Abstract

The paper is based on the results of the identification of clearly defined modern tendencies in the bond market development, the main of which is its computerization, which leaves an imprint on other tendencies in the development of not only the bond market, but also the financial market as a whole. Against the backdrop of the maximum interest rate on deposits declining over the studied period, the issue of choice, through the use of digital technologies, a more efficient option for investing money, ensuring the accumulation of savings and protecting them from inflation, is particularly acute. In order to determine the most effective factor in increasing income from investments in financial assets through individual investment accounts, a comparative assessment of the correlation between performance and factor indicators was carried out. It is found that the factors in the formation of property income in Russia in general and in the Chechen Republic have common characteristics. They consist of a weak relationship between the dividend income change and in the property income change. It is concluded that it is necessary to increase the assets, which are expressed in state and corporate debt tools, as the most effective aspect in the increase in the income of private investors from property at regional and federal levels.

Keywords: Computerization, correlation coefficient, investor, individual investment account, property income

Introduction

In the context of the need to ensure the effective development of economy, solve national problems through the implementation of a unified monetary and debt policy, while preventing the negative consequences of changes in the external environment, the issues of stable functioning of the bond market by maximizing its potential and involving the general public in investment processes with the use of digital technologies are of particular importance.

Digital technologies, today, lead to the “interlacing” of the activities of all actors in the financial market, changing it into a single financial mechanism. The integrated services are provided by banking and non-banking agencies in this mechanism. First of all, the consumers of these financial services are private investors. In recent years their presence in the financial market has increased dramatically. Today about 4 million people prefer transactions with bond according to the Bank of Russia official data. As a result, the outflow of private investors from banking sector to stock market appear. In 2019, the stock market was augmented by almost 2 million private investors. At the same time, the activities of a private investor in the stock market largely determine corporate clients’ strategy in the stock market. In turn, it affects the stability and stability of financial market in general (Mitrofanov, 2016; Zvonova, 2017).

Problem Statement

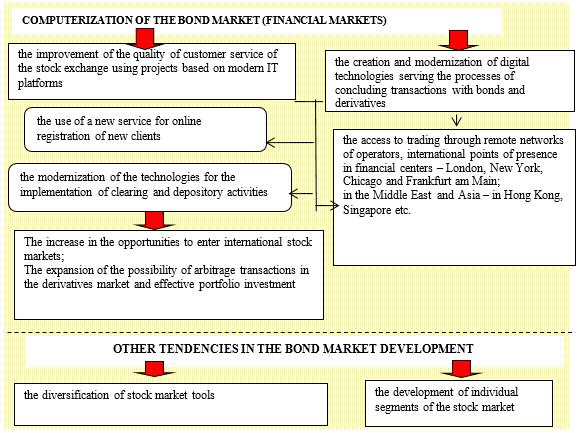

A distinctive feature of the development of the modern financial market is the active penetration of digital technologies into the processes taking place in it. Qualitative and quantitative of the tendencies in the process of development of the bond market are determined by the level of its digitalization (Table 01, Figure 01).

The consideration of the trend of computerization as dominant in the bond market is associated with that:

Today the implementation and application of digital technologies determine the vectors for the development of other tendencies affected by this research (innovations, securitization, diversification of stock market instruments etc.);

The identified qualitative and quantitative aspects of the tendencies in the development of the bond market are closely interconnected. They are interdependent and naturally integrated into the processes of computerization.

The involvement of a private investor in investment processes through the introduction of digital technologies implies the need to choose a more efficient option for investing money that ensures the accumulation of savings and their protection from inflation.

Research Questions

The works of many Russian and international scientists are devoted to the study of the use of digital technologies. First of all, the results reflect the impact of digital technologies on the banking sector. The main results and conclusions of the conducted studies are the following:

- Banking institutions are becoming more predictable (Lakew & Azadi, 2020);

- Internet banking simplifies the procedure for entering the market (Baabdullaha et al., 2019; Gorbunova, 2020; Kornilova, 2019; Solovyov, 2015; Yiuab et al., 2017)

- The use of blockchain technologies ensures that financial isolation is overcome (Schuetz & Venkatesh, 2020);

- Digital technologies significant affect the investment decisions of banking clients (Pousttchi & Dehnert, 2018), the quality of the relationship between a customer and a provider of a financial services (Lang & Colgate, 2020), the competitiveness and structure in financial services industries (Claessens et al., 2002).

Nowadays, economic science has the results of the studies on the level of influence of digital technologies on the parameters of the financial market development, integration processes, investment preferences of investors, transaction costs etc.

Purpose of the Study

At the same time results of the application of digital tools, their effectiveness in terms of the expansion of the opportunities for private investors to invest their own capital and earn additional income through operations with bond (shares) and risk diversification are not sufficiently consecrated. The issues associated with the assessment of the level of influence of digital techniques on the changes in the investment preferences of a private investor deserve attention. This allows identifying the most effective factors for the increase in income from investments in financial assets. Based on this, the purpose of this research is to identify the most effective factor in the increase of income from investments in financial assets through individual investment accounts based on a comparative assessment of the correlation between performance and factor indicators that characterize various types of property income at the federal and regional levels and assets on individual investment account (IIA).

Research Methods

Due to the digital technologies development that allow working with individual investment accounts (IIA), the stock market is augmented by a record number of new private investors investing free cash in bond. Against the background of the maximum interest rate declining for the period January, 1, 2015 – January, 1, 2020 for the ten largest banks in Russia from 15.325 % to 5.927 %, the possibility to obtain the integration with online services and mobile applications and tax deduction are important advantages of IIA. It is confirmed by the rapid increase in their quantity (more than 4 million as of May 1, 2021) and turnover on them (over 714 billion rubles from the beginning of 2021). For 6 months in 2020, more than 1.8 million IIAs were opened (Figure 02). The turnover on IIAs exceeded 1.4 trillion rubles, in the structure of turnover, 85.6 % were shares transactions, 10.1 % –bonds transactions, 4 % –exchange-traded funds transactions.

Dynamics of the number of individual investment accounts opened with credit and non-financial organizations in Russia, thousand units

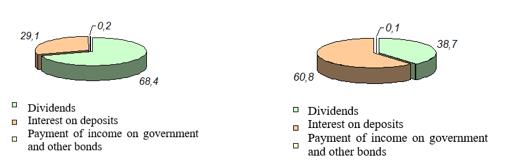

In the structure of income of a private investor from property for the period 2015-2019 there have been changes in the direction in Russia as a whole and in the Chechen Republic (Figure 3)

Structure of property income in Russia as a whole and the Chechen Republic in 2020

- The increase in the share of dividend income: in Russia: from 58.5 to 68.4 % and in the Chechen Republic: from 21.3 to 38.7 %;

- The reduction in the share of interest accrued on bank deposits, which occupied the largest share at the beginning of the studied period both in Russia as a whole and in the Chechen Republic: from 40.2 to 29.1 % and from 76.1 to 60.8 %, respectively. However, in the Chechen Republic, the predominant share of this income in the total amount of property income remains;

- The reduction in interest income from government and other debt bond both in Russia as a whole and in the Chechen Republic in general: from 0.3 to 0.2 % and from 1.2 to 0.1 %.

In order to determine the most effective factor in the increase in income from investments in financial assets through individual investment accounts. The assessment was made of the correlation between performance and factor indicators property income in the Russian Federation as a whole and the Chechen Republic, various types of income from investments in credit organizations and valuable bond, as well as assets on IIAs, in the form of shares, cash on deposits and debt bond. The obtained correlation coefficients are shown in Table 02.

Findings

The assessment of the correlation dependence between the studied indicators shows that the factors of formation of property income in Russia as a whole and the Chechen Republic have common characteristics:

- the weak relationship between the change in dividend income and in property income change;

- the presence of a noticeable relationship between changes in state income and other debt bond and property income;

- the inverse (negative) pronounced relationship between state income and other debt bond and assets in state and municipal bonds on IIAs (the number of IIAs) may indicate:

- investments in state and municipal bonds aimed at their resale and quick profits. According to the results of the study it leads to the increase in assets in cash and deposits on IIAs;

- the use of corporate bonds of residents in IIAs as an instrument that brings a constant interest income, the volume of investments in which, according to the latest data, is more than 40 billion rubles in Russia as a whole. This is also evidenced by the determined noticeable correlation between the indicator of total property income and state interest income and other debt bond.

Conclusion

The distinctive feature of the relationship between the studied indicators for the Chechen Republic is weak relationship between property income and interest income on bank deposits. While the correlation coefficient between the number of IIAs and income accrued on bank deposits is 0.96. Taking into account this weak dependence of income from bond on changes in the number of IIAs (Demilkhanova et al., 2020), we note that IIAs are used by investors of the Chechen Republic for bank deposits. This means that income from investments obtained due to the use of digital investment channels is still generated through transactions in the banking services market, and investments in bond are made mainly through brokerage accounts.

Thus, a comparative and generalized assessment of the level of digital technologies that allow investing equity through individual investment accounts makes us conclude that:

the necessity to increase assets, expressed in the form of state and corporate debt instruments, as the most effective factor in the increase in the income of private investors from property at regional and federal levels;

the indirect positive impact of tax incentives embedded in IIAs, which contributes to the increase in assets in the form of cash and deposits.

References

Baabdullaha, A., Abdallah, A., & Nripendra, A. (2019). Consumer use of mobile banking (M-Banking) in Saudi Arabia: Towards an integrated model. International Journal of Information Management, 44, 38–52.

Claessens, S., Glaessner, T., & Klingebiel, D. (2002). Electronic Finance: Reshaping the Financial Landscape Around the World. Journal of Financial Services Research, 22, 29–61.

Demilkhanova, B. A., Sadaeva, F. M., & Sakhrudinova, Z. R. (2020). Individual investment accounts in the formation of income of private investors. Economics and management: problems, solutions, 1(11(107)), 86–92.

Gorbunova, M. B. (2020). Overview of the problems of implementing distributed ledger technology. Information and control systems, 2, 10–19.

Kornilova, E. V. (2019). Blockchain technology and the possibilities of its use in the financial sector. Finance and credit, 25(4), 789–803.

Lakew, B., & Azadi, Х. (2020). Financial inclusion in Ethiopia: is it on the right track? International Journal of Financial Studies, 8(2).

Lang, B., & Colgate, M. (2020). Relationship quality, on-line banking and the information technology gap. International Journal of Bank Marketing, 21(1), 29–37. https://doi.org/10.1108/02652320310457785

Lukasevich, I. Ya. (2018). ICO as a business financing tool: myths and reality. Economy. Taxes. Right, 11(2), 45. https://ideas.repec.org/a/scn/econom/y2018i2p41-51.html

Mitrofanov, V. I. (2016). The role of private investors in the development of the Russian stock market. Modern tendencies in economics and management: a new look, 38, 22–27. https://cyberleninka.ru/article/n/rol-chastnyh-investorov-v-razvitii-rossiyskogo-rynka-aktsiy

Pousttchi, K., & Dehnert, M. (2018). Exploring the digitalization impact on consumer decision-making in retail banking. Electronic Markets, 28, 265–286.

Schuetz, S., & Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India: Research opportunities. International Journal of Information Management, 52, 101936. https://doi.org/10.1016/j.ijinfomgt.2019.04.009

Solovyov, D. (2015). Digitalization of the infrastructure of the bond market. Stocks and bod market, 4, 21–23.

Tropin, A. I. (2020). The use of robo-advisers by Russian banks, brokers and management companies. Banking, 4, 58–61.

Yiuab, C., Grantc, K., & Edgarc, D. (2017). Factors affecting the adoption of Internet Banking in Hong Kong-implications for the banking sector. International Journal of Information Management, 27(5), 336–351.

Zvonova, E. A. (2017). Features of the accumulation of savings of the population in the Russian stock market. Economy. Taxes. Right, 2, 40–48. https://cyberleninka.ru/article/n/osobennosti-akkumulyatsii-sberezheniy-naseleniya-na-rossiyskom-fondovom-rynke

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 December 2022

Article Doi

eBook ISBN

978-1-80296-128-7

Publisher

European Publisher

Volume

129

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1335

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Demilkhanova, B. A., & Dzobelova, V. B. (2022). Factors Of Asset Formation On Individual Investment Accounts Of Private Investors. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization- ISCKMC 2022, vol 129. European Proceedings of Social and Behavioural Sciences (pp. 311-318). European Publisher. https://doi.org/10.15405/epsbs.2022.12.39