Abstract

This study aims to develop a conceptual framework to identify the readiness of SMEs to implement the International Financial Reporting Standards (IFRS) in connection with Change efficacy, change valence and contextual factors, and Management Support. The study proposed a conceptual model adopted and modified from the literature by considering management support. It is expected that the readiness will be enhanced. Moreover, non-implementation of the standards will make the comparability of financial statements of SMEs among countries difficult for investment analysis. Based on the literature reviewed, we have used the organisational readiness for change theory to conceptualise the relationship between the variables. This study will use a quantitative and structured questionnaire that will be distributed to the respondents in Northeastern Nigeria, which will be randomly selected. Previous studies only considered the listed entities. The goal of this study is to add to the existing body of knowledge, enable owners of SMEs to know the level of readiness in terms of IFRS implementation and regulators & the standard-setting bodies to use this information to detect the report of the entities which are reluctant or ready to implement the IFRS for SMEs.

Keywords: Change Efficacy, Change Valence, Management Support, Organizational Change Readiness

Introduction

The need for International Financial Reporting Standards (IFRS) implementation is a crucial determinant of enhanced investor interest in the Nigerian Stock Exchange (NSE) (Beredugo, 2021). The accomplishment of SMEs depends not only on the value of goods or services but also the capability to form partnerships to expand firms in a global market (Priambodo et al., 2021). In response to strong international demand, the International Accounting Standards Board (IASB) published the IFRS for Small and Medium Enterprises (SMEs) on 9 July 2009 (Jermakowicz et al., 2009). According to empirical findings, the political factor might be a barrier to successfully implementing IFRS, as internal adoption of an external regulatory system can face resistance (Al-Htaybat, 2018). SMEs were directed to implement the IFRS by 1 January 2014 (Ofoegbu, 2015). Struggles and power conflicts among recognized entities involved in the IFRS implementation procedure abound during the implementation phase (Osinubi, 2020). Therefore, the SMEs have not applied the standards as specified. Auwal Ibrahim Bununu, in an interview, claimed that because most SMEs are run informally and do not adhere to regulatory requirements, it is difficult for regulators to keep track of their business operations (PwC MSME, 2020).

Likewise, Assessments of organizational preparedness have a long history of being established as critical tools for effective implementation (Miake-Lye et al., 2020). Performing a readiness assessment systematically examines an organization's ability to carry out possible sustainability quality enhancement by recognizing the organization's potential weaknesses and assisting in reducing or eliminating these weak areas before implementation (Bhakar et al., 2020). Moreover, support from the management is a crucial motivator for overcoming change-related barriers.

Therefore, it is crucial to provide an insight into the readiness of SMEs to implement IFRS, the lack of which will make implementing IFRS by SMEs unsuccessful and thereby make a comparison of their financial statements around the world and access to loans difficult (Jermakowicz et al., 2009). Thus, an organisational readiness assessment formally examines a firm's readiness to undergo significant changes. It helps companies to determine if they can implement such a change and whether they are ready for it (Gallagher, 2019). It is critical to note that the concept of readiness as a measurement of organisational changes is widely acknowledged as fundamental to implementation success (Weiner, 2009a). Regardless of the discrepancy in the interpretation of readiness, the organisational change theory underpinned this study. Similarly, it has regularly been discovered that top management support is crucial for successful implementation (Premkumar et al., 1997). Many researchers have considered it vital to ensure the proposed change is successful (Aziz et al., 2018; Budur et al., 2021; Nilsen et al., 2018).

Moreover, Hussain and Papastathopoulos (2022) also recommended testing the theory in other industries and economies. Therefore, this study is prompted based on their recommendations. In addition, Ezeagba (2017) suggested that the conversion of SMEs' business reporting systems to IFRS, which began in 2014, would be postponed for the subsequent five years to allow SMEs to determine how to meet employees' demands. Even if five years are added to the implementation period, will the SMEs be ready to comply? Suppose organisational readiness can be consistently and adequately measured at the start of a conversion endeavour. In such a situation, it may be used to evaluate the success of implementation support initiatives and monitor changes in readiness indicators over time (Weiner, 2009b).

Many factors influence the implementation of IFRS; the hypothetical restrictions of the readiness concept are used to develop the initial ideas of the readiness model. In keeping with the proposed assessments, the preparedness theory states that "readiness for change" is a prerequisite for effectively adopting substantial changes. The readiness theory, in particular, provides the foundations for formulating relevant constructs for organisational preparedness for IFRS adoption by considering change valence, change efficacy, and contextual aspects. Similarly, the organisational change will only succeed if management is willing to support it and is regarded as the most crucial factor in determining whether or not a company is ready to implement a change (Nguyen et al., 2021). Moreover, to achieve the aim, managers and their Staff should be enlightened on the IFRS implementation process because an efficient IFRS implementation process will involve the capability to implement and value the anticipated benefits for the organization. Enhance their commitment and all those factors in SME settings that affect the readiness of IFRS implementation.

Hence, this is a relevant research context for regulators aiming to identify the information of unwilling entities to implement the IFRS for SMEs. Thus, ascertain strategies to enhance the readiness of those enterprises for an effective implementation procedure and for other stakeholders of SMEs' financial statements to understand whether SMEs are ready to comply with the standards. In principle, assessing an organisation's preparedness for change can be a roadmap for developing a strategy for applying organisational reforms (Holt et al., 2007).

Prior research also analyses the organisational readiness to implement changes in practices and processes. Guerreiro et al. (2012) in Portugal, Guerreiro et al. (2008) in Portugal Hussain and Papastathopoulos (2022) in digital monetary invention and financial resilience, Abayneh (2017) private commercial banks in Ethiopia, Lokuge et al. (2019) in digital modernization, Halpern et al. (2021) on the numerical transition, Bakr and Napier (2022) in Saudi Arabia, Bhakar et al. (2020) in Indian cement sector, Ghani et al. (2021) in Malaysia custom officers', Nilsen et al. (2018) in Sweden's nurturing homes, Sanders et al. (2017) on health- system in Kimberly, Wulandari, et al. (2019) in Indonesia, measures to advance the worth of health services are being implemented and Uyar and Güngörmüş (2013) in Turkey. However, to the best of our knowledge, there is no systematic study undertaken on the relationship between change valence, change efficacy, contextual factors, management support, and readiness of SMEs to implement IFRS with a strategy to implement it as a moderating effect in Northeastern Nigeria. In the context of SMEs from Nigeria, this aspect has not been examined in terms of adoption capability. As a result, this study will review how this variable affects SMEs' ability to adopt the IFRS in Nigeria.

Therefore, this study is encouraged by the need to know whether there is a significant effect of SMEs on the readiness of SMEs for IFRS implementation in Nigeria, as well as to examine the impact of change efficacy, change valence, contextual factors, and management support are related by the readiness of SMEs to implement IFRS, moderated by the strategy of implementation.

Literature Review

Readiness of SMEs to implement IFRS

IFRS readiness is the ability to apply the IFRS in its entity. Some researchers define readiness as the capability to fully implement change, while familiarity is the entity's understanding and skill in applying the IFRS (Floropoulos & Moschidis, 2004).

Other researchers defined readiness as an emotional and behavioral state of being prepared to act (Weiner, 2009b). This could include support systems, a combination of resources, and opportunities for professional growth. For this review, the term readiness for implementation refers to the vital antecedent to successful implementation. It is tangible and immediate evidence of organisational commitment to its decision to execute an involvement as defined by (Weiner, 2009b). There is a passionate element, which describes how individuals sense the change being implemented; a reasoning element, which represents people's views and beliefs about the change's outcomes; and a deliberate element, which describes how much strength and energy organisational participants are prepared to put into the change procedure (Kirrane et al., 2017).

Researchers, experts, and practitioners have published various tools, implying that readiness can be measured in diverse ways and that the idea of readiness is not well defined. Traditionally, managers' attempts to avoid or overcome employee confrontation to change have been addressed in the context of readiness. The characteristic and personality method for measuring readiness is beneficial for evaluating the proportion of employees who fear change or are predisposed to it. This method could help determine the various tactics suitable for generating readiness and the rate at which an organisational change initiative should be undertaken (Holt et al., 2007). Similarly, (Miake-Lye et al., 2020) indicated that readiness could be conceptualised, tested, and considered at any level of analysis.

Thus, SME owners/managers operating in northeastern Nigeria will be used as the unit of analysis in this study. Moreover, an organisational readiness assessment is usually tailored to the firm's position and the factors and criteria of the change or initiative you want to implement (Gallagher, 2019). Organisational change readiness is widely acknowledged as critical to implementation success (Weiner, 2009a). By choosing 100 workers at random and delivering questionnaires to them, Andrew and Mohankumar (2017) performed a readiness assessment to look at employee preparedness for organisational change and self-efficacy.

Similarly, primary instructional leadership and teacher preparation for change was assessed using a readiness assessment (Aziz et al., 2018). Facts were collected from 402 Selangor secondary school instructors who were chosen through stratified accidental sampling. Barber (2010) examined the organisational commitment, relationship with a direct administrator, and perceived corporate provision to see whether there were any changes in preparation levels. The research used a single-subject survey design using quantitative methodology.

Moreover, Madsen et al. (2005) studied the link between organisational commitment and social interactions in the workplace and transition readiness. Full-time employees from four enterprises in two northern Utah counties returned 464 valid questionnaires. Significant links exist between enthusiasm for transformation, organizational commitment, and community relationships. Likewise, Holt et al. (2007) examined the creation and testing of a mechanism that can be used to assess individual willingness for organisational transformation. More than 900 people from the community and private sectors participated in the various research stages. The study concluded that change readiness is multifaceted and impacted by employee attitudes about change efficacy, appropriateness, management support, and personal valence.

In addition, Ghani et al. (2021) investigate the elements influencing custom constables' readiness for Malaysia's adoption of the Sales and Service Tax. Specifically, they used the features identified by the theory of organisational readiness for SST 2.0 implementation. The study's conclusions suggest that the higher the organisation's employee's value changes, the more likely they desire to execute it. Furthermore, Helfrich et al. (2018) examined two rounds of readiness-to-change review data as part of a three-arm, randomised experiment to introduce evidence-based fitness advancement activities in low-wage businesses' tiny workplaces. The five readiness factors examined were the setting conditions, change valence, information evaluation, change commitment, and efficacy. Beyond that, Hussain and Papastathopoulos (2022) investigated organisations' readiness for monetary technology innovation and economic resilience. The organisational readiness and strategic support theories are used in this study to understand better how different aspects of corporate preparedness influence Digital Monetary Innovations. DMIs have a favorable effect on businesses' financial act and resilience (robustness and adaptability).

Similarly, the preparedness of organisations for digital innovation was evaluated by Lokuge et al. (2019). Resource readiness, information technology readiness, cognitive readiness, partnership readiness, innovation valance, cultural readiness, and strategic readiness are some of the 21 measures that make up the suggested design. As well as Trisnawati et al. (2020) determined the effect and aspects of change valence that have the most significant impact on change readiness. This study used a cross-sectional research design characterised as an observational analysis. The findings revealed that change valence emotional change readiness.

Furthermore, Sanders et al. (2017) evaluate preceptors' views on change readiness before and after implementing a prototype early immersion program involving student pharmacists in direct patient care. The ORIC assesses two aspects of organisational change readiness: change dedication and change efficacy. Implementation desires, support, and the supposed value of the change were also evaluated. Except for a decrease in organisational change commitment, there were no significant differences between the pre-and post-survey variables. Fuller et al. (2007) also use a readiness assessment to assess the impact of organizational readiness for change and managerial viewpoints using four empirically supported methods.

Factors impacting large unlisted enterprises' readiness to apply accepted International Financial Reporting Standards in Portugal were investigated (Guerreiro et al., 2012). The research was based on a survey of 116 big private Portuguese enterprises. The Portuguese accounting occupation's resistance and the preparation process were hampered by the dominant logic's injection of code-law practices, even though necessary and simulated institutional factors affected preparedness levels. In Sweden’s nursing homes, (Nilsen et al., 2018) researched to see if the organisation was ready to provide palliative care using evidence-based methods. They interviewed 20 directors from 20 nursing households in two communities, and the inquiries were based on the theory of organisational readiness for change. Halpern et al. (2021) investigate the effect of organisational readiness, invention, and the size and ownership of airports on the digital transition. Data was gathered and analysed from a poll of 94 airport managers worldwide. It has been discovered that organisational inclination directly impacts digital change.

In addition, Azmi and Mohamed (2014) have recognized major concerns and obstacles in transitioning to accrual accounting for implementing accrual accounting among Malaysian public sector personnel at the Ministry of Education. A questionnaire, observation, and interview were used for data collection. It is found that accounting personnel are also willing to transform their minds and adopt accrual accounting because they feel it will make government accounting more precise and effective. Similarly, Vaishnavi and Suresh (2022) investigated the readiness of health institutions to change, and a fuzzy logic technique was used to regulate the amount of willingness for change. The Hospital's organisational preparedness level was determined using the Fuzzy Organisational Readiness Index and the Fuzzy Performance Importance Index. It resolved that the clinic is averagely ready for change.

In a study by Titilayo et al. (2014), the appraisal was used to investigate the readiness of SMEs in Lagos State. The data was collected using a survey design and primary sources. According to the findings, various challenges are now obstructing the adoption of IFRS for SMEs in Nigeria. If not resolved immediately, it could prevent the proper adoption and implementation of IFRS for SMEs in Nigeria by 2014. They used a descriptive survey design. Likewise, Floropoulos and Moschidis (2004) evaluated the preparation and familiarity with IFRS among SMEs in Greek businesses. Questionnaires were circulated to company bookkeepers, and finally, chi-square was used for statistical investigation. In addition to that, Bhakar et al. (2020) also measured the readiness of the Indian cement sector for overall sustainability enhancement. A cross-functional team of experts from a multinational cement firm participated in an offline survey. Two hundred seventeen questions based on resource-based theory are used. According to the self-assessment, the organisation is prepared to pursue sustainability improvement efforts, as it exceeds the qualifying score in all relevant criteria and resources. Moreover, In Saudi Arabia Bakr and Napier (2022) researched attitudes about and views on adopting the IFRS for SMEs. An extensive interview was conducted with business owners/managers, accountants, auditors, and regulators.

Besides that, Guerreiro et al. (2008) measured the readiness of itemised Portuguese enterprises to adopt IFRS as of August 2003. They revealed that corporate scope, commercial internationalisation, an appraisal by a 'Big 4' accounting firm, and effectiveness considerably impacted preparation. Finally, Indonesia's inspired e-commerce readiness was investigated (Priambodo et al., 2021). The quantitative study method and questionnaires from 383 business owners were used for data collection. It is determined those in times of indecision, such as the COVID-19 pandemic, E-Commerce promptness is critical. According to the findings, many SMEs in Indonesia still lack trustworthy human resource readiness with knowledge and skills in information technology.

In all the above research, different measurements were used to assess the readiness in areas in their respective studies. Similarly, this research intends to use the willingness to determine the readiness of SMEs in Nigeria to implement the IFRS.

Change efficacy and readiness of SMEs for IFRS implementation

From the standpoint of change attempts, change efficacy is the belief that "we can accomplish this." Employees must be assured that they can prosper in the change procedure by change agents. Efficacy perceptions affect cognitive designs, actions, conducts, and enthusiastic responses in stressful circumstances. The efficacy has been revealed to account for dissimilarities in managing strategies, pressure reactivity, and objective attainment in studies. Bernerth (2004) views self-efficacy as a critical component of transformation success. Scholars understand self-efficacy as self-efficacy of change (Andrew & Mohankumar, 2017). With fresh knowledge and experience, judgement becomes more effective (Gist & Mitchell, 1992).

Change efficacy should have a linear relationship with readiness because the readiness to perform any change depends on whether the employees can implement the change. Members of the organisation with high change efficacy will be encouraged to display more cooperative conduct resulting in a high organisational willingness to change (Shea et al., 2014). Wulandari et al. (2019) established that implementing efforts to improve the value of health facilities was a significant relationship with change efficacy. In a study conducted by (Andrew & Mohankumar, 2017; Emsza et al., 2016; Ghani et al., 2021; Helfrich et al., 2018), change efficacy significantly affects readiness for change.

Proposition 1: Change efficacy has a positive effect on the readiness of SMEs to the adoption of IFRS

Change valence and readiness of SMEs for IFRS implementation

Change valence refers to the benefits employees and the organisation will derive from implementing the organizational changes. These could include better work and an increase in long-term employment stability. They may value it since they believe the adjustment is operative and will address a critical organisational issue. They may appreciate it because of the anticipated benefits for the organisation, employees, or themselves that the managerial revolution will bring. It may be valuable to them because it aligns with their underlying values. They may value it because their managers, opinion leaders, or peers support it (Weiner, 2009b). The more organisational participants appreciate the change, the more they desire to implement it or the more determined they will be to participate in the change implementation courses of action (Jack Walker et al., 2007). The change target should be able to identify how fruitful implementation of the change will benefit them personally. Change valence is a clear conception that presents some hypothetical consistency to the many varied handlers of readiness that change administration experts and researchers have addressed (Armenakis & Harris, 2002).

One of the most necessary and proximal aspects in shaping employees' reactions to change is valence (Armenakis et al., 2007), as the workers' reaction changes, which may directly affect their ability to implement the change. Employees will be ready to engage in any difficulties and be capable of changing their attitude toward achieving the organisational change due to the projected benefit they will get from implementing it. Abayneh (2017) indicated a higher change valence on readiness. Similarly, Trisnawati et al. (2020) revealed that change valence influenced change readiness. The following proposition is proposed based on the discussion mentioned above and justifications.

Proposition 2: Change valence has a positive effect on the readiness of SMEs to the adoption of IFRS

Contextual Factors and Readiness of SMEs for IFRS

According to the organisational readiness for change theory, contextual factors are also a predictor of organisational willingness to change, as they can affect change commitment and efficacy. Weiner (2009a) outlined five contextual characteristics that aid as forerunners to an organisation's change readiness: organizational culture; policies and procedures; experience; corporate resources, and organisational structure. It was recognized that organisational culture, organisational elasticity, and prior experience would influence change valence and efficacy judgments (Weiner, 2009b). The more basic contextual conditions, primarily the SME settings, affect organisational readiness through social relations, supervision, political instability, and partnership. For this study, conceptual factors refer to those in SME settings that mainly affect the readiness for IFRS implementation.

The circumstances of SMEs and listed companies can differ dramatically. Unlike publicly traded companies, SMEs have fewer problems obtaining support, supervision, application method, and timing. The availability of support from government and professional accounting bodies may directly impact the change efficacy of the Staff. Regarding the implementation of IFRS by SMEs, the manner of social relations, firm size, organisational culture, and partnership are necessary for determining the level of change efficacy for readiness. The attachment of external shareholders to an organization's numerical invention is known as partnership readiness (Lokuge et al., 2019). Besides, accepting change necessitates a change-friendly culture. Thus, it's crucial to grasp the link between organisational culture and change readiness (Imam et al., 2013). Similarly, Alolabi et al. (2021) stated that employee perceptions of existing organizational practices in open structure principles and human morals and how they are strongly associated with greater readiness levels, forecasting the level of change in an enterprise, make up organizational philosophy.

However, a lot of academics have examined how organisational culture and openness to change are related (Alolabi et al., 2021; Britel & Cherkaoui, 2022; Budur et al., 2021; Helfrich et al., 2018; Lokuge et al., 2019; Miake-Lye et al., 2020; Nguyen et al., 2021; Samal et al., 2021; Tran et al., 2020). Samal et al. (2021) found a substantial unfavourable association between organisational culture and transition readiness. For instance, according to Jones et al. (2005), an organisational culture supporting change is important. Hence, contextual factors represent organisational culture. The following proposition is proposed based on the abovementioned debate and justification.

Proposition 4: organisational culture has a positive effect on the readiness of SMEs to the adoption of IFRS.

Management support and readiness of SMEs for IFRS implementation

The influence of the owner/manager on the implementation of IFRS is of excellent reputation when it comes to SMEs, especially when resources are needed. Looking at the peculiar nature of SMEs, the owner manages the business. A leader is responsible for establishing and attaining organisational goals in collaboration with and through others (Info et al., 2020). Thus, support from management will influence the readiness to implement the standards. Management support is the degree to which the entity's administration contributes toward actualizing a change to improve any activity. The management support message is anticipated to signal that the organisation's leaders are committed to investing the time and resources required to move the change in the institutionalisation process (Armenakis & Harris, 2002).

Similarly, Holt et al. (2007) defines it as the magnitude to which members of the organisation believed senior leaders were compassionate of the change. It was also discovered that leaders significantly influence subordinates' change commitments and efficacy, eventually affecting organisational preparedness for transformation (Wulandari et al., 2019). Implementing IFRS by SMEs may result in a key change in the routine in which SMEs present their financial statement; therefore, management support will be helpful. The difference in an inability to perform the responsibilities affects the degree of organisational change readiness (Info et al., 2020).

Moreover, Staff has seen several change struggles fail due to insufficient support. They are distrustful and unable to dynamically support the transformation unless they see a clear demonstration of support (Armenakis & Harris, 2002). Considering the owners of SMEs and how the enterprises were managed, management support is essential for successfully implementing the IFRS. A study by Kirrane et al. (2017), (Info et al., 2020) indicated a positive and significant relationship between recognized management support for change and readiness for change. The following proposition is proposed based on the abovementioned debate and justification.

Proposition 3: Management support has a positive effect on the readiness of SMEs to the adoption of IFRS.

Organisational readiness for change theory

The approach will enable us to understand organisational change better and consider influential areas to which change efforts should be dedicated and techniques employed to encourage change. Organisations need to be prepared for a change that might be inspiring in many instances to achieve the objectives, and literature suggests different categories of theories. The underpinning theory for this study is the theory of organisational willingness for change, which can measure the IFRS implementation readiness by measuring organisational change valence, change efficacy, related factors, and management support as used by (Hussain & Papastathopoulos, 2022; Lokuge et al., 2019).

Since there is currently no golden standard assessment for determining organisational change willingness (Miake-Lye et al., 2020). Weiner's notion of organisational willingness to change drove the readiness measurements and analysis. In addition, Weiner (2009b) presents a multi-level and multi-layered readiness theory for change, which states, "A shared psychological state in which organisational members feel committed to implementing an organisational change and confidence in their collective abilities to do so" (Weiner, 2009a, p 5).

According to the notion, the organisational members may appreciate a planned organisational change if they feel that a change is urgently required (Weiner et al., 2020). The idea of organisational readiness provides a broad framework for evaluating SMEs' readiness to implement the IFRS. The theory of organizational readiness proposes a comprehensive framework to assess the readiness of SMEs for IFRS Implementation. Change valence, change efficacy, and contextual factors are the three primary components of Weiner et al. (2020) and Lokuge et al. (2019) organisational readiness theory for change. With the theory of measuring readiness for organisational change, it tried to combine with IFRS adoption in Nigerian SMEs.

For this reason, IFRS implementation is expressed as a change in the accounting policy and practice of the enterprises, which refers to organisational change. Hence, the theory of organisational readiness for change can be used to measure the preparedness for adopting IFRS by measuring organisational change valence, change efficacy, and related factors as deliberate. Moreover, the organisational level of analysis addresses the theory of organisational readiness for change. Thus, to test the theory's expectations, a multi-organization study design is needed where a group of organisations adopts a shared, or at least comparable, significant organisational change.

The theory explains that the organizational members consider the organisation's structural resources and shortfalls in formulating their change efficacy judgments. The theory further holds that the organisational readiness for change differs as a function of how organisational members value the demands for change, resource accessibility, and situational factors that may necessitate the change (Weiner, 2009b). However, this elaborates why many organisations cannot generate adequate organisational readiness and therefore encounter problems or face failure when executing complicated organisational change (Abayneh, 2017).

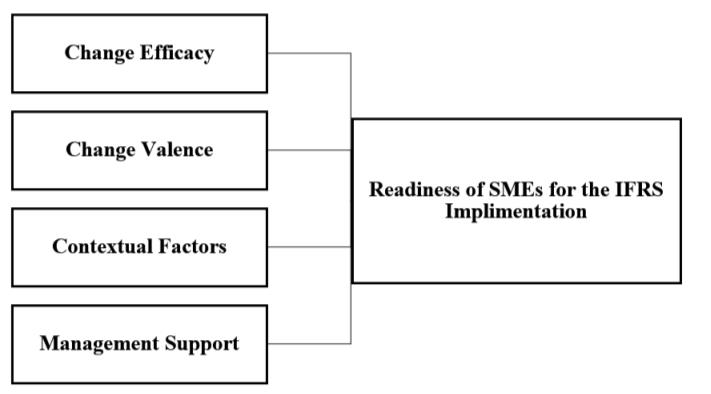

This paper, therefore, intends to apply and extend the model of Weiner (2009a). The model demonstrates the effect of four independent variables on the dependent variable through a moderator. The model's independent variables are change efficacy, valence, contextual factors, and management support. The readiness of SMEs to implement IFRS is a dependent variable. The conceptual framework is shown in figure 1.

Methodology

This study intends to use a cross-sectional study design to determine the readiness of SMEs to implement IFRS. The study will focus on SMEs in the Northeastern region of Nigeria because the area has suffered from the insurgency of Boko-Haram for many years before the implementation date of IFRS (Aro, 2013). The methodology used in this study comprises a library search and review of previous literature on the change efficacy, change valence, management support, contextual factors, and readiness to implement changes.

Practical and Theory Implications

The research findings may enable SME owners to know the readiness level for IFRS implementation. Regulatory and standard-setting authorities may utilise this information to identify tentative entities to implement the IFRS for SMEs and, as a result, devise methods to boost such organisations' readiness to adopt the IFRS for SMEs more effectively. Additionally, the suggestions made by the researchers will assist the SMEs in considering how they could prepare for the following stage.

In addition, the study also stimulated more researchers into this area since research literature work is still negligible. The study will also augment existing literature on SMEs' readiness levels and deepen the organisational readiness change theory. The measurement of their level of willingness will give an overall impression of what has been committed. It should be committed to achieving a more effective adoption process in Nigeria and similar prominent countries. Lastly, this study will provide new insight into the implementation procedure of the IFRS by SMEs in Nigeria.

Conclusion

The study used the organisational change theory to support the variables. This theory gives a framework for comprehending the correlation of the problem. Furthermore, even though SMEDAN has made it mandatory to implement the standards, this research aims to demonstrate that SME firms are not ready to implement the IFRS due to changes in efficacy, change valence, and support from the management.

This study proposes there will be significant influence of change efficacy, change valence, contextual factors and management support on the readiness to implement the IFRS by SMEs. Therefore, if the result confirms that there is a substantial influence between the variables and the willingness to implement the IFRS, then the owners/managers should ensure that they put all things in place for a smooth implementation of the standards as directed. On the contrary, the Regulator and the standard setters should check to resolve the issues. However, empirical research needs to take place to assess these variables and their interrelationships. There are concerns when considering the readiness of SMEs to implement IFRS. We will further empirically examine the interrelationships between the variables to determine the level of preparedness SMEs have for IFRS implementation in Nigeria.

References

Abayneh, S. A. (2017). IFRS Implementation readiness in Ethiopia: The Case of Private Commercial Banks. Solid State Ionics, 2(1), 1–10.

Al-Htaybat, K. (2018). IFRS Adoption in Emerging Markets: The Case of Jordan. Australian Accounting Review, 28(1), 28-47. DOI:

Alolabi, Y. A., Ayupp, K., & Dwaikat, M. A. (2021). Issues and Implications of Readiness to Change. Administrative Sciences, 11(4), 140. DOI:

Andrew, A., & Mohankumar, S. (2017). The relationship between self-efficacy and employee readiness for organisational change. International Journal of Engineering Research and General Science, 5(1), 16–27.

Armenakis, A. A., & Harris, S. G. (2002). Crafting a change message to create transformational readiness. Journal of Organizational Change Management, 15(2), 169-183. DOI:

Armenakis, A. A., Bernerth, J. B., Pitts, J. P., & Walker, H. J. (2007). Organizational Change Recipients' Beliefs Scale: Development of an Assessment Instrument. The Journal of Applied Behavioral Science, 43(4), 481-505. DOI:

Aro, O. (2013). Boko Haram Insurgency in Nigeria: Its implication and way forwards toward avoidance of future insurgency. International Journal of Scientific and Research Publications, 3(11), 1–9.

Aziz, N. A. A., Asimiran, S., Fooi, F. S., & Hassan, A. (2018). Principal Instructional Leadership and Teacher Readiness for Change to Implement School Based Assessment in Secondary Schools. International Journal of Academic Research in Business and Social Sciences, 8(12). DOI:

Azmi, A. H., & Mohamed, N. (2014). Readiness of Malaysian Public Sector Employees in Moving towards Accrual Accounting for Improve Accountability: The Case of Ministry of Education (MOE). Procedia - Social and Behavioral Sciences, 164, 106-111. DOI:

Bakr, S. A., & Napier, C. J. (2022). Adopting the international financial reporting standard for small and medium-sized entities in Saudi Arabia. Journal of Economic and Administrative Sciences, 38(1), 18-40. DOI:

Barber, V. A. (2010). A Study of Change Readiness: Factors That Influence the Readiness of Frontline Workers Towards a Nursing Home Transformational Change Initiative. How has open access to Fisher Digital Publications benefited you?

Beredugo, S. B. (2021). Determinants of Earnings Response Coefficient in the Nigerian Post-IFRS Implementation Era. Asian Journal of Economics, Business and Accounting, 24-31. DOI:

Bernerth, J. (2004). Expanding Our Understanding of the Change Message. Human Resource Development Review, 3(1), 36-52. DOI:

Bhakar, V., Sangwan, K. S., & Digalwar, A. K. (2020). Readiness self-assessment of cement industry for sustainable manufacturing implementation: A case study of India. Procedia CIRP, 90, 449-454. DOI:

Britel, Z., & Cherkaoui, A. (2022). Measuring an Organization's Change Readiness Regarding the Implementation of Corporate Social Responsibility. International Journal of Management and Sustainability, 11(1), 1-20. DOI:

Budur, T., Demir, A., & Cura, F. (2021). University Readiness to online education during covid-19 pandemic. International Journal of Social Sciences & Educational Studies, 8(1), 180–200. DOI:

Emsza, B., Eliyana, A., & Istyarini, W. (2016). The Relationship Between Self Efficacy and Readiness for Change: The Mediator Roles of Employee Empowerment. Mediterranean Journal of Social Sciences. DOI:

Ezeagba, C. (2017). Financial Reporting in Small and Medium Enterprises (SMEs) in Nigeria. Challenges and Options. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(1). DOI:

Floropoulos, J. N., & Moschidis, O. E. (2004). Are small Enterprises ready for the implementation of IFRS? The case of Greece. Journal of Economics and Business, VI I(2), 81–116.

Fuller, B. E., Rieckmann, T., Nunes, E. V., Miller, M., Arfken, C., Edmundson, E., & McCarty, D. (2007). Organizational Readiness for Change and opinions toward treatment innovations. Journal of Substance Abuse Treatment, 33(2), 183-192. DOI: 10.1016/j.jsat.2006.12.026

Gallagher, B. (2019). Why Organizational Readiness Assessments. Partner Audits without Anxiety.

Ghani, E. K., Mohammad, N., & Muhammad, K. (2021). Custom officers' readiness for sales and service tax implementation in Malaysia: An organizational readiness for change perspective. Journal of Asian Finance, Economics, and Business, 8(3), 459–468. DOI:

Gist, M. E., & Mitchell, T. R. (1992). Self-Efficacy: A Theoretical analysis of its determinants and malleability. Academy of Management Review, 17(2), 183–211. DOI:

Guerreiro, M. S., Rodrigues, L. L., & Craig, R. (2008). The preparedness of companies to adopt. International Financial Reporting Standards: Portuguese evidence. Accounting Forum, 32(1), 75–88. DOI:

Guerreiro, M. S., Rodrigues, L. L., & Craig, R. (2012). Factors influencing the preparedness of large unlisted companies to implement adapted International Financial Reporting Standards in Portugal. Journal of International Accounting, Auditing and Taxation, 21(2), 169–184. DOI:

Halpern, N., Mwesiumo, D., Suau-Sanchez, P., Budd, T., & Bråthen, S. (2021). Ready for digital transformation? The effect of organisational readiness, innovation, airport size and ownership on digital change at airports. Journal of Air Transport Management, 90, 101949. DOI:

Helfrich, C. D., Kohn, M. J., Stapleton, A., Allen, C. L., Hammerback, K. E., Chan, K. C. G., Parrish, A. T., Ryan, D. E., Weiner, B. J., Harris, J. R., & Hannon, P. A. (2018). Readiness to Change Over Time: Change Commitment and Change Efficacy in a Workplace Health-Promotion Trial. Frontiers in Public Health, 6. DOI:

Holt, D. T., Armenakis, A. A., Feild, H. S., & Harris, S. G. (2007). Readiness for Organizational Change: The Systematic Development of a Scale. The Journal of Applied Behavioral Science, 43(2), 232-255. DOI:

Hussain, M., & Papastathopoulos, A. (2022). Organizational readiness for digital financial innovation and financial resilience. International Journal of Production Economics, 243, 108326. DOI:

Imam, A., Abbasi, A. S., Muneer, S., & Qadri, M. M. (2013). Organizational culture and performance of higher educational institutions: the mediating role of individual readiness for change. European Journal of Business and Management, 5(20), 23–35.

Info, A., On, R., On, R., On, A., Print, I., & Online, I. (2020). Role of leaders in building organisational readiness to change – a case study at public health centers in Indonesia. Problems and Perspectives in Management, 18(3), 0–10. DOI:

Jack Walker, H., Armenakis, A. A., & Bernerth, J. B. (2007). Factors influencing organizational change efforts: An integrative investigation of change content, context, process and individual differences. Journal of Organizational Change Management, 20(6), 761-773. DOI:

Jermakowicz, E. K., Epstein, B. J., Novak, R., & Llp, C. (2009). IFRS for SMEs - An Option for U. S. Private Entities? 72–80.

Jones, R. A., Jimmieson, N. L., & Griffiths, A. (2005). The Impact of Organizational Culture and Reshaping Capabilities on Change Implementation Success: The Mediating Role of Readiness for Change. Journal of Management Studies, 42(2), 361-386. DOI:

Kirrane, M., Lennon, M., O’Connor, C., & Fu, N. (2017). Linking perceived management support with employees' readiness for change: the mediating role of psychological capital. Journal of Change Management, 17(1), 47-66. DOI:

Lokuge, S., Sedera, D., Grover, V., & Dongming, X. (2019). Organizational readiness for digital innovation: Development and empirical calibration of a construct. Information & Management, 56(3), 445-461. DOI:

Madsen, S. R., Miller, D., & John, C. R. (2005). Readiness for organizational change: Do organizational commitment and social relationships in the workplace make a difference? Human Resource Development Quarterly, 16(2), 213-234. DOI:

Miake-Lye, I. M., Delevan, D. M., Ganz, D. A., Mittman, B. S., & Finley, E. P. (2020). Unpacking organizational readiness for change: an updated systematic review and content analysis of assessments. BMC Health Services Research, 20(1). DOI:

Nguyen, G. T., Liaw, S., & Mai, T. (2021). Predicting factors affecting the readiness of big data adoptions: An application of data mining algorithms. Proceedings of the 2nd International Conference on Human-Centred Artificial Intelligence, Computing4 Human 2021 (pp. 182–190).

Nilsen, P., Wallerstedt, B., Behm, L., & Ahlström, G. (2018). Towards evidence-based palliative care in nursing homes in Sweden: a qualitative study informed by the organizational readiness to change theory. Implementation Science, 13(1). DOI:

Ofoegbu, G. N. (2015). Towards successful implementation of International Financial Reporting Standards (IFRS) In Nigeria: Unresolved issues. International Journal of Research in Management, 2(4), 1–20.

Osinubi, I. S. (2020). The three pillars of institutional theory and IFRS implementation in Nigeria. Journal of Accounting in Emerging Economies, 10(4), 575-599. DOI:

Premkumar, G., Ramamurthy, K., & Crum, M. (1997). Determinants of EDI adoption in the transportation industry. European Journal of Information Systems, 6(2), 107-121. DOI:

Priambodo, I. T., Sasmoko, S., Abdinagoro, S. B., & Bandur, A. (2021). E-commerce readiness of the creative industry during the COVID-19 pandemic in Indonesia. Journal of Asian Finance, Economics and Business, 8(3), 865–873. DOI:

PwC MSME. (2020). PWC's MSME Survey 2020 Building to Last Nigeria Report (Issue June).

Samal, A., Patra, S., & Chatterjee, D. (2021). Impact of culture on organizational readiness to change: context of bank M&A. Benchmarking: An International Journal, 28(5), 1503-1523. DOI:

Sanders, K. A., Wolcott, M. D., McLaughlin, J. E., D'Ostroph, A., Shea, C. M., & Pinelli, N. R. (2017). Organizational readiness for change: Preceptor perceptions regarding early immersion of student pharmacists in health-system practice. Research in Social and Administrative Pharmacy, 13(5), 1028-1035. DOI:

Shea, C. M., Jacobs, S. R., Esserman, D. A., Bruce, K., & Weiner, B. J. (2014). Organizational readiness for implementing change: a psychometric assessment of a new measure. Implementation Science, 9(1). DOI:

Titilayo, A. D., Folashade, O., & Ifeoma, O. O. (2014). International Financial Reporting Standards (IFRS) for SMEs adoption process in Nigeria. European Journal of Accounting Auditing and Finance Research, 2(4), 33–38. www.ea-journals.org

Tran, Q., Nazir, S., Nguyen, T.-H., Ho, N.-K., Dinh, T.-H., Nguyen, V.-P., Nguyen, M.-H., Phan, Q.-K., & Kieu, T.-S. (2020). Empirical Examination of Factors Influencing the Adoption of Green Building Technologies: The Perspective of Construction Developers in Developing Economies. Sustainability, 12(19), 8067. DOI:

Trisnawati, A., Damayanti, N., Novita, R. D., & Damayanti, N. A. (2020). How change valence impacts readiness to change in teaching Hospitals. European Journal of Molecular & Clinical Medicine, 07(05), 310–316.

Uyar, A., & Güngörmüş, A. H. (2013). Perceptions and knowledge of accounting professionals on IFRS for SMEs: Evidence from Turkey. Research in Accounting Regulation, 25(1), 77-87. DOI:

Vaishnavi, V., & Suresh, M. (2022). Assessment of healthcare organizational readiness for change: A fuzzy logic approach. Journal of King Saud University - Engineering Sciences, 34(3), 189-197. DOI:

Weiner, B. J. (2009a). A theory of organisational readiness for change. Implementation Science, 9(4), 1–9. DOI:

Weiner, B. J. (2009b). A theory of organisational readiness for change. Implementation Science, 4(1), 1–9. DOI:

Weiner, B. J., Clary, A. S., Klaman, S. L., Turner, K., & Alishahi-Tabriz, A. (2020). Organizational Readiness for Change: What We Know, What We Think We Know, and What We Need to Know. Implementation Science 3.0, 101-144. DOI:

Wulandari, R. D., Supriyanto, S., Qomaruddin, M. B., Damayanti, N. A., & Laksono, A. D. (2019). Change Commitment and Change Efficacy of Public Health Center in Indonesia in Implementing Efforts to Improve the Quality of Health Services. Indian Journal of Public Health Research & Development, 10(10), 1923. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2023

Article Doi

eBook ISBN

978-1-80296-131-7

Publisher

European Publisher

Volume

132

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-816

Subjects

Accounting and finance, business and management, communication, law and governance

Cite this article as:

Tanimu, I. M., Musa, A., & Haruna, M. (2023). Determinant of SMEs Readiness for The Implementation of International Financial Reporting Standards. In N. M. Suki, A. R. Mazlan, R. Azmi, N. A. Abdul Rahman, Z. Adnan, N. Hanafi, & R. Truell (Eds.), Strengthening Governance, Enhancing Integrity and Navigating Communication for Future Resilient Growth, vol 132. European Proceedings of Social and Behavioural Sciences (pp. 203-217). European Publisher. https://doi.org/10.15405/epsbs.2023.11.02.16