Abstract

This study is to focus on Debt Management Programme or Plan (DMP) and Financial or Credit Counselling that provide assistance as well as advice for those suffering financial difficulties, of which has been largely associated with the rise in personal and household indebtedness in Malaysia, Thailand and Indonesia. This paper aims to examine on such programme or plan in Malaysia, carried out by (AKPK), an agency offering aid and guidance for individuals experiencing issues with their finances. It also seeks to discuss DMP and Financial or Credit Counselling equivalents in Thailand and Indonesia. The data are collected from secondary sources, derived from reports, research papers and articles from journals and reviews from social science journals. The findings of this study show that the components of DMP consist of one to one financial counselling, financial education, financial literacy and financial management. DMP is recognised as a voluntary debt repayment plan being alternative to bankruptcy. While DMP is vital in household financial management, credit counselling is also becoming more popular as concerns for major credit card challenges gradually grow. It is uncovered that education which includes life skills in financial management is essential for the present volatile economy. Proper financial literacy is also critical for younger generation, in order for them to possess the skills and information to handle their financial affairs in the future.

Keywords: Bankruptcy, Credit Counselling, Debt Management Plan, Financial Management and Education, Financial Literacy

Introduction

The Southeast Asia region is made up of 11 countries with a population of 645 million, accounting for 6 % of the world’s gross domestic product (GDP), with Malaysia, Thailand and Indonesia named among the largest emerging economies in the region (Alston et al., 2018). It is unrebuttably that the global financial and economic turmoil were triggered by COVID-19 pandemic and sadly, economies in the Southeast Asia have not been spared. According to the report published in 2021 by the Asian Development Bank (ADB) whereby Malaysia, Thailand and Indonesia are the ADB developing member countries, the outbreak of the virus and the resulting lack of demand were caused by both uncertainty and policy interventions such as lockdowns, social distances and travel restrictions, have serious implications for the Asian economy and hence on Asian household (Morgan & Trinh, 2021). The survey by ADB which involved countries including Malaysia, Thailand and Indonesia revealed that as a result of the COVID-19 pandemic, more than half of Asian households faced financial difficulties (Asian Development Bank, 2020). Unsurprisingly, many who experienced an income shock have resorted to utilising their savings, deferring payments, restructuring of debt repayment as well as seeking the respective government aids (Asian Development Bank, 2020). The Organisation for Economic Co-operation and Development (OECD) in its most recent report pointed out that income and expenditure shocks caused by the pandemic have not only affected people’s financial coping capacity, but may also have affected on the mental health of certain people (Organisation for Economic Co-operation and Development [OECD], 2021). Undoubtedly, debtors are in need of advice in dealing with debts). In many instances, debtors will always conclude that becoming bankrupt is their last resort. Therefore, many approaches were introduced in order to assist debtors to tackle the indebtedness problem. One of the common remedies available to the debtors is by enrolling them into a Debt Management Programme or Plan (DMP) organized by Credit Counselling Agency (Collard, 2009). In this regard, an efficient bankruptcy procedure prior being implemented is determined by having specific provisions, for instance early warning systems and possibilities for out of court settlement (Wymenga et al., 2014).

Considering that the financial and economic turmoil to the consumers or households of the emerging economies in Southeast Asia region that are largely associated with increased in personal and household indebtedness as well as arrears that eventually have affected people’s financial coping capacity, this research aims to focus on the programmes or plans that give assistance and advice for those experiencing such issues. This paper thus seeks to examine the position in Malaysia in dealing with debt management, and financial or credit counselling. It also aims to discuss an equivalent DMP and financial or credit counselling in Thailand and Indonesia. In this study, firstly, DMP and financial or credit counselling in Malaysia will be discussed. Next, it explains an equivalent DMP and financial counselling mechanism available in Thailand and Indonesia. Finally, the discussion ends with findings and conclusion.

Methods

Three countries within the emerging economies of the Southeast Asia are selected in this writing, namely, Malaysia, Thailand and Indonesia, to reflect different models or programmes of DMP and financial or credit counselling. For the purpose of this study, secondary data method is employed, and such data is crucial in assessing the models and modus operandi of DMP, and financial or credit counselling in the three selected jurisdictions. Secondary data obtained are data collected from written documents consisting of various journals, articles, reports, books and online resources. Data from these sources help to achieve a deeper understanding of data collected from the primary sources, particularly to describe how the research is conducted and what methods are used. Subsequently, the collected data are utilized to obtain diverse insight into various issues concerning DMP and financial or credit counselling. These issues are paramount in the pursuit of assessing the programmes available under DMP and financial or credit counselling which give assistance as well as advice for those experiencing financial difficulties. In Malaysia, Thailand and Indonesia, such financial problems are largely connected with increased in personal and household indebtedness. Thus, secondary data from policy, textbooks, reports and articles from journals and reviews as well as other social science journal are collected to enable the authors to analyse DMP and financial or credit counselling under AKPK as practiced in Malaysia. The data also reveal details about any equivalent of DMP programme and financial counselling in Thailand and Indonesia.

Discussions

Malaysia: Debt management programme or plan and financial or credit counselling

As mentioned previously, Southeast Asia countries have experienced rapid growth in household debt in terms of economy size and household income. If not dealt correctly and quickly, all the countries including Malaysia can be exposed to financial instability. The rising cost of living remains a primary concern for the Malaysian public and the government has been pointed out by the World Bank. Hence, Malaysia needs to curb the issue of financial vulnerability on the path of progress toward a high-income nation (Fei et al., 2022). The increment of debt among Malaysian households has raised concerns, since the extension of loan duration has resulted in a spike in household debt. Further, Malaysia is among the highest household debt level in the Southeast Asian region, with 89.1% back in 2015. It is discovered that in the nations that have an established consumer credit sector, younger and older families are more prone to engage in excessive spending. Various socio-demographic characteristics, such as household composition, were discovered to influence consumer debt. Finally, homeowners and households with small kids were shown to be more inclined to possess a high debt-income ratio (Mohamed et al., 2020).

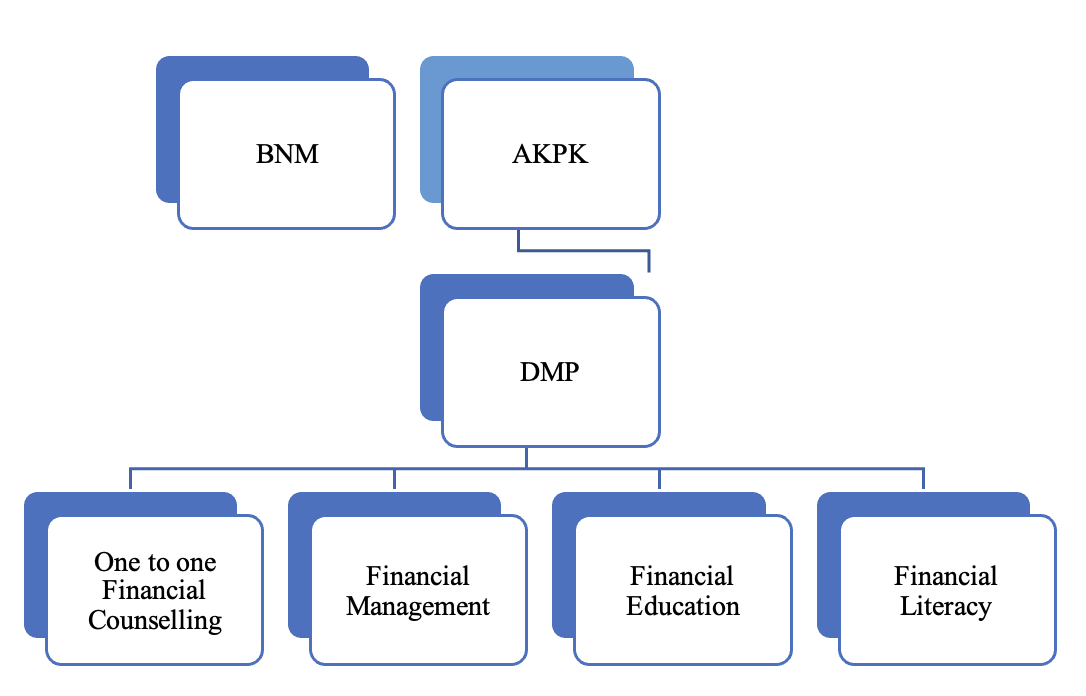

The Central Bank of Malaysia or Bank Negara Malaysia (BNM) has launched Financial Sector Master Plan (FSMP) in 2001. Since then, BNM has been aiming to align its business strategy and institutional capacity alongside the goals of the FSMP. With financial stability as its major goal, BNM launched programmes to help financial institutions develop their capacity, promoting economic education among consumers, and guarantee that financial institutions comply with fair market practises. The FSMP prioritised financial sector stability, competent intermediation, and the efficient operation of financial markets. Additionally, the FSMP advocates for a robust foundation to support competition and liberalisation in the financial services industry: a marketplace in which consumers can make educated financial decisions, have trust in the market, comprehend and assert their rights, and have legal remedies to remedy difficulties. Following the implementation of the FSMP in 2001, the Financial Sector Blueprint 2011-2020 additionally aims to provide customers with enough financial information in order to help them make good investment decisions. With a view to supervise and significantly curb the rising number of bankruptcy cases, BNM established the Credit Counselling and Debt Management Agency or (AKPK). This agency aims to assist individuals in taking control of their economic situation and managing one’s credit and finance properly. Consequently, AKPK launched DMP as one of the programmes by BNM to safeguard consumers' welfare, accompanied with an extensive financial literacy programme designed to improve consumers' financial capabilities (Di Castri, 2011).

Debt Management programme or plan and financial or credit counselling under AKPK

In Malaysia, the Credit Counselling and Debt Management Agency or known as AKPK is a government agency that provides financial advice and help to individual debtors. It contributes to the development of a financially literate community by providing services such as one-on-one financial counselling and advise on money management skills, a tailored debt management programme and financial education. As previously stated, AKPK had launched DMP, a personalised programme that provides qualified borrowers with financial alternatives. DMP had a significant effect on lowering bankruptcies and allowing participating financial institutions to recover defaulted debts from borrowers without having to go to court (Hashim & Syazana, 2018). DMP is recognised as a voluntary debt repayment plan which becomes as an alternative to bankruptcy. It can be considered as a tool in repaying the creditor since the facilitator or counsellor assists the debtor in negotiating the repayment plan. This mechanism benefits both consumers and creditors since it allows consumers to escape the pestering from debt collection agency and legal action while still enjoying low interest and a lesser monthly commitment. Interestingly, DMP is said to be an excellent approach for a Muslim who is in debt to repay the amount owed because loan repayment is a religious responsibility in Islam (Yusoff et al., 2015).

Consumers are frequently offered DMP as part of credit counselling. There are various methods through which credit counselling could result in better credit outcomes, including increased consciousness and attention towards household finance, increased financial expertise and more educated economic decisions, increased accountability and assistance for financial choices, and counselling-related major reforms that modify the proportion or debt costs. Therefore, considering the potential advantages of this fairly low investment, credit counselling services should remain a component of the policy discourse to tackle consumer debt challenges (Roll & Moultan, 2016). Financial counselling promotes excellent health benefits by reducing stress and anxiety caused by financial challenges. Money management is one part of this service. Such financial advisors support customers by dealing with creditors on their behalf. Financial counselling also assisted in minimizing the negative consequences of environmental pressures like personal connections and security systems, which, if left unaddressed, can worsen financial stress (Brackertz, 2014).

Nevertheless, it is stated that credit counselling services has enhanced the financial behaviour of the consumers with debt difficulties. DMP helps debtors to get out of debt because customers are fully educated regarding their alternatives and implement choices that are suitable for their circumstances, whereas creditors and credit counselling companies act responsibly and competently. As a result, DMP can help everyone that are directly engaged in such state of affairs (Xiao & Wu, 2008). During an economic downturn, financial stress becomes more prevalent and the COVID-19 epidemic has had a significant influence on Malaysia's economic wellbeing in principle, and on families specifically. It has been pointed out that unrestrained spending was the source of financial stress, and if one person spends more than his or her whole earnings, he or she may end up in debt. Poor financial management is also obviously connected to irresponsible expenditure and unmanageable debt activity. Furthermore, nearly half of all debt repayment default situations are the result of inadequate financial planning. Therefore, it is not surprising that poor budgeting preparedness is frequently cited as the primary source of financial stress among Malaysian households (Adnan et al., 2021).

Financial management, financial education and financial literacy

AKPK, with its slogan "Make Prudent Financial Management a Way of Life," is a non-profit organisation that assists people in managing their finances. AKPK offers three key financial services: financial counselling, financial education, and debt management. The primary goal of AKPK is to establish a communal institution that is constantly financially literate. In addition to attaining its aim of producing a society in which careful management of home financial resources is the norm in daily life, AKPK delivers dependable financial education. This would indirectly lower Malaysia's poverty rate, which is caused by poor financial management. Therefore, AKPK sees financial education as critical to ensuring that understanding among Malaysians, particularly during the childhood period, is strong in order to manage financial resources properly. AKPK is resolute to increase awareness on financial literacy and improve financial wellness in society by offering services such as DMP which include financial counselling and financial education programmes (Mason & Madden, 2017). In order to attaining its aim of producing a society in which careful management of home financial resources is the standard in ordinary routine, AKPK delivers reliable financial education. As a result, AKPK considers financial education to be extremely vital in order to increase knowledge among Malaysians, particularly from childhood, on how to handle financial resources properly (Fisol & Hamid, 2022).

It should be noted that the distinctions between financial education and counselling are frequently vague. Generally, financial counselling implies one-on-one guidance or consultation. Financial education, on the other hand, often refers to programmes that give financial data or information. Financial counselling, as cited by Collins and O'rourke (2010), may include instructional themes and resources, as well as consumers in financial education programmes may have unique difficulties or personal inquiries to be handled by the counsellor. Study by Collins and O'rourke (2010) had pointed out a few categories of programme within financial education, namely, (1) bankruptcy programmes; (2) credit rating programmes; (3) post-purchase mortgage counselling; and (4) debtor education. It is claimed that within the debtor education programme, prebankruptcy counselling was analysed, and was revealed that positive behaviour changes, and improvements in financial knowledge was established in studies that analysed knowledge gains.

Financial literacy is the collection of information and abilities that enables a person to achieve an educated and successful financial choice using all of their financial resources. A basic awareness of investment, credit management, and other personal finance matters is referred to as financial literacy. In addition to encouraging sound financial habits, AKPK promotes financial awareness initiatives to improve financial literacy. According to AKPK, the most significant financial challenge experienced by consumers is inadequate financial planning, accompanied by slowdown or failure of business, high living costs, and medical costs. In order to reduce youth debt burden and evade bankruptcy, measures have been taken for the purpose of providing comprehensive financial knowledge in schools and universities. Among others BNM has partnered with the Ministry of Education to incorporate financial education into the education system, while AKPK instated financial education in collaboration with colleges, polytechnics and universities. There are two factors of financial literacy and financial behaviour, namely family status and income brackets. It was suggested that university students with more educated families seem to be more engaged with financial planning and are more resourceful, as people with higher education demonstrate better financial behaviour and financial literacy. Furthermore, those with greater income brackets may have better financial habits and financial knowledge (Yong & Tan, 2017).

As part of an AKPK managed consumer education campaign, it has been stated that the (POWER! Programme) initiative was created in order to minimise financial stress and address financial illiteracy. It seeks to provide consumers with actual information and capabilities in debt and financial management, with a focus on present and potential borrowers as well as teenagers. The curriculum emphasises on the real-world applications of financial choices and their repercussions in real-life situations, providing consumers with the information and abilities they need to accomplish their financial objectives and avoid excessive debt by making smarter financial judgments. The growing demand for assessment of such programmes is critical in order for individuals to reduce his or her debts. As a result, the primary financial education structure proposed defining necessity, responsibility, fine-tuning, micro effect, and macro impact of financial educational programmes in order to enhance financial education programme assessment in the long term (Di Castri, 2011).

Consumers in financial distress might find themselves under circumstances whereby their debt service payments exceed their earnings and they are unable to cover unanticipated large expenses. This is due to the fact that they are among the most vulnerable categories in regards to their financial wealth. Individuals who fail to grasp their own money and demonstrate unsuitable financial behaviour, on the other hand, will remain to struggle financially in the future. Many nations, like Malaysia, are still weak in different elements of financial literacy causing Malaysian to underestimate the value of financial literacy. It is said that many of Generation Y (Gen-Y) are experiencing financial difficulties, with one of the factors being a lack of financial literacy. Most people have yet to adopt personal financial planning as they have poor financial literacy, and many remain unwilling to seek for qualified assistance. Furthermore, educational status may play a key part in defining financial literacy level, as individuals with a better educated financial status have a greater financial literacy level compared to those who do not. Also, persons earning less than the minimum hourly wage are more likely to have inadequate financial literacy. In addition, parents may have an impact on their child's financial literacy as most people acquire about money through their parents. Finally, parents may have an impact upon their child's financial literacy and indeed many people learn managing money directly through their parents (Aziz & Kassim, 2020)

An inadequate level of financial literacy is linked to increased debt burdens, higher costs, loan defaults, and loan delinquency. Having low financial literacy as well as savings and a growth in family debt might became the obstacles to the nation's goal of Malaysia to achieve the "high-income status" nation. Money management skills and financial planning abilities are crucial aspects of financial literacy. Individuals that are financially illiterate will have financial troubles, particularly if they are in debt. There is a surge in individual debt levels due to excessive use of credit cards, utilising private loans for one's usage and using overoptimistic home-loan commitments, wasteful spending on expenditure, and unwise devotion to get-rich-quick strategies are all signs of inadequate financial literacy among individuals. In Malaysia the National Financial Literacy Strategy (NFLS) 2019-2023 aims to raise financial literacy levels while also fostering responsible financial behaviour and good financial management attitudes. The NFLS complements the country's goal of economic equality by equipping Malaysians with the information and abilities to make sound financial decisions throughout all the phases of their lives. It also aims to raise financial literacy levels while also fostering good fiscal behaviour and sound economic management mindsets Malaysians are affected due the absence of financial literacy and bad management techniques, as financial literacy is essential for guiding their financing decisions. As a result, it is highlighted how financial literacy should be taught in colleges and universities as a course of study (Idris et al., 2016). Moreover, Malaysia has poorer financial literacy than most of its Southeast Asia countries and high-income countries. Therefore, based on Malaysians' present financial well-being and financial education, the Financial Education Network developed the NFLS 2019-2023, a five-year roadmap that aims to establish major goals and improve Malaysians' financial literacy. There are five primary objectives, which are to (1) instil suitable morals in children; (2) improve the availability of data and techniques relevant to financial management; (3) encourage positive behaviour among specific populations such as recent graduates, self-employed individuals, and stay at home moms; and (4) improve long-term financial and pension benefits planning. Therefore, financial education is currently given at various levels by all Malaysian financial institutions in accordance with BNM and Securities Commission Malaysia consumer safety requirements (Simler et al., 2020).

It has been submitted that borrowing allows one to relocate their expenditures and invest money. Nevertheless, outstanding debt restricts expenditures because a share of household income must now be committed to monthly loan repayments. Accordingly, in order to sustain better living conditions, households frequently depend on another type of borrowing: credit cards. Credit cards are becoming more widely available, and households are progressively relying on them to assist them in making up the shortfall. Furthermore, it is claimed that a considerable proportion of bankruptcies are associated with borrowing for expenditure rather than personal savings (Ahmad & Omar, 2013).

AKPK also has pointed out that the high living expenses was the principal cause on why many working Malaysians were not able to have savings. Therefore, it is crucial to highlight NFLS 2019-2023 aims to raise financial literacy levels while also fostering good fiscal behaviour and stable financial management attitudes. Thus, financial conduct is positively related to a few factors. Firstly, financial literacy and increased knowledge and abilities in handling financial problems will help individuals to practise good financial behaviour self-efficacy, which will cause less debt and more assets. Secondly, self-coping serves as a bridge among financial stress and financial stability. In order to create an effect on their operations, freelance financial counsellors and advisers must be well informed on the effect of financial behaviour on general financial literacy, self-coping and self-efficacy techniques (Adnan et al., 2021). Interestingly, based on the World Bank, men are inversely connected with financial behaviour. Men could be more vulnerable and more risk-taking, whilst females seem to be more cautious. Further, financial behaviour has a major negative impact on financial susceptibility because riskier investment exposes households to financial fragility. Self-efficacy, on the other hand, had a strong beneficial impact on financial behaviour. People with high self-efficacy manage their finances in a good and self-controlled way, whereas those with low self-efficacy become less likely to address financial issues (Fei et al., 2022)

The approach of Gen-Y regarding financial management poses new issues for banks, since they concentrate on living in the moment and "spending immediately, saving afterwards". A variety of other factors influence credit card usage behaviour. To begin with, there have been considerable disparities in credit card usage based on many demographic characteristics like marriage status, educational attainment, industry sector, and race. Second, existing literature divides credit card users into 2 categories: leisure consumers and revolvers, depending on the primary usage of credit cards and the rewards desired. Leisure consumers often utilize credit cards as a simple payment option and settle their debt in whole when they receive their bank statements. Revolvers, in contrast, use the card primarily for finance and choose to pay interest of the outstanding amount. Moreover, credit is commonly used as a cash replacement by Malaysian customers. As a consequence, the link among credit and debt has been emphasized, with several academics expecting that an increase in consumer debt and expenditure has led to an emergence in consumer debt. (Wel et al., 2015)

Gen-Y is more likely to take out new loans to pay off past debts. They will ultimately have to incur further debt. As a result, the major causes of bankruptcy in Malaysia were poor financial management as well as an incapacity to settle existing debts. It has been pointed out that a few characteristics that influence risk of bankruptcy. To begin with, individuals with poor self-esteem are more prone to acquire costly and extravagant items in attempt to mend or increase their self-esteem. Secondly, financial investment as a greater financial engagement than income is the beginning point for debt build-up. Finally, financial literacy is important because individuals with insufficient financial understanding may face financial troubles, eventually leading to bankruptcy. Therefore, it is suggested that proper financial literacy is critical for Gen-Y so that they possess the skills and information to handle their financial affairs. Ignorance of financial literacy may result in excessive spending, reckless credit card use, and increased financial responsibility, which may ultimately to bankruptcy (Syan et al., 2020).

Recently, many young individuals' financial and economic well-being (FWB) has been jeopardised. This is due to the more complicated consumer choices in the marketplace, therefore, modern young adults tend to have greater problems producing financial decisions for themselves than older decades. It is also because they embark adulthood in the midst of unpredictable and shifting economic consequences triggered from the financial market crash, which has inflicted financial suffering. For young people, FWB is significant because it can influence physical, mental, and social health, resulting in poor ability to do the job, inability to focus, poorer efficiency, and detachment from daily activities. It should be noted that many Malaysian young adults are affected by poor financial practises and the absence of financial education. It is revealed that financial information received via various educational systems is critical for consumers to establish healthy financial practices or patterns that result in a higher assessed FWB. It is claimed that the relationship amongst limited wage, high cost of living, and perceived FWB is worth examining and should be taken into account by regulators and Malaysian authorities (Sabri et al., 2022).

It is important to note that individual financial planning in Malaysia is determined to be in its infancy since Malaysians haven not yet taken responsibility for their respective financial issues. Thus, the present increased degree of consumer debt emphasises the importance of good financial management knowledge among Malaysians, since financial illiteracy is a major cause of personal financial troubles. Furthermore, it was shown that increased financial literacy had a good influence on an individual's personal existence. Individuals with a significant amount of financial awareness are said to be less stressed and have fewer money disagreements in their households. This is due to the fact that financial literacy assists people and households in meeting their financial objectives and securing personal financial well-being in the context of social engagement. Thus, financial literacy not only promotes financial literacy but also assists and empowers consumers to make better financial decisions that lead to increased financial well-being (Nahar et al., 2022).

Figure 1 shows the position in Malaysia in dealing with debt management and financial or credit counselling under AKPK established by BNM.

Debt management plan under credit or loan system in Thailand

A study on Rural Credit Management in Thailand had discovered that formal and informal credit systems co-exist in the village areas (Barnaud et al., 2007). While informal credit is considered as loans made among villagers, either without interest within networks of acquaintances or with high interest rates when loan sharks are involved, formal credit correlates to institutionalised credit funds. The majority of well-off farmers have access to official finance whereby an agent farmer will repeatedly attempt to obtain the necessary loan from the government fund if credit is needed. It is said that even if all farmers have access to legal credit, friends and family can still be a highly valuable source of informal credit. It can be seen that credit management is associated with Thailand agricultural society, and farmers have access to both formal and informal credit system.

Kislat (2013) in his study focuses on how rural credits have an effect on the economic situation in Thailand and contributes to reducing the poverty in Thailand. Lenders are divided into informal, formal and semiformal, wherein the typical informal loans can be small, unsecured and short in maturity. Nevertheless, offering actual collateral and informal loans boosts creditworthiness and make formal borrowing easier. Formal credit programmes are designed with the aim to minimise reliance on informal credit sources. It is claimed that the informal loans are employed for relatively poor households; indeed such loans boost asset endowment, while increasing consumption for relatively wealthy households.

According to Tirasriwat (2015), there are two types of loan schemes that exist for students in Thailand which include Student Loan Funds (SLF) and Income Contingent Loan (ICL). For SLF, the government acts as the guarantor for the loans provided by the banks, and the students are given a period up to 15 years to repay the loan. On the other hand, ICL the repayment of the students’ loans is made through the income tax system. It was submitted that a study analysing the relationship between education and other forms of debt found that college students with high levels of student loan debt were also likely to carry significant credit card debt. One of the reasons that caused the likeliness of loan repayment defaults by the students is due to the gradual increase in the number of dependants borne by the students (Tirasriwat, 2015).

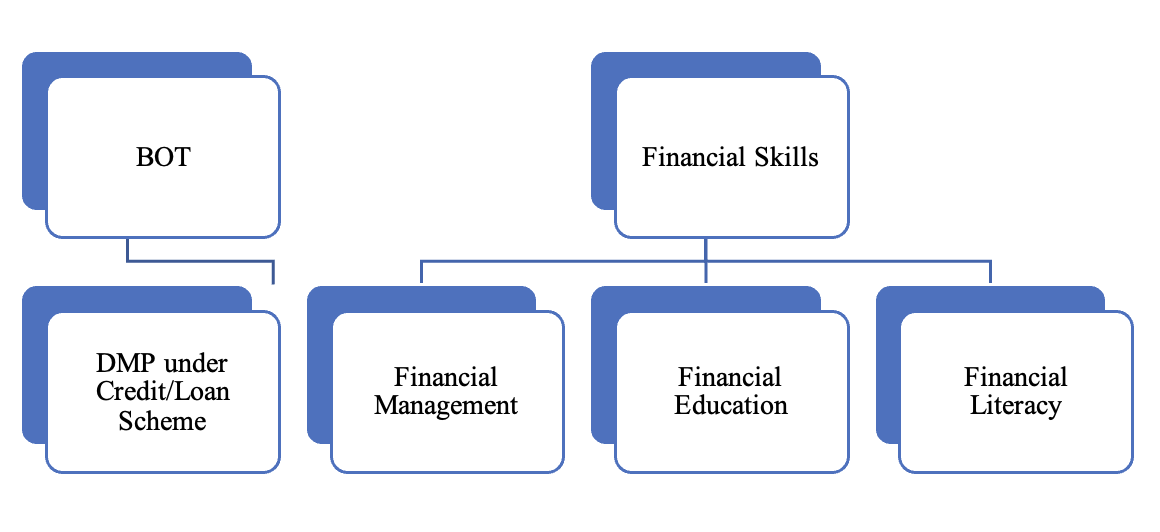

Chichaibelu and Waibel (2017) have compared Thailand and Vietnam debts which include the over-indebtedness between the rural households in both jurisdictions. It is discovered that the level of education and age play a significant role to determine how much debt of a country’s population incurred. Since rural households in Thailand are older and less educated than the Vietnam rural households, hence, the former have more debt. In Thailand, the higher incidence of debt and over-indebtedness consist of the poor and other vulnerable groups. In fact, given the ever-changing economic conditions, the people in Thailand associated with this position are those who are more likely to face difficulty in repaying their debt. Chotewattanakul et al. (2019) examined the nature of household debt in Thailand and the risks it poses. It is contended that depending on the situation, a growth in family debt may have different macroeconomic impacts. Indeed, increasing family debt can exacerbate financial fragility, which can have detrimental economic effects. Meanwhile, personal debt accumulated from various credit card usages and could not be repaid. This becomes an issue as it makes up 30% of the Thai population and hence have a big impact on the economic system (Srisamarn & Fernando, 2018). Among the recommendations to reduce debts are; recording expenditures properly, delegating income for savings, and spending under the category of good debt. Good debt that exists may generate revenue for education loans, and home loans for renting or selling. Meanwhile, a study by Charoensombatpanich (2022) that focuses on household debt mentioned that the Bank of Thailand (BOT) has raised concerns about the impact of rising household debts on the economy and the country. Thailand has to work on regulating the surging household debts since it ranks among the world’s highest household debts. Indeed the increment was driven by higher personal and credit loans, since the nation’s GDP is also reaching 90%. In order to maintain economic stability and reduce over-indebtedness, the BOT has opened itself to hearing from interested parties before implementing regulations to bring the hire purchase business of purchasing vehicle leasing under the Financial Institution Business Act B.E 2551.

Financial management: financial planning and financial literacy

Back in 1993, it was submitted that having no knowledge and responsibility on personal financial management is one cause of financial issues in Thailand (Sangsutisearee, 1993). During this period, universities in Thailand do not offer courses in family and consumer economics, and furthermore, not much efforts taken to develop knowledge of credit card usage. A report from BOT revealed that Thai people are burdened with high household debt and financial planning can help the individuals make sensible decisions about money that can help them achieve their goals in life. Furthermore, this could help them to determine their short and long-term financial goals and create a balanced plan (Kowhakul, 2019). However, although personal factors such as gender and status have no significance in financial planning, yet, one’s occupation is important to consider as it can influence the individual’s financial planning. Indeed, the higher the career level, the greater the financial planning (Nampud, 2014).

Tambunlertchai (2015) pointed out that there are three main elements of financial literacy, which are financial knowledge, behaviour, and attitude. Additionally, Amonhaemanon and Vora-Sitta (2020) opined that financial attitude links financial literacy to financial capability. Everyone requires a certain level of financial literacy, such as the knowledge and skill in finance to be able to make good financial decisions. Moreover, with the right financial attitude, people of all generations would be furnished with a higher level of financial capability. Therefore, an individual’s financial literacy can be expected to influence the individual’s attitude.

It is reported that in Malaysia, Thailand and Indonesia, the banking business accepts and protects money owned by the general public and lends it out in the form of loans or credits, while financial distress affects earnings management in Thailand (Karina & Soenarno, 2022). The ways of managing debt by Gen-Y or also known as the Millennials in Thailand are prone to materialism. Gen-Y spends more than 75% of their income and the majority of their debts are from credit cards and personal loans. This is due to personal debt, spending habits and lifestyle. It is claimed that Gen-Y likes to invest in high-risk financial instruments, however, financial literacy is common among them because they rely on it to be wealthier as they are big spenders (Srisamarn & Fernando, 2018). In a different study, it is mentioned that Gen-Y had the highest average score in financial literacy and financial capacity; higher than that of Gen-X and Gen-B. Nevertheless, the one with the highest debt was Gen-Y as compared to Gen-B and Gen-X. On the other hand, in order to encourage Gen-B people to be financially literate, the Government should promote a policy that educates them about money (Amonhaemanon & Vora-Sitta, 2020).

Thus, education that includes life skills in financial management is significant for today's volatile economy. In Thailand, learning about financial management is not only reading in context but also understanding by situation, which helps individuals to interpret and apply relevant knowledge in daily life. Indeed, it is asserted that young people in Thailand have the potential to be educated and to share knowledge through social networking and social sharing. Furthermore, by using a variety of learning resources it could develop appropriate financial management habits as they grow older. There are four factors that contribute in achieving financial competency: knowledge, skill, ability, and youth financial potential. Accordingly, when the youth get matured, they will have developed the habit of good financial management, which they will be able to apply to their lives and security in the future (Mueangpud et al., 2019). It is said that Thailand should consider financial management as a subject to be taught in learning institutions, as this can possibly tackle the issues on youth who are lacked of understanding on the value of money (Mueangpud et al., 2019). Bangkok Post (2022) reported that poor financial planning can be a cause of financial problems in Thailand. For example, when merchants were unable to use the funds efficiently, they unfortunately turned to loan sharks for additional finances.

As shown in Figure 2 DMP and financial skills instead of financial or credit counselling for Thailand. Financial skill consists of financial management, financial education and financial literacy.

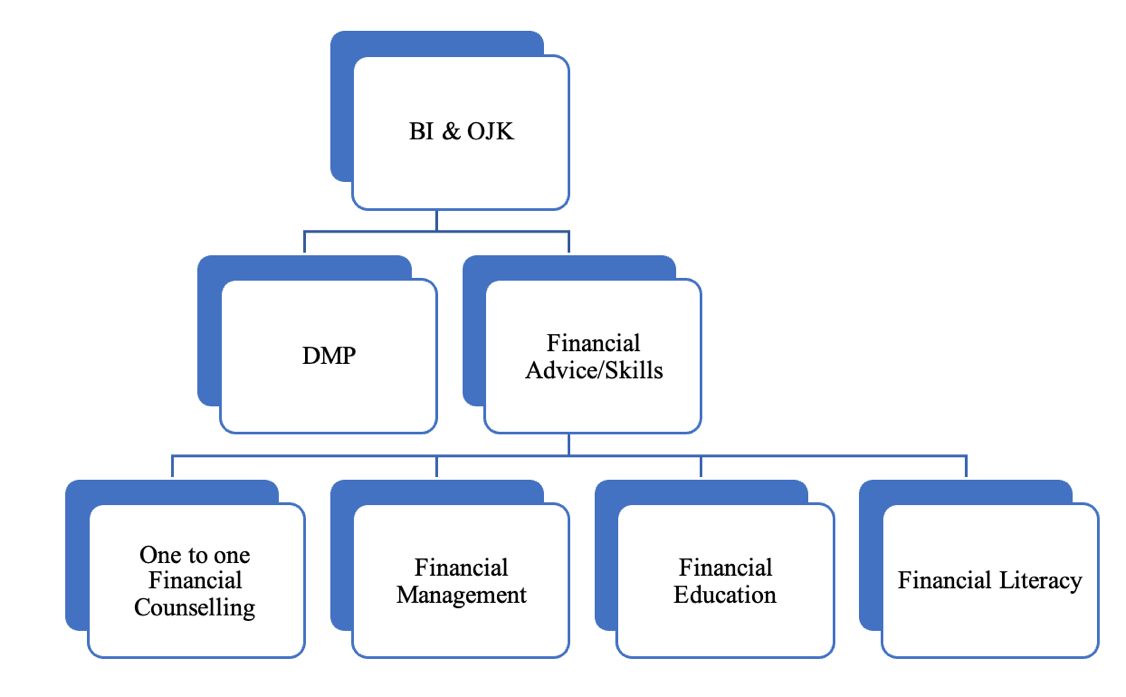

Debt management plan and financial or credit counselling under the financial services authority (FSO)/ (Otoritas Jasa Keuangan) of Indonesia

The FSO, officially known as (OJK), is a government institution that plays the role in financial services sector. This body ensures that the financial sector will be based on the well-organized system, just, in accountable manner and transparency principle. In respect of controlling function, the OJK's primary role is to establish and maintain the regulatory and control framework. Responsibility for regulation and oversight of OJK's financial services activities rests with the banking and non-banking area, as well as capital markets sector (Otoritas Jasa Keuangan, n.d.). When these mechanisms are well implemented, the clients’ and society’s interest will be fully protected.

A division called Financial Services Authority Regulation or(POJK) has been established to provide supporting measure in maintaining stability in the financial system, such as assisting borrowers who are affected by the COVID-19 crisis. Most consumers have been struggling financially during the COVID-19 period and this has caused them lack of capacity and get reduction of efficiency. Thus, this supporting measure is aimed to prevent turning aside an increase in credit risk intended to support the domestic economy to overcome the effects of COVID-19. As stated in the Indonesian Law No. 10 of 1998 regarding banking sector, bank is a business entity, it gathers funds from the public then it dispenses them back in the form of credit and or other forms in order to mend the standard of living of the people. From this description, evidently, banks play an important role to increase economic growth and social welfare.

Indonesia has faced various real financial problems, and debt management is the most general issue in the society (Suroso et al., 2020). In Indonesia, debt is the most common amongst the working class. There are indications showing that a quarter of the income would be spent on unsecured debt repayments. A nationwide survey in 2019 by OJK revealed that despite people are now provided with some better access to financial services, nevertheless, insufficient knowledge of debt management has been a factor to financial trouble (Yuesti et al., 2020).

During the pandemic, OJK supported a relaxation measure towards those whose commercial sector have been either directly or indirectly affected. This policy encourages banks or financial institutions to apply relief or provide assistance to consumers regarding their credit payment or leases. The payment reduction treatment would apply by making the period to pay longer, lowering the interest rate and principal, reducing interest debt, adding credit/rental facility, and credit conversion/lease of temporary participation in capital.

The Central Bank Indonesia known as Bank Indonesia (BI) arranges a relaxation policy for credit card in the beginning of April 1 2020 by lowering the rate of maximum interest. It is known that the rate range was previously between 2.5% and 2% per month. The temporary reduction on the minimum payment value has been applied. The decrease of the value was from 10% to 5%, and additionally, a large temporary decrease in late fees. This policy introduced by BI maintains the ability of debtors (credit card holders) to be able to make payments (Kompas, n.d.).

A credit counselling service is the management of a debt management plan arranged through a credit counselling agency. Counselling agencies can help to establish payment schedules and terms to help manage debt better. By using this service, customer will get a single monthly payment and lower interest rates. This counselling can also help pay debts faster and more affordable, therefore borrowers can be debt free in three to five years. Usually, this service is offered to borrowers who are considered unable to repay the loan by the credit counsellors, based on their financial review. Debt management plans generally cover unsecured debt including the debt for medical invoice or credit card (Albanjari & Kurniawan, 2022).

Alternatively, credit card borrowers can opt for debt consolidation or debt settlement services. Debt consolidation aims to get new loan or balance rearrangement in order to combine all current balances that ideally at a lower interest rate. Then another alternative that can be done is to use a debt settlement service. Debt settlement companies can negotiate with creditors in order to reducing or eliminating part or all of the debt. However, the contradiction is that by drawing out a new credit card or loan, it will temporarily damage the credit score (Utami & Yustiawan, 2021). Furthermore, if the borrowers stop making payments to creditors during negotiations, this could result in late payments.

It is advisable to choose financial counselling that is officially registered under OJK authority. The fact shows that not all of debt management institutions must be registered under the OJK. Only institutions that offer debt restructuring services need OJK permits. This is due to the circulation of money in the transaction (Dolpheen, n.d.). However, it is lack of information regarding provision or relevant policy mentioning the authorized financial counselling or the mechanism to do monitoring towards debt management institutions activities.

Furthermore, to alleviate the effect of COVID-19 on the financial sector, the Indonesian Government has formed financial plans called Financial Services Authority Regulation (POJK) Number 11/POJK.03/2020 regarding National Economic Stimulus as a Countercyclical policy on the effect of the spread of COVID-19 for banks. Bad credit is the main concern of the policy, that is defined as a circumstance where the debtor is incapable to settle the credit according to the agreement previously agreed with the bank.

There are three categories in which bad credit occurs: lack of ability to pay whole instalments, capacity to fulfil half instalment payments, or able to fulfil the payment commitment after the termination period of the credit agreement. According to Utami and Yustiawan (2021), if the customer experiences bad credit and if it is still possible to achieve more in fulfilling their obligations, then the bank will usually carry out the settlement properly, namely helping the customer who is experiencing difficulties by carrying out rescuing and rehabilitating their debts. As for the efforts to save or rescue the debtors, it can be in the form of scheduling to return (rescheduling), requirements to return (reconditioning), and arrangement to return (restructuring).

Financial management or inclusion and financial education and literacy

The well achievement of financial management or inclusion are subject to number of reasons. The most significant factor is how high the percentage of financial literacy in the population. It is reported that the median level of formal education in Indonesian society shows that most of population have primary education, which means that the education level is below the standard whereas in fact, this education element is important. Financial education and knowledge, as well as the availability of financial tools are all factors that affect financial literacy.

BI has defined the importance of educating society towards financial literacy. The goals are mentioned as follows: (i) society has sufficient awareness towards the bank existence; (ii) society has better understanding towards products and services provided by bank, thus, the customers will fully realise their rights and obligations; (iii) society will have awareness towards financial transactions; and (iv) society will have knowledge regarding complaints mechanism and possible dispute settlement to tackle any problems (Wibowo, 2013). From 2007 to the present, BI financial education programmes include public education in banking, austerity campaigns, integration of financial education in primary and secondary schools, and financial education for migrant workers.

In order to reach the goal expectation of financial education, the applicable measurement is by reviewing whether there is a grow in opening bank accounts by the society. Accordingly, there should be a constructive relation among financial education programmes and the channel to access financial services. Society’s behaviour to make decision in opening a bank account, as well as to have trust towards bank in making business or personal transaction can be influenced by some factors including individual earnings, and job status, the accessibility of bank branches, and the problem of location or geographic matter that is connected to the availability of transportation choices.

The results of the National Survey of Financial Inclusion and Literacy (SNLIK) by Financial Service Authority (Otoritas Jasa Keuangan, 2022) describe the measured index of society in Indonesia regarding financial literacy is about 49.68 percent. This percentage shows an increase from 2019 when it was merely 38.03 percent. Improvement is also detected in the percentage of financial inclusion. In 2022, the index reached 85.10 percent, while in 2019 period, it was 76.19 percent. In conclusion, the level of literacy and inclusion are not in a big gap as the index percentage has decreased from 38.16 to 35.42 percent between 2019 and 2022.

Field observations is other method to measure the achievement of financial education programs. Interview should be held with new bank account holders in order to gain the consumer perspective while deciding to open a bank account. However, OJK or other common bank has always prioritised quantitative method or statistic model. In fact, the interview method is supposedly used to evaluate the measurement of success or failure.

The pandemic at the beginning of 2020 became a crucial acceleration factor in the transformation of financial education. A combination way either offline or digital (online) is effective strategy to encourage the financial education and inclusion for society in massive way and borderless. Further, in 2022, OJK and many stakeholders have taken the survey of SNLIK as consideration to make formulation of policy and plans, as well as to create an affective design of financial products and services to fulfil the needs of consumer and contribute to improve the social welfare. In 2023, a policy is issued by OJK known as “Financial Literacy Strategic Direction for 2023”. The main concern of the policy is to encourage the financial literacy in particular to people living in village region. The targeted segment of literacy including students, women, small scale business, rural areas, and the Islamic sector of financial services.

Figure 3 shows the position in Indonesia in dealing with debt management. Financial advice includes financial counselling, financial management, financial education and financial literacy under the Financial Services Authority (FSO)/ () of Indonesia.

Findings

It has been identified that debt management is vital in household financial management, and credit counselling also is becoming more popular as concerns of major credit card problems arise. Indeed, financial or credit counselling is also successful and produces demonstrable beneficial effects on a variety of variables, including debt settlement, advocacy, financial competence, health and wellness (Brackertz, 2014; Elliehausen et al., 2007). Furthermore, financial counselling is regarded as a crucial service that clearly assists clients on several aspects of financial stress (Brackertz, 2014). Meanwhile, the world-wide federation, International Association of Restructuring, Insolvency and Bankruptcy Professions (INSOL International) in its report on Consumer Debt recommended that each country’s bankruptcy system is to provide sufficient competent and independent debt counselling through professional independent debt counsellors. The counsellor must be able to negotiate with creditors, on behalf of the debtor, until they can enter into an arrangement. Besides, the counsellor must be knowledgeable about the specific problems of the debtors in order to be competent to negotiate. The counsellor also must be able to advise the debtors in respect of budgeting-aid and debt settlement. However, to ensure the effectiveness of such debts counselling and to avoid the debtor from becoming victims of unprofessional or even corrupt debt counsellors, the continuous supervision is needed from the Governments, quasi-governmental or private organizations throughout its implementation system (INSOL International, 2001).

In DMP, consumers work with counsellors to create strategies for debts repayment in attempt to avoid bankruptcy. According to Celsi et al. (2017) there are many particular elements related to self-efficacy when one is living with debt. These include emotional control, objective orientation and unrealistic expectations. To begin, comprehending the central position of temptations within the DMP is critical because being deeply in debt is frequently the outcome of a sequence of small self-failures. By recognising it, credit counselling organisations can layout initiatives that are applicable to the perceptions of DMP participants. Furthermore, those with strong self-efficacy are the most capable of achieving behavioural change with minimum help. It has been pointed out that temptation responses are connected with programme success or failure. Failure in the programme is related with a pattern of thoughtlessness during temptation episodes. As a result, these participants sometimes succeed and sometimes fail. Furthermore, thoughtful individuals praise themselves and feel good once they avoid temptation. In order to thrive in the DMP, individuals must properly control the various sentiments they encounter when tempted over a lengthy period of time while coping with constrained finances (Celsi et al., 2017).

In most circumstances, debt reduction is impossible to handle without credit counselling. A DMP is one approach for consumers to address their financial troubles. Previously, this has been the most commonly utilised device in credit counselling. Nevertheless, a DMP might not be suitable for all consumers, or the repercussions of a DMP, such as budget restriction, are frequently overlooked by debtors. Some customers merely want free financial counselling from numerous credit counselling agencies, whilst others might be required to declare bankrupt. Individuals who believe a DMP is a great alternative should recognise that it will affect their lives and their spending habits. It is consequently crucial to be able to identify those who are qualified for a DMP. As a result, many credit counselling firms employ self- assessment techniques and criteria for enrolling the most suited individuals in a DMP.

As noted in Malaysia, BNM is aided by AKPK, which is responsible with providing credit counselling and debt management guidance to its citizens who have had credit problems. Meanwhile, financial education seminars were incorporated as a component of its public engagement efforts. Malaysian consumer duties and rights are being thought in the designated syllabus and programmes that cover topics that are critical in building financial skills and knowledge. This is conformed with the aims of BNM that is to safeguard the rights and interests of financial products and services users. Indeed, as the life expectancy for Malaysia grows, it is critical that its citizens are adequately responsible to sustain themselves, particularly in old age when they can no longer work or are compelled to retire. To accomplish this, its citizen’s financial knowledge and capacity needs to be improved with the help of financial education (Ng Chooi & Masud, 2018). It should also be noted that BNM has also made an attempt to encourage saving habits by developing the Pocket Money Book. Thus, saving practice is an individual's constant attitude that may contribute to personal prosperity in the future. It has been emphasised that awareness programmes should be planned on a regular basis by competent authorities such as the AKPK or other financial institutions in order to promote awareness about saving, while banks and financial institutions should remain assertive in enticing and motivating customers for saving or make investments (Ripain & Ahmad, 2019).

Further, Malaysian adolescents now bear the weight of university debts, as well as credit cards and personal loans. As a result, their financial issues in terms of household debt have gotten much worse. Thus, AKPK attempts to help clients with debt and financial issues by offering financial counselling, financial education and debt management services. Measures such as DMP which included the launch of the POWER! Programme and tight credit card eligibility requirements, have been adopted. The POWER! Programme teaches youthful and first-time customers on ethical borrowing in order to assist customers in debt management. Most importantly, financial management skills, debt management, and self-esteem are all key parts of financial management that influence debt management (Yunus et al., 2015).

Another worrying issue is the Malaysian consumers' "compulsive shopping habit" which is based on the reality of credit cards that are freely accessible to "approved" users. If credit card interest rates are greater, they have a lower economic influence on families since credit cards may be utilised to offset this impact. Consumers who are unable to cope with their home obligations are increasingly turning to credit cards as a supply of lengthy borrowed funds. While a borrower with decent credit is capable of obtaining an uninsured loan from a bank at a reasonable interest rate, the annual percentage rate (APR) for credit card debt is significantly greater. As a result, it is critical that credit card customers receive proper education in order to handle their credit card bills in a reasonably sensible way. (Ahmad & Omar, 2013)

It is worth noting that the OECD conducted a research study regarding national financial education teaching methodologies, with the goal of comparing the strategies of emerging and developed nations, as well as its aim to determining who is in charge of the financial education venture in nations that have implemented a nationwide financial education strategy. The OECD/INFE Policy Handbook on National Strategies for Financial Education listed eleven countries, notably Malaysia, that had adopted a national plan for financial education and were updating or adopting a secondary national plan. Each country, based on the report, has identified a leading authority as the prime motivator of its own national financial education strategy. It is worth mentioning that Malaysia has a similar arrangement like Australia, with BNM serving as the supervisor for the insurance and banking industries (Ng Chooi & Masud, 2018). The OECD then in 2020 published a study on specific nations' financial literacy, mindset, and behaviour. Malaysians had a score of 52.3 for financial literacy, 54.9 for financial attitude, and 68.1 for financial behaviour while Indonesians received a score of 53.2 for financial literacy, 66.8 for financial attitude, and 69.7 for financial behaviour (Ng Chooi & Masud, 2018).

Based on these findings, it is possible to conclude both Indonesians and Malaysians are alike in certain particular aspects of financial behaviour. The literature study discusses how caregivers may establish financial awareness and relevant experience in their children, as financial education should be incorporated in the school and university curriculum Secondly, students' financial behaviour might affect subsequent judgments since incapacity to tackle money concerns can eventually result in poor financial choices and consequences for their career (Khalisharani et al., 2022). Meanwhile, in Thailand according to (Maneejuk et al., 2021) there was a rise in household debt at regional and national levels. Such debts include the short-term loan, personal loans, credit cards, and car loans. It is emphasised that high debt level can be harmful to human quality of life as they fall into debt traps. However personal characteristics, notably education level, have a significant impact on the amount of household debt.

Conclusions

Consumers are frequently provided with credit counselling as a component of DMP. It can be seen that a number of methods through which credit counselling could result in better credit end results, including public emphasis of and recognition to household finance, increased financial knowledge and more educated financial decisions. Furthermore, credit counselling increased responsibility and assistance for financial decisions, and counselling-related major reforms that modify the structure or debt costs. As a result, considering the possible advantages of this pretty modest investment, credit counselling services must remain a component of the policy conversation to tackle consumer debt challenges. In Malaysia, AKPK's popularity variables encompass its capacity to reap from collaborative efforts with relevant parties, offering services at no cost, luring others to obtain additional counselling not just to manage debt but also the care offered by a spectral range of stakeholders like government entities, private entities including non-government organisations (NGOs), supervisors, and the mainstream press. AKPK also assists customers to reorganise one’s debts is its capacity to keep a positive relationship with the financial institutions. As confidence in AKPK and the financial institutions grew, negotiating debt restructuring arrangements became simpler. For instance, AKPK has collaborated with the Department of Labour under the Ministry of Human Resources to discover firms experiencing layoff operations and counsel on pertinent issues of personal finance management. Additionally, DMP is recognised as a voluntary repayment plan which becomes as an alternative to bankruptcy. DMP is seen as a tool in repaying the creditor since the facilitator or counsellor assists the debtor in negotiating the repayment plan.

Perhaps it is not exaggerating to say that financial counselling subsidises to positive health outcomes, such as easing stress and anxiety related with financial difficulties. One of the aspects of this service is money management. These financial counsellors help, by negotiating with creditors on the client’s behalf. Additionally, financial counselling helped lessen the negative effects of environmental stressors including interpersonal connections and home security, which, if unchecked, may worsen financial stress. The number of profitable claims resolved can be used to determine the efficiency of the AKPK programme. AKPK includes three major initiatives: financial counselling, financial education, and debt management. In Malaysia, people or group requesting assistance from AKPK are individuals who have incurred debts. Hence, marketing efforts to encourage these people to resort to AKPK have an impact on the efficacy of its programme. It can also be seen that financial education promotes financial independence and contributes to a more comfortable living by motivating financial institutions to provide high-quality financial products and make appropriate usage family financial assets. Hence, financial education is critical to empowering consumers to generate educated decisions and modify their behavioural patterns, since the correct financial education programmes influence one's attitudes and behaviours about money. It is not exaggerating to say in Malaysia, BNM launched the POWER! Programme to provide consumers with realistic information and expertise in debt and financial management, with a focus on new and potential consumers as well as young adults and indeed the curriculum focuses on real-world implementations of financial decisions and their repercussions. It is claimed that the participants of POWER! Programme exhibited greater knowledge than non-participants, whereby financial education effects financial literacy, attitude, and behaviour. Nevertheless, the POWER! Programme must also teach financial planning knowledge, allowing participants to such programme to receive a useful guideline on handling their money thoroughly. In order to allow consumers to learn something after experiencing POWER! Programme, a thorough module on particular personal financial subjects must be prepared.

In Indonesia, the OJK has given directions that mandate that banks or finance companies provide relaxation or relief from bank credit payments or leasing loans for debtors or borrowers whose businesses and jobs are impacted—directly or indirectly—by the rise in personal and household debt through DMPs. Similar to Malaysia, in Indonesia and Thailand, one type of banking service product is a credit card which is a form of embodiment of bank services to the public. The issuance of credit cards provides convenience facilities for consumers in making transactions such as buying and selling, online transactions, hospital payments, booking airplane tickets, and so on. The creditor provides an opportunity for the debtor to carry out a settlement by providing credit relaxation, namely providing rescheduling or restructuring (debt restructuring). In this terms, credit or debt restructuring can only be given and carried out to debtors who have good business prospects but experience difficulties in making principal and interest payments. Debt restructuring can be carried out by commercial banks by lowering lending rates, reducing arrears of principal and loan interest, extending the credit period and taking over debtor assets in accordance with applicable regulations. Furthermore, Malaysia, Thailand and Indonesia recognised that having no knowledge and responsibility on personal financial management is one cause of financial issues, therefore if one is exposed widely on financial education and literacy, it certainly empowers him or her to make better financial decisions that lead to increased financial well-being; As far as DMP and Financial Counselling are concerned, Malaysia is far more advanced as compared to Indonesia and Thailand. Furthermore, so far nothing is equivalent to AKPK which is significance for Malaysian since it provides programmes and plans aim to help Malaysian to manage their financial and understand the important of financial education and financial literacy;

Acknowledgements

This paper is based on work for a future research project of the Alternative Economies for Transformation programme at the United Nations Research Institute for Social Development (UNRISD). The project focuses on personal and household over-indebtedness and assistance for those who experience it. For more information, visit the programme page on the UNRISD website.

References

Adnan, A. A., Zin, S. M., Abdul, M. I., Aziz, J. A. E., & Rashid, N. (2021). Causes of Personal Financial Stress in Malaysia: A Phenomenological Study. Journal of Contemporary Issues in Business and Government, 27(2), 192.

Ahmad, R., & Omar, N. (2013). Credit card debt management: a profile study of young professionals. Asia-Pacific Management Accounting Journal (APMAJ), 8(1), 1-17.

Albanjari, F. R., & Kurniawan, C. (2022). Implementasi Kebijakan Peraturan Otoritas Jasa Keuangan (POJK) No. 11/Pojk. 03/2020 dalam Menekan Non Performing Financing pada Perbankan Syariah [The Implementation of Financial Service Authority Policy of No. 11/Pojk. 03/2020 in Pressing Non-Performing Financing in Sharia Finance]. EKSYAR: Jurnal Ekonomi Syari'ah & Bisnis Islam, 9(1), 82-84.

Alston, M., Arsov, I., Bunny, M., & Rickards, P. (2018). Developments in Emerging South-East Asia. RBA RBA Bulletin, December.

Amonhaemanon, D., & Vora-Sitta, P. (2020). From Financial Literacy to Financial Capability: A Preliminary Study of Difference Generations in Informal Labor Market. The Journal of Asian Finance, Economics and Business, 7(12), 355-363.

Asian Development Bank. (2020, December). The Impact of COVID-19 on Developing Asia. ADB Briefs. http://www.adb.org/publications/series/adb-briefs

Aziz, N. I. M., & Kassim, S. (2020). Does financial literacy really matter for Malaysians? A review. Literacy, 2(2), 13-20. ttps://doi.org/

Bangkok Post. (2022). BoT preps measures for household debt. https://www.bangkokpost.com/business/2309274/bot-preps-measures-for-household-debt

Barnaud, C., Bousquet, F., & Trebuil, G. (2007). Multi-agent simulations to explore rules for rural credit management in a highland farming community of northern Thailand. In Advancing Social Simulation: The First World Congress. Springer.

Brackertz, N. (2014). The Impact of Financial Counselling on Alleviating Financial Stress in Low Income Households: A National Australian Empirical Study. Social Policy and Society, 13(3), 389-407.

Celsi, M. W., Nelson, R. P., Dellande, S., & Gilly, M. C. (2017). Temptation's itch: Mindlessness, acceptance, and mindfulness in a debt management program. Journal of Business Research, 77, 81-94.

Charoensombatpanich, T. (2022, August 30). Bank of Thailand warns of impact from rising household debts, looks to regulate hire/purchase industry. Thai Enquirer.

Chichaibelu, B. B., & Waibel, H. (2017). Explaining differences in rural household debt between Thailand and Vietnam: Economic environment versus household characteristics (No. WP-002). TVSEP Working Paper.

Chotewattanakul, P., Sharpe, K., & Chand, S. (2019). The drivers of household indebtedness: Evidence from Thailand. Southeast Asian Journal of Economics, 1-40.

Collard, S. (2009). An independent review of the fee-charging debt management industry. Personal Finance Research Centre, University of Bristol.

Collins, J. M., & O'rourke, C. M. (2010). Financial Education and Counseling-Still Holding Promise. Journal of Consumer Affairs, 44(3), 483-498.

Di Castri, S. (2011). Empowering and protecting financial consumers: Bank Negara Malaysia’s consumer and market conduct framework.

Dolpheen. (n.d.). Solusi Penagihan Hutang [Solution for Debt Collection]. https://www.dolpheen.id/debt-solutions/

Elliehausen, G., Christopher Lundquist, E., & Staten, M. E. (2007). The Impact of Credit Counseling on Subsequent Borrower Behavior. Journal of Consumer Affairs, 41(1), 1-28.

Fei, C. K., Sabri, M. F., Husinyah, A. R., & Mohd, A. O. (2022). Determinants of Financial Vulnerability Among Credit Counseling and Debt Management Agency Customers. https://www.researchgate.net/publication/361384029_Determinants_of_Financial_Vulnerability_Among_Credit_Counseling_and_Debt_Management_Agency_Customers

Fisol, W. N. M., & Hamid, A. M. (2022). Childhood Education through Akpk towards Poverty Eradication Using Maqasid Shariah Model. https://www.researchgate.net/publication/370755649_CHILDHOOD_EDUCATION_THROUGH_AKPK_TOWARDS_POVERTY_ERADICATION_USING_MAQASID_SHARIAH_MODEL

Hashim, S., & Syazana, I. (2018). AKPK–Advancing prudent financial behaviour. Bank Negara Malaysia, Central Bank of Malaysia, Prime Minister and Minister of Finance, Putrajaya, Malaysia.

Idris, N. H., Yazid, Z. A., Faique, F. A., Daud, S., Ismail, S., Bakri, M. H., & Taib, N. M. (2016). Financial Literacy and Debt Burden among Malay Youth Workers in Malaysia. Advanced Science Letters, 22(12), 4288-4292.

INSOL International. (2001). Consumer Debt Report: Report of Findings and Recommendations. https://insol.azureedge.net/cmsstorage/insol/media/document-library/books/consumer-debt-report-report-of-findings.pdf

Karina, R., & Soenarno, Y. N. (2022). The impact of financial distress, sustainability report disclosures, and firm size on earnings management in the banking sector of Indonesia, Malaysia, and Thailand. Journal of Accounting and Management Information Systems, 21(2), 289-309.

Khalisharani, H., Johan, I. R., & Sabri, M. F. (2022). The Influence of Financial Literacy and Attitude Towards Financial Behaviour Amongst Undergraduate Students: A Cross-Country Evidence. Pertanika Journal of Social Sciences and Humanities, 30(2), 449-474.

Kislat, C. (2013). Rural credit markets and their impact on vulnerability to poverty: Empirical evidence from Northeast Thailand [Unpublished Doctoral’s dissertation]. Gottfried Wilhelm Leibniz Universität Hannover.

Kompas. (n.d.). Inflation. Retrieved on 3 May, 2023 from https://money.kompas.com/read/080928026/menjaga-inflasi-tetap-rendah

Kowhakul, M. (2019). Personal factors affecting to financial planning of thai people. In RSU International Research Conference (Vol. 4, No. 1, pp. 1-23).

Maneejuk, P., Teerachai, S., Ratchakit, A., & Yamaka, W. (2021). Analysis of Difference in Household Debt across Regions of Thailand. Sustainability, 13(21), 12253.

Mason, C., & Madden, R. (2017). Making prudent financial management a way of life: the aspiration of the Credit Counselling and Debt Management Agency (AKPK). Asian Institute of Finance, Kuala Lumpur, Malaysia.

Mohamed, S., Siti, S. M., Wan, M. F. W. I., Siti, S. H., Mohd, K. A. N., Ferri, N., & Mohamad, A. M. I. (2020). Malaysia’s household debt dilemma. The Interdisciplinary of Management, Economic and Social Research, Vol (1) 72-76.

Morgan, P. J., & Trinh, L. Q. (2021). Impacts of COVID-19 on Households in ASEAN Countries and Their Implications for Human Capital Development. SSRN Electronic Journal.

Mueangpud, A., Khlaisang, J., & Koraneekij, P. (2019). Mobile Learning Application Design to Promote Youth Financial Management Competency in Thailand. International Journal of Interactive Mobile Technologies (iJIM), 13(12), 19.

Nahar, A. I. M., Shahrul, S. N. S., Rozzani, N., & Saleh, S. K. (2022). Factors Affecting Financial Literacy Rate of Millennial in Malaysia. International Journal of Publication and Social Studies, 7(1), 1-11.

Nampud, S. (2014). Personal Finance Management Strategy. University of Thammasert Press.

Ng Chooi, F., & Masud, J. (2018). Financial Education Initiatives in Malaysia: Comparison with 5 Countries. SSRN Electronic Journal.

OECD. (2021). Financial consumer protection and financial literacy in Asia in response to COVID-19. www.oecd.org/financial/education/financial-consumer-protection-and-financial-literacy-in-asia-inresponse-to-covid-19.htm

Otoritas Jasa Keuangan. (2022, July 28). National Strategy on Indonesian Financial Literacy (SNLKI) 2021-2025. https://ojk.go.id/en/berita-dan-kegiatan/publikasi/Pages/National-Strategy-on-Indonesian-Financial-Literacy-(SNLKI)-2021---2025.aspx

Otoritas Jasa Keuangan. (OJK). (n.d.). Financial Plan. https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Default.aspx

Ripain, N., & Ahmad, N. W. (2019). Determinants of Saving Behaviour: An Article Review. Proceeding of the 6th International Conference on Management and Muamalah 2019, 1, 56-59. http://conference.kuis.edu.my/icomm/6th/images/eproceedings/ICD07.pdf

Roll, S., & Moultan, S. (2016). The impact of credit counseling on consumer outcomes: Evidence from a national demonstration program. Working Paper. Ohio State University.

Sabri, M. F., Wahab, R., Mahdzan, N. S., Magli, A. S., & Rahim, H. A. (2022). Mediating Effect of Financial Behaviour on the Relationship Between Perceived Financial Wellbeing and Its Factors Among Low-Income Young Adults in Malaysia. Frontiers in Psychology, 13.

Sangsutisearee, W. (1993). Credit card usage and knowledge in Thailand.

Simler, K., Binti Ali Ahmad, Z., Harrison, D. H., Biradavolu, M. R., Asia, E., & Pacific, D. D. (2020). Aspirations Unfulfilled: Malaysia's Cost of Living Challenges. Disclosure.

Srisamarn, C., & Fernando, M. (2018). A study of factors influence gen y managing debt in Thailand. International Research E-Journal on Business and Economics, 4(2), 1-14.

Suroso, A., Rafinda, A., Gal, T., & Alhendi, O. (2020). Primary Personal Finance Problem in Indonesia. SHS Web of Conferences, 86, 01026.

Syan, C. L., Noor, A. M. R., & Nurbani, M. H. (2020). Financial Literacy. International Journal of Advanced Research in Education and Society, 2(3), 32-40.

Tambunlertchai, K. (2015). Financial Inclusion, Financial Regulation, and Financial Education in Thailand. SSRN Electronic Journal.

Tirasriwat, A. (2015). Analysis of Problems on Student Loan Defaults in Thailand and Guideline Solutions. SSRN Electronic Journal.

Utami, P. D. Y., & Yustiawan, D. G. P. (2021). Non Performing Loan sebagai DampaDonek Pandemi Covid-19: Tinjauan Force Majeure Dalam Perjanjian Kredit Perbankan [Non-Performing Loans as a Impact of the Covid-19 Pandemic: A Review of Force Majeure in Banking Credit Agreements]. Jurnal Kertha Patrika, 43(3).

Wel, C. A. C., Nor, A. O., & Syed, S. A. (2015). Credit Card Usage Behavior among Working Student. Jurnal Personalia Pelajar, 18(1).

Wibowo, P. P. (2013). Financial education for financial inclusion: indonesia perspective. Jakarta: Department of Banking Research and Regulation, Bank Indonesia.

Wymenga, P., Gloser, J., Bezegova, Е., & Besseling, С. (2014). Bankruptcy and second chance for honest bankrupt entrepreneurs. Final report. ECORYS.

Xiao, J. J., & Wu, G. (2008). Completing debt management plans in credit counseling: An application of the theory of planned behavior. Journal of Financial Counseling and Planning, 19(2).

Yong, H. N. A., & Tan, K. L. (2017). The Influence of Financial Literacy Towards Risk Tolerance. International Journal of Business and Society, 18(3), 469-484.

Yuesti, A., Rustiarini, N. W., & Suryandari, N. N. A. (2020). Financial literacy in the COVID-19 pandemic: pressure conditions in Indonesia. Entrepreneurship and Sustainability Issues, 8(1), 884-898.

Yunus, Y., Sabri, M. F., & Yuliandi, S. (2015). Determinants of debt management among young employees in the central region of Peninsular Malaysia. Malaysian Journal of Youth Studies, 12, 139-155.

Yusoff, S. S. M., Soh, T. B. H. T., & Hasan, R. (2015). Debt Management Program for Banking and Islamic Banking Facilities in Malaysia: From the Sharī'ah and Legal Perspective.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2023

Article Doi

eBook ISBN

978-1-80296-131-7

Publisher

European Publisher

Volume

132

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-816

Subjects

Accounting and finance, business and management, communication, law and governance

Cite this article as:

Azmi, R., & Indriyani, R. (2023). Debt Management Programme or Plan and Financial or Credit Counselling: An Analysis. In N. M. Suki, A. R. Mazlan, R. Azmi, N. A. Abdul Rahman, Z. Adnan, N. Hanafi, & R. Truell (Eds.), Strengthening Governance, Enhancing Integrity and Navigating Communication for Future Resilient Growth, vol 132. European Proceedings of Social and Behavioural Sciences (pp. 779-801). European Publisher. https://doi.org/10.15405/epsbs.2023.11.02.61