Abstract

To generate a sufficient amount of tax revenue, which is widely acknowledged by authorities as one of the most significant sources of government revenue and a very reliable source of funding for economic and social development, efficient tax administration and tax collection are essential. Better understanding the factors that contribute to tax evasion and finding effective ways to combat those factors would help governments in both developing and developed countries minimize the negative effects brought on by a decrease in tax revenue. Various economic factors are cited in the literature as having an effect on tax evasion. However, there is a dearth of research into how tax audits and amnesties affect the ability of individuals to avoid paying their fair share of taxes. Accordingly, this study uses political instability as a moderator to empirically examine the impact of tax audit examination and tax amnesty on tax evasion practices of Libya's self-employed taxpayers. The data is gathered using a quantitative approach and a questionnaire. To conduct the survey, 490 taxpayers who are self-employed in Tripoli were given questionnaires. In order to investigate the information collected from respondents, we will use SPSS version 25 and PLS-SEM 0.3. The study's findings would help shed light on how political factors play a part in explaining tax evasion. The current study makes a significant theoretical contribution by examining how political instability in Libya affects the association between economic factors and tax evasion.

Keywords: Political Instability, Tax Evasion, Tax Amnesty, Tax Audit Examination

Introduction

Taxes have been an important part of a country's economic development because they provide a steady stream of money for the government to spend on things such as education, justice, and social welfare, all of which contribute to the general prosperity of the country (Aktaş Güzel et al., 2019; Abd Obaid, 2021; Al-Rahamneh & Bidin, 2022; Shakkour et al., 2021). For both economic and non-economic reasons, as well as for internal efficiency, governments across the globe have traditionally relied on taxation (Sinnasamy & Bidin, 2017). The collection of income taxes is the primary source of funding for the government everywhere, in both developing and developed countries, accounting for more than fifty percent of total earnings (Ortiz-Ospina & Roser, 2020). A number of studies have demonstrated that tax evasion is a global issue that has caused in a significant harm of revenue because taxation is obviously one of the primary issues that affect a country's income (Alasfour, 2019), specifically in developing countries (Abodher et al., 2020). As indicated by Tusubira (2018) people who intentionally and illegally act in order to lower their tax obligations are said to be engaging in tax evasion, which is generally regarded as a modern-day financial crime. In addition, Kirchler (2007) defined tax evasion as occurring when taxpayers do not follow the applicable provisions of the tax law. Given the ever-changing nature of tax evasion schemes, it has been a major challenge for tax authorities around the world to keep up with the practice and crack down on it (Alleyne & Harris, 2017). Tax evasion therefore greatly hampered governments' attempts to raise citizens' standards of living and distribute money for public spending, which in turn generated economic disease (Rashid et al., 2021; Rashid & Morshed, 2021).

Problem Statement

One of the biggest issues in developing countries is a decline in tax revenue, which reduces the government's revenue and thus its ability to fund increasing expenditures (Al-hadidi, 2017; Abd Obaid, 2021) For instance, in 2019, the developing nationd of Libya lost about $254 million in tax revenue, while in 2020, that number grew to $667 million, and in 2021, it rose to more than $501 million (Libyan Audit Bureau, 2021). See Table 1.

Numerous studies all over the world have looked into the factors that lead to tax evasion, some of which have concentrated on developed nations while others have focused on developing nations (Abodher et al., 2018; Abd Obaida et al., 2020). Libyan taxpayers, particularly the self-employed, cheated on their taxes, according to the Libyan Audit Bure (Libyan Audit Bureau, 2018). Tax evasion has increased since Libya's 2011 revolution, Therefore, the causes of tax evasion should be investigated, especially in light of the current economic climate as well as the political context that may have contributed to the country's declining tax collection (Abodher et al., 2018). On the other hand, there have not been a great deal of studies conducted on the countries that are located in the north Africa and Middle East. As a result, the list of factors that play a role in tax evasion is not comprehensive (Al-Ttaffi, 2017; Mohamed, 2015). According to the findings of researchers, in many third world countries, tax evasion is a major issue, with much higher rates of evasion reported by taxpayers than in developed countries (Abd Obaid, 2021; Al-Rahamneh & Bidin, 2022; Cobham & Janský, 2018). Furthermore, economic deterrence theory suggests that tax amnesty and audits of tax returns impact the efficiency of the tax system. However, there has been a severe lack of research into tax evasion. As a result, it is crucial to look into the interactive effects of tax amnesty and tax audit analysis on tax evasion with political instability as moderating in this study. As a result of what has been said above, this paper offers a theoretical foundation for examining how economic factors contribute to tax evasion among Libya's self-employed workers.

Literature Review

Tax evasion

Tax administration is essential in stopping taxpayers from evading taxes. Nevertheless, some taxpayers continue to ignore the laws and regulations (Abodher et al., 2020). Businesses and individuals engage in tax evasion when they take measures that are both unlawful and designed to minimize their tax liabilities (Alm et al., 2019). Tax evasion, according to Alm and Liu (2017), is defined as any intentional and unlawful act performed by taxpayers with the intent to either reduce or completely evade paying taxes. In a similar vein, Nangih and Dick (2018) explained that tax evasion occurs when a taxpayer hides or underreports his or her income from the tax authorities. According to a number of earlier reviews, tax evasion is a major issue especially in Middle Eastern and North Africa nations (Abodher et al., 2020; Al-Freijat & Adeinat, 2020). Thus, this study focused on that particular aspect of the problem. The issue of tax evasion is widely regarded as a major problem (Abodher et al., 2020; Al-Rahamneh & Bidin, 2022; Mohamed, 2015). However, the literature emphasized that there are few studies of tax evasion in Libya context. Studies of tax evasion typically ignore the significant role of taxpayers who work for themselves, especially in developing countries like Libya. This study is based on literature on tax evasion. The deterrence theory and the contributing factors to tax evasion are presented in the following section. The issue of tax evasion is widely regarded as a major problem (Abodher et al., 2018; Al-Rahamneh & Bidin, 2022; Mohamed, 2015). However, the literature emphasized that there are few studies of tax evasion on Libya context (Abodher et al., 2020; Mohamed, 2015) and also mentioned that studies of tax evasion typically ignore the significant role of taxpayers who work for themselves, especially in developing countries like Libya. The previous research on tax evasion served as the foundation for this study. In the following section, the theory of deterrence as well as the factors that contribute to tax evasion will be discussed.

Deterrence theory

Tax evasion as a phenomenon has been studied extensively from a wide range of theoretical frameworks. Earlier studies used economic theories to suggest that taxpayers consider the potential benefits and costs of tax evasion and adjust their behavior accordingly (Allingham & Sandmo, 1972). From a theoretical perspective, studies of tax compliance and tax evasion have frequently employed deterrence theory (Jackson & Milliron, 1986). Taxpayers may comply with the law more effectively as a result of increased tax auditing. Accordingly, it is advised, in line with this theory, to increase compliance auditing in order to increase self-generated revenue. The rate of tax law compliance will significantly increase if tax law compliance audits are successful in lowering tax evasion among taxpayers. (Allingham & Sandmo, 1972; Al-Ttaffi, 2017; Abodher et al., 2018; Alshira'h, 2018; Abd Obaid, 2021; Mazzolini et al., 2022; Sternburg, 1993; Saad, 2011; Werekoh, 2022) are a few examples of studies in this category. According to this theory, they supported for a rise in compliance auditing as a means of boosting internal earnings. Compliance with tax laws could be significantly affected by audits aimed at stopping tax evasion by taxpayers. Tax amnesty is discussed in the standard economic theory of tax evasion. Tax amnesties make it difficult for governments to commit to a deterrence strategy, which reduces the effectiveness of deterrence (Feld & Frey, 2007). Economic deterrence states that rational people protect their financial interests to avoid losing money (Mendoza et al., 2017). Furthermore, Tittle (1980) argued that stricter enforcement measures should be put in place after a tax amnesty in order to prevent tax evasion. Therefore, it stands to reason that taxpayers would benefit from a tax amnesty in order to forestall the introduction of more stringent enforcement measures. Studies have examined how a tax amnesty might impact tax compliance and tax evasion using the economic deterrence theory. One of these research (Ahmed, 2020; Mumo, 2018; Mbithe, 2018; Wanjohi & Mincu, 2019).

Tax amnesty

Tax amnesty, as defined by Le Borgne and Baer (2008), a temporary governmental program in which taxpayers can pay a certain amount of tax in exchange for the cancellation of their entire tax debt from the prior year, including any accrued interest and penalties. According to Ogbonna and Jumbo (2021), who explained the outcomes from introducing the variable of tax amnesty, there are three basic objectives of tax amnesty: As a first step, the government plans to recover tax money that was previously unreachable because of inadequate tax administration infrastructure. Second, tax amnesty has the potential to increase future compliance with tax laws by both individuals and businesses; thirdly, tax amnesty will encourage full tax payment. However, it is possible that the goals of tax amnesty, namely increased tax compliance, will not be realized if the cost of compliance does not increase and a correspondingly large penalty is not imposed (Bose & Jetter, 2012; Dunn et al., 2018). Several authors, including Suyanto and Putri (2017), Nangih et al. (2018), Mujahid and Siddiqui (2019), and others, have found that tax amnesty increases taxpayers' compliance with tax laws. They also came to the conclusion that tax amnesty lowers the unemployment rate and increases tax compliance among taxpayers. Other studies and this discovery are connected. For instance, Sayidah and Assagaf (2019) in Indonesia investigated the effect of tax amnesty on tax compliance and discovered a significant and positive relationship between the two. Tax amnesty programs in other countries, however, have shown the opposite to be true, showing a positive correlation between tax amnesty programs and tax evasion. For example, in Turkey by Ipek et al. (2012) focused on the factors that contribute to tax amnesty among taxpayers in a particular region of Turkey. The findings showed a strong and positive correlation between tax amnesty and tax evasion. Additionally, they claimed that tax amnesty has a negative impact on taxpayers, encourages tax evasion, reduces tax compliance, and undermines government confidence. They advised against using tax amnesty because it protects some taxpayers in Turkey and should never be used. According to Junpath et al. (2016), tax amnesty has a negative impact on tax compliance. They pointed out that the proposed tax amnesty may not increase revenue because noncompliant taxpayers will continue to evade paying their taxes in the hope of receiving further amnesties in the future. Likewise, Apaza-Mendoza (2022) found that tax amnesty for long time will affect the level of tax compliance. Others have come to the same conclusion, such as According to Tofan (2017), tax evaders view tax amnesty as an attractive alternative to evasion, which has a negative effect on tax compliance. According to Libyan Audit Bureau (2018), one of the factors that influences the degree to which taxpayers comply with their tax obligations is the availability of tax amnesty. However, other research has not discovered a connection between tax amnesty and tax evasion. For instance, Waluyo (2017) examined how an Indonesian tax amnesty program affected people's willingness to follow the law. No concrete evidence was found to support the claim that tax amnesty increased tax compliance in Jakarta. Additionally, Alm et al. (2019) found no evidence of a connection between tax amnesty and taxpayer compliance in a related study. Based on these ideas, the current study put forth the following hypotheses:

H1. There is a significant correlation between tax amnesty and tax evasion among self-employed taxpayers.

Tax audit examination

Audits are carried out by tax authorities to ensure that taxpayers have paid the correct amount of tax due (Jayawardane & Low, 2016). A higher rate of tax audits among taxpayers will encourage tax compliance behavior, as Kirchler (2007) argues that it gives the impression that the tax authorities are attempting to stop tax evasion, which increases the taxpayer's perception of trust and fairness. Tax audits have been shown to be effective in reducing tax evasion and promoting voluntary compliance, according to a number of studies (Ademe & Simret, 2020; Bani-Mustafa et al., 2022; Hurre, 2022; Jayawardane & Low, 2016; Modugu & Anyaduba, 2014; Mazzolini et al., 2022; Niyi et al., 2021; Nguyen , 2022; Purwanto & Indrawan, 2020). They also noted that the tax authority could do a better job of conducting audits and investigating possible tax evasion. However, there is a positive and significant link between tax evasion and tax audits. Tumwesigye (2011), for instance, investigated how tax audits influenced taxpayer compliance in Uganda. The study found that audits have a significant and beneficial effect on tax evasion. Tax audits have a negative impact on the level of tax compliance among taxpayers according to research by Palil et al. (2012). A high number of audits were also found to discourage taxpayers from paying their taxes and to encourage them to avoid paying tax. Additional research, such as those by Assfaw and Sebhat (2019) and Irawan and Utama (2021) have found no evidence linking tax audits to tax evasion. The current study made the following suggestion in light of the discussion above:

H2. There is a significant correlation between tax audit examination and tax evasion among self -employed taxpayers in Libya.

Political instability in this study

Numerous studies have shown that the essential tax evasion model falls short in explaining the issue, indicating that the model needs to be usefully expanded (Feld & Frey, 2007; Slemrod et al., 2001; Torgler & Schneider, 2007) when there is a weak, inconsistent connection between the independent and dependent variables, a moderating variable may be added to the model (Baron & Kenny, 1986). One of the things that may significantly affect whether someone engages in tax evasion or ups their tax compliance is generally the political unrest in Libya (Abodher et al., 2018; Abu Bakar et al., 2021; Tedds, 2010). As a result of their confidence in the government's capacity to ensure fair play and protect its citizens, supporters of the current administration are therefore more likely to uphold the law. On the other hand, a taxpayer who backs the opposing party may be more likely to engage in tax evasion because he feels that the government is not on his side and is ineffective (Modugu & Anyaduba, 2014; Profeta & Scabrosetti, 2017). Meanwhile, a report confirmed by the Libyan Audit Bureau has been made public (Libyan Audit Bureau, 2021) the likelihood of taxpayers evading taxes and their willingness to comply with the law are both likely to be affected by the political situation in Libya. As a result, when thinking about tax evasion behavior and the factors that contribute to it, political instability can act as a moderating factor. Taxpayers are taking advantage of the current climate because they expect government revenue to decline as a result of the political unrest (Abodher et al., 2020). Few studies have examined the impact of political unrest as an independent variable on tax compliance and tax evasion (Abodher et al., 2020; Abd Obaid, 2021; Palil et al., 2012). For instance, Alm and Torgler (2006) contend that political stability ought to increase tax compliance, which in turn ought to reduce tax evasion. In the context of Tunisia, Chakroun and Khemir (2020) examined the impact of politics on tax evasion in Tunisia between 2012 and 2015. The study's findings showed that political unrest promotes tax evasion. Furthermore, Huda (2021) has researched the economic and non-economic aspects of tax evasion in Ancient Egypt in the context of that country. The study's conclusions demonstrated that political and economic stability are the most crucial elements in determining how successfully taxpayers comply with tax laws. She added that political unrest significantly and favourably affects tax evasion. In contrast, other studies have discovered that political instability is positively related to tax compliance and negatively related to tax evasion. Similar to Abd Obaid's work from 2021, who investigated the elements that affect SEMs' tax compliance in Yemen. The findings demonstrated that instability in politics has a significant and advantageous impact on SEMs' tax compliance. According to the results of another study by Tedds (2010), instability in politics has no effect on tax compliance or tax evasion.

As a result, this research draws from the existing literature on the relevant variables to analyse how they affect tax evasion among Libya's self-employed taxpayers. This research contributes to the literature on tax compliance and provides new insight into the effects of political instability, tax amnesty, and audit examination on tax evasion. It is anticipated that this study will be the first of its kind to be conducted in Libya.

Research Methods

The research design for the study was an adaptation of survey research. A survey using a five-point Likert-scale will be used to collect information from 490 randomly selected self-employed taxpayers in the Tripoli capital of Libya. There are five possible responses, with 1 representing "Strongly Disagree" (SD), 2 "Disagree," 3 "Neutral," 4 "Agree," and 5 "Strongly Agree". This research will utilize SPSS Version 25 and PLA -ESM Version 0.3. Multiple regression analysis will also be performed on the data to learn more about the connection between the dependent variable and its predictors.

Research framework

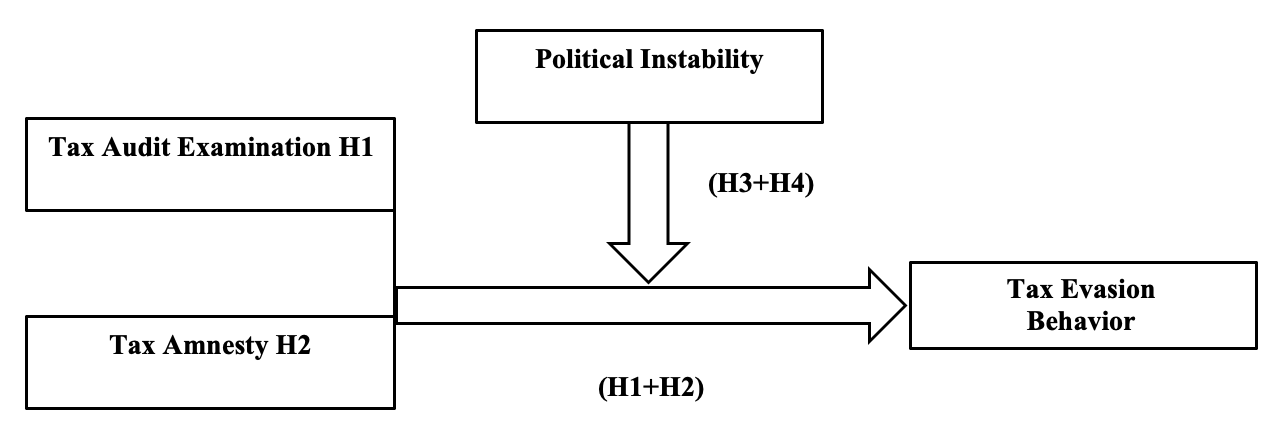

Figure 1 demonstrates the research framework for this specific study. One dependent variable (tax evasion behavior) and one moderating variable (political instability) are shown in the figure along with two independent variables (tax audit examination and tax amnesty). As a moderating variable, political instability has been used. According to the study's discussion, this component may increase or decrease the correlation between the different factors that determine tax evasion behavior.

Conclusion

It is obvious that the fight against tax evasion is currently a challenge for the entire world. To prevent tax evasion, it is essential to have a thorough understanding of the contributing factors. Tax audit and tax amnesty have been found to be the most empirically studied determinants of tax evasion, with political instability playing a moderating role. As a result, there is a critical need for ongoing research in this field because it presents stimulating study opportunities for both academics and tax administrators. This, in short, is based on earlier research on the aspects of tax evasion that are primarily influenced by economic factors, and it then makes recommendations for future research that also takes into account non-economic factors. The research on tax compliance also showed that developed countries were the focus of the majority of tax evasion literature, which included both analytical and empirical studies. However, there is a dearth of information on tax evasion in the Middle East and North Africa. Therefore, it makes sense to give developing nations like Libya more attention.

References

Abd Obaid, M. M. (2021). Determinants of Tax Compliance Behaviour Among Yemeni SMEs: The Moderating Effect of Removal of Government Subsidies.

Abd Obaida, M. M., Ibrahimb, I., & Udinc, N. M. (2020). The moderating role of subsidy removal on factors influencing SMEs tax compliance in Yemen. International Journal of Innovation, Creativity and Change, 11(10), 316-338.

Abodher, F. M., Ariffin, Z. Z., & Saad, N. (2018). Effect of political factors on tax noncompliance behaviour among Libyan self-employed taxpayers. Academy of Accounting and Financial Studies Journal, 22(4), 1-9.

Abodher, F. M., Ariffin, Z. Z., & Saad, N. (2020). Religious factors on tax non-compliance: evidence from Libyan self-employed. Problems and Perspectives in Management, 18(1), 278-288. DOI:

Abu Bakar, M. A. A., Palil, M. R., & Maelah, R. (2021). Governance Quality and Tax Compliance Behavior in East Malaysia. Asian Journal of Accounting and Governance, 15, 1-14.

Ademe, H., & Simret, D. (2020). Determinants of Tax Compliance Behaviour in Ethiopia: Evidence from South Gondar Zone. Research Journal of Finance and Accounting, 11(5), 26-36.

Ahmed, J. (2020). Effectiveness of Tax Amnesty on Revenues Increase in Tanzania: A Case of Large Taxpayers [Doctoral dissertation, Mzumbe University].

Aktaş Güzel, S., Özer, G., & Özcan, M. (2019). The effect of the variables of tax justice perception and trust in government on tax compliance: The case of Turkey. Journal of Behavioral and Experimental Economics, 78, 80-86. DOI: 10.1016/j.socec.2018.12.006

Alasfour, F. (2019). Costs of Distrust: The Virtuous Cycle of Tax Compliance in Jordan. Journal of Business Ethics, 155(1), 243-258. DOI:

Al-Freijat, S. Y., & Adeinat, M. K. (2020). Determinants of tax effort and tax capacity in Jordan during the period (2000-2017). Int. J. Bus. Econ. Res, 9(1).

Al-hadidi, E. (2017). Tax evasion in Jordan: Reality, causes, and result, research. Journal of Finance and Accounting, 8(12), 149-163.

Alleyne, P., & Harris, T. (2017). Antecedents of taxpayers' intentions to engage in tax evasion: evidence from Barbados. Journal of Financial Reporting and Accounting, 15(1), 2-21. DOI:

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: a theoretical analysis. Journal of Public Economics, 1(3-4), 323-338. DOI:

Alm, J., & Liu, Y. (2017). Corruption, taxation, and tax evasion. eJTR, 15, 161.

Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology, 27(2), 224-246. DOI:

Alm, J., Liu, Y., & Zhang, K. (2019). Financial constraints and firm tax evasion. International Tax and Public Finance, 26(1), 71-102. DOI:

Al-Rahamneh, N. M., & Bidin, Z. B. (2022). The Moderating Role of Moral Obligation on the Relationship between Non-Economic Factors and Tax Evasion among SMEs: A Conceptual Framework. Universal Journal of Accounting and Finance, 10(2), 425-432. DOI:

Alshira’h, A. F. (2018). Determinants of sales tax compliance among Jordanian SMEs: the moderating effect of public governance [Unpublished Doctoral dissertation, Universiti Utara Malaysia, Changlun, Malaysia].

Al-Ttaffi, L. H. A. (2017). Determinants of tax non-compliance behaviour of Yemeni SMEs: a moderating role of Islamic religious perspective. [Unpublished doctoral dissertation, University Utara Malaysia].

Apaza-Mendoza, E. T. (2022). Application of the tributary amnesty and its occurrence in the generation of tribute to contributors to the Municipality of Lima in 2021.

Assfaw, A. M., & Sebhat, W. (2019). Analysis of Tax Compliance and Its Determinants: Evidence from Kaffa, Bench Maji and Sheka Zones Category B Tax Payers, SNNPR, Ethiopia. Journal of accounting finance and auditing studies (JAFAS), 5(1), 32-58. DOI:

Bani-Mustafa, A., Nimer, K., Uyar, A., & Schneider, F. (2022). Effect of Government Efficiency on Tax Evasion: The Mediating Role of Ethics and Control of Corruption. International Journal of Public Administration, 1-17. DOI:

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182. DOI:

Bose, P., & Jetter, M. (2012). Liberalization and tax amnesty in a developing economy. Economic Modelling, 29(3), 761-765. DOI:

Chakroun, R., & Khemir, A. (2020). The effect of political connection on tax evasion: Post-revolutionary evidence from Tunisian firms. Asian Journal of Empirical Research, 10(4), 111-126. DOI:

Cobham, A., & Janský, P. (2018). Global distribution of revenue loss from corporate tax avoidance: re-estimation and country results. Journal of International Development, 30(2), 206-232. DOI:

Dunn, P., Farrar, J., & Hausserman, C. (2018). The Influence of Guilt Cognitions on Taxpayers' Voluntary Disclosures. Journal of Business Ethics, 148(3), 689-701. DOI:

Feld, L. P., & Frey, B. S. (2007). Tax evasion, tax amnesties and the psychological tax contract. International Studies Program Working Paper Series, GSU paper, 729.

Huda. (2021). Tax Evasion in Ancient Egypt. Journal of the Faculty of Arts, Fayoum University, (Issue Humanities) 13(2), 3715. https://journals.ekb.eg/article_203311_d4910dc89b9f77cc9581fbdfc6158ac3.pdf

Hurre, A. A. (2022). Determinants of Tax Compliance Behavior: The Case of Small and Medium Enterprises in Burao City, Somaliland. International Journal of Economics, Finance and Management Sciences, 10(4), 185.

Ipek, S., Öksüz, M., & Özkaya, S. (2012). Considerations of taxpayers according to situation of benefiting from tax amnesty: An empirical research. International Journal of Business and Social Science, 3(13).

Irawan, F., & Utama, A. S. (2021). The impact of tax audit and corruption perception on tax evasion. International Journal of Business and Society, 22(3), 1158-1173.

Jackson, B. R., & Milliron, V. C. (1986). Tax compliance research: Findings, problems, and prospects. Journal of accounting literature, 5(1), 125-165.

Jayawardane, D., & Low, K. (2016). Taxpayer attitude and tax compliance decision in Sri Lanka. International Journal of Arts and Commerce, 5(2), 124.

Junpath, S. V., Kharwa, M. S. E., & Stainbank, L. J. (2016). Taxpayers' attitudes towards tax amnesties and compliance in South Africa: an exploratory study. South African Journal of Accounting Research, 30(2), 97-119. DOI:

Kirchler, E. (2007). The economic psychology of tax behaviour. Cambridge University Press.

Le Borgne, M. E., & Baer, M. K. (2008). Tax amnesties: Theory, trends, and some alternatives. International Monetary Fund.

Libyan Audit Bureau (LAB). (2015). General Annual Report 2015. Tripoli, Libya: The Libyan Audit Bureau. https://www.audit.gov.ly/ar/reports/

Libyan Audit Bureau (LAB). (2018). General Annual Report 2018. Tripoli, Libya: The Libyan Audit Bureau. https://www.audit.gov.ly/ar/reports/.

Libyan Audit Bureau (LAB). (2021). General Annual Report 2021. Tripoli, Libya: The Libyan Audit Bureau. https://www.audit.gov.ly/ar/reports/.

Mazzolini, G., Pagani, L., & Santoro, A. (2022). The deterrence effect of real-world operational tax audits on self-employed taxpayers: evidence from Italy. International Tax and Public Finance, 29(4), 1014-1046. DOI:

Mbithe, J. (2018). Effect of Tax Amnesty on Rental Revenue Collection: A Case Study of South of Nairobi.

Mendoza, J. P., Wielhouwer, J. L., & Kirchler, E. (2017). The backfiring effect of auditing on tax compliance. Journal of Economic Psychology, 62, 284-294. DOI:

Modugu, K. P., & Anyaduba, J. O. (2014). Impact of tax audit on tax compliance in Nigeria. International journal of business and social science, 5(9), 207-215.

Mohamed, S. A. A. M. (2015). Determinants of Tax Evasion: Evidence from Libya [Unpublished M. Sc. Dissertation].

Mujahid, A., & Siddiqui, D. A. (2019). The Effect of Tax Amnesties Programs on Tax Collection and Economic Performance: A Global Macro Economic Analysis. International Journal of Social and Administrative Sciences, 4(2), 108-128. DOI:

Mumo, J. F. (2018). Effect of Rental Tax Amnesty on Tax Compliance on Individual Taxpayers in Kenya: A Case of Sub-County, Nairobi.

Nangih, E., & Dick, N. (2018). An Empirical Review of the Determinants of Tax Evasion in Nigeria: Emphasis on the Informal Sector Operators in Port Harcourt Metropolis. Journal of Accounting and Financial Management ISSN, 4(3), 2018.

Nangih, E., Idatoru, A. R., & Kumah, L. J. (2018). Voluntary Assets and Income Declaration Scheme (VAIDS) Implementation in Nigeria: A Case of an ‘Executive Order’with Many Faces. Journal of Accounting and Financial Management ISSN, 4(6), 2018.

Nguyen, T. H. (2022). The Impact of Non-Economic Factors on Voluntary Tax Compliance Behavior: A Case Study of Small and Medium Enterprises in Vietnam. Economies, 10(8), 179. DOI:

Niyi, S., Adebayo, O. O., & Andsamuel Ajibade, D. A. D. A. (2021). Effect of Tax Audit and Tax Amnesty on Tax Yield in Southwest in Nigeria.

Ogbonna, G. N., & Jumbo, V. I. (2021). Tax Amnesty and Economic Development in Nigeria. Middle European Scientific Bulletin, 12, 285-297.

Ortiz-Ospina, E., & Roser, M. (2020). Taxation. Our World in Data. https://Ourworldindata.Org/Taxation

Palil, M. R., Zain, N. H. M., & Faizal, S. M. (2012). Political affiliation and tax compliance in Malaysia. Humanities and Social Sciences Review, 1(4), 395-402.

Profeta, P., & Scabrosetti, S. (2017). The Political Economy of Taxation in Europe. Revista Hacienda Pública Española, 220(1), 139-172. DOI:

Purwanto, P., & Indrawan, R. (2020). The Determinants of Tax Evasion in Directorate General of Customs and Excise Jakarta. Proceedings of the Annual International Conference on Accounting Research (AICAR 2019). DOI:

Rashid, M. H. U., & Morshed, A. (2021). Firms' Characteristics and Tax Evasion. Handbook of Research on Theory and Practice of Financial Crimes, 428-451. DOI:

Rashid, M. H. U., Buhayan, M. S. A., Masud, M. A. K., & Sawyer, A. (2021). Impact of Governance Quality and Religiosity on Tax Evasion: Evidence from OECD Countries. Advances in Taxation, 89-110. DOI:

Saad, N. (2011). Fairness perceptions and compliance behaviour: Taxpayers' judgments in self-assessment environments.

Sayidah, N., & Assagaf, A. (2019). Tax amnesty from the perspective of tax official. Cogent Business & Management, 6(1). DOI:

Shakkour, A., Almohtaseb, A., Matahen, R., & Sahkkour, N. (2021). Factors influencing the value added tax compliance in small and medium enterprises in Jordan. Management Science Letters, 11(4), 1317-1330.

Sinnasamy, P., & Bidin, Z. (2017). The Relationship between Tax Rate, Penalty Rate, Tax Fairness and Excise Duty Non-compliance. SHS Web of Conferences, 34, 11001. DOI:

Slemrod, J., Blumenthal, M., & Christian, C. (2001). Taxpayer response to an increased probability of audit: evidence from a controlled experiment in Minnesota. Journal of Public Economics, 79(3), 455-483. DOI:

Sternburg, T. J. (1993). An empirical investigation of deterrence theory and influence theory on professional tax preparers' recommendations. Arizona State University.

Suyanto, S., & Putri, I. S. (2017). The Influence of Taxpayer Perceptions Regarding the Tax Amnesty Policy(Tax Forgiveness), and Motivation to Pay Taxes on Tax Compliance. Journal of Accounting, 5(1), 49.

Tedds, L. M. (2010). Keeping it off the books: an empirical investigation of firms that engage in tax evasion. Applied Economics, 42(19), 2459-2473. DOI:

Tittle, C. (1980). Sanctions and Social Deviance: The Question of Deterrence. Praeger.

Tofan, M. (2017). Tax Amnesty for Social Contribution in Romanian Legal Framework. Journal of Public Administration, Finance and Law, (11), 190-196.

Torgler, B., & Schneider, F. (2007). What Shapes Attitudes Toward Paying Taxes? Evidence from Multicultural European Countries*. Social Science Quarterly, 88(2), 443-470. DOI:

Tumwesigye, S. (2011). Audit rates, penalties, Fairness, and tax compliance in Uganda Revenue Authority [Doctoral dissertation, Makerere University].

Tusubira, F. N. (2018). Tax compliance by the small and medium-sized corporations: A case of uganda. University of Exeter (United Kingdom).

Waluyo. (2017). Tax Amnesty and Tax Administration System: An Empirical Study in Indonesia. EUROPEAN RESEARCH STUDIES JOURNAL, XX(Issue 4B), 548-556. DOI:

Wanjohi, C. M., & Mincu, M. B. (2019). Factors Affecting the Uptake of Tax Amnesty by Real Estate Owners in Mombasa. Kenya.

Werekoh, E. A. (2022). The Effects of Taxation on Economic Development: the Moderating Role of Tax Compliance Among SMEs. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2023

Article Doi

eBook ISBN

978-1-80296-131-7

Publisher

European Publisher

Volume

132

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-816

Subjects

Accounting and finance, business and management, communication, law and governance

Cite this article as:

Sidik, M. H. J., Mohamed, S. A. A., & Hassan, H. B. (2023). Economic Factors and Tax Evasion in Libya: Moderating Role of Political Instability. In N. M. Suki, A. R. Mazlan, R. Azmi, N. A. Abdul Rahman, Z. Adnan, N. Hanafi, & R. Truell (Eds.), Strengthening Governance, Enhancing Integrity and Navigating Communication for Future Resilient Growth, vol 132. European Proceedings of Social and Behavioural Sciences (pp. 505-515). European Publisher. https://doi.org/10.15405/epsbs.2023.11.02.39