Abstract

The article focuses on the socio-economic significance of the category of public debt. The aim of the article is to develop recommendations on the optimal parameters of public debt, allowing the creation of a mechanism that increases the effectiveness of this financial instrument. By using debt obligations, the state becomes a real participant in the movement of loan capital on the capital market. It is found that without a clear purpose for the financial resources borrowed, public debt can have the opposite effect, depriving the state of its status as a sovereign borrower of financial resources on the financial market. The study substantiates the role of public debt in economic development and the implementation of a digitalization programe, both in the production process itself and in the organization and management of production. It is established that investing in the economy implies the focus on attracting real investments regarding the nature of investment, direct investments according to the participation in investments and the duration of long-term investments. Systematic economic development, based on the comprehensive use of public financial instruments, will provide the country's regions with their own financial resources to form a development budget. The existence of these conditions increases the financial stability and investment attractiveness of the country. It is proven that the effect of public debt is minimal if the fiscal and, consequently, economic policies pursued by the state are ineffective.

Keywords: Budget deficit, economic policy, economic development, finance, public debt, sovereign borrower

Introduction

In modern times, while the economies of some states are developing rapidly, with continuity ensured by introducing the latest techniques and modern technology into the production process, the economies of other states are in a developing and undeveloped state. The economies of underdeveloped countries aside, there is a process of increasing the presence of science in the production process in emerging as well as developed economies. Increasingly, old equipment is being replaced by new equipment enabling the use of modern technology. In recent years, the economy of the Russian Federation has been changing under the impact of the digitalizing the economy. This process is influenced by the introduction of scientific developments into the production process (Abdulgalimov et al., 2021). However, we should point out that not all sectors of the economy have the same rate of implementation of scientific developments. There are industries in which the bulk of material goods are produced using old methods, without the use of modern machinery and modern processing techniques for materials and raw materials. Digitizing the economy, introducing modern scientific developments are linked to the availability of financial resources (Kydland, 2015). The main source of funding for such expenditure is the state budget and state funds, since the development of modern production and new industries is only possible with state funding. The funds in the state budget and public fund budgets are already structured and have clearly defined areas of expenditure. Therefore, additional funds will be needed to set up new types of production. In such a case, the state uses the most realistic source of fundraising as public debt (Alekhin, 2011). The Russian Federation has successfully used this financial instrument.

Problem Statement

The socio-economic importance of public debt as one of the effective financial instruments through which it can bring about structural change in the economy and ensure that organizations and industries linked to the innovative development of the economy function. Scientific justification of the parameters for attracting public debt, allowing for its effectiveness, contributing to the country's economic growth.

Research Questions

Creating the conditions for the task at hand requires research into the following issues:

- addressing the problems associated with the use of public debt;

- linking the parameters of attracted public debt to the financial capacity of the organizations and individuals involved in investing the state with their own financial resources;

- optimizing debt obligations by considering the capacity of the parties involved in the public debt relationship.

Purpose of the Study

The purpose of this paper is to identify the creative essence of the category "public debt". On this basis, it aims to formulate recommendations for the effective use of this financial instrument for regulating the socio-economic development and economic growth of the country.

Research Methods

Public debt is identical to the amount of financial borrowing needed to cover the budget deficit. The specific amount of public debt should be equal to the difference between the cumulative budget deficit of previous years and the budget surplus for that period.

We should note that in considering the amount of public debt, it is necessary to exclude the amount of counterclaims of the state in question against other states, their natural and legal persons. In addition, the calculation of public debt does not consider financial obligations of a social and pensionary nature.

To examine the state of public debt, a comparative assessment of it with other macroeconomic indicators of a country's development is necessary (Kulik, 2019). Practice shows that an objective measure of public debt can be given by comparing it to the (GDP) of the country.

Table 01 shows the ratio for Russia between 2018 and 2021.

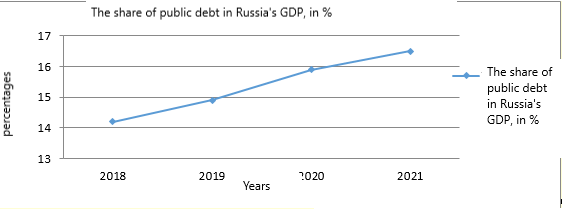

The data in Table 01 shows an increase in public debt during the period under study. This means that in Russia the state budget deficit prevails over the surplus. The state is actively using public debt, especially at the expense of the domestic part of it.

From 2018 to 2021, GDP increased by 2,306 billion roubles. = (118327–98021) or by 20.7 %. In terms of public debt, it has increased by 5,605 billion roubles. = (19,524–13,919), representing 40.2 %. This suggests that the public debt growth rate is twice as high as the GDP growth rate.

On the one hand, this suggests that the Russian state is actively using this instrument to address issues related to the country's economic development. On the other hand, with a relatively low GDP growth rate, a high growth rate of public debt may mean that the funds attracted by the state are not used efficiently. Table 01 shows that the share of public debt in GDP has been increasing over the period under study, indicating the inefficiency of the government's debt policy.

The dynamics of the share of the public debt of the Russian state are shown in the graph in Figure 01.

For a more in-depth analysis of the use of funds raised by the state, it is necessary to conduct a study of the dynamics of state expenditure to support the national economy. In Table 2 we present data on investment in fixed capital by region of the country. Table 02 shows data for parts of the regions of the country, which allows us to establish the nature of public funding, including the use of public debt. To compile the table, we sampled the subjects with the highest and the subjects with the lowest financial performance. We selected the most characteristic subjects of the Central Federal District and subjects of the North Caucasus Federal District.

The data in Table 02 show that the regions of the Central Federal District have significantly higher indicators for GRP and investment in the economy than the regions of the North Caucasus Federal District. This suggests the efficienty of financial policy in the Central Federal District. However, the share of investment in fixed capital in the regions of the Central District is significantly lower than in the regions of the North Caucasus. This factor, to a certain extent, misleads researchers. In the economically underdeveloped Republic of Dagestan, for example, this figure is 40 % of GRP, while in the economically developed Moscow it is 18 %.

The Republic of Dagestan has a policy of increasing investment in fixed capital. However, these funds are not sufficient to bring the region out of its underdeveloped state. The main source of repayment of public debt, as in other economically underdeveloped regions of the country, are subsidies from the federal budget.

Public debt should be seen as an economic category, the need for which arises in circumstances associated with the emergence of state and local budget deficits. The question arises whether it is necessary to use a method of raising funds such as public debt if the budget is in surplus.

The answer to this question lies in the socio-economic challenges the state is addressing. These challenges are always faced by the state, as the state in its broadest sense needs to address not only the budget deficit, but also the problems associated with expanded reproduction and the achievement of economic growth (Yarygina, 2020). In this context, it is important to note that public debt, as an economic category, needs to be considered more broadly, as the problems being addressed go beyond the budget deficit problem.

We should bear in mind that without a clearly defined purpose for the use of funds borrowed at home and abroad, public debt can have the opposite effect (Guscina, 2014).

First, getting the state into debt bondage. If such dependence increases, the state may lose its economic and political sovereignty. This was the situation in the Russian foreign economic sphere in the 1990s, due to political and economic reforms. In August 1998, the Russian government announced that it was unable to repay its debts to the international monetary fund and other international financial institutions (Zavyalov, 2005). Although default was declared on the loans, there was also no repayment of the Russian government's debt obligations from that period.

Second, there is the risk of late repayment of the debt obligation. Increased public expenditure on law enforcement and defence, and the political economic security of the state, may lead to an increase in the funds raised by the state in the form of public debt.

Third, by increasing public debt to enable the government to better perform its duties to society, the flip side of this category is revealed, showing the process of increasing the risk of the state becoming indebted.

Unlike domestic debt, the external debt of the Russian state contains the risk of becoming indebted to a foreign state or international financial institutions. Russia is now a developing economy. It lags economically developed countries in many respects. This lag is due to the non-competitiveness of domestically produced goods, services, in the world market (Norenkov, 2017). If economic development is weak and public debt is growing, sovereignty will not be fully realised in Russian debt relations with other countries, which increases the risk of falling into debt bondage.

Problems related to the increased risk of government debt have always been topical, since the full realization of debt obligations is only possible if the country realizes its sovereignty, which is ensured by its economic, and consequently political, independence.

Today, sovereignty is not achievable for the vast majority of states in the world. The growing alarming trends in global debt markets are becoming the defining vectors, the driving forces behind the development of modern world economic relations (Poole, 2018).

A number of European Union countries are in pre-default state. These countries include Greece, Portugal, Spain, Bulgaria, Romania. They have fallen into a debt trap, using debt provided by other, more developed EU countries, such as Germany, France, Italy, Austria, Switzerland Sweden, Finland.

Almost all countries in the Middle East, Latin America, Africa, Central Asia and the Far East, except Japan, South Korea and China, are not in a pre-default state, but have substantial external debts. It makes them economically and politically dependent on the developed countries.

Fourth, the external debt situation can be influenced by a factor of change in the political and economic course of the state. Changes of this nature occur in the political-economic systems operating in countries, influenced by internal and external processes. In the modern world, external influences on domestic processes are more often than not the generator of such change (Puzakova, 2018). This is why there is a change in the political regime in the country and a change in the economic course of the state. An example is what happened in our country in the 1990s. In Russia, there was a change in the whole political and economic system of state-building, based on a planned economy, due to the transition of the economy and the state to market relations.

Fifth, the effect of using public debt as a source of financial resources for implementing the state's socio-economic programmes is minimal if the state's financial, and therefore economic, policies are ineffective.

In Russia, state economic policy has its shortcomings. The first thing to consider is the shortcomings of regional economic policy. In our view, the Russian governmental policy of financial support to regions has become a brake on the economic development of subsidized regions. After all, any aid, in this case, financial aid to the region, should be given for a certain period of time, not to legitimize it forever. Financial assistance to the regions has become a financing system. However, there are no regulations governing this aid, and no one is specifically responsible to the federal centre for how it is spent. On the contrary, regional authorities get the right to dispose of these funds at their own discretion. In some cases, such as in the case of the Republic of Dagestan, this policy has led to increased embezzlement, corruption and the formation of clan groups in the republic's power structures. In such a case, the economy will not develop unless there is a clause in the terms of financial aid that holds the authorities responsible for its use.

Findings

1. Public debt is seen as an economic category. Its significance is revealed in the context of society's economic growth. Public debt problems have links not only to budget deficits, but also to problems related to achieving economic growth. Thus, we should consider public debt as an economic category, since the problems to be addressed go beyond the problem of budget deficits.

2. Using public borrowing in its various forms in its activities, the state becomes a real participant in the movement of loan capital in the capital market. In doing so, it becomes a sovereign borrower in the financial market.

3. It is argued that without a clear purpose for the funds borrowed at home and abroad, public debt can be counterproductive:

- first, getting the state into debt bondage. If such dependence increases, the state may lose its sovereignty and become dependent on the policies of other states;

- second, there is a risk of late repayment of the debt obligation;

- third, in increasing public debt, which enables the state to better perform its duties to society, there is a flip side to this category, which is a process of increasing the risk of the state becoming indebted;

- fourth, change in the political and economic course of the state can have an impact on the external debt situation. In the modern world, external influences on the internal processes of a country are more often than not the generator of such changes, which leads to a change in the political regime of the country and a change in the economic course of the state;

- fifth, the effect of public debt as a source of financial resources for the implementation of the state's socio-economic programmes is minimal if the financial, and consequently economic, policies pursued by the state are ineffective.

4. The state uses public debt when there are insufficient funds to carry out the functions entrusted to it. In Russia, many regions are allocated funds from the federal budget as financial assistance. In this case, the public debt at the regional level becomes a factor worsening the welfare of the population and the financial insolvency of organisations, increasing the tax burden on all macro and microeconomic indicators of the Russian Federation.

Conclusion

The state or a regional authority uses public debt when funds are insufficient to carry out certain of its functions. In the current conditions in Russia, many regions are allocated funds from the federal budget as financial assistance. Nevertheless, they use public debt as a source of funding for their expenditure commitments. In such a case, the burden of the lack of financial resources will fall on the organizations and citizens in the region who live with insufficient means of subsistence.

The use of public debt in the context of uncompensated and untargeted financial aid to the regions from the federal budget plays a role of a deteriorating factor in the well-being of the population, and increases the financial insolvency of organizations. In this context, we should mention that with a budget deficit in the tens of billions, public debt increases the fiscal burden on all macro and microeconomic indicators of the constituent entity of the Russian Federation.

References

Abdulgalimov, A. M., Mokhov, I. A., & Urumova, F. M. (2021). Problems of the Russian Federation's financial system and the use of public debt. Bulletin of the Moscow Region State University. Ser. Economics, 4, 19–28.

Alekhin, B. I. (2011). Public debt. Textbook. Magister; INFRA-M.

Guscina, A. (2014). First-time international bond issuance – New opportunities and emerging risks. IMF Working Paper, NoWP/14/127. International Monetary Fund. Washington, DC.

Kulik, A. O. (2019). The Russian Federation's external public debt during the crisis. Alley of Science, 1(8), 112–117.

Kydland, F. N. (2015). Smart Development Goals, Copenhagen. Consensus Center.

Norenkov, D. N. (2017). Rising public debt as a threat to Russian economic security. Contentus, 4(57), 15–22.

Poole, L. (2018). Financing for stability in the post-2015 era. OECD Development Policy Papers. OECD Publishing, no. 10.

Puzakova, E. P. (2018). International economic relations. International business. Phoenix.

Yarygina, T. N. (2020). Public debt in the Russian financial security system. Academic Publicism, 2, 153–159.

Zavyalov, F. N. (2005). World Market Prices. Textbook. YrSU.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 December 2022

Article Doi

eBook ISBN

978-1-80296-128-7

Publisher

European Publisher

Volume

129

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1335

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Abdulgalimov, A. M., Mokhov, I. A., & Kurnosova, T. I. (2022). The Role Of Public Debt In Russian Economic Growth. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization- ISCKMC 2022, vol 129. European Proceedings of Social and Behavioural Sciences (pp. 23-30). European Publisher. https://doi.org/10.15405/epsbs.2022.12.4