Abstract

This study aims to investigate the current dynamics in the published works on corporate governance and risk disclosure and suggest future research directions. The link between these two ideas is synergistic, since good corporate governance processes frequently lead to better risk detection, mitigation, and disclosure. Understanding this delicate link is critical for researchers, practitioners, and policymakers seeking to encourage responsible corporate conduct and effective risk management in today's complex business world. Using a bibliometrics analysis, we analyse 108 studies from the Scopus database to identify research activity on the field until the year of 2022. With the aid of Vosviewer, the papers were evaluated and presented based on the authors, sources, and nations with the greatest publishing rates, journals with the largest number of publications, and highly referenced documents and authors. Based on their papers, references, placement in the network, and relevance, we identify the most noteworthy publications and authors. The findings and possible pathways for future study have been offered. This would help aspiring researchers find scholars in the subject while researching future research routes to fill resulting gaps.

Keywords: Bibliometrics, Corporate Governance, Risk Disclosure

Introduction

Risk disclosure is an essential part of corporate governance and accountability because it informs stakeholders about the risks that a company confronts and the steps it is taking to mitigate these risks. Risk disclosure has grown in popularity in recent years, as stakeholders such as investors, regulators, and the general public have become increasingly concerned about the possible dangers that businesses face especially after the financial crisis 2007-2008 (Gonidakis et al., 2020; Nahar et al., 2020). As a result, there has been a considerable surge in risk disclosure research. The practice of risk disclosure, however, differs greatly across companies and nations. It depends on a variety of factors such as the law system, type of industry, profitability, debt ratio, risk factor and the level of uncertainty-avoidance (Khlif & Hussainey, 2016).

Corporate governance has long been linked with corporate disclosure activities (Effah et al., 2023), including risk disclosure (Elamer et al., 2019; Gull et al., 2023; Ibrahim et al., 2019; Muturi, 2019; Ntim et al., 2013; Raimo et al., 2022; Saggar & Singh, 2017; Saggar et al., 2022). Among important corporate governance factors are board characteristics as well as ownership structure (Alshirah et al., 2020; Salem et al., 2019a). The board is critical since it supervises the firms’ management as well as guarantees the quality and transparency of financial reports. Yet, the indication on the connection between board qualities and risk disclosure is neither obvious or consistent (Habtoor & Ahmad, 2017; Khandelwal et al., 2020; Moumen et al., 2016; Raimo et al., 2022). Meanwhile, ownership structure plays a significant role as a power-balancing mechanism in firms and therefore can affect corporate governance practices (Shleifer & Vishny, 1997). Still, however, studies on the ownership structure-risk disclosure relationship finds conflicting results (Grassa et al., 2020a; Mokhtar & Mellett, 2013; Salem et al., 2019a). Consequently, a greater awareness of the prevailing studied topics in firm governance and the relationship with disclosure is pivotal to discern research patterns amid various advances.

Reviews on corporate governance and risk communication have been conducted previously. However, those investigations have only concentrated on one of the key subjects, namely board features (Kent Baker et al., 2020; Khatib et al., 2023; Sánchez-Teba et al., 2021; Trinarningsih et al., 2021) or risk disclosure (Baan Wahh et al., 2020; Ibrahim et al., 2022; Khandelwal et al., 2022; Mbithi et al., 2022). Other studies such as Singhania et al. (2022) focus on corporate governance and broader aspects of risk management instead.

The current study takes the scope of the link between the two, resulting in a more comprehensive and impartial examination of the dispute over corporate governance and risk disclosure. Therefore, this article aims to conduct a bibliometric analysis of the association between corporate governance and risk disclosure. Bibliometric analysis is a quantitative approach that measures and evaluates many elements of scientific publications, such as authors, journals, citations, keywords, and co-citations, using statistical methods (Khandelwal et al., 2022). We intend to contribute to a better knowledge of the latest development in the research field by offering a complete summary of the research. We specifically aim to identify the field's important research issues and trends, as well as the most significant authors, publications, and journals. We also hope to uncover any gaps in the field's research and make recommendations for future research.

The rest of the paper is structured as follows: Section 2 reviews the relevant literature on corporate risk disclosure and board characteristics; Section 3 describes the data collection and bibliometric analysis methods; Section 4 presents and discusses the results; Section 5 concludes and offers some implications for future research.

Literature Review

Bibliometrics Analysis

Bibliometric analysis is a technique that measures and evaluates scientific publications on a particular subject or field using statistics (Donthu et al., 2021). It can assist scholars in comprehending scholarly academia's developments, themes, consequences, and connections. Bibliometric analysis often entails gathering information from databases like Scopus or Web of Science, using software like Vosviewer or Gephi to visualize and investigate the data, and utilizing metrics like citation counts or h-index to assess the caliber and effect of publications (Ninkov et al., 2021).

In many study domains, including business, education, health, and engineering, bibliometric analysis has become a popular technique (Donthu et al., 2021). There has been a noticeable growth in the number of papers utilizing this method in recent years, according to the trend of publications on bibliometric analysis. For instance, Donthu et al. (2021) reports a growth from 3 to 198 in the number of bibliometric articles published in the fields of "business, management, and accounting," "economics, econometrics, and finance," and "social sciences" between 2005 and 2020. Between 2010 and 2019, there were more than 3000 articles on bibliometrics, according to Ninkov et al. (2021).

Corporate Governance

Corporate governance is actually an old concept, however, the phrase is relatively new (Tricker, 2012). Corporate governance refers to “the system by which companies are directed and controlled” (Cadbury, 1992). The definition is known as the most generic one provided by the Cadbury Report (Clarke, 2021). The literature has introduced two conceptions: narrow concepts and enlarged concepts of corporate governance. The narrow concept of corporate governance is heavily influenced by the Anglo-Saxon systems. Shareholders as one of the groups of stakeholders uphold their control using voting power on strategic decisions such as board member appointment. In this situation, CG is viewed as a tool that encourages managers to fight for shareholders' interests, and the connection between shareholders and members of the board of directors might be put together as an agency relationship. The biggest problem occurs when there is an excessive split of ownership structure. The consequences are substantial: lessen the incentive for shareholders to exert proper scrutiny of executive action, and grants managers authority over the board of directors (and the whole firm). The expanded idea of CG addresses the limitations of the restricted concept by broadening its emphasis to all of the firm's internal and external stakeholders. Existing studies on the expanded idea of CG have revealed that the issue of separation of ownership and control is unique to major Anglo-Saxon public firms (Mastrodascio, 2021).

Risk Disclosure

As the growing complexities in business operations and regulations, companies are expected to deliver outsiders with further risk information (Khandelwal et al., 2022). Risk disclosure is broadly defined as the sharing of components that have the potential to influence expected results both favourably and adversely (Beretta & Bozzolan, 2004). On the other hand, there is another view that the pre-modern understanding of risk as a loss and risk disclosure as exclusively negative consequences should be embraced (Ibrahim et al., 2019). Firm performance is significantly influenced by the extent of risk (Hamid et al., 2014).

The body of research on risk disclosure makes a distinction between revelation of mandatory and voluntary risk information. Disclosing risk information mandatorily means the sharing of risk information that is required by law. Disclosing risk information voluntarily refers to the amount of risk information disclosed by firms that surpasses the criteria stipulated by accounting standards and law. Financial risk for instance impacted the users of financial reporting (Selahudin et al., 2014).

Data and Methodology

The study adopts bibliometrics analysis in order to further assess the publications on the connections between corporate governance and risk disclosure. The methods for bibliometric analysis fall under the following two headings: performance analysis and science mapping. Performance analysis essentially takes into consideration the contributions of research constituents, whereas science mapping primarily focuses on the connections between research constituents (Donthu et al., 2021). Bibliometric approach adopted in the current study similar to Effah et al. (2023) and Khandelwal et al. (2022).

Using data from the Scopus database, this study looked at papers that were published between 2012 and 2022 to generate a significant time frame for evaluating prior investigations. The Scopus database is a unique and comprehensive collection of scholarly literature and data that spans a wide range of fields. With more than 17,000 titles and more than 5,000 publishers, it offers a sizable abstract base that enables global multidisciplinary convergence.

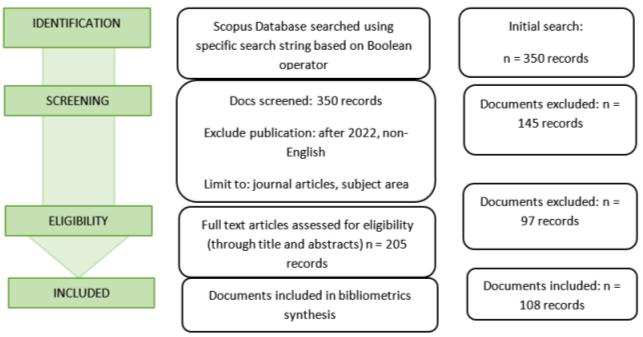

We concentrated on papers from journals in business-related fields. Figure 1 summarizes the procedure followed to obtain the quantity of journal articles for the study. To symbolize risk disclosure, the keywords included in the search query are: "risk closure", "risk reporting", and "risk communication". Meanwhile, the keywords utilized in the search query for corporate governance include “corporate governance”, "board”, or “ownership” These terms are utilized in this study to search the literature since they have been firmly rooted in the risk divulgence and corporate governance works for years. The details of how to search and retrieve data is revealed in Table 1.

The process was executed on 19 March 2023 from the Scopus database. The search string used based on a Boolean operator was: TITLE-ABS-KEY (“governance" OR "board" OR "ownership”) AND ( "risk disclosure" OR "risk communication" OR "risk reporting" ). According to this search strategy, only publications using these phrases together will be retrieved and displayed.

Multiple applications can be used to carry out bibliometric analysis such as BibExcel, HistCite, and VosViewer. VosViewer was chosen due to its advantages and adaptability in network research (Khatib et al., 2023).

Analysis and Findings

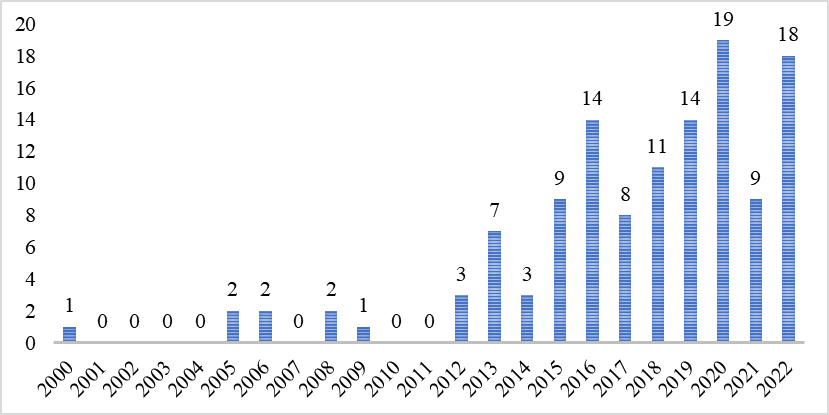

Figure 2 displays the growing tendency in the corporate governance and risk disclosure works especially since 2012, with its first reference on the Scopus database in the year 2000. Although the graph has changed up and down, it is still showing an overall upward trend. With 19 publications, 2020 had the highest volume of papers generated about corporate governance and risk disclosure, followed by 2022 with 18.

The expansion of the research field and the researchers' continual efforts to find gaps and undertake relevant investigations could have been the causes of the publishing surges in 2020 and 2022. In particular, the latest publications in 2020 are on non-financial reporting rules (Amezaga-Alonso et al., 2020), climate risk disclosure (Chithambo et al., 2020), Islamic banks’ risk reporting (Elamer et al., 2020; Grassa et al., 2020a; Hemrit, 2018, 2020; Mukhibad et al., 2020; Grassa et al., 2020b), family ownership (Alshirah et al., 2020), emerging risks and other non-quantifiable risks (Manab et al., 2020). While in 2022, the articles themed on various aspects such as cybersecurity risk (Kiesow Cortez & Dekker, 2022), political connection (Alshirah et al., 2022), board diversity (Saggar et al., 2022; Seebeck & Vetter, 2022).

The authorship analysis weights on foremost researchers in the field. Figure 3 pictures the first 15 researchers who have recorded at least 3 publications. In addition, collaboration among the 15 authors is calculated in the co-authorship image. The strongest connection exists between Khamis Hamed Al-Yahyaee and Ahmed Al-Hadi with the link strength of 9. For example, Al-Hadi et al. (2019) who conclude that corporate governance structure positively affects market risk disclosure. Tabel 1 shows 15 authors that contribute most to the field, with Khaled Hussainey being the most productive researcher and record highest citations as well.

Table 2 depicts nations where researchers yield utmost papers on corporate governance and risk disclosure. It is unsurprising to see that UK authors dominate the field. Despite being third best in terms of productivity, Egypt ranked much better in terms of citations per paper score (43.2) compared to Malaysia (4.3). In a similar vein, US who produced 6 papers enjoy higher citations per paper score (50). Developing countries like Tunisia, Indonesia, and India have good potentials for research in this field.

Regarding co-authorship, the analysis on a country level assists in defining the degree of association between researchers internationally. As portrayed in figure 3, the main countries where co-authorships exist are in the UK, US, Tunisia, and Egypt. The connection strength between UK and Egypt is 9, UK and Tunisia is 5, UK and US is 2.

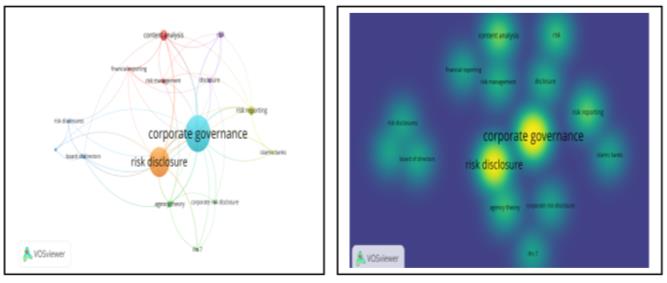

Keywords co-occurrences are the quantity of works wherein the keywords are found in the title, abstract, or keyword list together (van Eck & Waltman, 2023). The largeness of the nodes or keywords on the bibliometric plot represent their heaviness and frequency in the model. As a result, how far between two nodes or words indicates the degree of their link. A greater connection between the nodes is represented with a shorter link (Liao et al., 2018). Table 3 shows the top 15 keywords in the field including their frequencies and the total of connections strength.

The co-occurrence map in figure 4 generated 7 clusters with 254 total link strength. Corporate governance and risk disclosure emerge as the largest node with close range between the two, implies that authors frequently use them simultaneously in their papers. Besides, in the density map each keywords has a color that specifies the thickness in the map. Colors by setting vary from blue to green to yellow. The blue color represents the fewer items in a point's immediate vicinity and the surrounding items' lower weights. In reverse, the yellow color indicates that there are more items in the vicinity of a point and that the weights of the nearby objects are greater (van Eck & Waltman, 2023)(van Eck & Waltman, 2023). It can be seen the extensive use of “corporate governance” and “risk disclosure” keywords in the field as depicted in the density map.

Analyzing citations means evaluating the caliber of subjects using quantitative tool, such as authors, journals, and so on (Liao et al., 2018). In order to find the most referenced publications, the top ten papers with the most citations were chosen and are shown in Table 4. Among the top papers in Table 4, only two of them published within 2000-2010. The remaining that are produced between 2010-2020 received more citations. Most cited journal article goes to Abraham and Cox (2007) which examine the link between the amount of narrative risk information in annual reports and factors including ownership, governance, and US listing features.

The study also try to identify the most cited academic journal in corporate governance and risk disclosure research. Minimum number of documents for each journal is limited to two. The search yielded ten most cited journals as reported in Table 5 with “International Review of Financial Analysis” obtain 461 citations from its three journal articles as the first rank. With only two papers, “British Accounting Review” receives 433 citations rank second.

Discussion and Conclusions

The present investigation looked at the existing state of corporate governance and the disclosure of risk information publication in Scopus databases from 1994 to 2022 using bibliometrics analysis. In order to comprehensively map the field, we identify most important authors and articles, co-authorships as well as co-occurrences, keywords analysis, and countrywide dispersion of studies over the period.

Verdicts divulges that research in the field grows extensively, with the year 2020 and 2022 peaked with 19 and 18 publications respectively. Result also conveys that individually, Khaled Hussainey is the most productive as well as most cited author in the field. He received 761 records from 14 papers. The paper varies in themes such as risk disclosure determinants in UK (Elzahar & Hussainey, 2012; Elshandidy et al., 2013), in Tunisia (Salem et al., 2019b), in Indonesia (Aryani & Hussainey, 2017); value relevance of risk disclosure (Moumen et al., 2015); measurement of risk disclosure (Ibrahim et al., 2019).

The article by Abraham and Cox (2007) receives the most citations with 287 hits. They focus on the associations between ownership, governance, and US listing features and the volume of narrative risk disclosure in annual reports. It came to light that shareholding by long-term institutions has an opposite relationship with risk reporting. This shows that this significant category of institutional investors favors companies with a lower level of risk disclosure for their investments. The study also discovered that different board director types serve distinct purposes, with the quantity of independent and executive directors having a positive association with the degree of risk information, but not the quantity of dependent non-executive directors. This is in line with recent UK focus on non-executive directors' independence as a key component of good corporate governance.

UK, Malaysia, and Egypt are the top three countries which had the most article publications in the field. The UK as the most productive country in the field also receives the highest citations per article (64.9). Malaysia comes in second place in terms of quantity, but with an average of only 4.3 citations per piece, it falls short of the other top ten nations. Egypt, on the other hand, enjoys 605 records from 14 papers, resulting in 43.2 citations per article.

UK’s productivity may be due to the richness of context in the UK regulatory setting. Mcchlery and Hussainey (2021) for instance using the UK's extractive industry setting where voluntary and mandatory risk reporting debates existed. UK also offers a distinct corporate governance arrangement. In the UK, there are strong demands placed on board leadership to encourage transparency and accountability inside their organizations. Due to this, board members' fiduciary obligations are even more crucial. As a result, there is a greater need for better-quality boards (Cumming et al., 2017).

Limitations and Research Opportunities

Despite the use of a bibliometric approach in investigating the current corporate governance and disclosure tendencies, the present investigation is constrained in certain ways. Firstly, it might not include valuable papers from databases other than Scopus. Secondly, limitations in language where only English language articles are accepted. Thirdly, the current study excludes sources such as conference proceedings, book chapters and concentrate only at journal articles. Future studies may consider expand the limit set by the current study.

Even though there has been increasing number of research, several areas of inquiry on the connection between corporate governance and risk disclosure can be developed in following areas. Future review study may further investigate the results of the empirical investigations on the association between corporate governance and risk disclosure through meta-analysis. While future empirical studies may use alternatives to manual content analysis to measure risk disclosure as it is more vulnerable to subjectivity (Gull et al., 2023). To increase generalizability, future investigation may also expand existing literature using different regulatory and institutional context such as various emerging markets, unique settings such as in pandemic situations.

Acknowledgment

The authors are grateful to the Accounting Research Institute, (ARI- HICoE), Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education for providing research funding.

References

Abraham, S., & Cox, P. (2007). Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review, 39(3), 227-248. DOI:

Al-Hadi, A., Al-Yahyaee, K. H., Hussain, S. M., & Taylor, G. (2019). Market risk disclosures and corporate governance structure: Evidence from GCC financial firms. The Quarterly Review of Economics and Finance, 73, 136-150. DOI:

Alshirah, M. H., Abdul Rahman, A., & Mustapa, I. R. (2020). Board of directors’ characteristics and corporate risk disclosure: the moderating role of family ownership. EuroMed Journal of Business, 15(2), 219–252. DOI:

Alshirah, M. H., Alshira'h, A. F., & Lutfi, A. (2022). Political connection, family ownership and corporate risk disclosure: empirical evidence from Jordan. Meditari Accountancy Research, 30(5), 1241-1264. DOI:

Amezaga-Alonso, M. T., Cilleruelo-Carrasco, E., Zarrabeitia-Bilbao, E., & Ruiz-de-Arbulo-López, P. (2020). Present and future of risk disclosure in Spanish non-financial listed companies. Revista de Contabilidad, 23(1), 18-49. DOI:

Aryani, D. N., & Hussainey, K. (2017). The determinants of risk disclosure in the Indonesian non-listed banks. International Journal of Trade and Global Markets, 10(1), 58. DOI:

Baan Wahh, W., Wong Sek Khin, E., & Abdullah, M. (2020). Corporate Risk Disclosure in Emerging Economies: A Systematic Literature Review and Future Directions. Asian Journal of Accounting Perspectives, 13(2), 17-39. DOI:

Beretta, S., & Bozzolan, S. (2004). A framework for the analysis of firm risk communication. The International Journal of Accounting, 39(3), 265-288. DOI:

Cadbury, A. (1992). Cadbury Report: The Financial Aspects of Corporate Governance. Science, 1–90. http://www.jbs.cam.ac.uk/cadbury/search/scans/CAD-02253.pdf

Chithambo, L., Tingbani, I., Agyapong, G. A., Gyapong, E., & Damoah, I. S. (2020). Corporate voluntary greenhouse gas reporting: Stakeholder pressure and the mediating role of the chief executive officer. Business Strategy and the Environment, 29(4), 1666–1683. DOI:

Clarke, T. (2021). Corporate Governance: A Survey. In Cambridge Elements in Corporate Governance. Cambridge University Press.

Cumming, D., Filatotchev, I., Knill, A., Reeb, D. M., & Senbet, L. (2017). Law, finance, and the international mobility of corporate governance. Journal of International Business Studies, 48(2), 123–147. DOI:

Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285-296. DOI:

Effah, N. A. A., Asiedu, M., & Otchere, O. A. S. (2023). Improvements or deteriorations? A bibliometric analysis of corporate governance and disclosure research (1990-2020). Journal of Business and Socio-economic Development, 3(2), 118-133. DOI:

Elamer, A. A., Ntim, C. G., Abdou, H. A., & Pyke, C. (2020). Sharia supervisory boards, governance structures and operational risk disclosures: Evidence from Islamic banks in MENA countries. Global Finance Journal, 46, 100488. DOI:

Elamer, A. A., Ntim, C. G., Abdou, H. A., Zalata, A. M., & Elmagrhi, M. (2019). The impact of multi-layer governance on bank risk disclosure in emerging markets: the case of Middle East and North Africa. Accounting Forum, 43(2), 246-281. DOI:

Elshandidy, T., Fraser, I., & Hussainey, K. (2013). Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies. International Review of Financial Analysis, 30, 320–333. DOI:

Elzahar, H., & Hussainey, K. (2012). Determinants of narrative risk disclosures in UK interim reports. The Journal of Risk Finance, 13(2), 133-147. DOI:

Gonidakis, F. K., Koutoupis, A. G., Tsamis, A. D., & Agoraki, M.-E. K. (2020). Risk disclosure in listed Greek companies: the effects of the financial crisis. Accounting Research Journal, 33(4/5), 615-633. DOI:

Grassa, R., Moumen, N., & Hussainey, K. (2020a). Do ownership structures affect risk disclosure in Islamic banks? International evidence. Journal of Financial Reporting and Accounting, ahead-of-print(ahead-of-print). DOI:

Grassa, R., Moumen, N., & Hussainey, K. (2020b). What drives risk disclosure in Islamic and conventional banks? An international comparison. International Journal of Finance and Economics, June, 1–24. DOI:

Gull, A. A., Abid, A., Hussainey, K., Ahsan, T., & Haque, A. (2023). Corporate governance reforms and risk disclosure quality: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 13(2), 331-354. DOI:

Habtoor, O. S., & Ahmad, N. (2017). The influence of royal board of directors and other board characteristics on corporate risk disclosure practices. Corporate Ownership and Control, 14(2), 326–337. DOI:

Hamid, N. H. A., Zakaria, N. B., & Aziz, N. H. A. (2014). Firms' Performance and Risk with the Presence of Sukuk Rating as Default Risk. Procedia - Social and Behavioral Sciences, 145, 181-188. DOI:

Hemrit, W. (2018). Risk reporting appraisal in post-revolutionary Tunisia. Journal of Financial Reporting and Accounting, 16(4), 522–542. DOI:

Hemrit, W. (2020). Difference between the determinants of operational risk reporting in Islamic and conventional banks: evidence from Saudi Arabia. The Journal of Operational Risk, 15(1). DOI:

Ibrahim, A. E. A., Hussainey, K., Nawaz, T., Ntim, C., & Elamer, A. (2022). A systematic literature review on risk disclosure research: State-of-the-art and future research agenda. International Review of Financial Analysis, 82, 102217. DOI: 10.1016/j.irfa.2022.102217 7

Ibrahim, A., Habbash, M., & Hussainey, K. (2019). Corporate governance and risk disclosure: evidence from Saudi Arabia. International Journal of Accounting, Auditing and Performance Evaluation, 15(1), 89. DOI:

Kent Baker, H., Pandey, N., Kumar, S., & Haldar, A. (2020). A bibliometric analysis of board diversity: Current status, development, and future research directions. Journal of Business Research, 108, 232-246. DOI:

Khandelwal, C., Kumar, S., & Sureka, R. (2022). Mapping the intellectual structure of corporate risk reporting research: a bibliometric analysis. International Journal of Disclosure and Governance, 19(2), 129-143. DOI:

Khandelwal, C., Kumar, S., Madhavan, V., & Pandey, N. (2020). Do board characteristics impact corporate risk disclosures? The Indian experience. Journal of Business Research, 121, 103–111. DOI:

Khatib, S. F. A., Abdullah, D. F., Elamer, A., Yahaya, I. S., & Owusu, A. (2023). Global trends in board diversity research: a bibliometric view. Meditari Accountancy Research, 31(2), 441-469. DOI:

Khlif, H., & Hussainey, K. (2016). The association between risk disclosure and firm characteristics: a meta-analysis. Journal of Risk Research, 19(2), 181-211. DOI:

Kiesow Cortez, E., & Dekker, M. (2022). A Corporate Governance Approach to Cybersecurity Risk Disclosure. European Journal of Risk Regulation, 13(3), 443-463. DOI: 10.1017/err.2022.10

Liao, H., Tang, M., Luo, L., Li, C., Chiclana, F., & Zeng, X.-J. (2018). A Bibliometric Analysis and Visualization of Medical Big Data Research. Sustainability, 10(2), 166. DOI:

Manab, N. A., Aziz, N. A. A., & Jadi, D. M. (2020). Sustainability risk management: an integrative framework to evaluate emerging risks and other non-quantifiable risks affecting company survival. World Review of Science, Technology and Sustainable Development, 16(2), 87. DOI:

Mastrodascio, M. (2021). Corporate Governance Models. In Corporate Governance Models. DOI:

Mbithi, E., Moloi, T., & Wangombe, D. (2022). Corporate risk disclosure: A systematic literature review and future research agenda. Cogent Business & Management, 9(1). DOI:

Mcchlery, S., & Hussainey, K. (2021). Risk disclosure behaviour: evidence from the UK extractive industry. Journal of Applied Accounting Research, 22(3), 484–506. DOI:

Mokhtar, E. S., & Mellett, H. (2013). Competition, corporate governance, ownership structure and risk reporting. Managerial Auditing Journal, 28(9), 838–865. DOI:

Moumen, N., Ben Othman, H., & Hussainey, K. (2015). The value relevance of risk disclosure in annual reports: Evidence from MENA emerging markets. Research in International Business and Finance, 34, 177-204. DOI:

Moumen, N., Ben Othman, H., & Hussainey, K. (2016). Board structure and the informativeness of risk disclosure: Evidence from MENA emerging markets. Advances in Accounting, 35, 82-97. DOI:

Mukhibad, H., Nurkhin, A., & Rohman, A. (2020). Corporate governance mechanism and risk disclosure by Islamic banks in Indonesia. Banks and Bank Systems, 15(1), 1-10. DOI:

Muturi, W. (2019). Corporate governance and risk disclosures: An empirical study of listed companies in Kenya. African Journal of Business Management, 13(17), 571–578. DOI:

Nahar, S., Azim, M. I., & Hossain, M. M. (2020). Risk disclosure and risk governance characteristics: evidence from a developing economy. International Journal of Accounting & Information Management, 28(4), 577-605. DOI: 10.1108/ijaim-07-2019-0083

Ninkov, A., Frank, J. R., & Maggio, L. A. (2021). Bibliometrics: Methods for studying academic publishing. Perspectives on Medical Education, 11(3), 173-176. DOI:

Ntim, C. G., Lindop, S., & Thomas, D. A. (2013). Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre- and post-2007/2008 global financial crisis periods. International Review of Financial Analysis, 30, 363-383. DOI: 10.1016/j.irfa.2013.07.001

Raimo, N., NIcolò, G., Tartaglia Polcini, P., & Vitolla, F. (2022). Corporate governance and risk disclosure: evidence from integrated reporting adopters. Corporate Governance: The International Journal of Business in Society, 22(7), 1462-1490. DOI: 10.1108/cg-07-2021-0260

Saggar, R., & Singh, B. (2017). Corporate governance and risk reporting: Indian evidence. Managerial Auditing Journal, 32(4/5), 378-405. DOI:

Saggar, R., Arora, N., & Singh, B. (2022). Gender diversity in corporate boardrooms and risk disclosure: Indian evidence. Gender in Management: An International Journal, 37(2), 182-201. DOI:

Salem, I. H., Ayadi, S. D., & Hussainey, K. (2019). Corporate governance and risk disclosure quality: Tunisian evidence. Journal of Accounting in Emerging Economies, 9(4), 567–602. DOI:

Sánchez-Teba, E. M., Benítez-Márquez, M. D., & Porras-Alcalá, P. (2021). Gender Diversity in Boards of Directors: A Bibliometric Mapping. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 12. DOI:

Seebeck, A., & Vetter, J. (2022). Not Just a Gender Numbers Game: How Board Gender Diversity Affects Corporate Risk Disclosure. Journal of Business Ethics, 177(2), 395-420. DOI:

Selahudin, N. F., Zakaria, N. B., Sanusi, Z. M., & Budsaratragoon, P. (2014). Monitoring Financial Risk Ratios and Earnings Management: Evidence from Malaysia and Thailand. Procedia - Social and Behavioral Sciences, 145, 51-60. DOI:

Shleifer, A., & Vishny, R. W. (1997). A Survey of Corporate Governance. The Journal of Finance, 52(2), 737-783. DOI:

Singhania, S., Singh, R. K., Singh, A. K., & Sardana, V. (2022). Corporate Governance and Risk Management: A Bibliometric Mapping for Future Research Agenda. Indian Journal of Corporate Governance, 15(2), 223–255. DOI:

Tricker, R. I. B. (2012). The Evolution of Corporate Governance. The SAGE Handbook of Corporate Governance, 39-61. DOI:

Trinarningsih, W., Anugerah, A. R., & Muttaqin, P. S. (2021). Visualizing and mapping two decades of literature on board of directors research: a bibliometric analysis from 2000 to 2021. Cogent Business & Management, 8(1). DOI:

van Eck, N. J., & Waltman, L. (2023). {VOSviewer} manual. Leiden: Univeristeit Leiden, January. http://www.vosviewer.com/documentation/Manual_VOSviewer_1.6.1.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Setyawan, H., Zakaria, N. B., & Ason, Y. J. (2023). A Bibliometrics Analysis on Corporate Governance and Risk Disclosure Literature. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 153-166). European Publisher. https://doi.org/10.15405/epsbs.2023.11.13