design and Method

Sample Selection

This study utilised an area sampling method by focusing on manufacturing companies. The population of this study is Malaysian public listed companies, and this study consists of all energy companies as a sample. The initial sample size is 385 companies for the year 2016 until 2021. This study excluded companies with no annual reports, which resulted in a final sample of 268 companies.

This study focuses on the environmental disclosure practises of listed companies in Malaysia's manufacturing sector, which is a significant contributor to the Malaysian economy. The manufacturing sector accounted for 86.6% of Malaysia's overall exports in 2021, according to the Malaysia External Trade Statistics (2021). Environmental protection spending in the sector has also expanded dramatically during the last decade. According to the Department of Statistics Malaysia (2021), the manufacturing industry remained the second-largest contributor to Malaysia's GDP (22.3%) in 2020. According to the same analysis, the manufacturing sector has been one of the most resilient during the COVID-19 pandemic, with a low 2.5% decline in 2020 compared to a 5.6% decline for the whole economy.

Data Collection

This study uses content analysis from the annual report of manufacturing listed companies by Bursa Malaysia. The Malaysian listed companies classified by Bursa Malaysia are Main Market, Ace Market and LEAP Market. The Main Market is the prime market that offers companies a platform to raise funds as the company has met the standards in terms of size, quality and operations. Ace Market is a sponsor driven market which offers companies a growth prospect. LEAP Market is an adviser driven market and provides the company a platform for companies to raise funds and be visible by the capital market. However, the companies under the LEAP Market will not be the sample, as it started in 2017. Hence, this study decided to take the sample for listed companies under the main market.

Findings and Discussion

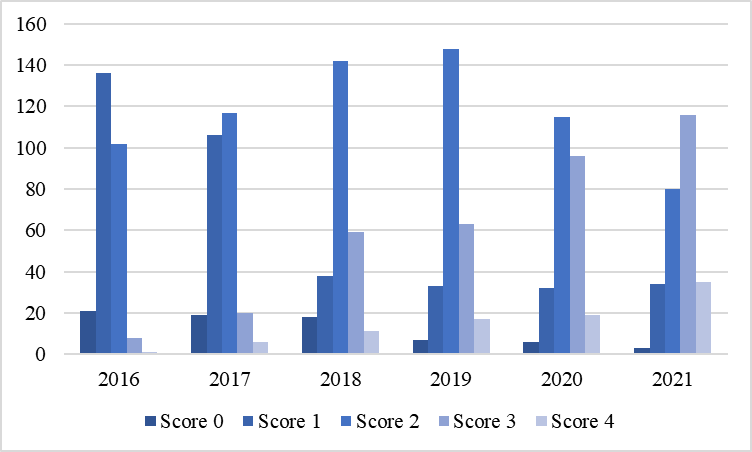

Figure 1 shows the number of companies disclose according to the score 0 to 4 in which it examines the extent and quality of sustainability reporting by companies in an undisclosed industry. The scoring system used in the study evaluated the quality of reporting based on four categories: reporting coverage, reporting quality, verification, and stakeholder engagement.

According to the results presented in Figure 1, the majority of companies had scored between 1 and 2 for 2016 and 2017, which is 88.8% and 83.3% out of 268 total companies respectively. This indicates that companies were awarded a score of 1 only for providing the minimum required environmental information in a vague and ambiguous manner, or a score of 2 which companies disclosed in a descriptive manner without offering any quantitative details. Based on the results, in 2016, 8 companies scored 3 and only 1 scored 4, while little improvement can be seen in 2017, as 20 companies scored 3 and 6 companies scored 4 which increased 150%. This indicates that companies had not reported in depth and no quality environmental information were provided such as the graph or statistics and any future planning which align with previous research Lee (2015). It shows that companies are disclosing the environmental information due to the Bursa Malaysia requirement for all companies to disclose the sustainability report as at year ended 31 December 2015.

Results showed that in 2018, 2019 and 2020 majority of companies had scored 2 which means companies starting to disclose clearer information. In these 3 years also companies had started to disclose quantitative information (Score 3) such as the amount of money spent for environmental purposes such as for energy usage, emissions, water consumption and waste generated. Based on the result, from 2017 to 2018, a 195% increase of companies disclosed environmental information clearly with the measurement of environmental performance and disclosing amount spent for environmental related in their annual report. The increase shows that companies are transparent on environmental reporting (Baumüller & Sopp, 2022; Sulkowski & Waddock, 2013). Improvement is seen from the year 2019 to 2020, as companies start to report quantitatively with an increase of 52.4%. This increase, however, is still low as only 59 companies (22%) for 2018, 63 companies (23.3%) for 2019 and 96 companies (35.8%) for 2020. It shows that more than 50% companies had not disclosed the information clearly, transparency and included quantitative information for 2018 and 2019 respectively. Furthermore, in this study there is only an increase of a small percentage of companies reporting extraordinary (Score 4) with only 11, 17 and 19 companies out of 286 companies in 2018, 2019 and 2020 respectively.

In 2021, there was a slight improvement in which many companies had scored 3, which is the highest number of companies reporting monetary or quantities information with the percentage of 43.3 % in 2021. Result shows that 56.4% companies had reported better reporting compared to the years before, as companies are starting to disclose monetary or physical quantities. However, the increase of companies reporting extraordinary information (Score 4) is still low. Only 35 companies (13.4%) out of 268 companies had extraordinary reporting. Companies that scored 4 had better reporting which followed the sustainability guideline of Bursa Malaysia and the information is disclosed in depth. The information in annual reports are transparent and clearer with graphs or statistics, amount spent on each environment such as energy and water, disclosed positive and negative information, solutions are reported, engage with the community related to the environment and report what their future planning is.

Based on the annual report, companies that scored 4 had reported the amount spent using charts and/ or in sentences. For instance, the following information is disclosed by the company in its annual report.

“During FY Jun 2021, water usage stood at 47,821 m3, which was 21% lower than the previous financial year.”

“In 2021, our combined use of 4,690 MWh of solar energy saved over 2,999 tCO2e. Since the installation of the PV system, our combined use of 13,317MWh of solar energy saved over 8,509 tCO2e.”

“In FPE2021, we recorded 9,912,073 kWh of electricity consumption for our Malaysia operations as new operational facilities such as Telum Ramunia was set up during the year.”

Other than that, score 4 companies had disclosed future plans related to the environment. This has shown that companies are willing to involve and spend money related to environmental sustainability. For instance, the information below is disclosed in the annual report.

“We intend to include environmental aspects into our Sustainable Supply Chain Policy such as energy use, climate change impact, water use, biodiversity, pollution, waste reduction and resource use.”

“Our goal is to set carbon reduction targets for the Group that would act as benchmarks for our future environmental initiatives.”

“We strive to reduce our water footprint by promoting water-saving practices to employees, in which related signages and notices are placed at common water fixtures and faucets, toilets and pantries. To reinforce our commitment in cutting water consumption, we have set an annual target of lowering water usage by 0.6%.”

Based on the analysis, the company had disclosed in the annual report on engaging with the community. For example, the disclosure of companies in the annual report.

“Concept of environmental stewardship is collaborative action with communities, starting from educational outreach to simple but effective conservation and rejuvenation campaigns. Over the years, our initiatives have included tree planting and clean-ups.”

“Developed and distributed ‘Plastic, Sustainability & You’ Education (PSYE) modules to all schools in Malaysia, in collaboration with the Ministry of Education (MOE), Solid Waste Management and Public Cleansing Corporation (SWCorp) and Malaysian Plastics Manufacturers Association (MPMA).”

Company had also reported negative and/or positive information in which the company disclosed any emission or pollution held by the company and had the solution on reducing it. For instance, the following information is disclosed in the company's annual report.

“Aims to reduce the amount of waste to landfills by increasing our recycling efforts across all our outlets. We adopt lean manufacturing principles, the Japanese method of minimising waste without compromising on the quality of our products.”

“Employees are equipped with the relevant knowledge and trained to understand the environmental standards and all sustainability aspects. “ and “With the recent fines which were issued by the Department of Environment (“DOE”), totalling an amount of RM10,500, for not complying with the Environmental Quality (Scheduled Wastes) Regulations 2007, had made us more vigilant in our operations.”

“In FY2021, our electricity consumption (MWh) increased by 7% to 33,987 MW/h as compared to 31,872 MW/h in FY2020, the increase was due to higher production output. We continue to explore new methods and technologies to reduce our carbon footprint and improve energy efficiency across our business operations.”

Most companies had reported descriptives during year 2016 until year 2018 and improved from year 2019 up to year 2021. The reporting of manufacturing companies is inline with the sustainability guidelines by Bursa Malaysia. However, the depth of information being disclosed varies among companies. It had shown that larger companies reported environmental information in depth while others had only reported quantitative without further information (Al-Tuwaijri et al., 2004; D’Amico et al., 2016). The larger companies had also engaged with the communities and educated on the environment through events or awareness programs. Furthermore, the companies had also reported the increase or reduction of any pollution, emission, water consumption or other waste in annual reports. The stakeholder is also being informed on the future planning or solution to any environmental issues in the annual report. This had shown the transparency of the company in disclosing environmental information. In fact, in ensuring the environmental footprint is to be reduced, companies have invested in new technologies and equipment.

Though environmental disclosure has become an essential aspect of corporate reporting in Malaysia, 43.6% companies still provide only descriptive information about their environmental initiatives and performance without providing specific figures or monetary values. This type of disclosure can be inadequate, as it makes it difficult for stakeholders to assess the company's environmental impact or progress. Recent research has shown that there has been a growing demand for companies to provide more detailed sustainability reporting. According to Tzouvanas and Mamatzakis (2021) found that environmentally sensitive companies have seven percent higher returns and thirty percent lower risk than other enterprises.

Conclusions

Sustainability reporting had been made compulsory reporting for all listed companies in Malaysia. CED is part of the sustainability reporting which in this study explores the disclosure of Malaysian listed manufacturing companies from year 2016 until year 2021. 56.4% of these companies had disclosed clear information about the environment with monetary or quantitative figures. From the findings, 43.6% companies had still not disclosed the information with any figures or monetary values. There is a probability that companies had less capital to invest in new technology, environmentally materials or equipment. Despite that, the companies had disclosed environmental information to fulfil the requirement of Bursa Malaysia as all listed companies are compulsory to disclose the sustainability reporting. This selective disclosure may be an issue which may lead to greenwashing (Xia et al., 2023).

This study is on the overall CED in the annual report. Despite this, the scope of this study was limited to just one industry, which may make it difficult to generalise the findings of this research to other industries. Future research may extend the study to other industries and can be conducted to provide stronger evidence on the disclosure of Malaysian listed companies. Furthermore, a comparative study with a larger sample of firms in developing countries could be examined. The study recommends that future research should analyse the consequences of lack of CED and/or can complement our study.

References

Abdul Rahman, R., & Alsayegh, M. F. (2021). Determinants of corporate environment, social and governance (ESG) reporting among Asian firms. Journal of Risk and Financial Management, 14(4), 167. DOI:

Albitar, K., Hussainey, K., Kolade, N., & Gerged, A. M. (2020). ESG disclosure and firm performance before and after IR: The moderating role of governance mechanisms. International Journal of Accounting & Information Management, 28(3), 429-444. DOI:

Al-Tuwaijri, S. A., Christensen, T. E., & Hughes, K. E., II. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, Organizations and Society, 29(5-6), 447-471. DOI: 10.1016/s0361-3682(03)00032-1

Baalouch, F., Ayadi, S. D., & Hussainey, K. (2019). A study of the determinants of environmental disclosure quality: evidence from French listed companies. Journal of Management and Governance, 23(4), 939-971. DOI:

Banerjee, S. B. (2018). Transnational power and translocal governance: The politics of corporate responsibility. Human Relations, 71(6), 796-821. DOI:

Baumüller, J., & Sopp, K. (2022). Double materiality and the shift from non-financial to European sustainability reporting: review, outlook and implications. Journal of Applied Accounting Research, 23(1), 8-28. DOI:

Belhaj, M., & Ayadi, S. D. (2011). Financial performance, environmental performance and environmental disclosure: the case of Tunisian firms. Afro-Asian J. of Finance and Accounting, 2(3), 248. DOI:

Bernaciak, A., Halaburda, M., & Bernaciak, A. (2021). The Construction Industry as the Subject of Implementing Corporate Social Responsibility (the Case of Poland). Sustainability, 13(17), 9728. DOI:

Carbon Disclosure Project. (CDP). (n.d.). How to disclose as a company. https://www.cdp.net/en/companies-discloser/how-to-disclose-as-a-company

Cheng, Z., Wang, F., Keung, C., & Bai, Y. (2017). Will Corporate Political Connection Influence the Environmental Information Disclosure Level? Based on the Panel Data of A-Shares from Listed Companies in Shanghai Stock Market. Journal of Business Ethics, 143(1), 209-221. DOI: 10.1007/s10551-015-2776-0

Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32(7-8), 639-647. DOI:

Compendium of Environment Statistics Malaysia. (2021). Department of Statistics Malaysia.

D'Amico, E., Coluccia, D., Fontana, S., & Solimene, S. (2016). Factors Influencing Corporate Environmental Disclosure: Factors Influencing Corporate Environmental Disclosure. Business Strategy and the Environment, 25(3), 178-192. DOI: 10.1002/bse.1865

Department of Statistics Malaysia. (2021). Gross Domestic Product (GDP) by Industry 2020. https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=155&bul_id=TVVoU3RRU3VjWUJHVjUzV0hSVmx2QT09

Dissanayake, D., Tilt, C. A., & Qian, W. (2021). How do public companies respond to national challenges through sustainability reporting? - The case of Sri Lanka. Qualitative Research in Accounting & Management, 18(4/5), 455-483. DOI:

Elshabasy, Y. N. (2018). The impact of corporate characteristics on environmental information disclosure: an empirical study on the listed firms in Egypt. Journal of Business & Retail Management Research, 12(02). DOI:

García-Sánchez, I.-M., Raimo, N., & Vitolla, F. (2021). Are Environmentally Innovative Companies Inclined towards Integrated Environmental Disclosure Policies? Administrative Sciences, 11(1), 29. DOI:

Gerged, A. M., Al-Haddad, L. M., & Al-Hajri, M. O. (2020). Is earnings management associated with corporate environmental disclosure?: Evidence from Kuwaiti listed firms. Accounting Research Journal, 33(1), 167-185. DOI:

Global Reporting Initiative. (2023). Sustainability reporting standards. https://www.globalreporting.org/standards/

Johnson, R. (2020). The link between environmental, social and corporate governance disclosure and the cost of capital in South Africa. Journal of Economic and Financial Sciences, 13(1). DOI:

Jusoh, R., Yahya, Y., Zainuddin, S., & Asiaei, K. (2023). Translating sustainability strategies into performance: does sustainability performance management matter? Meditari Accountancy Research, 31(2), 258-293. DOI:

Khan, I., Khan, I., & Saeed, B. b. (2019). Does board diversity affect quality of corporate social responsibility disclosure? Evidence from Pakistan. Corporate Social Responsibility and Environmental Management, 26(6), 1371-1381. DOI:

KPMG. (2020). Sustainable investing: Fast-forwarding its evolution. https://home.kpmg/xx/en/home/insights/2020/10/sustainable-investing-fast-forwarding-its-evolution.html

Lee, K. H. (2015). A quantitative analysis of corporate environmental reporting: a case study of the Australian mining and metal industry. Journal of Cleaner Production, 108, 1181-1195.

Lin, J., & Qamruzzaman, M. (2023). The impact of environmental disclosure and the quality of financial disclosure and IT adoption on firm performance: Does corporate governance ensure sustainability? Frontiers in Environmental Science, 11. DOI:

Loh, L., Thomas, T., & Wang, Y. (2017). Sustainability Reporting and Firm Value: Evidence from Singapore-Listed Companies. Sustainability, 9(11), 2112. DOI:

Shabbir, M. S., & Wisdom, O. (2020). The relationship between corporate social responsibility, environmental investments and financial performance: evidence from manufacturing companies. Environmental Science and Pollution Research, 27(32), 39946-39957. DOI:

Shen, F., Ma, Y., Wang, R., Pan, N., & Meng, Z. (2019). Does environmental performance affect financial performance? Evidence from Chinese listed companies in heavily polluting industries. Quality & Quantity, 53(4), 1941-1958. DOI:

Sri, W. I. F., & Arief, B. M. (2018). Relationship between company financial performance, characteristic and environmental disclosure of ASX listed companies. In E3S Web of Conferences (Vol. 73, p. 10024). EDP Sciences.

Sulaiman, M., Abdullah, N., & Fatima, A. H. (2014). Determinants of environmental reporting quality in Malaysia. International Journal of Economics, Management and Accounting, 22(1).

Sulkowski, A. J., & Waddock, S. (2013). Beyond Sustainability Reporting: Integrated Reporting is Practiced, Required & More Would Be Better. SSRN Electronic Journal. DOI:

Talbot, D., & Barbat, G. (2020). Water disclosure in the mining sector: An assessment of the credibility of sustainability reports. Corporate Social Responsibility and Environmental Management, 27(3), 1241-1251. DOI:

Tang, M., Walsh, G., Lerner, D., Fitza, M. A., & Li, Q. (2018). Green Innovation, Managerial Concern and Firm Performance: An Empirical Study. Business Strategy and the Environment, 27(1), 39-51. DOI:

Tzouvanas, P., & Mamatzakis, E. C. (2021). Does it pay to invest in environmental stocks? International Review of Financial Analysis, 77, 101812. DOI:

Utomo, M. N., Rahayu, S., Kaujan, K., & Irwandi, S. A. (2020). Environmental performance, environmental disclosure, and firm value: empirical study of non-financial companies at Indonesia Stock Exchange. Green Finance, 2(1), 100-113. DOI: 10.3934/gf.2020006

van Staden, C. J., & Hooks, J. (2007). A comprehensive comparison of corporate environmental reporting and responsiveness. The British Accounting Review, 39(3), 197-210. DOI:

Xia, F., Chen, J., Yang, X., Li, X., & Zhang, B. (2023). Financial constraints and corporate greenwashing strategies in China. Corporate Social Responsibility and Environmental Management, 30(4), 1770-1781. DOI:

Zhang, K., Li, Y., Qi, Y., & Shao, S. (2021). Can green credit policy improve environmental quality? Evidence from China. Journal of Environmental Management, 298, 113445. DOI:

Zhao, X., Fan, Y., Fang, M., & Hua, Z. (2018). Do environmental regulations undermine energy firm performance? An empirical analysis from China's stock market. Energy Research & Social Science, 40, 220-231. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Izwan, I. D. M., Mohamad, M., Shukri, N. H. A., Yunus, M. H. S. M., & Zakaria, N. B. (2023). A Preliminary Study of Corporate Environmental Disclosure for Malaysian Manufacturing Companies. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 250-261). European Publisher. https://doi.org/10.15405/epsbs.2023.11.20